3 January 2023 Afternoon Session Analysis

Yen regained its luster as the monetary policy could be changed.

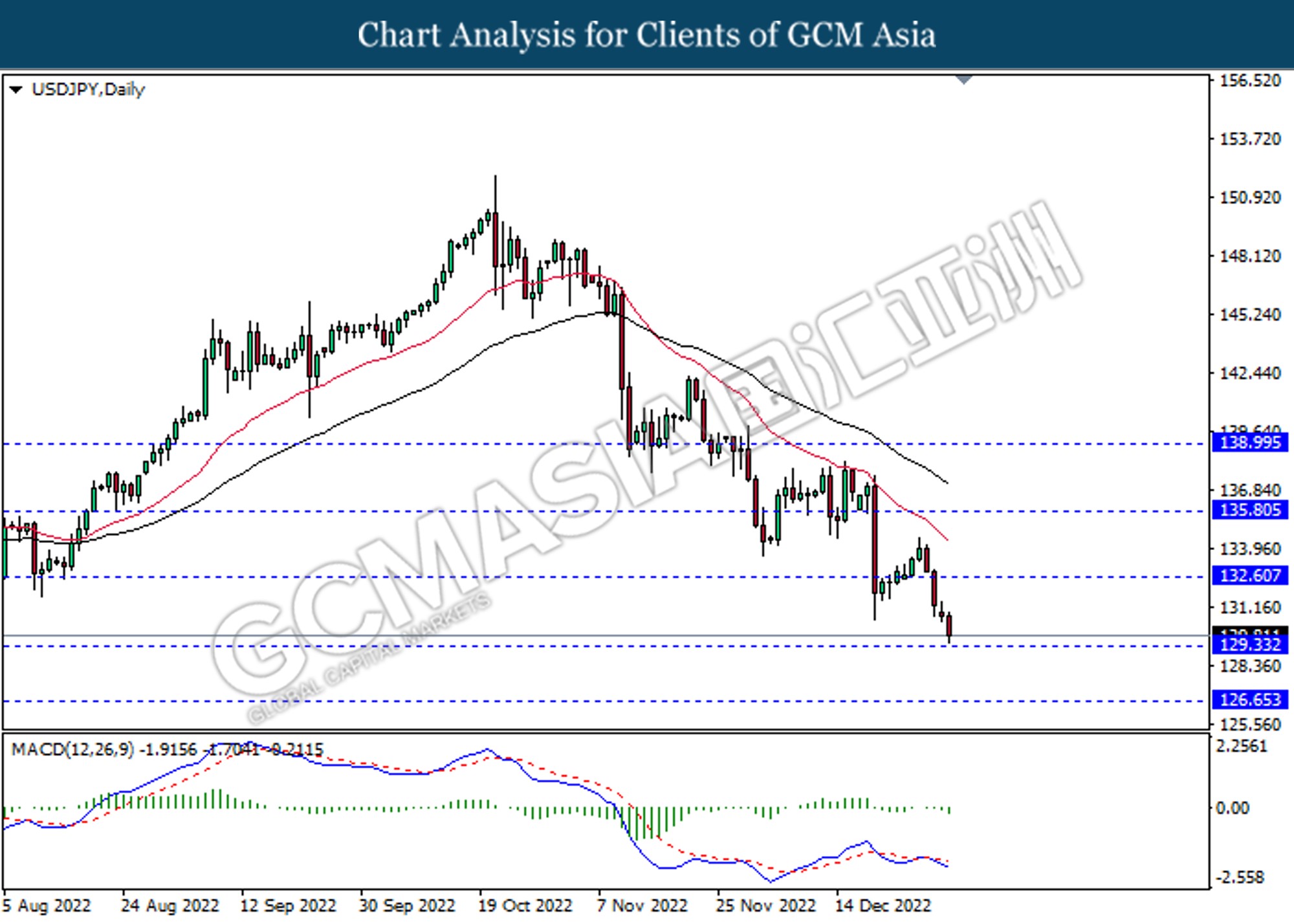

The USD/JPY, which widely traded by global investors slumped after the New Year holidays in many countries yesterday over the rising expectation of changing monetary policy of Bank of Japan (BoJ). In December, BoJ surprised market by increasing its yield curve band from 0.25% to 0.50%, which giving the hints that the BoJ could repeal its loosening monetary policy. Besides that, the current BoJ Governor Haruhiko Kuroda would put down his term in April, and the market participants anticipated that the BoJ would be planning to implement contractionary monetary policy after the new governor take over the seat. Though, Kuroda has claimed that he was not shy to remain the ultra-low interest rate until the end of his term. On the other hand, the AUD/USD rose significantly in the early trading session following the upbeat China economic data. According to Markit, China Caixin Manufacturing Purchasing Managers Index (PMI) for December came in at the reading of 49.0, exceeding the consensus forecast of 48.8. The Australia’s economy was benefited as China was the major trading partner for it. As of writing, the USD/JPY depreciated by 0.75% to 129.74 while AUD/USD had raised by 0.47% to 0.6834.

