3 February 2023 Afternoon Session Analysis

BoE hikes rates but sterling slumps.

The pound sterling paired with the dollar fall back toward $1.2200 after the interest rate decision by the Bank of England, the central bank of the UK. The BoE’s rate hike was in line with market expectations, where it raised its interest rate by 50 basis points to 4.00%. However, this rate hike did not let the pound break its highest level since June 2022. In the monetary policy decision communique by BoE, Andrew Bailey – the president of the central bank, commented that inflation has probably peaked. However, as the prices of goods and services in the UK and the global supply chain have started to ease, it increased the market expectation that the BoE might start to slow down its aggressive rate hike plan. Besides, the sharp decline in the pound market was also boosted by the strengthening of the dollar. The dollar regained its luster following the upbeat economic data released by the US Department of Labor. According to the report, the US initial Jobless claims hit 183K, which is lower than the previous reading 186kas well as the consensus expectation of 200k. As of writing, the GBP/USD depreciated -0.12% to $1.2208.

In the commodity market, the crude oil price rebounded by 0.01% to $75.89 per barrel after a sharp decline throughout the overnight trading session as the market concern on rate hike side effects kept hovering in the market. In addition, the gold price dropped by -0.01% to $1930.55 per troy ounce as of writing amid the strengthening of the US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

