03 April 2023 Morning Session Analysis

US dollar revived despite a series of downbeat data.

The dollar index, which is traded against a basket of six major currencies, regained its luster last Friday following the release of a series of economic data. According to the University of Michigan, the US consumer sentiment index dropped from 63.4 to 62.0, lower than the consensus forecast at 63.2, mirroring the market worries that the recent fallout in the banking sector might have a far-reaching impact on the US economy. Besides, the US Bureau of Economic Analysis posted the Core PCE Price Index dropped from the prior month’s reading at 0.5% to 0.3% in February, also weaker than the consensus forecast of 0.4%. Despite this, the sharp drop in the Feb Core PCE report did not trigger large sell-off pressures in the dollar market as US President Joe Biden’s hawkish statement twisted the market sentiment. In the statement from President Joe Biden on February PCE Report, he mentioned that the US is making progress in curbing inflation, which has been proven by a nearly 30 percent down in annual inflation rate this summer. Alongside, the labor market remains resilient while steady growth was able to see in the US economy over the months. He also highlighted the fight against inflation is not over yet, signaling that he is still in favor of high-interest rates at this point in time. As of writing, the dollar index rose 0.20% to 102.70.

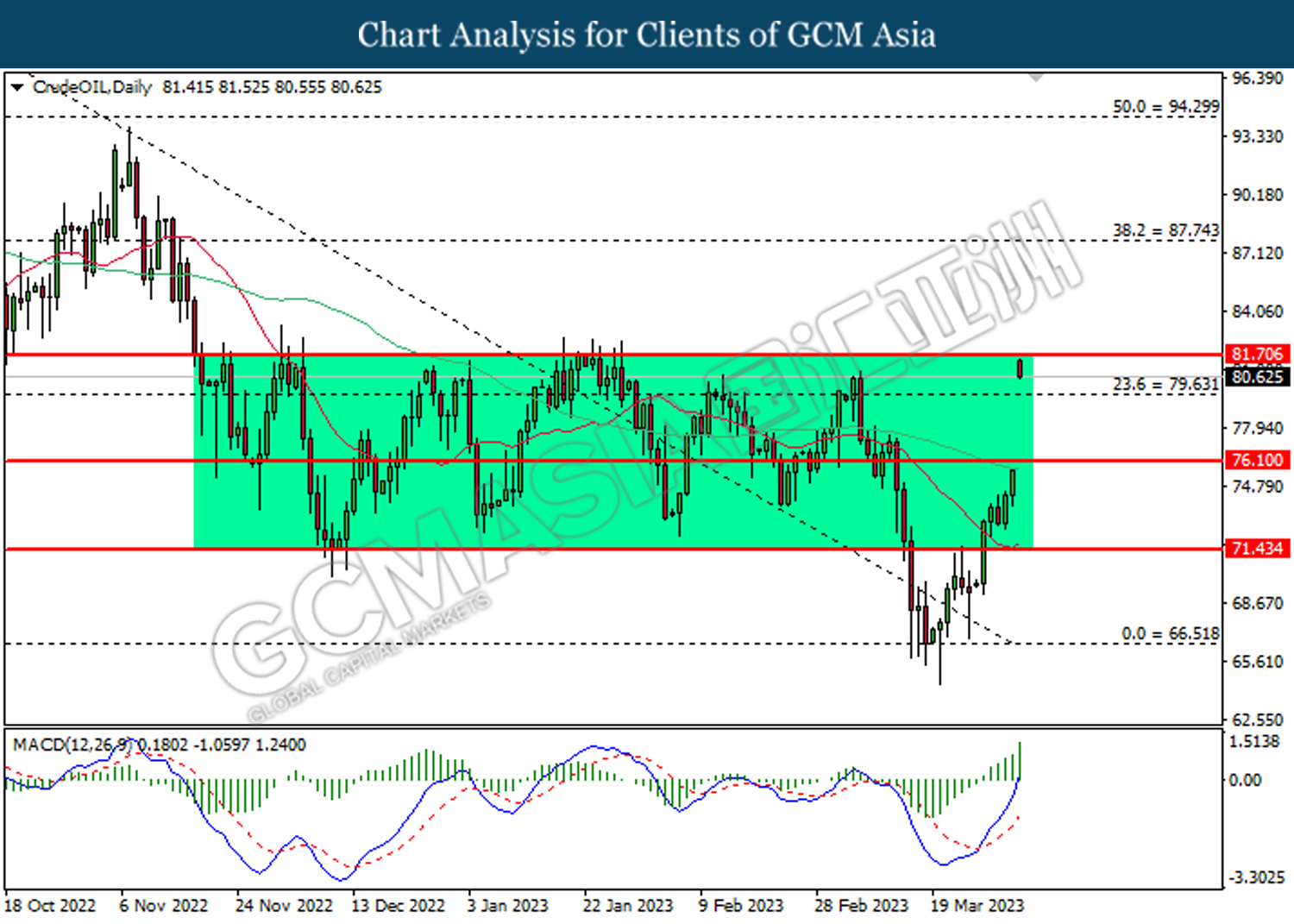

In the commodities market, crude oil prices were up by 7.41% to $81.20 per barrel following the surprise cuts of around 1.16 million barrels per day from May to the end of the year. Besides, gold prices edged down by -0.39% to $1962.30 per troy ounce as Biden’s hawkish statement diminished the appeal of the safe haven asset.

