3 February 2023 Morning Session Analysis

US Dollar revived as initial jobless claims decreased.

The Dollar Index which traded against a basket of six major currencies regained its luster on yesterday following the upbeat economic data has been unleashed. According to the US Department of Labor, the US Initial Jobless Claims has notched down from the previous reading of 186K to 183K, which is lower than the consensus forecast of 200K. The better-than-expected data has shown that the labor market in the US remained strong, as the number of unemployment was reducing. With that, it brought positive prospects toward economic progression in the US. On the other hand, investors would anticipating a bullish reading of NFP data might be released tonight with the upbeat employment report, which spurring further bullish momentum on the Greenback. In this juncture, market participants would continue to scrutinize the latest update of NFP announcement in order to gauge the likelihood movement of the market. Though, the gains experienced by the US Dollar was limited over the hawkish statement by European Central Bank (ECB). As of writing, the Dollar Index appreciated by 0.54% to 101.57.

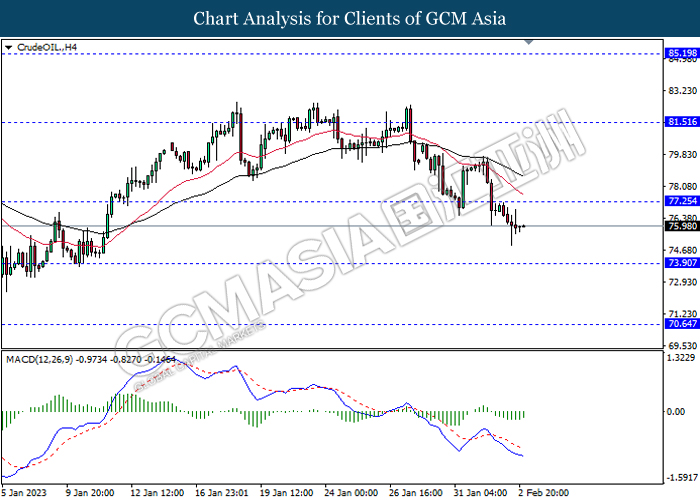

In the commodity market, the crude oil price rose by 0.16% to $76.00 per barrel as of writing after a sharp decline throughout overnight trading session following the concern of rate hike side effects keep hovering in the market. In addition, the gold price dropped by 0.03% to $1916.15 per troy ounce as of writing amid the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Composite PMI (Jan) | 47.8 | 47.8 | – |

| 17:30 | GBP – Services PMI (Jan) | 48 | 48 | – |

| 21:30 | USD – Nonfarm Payrolls (Jan) | 223K | 185K | – |

| 21:30 | USD – Unemployment Rate (Jan) | 3.50% | 3.60% | – |

| 23:00 | USD – ISM Non-Manufacturing PMI (Jan) | 49.6 | 50.3 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 102.05, 103.20