|

Time |

Nation & Data | Previous | Forecast | Actual |

| 17:30 |

GBP – Composite PMI (Jan) |

47.8 | 47.8 | – |

| 17:30 | GBP – Services PMI (Jan) | 48 | 48 | – |

| 21:30 | USD – Nonfarm Payrolls (Jan) | 223K | 185K | – |

| 21:30 | USD – Unemployment Rate (Jan) | 3.50% | 3.60% | – |

| 23:00 | USD – ISM Non-Manufacturing PMI (Jan) | 49.6 | 50.3 |

– |

Technical Analysis

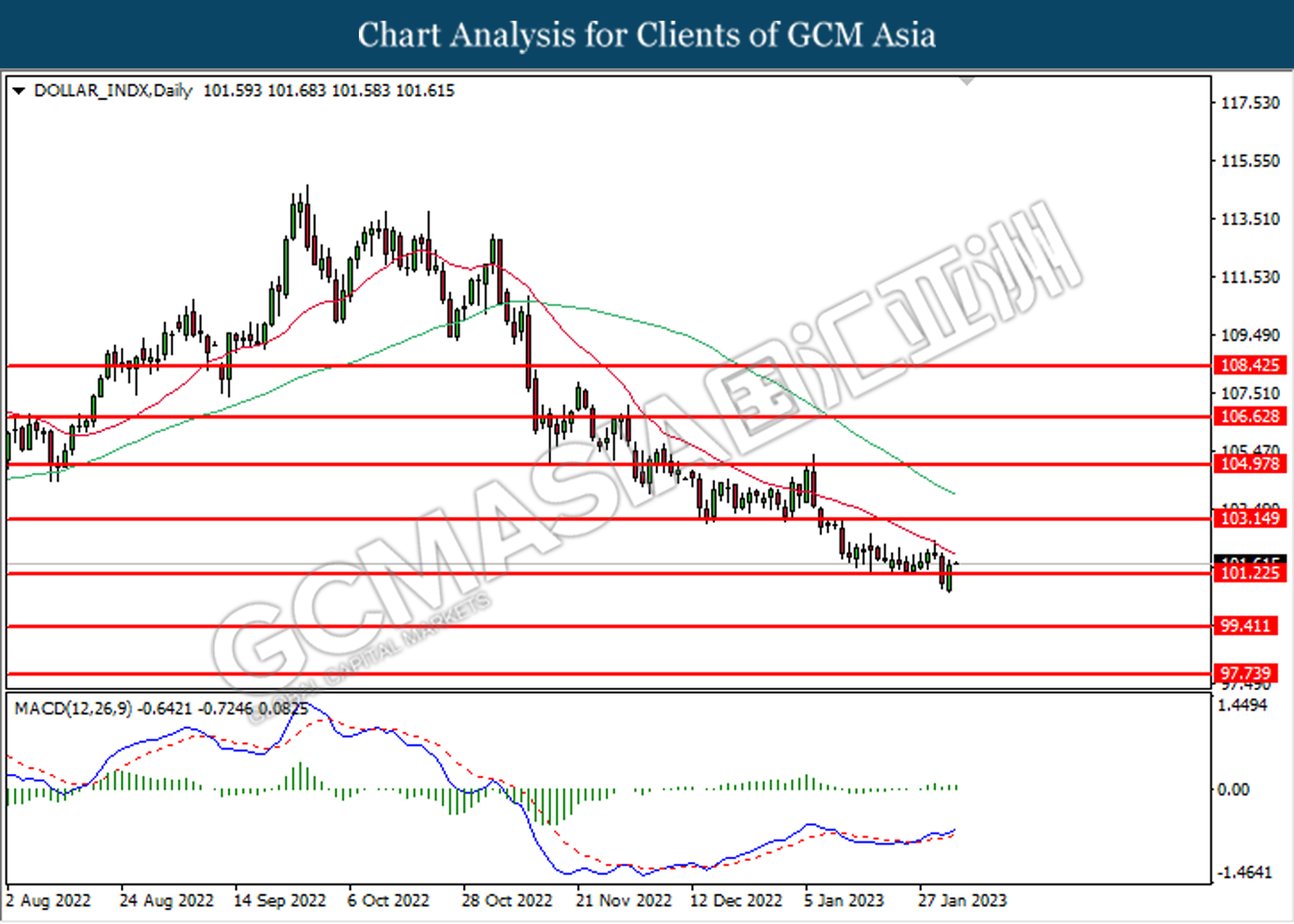

DOLLAR_INDX, Daily: Dollar index was traded higher following a prior breakout above the previous resistance level at 101.20. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 103.15.

Resistance level: 103.15, 105.00

Support level: 101.20, 99.40

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2200. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2345, 1.2470

Support level: 1.2200, 1.2105

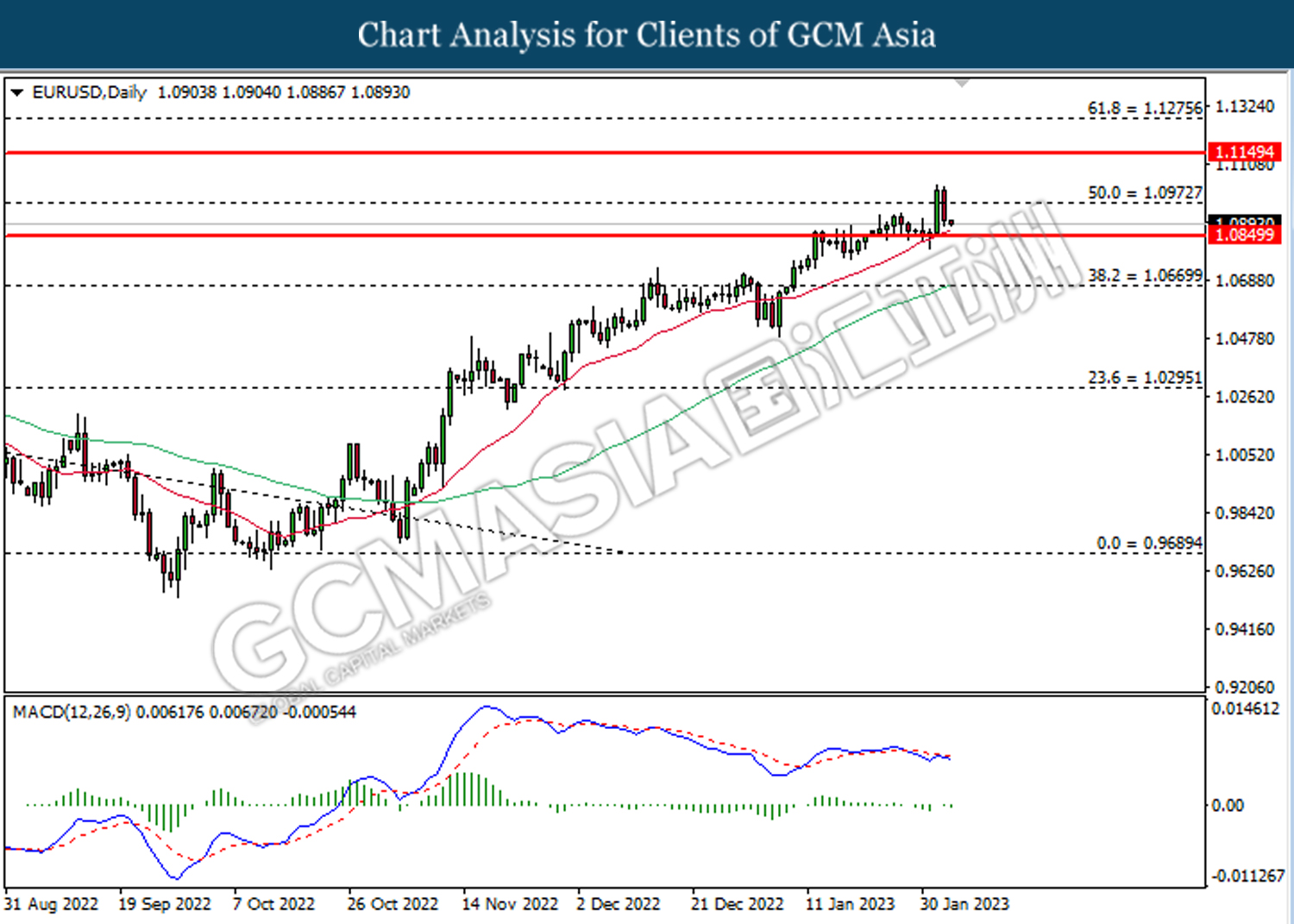

EURUSD, Daily: EURUSD was traded lower following a prior breakout below the previous support level at 1.0975. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.0850.

