03 February 2022 Afternoon Session Analysis

Euro surged amid spiking inflation reading.

The Euro surged over the backdrop of bullish economic data yesterday, spurring hopes for the European Central Bank to unleash their hawkish tone during the monetary policy meeting. According to Eurostat, Eurozone Consumer Price Index (CPI) notched up from the previous reading of 5.0% to 5.1%, exceeding the market forecast at 4.4%. The high inflation rate increases the odds for the ECB to increase their interest rates at 30 basis point by the end of the year, despite ECB insisted that any rate change is very unlikely. Contractionary monetary policy and rate hike will diminish the money circulation in the global financial market, spurring bullish momentum for the Euro. Nonetheless, market participants predicted that the ECB are almost certain to keep the policy unchanged, though they would still continue to scrutinize the latest updates with regards of the monetary policy statement to receive further trading signal. As of writing, EUR/USD appreciated by 0.03% to 1.1300.

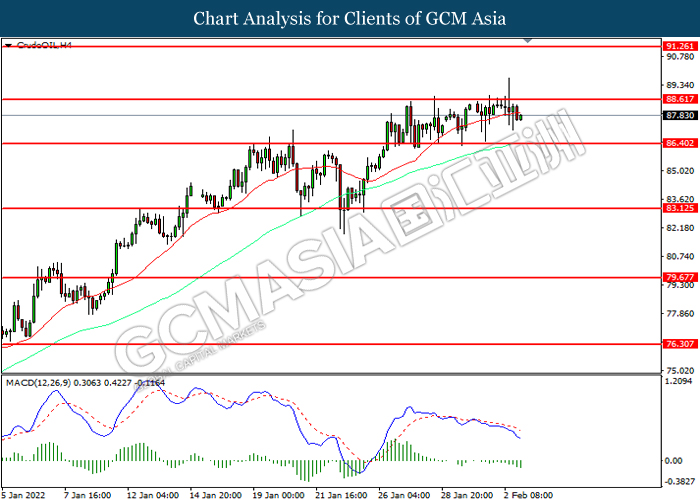

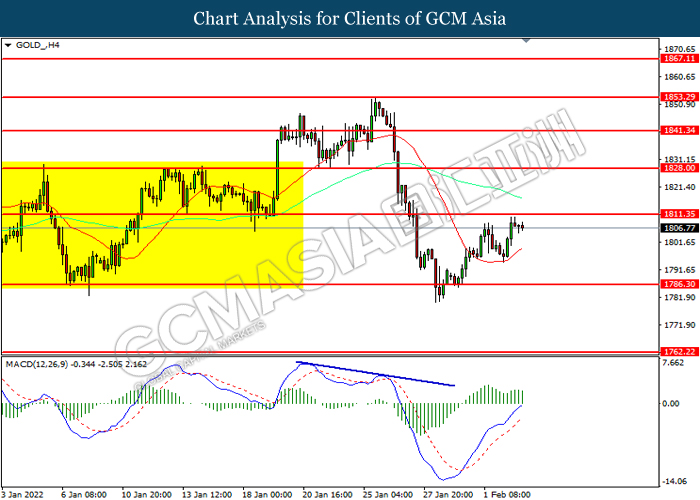

In the commodities market, the crude oil price surged 0.05% to $88.45 per barrel as of writing. The crude oil price edged higher over the backdrop of bullish inventory data. According to Energy Information Administration (EIA), US Crude Oil Inventories notched down from the previous reading of 2.377M to -1.046M, better than the market forecast at 1.525M. On the other hand, the gold price surged 0.02% to $1806.70 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:00 GBP BoE Inflation Report

