03 March 2022 Afternoon Session Analysis

Aussie surged amid positive economic data.

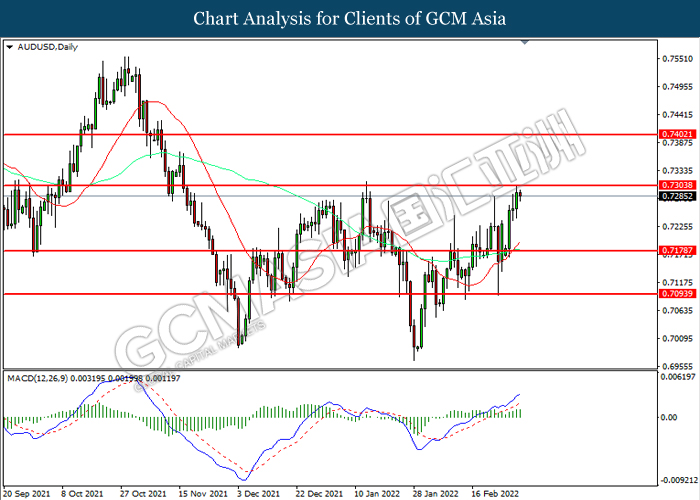

The Australian Dollar surged over the backdrop of upbeat economic data yesterday, which dialled up the market optimism toward the economic progression in the Australia region. According to Australian Bureau of Statistics, Australia Gross Domestic Product (GDP) for last quarter notched up significantly from the previous reading of -1.9% to 3.4%, exceeding the market forecast at -2.7%. The primary driver of the positive reading was mostly due to high consumer spending rate following Covid-19 lockdown restrictions was eased. Nonetheless, the gains experienced by the Australia Dollar was limited by diminishing risk appetite in the global market. Market participants remained concerns that the rising tensions between Russia-Ukraine as well as rate hike from Federal Reserve would likely to trigger turbulence in the global economy. As of writing, AUD/USD surged 0.05% to 0.7290.

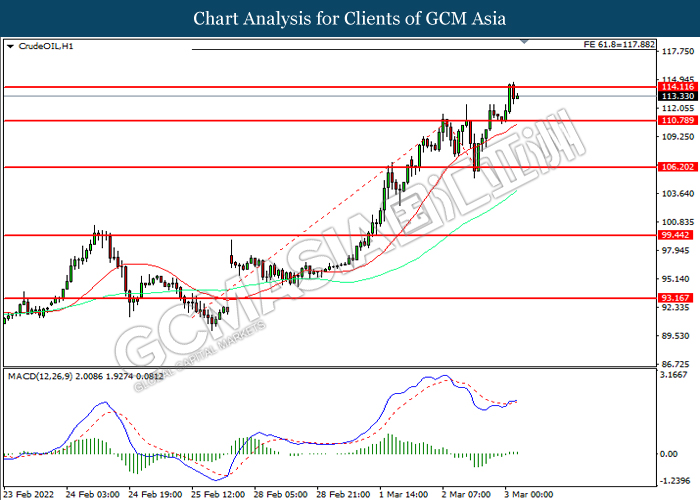

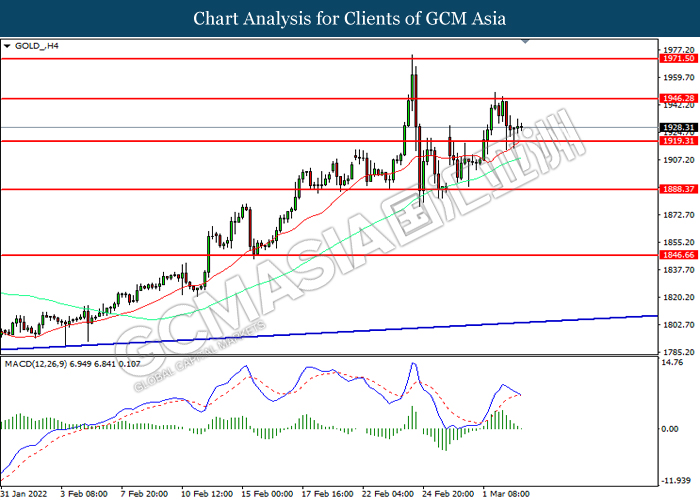

In the commodities market, the crude oil price appreciated by 1.78% to 114.85 per barrel as of writing. The crude oil price extends its gains following crude oil inventories data was released. According to Energy Information Administration (EIA), US Crude Oil Inventories data declined from the previous reading of 4.515M to -2.597M, better than the market forecast at 2.748M. On the other hand, the gold price appreciated by 0.06% to $1929.95 per troy ounces as of writing amid risk-off sentiment in the market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:30 EUR ECB Publishes Account of Monetary Policy Meeting

23:00 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Composite PMI (Feb) | 60.2 | 60.2 | – |

| 17:30 | GBP – Services PMI (Feb) | 60.8 | 60.8 | – |

| 21:30 | USD – Initial Jobless Claims | 232K | 226K | – |

| 23:00 | USD – ISM Non-Manufacturing PMI (Feb) | 59.9 | 61.0 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 97.45. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower in short-term as technical correction.