Resistance level: 1.0975, 1.1150

Support level: 1.0845, 1.0670

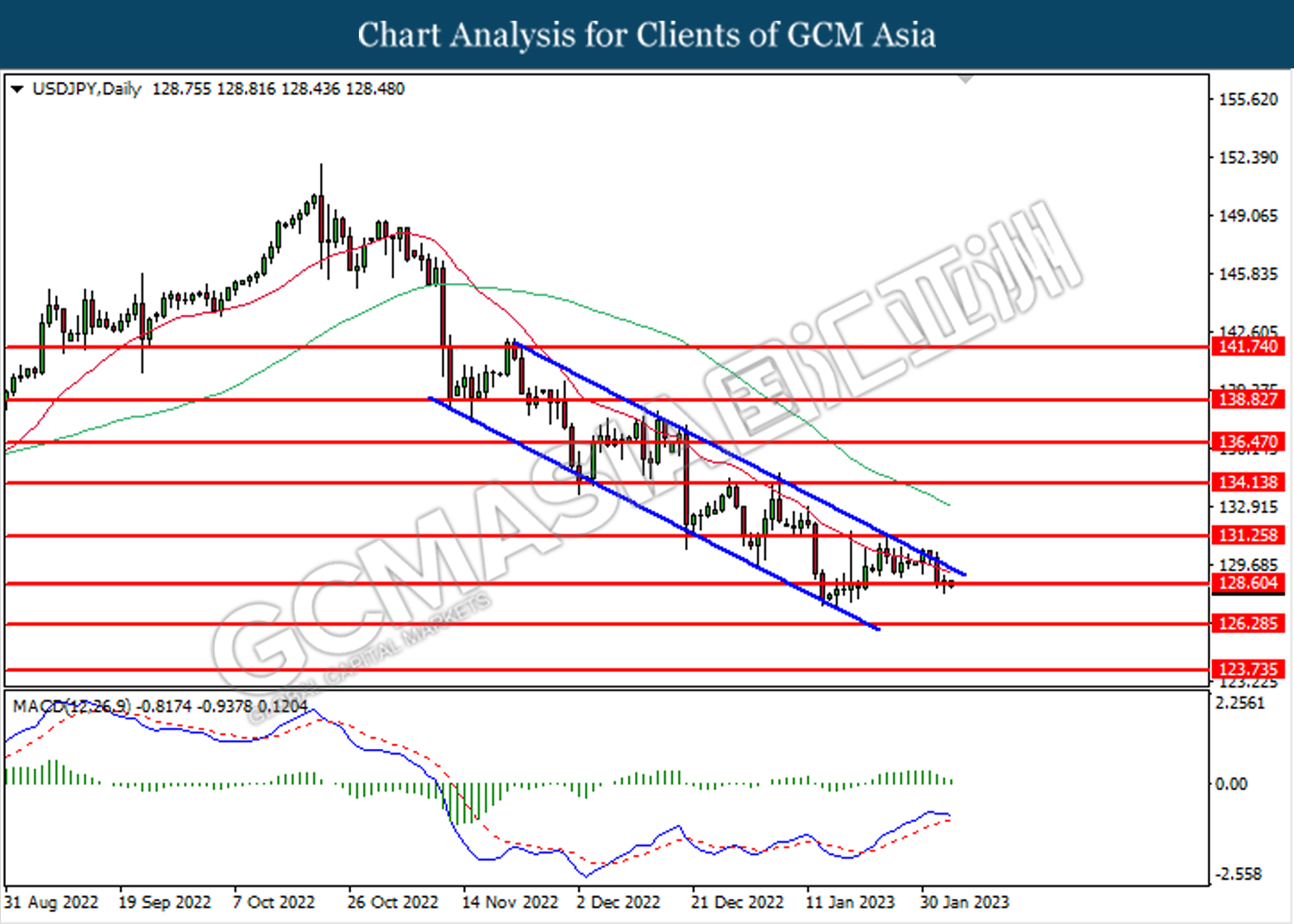

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 128.60. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level at 128.60.