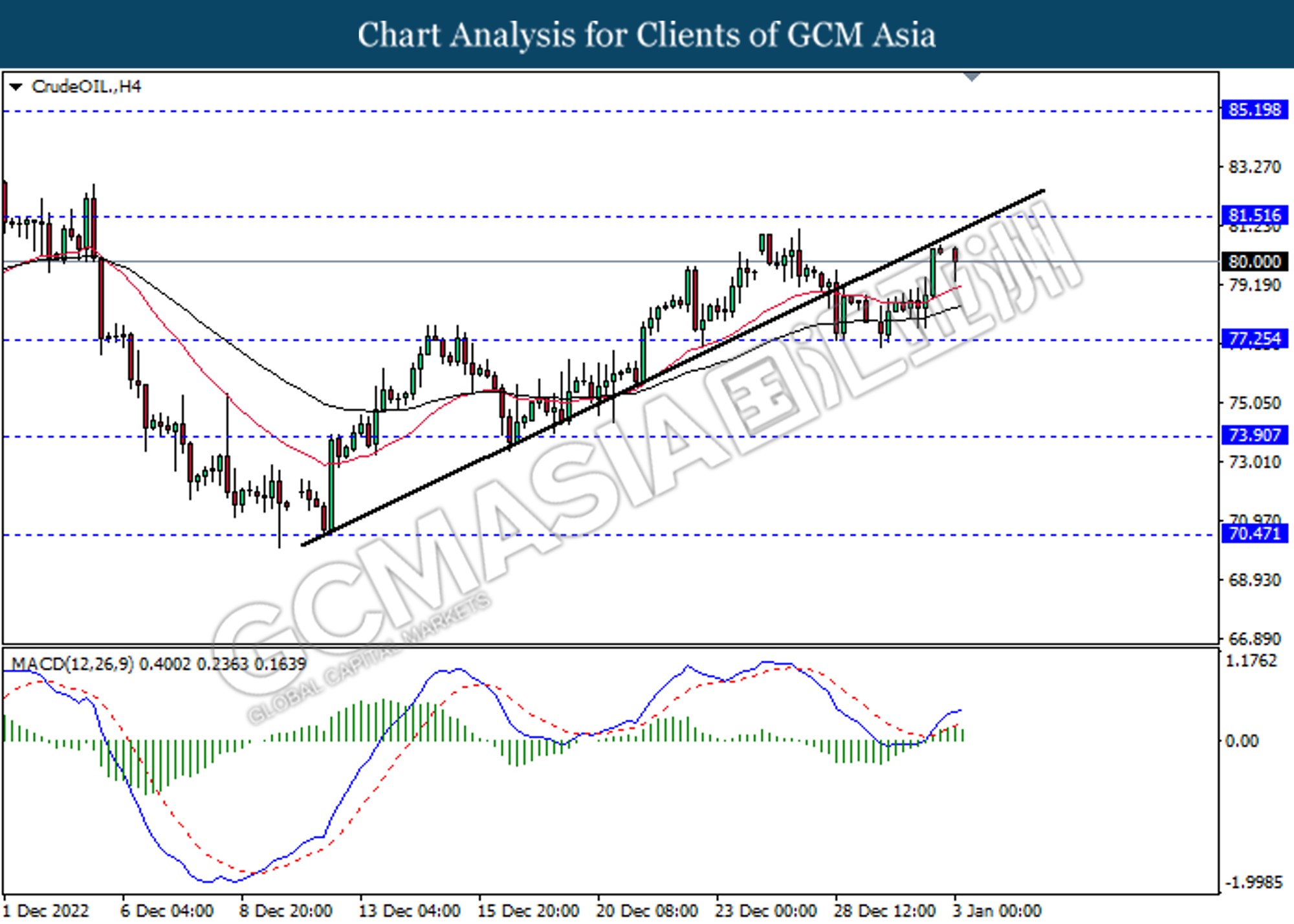

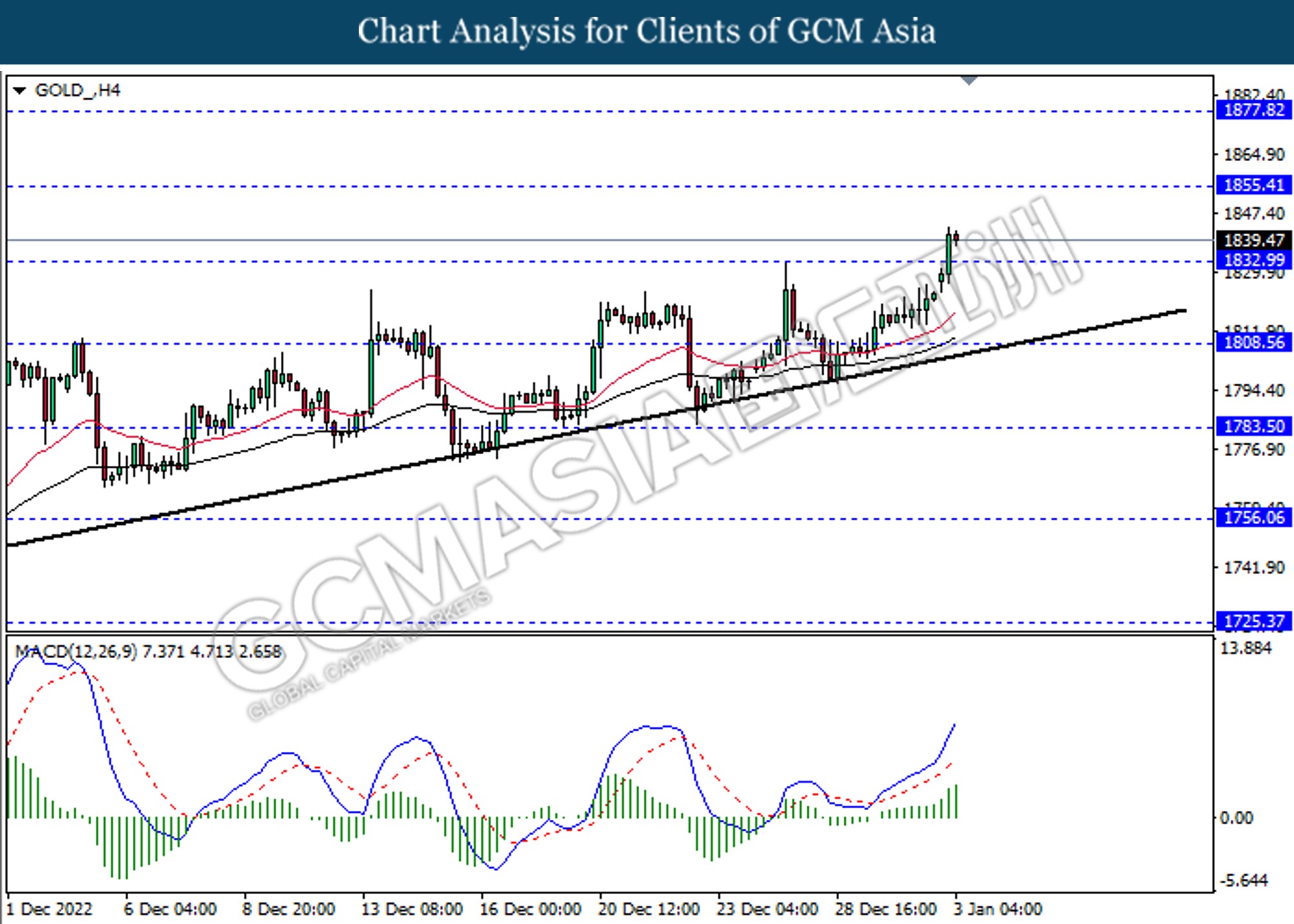

In the commodities market, the crude oil price eased by 0.22% to $80.08 per barrel as of writing as the warning on economic growth from the International Monetary Fund has weighed down the demand of oil. In addition, the gold price surged by 1.21% to $1841.62 per troy ounce as of writing following the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day NZD New Year’s Day

All Day JPY Market Holiday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Unemployment Change (Dec) | 17K | 15K | – |

