3 February 2022 Morning Session Analysis

ADP slumps as Omicron spreads.

Greenback extended its retracement from higher levels following the release of private sector employment data. Last month, ADP Nonfarm Employment Change decreased by -301,000, significantly lower than forecast of 207,000. Job losses were noticeable across all sector and most prominent in the services sector. The report highlighted the impact of Omicron variant which begins to spread rapidly during late of December 2021. However, economists expect negative impact from Omicron to persist in the short-term and employment market may rebound in the mid-term. Likewise, market reaction towards the data were limited due as Federal Reserve is expected to raise interest rates regardless in order to curb rising inflation in the US. As of writing, the dollar index was down by 0.02% to 95.93.

For the commodities market, crude oil price was down by 0.59% to $87.80 per barrel after Saudi Arabia and Kuwait announce plans to raise oil output in the Neutral Zone. On the other hand, gold price was up by 0.02% to $1,807.10 a troy ounce due to weaker greenback.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:00 GBP BoE Inflation Report

20:00 GBP BoE MPC Meeting Minutes

20:45 EUR ECB Monetary Policy Statement

21:30 EUR ECB Press Conference

22:15 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Services PMI | 53.6 | 53.3 | – |

| 20:00 | GBP – BoE Interest Rate Decision (Feb) | 0.25% | 0.50% | – |

| 20:45 | EUR – ECB Interest Rate Decision | 0.00% | 0.00% | – |

| 21:30 | USD – Initial Jobless Claims | 260K | 245K | – |

| 23:00 | USD – ISM Non-Manufacturing PMI (Jan) | 62 | 59.5 | – |

Technical Analysis

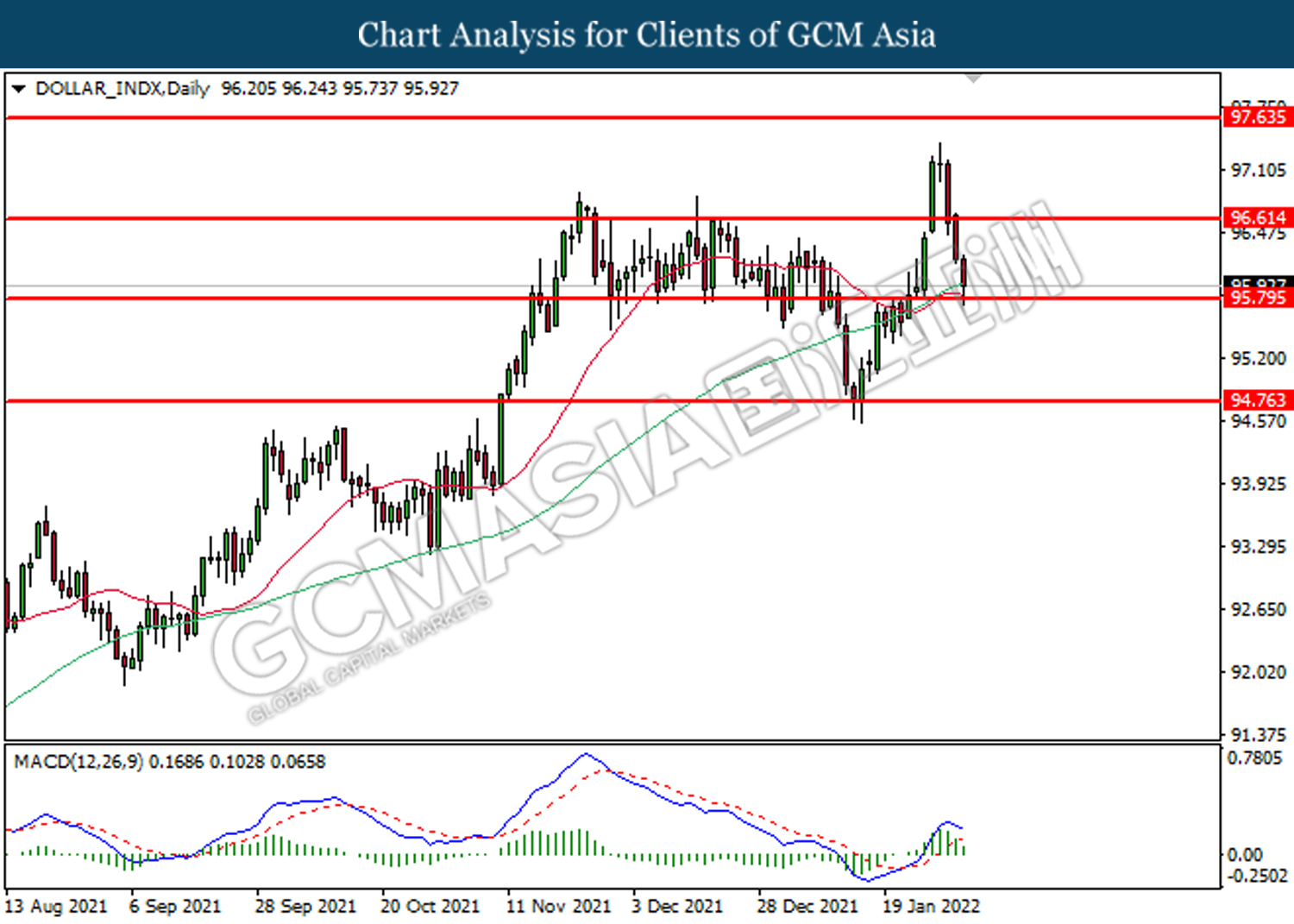

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retrace from higher levels. MACD which illustrate diminished bullish signal suggests the index to be traded lower after breaking its support level.

Resistance level: 96.60, 97.65

Support level: 95.80, 94.75

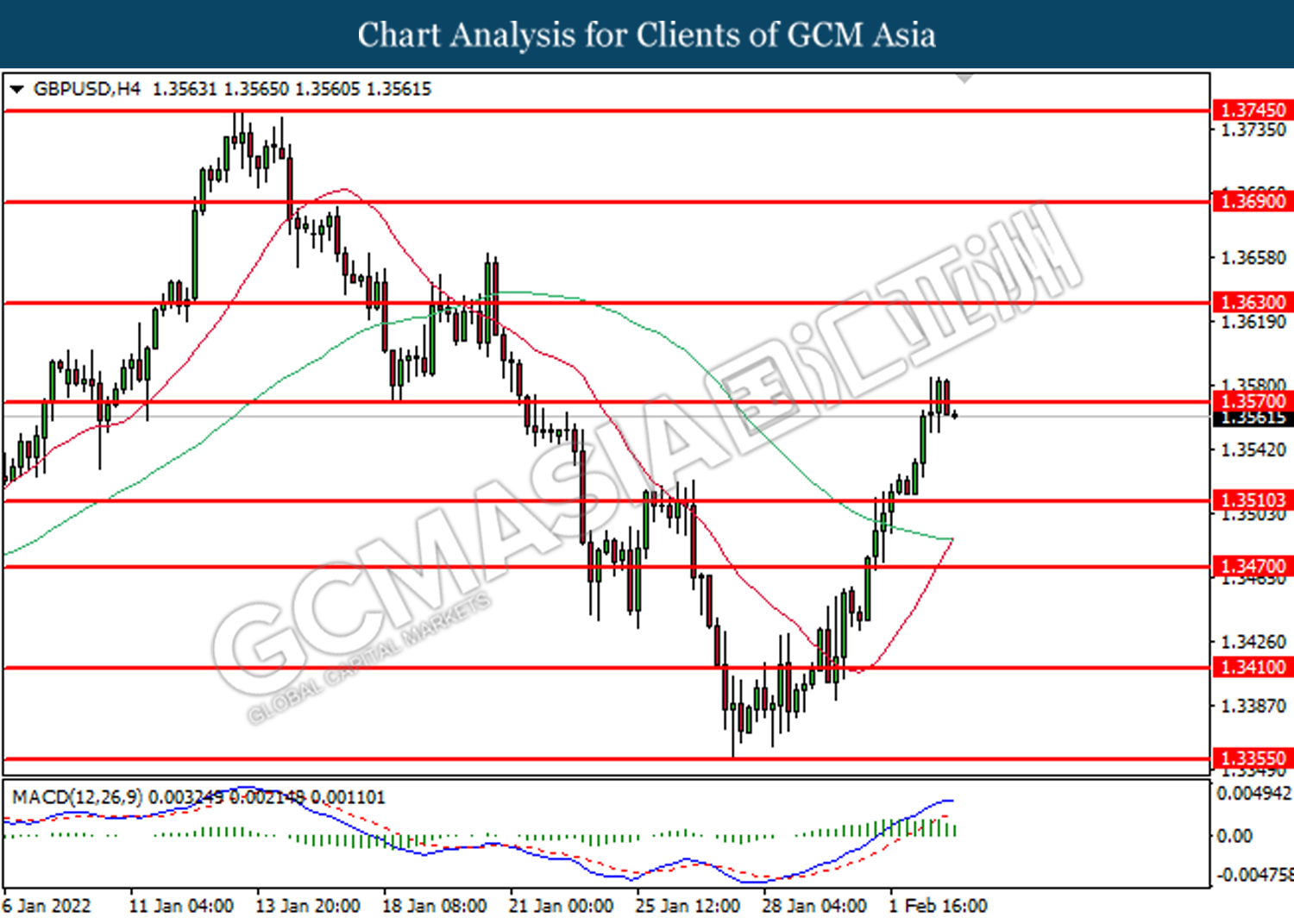

GBPUSD, H4: GBPUSD was traded higher following prior rebound from lower level. However, MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.3570, 1.3630

