3 March 2022 Morning Session Analysis

ADP data pushes greenback forward.

Greenback continues to hover near 21 months high as investors shift their focus towards US jobs market data. According to ADP, Nonfarm Employment Change came in at 475K for last month, significantly higher than forecasted reading of 378K. The higher than expected reading was due to vast hiring in services sector, indicating resilient economy despite widespread transmission of Omicron variant. Likewise, the data has cemented investors expectation towards a more positive outcome from Nonfarm Payrolls report due tomorrow. Nonetheless, any substantial upside on the greenback was limited after Russia and Ukraine announced for another round of talks later today. The news has prompted higher demand for risky asset such as equities and bonds. As of writing, the dollar index was up 0.01% to 97.31.

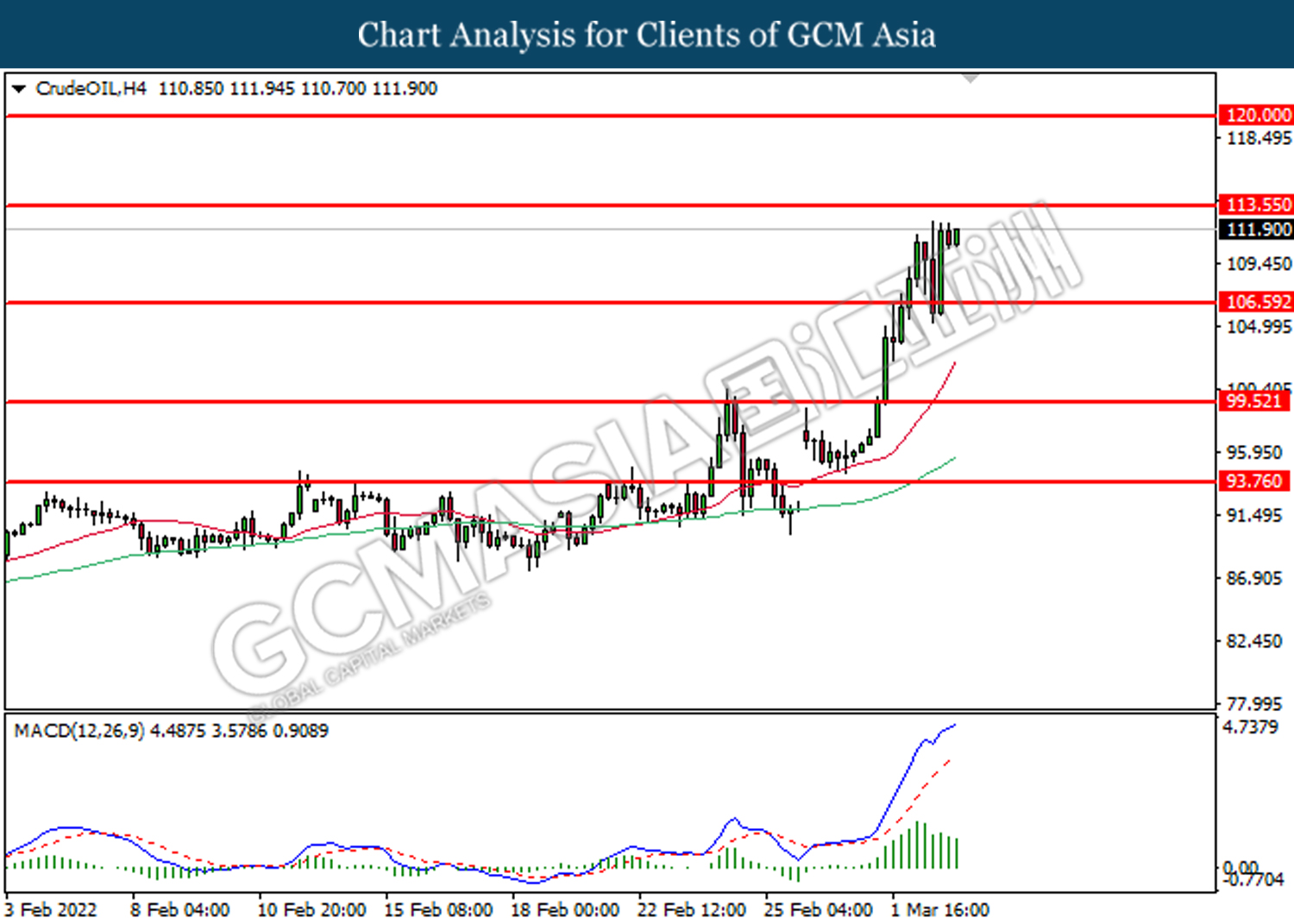

As for commodities market, crude oil price was down by 0.69% to $110.75 per barrel following technical correction from the higher levels. On the other hand, gold price was down by 0.10% to $1,929.27 a troy ounce due to higher demand for risky assets.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:30 EUR ECB Publishes Account of Monetary Policy Meeting