| 17:30 | GBP – Manufacturing PMI (Dec) | 46.5 | 44.7 | – |

| 21:00 | EUR – German CPI (YoY) (Dec) | 10.0% | 9.1% | – |

Technical Analysis

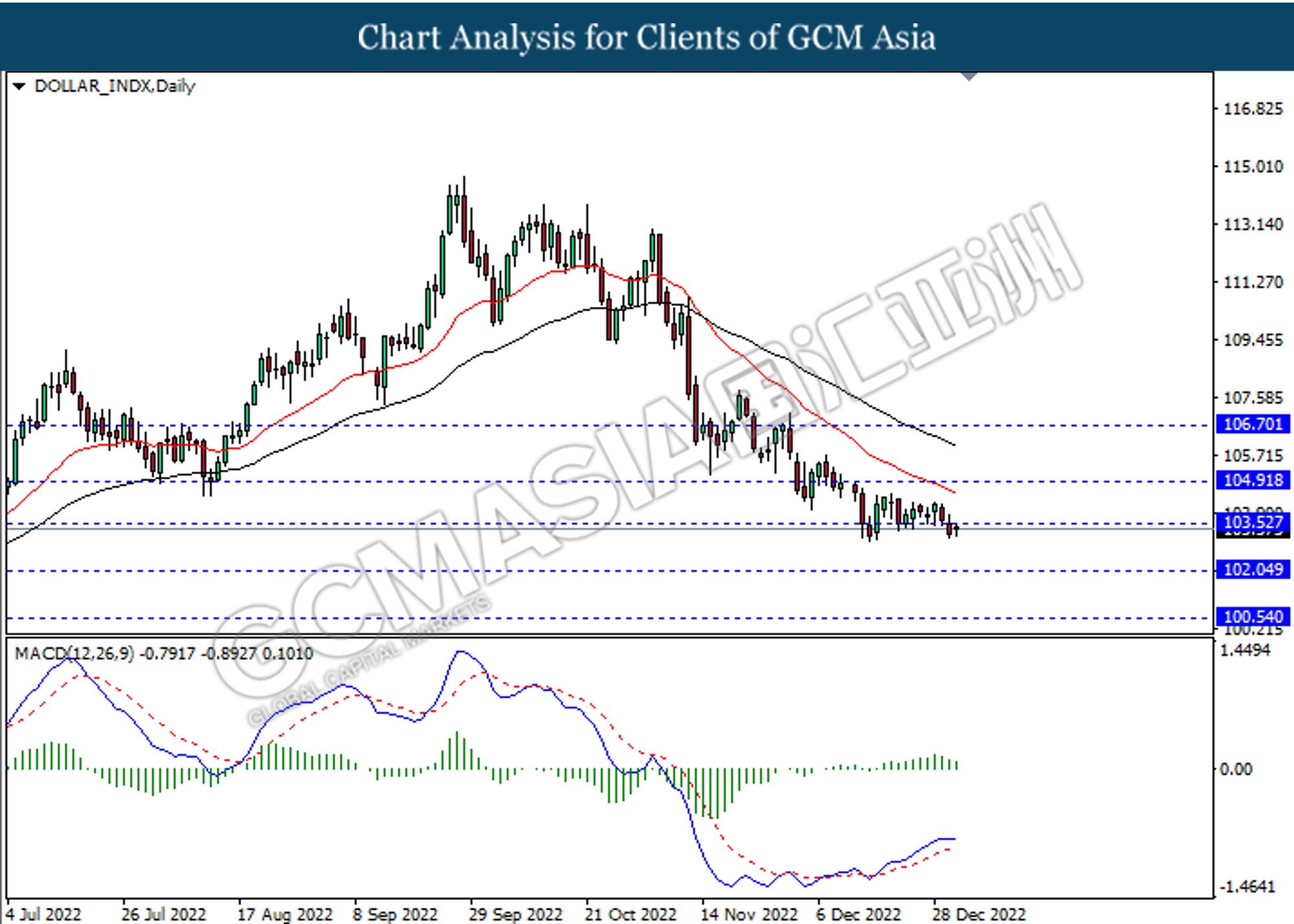

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout the previous support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 103.50, 104.90

