3 January 2023 Morning Session Analysis

Greenback ended the last trading session of the year 2022 with losses.

The dollar index, which traded against a basket of mainstream currencies, was teetering on the brink as investors resumed the sell-off activity, whereby betting on slower interest rate hikes by the Federal Reserve in the coming meeting. At this juncture, the dollar index hovered near the lowest level since June 2022 as the recent economic data showed that the US inflation has likely peaked, raising the likelihood of less aggressive rate hikes by the Fed. According to the CME FedWatch Tool, the possibility of a just 25 basis point rate hike is 67.7%, whereas the likelihood of a 50 basis point rate hike is 32.3%. On the other hand, the dollar index regained some luster after Germany released downbeat economic data. According to Markit Economics, the Germany Manufacturing Purchasing Managers Index (PMI) came in at 47.1, weaker than the consensus forecast at 47.4, mirroring the risk of the recession still surrounding the nation. Nevertheless, the direction of the dollar index would still be highly dependent on the nation’s economic performance as well as the Fed’s monetary policy stance in the near-term future. As of writing, the dollar index dropped by -0.03% to 103.50.

In the commodities market, crude oil prices increased by 0.02% to $80.55 per barrel as the dollar weakened, benefitting the non-US oil buyers from a lower cost. Besides, gold prices appreciated by 0.02% to $1823.95 per troy ounce amid the weakness in the US dollar.

Today’s Holiday Market Close

Time Market Event

All Day NZD New Year’s Day

All Day JPY Market Holiday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 09:45 | CNY – Caixin Manufacturing PMI (Dec) | 49.4 | 48.8 | – |

| 16:55 | EUR – German Unemployment Change (Dec) | 17K | 15K | – |

| 17:30 | GBP – Manufacturing PMI (Dec) | 46.5 | 44.7 | – |

| 21:00 | EUR – German CPI (YoY) (Dec) | 10.0% | 9.1% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 103.15. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses after it successfully breakout below the support level at 103.15.

