3 June 2022 Morning Session Analysis

Decelerating pace of job creation tampered the sentiment in the US dollar market.

The dollar index which gauges its value against a basket of six major currencies slumped after the recent job data showed an unexpectedly weak data. According to the Automatic Data Processing (ADP), the private sector employment rose by just 128,000 for the month, missing both the economist forecast of 300,000 and the prior month reading of 202,000. With that, it showed that the job creation at companies decelerated in a relatively quicker speed, the worst condition since the recovery of the pandemic-era. In fact, the significant decline in the May’s reading was mainly attributed to the fears of a broader economic pullback. The Inflation not only in the US, but around the world, running at its highest level in at least more than a decade, the ongoing war in Ukraine and a Covid-induced shutdown in China, have generated fears that the U.S. could be on the brink of recession. Following the release of the job data, the market sentiment of dollar index turned sourer, where a tremendous sell-off pressures were being noticed throughout the overnight trading session. As of writing, dollar index dropped -0.73% to 101.75.

In the commodities market, crude oil prices up by 0.30% to $118.25 per barrel as US Crude Inventories data fell more than expected, despite a boost of crude output from OPEC+. Besides, gold prices down -0.04% to $1869.35 per troy ounce amid the strengthening of dollar index.

Today’s Holiday Market Close

Time Market Event

All Day GBP United Kingdom – Bank Holiday

All Day CNY China – Dragon Boat Festival

All Day HKD Hong Kong – Dragon Boat Festival

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Nonfarm Payrolls (May) | 428K | 325K | – |

| 20:30 | USD – Unemployment Rate (May) | 3.6% | 3.5% | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (May) | 57.1 | 56.4 | – |

Technical Analysis

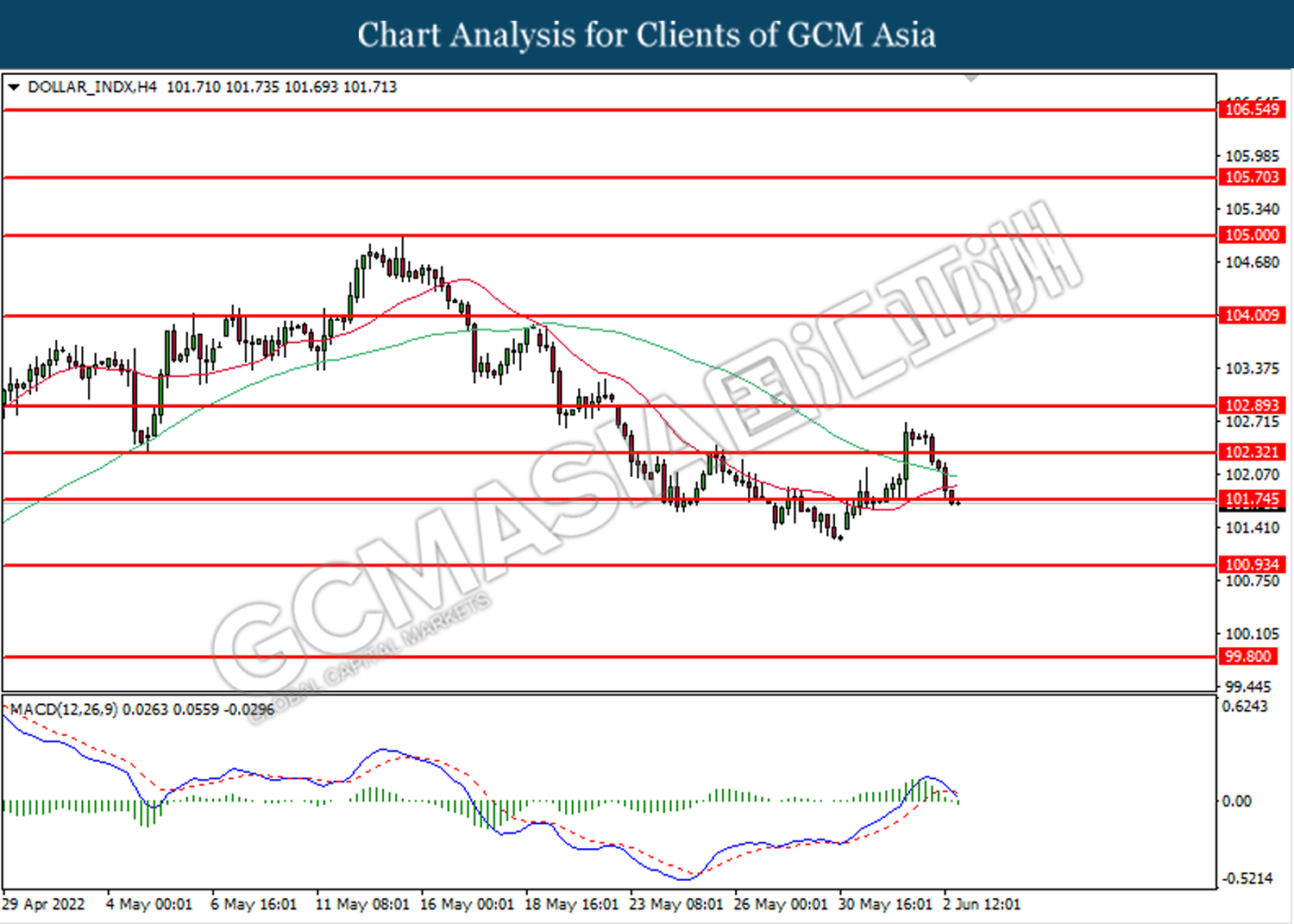

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level at 101.75. MACD which illustrated bearish bias momentum suggest the index to extend its losses toward the support level at 100.95.