Support level: 102.05, 100.55

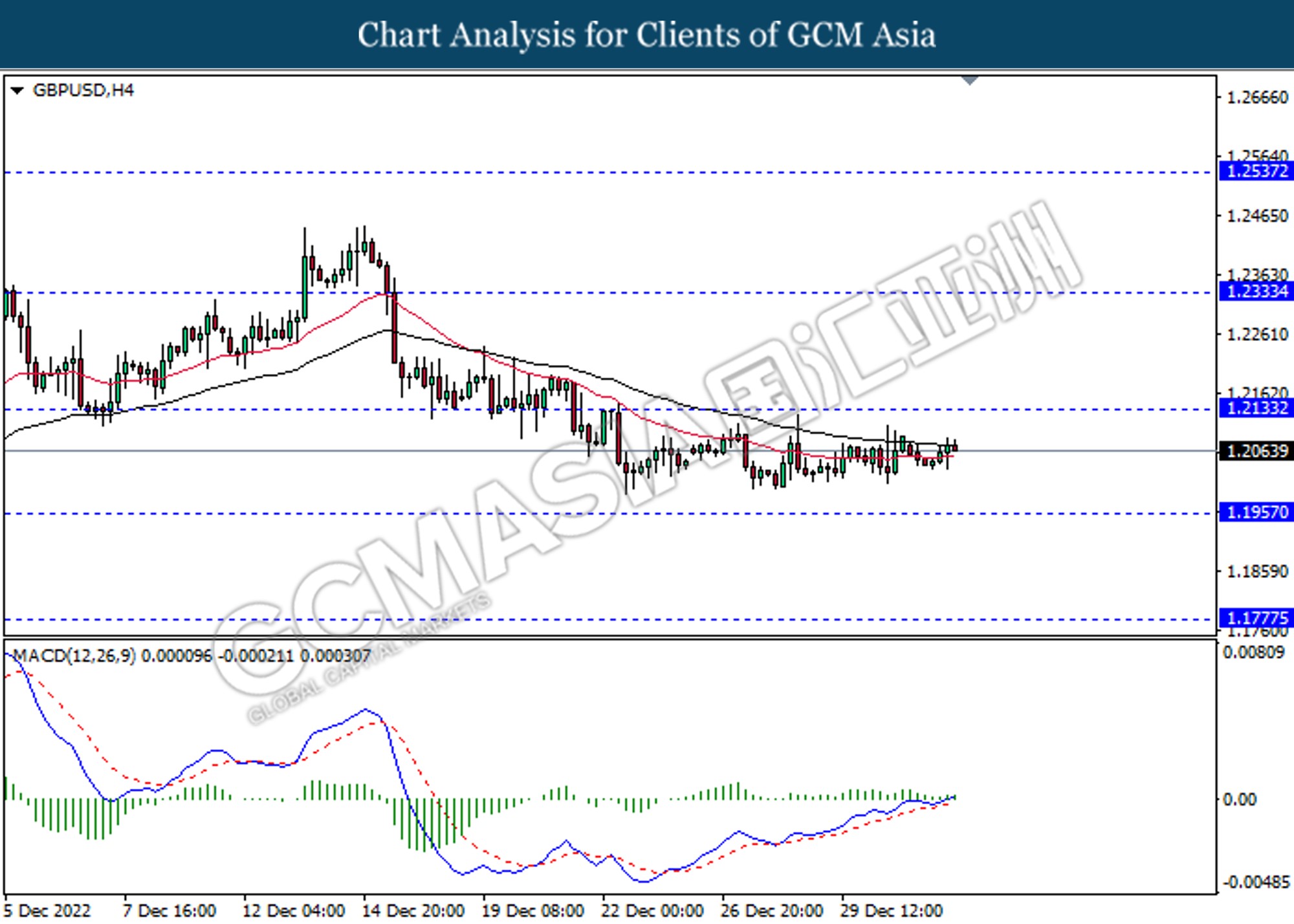

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2135, 1.2335

Support level: 1.1955, 1.1775