Resistance level: 131.25, 134.15

Support level: 128.60, 126.30

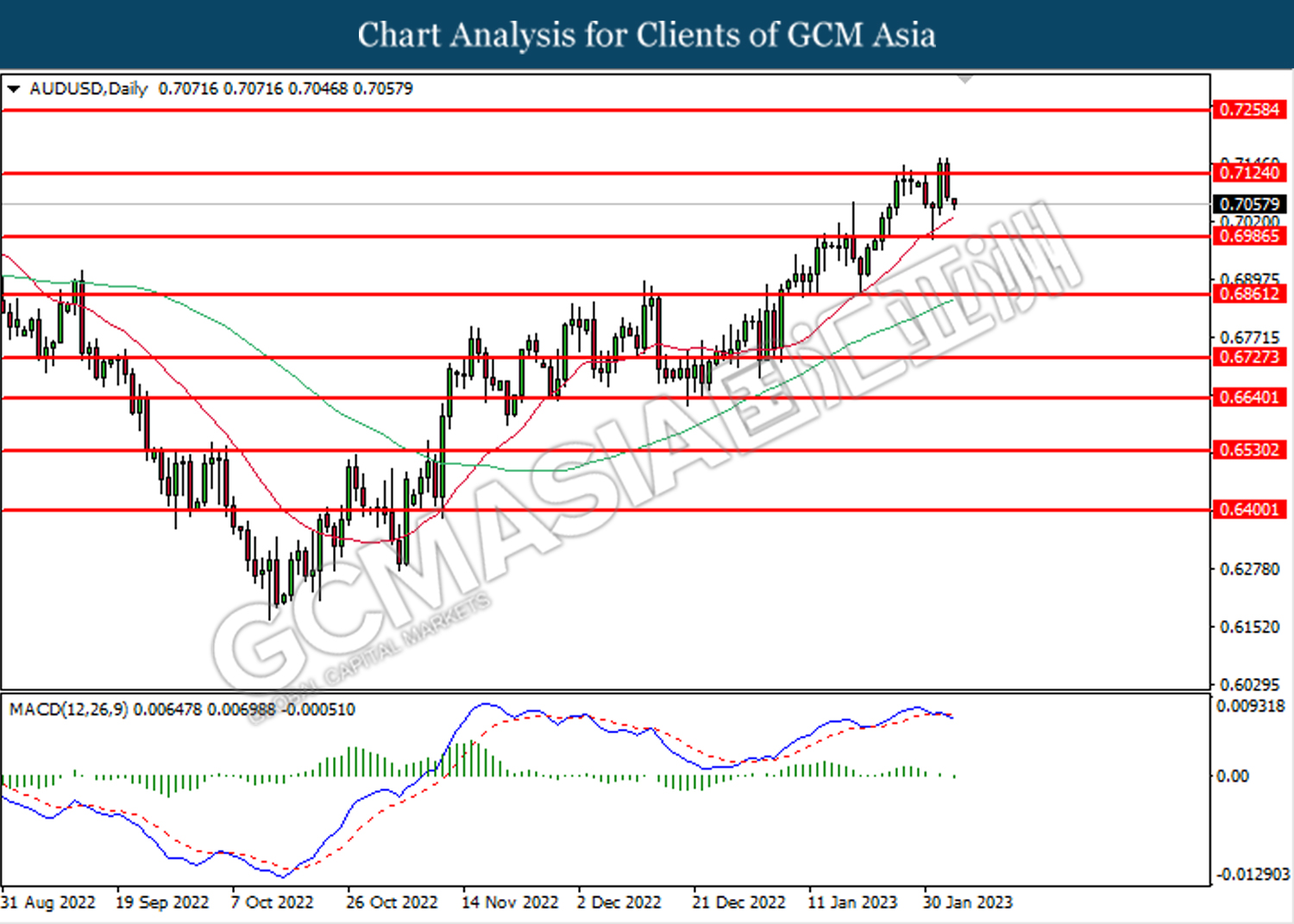

AUDUSD, Daily: AUDUSD was traded lower following the prior retracement from the resistance level at 0.7125. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 0.6985.