Support level: 1.3510, 1.3470

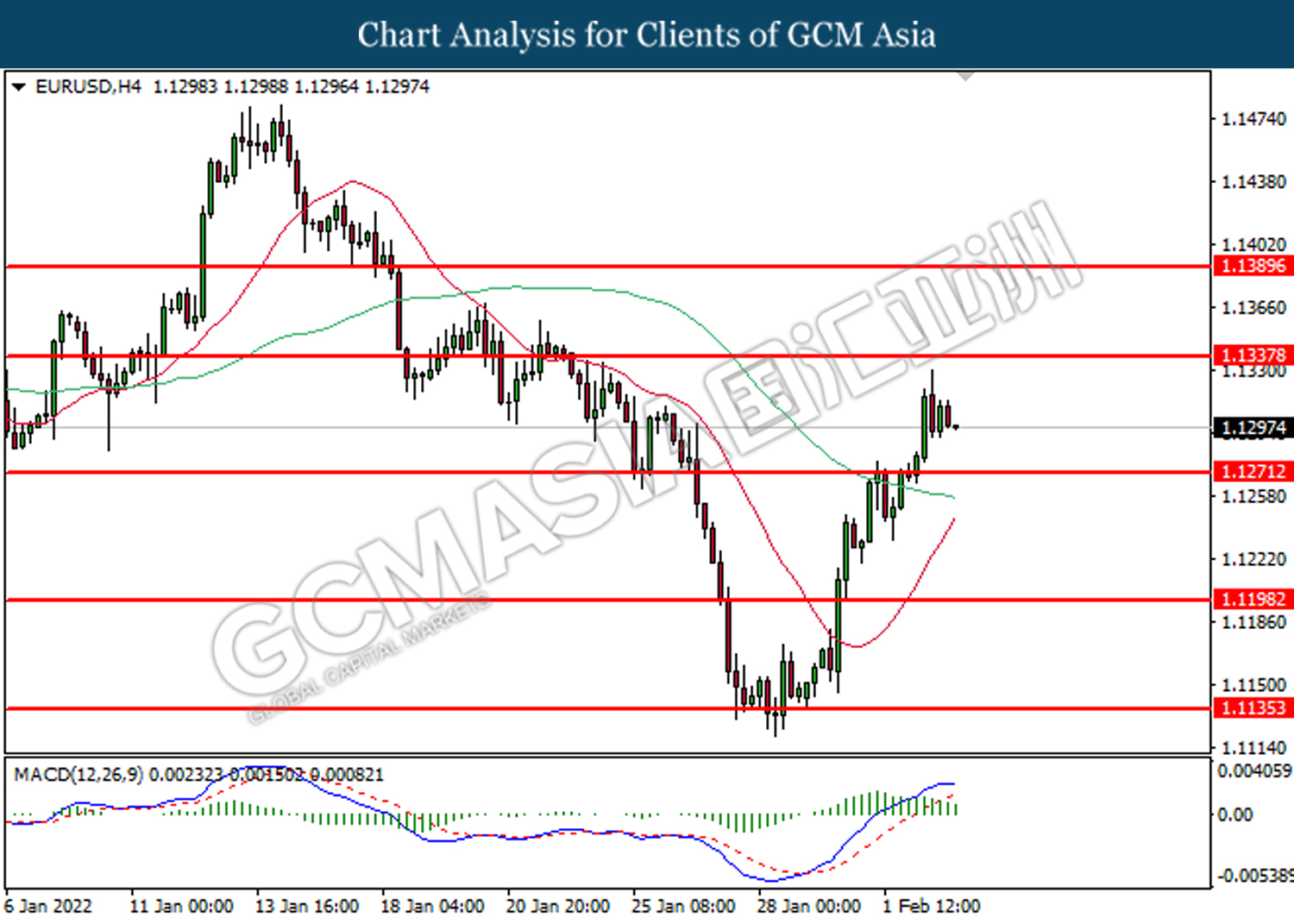

EURUSD, H4: EURUSD was traded higher following prior rebound from lower level. However, MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.1340, 1.1390