Resistance level: 101.75, 102.30

Support level: 100.95, 99.80

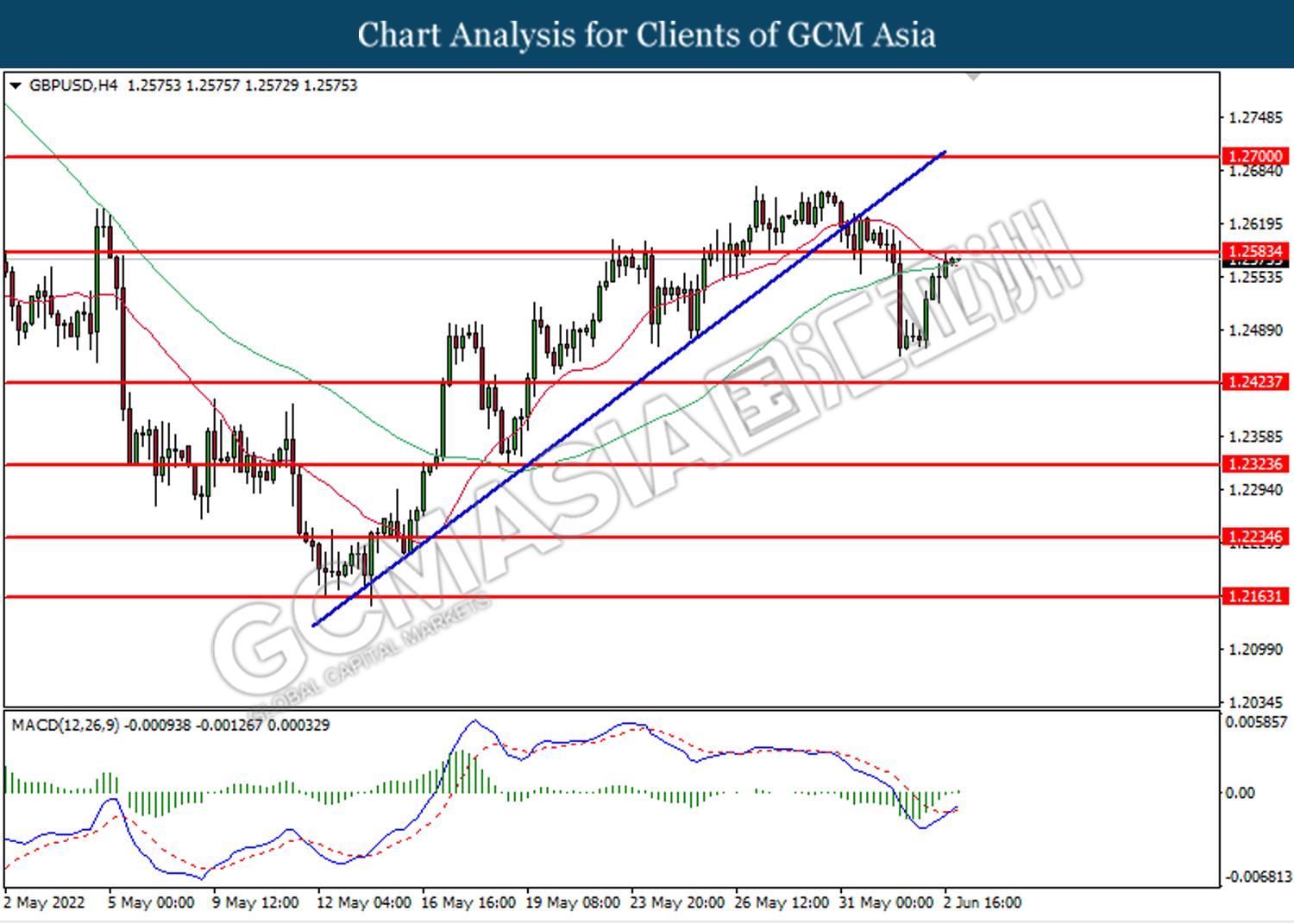

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.2585. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2585, 1.2700