Resistance level: 105.00, 107.90

Support level: 103.15, 101.25

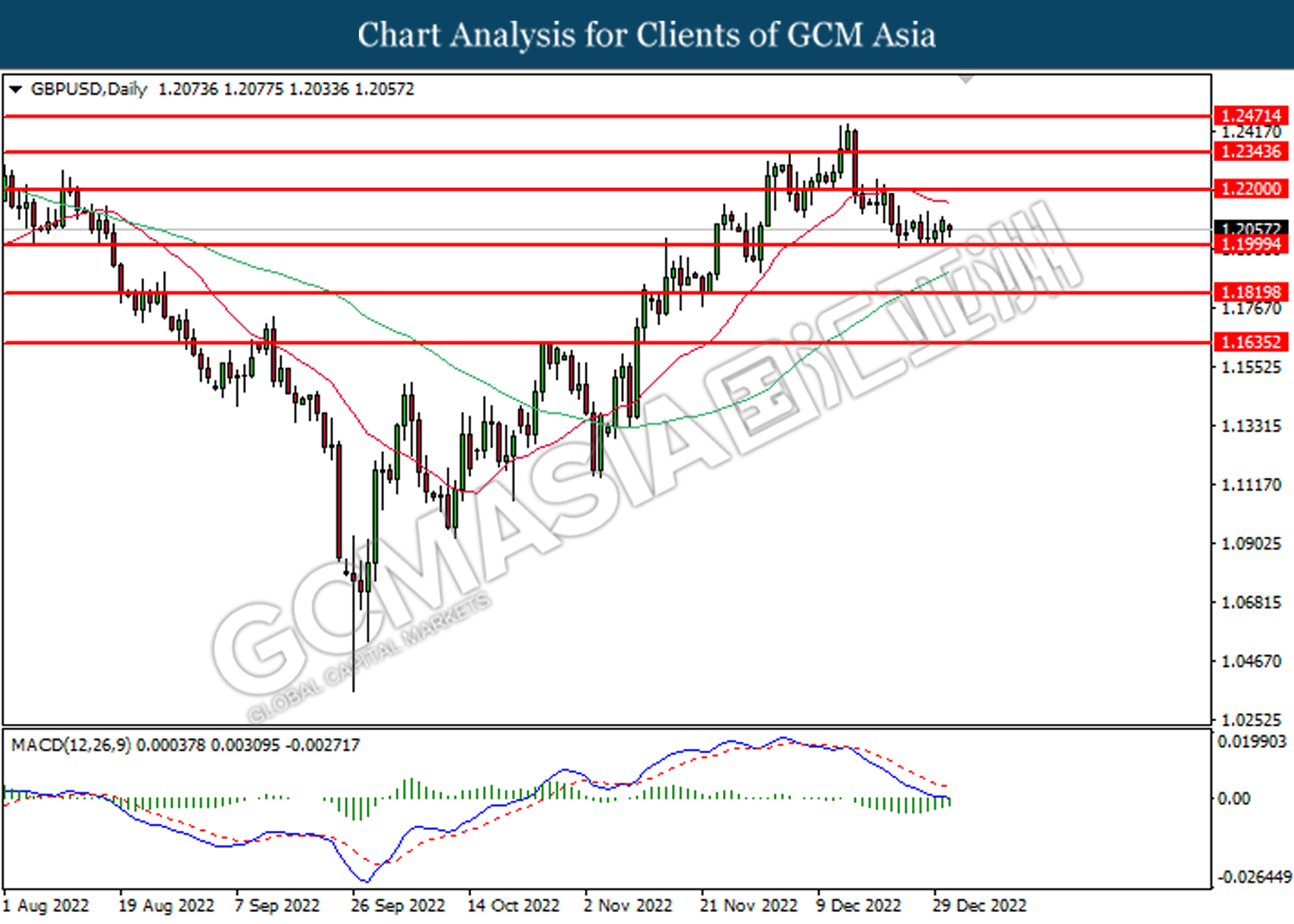

GBPUSD, Daily: GBPUSD was traded higher following prior rebound from the support level at 1.2000. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2200.