Resistance level: 97.45, 98.95

Support level: 96.55, 95.65

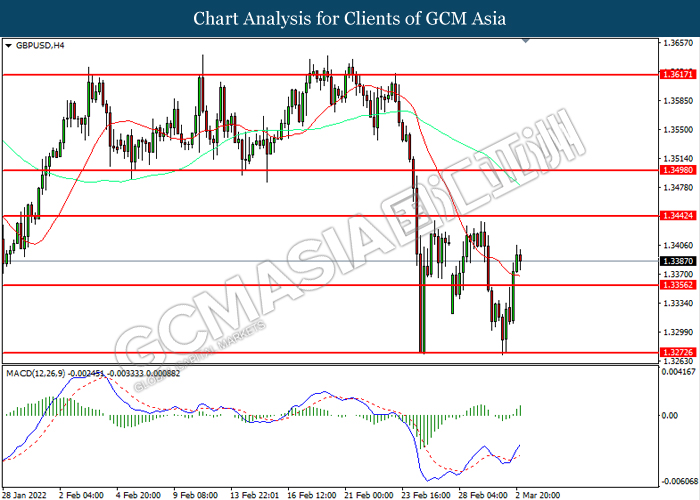

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.3355. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.3440.

Resistance level: 1.3440, 1.3500

Support level: 1.3355, 1.3275

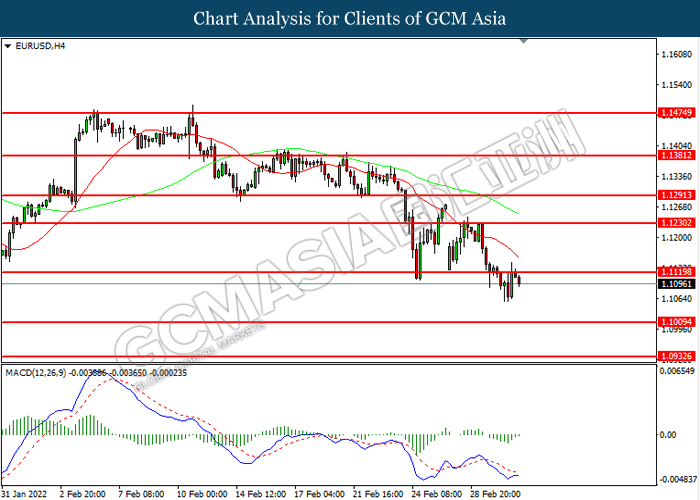

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level at 1.1120. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.1120, 1.1230

Support level: 1.1010, 1.0935

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 115.65. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 115.65, 116.25

Support level: 114.60, 113.65

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.7305. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7305, 0.7400

Support level: 0.7180, 0.7095

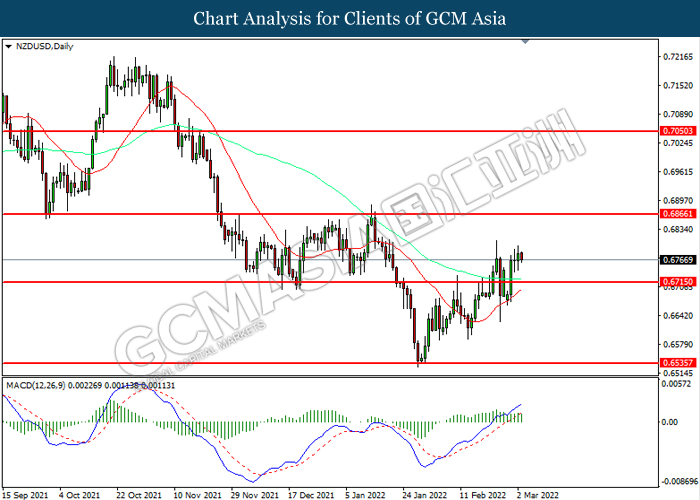

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6715. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.6865.

Resistance level: 0.6865, 0.7050

Support level: 0.6715, 0.6535

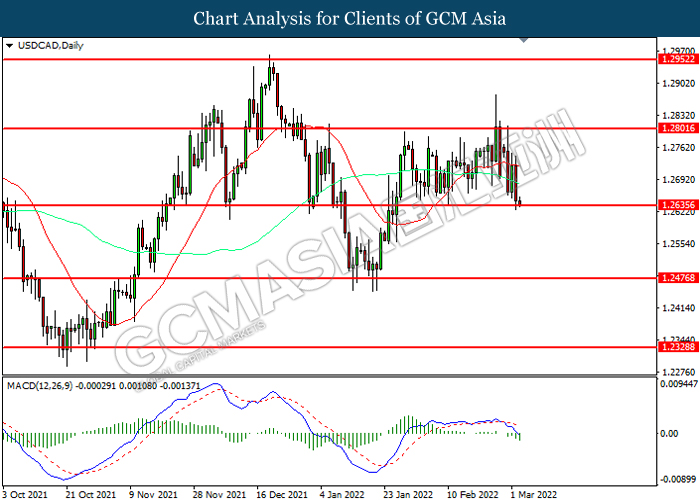

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.2635. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2800, 1.2950

Support level: 1.2635, 1.2475

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level at 0.9175. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 0.9270.

Resistance level: 0.9270, 0.9345

Support level: 0.9175, 0.9095

CrudeOIL, H1: Crude oil price was traded higher while currently testing the resistance level at 114.10. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 114.10, 117.90

Support level: 110.80, 106.20

GOLD_, H4: Gold price was traded lower while currently near the support level at 1919.30. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1946.30, 1971.50

Support level: 1919.30, 1888.35