Today’s Holiday Market Close

Time Market Event

All Day CNY China – Ching Ming Festival

Today’s Highlight Events

Time Market Event

18:00 CrudeOIL OPEC Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Manufacturing PMI (Mar) | 44.4 | 44.4 | – |

| 16:30 | GBP – Manufacturing PMI (Mar) | 48.0 | 48.0 | – |

| 22:00 | USD – ISM Manufacturing PMI (Mar) | 47.7 | 47.5 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the resistance level at 103.15. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 101.25.

Resistance level: 103.15, 105.00

Support level: 101.25, 99.40

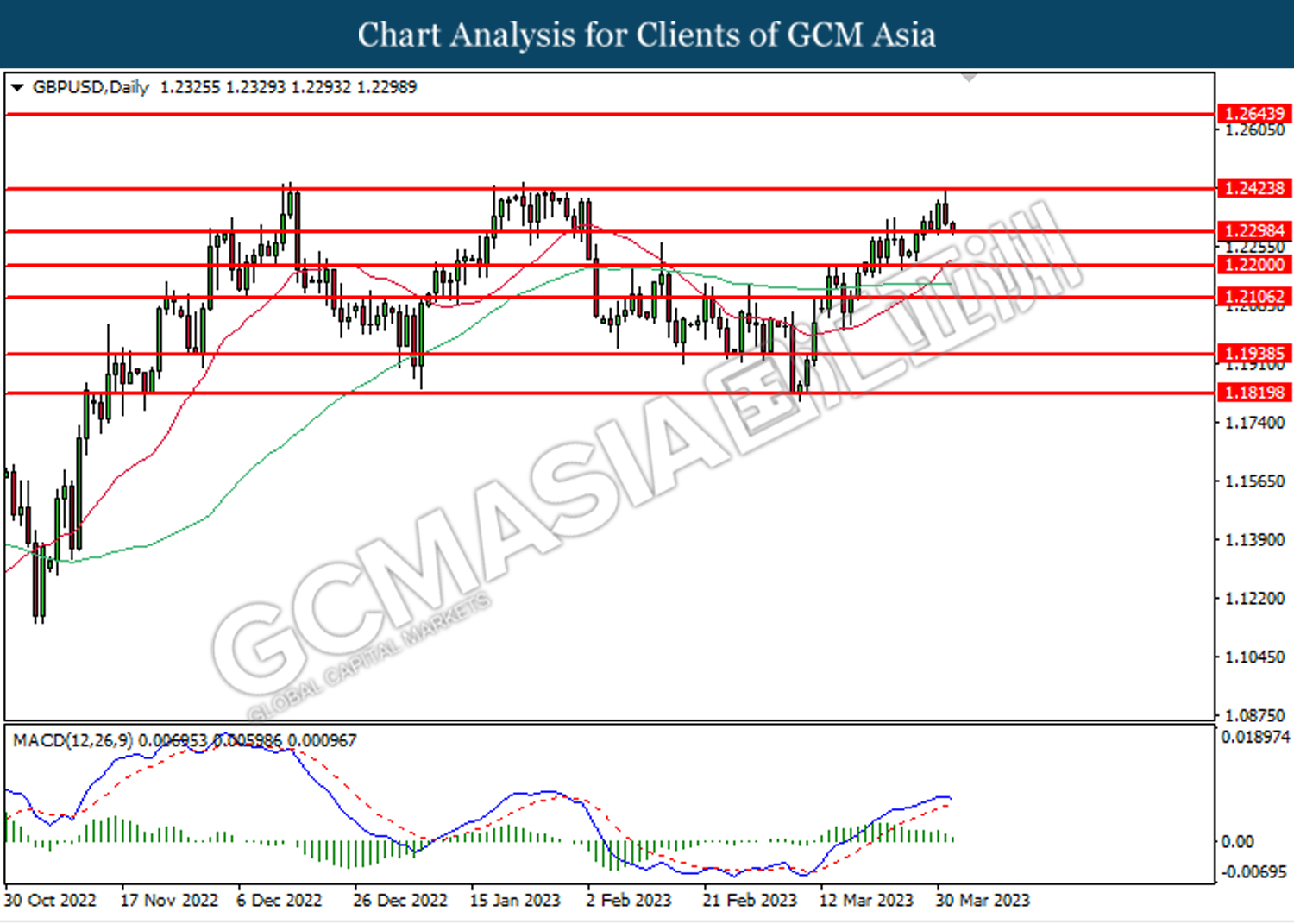

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2300. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2425, 1.2645