20:00 GBP BoE MPC Meeting Minutes

20:45 EUR ECB Monetary Policy Statement

21:30 EUR ECB Press Conference

22:15 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Services PMI | 53.6 | 53.3 | – |

| 20:00 | GBP – BoE Interest Rate Decision (Feb) | 0.25% | 0.50% | – |

| 20:45 | EUR – ECB Interest Rate Decision | 0.00% | 0.00% | – |

| 21:30 | USD – Initial Jobless Claims | 260K | 245K | – |

| 23:00 | USD – ISM Non-Manufacturing PMI (Jan) | 62 | 59.5 | – |

Technical Analysis

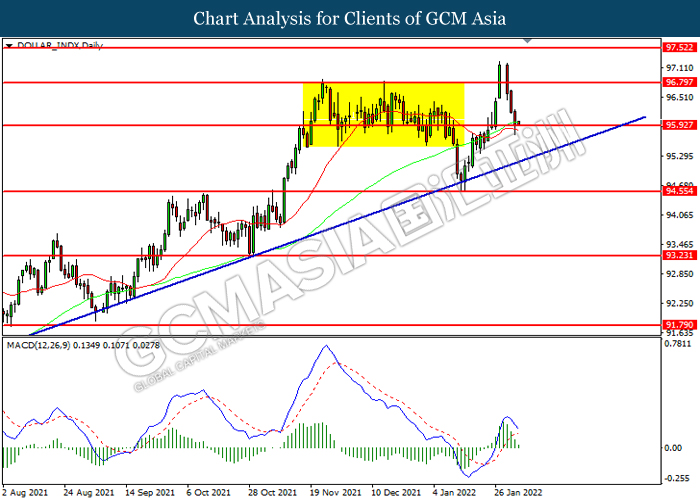

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 95.95. MACD which illustrated diminishing bullish momentum suggest the index to extend its losses after it successfully breakout below the support level.

Resistance level: 96.80, 97.50

Support level: 95.95, 94.55

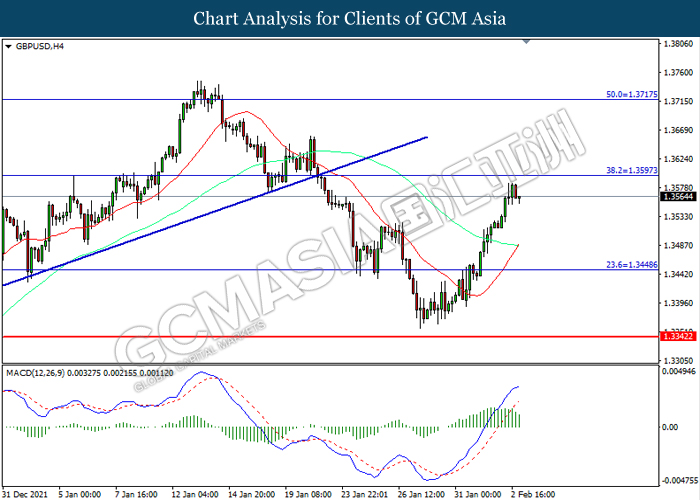

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.3595. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.3595, 1.3715

Support level: 1.3450, 1.3340

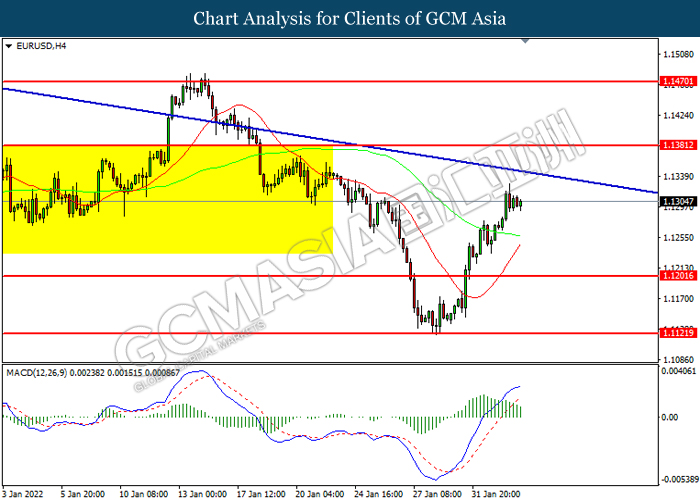

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.1200. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.1380, 1.1470

Support level: 1.1200, 1.1120

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level at 114.95. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 114.95, 115.65