Resistance level: 1.2200, 1.2345

Support level: 1.2000, 1.1820

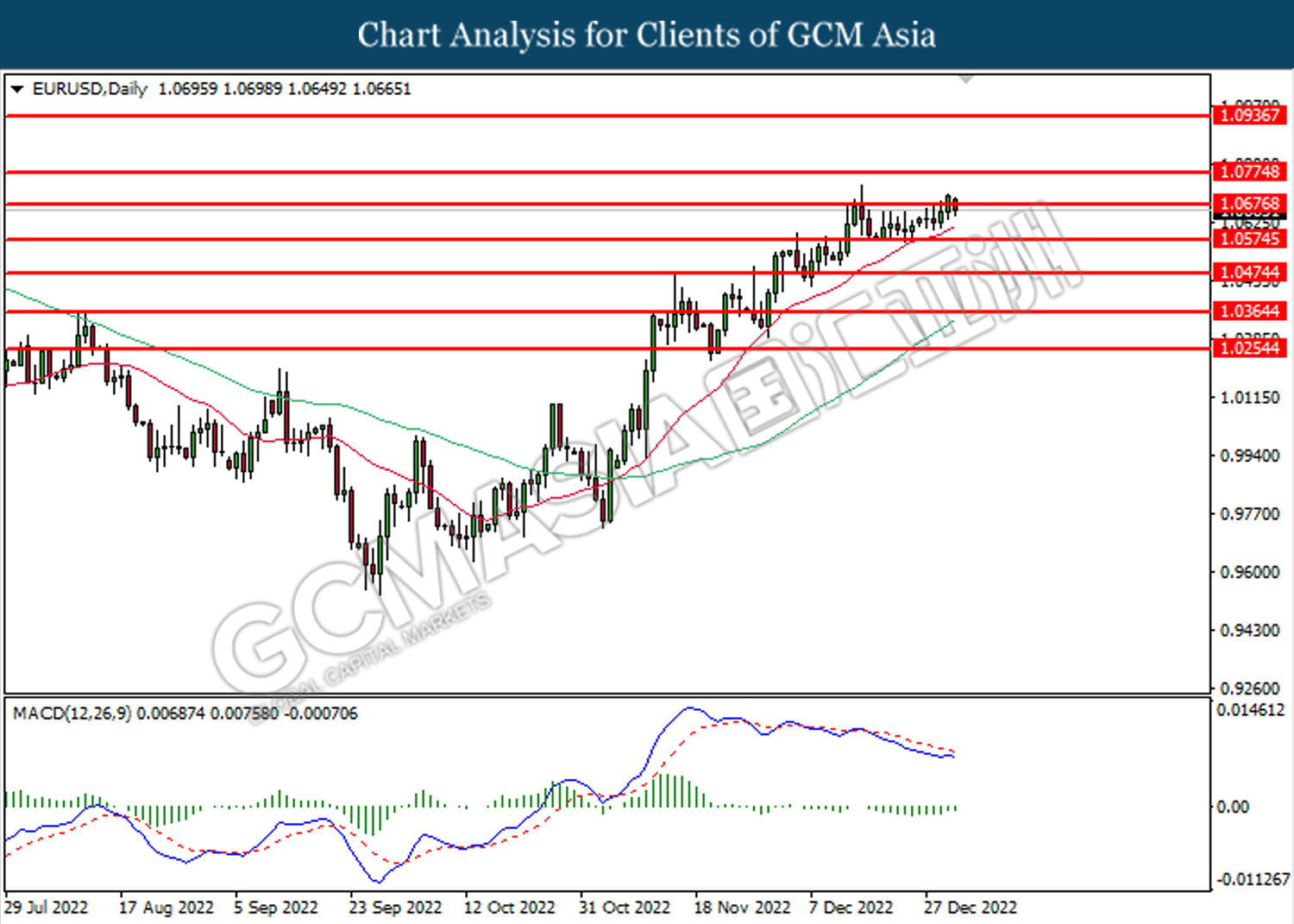

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0675. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0775.