Support level: 1.2300, 1.2200

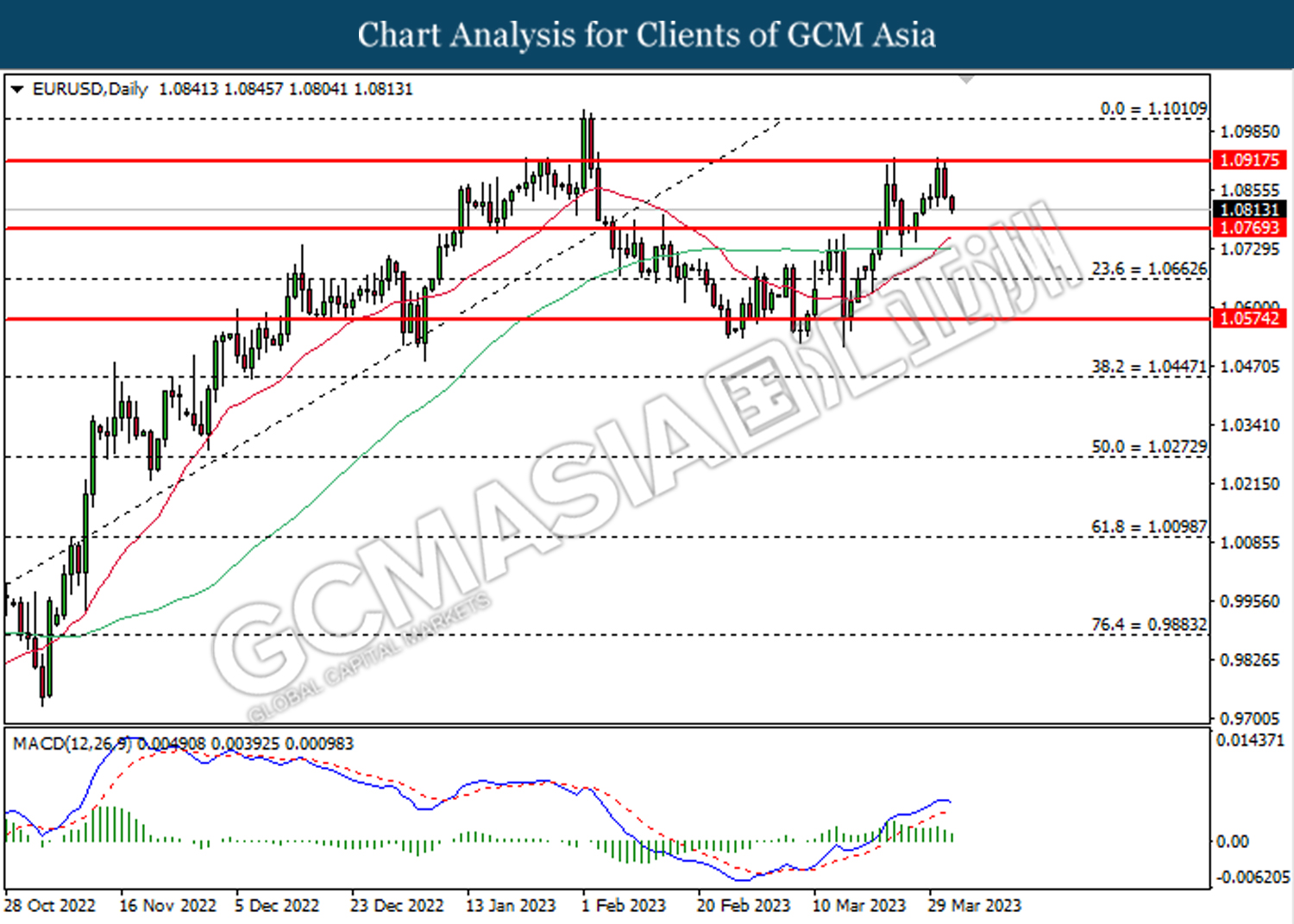

EURUSD, Daily: EURUSD was traded lower following the prior retracement from the resistance level at 1.0915. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.0770.