Support level: 1.2425, 1.2325

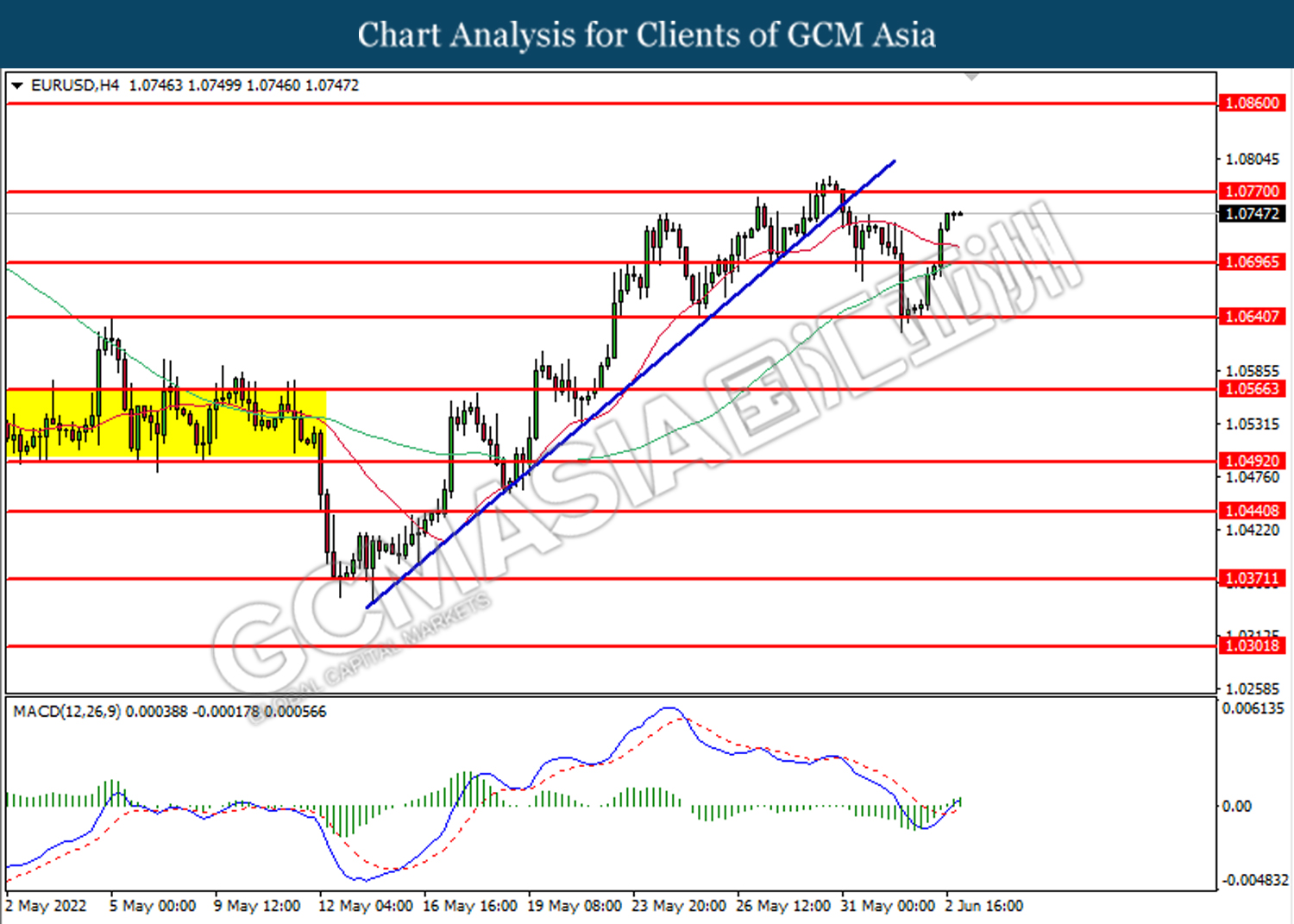

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0695. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0770.