Resistance level: 1.0775, 1.0935

Support level: 1.0675, 1.0575

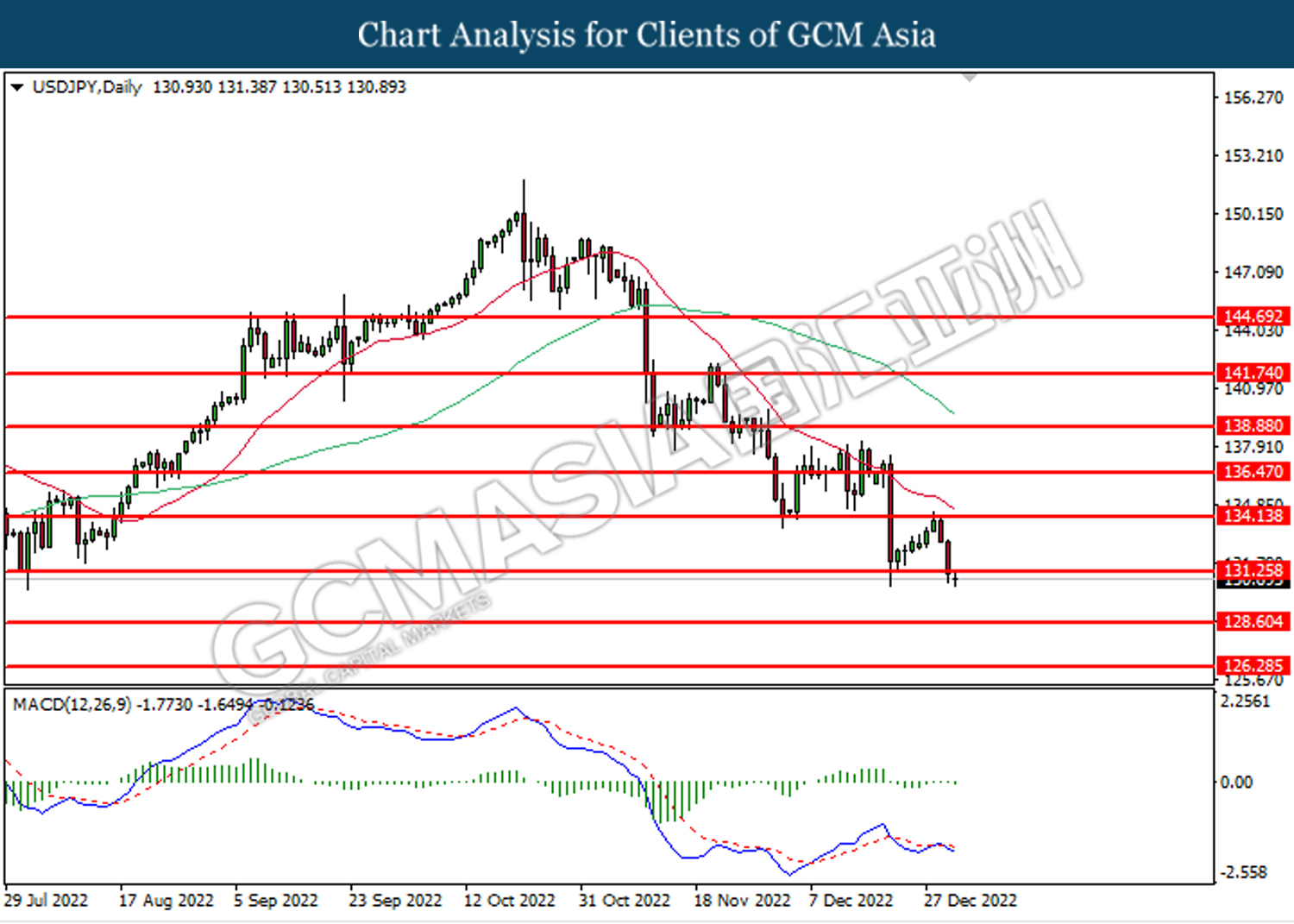

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level at 131.25. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 128.60.