Support level: 1.1270, 1.1200

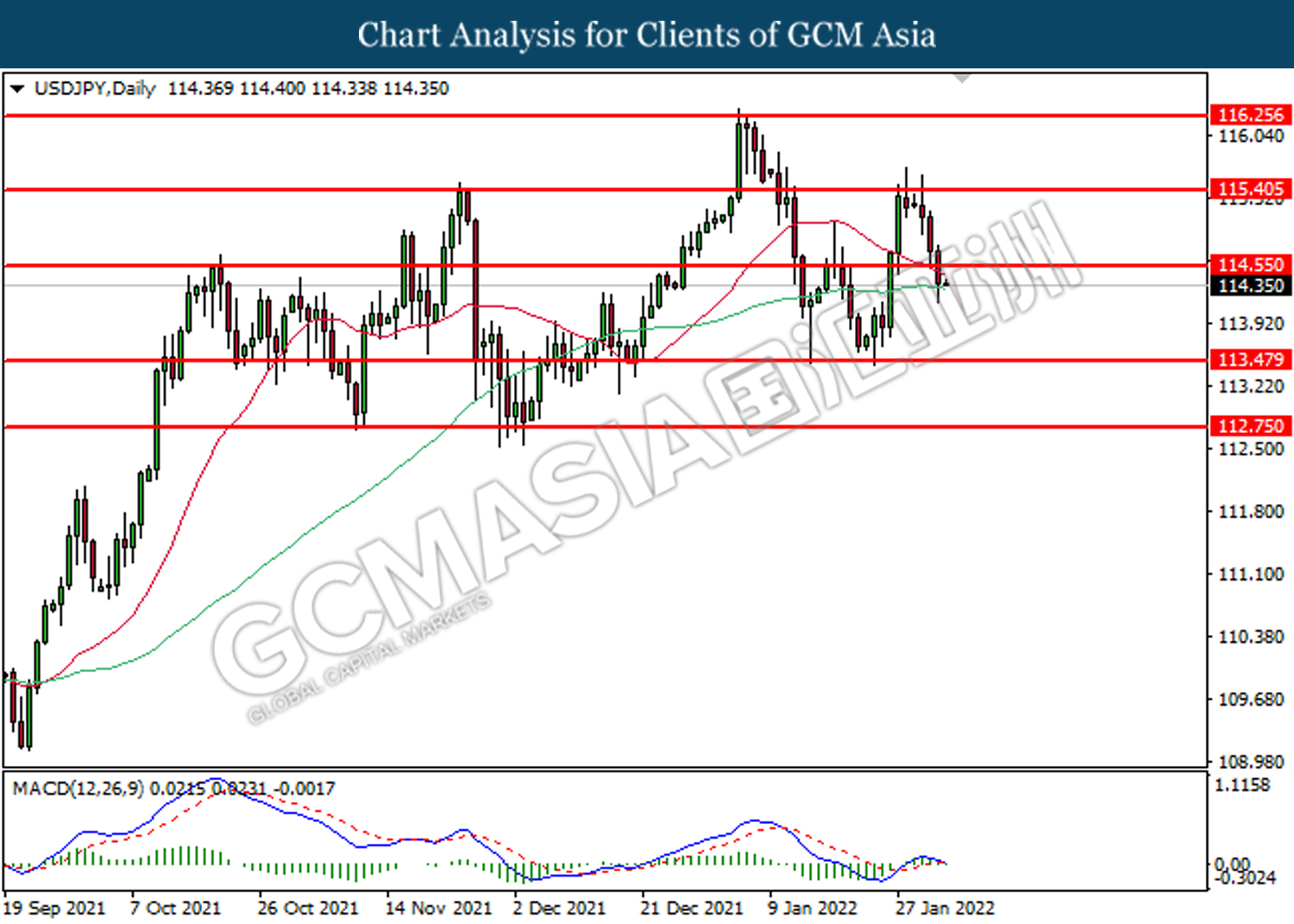

USDJPY, Daily: USDJPY was traded lower following prior retrace from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 114.55, 115.50