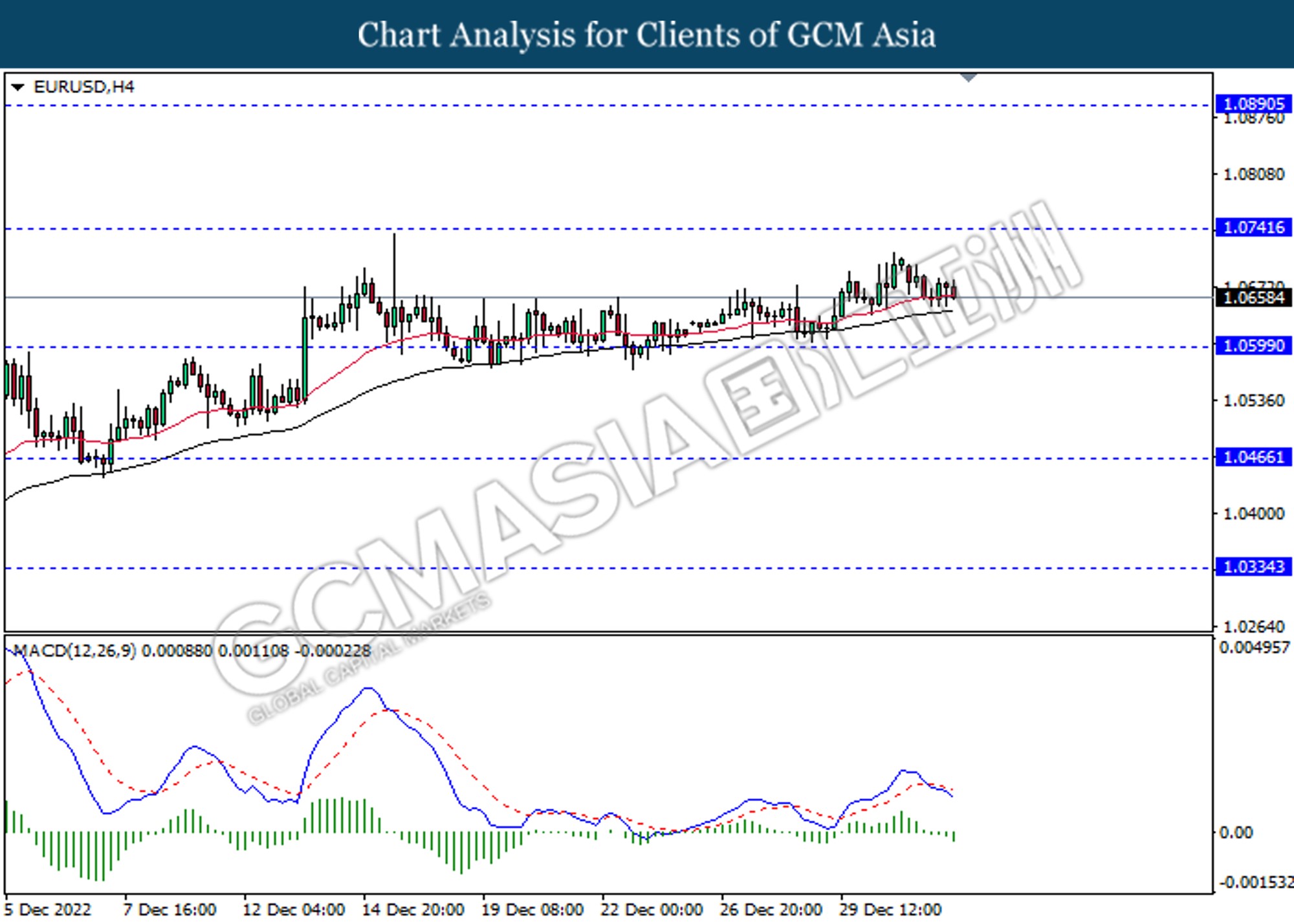

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0465

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 132.60, 135.80

Support level: 129.35, 126.65