Resistance level: 0.7125, 0.7260

Support level: 0.6985, 0.6725

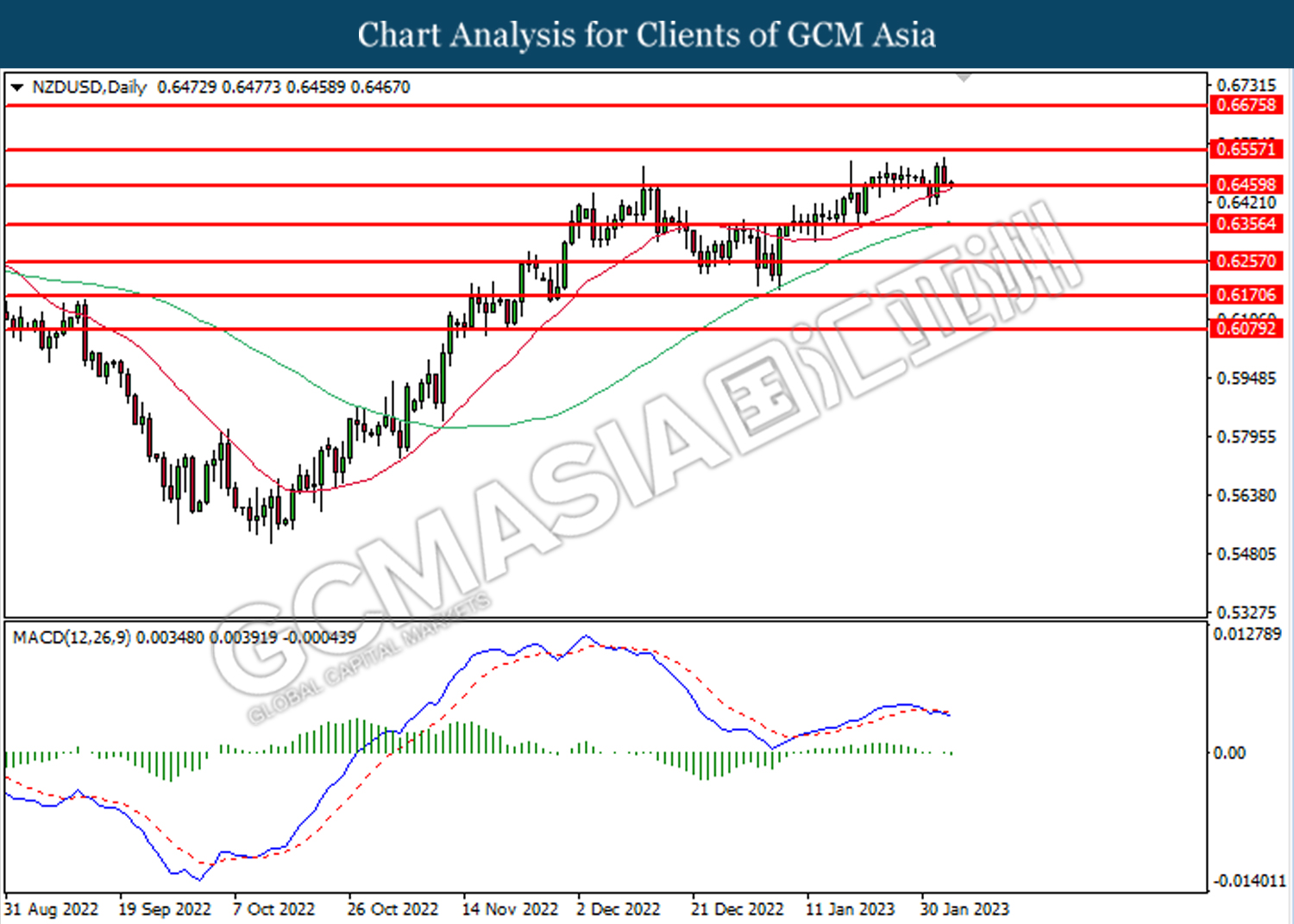

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6460. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6555, 0.6675