Resistance level: 1.0915, 1.1010

Support level: 1.0770, 1.0665

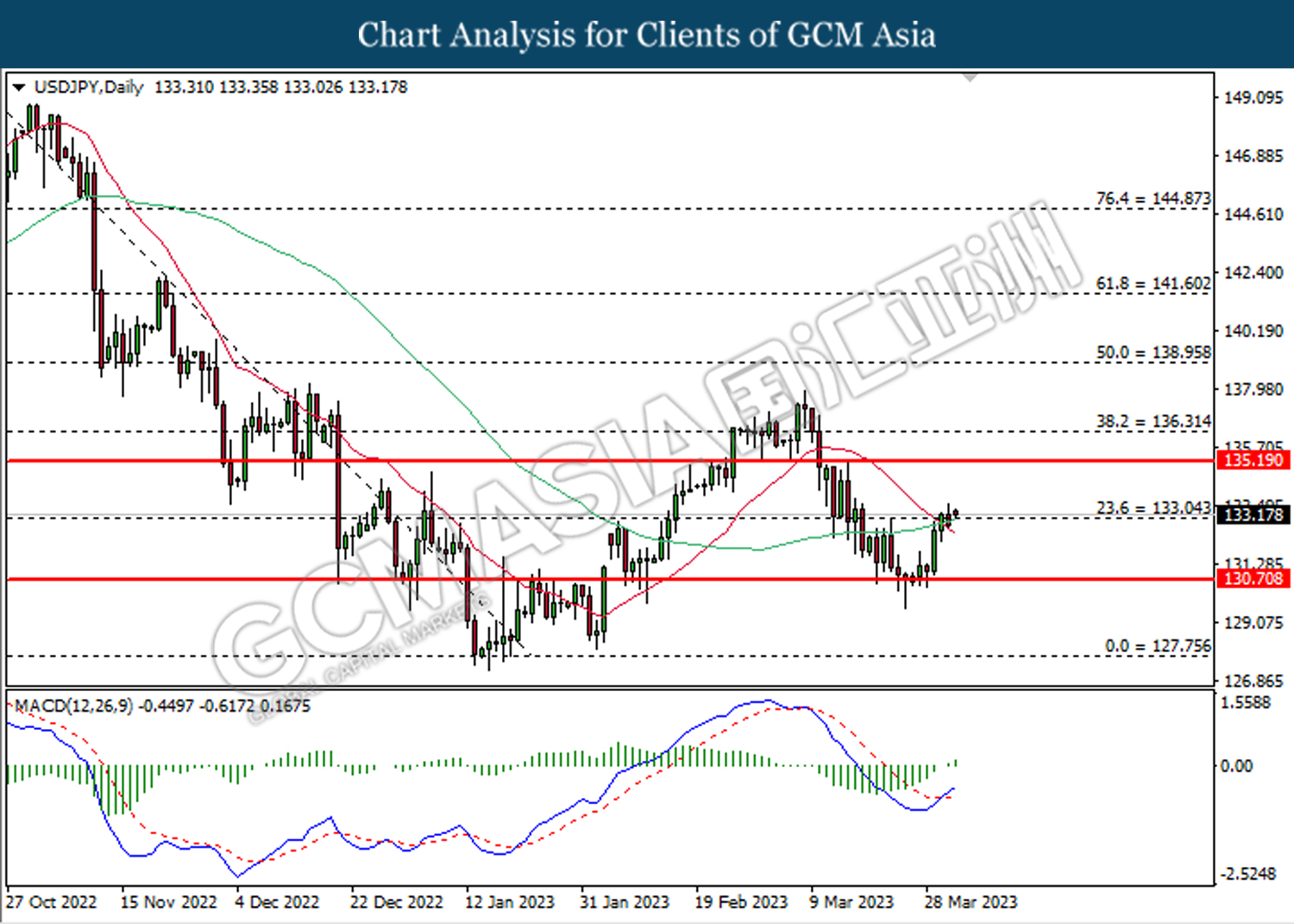

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 133.05. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 135.20.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