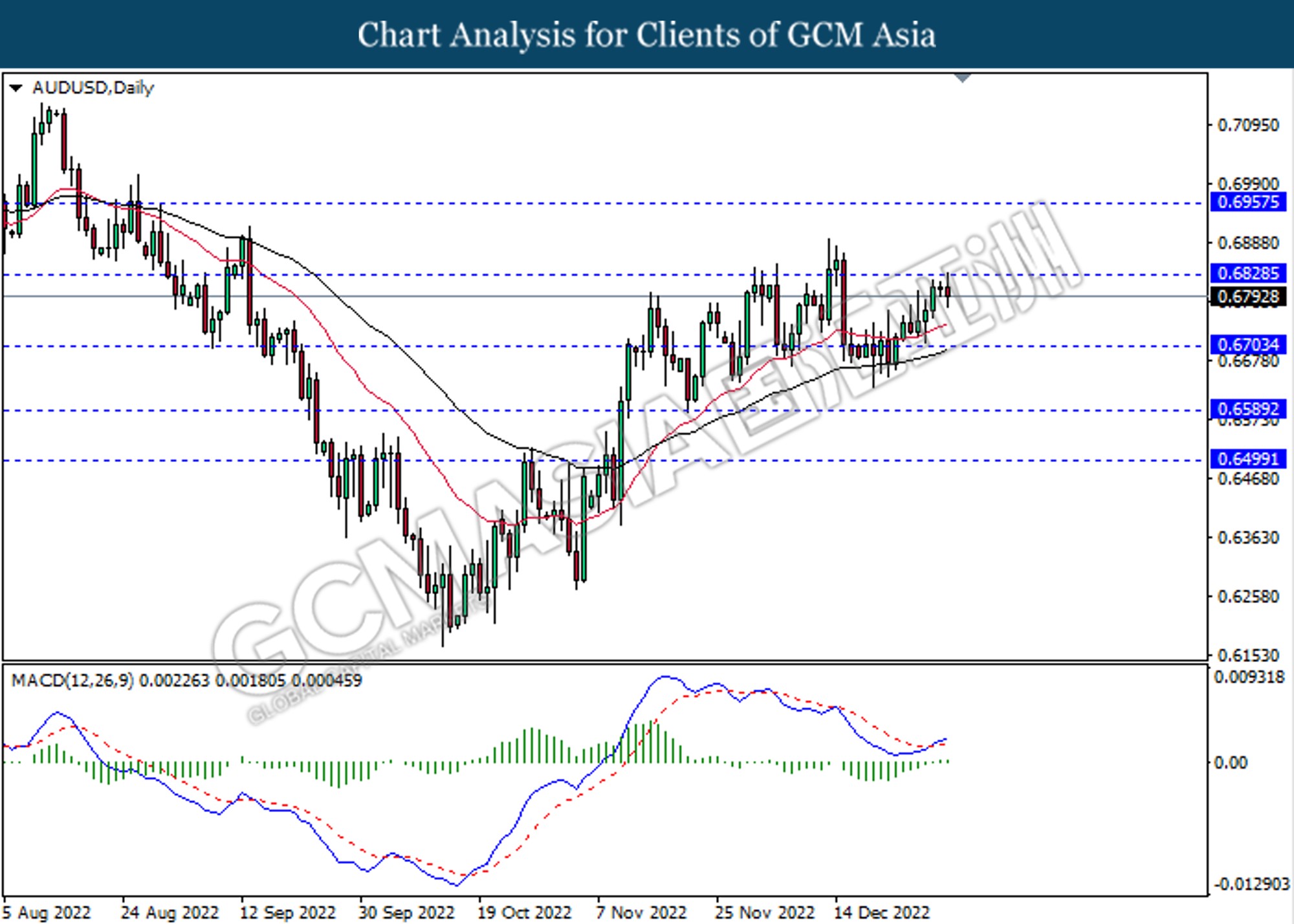

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6830, 0.6955

Support level: 0.6705, 0.6590

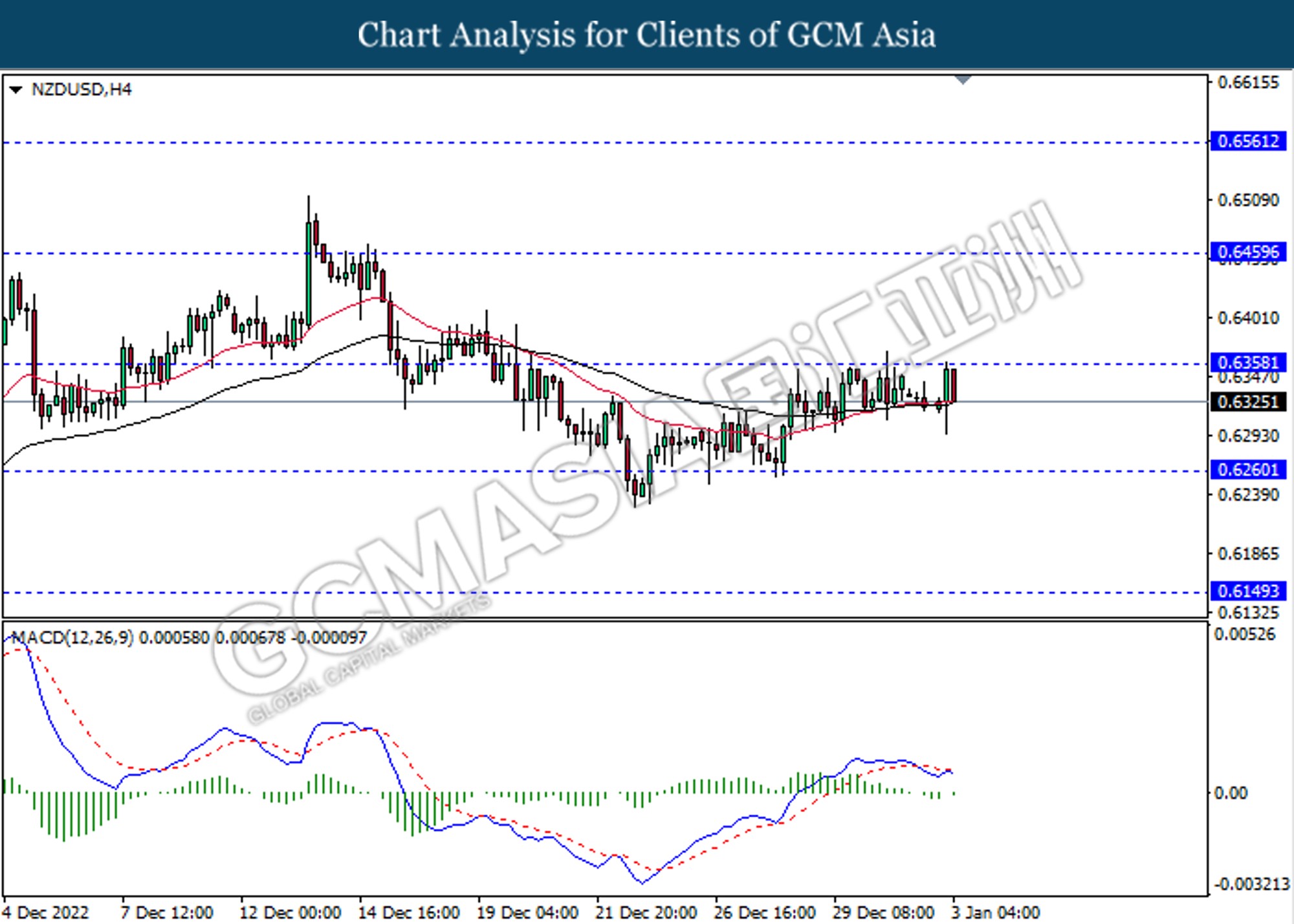