Support level: 113.50, 112.75

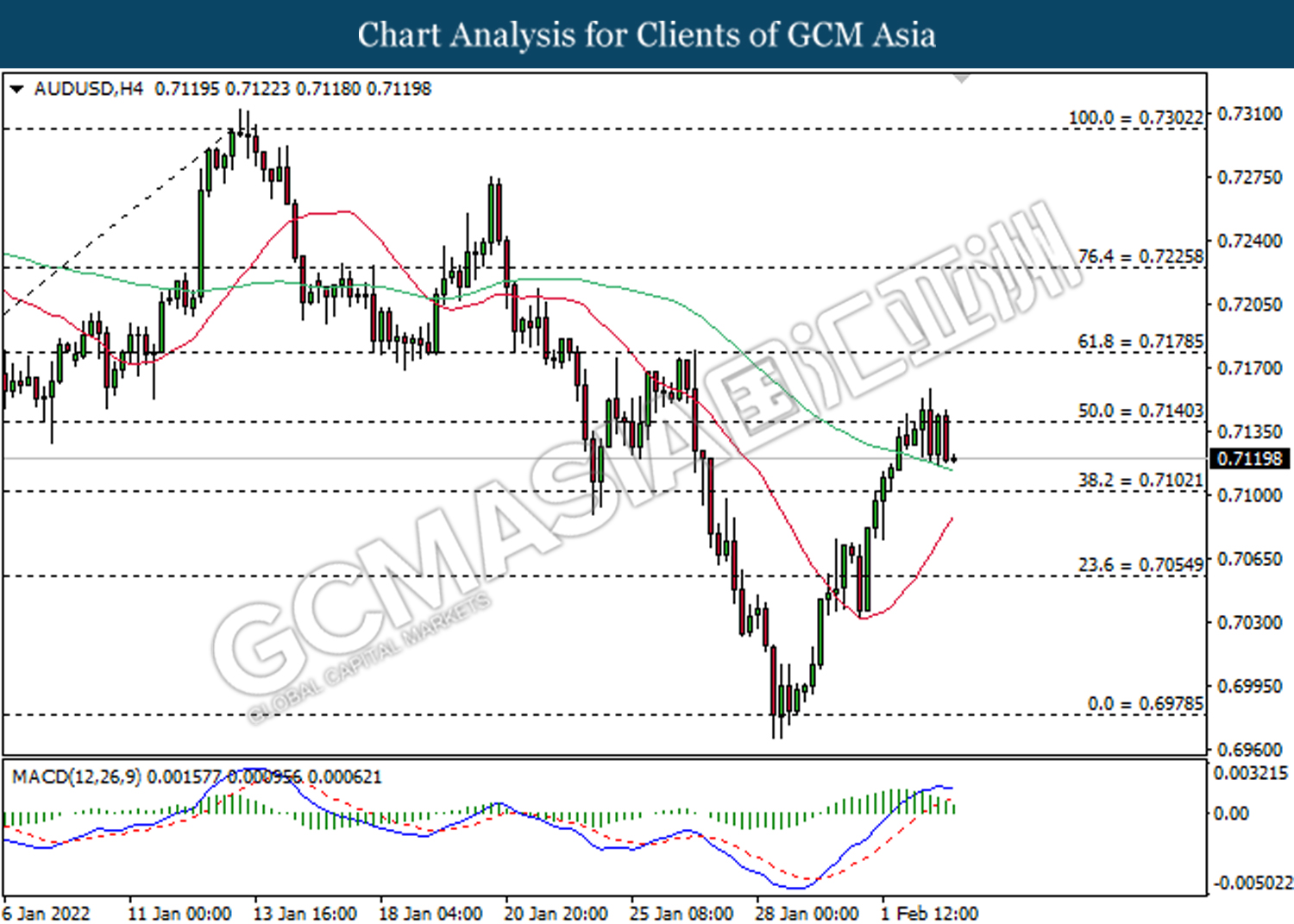

AUDUSD, H4: AUDUSD was traded higher following prior rebound from lower level. However, MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.7140, 0.7180