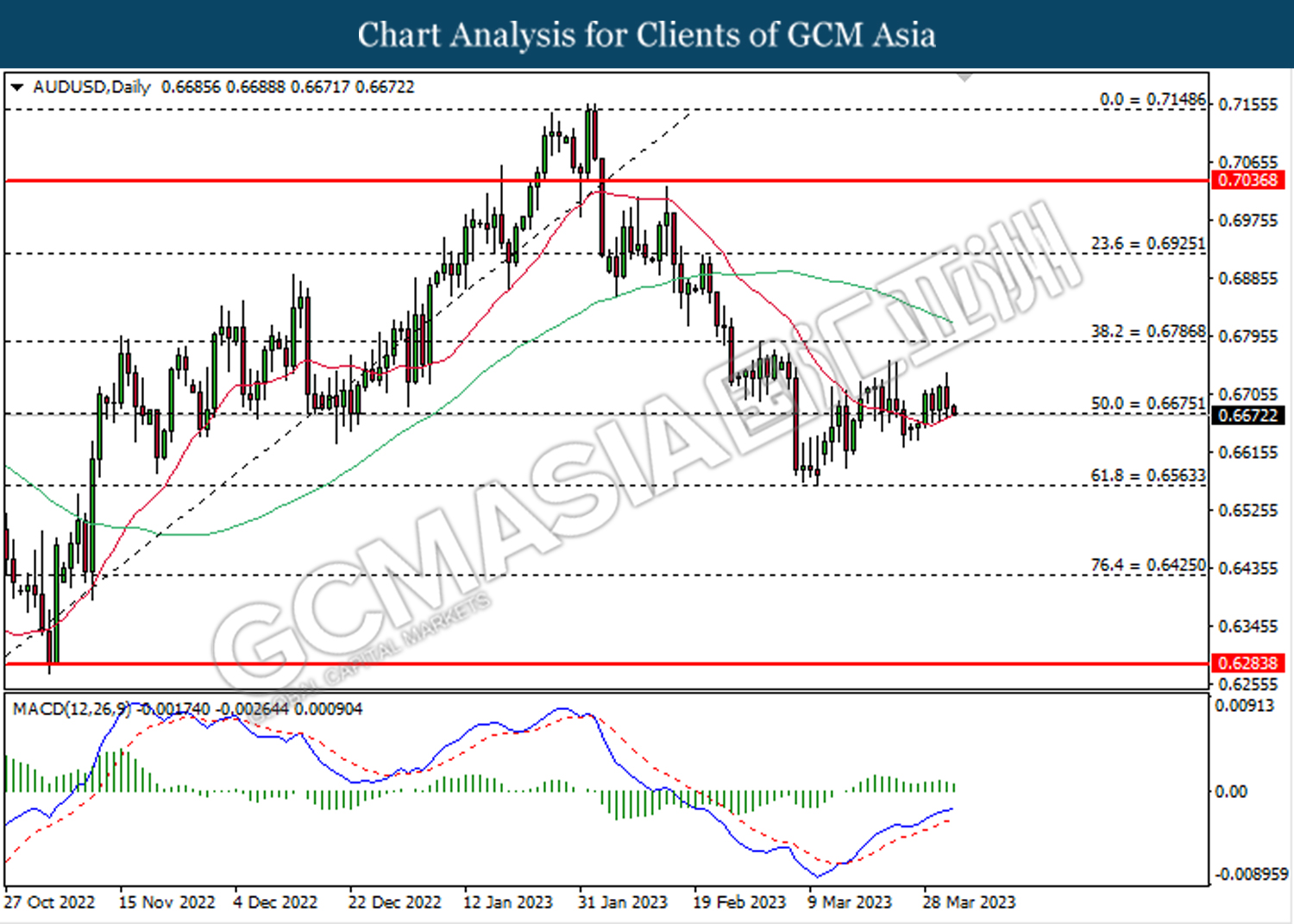

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6675. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