Resistance level: 131.25, 134.15

Support level: 128.60, 126.30

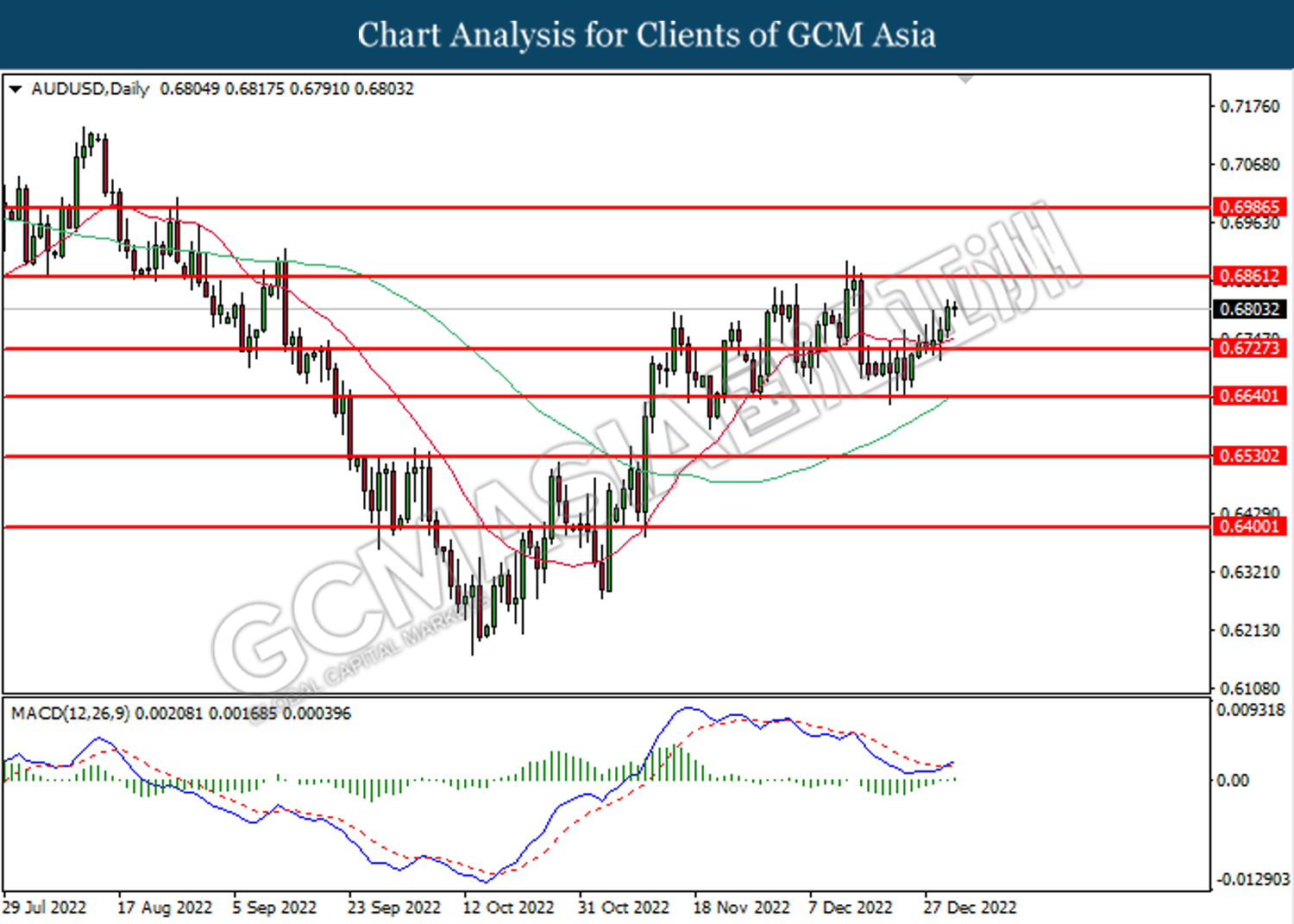

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6730. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6860.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