Resistance level: 1.0770, 1.0860

Support level: 1.0695, 1.0640

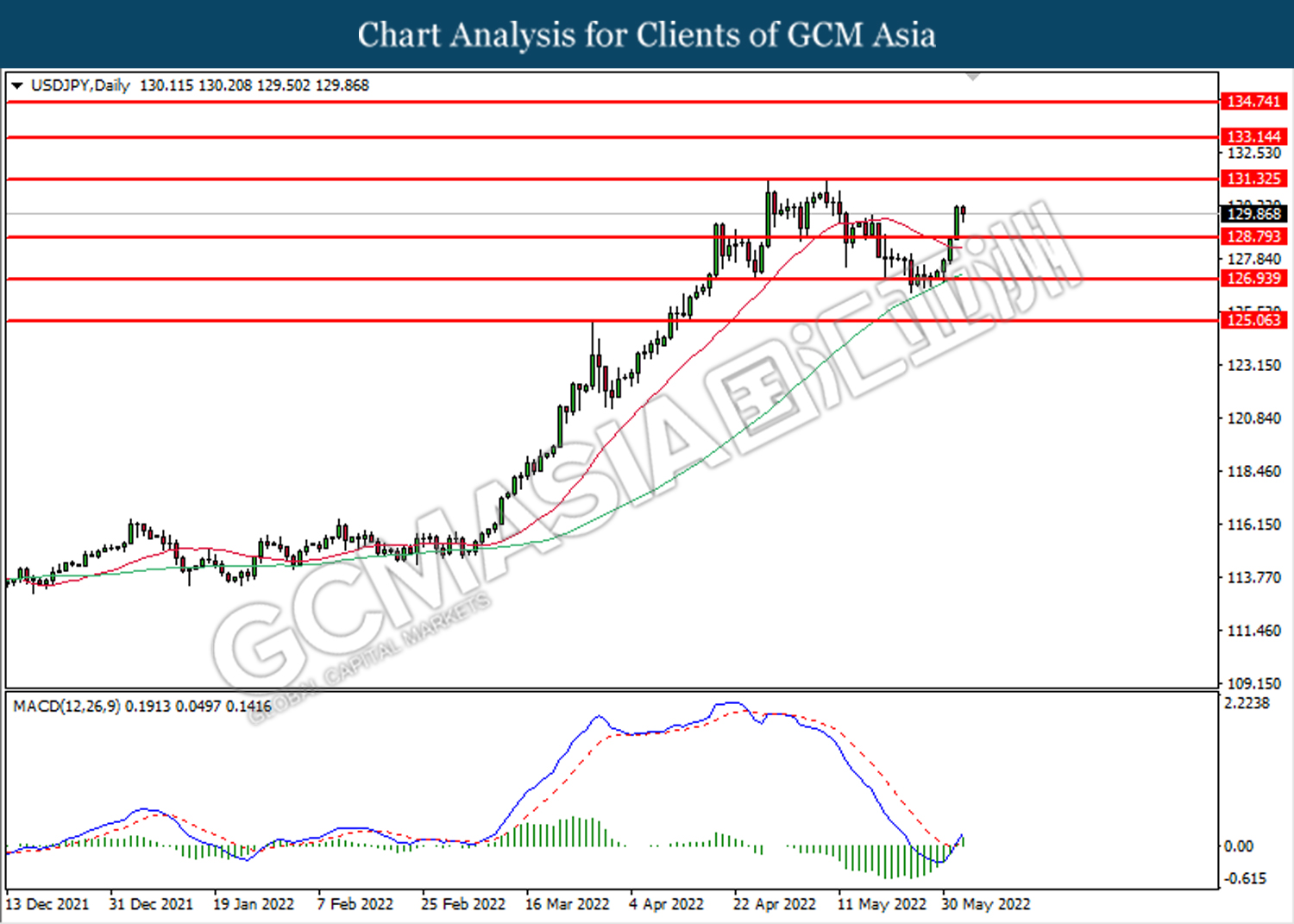

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 128.80. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the next resistance level.

