03 Jul 2023 Afternoon Session Analysis

Japan’s business sentiment improved but inflation expects to slip.

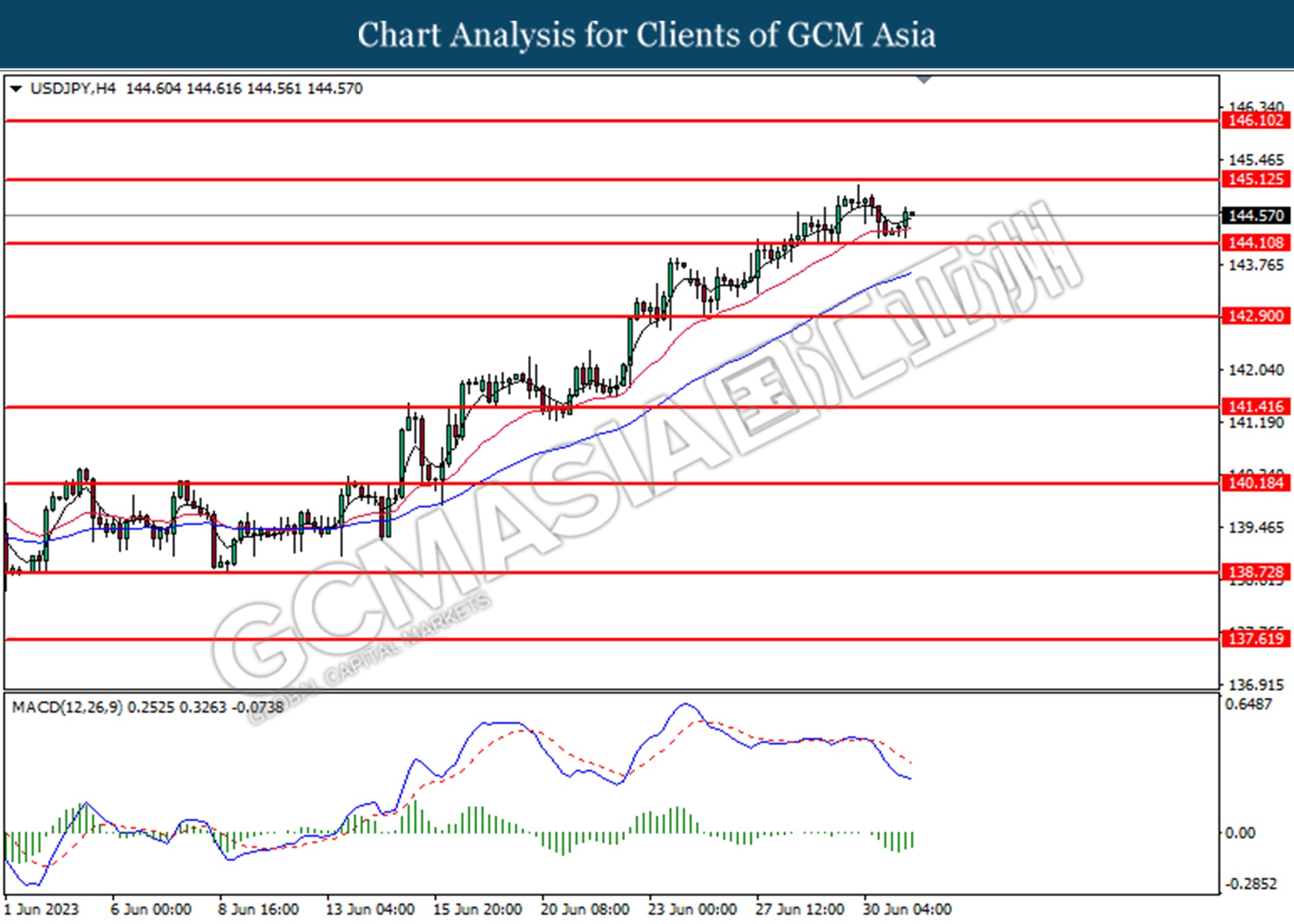

The Japanese Yen which traded against the dollar index slipped despite the Japanese business sentiment improved in the second quarter. Tankan Manufacturing June sentiment index improved to 5 from 1, upbeat the market expectations of 3. Meanwhile, the Tankan big manufacturing Outlook index improved to 9 from 3, above the economist’s expectation. The survey indicated that manufacturing firms were recovering from the hit from rising raw material prices and supply disruption. While the Tankan larger non-manufacturers index also increases to 23 from 20 in the previous reading, upbeat the economist estimations of 22. The sentiment index for big non-manufacturers increased for the fifth straight quarter and hit the highest since June 2019. In addition, the Tankan All Big industry capital expenditure increased to 13.4% from 3.2%, indicating the firms were expanding their business essentially when compared with the previous quarter. Overall economic indicators deliver a positive result reflecting a sign of steady recovery of the Japanese economy. However, the survey showed companies expect inflation to hit 2.6% a year down from the 2.8% projection made in March. The data prompted the Bank of Japan (BoJ) to keep an ultra-loosen monetary policy to achieve a sustainable 2% target. As of writing, the USDJPY increase 0.18% to 144.57.