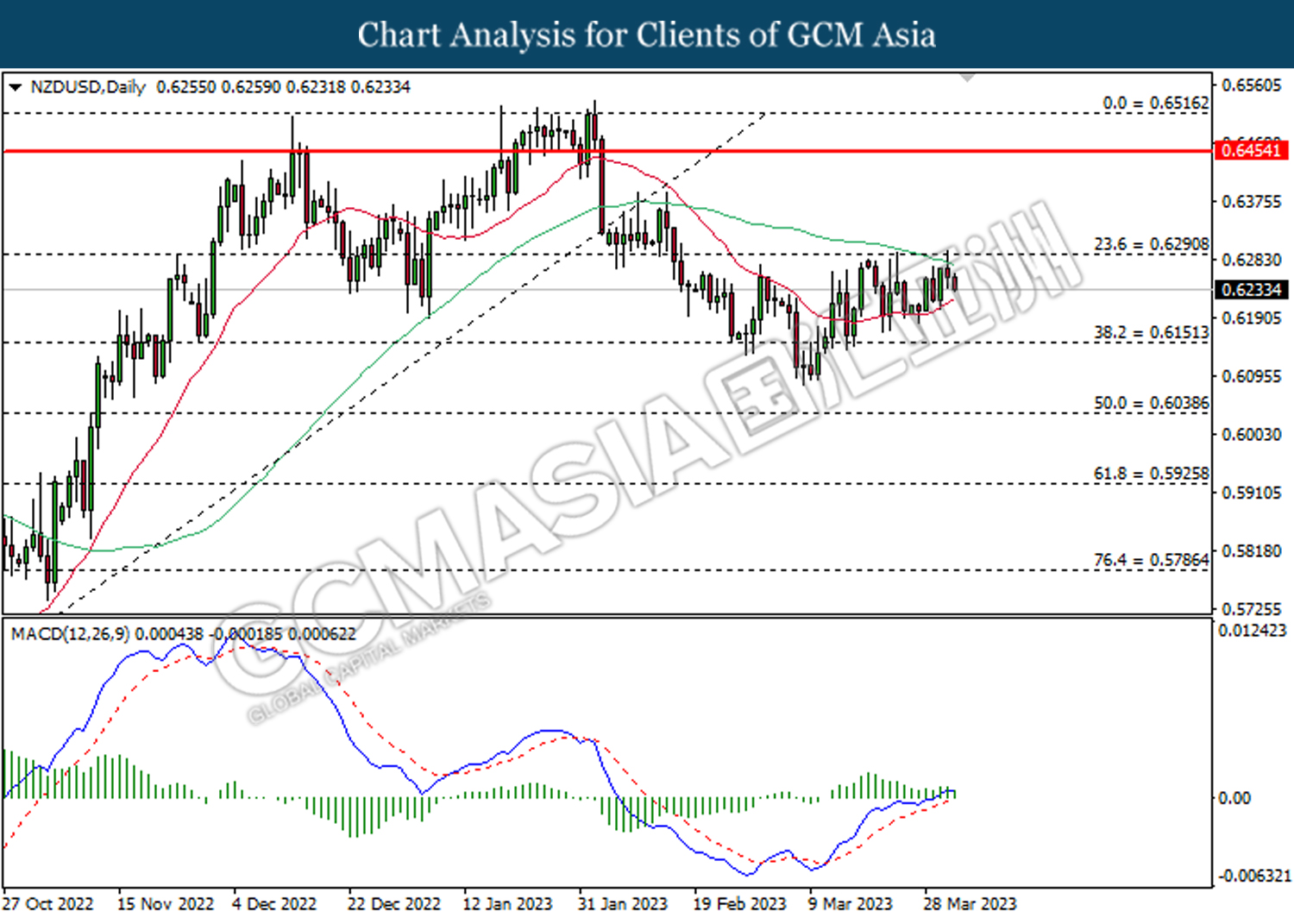

NZDUSD, Daily: NZDUSD was traded lower following the prior retracement from the resistance level at 0.6290. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6150.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