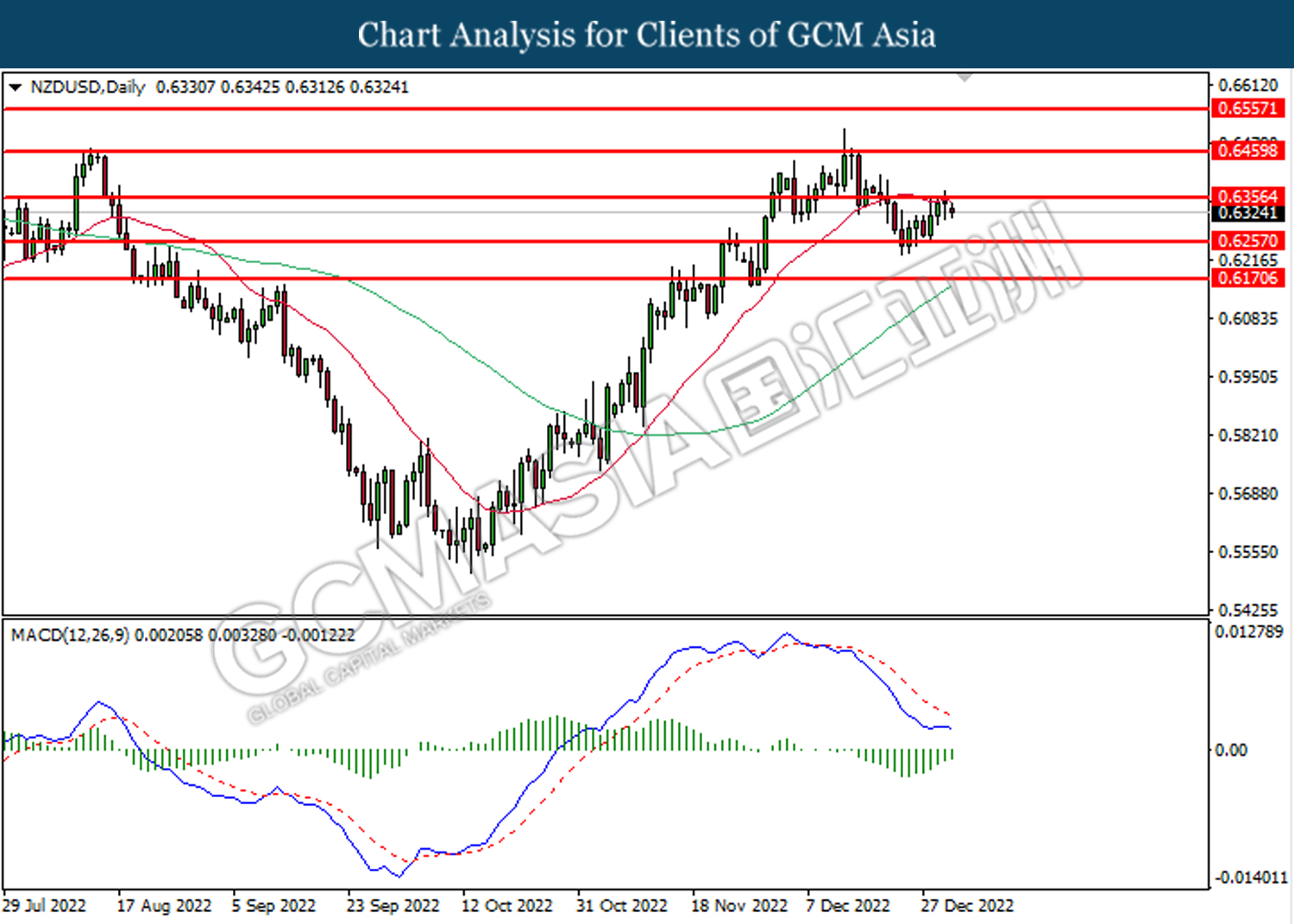

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.6355. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6255.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

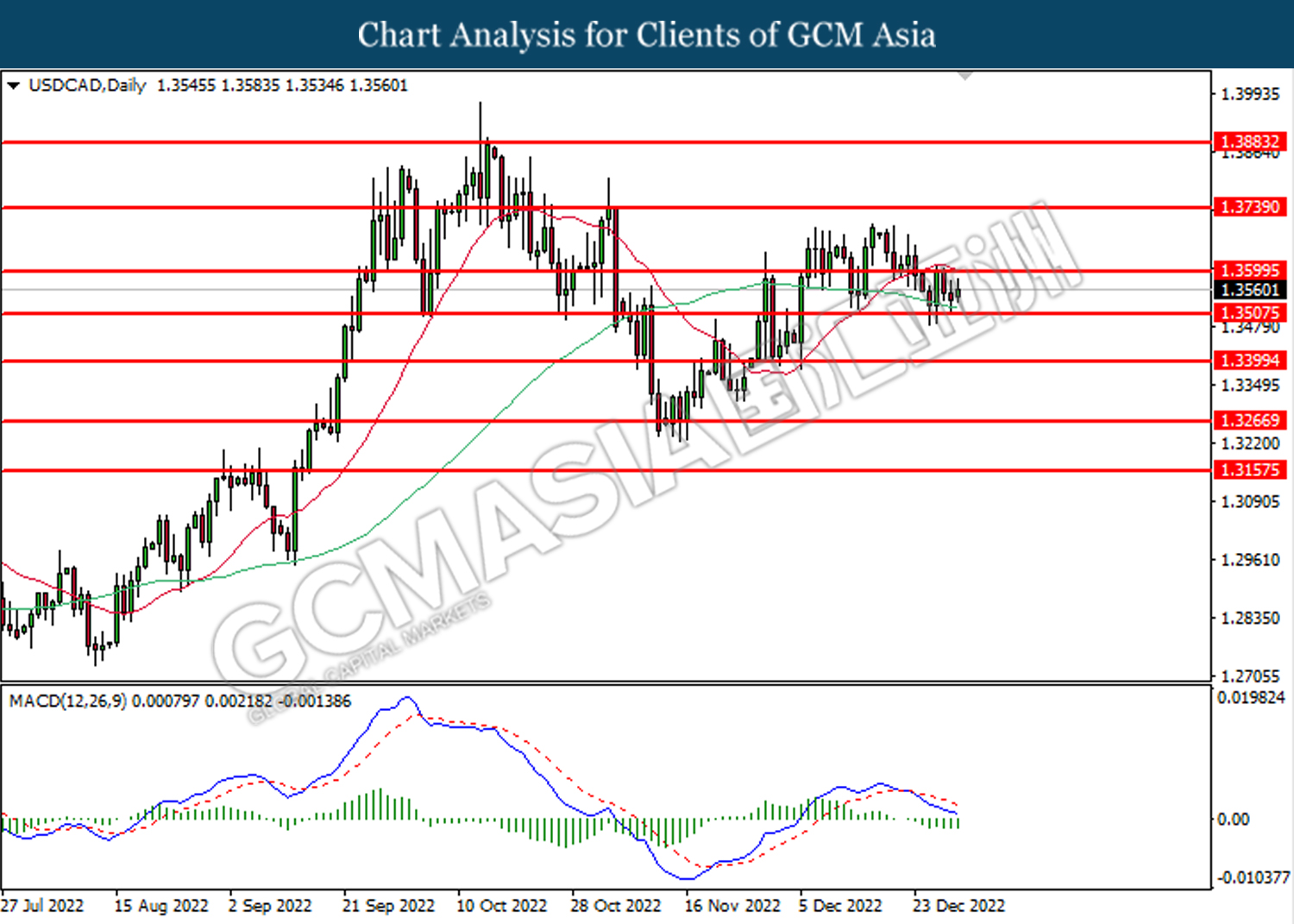

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3505. However, MACD which illustrated bearish bias momentum suggests the pair to undergo technical correction in short term.