Support level: 113.65, 112.85

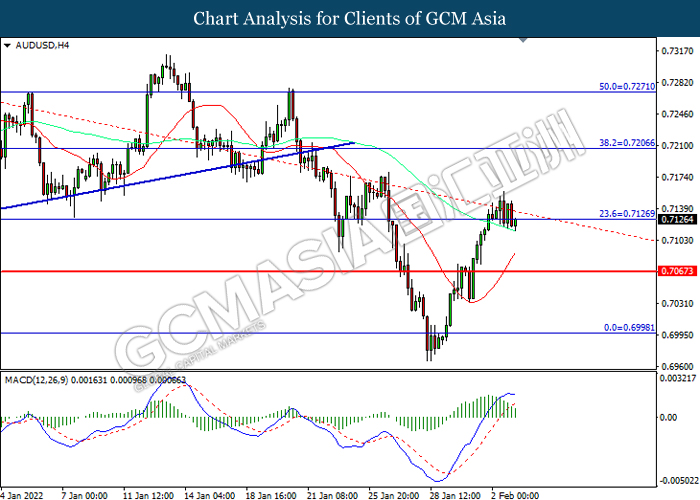

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.7125. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7065

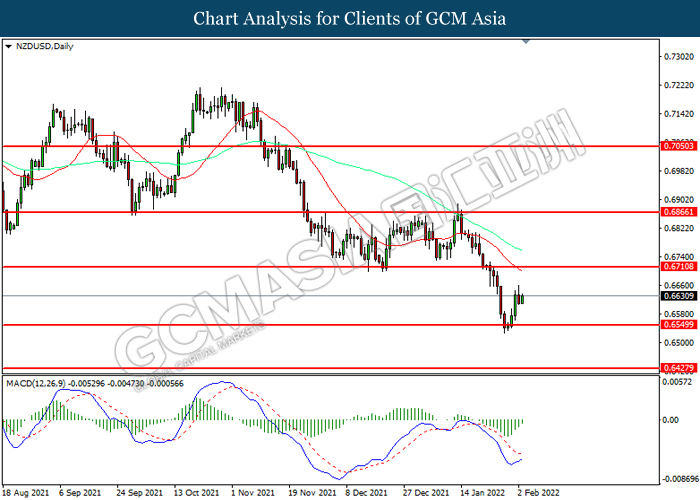

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.6550. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 0.6710.

Resistance level: 0.6710, 0.6865

Support level: 0.6550, 0.6430

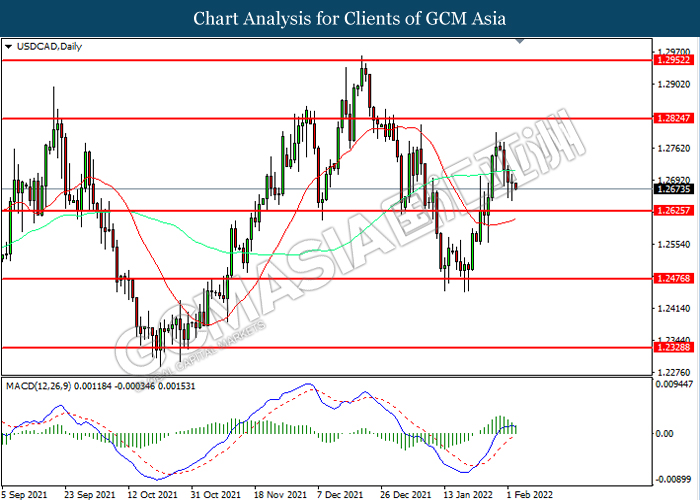

USDCAD, Daily: USDCAD was traded lower while currently near the support level at 1.2625. MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.2825, 1.2950

Support level: 1.2625, 1.2475

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9180. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9270, 0.9345

Support level: 0.9180, 0.9095

CrudeOIL, H1: Crude oil price was traded lower following prior retracement from the resistance level at 88.60. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level at 86.40.

Resistance level: 88.60, 91.25

Support level: 86.40, 83.15

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1811.35. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1811.35, 1828.00

Support level: 1786.30, 1762.20