Support level: 100.55, 99.10

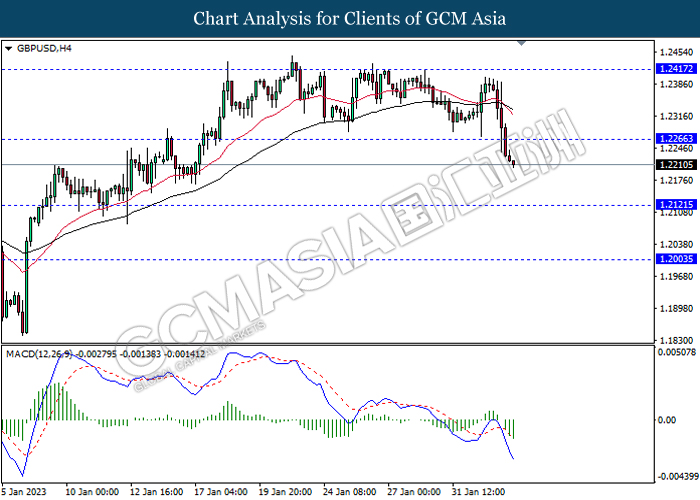

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2265, 1.2415

Support level: 1.2120, 1.2005

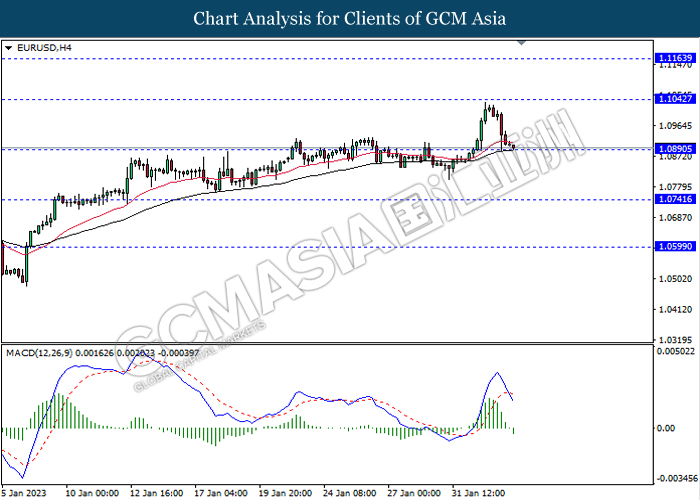

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.1040, 1.1165

Support level: 1.0890, 1.0740

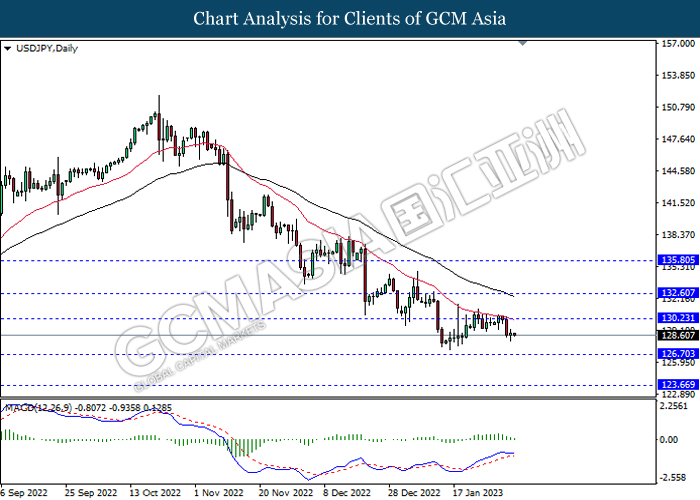

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 130.35, 132.60

Support level: 126.70, 123.65

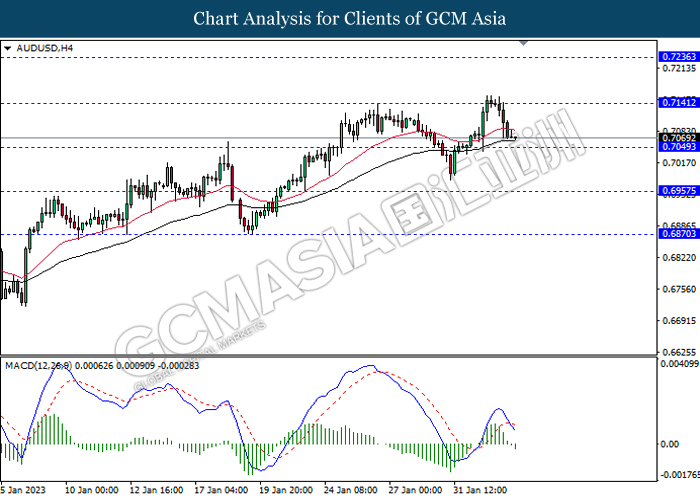

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.7140, 0.7235

Support level: 0.7050, 0.6955