Resistance level: 1.3600, 1.3740

Support level: 1.3505, 1.3400

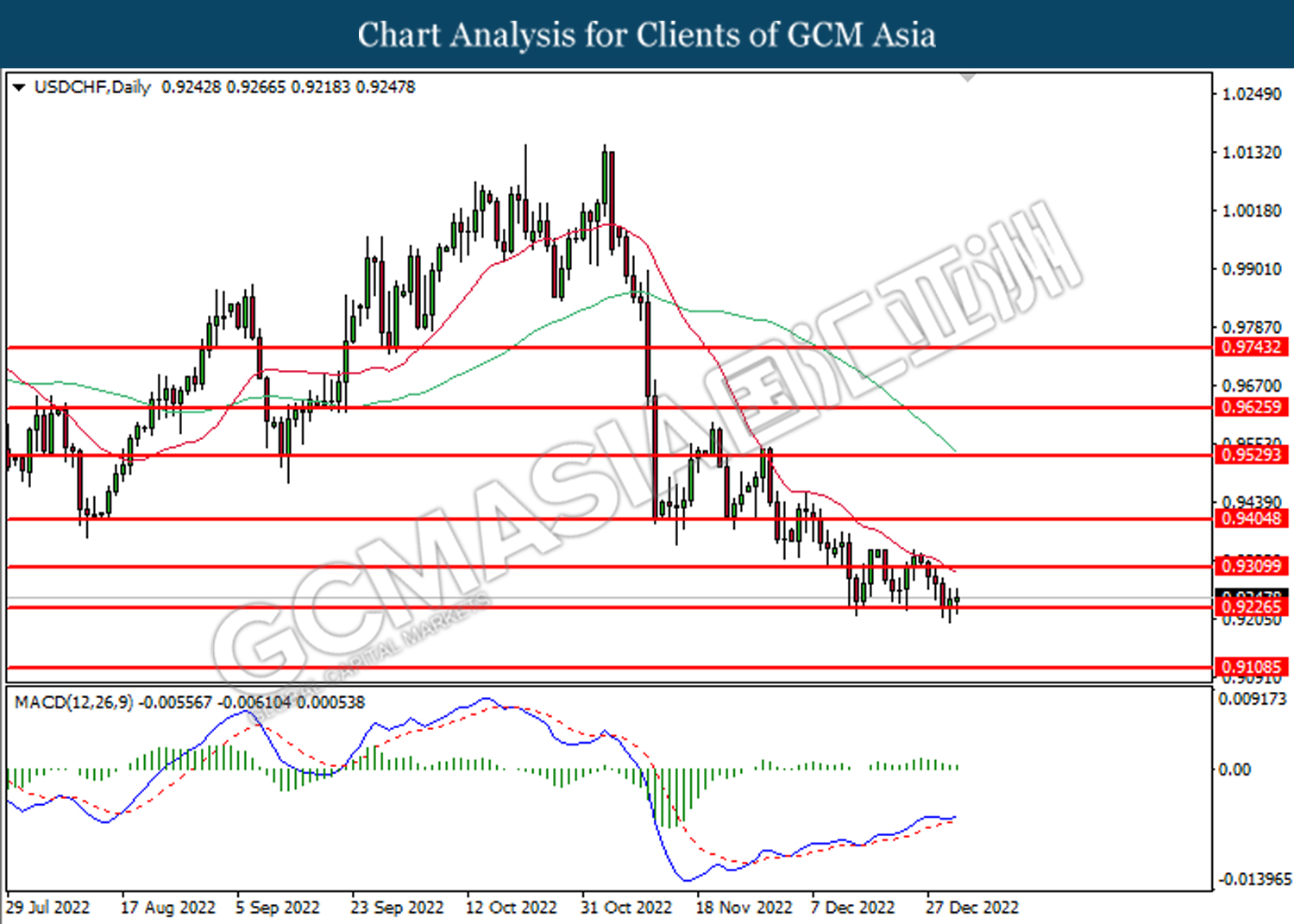

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level at 0.9225. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