23:00 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Composite PMI (Feb) | 60.2 | 60.2 | – |

| 17:30 | GBP – Services PMI (Feb) | 60.8 | 60.8 | – |

| 21:30 | USD – Initial Jobless Claims | 232K | 226K | – |

| 23:00 | USD – ISM Non-Manufacturing PMI (Feb) | 59.9 | 61.0 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to be traded higher after breaking its resistance level.

Resistance level: 97.65, 98.80

Support level: 96.60, 95.80

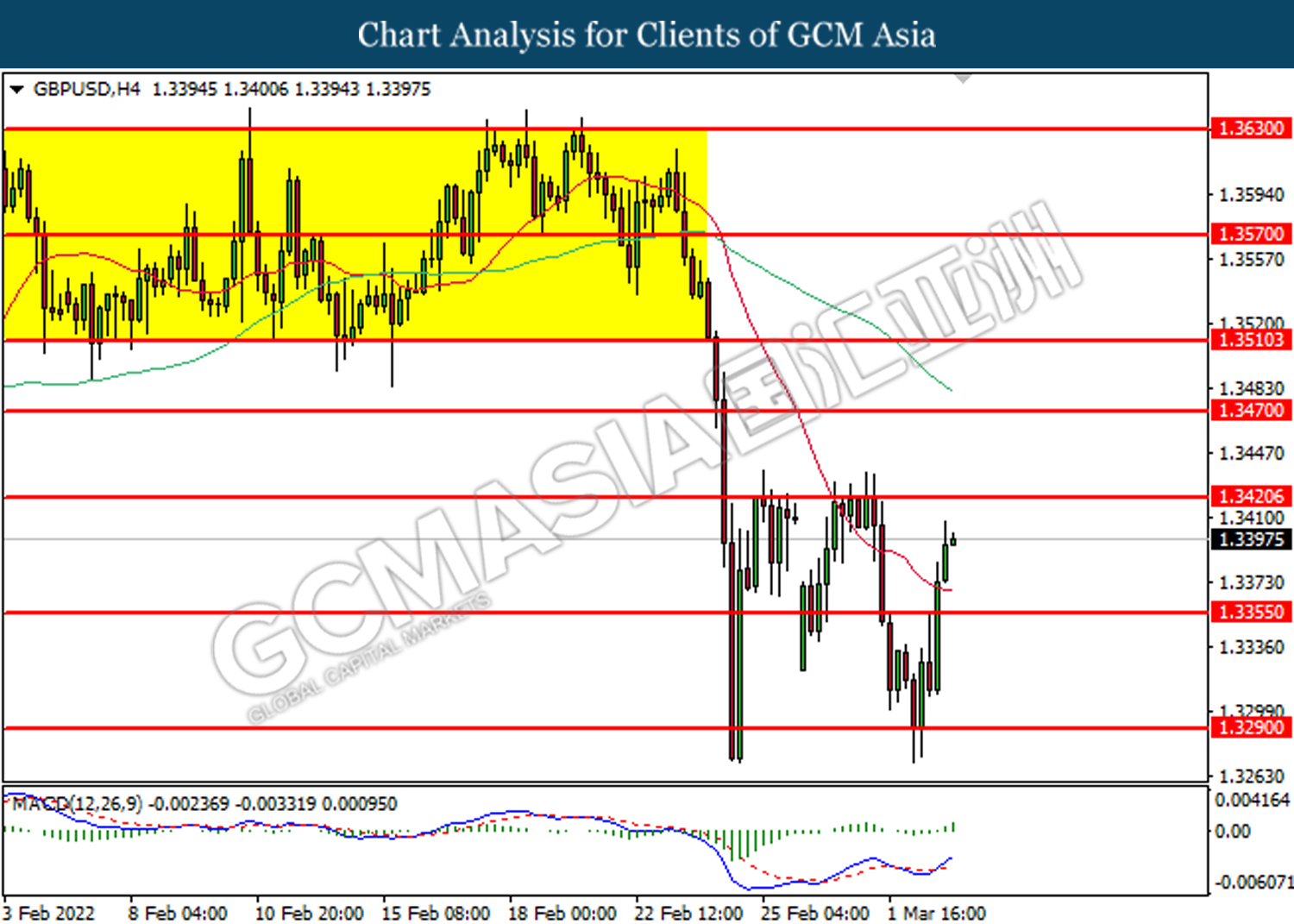

GBPUSD, H4: GBPUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher after breaking the resistance level.