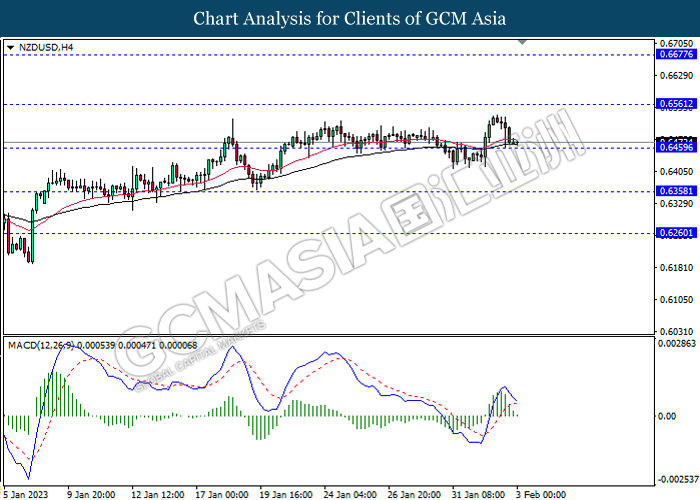

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6560, 0.6675

Support level: 0.6460, 0.6360

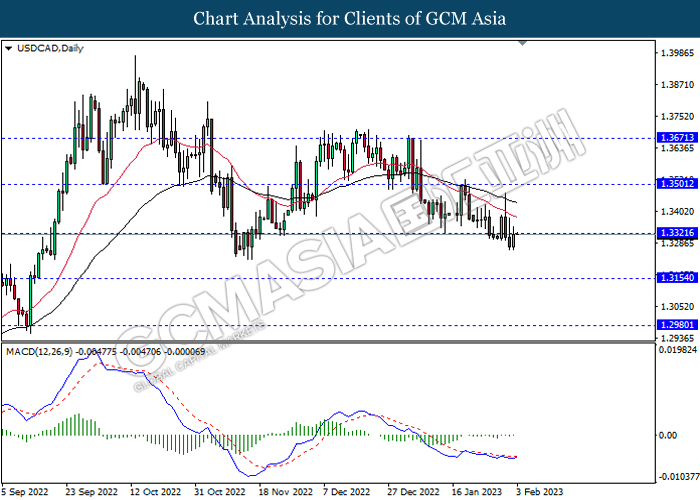

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3320, 1.3500

Support level: 1.3155, 1.2980

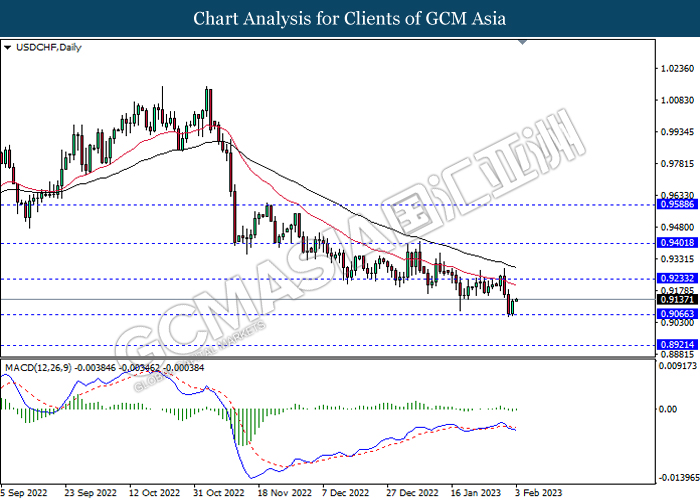

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9235, 0.9400

Support level: 0.9065, 0.8920

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.65

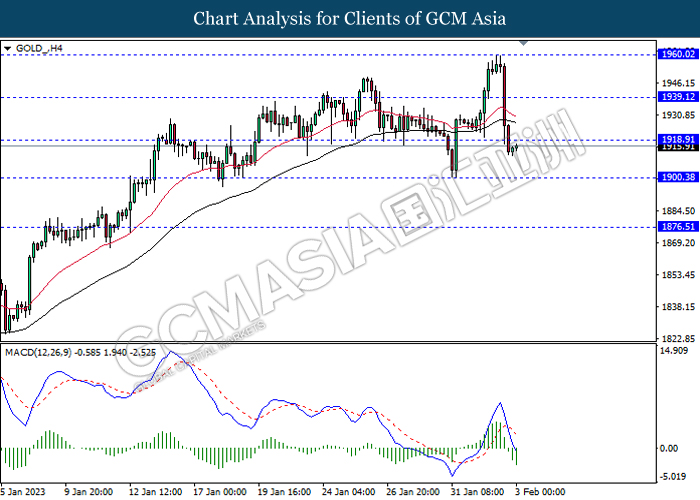

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1918.90, 1939.10

Support level: 1900.40, 1876.50