Support level: 0.6460, 0.6355

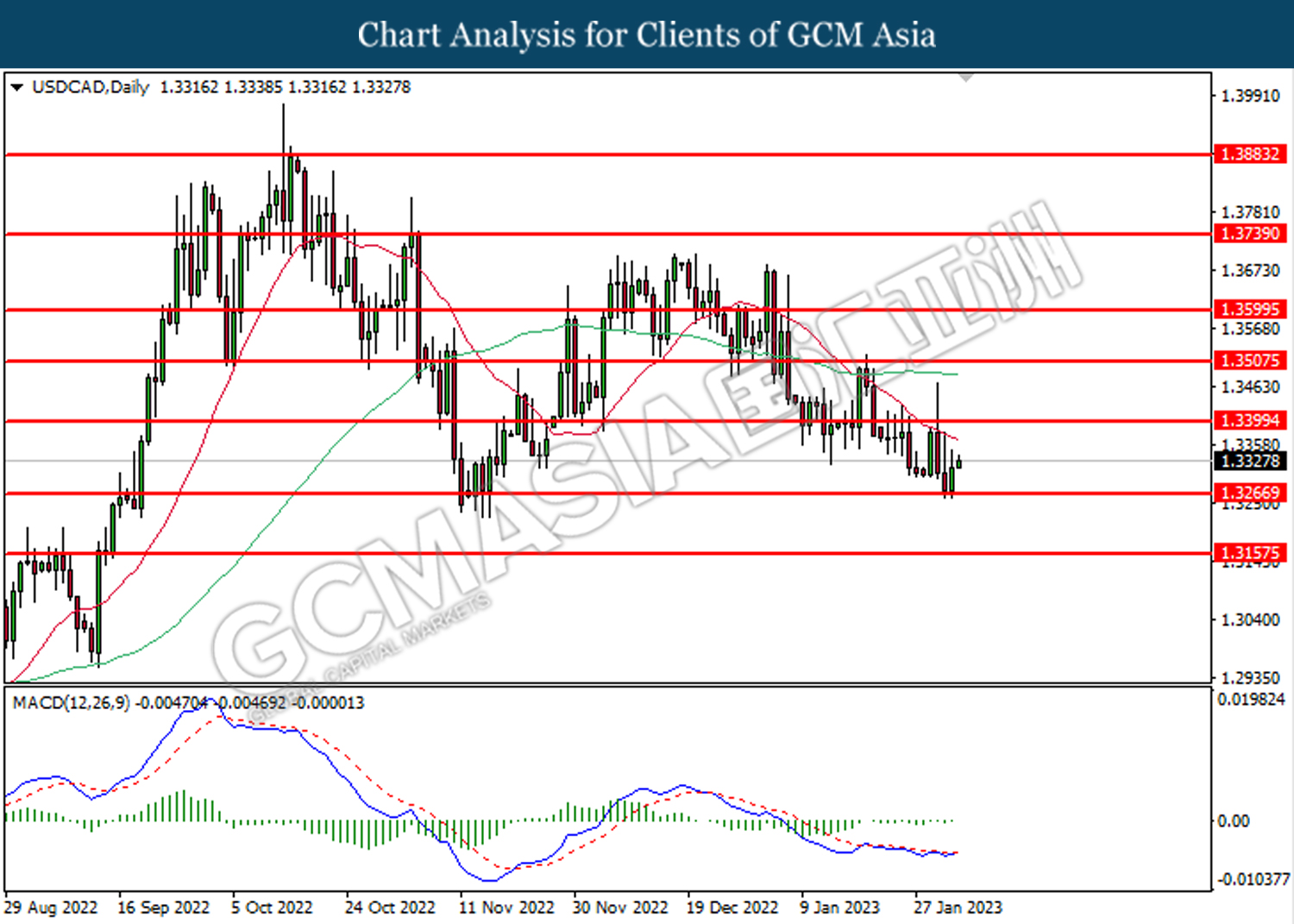

USDCAD, Daily: USDCAD was traded higher following a prior rebound from the support level at 1.3265. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3400.