Resistance level: 1.3420, 1.3470

Support level: 1.3355, 1.3290

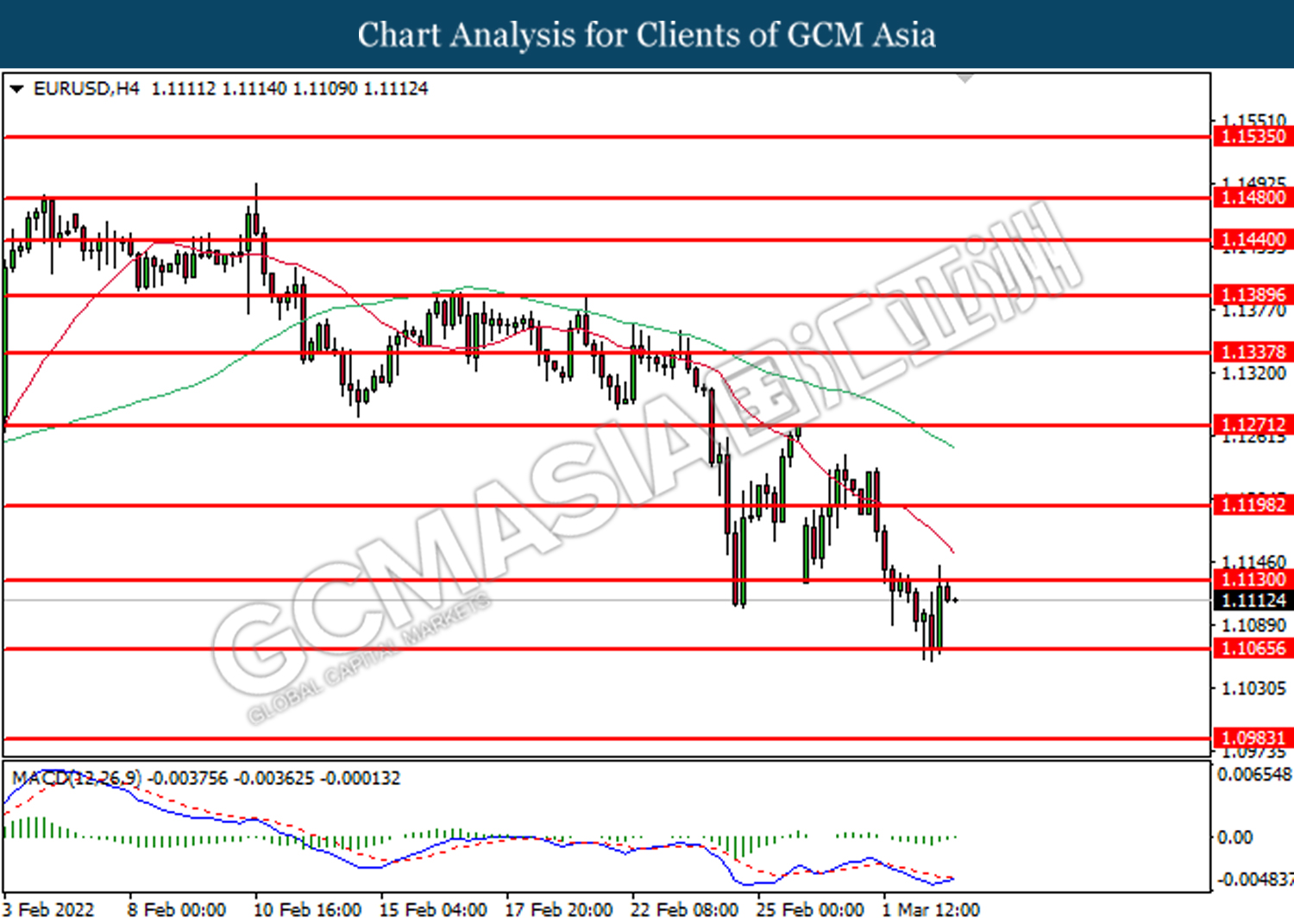

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.1130, 1.1200

Support level: 1.1065, 1.0985

USDJPY, Daily: USDJPY was traded higher following prior rebound from lower