Resistance level: 131.35, 133.15

Support level: 128.80, 126.95

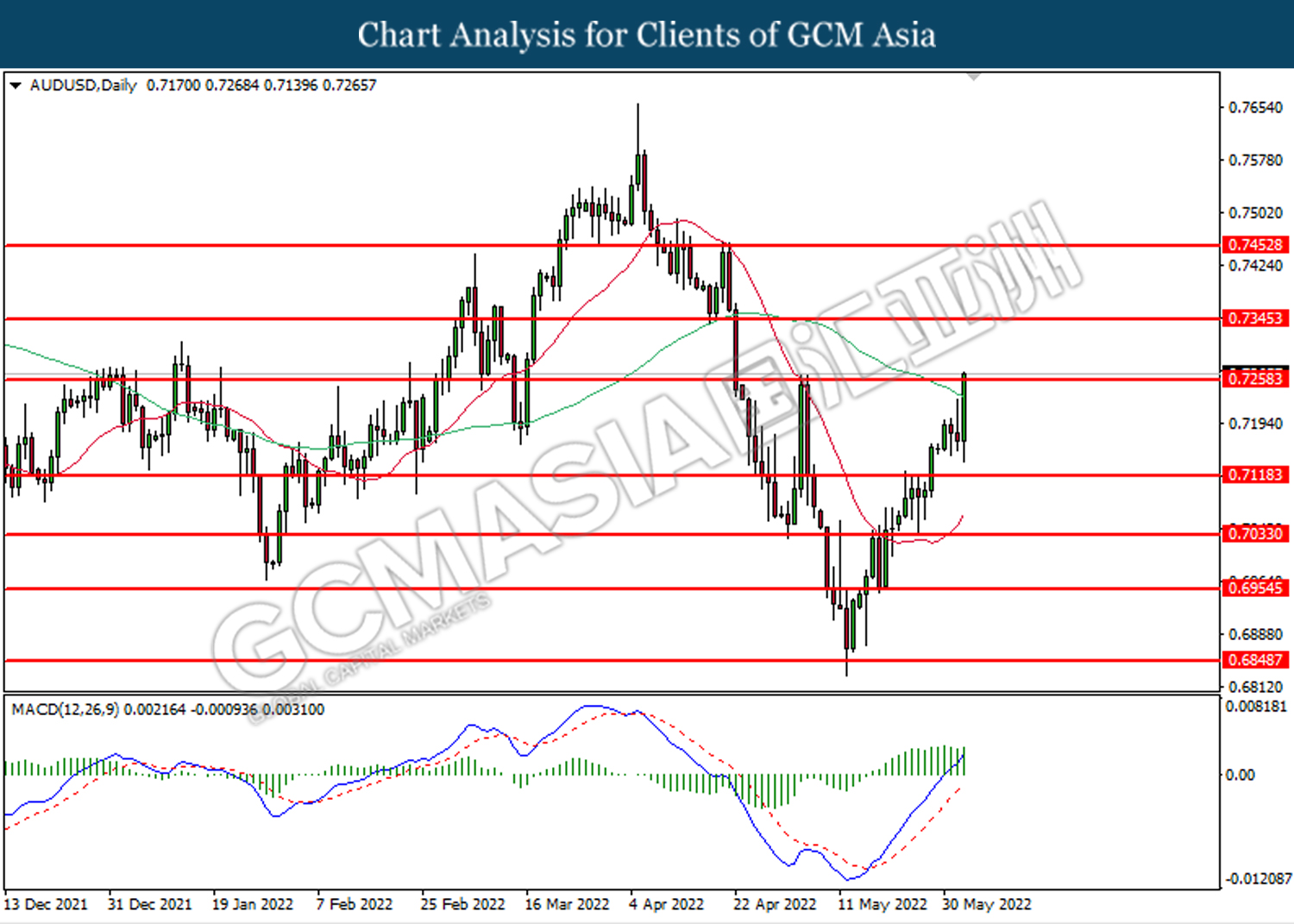

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.7260. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7260, 0.7345

Support level: 0.7120, 0.7035

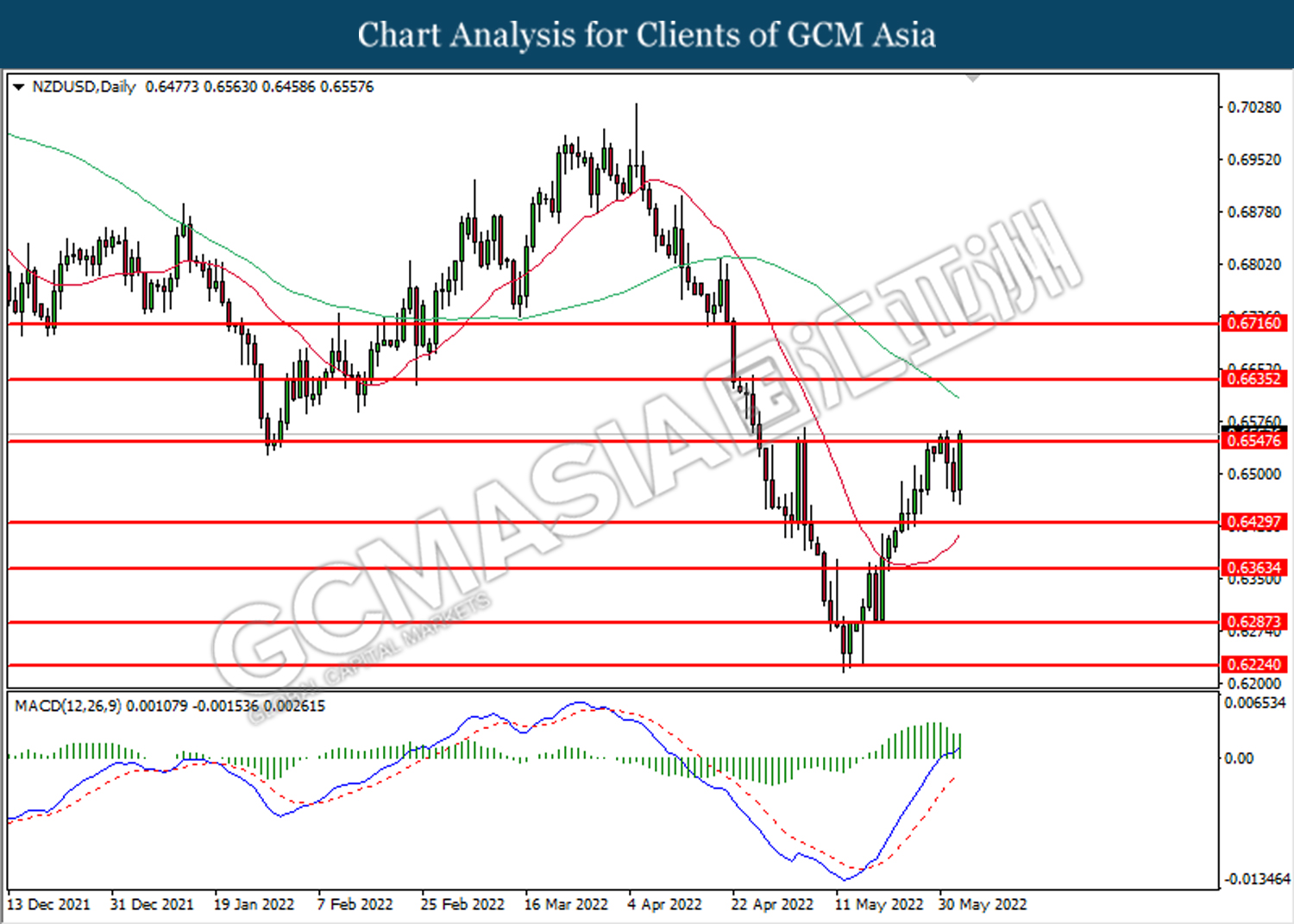

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6545. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6545, 0.6635