Support level: 0.7100, 0.7055

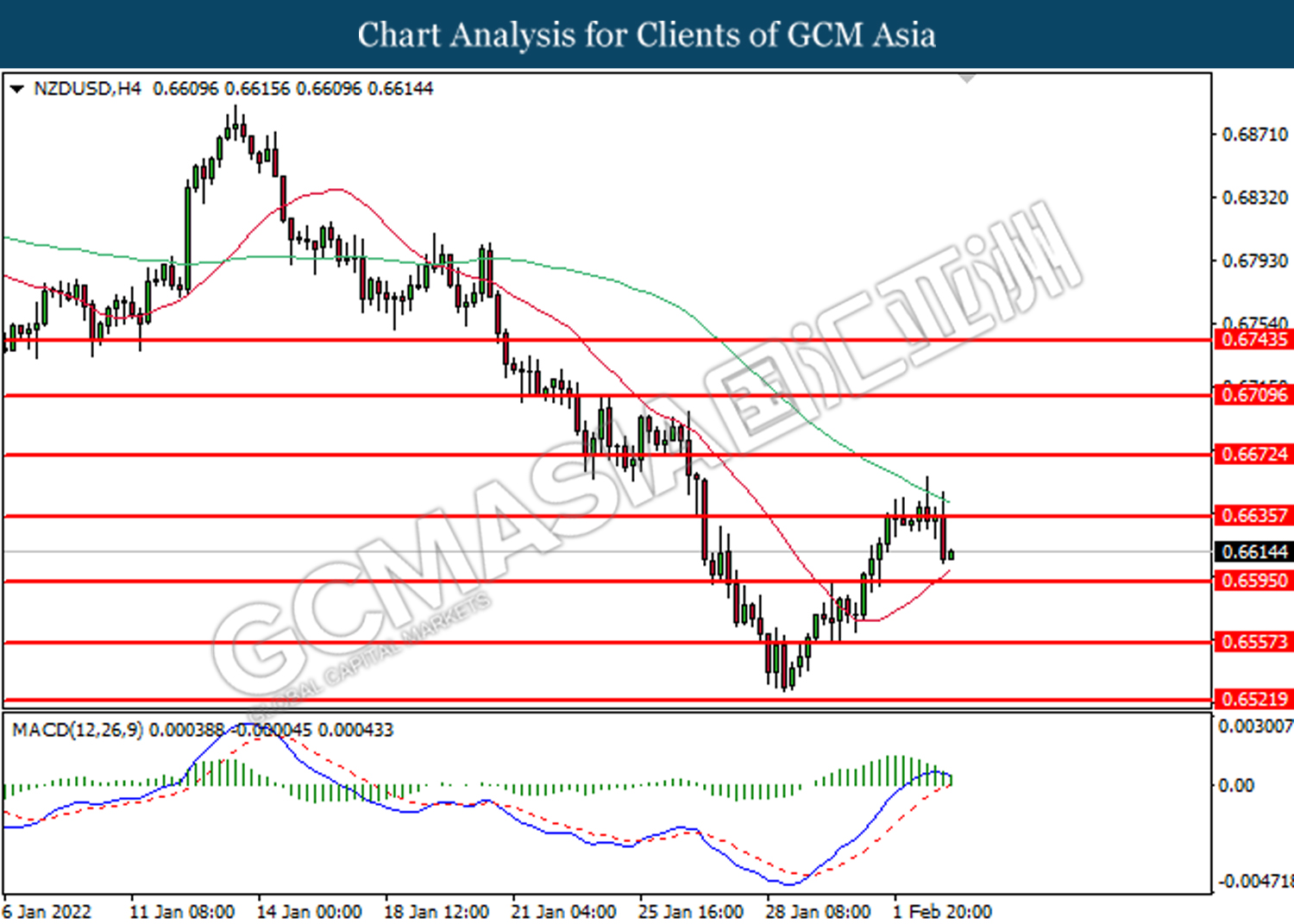

NZDUSD, H4: NZDUSD was traded higher following prior rebound from lower levels. However, MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6635, 0.6670