level. MACD which bullish momentum suggests the pair to be traded higher in short-term.

Resistance level: 116.25, 117.00

Support level: 115.40, 114.55

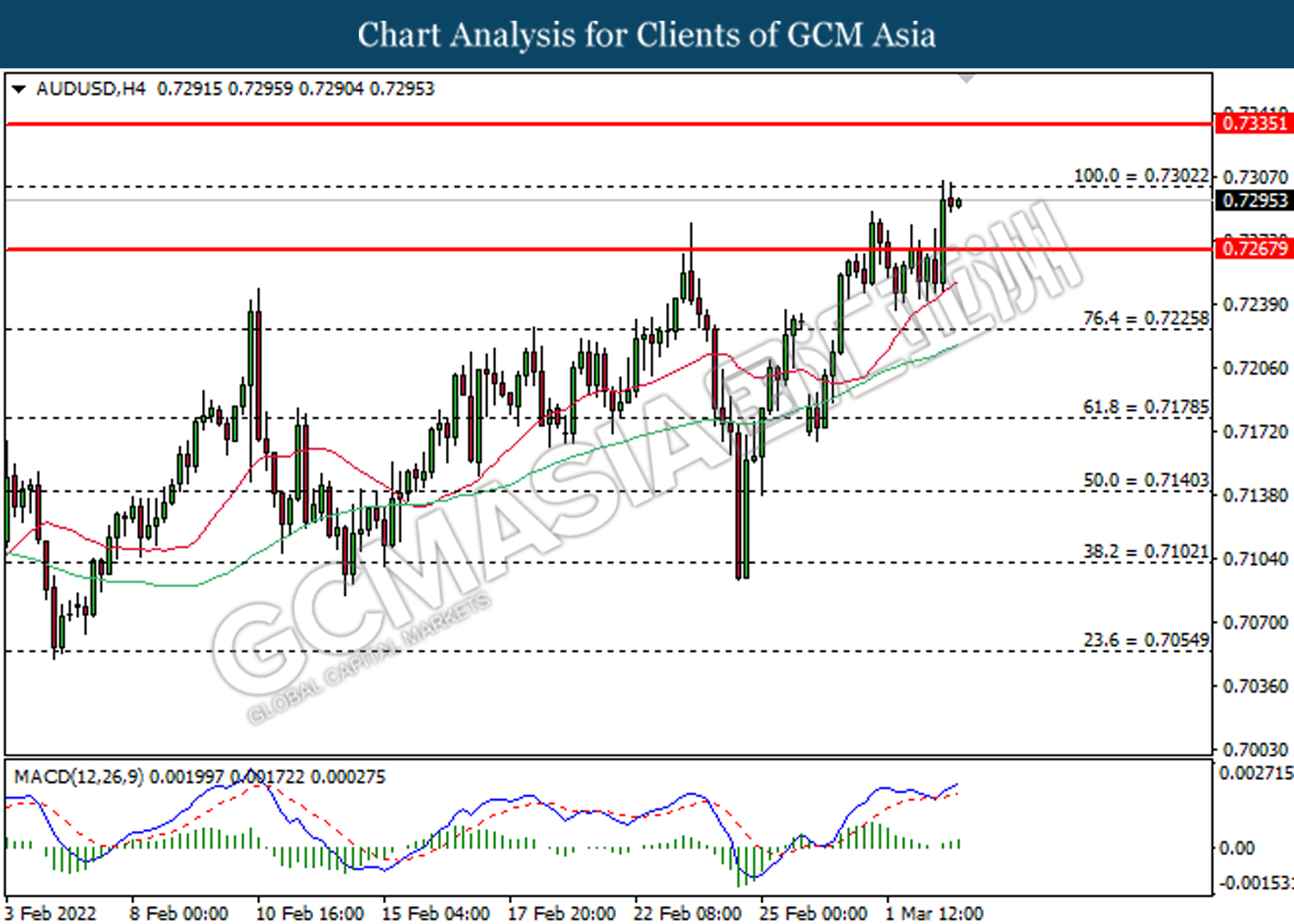

AUDUSD, H4: AUDUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.7300, 0.7335