Support level: 0.6430, 0.6365

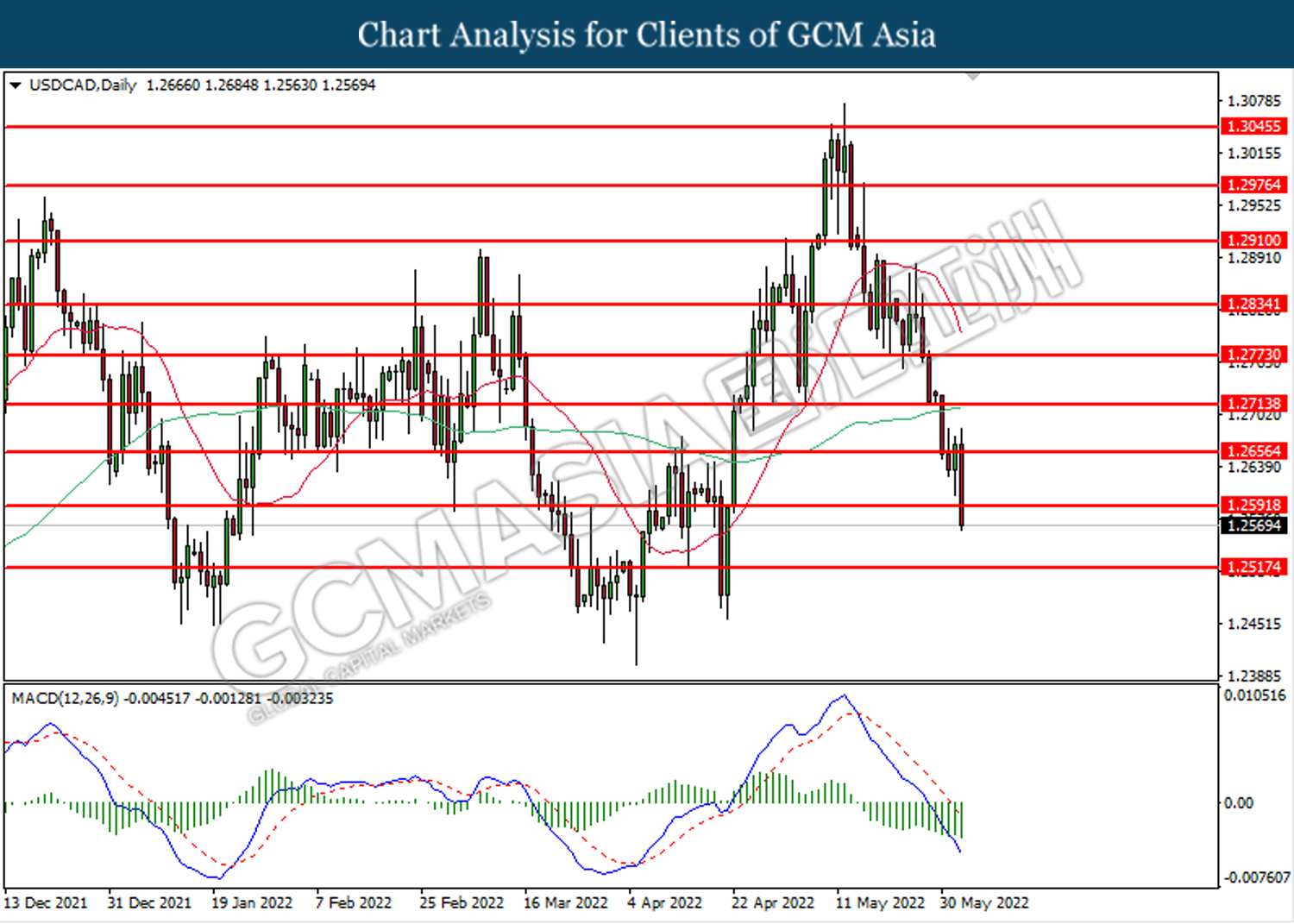

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.2590. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after its candle closed below the support level.