Support level: 0.6695, 0.6560

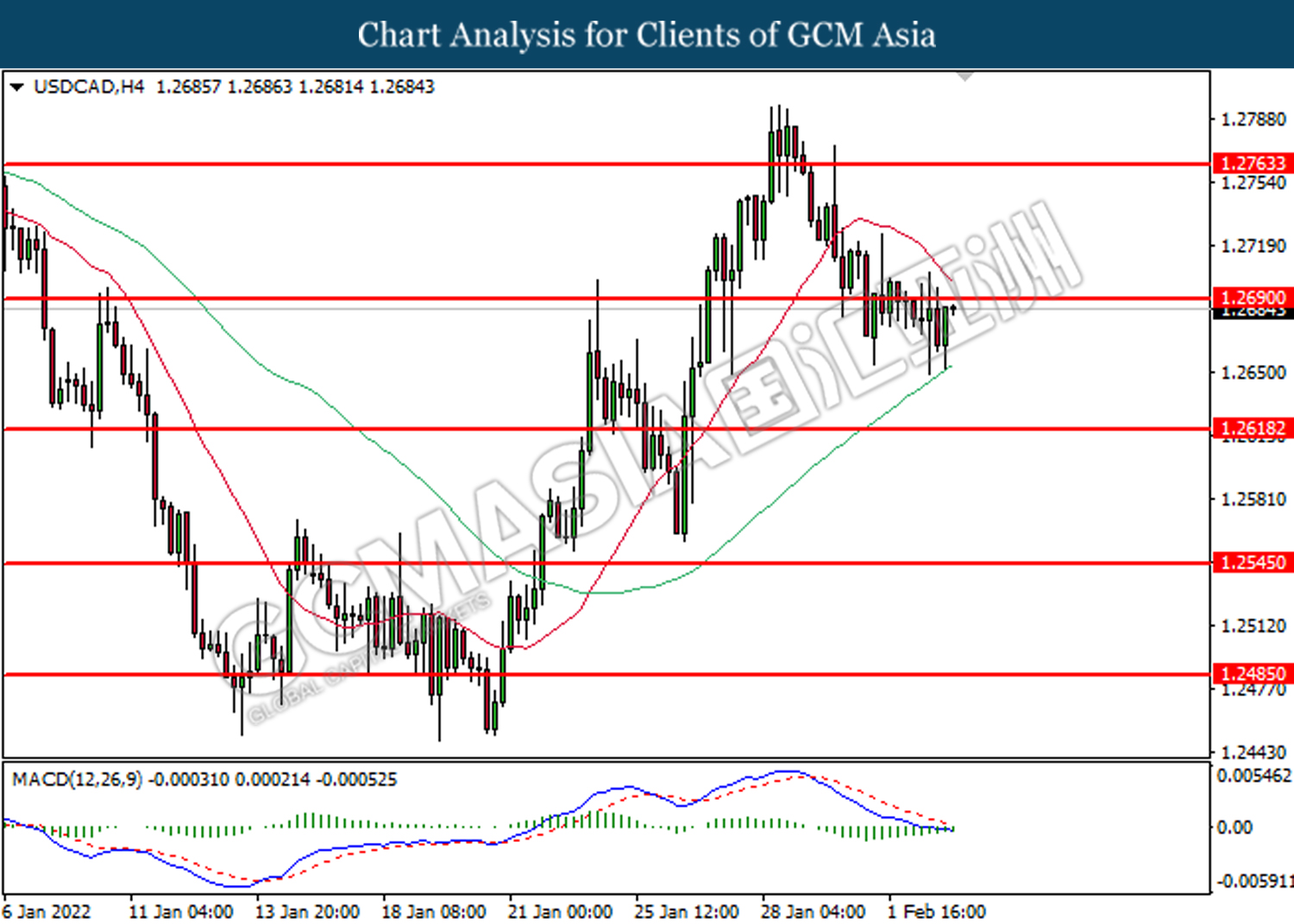

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish momentum suggests the pair to be traded higher after breaking its resistance level

Resistance level: 1.2690, 1.2765

Support level: 1.2620, 1.2545

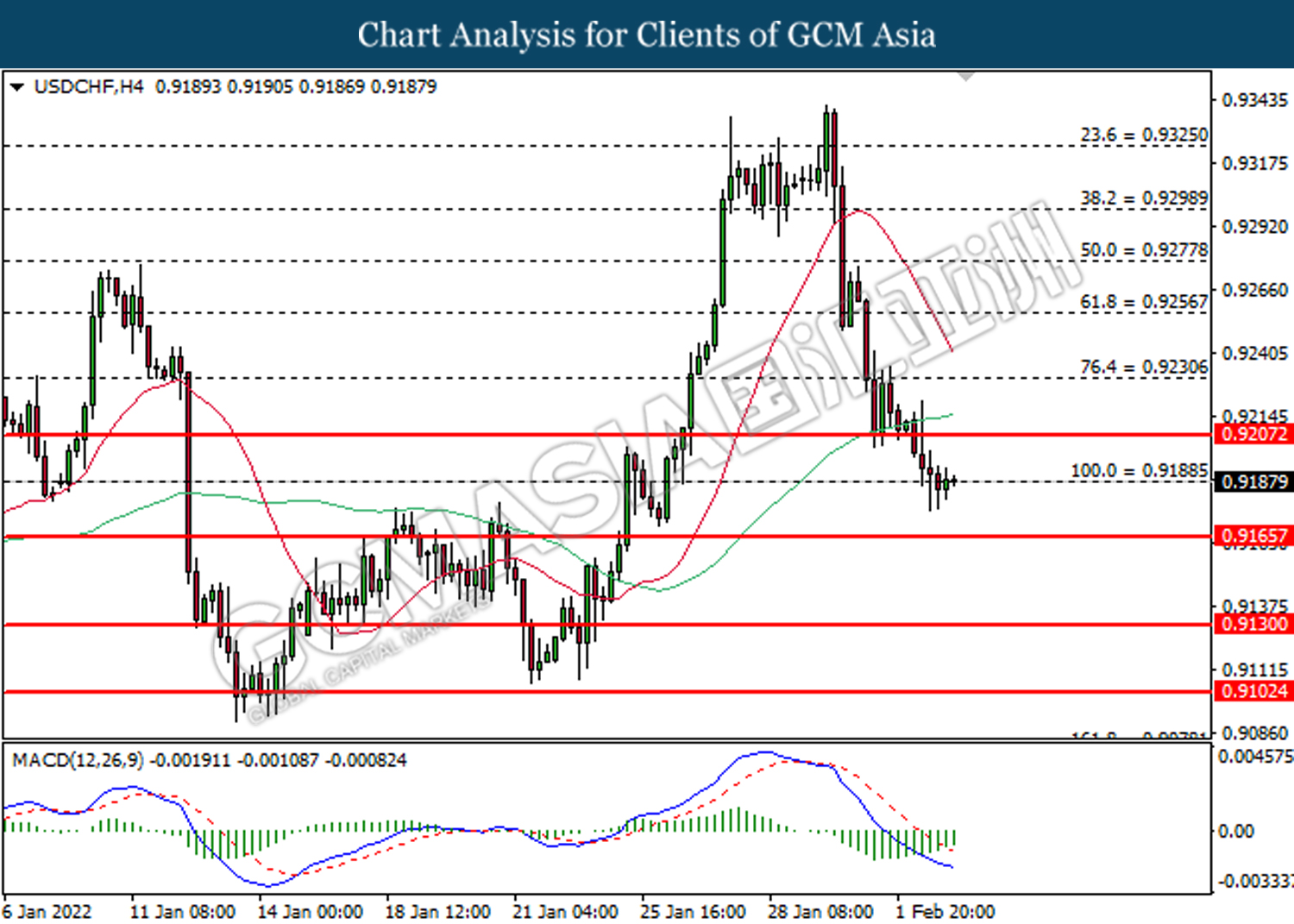

USDCHF, H4: USDCHF was traded lower following prior retracement from higher levels. However, MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9210, 0.9230

Support level: 0.9190, 0.9165

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests its price to be traded higher in short-term.