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

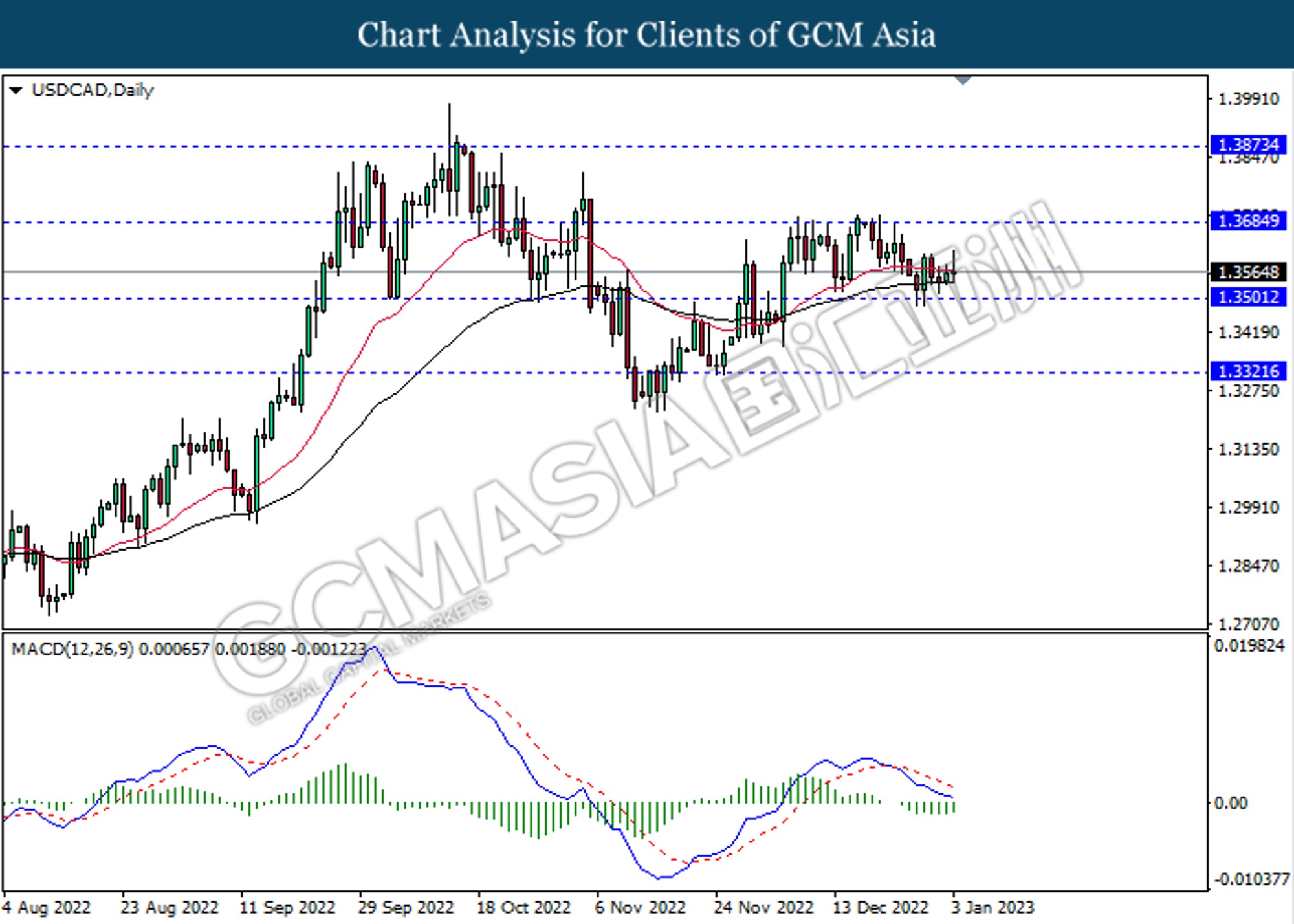

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

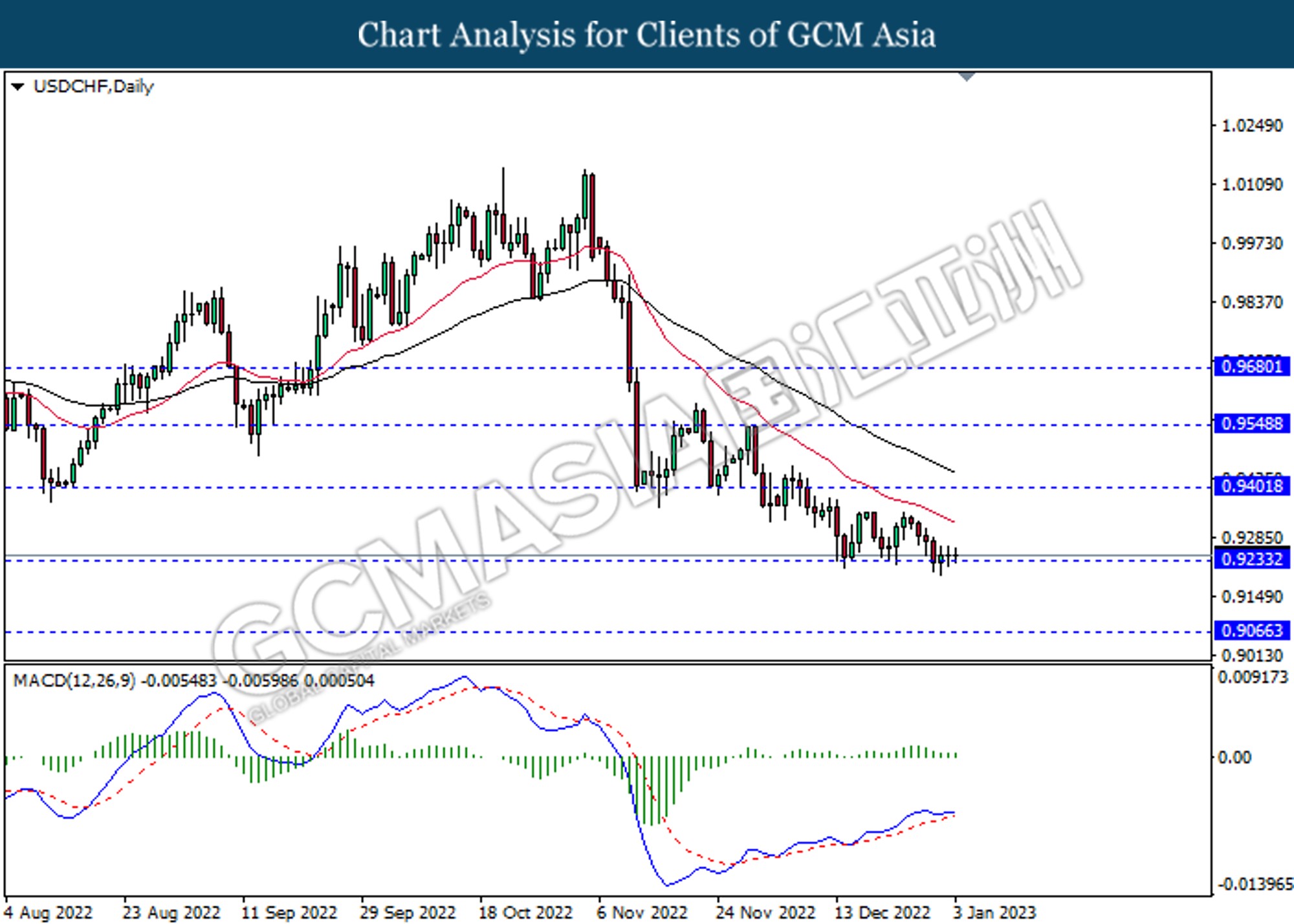

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 81.50, 85.20

Support level: 77.25, 73.90

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1855.40, 1877.80

Support level: 1833.00, 1808.55