Resistance level: 1.2655, 1.2715

Support level: 1.2590, 1.2515

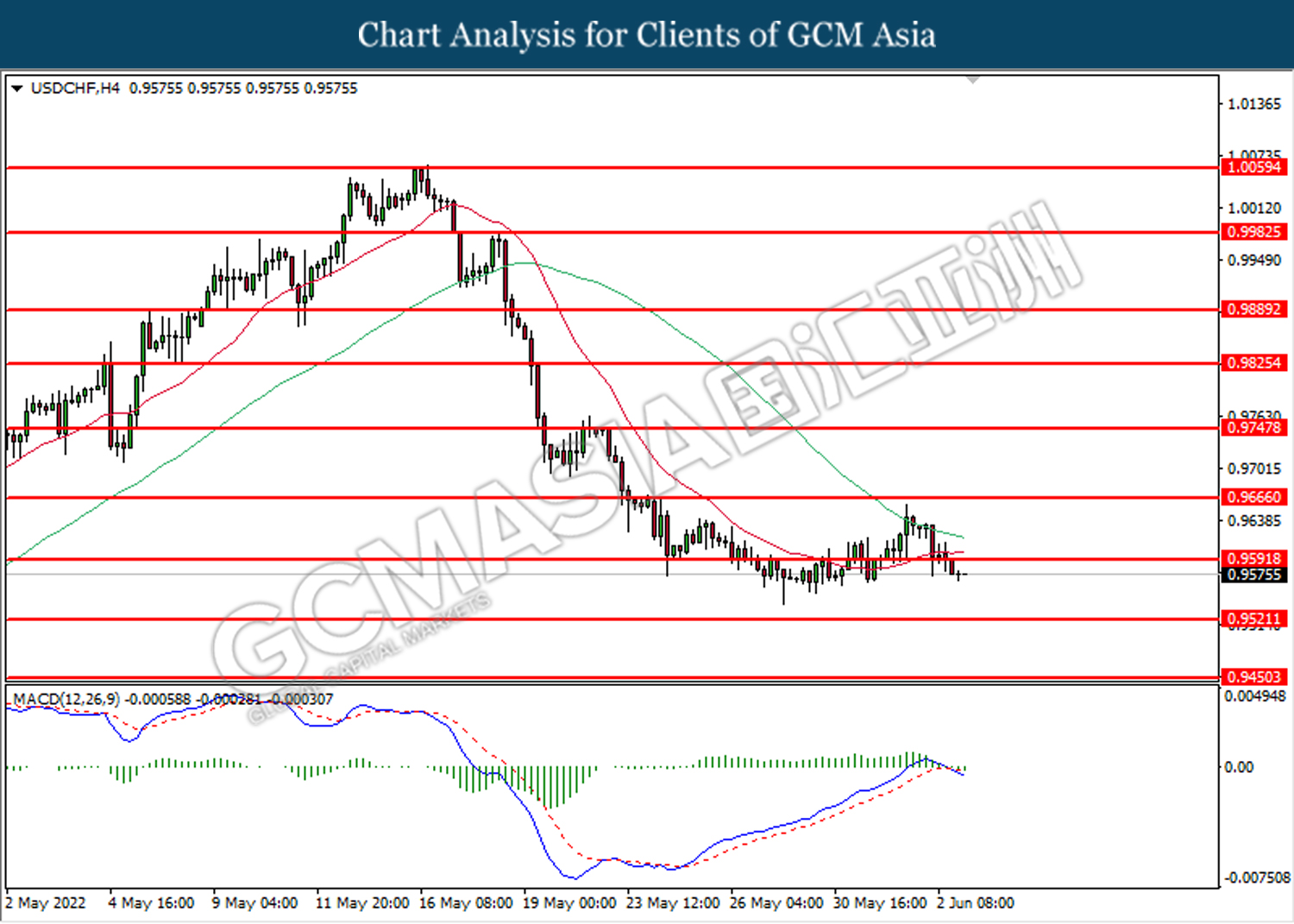

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9590. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.9520.