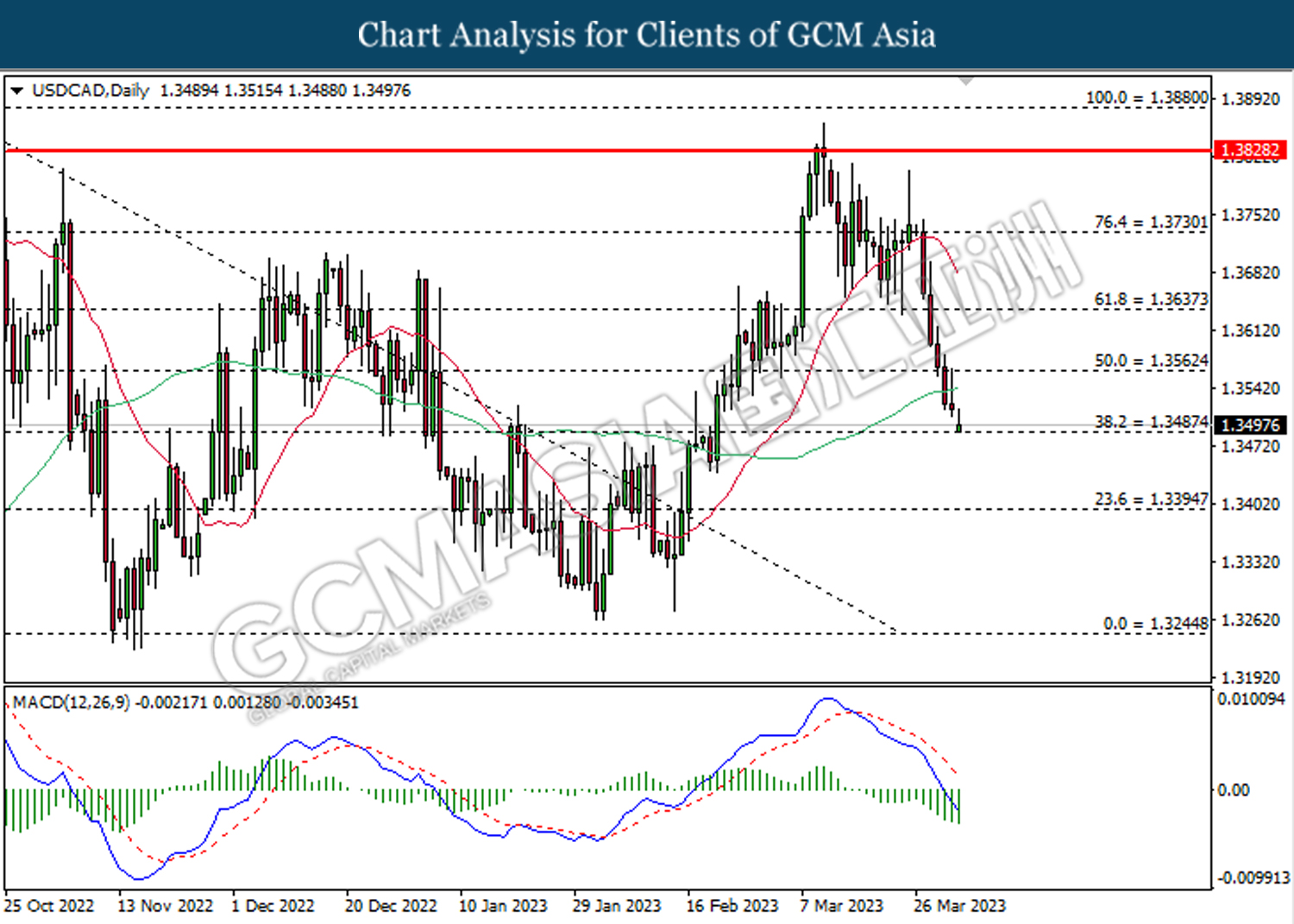

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3485. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3560, 1.3635

Support level: 1.3485, 1.3395

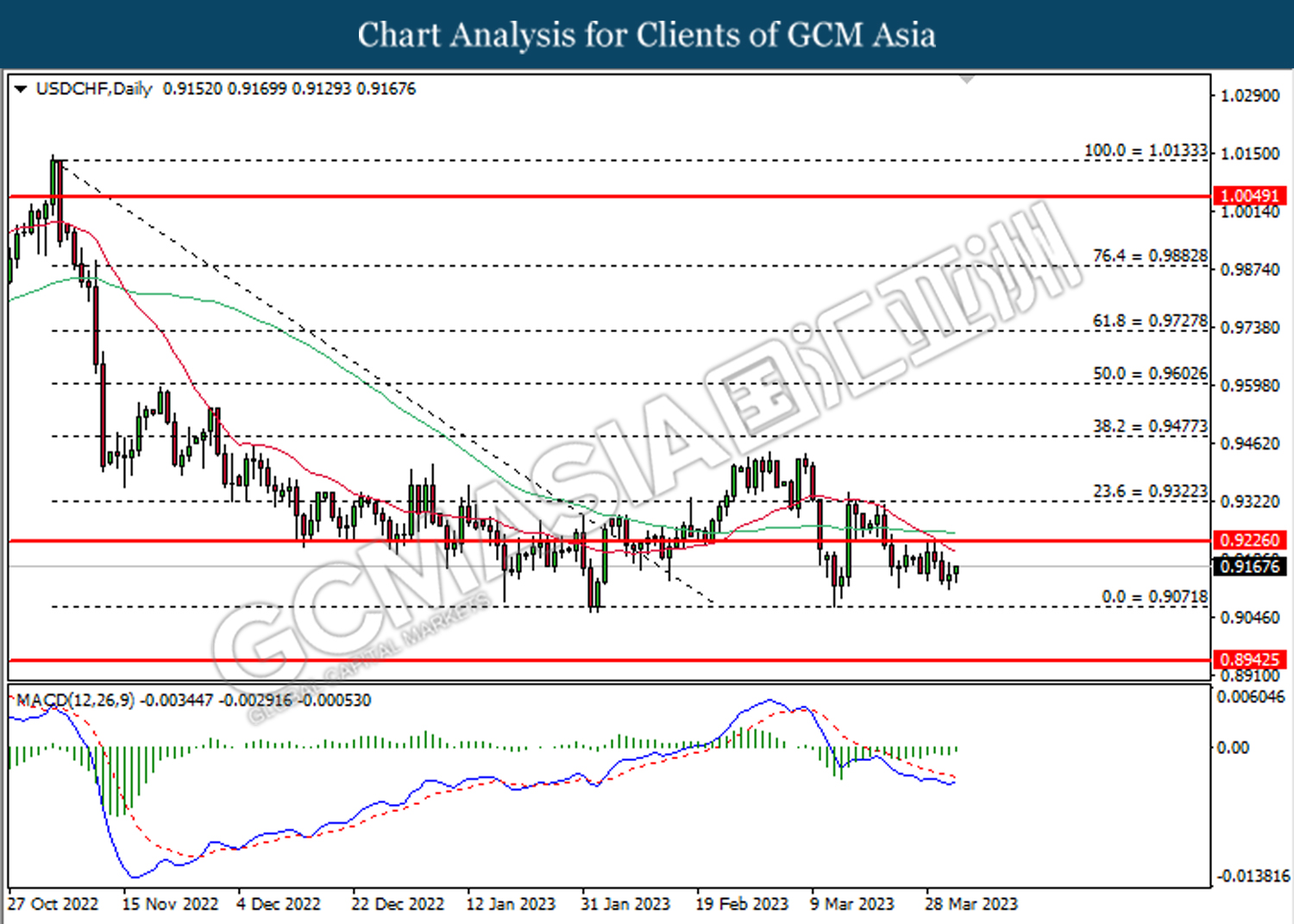

USDCHF, Daily: USDCHF was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9225.