Resistance level: 1.3400, 1.3505

Support level: 1.3265, 1.3155

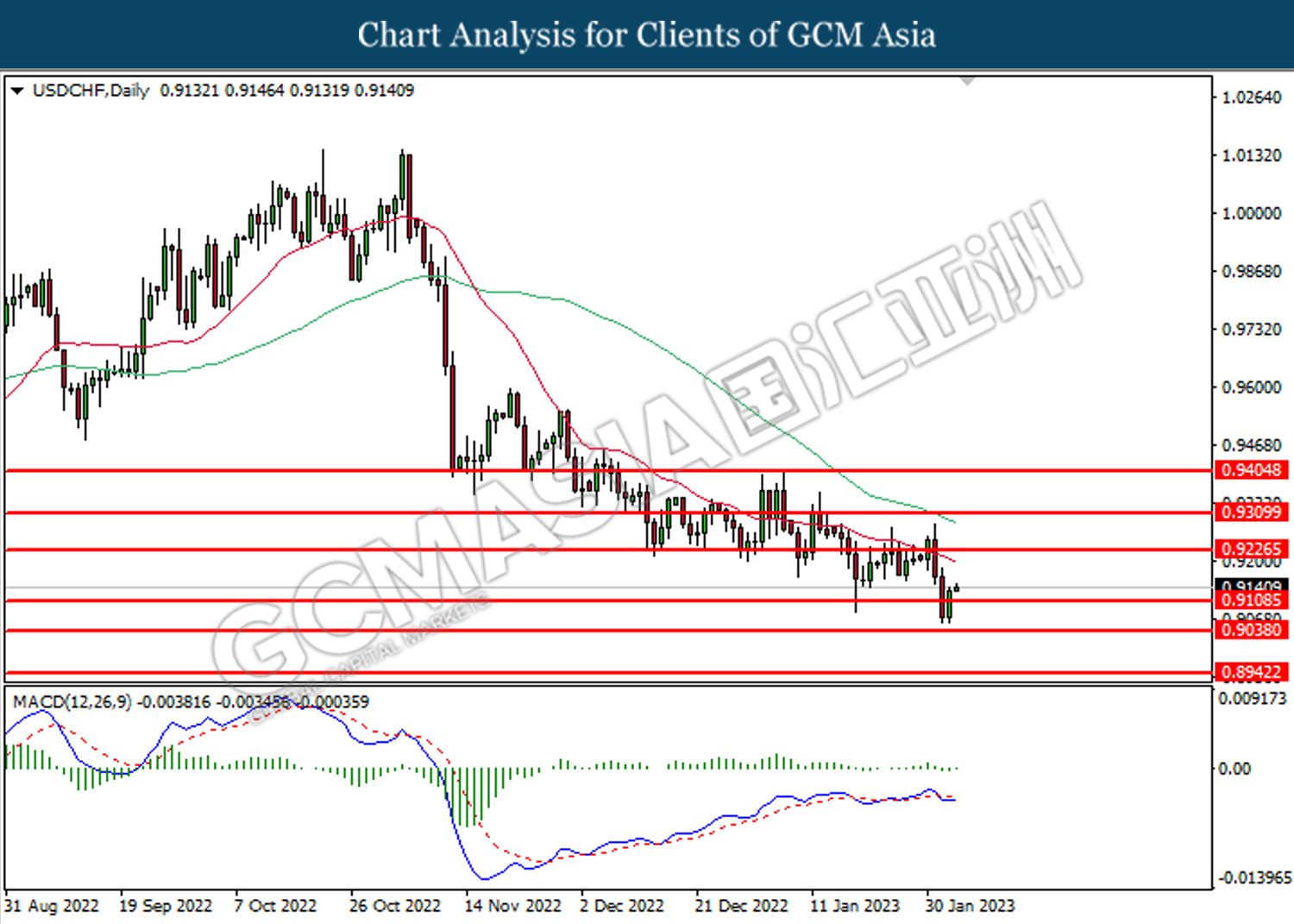

USDCHF, Daily: USDCHF was traded higher following a prior breakout above the previous resistance level at 0.9110. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 0.9225.

Resistance level: 0.9225, 0.9310

Support level: 0.9110, 0.9040

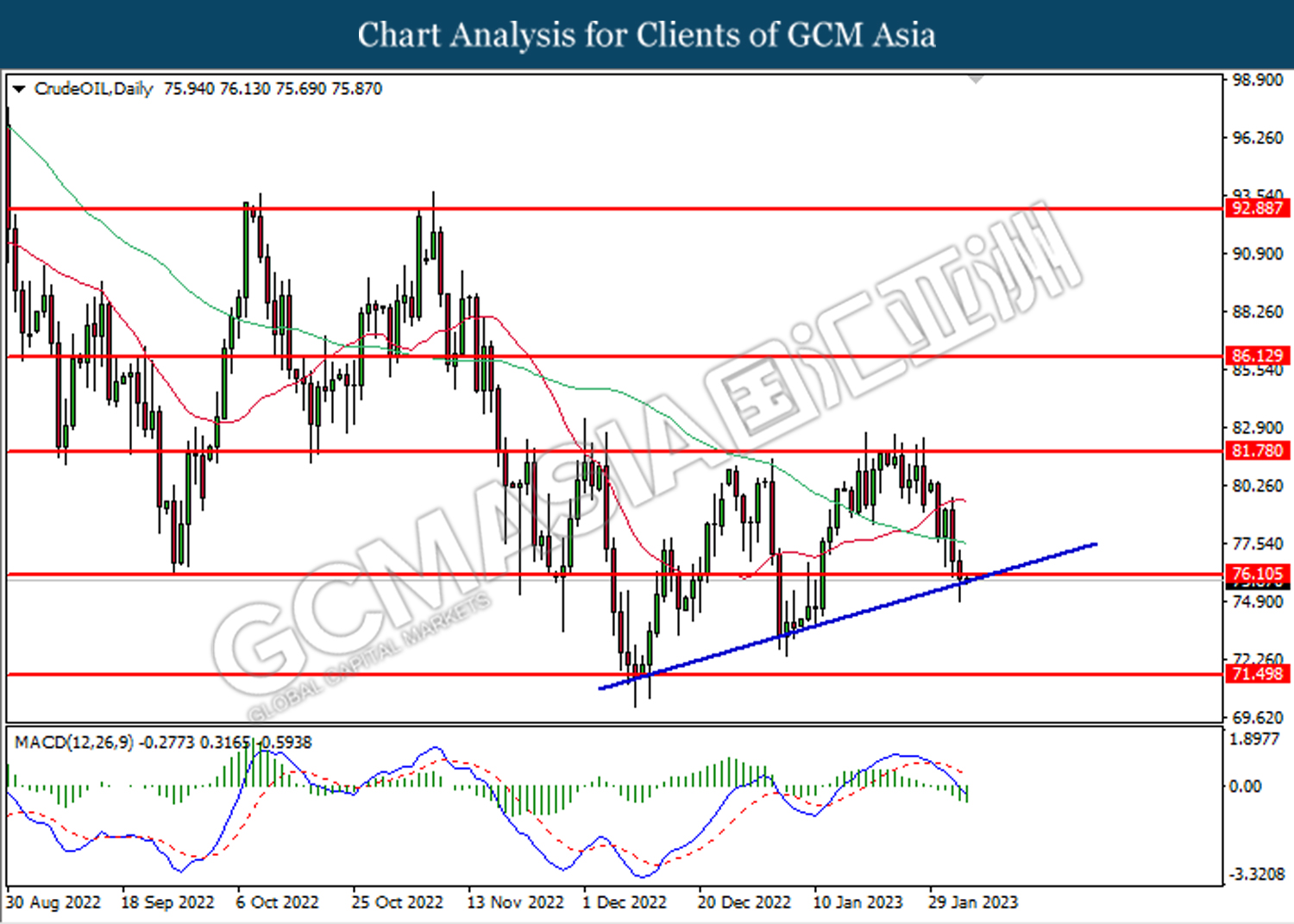

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the upward trendline. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the trendline.