Support level: 0.7270, 0.7225

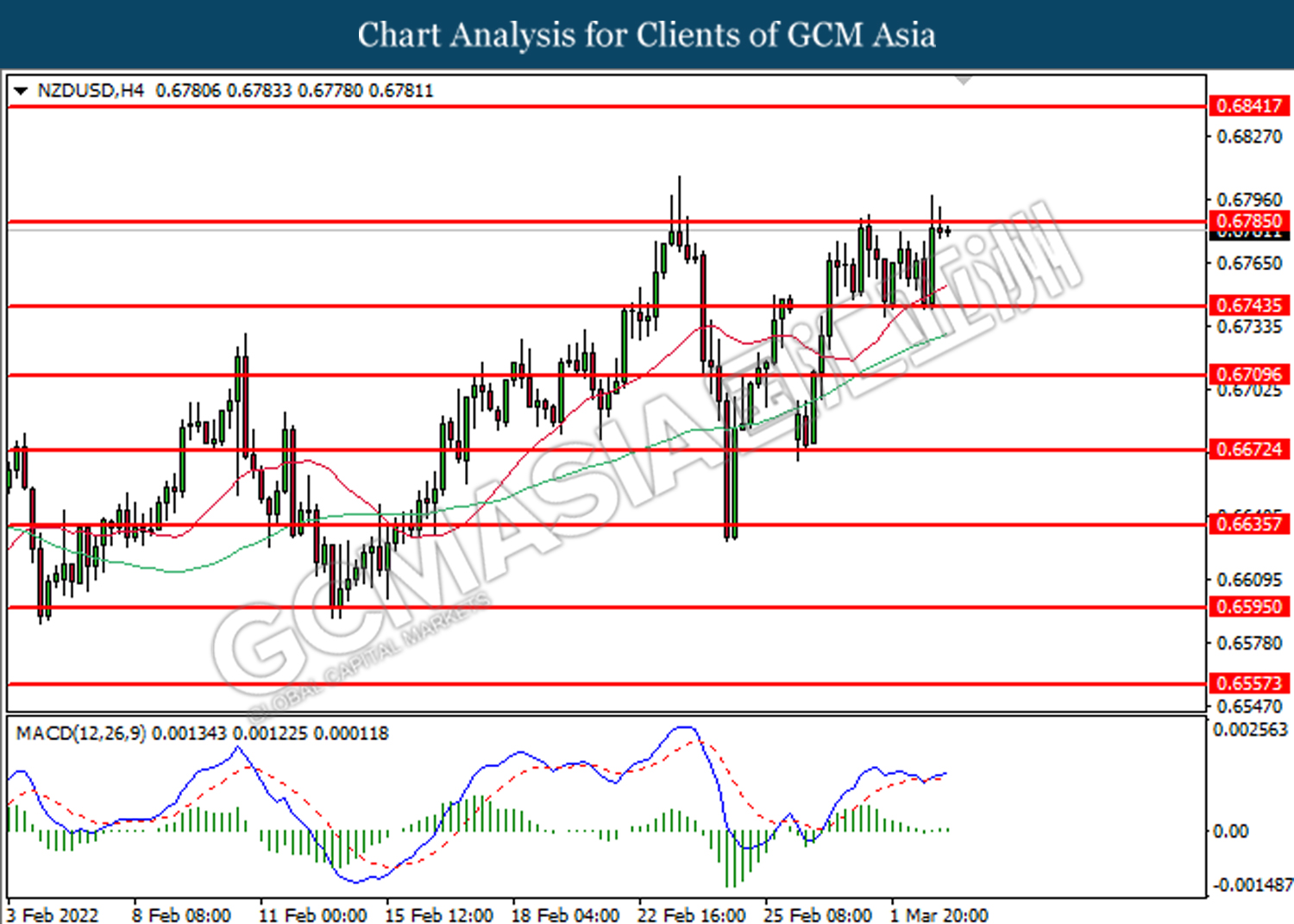

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6785, 0.6840

Support level: 0.6745, 0.6710