Resistance level: 0.9225, 0.9325

Support level: 0.9070, 0.8945

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 81.70. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 81.70, 87.75

Support level: 79.65, 76.10

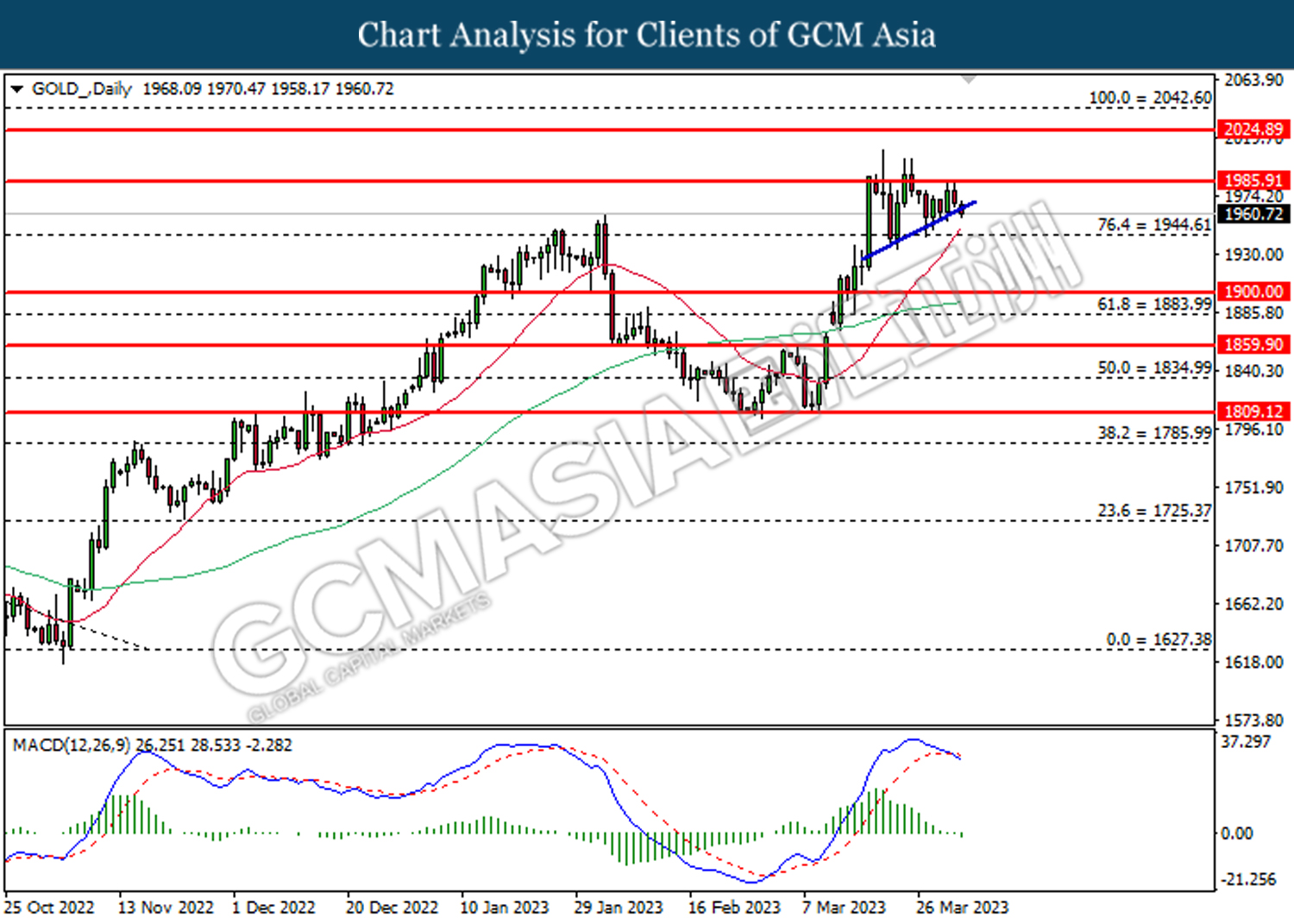

GOLD_, Daily: Gold price was traded lower following the prior retracement from the resistance level at 1985.90. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1944.60.

Resistance level: 1985.90, 2024.90

Support level: 1944.60, 1900.00