Resistance level: 76.10, 81.80

Support level: 71.50, 66.10

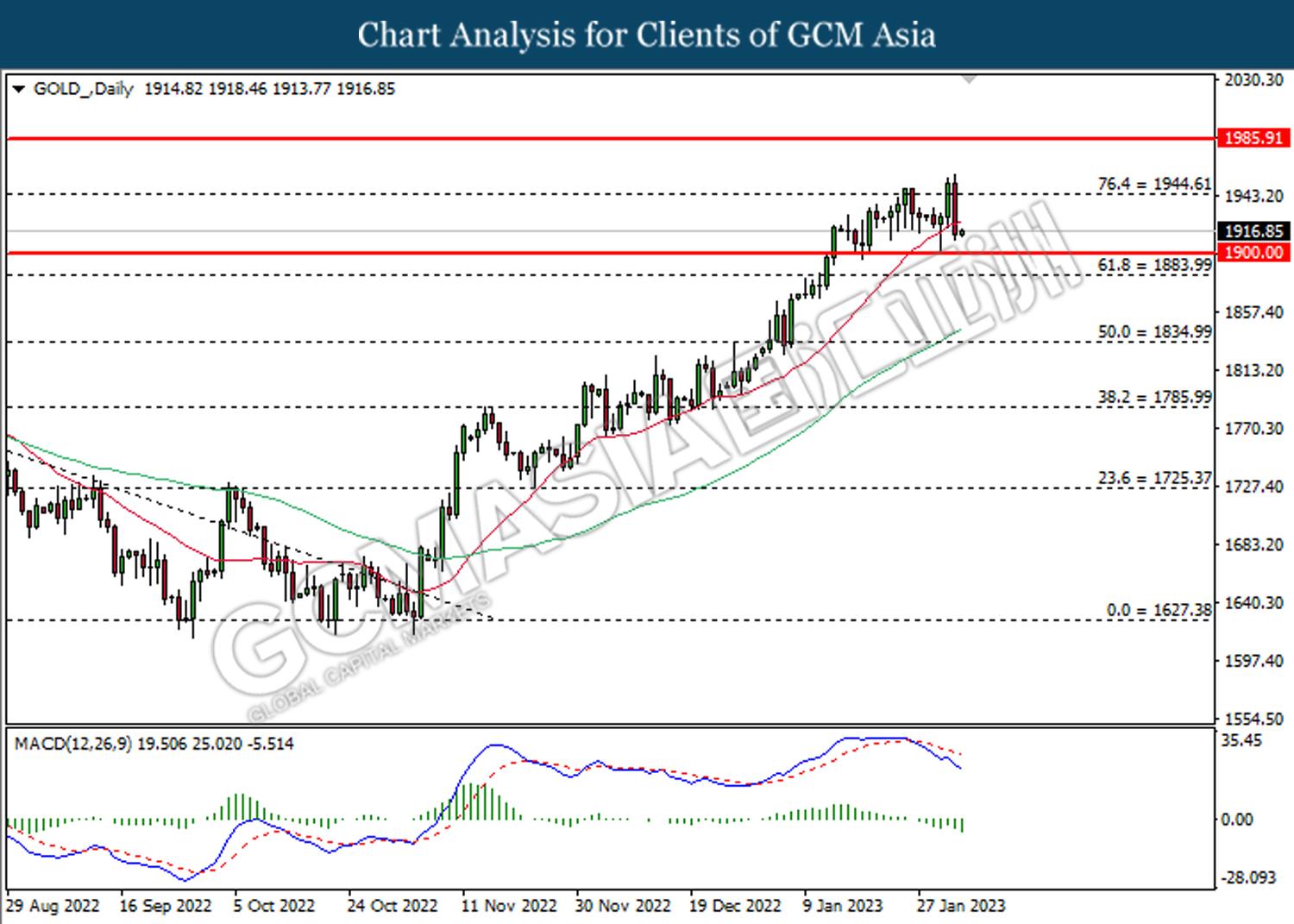

GOLD_, Daily: Gold price was traded lower following prior retracement from the resistance level at 1944.60. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1900.00.

Resistance level: 1944.60, 1985.90

Support level: 1900.00, 1884.00