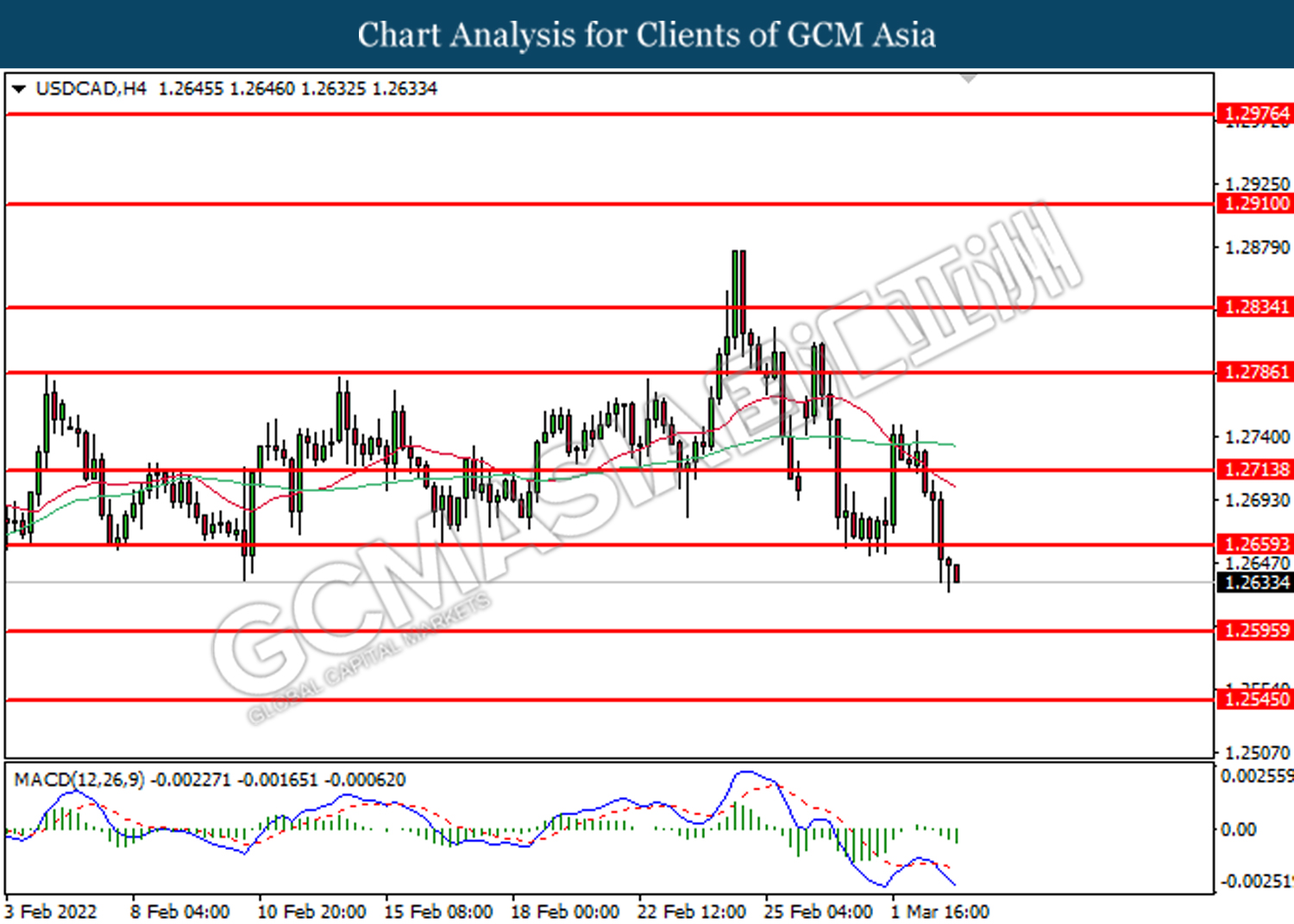

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate bearish momentum suggests the pair to be traded lower in short-term.