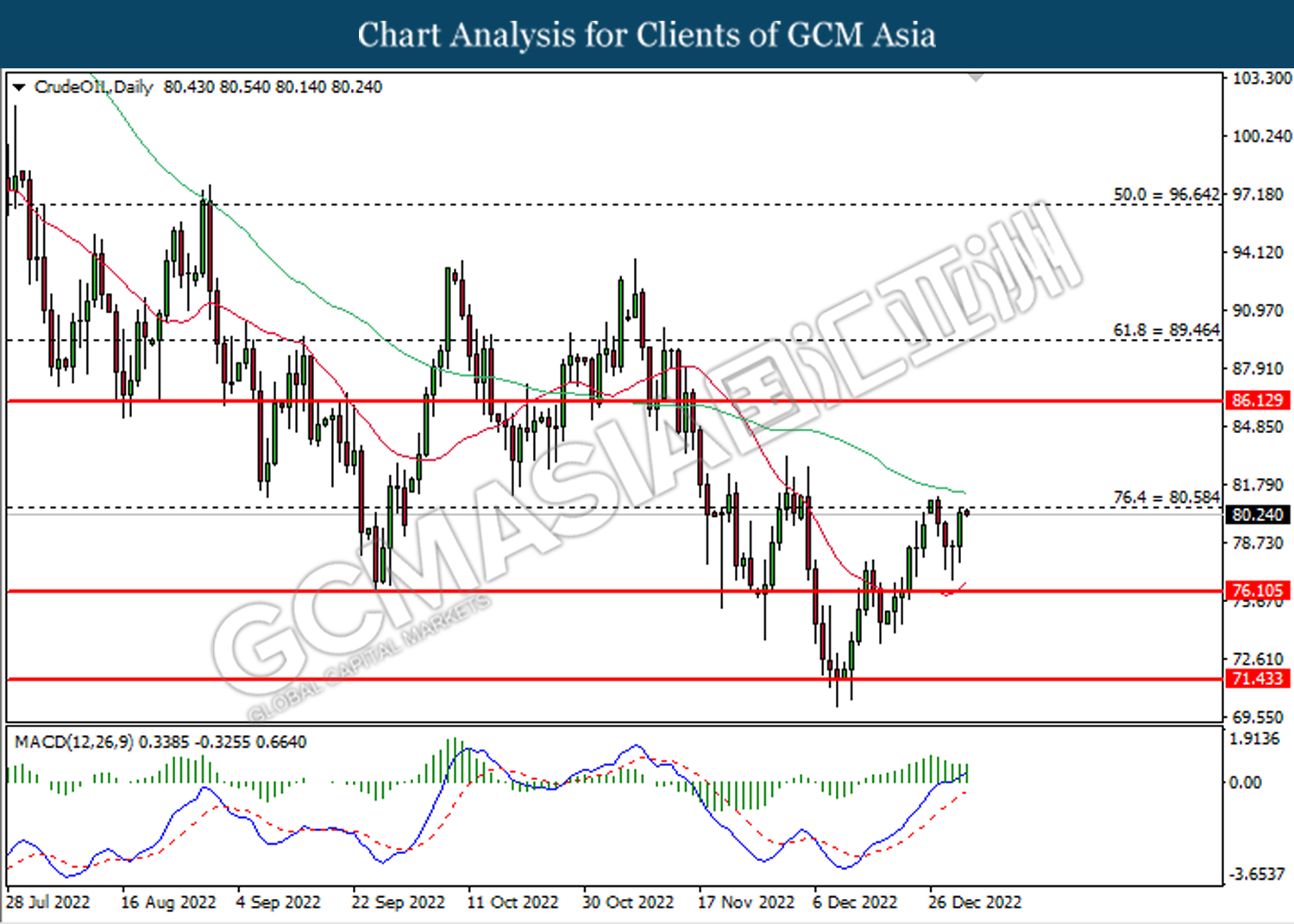

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 80.60. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 80.60, 86.15

Support level: 76.10, 71.45

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1807.85. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 1835.30.

Resistance level: 1835.30, 1869.85

Support level: 1807.85, 1786.00