Resistance level: 0.9590, 0.9665

Support level: 0.9520, 0.9450

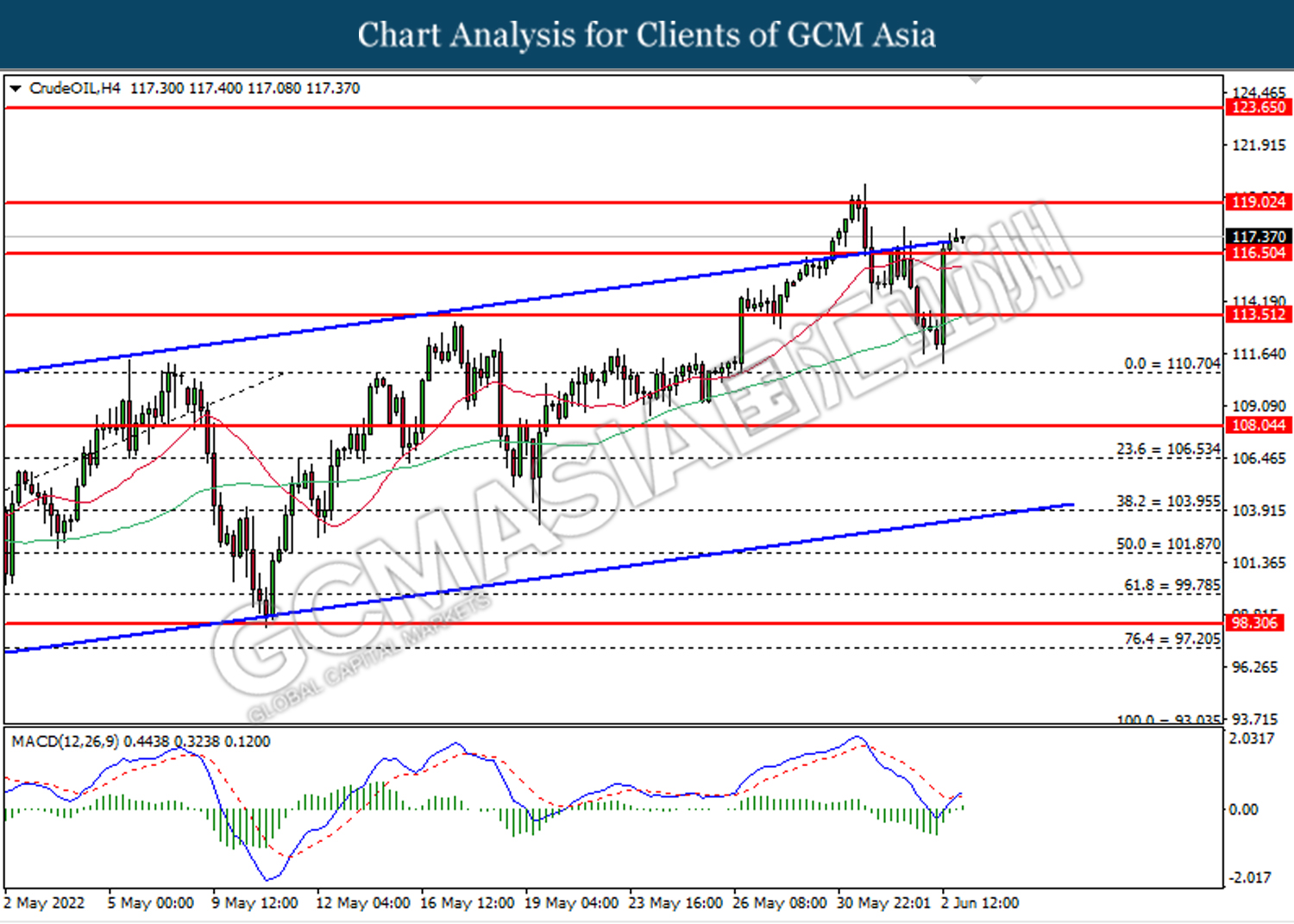

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 116.50. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 119.00.

Resistance level: 119.00, 123.65

Support level: 116.50, 113.50

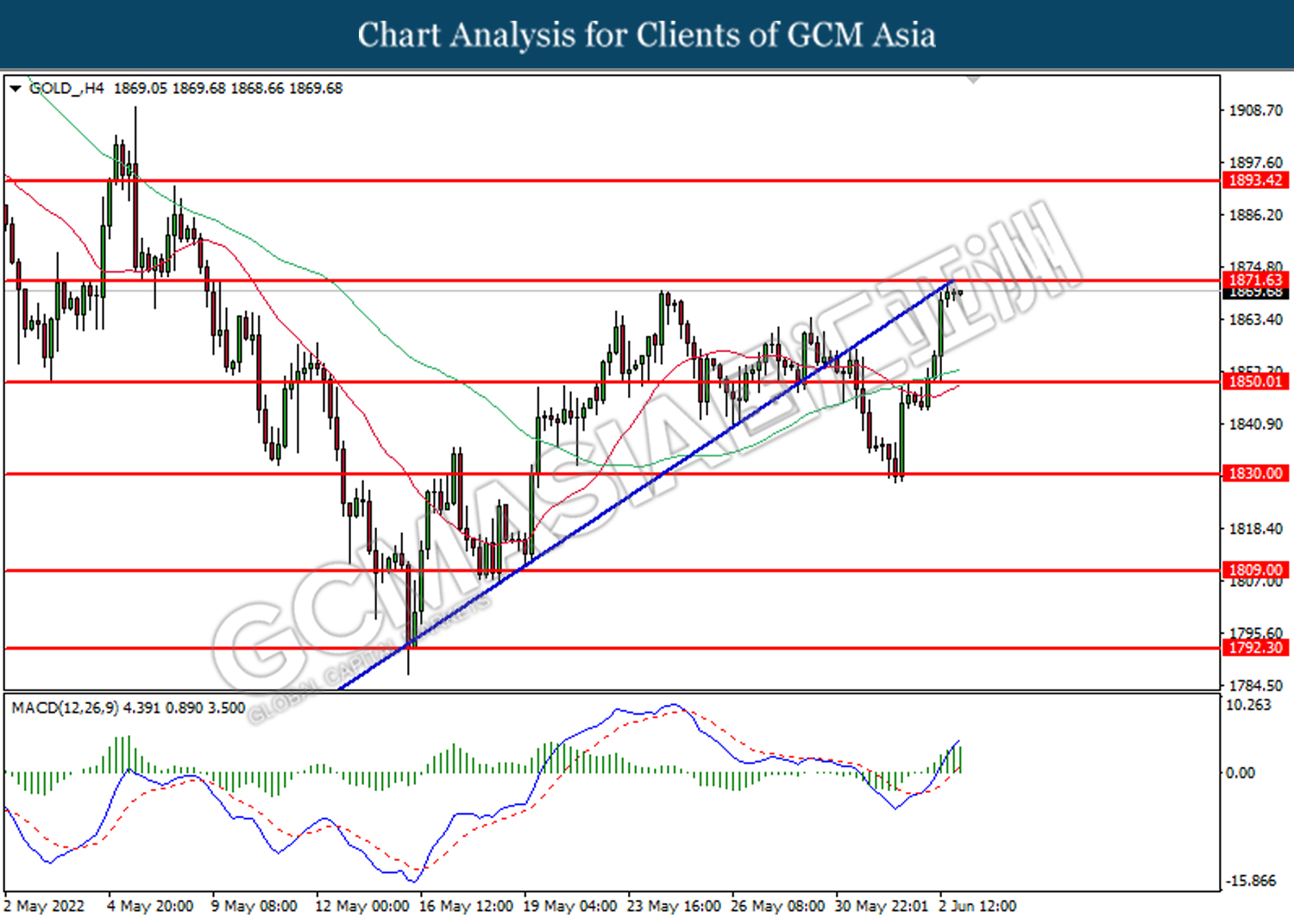

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1871.65. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1871.65, 1893.40

Support level: 1850.00, 1830.00