Resistance level: 1.2660, 1.2715

Support level: 1.2595, 1.2545

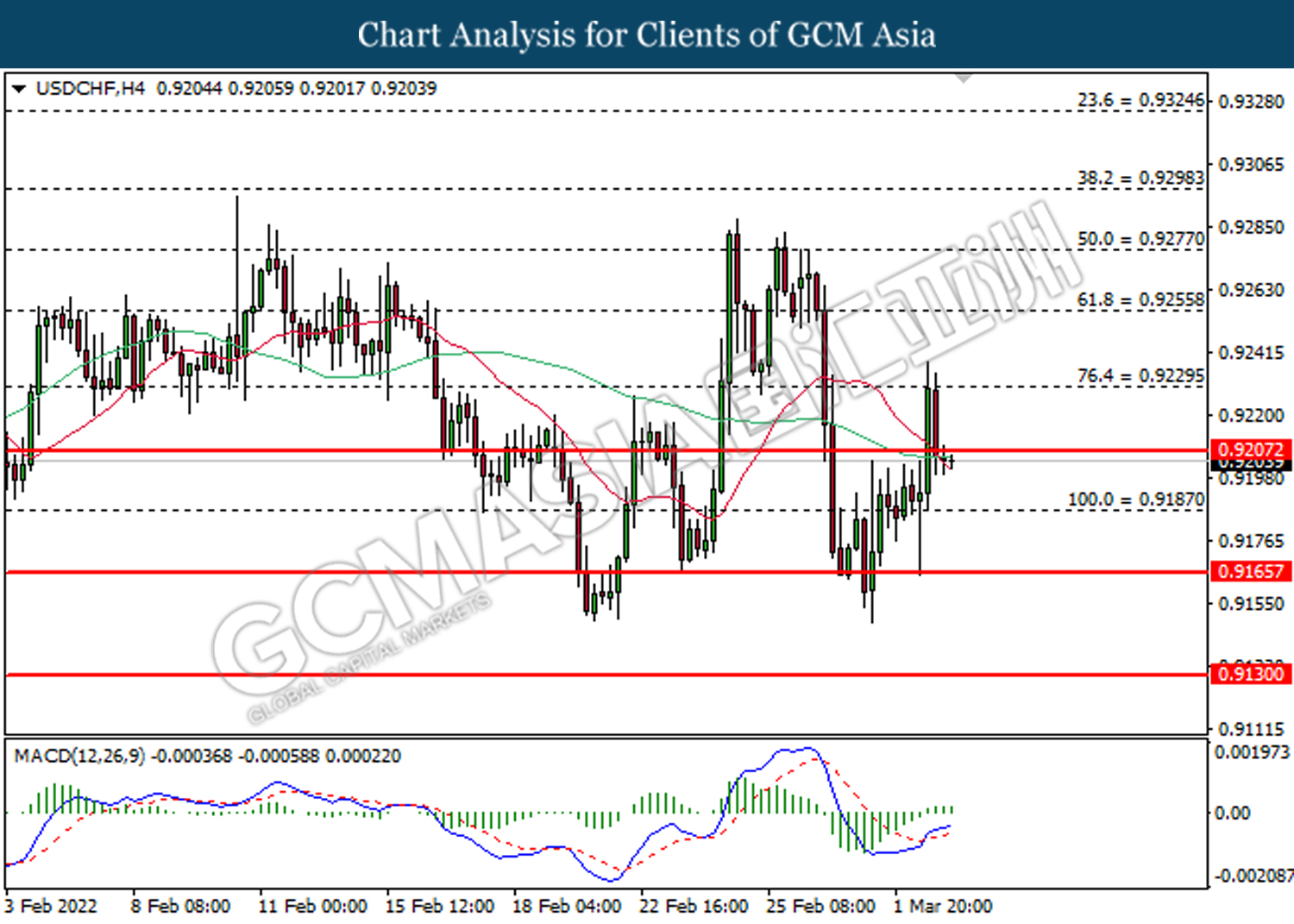

USDCHF, H4: USDCHF was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.9210, 0.9230

Support level: 0.9190, 0.9165

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher after breaking its resistance level.

Resistance level: 113.55, 120.00

Support level: 106.60, 99.50

GOLD_, H4: Gold price was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests its price to be traded lower in short-term.

Resistance level: 1960.55, 1991.50

Support level: 1921.95, 1886.90