Resistance level: 89.50, 91.00

Support level: 87.40, 84.60

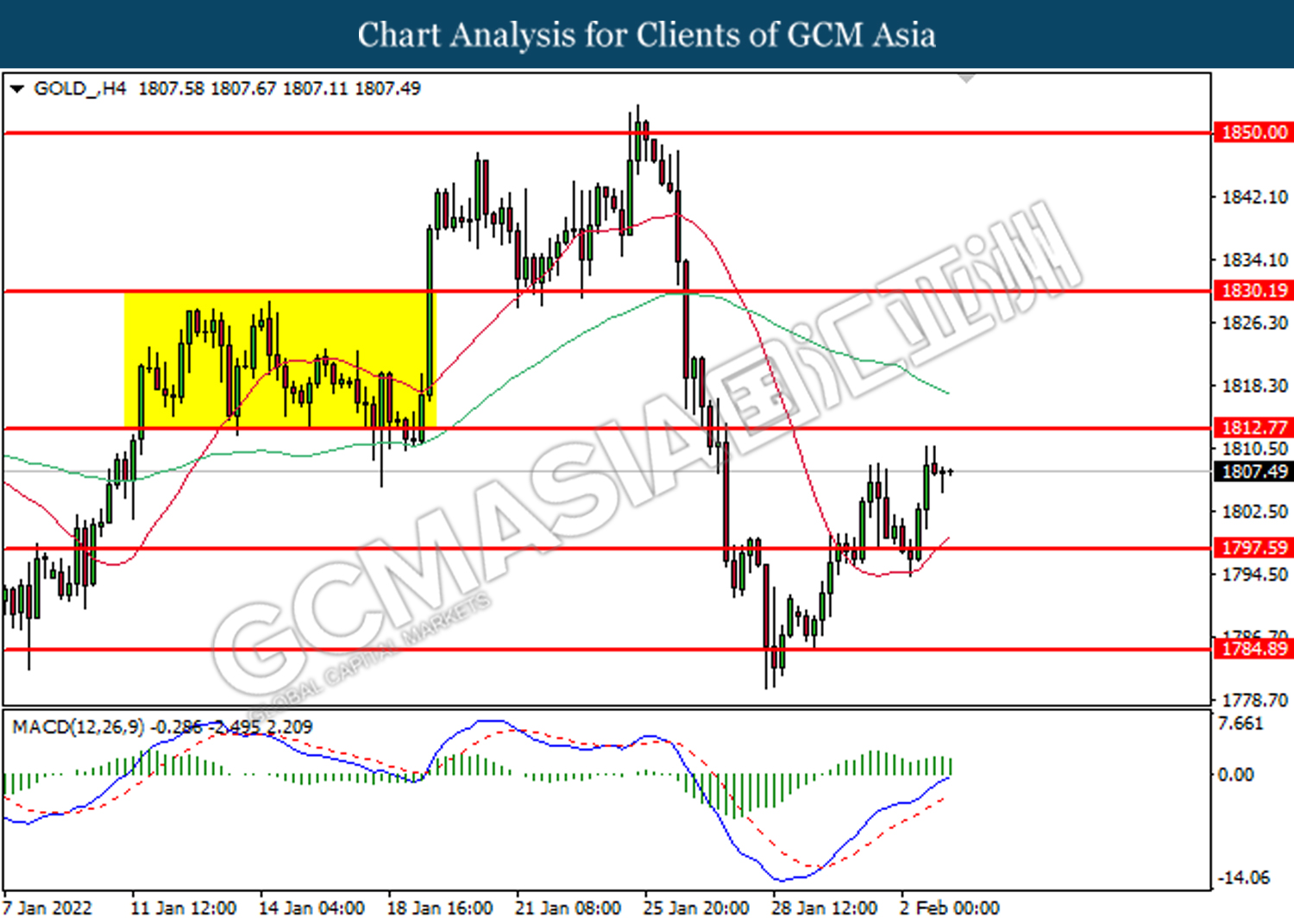

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher after breaking the resistance level.

Resistance level: 1812.80, 1830.20

Support level: 1797.60, 1784.90