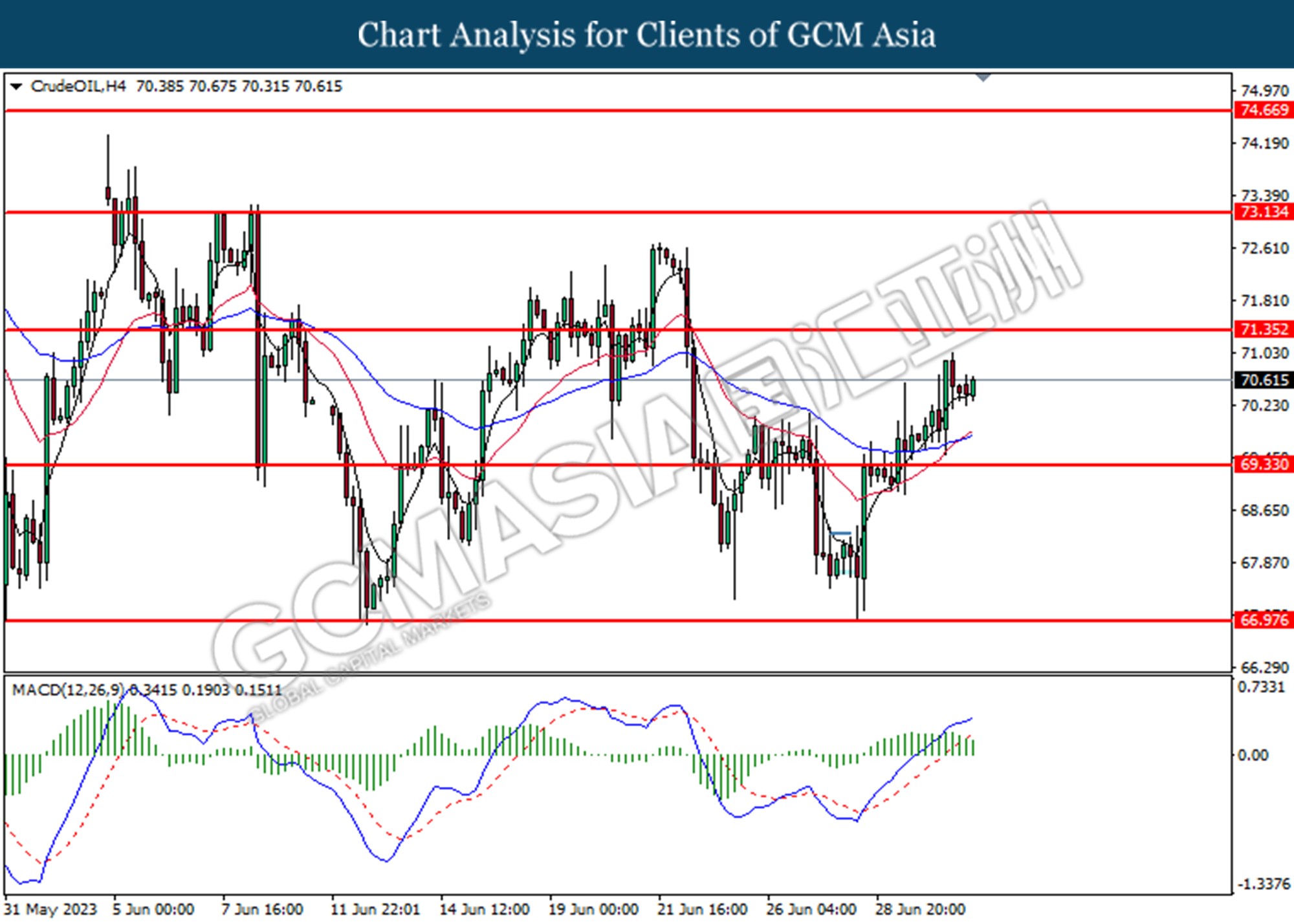

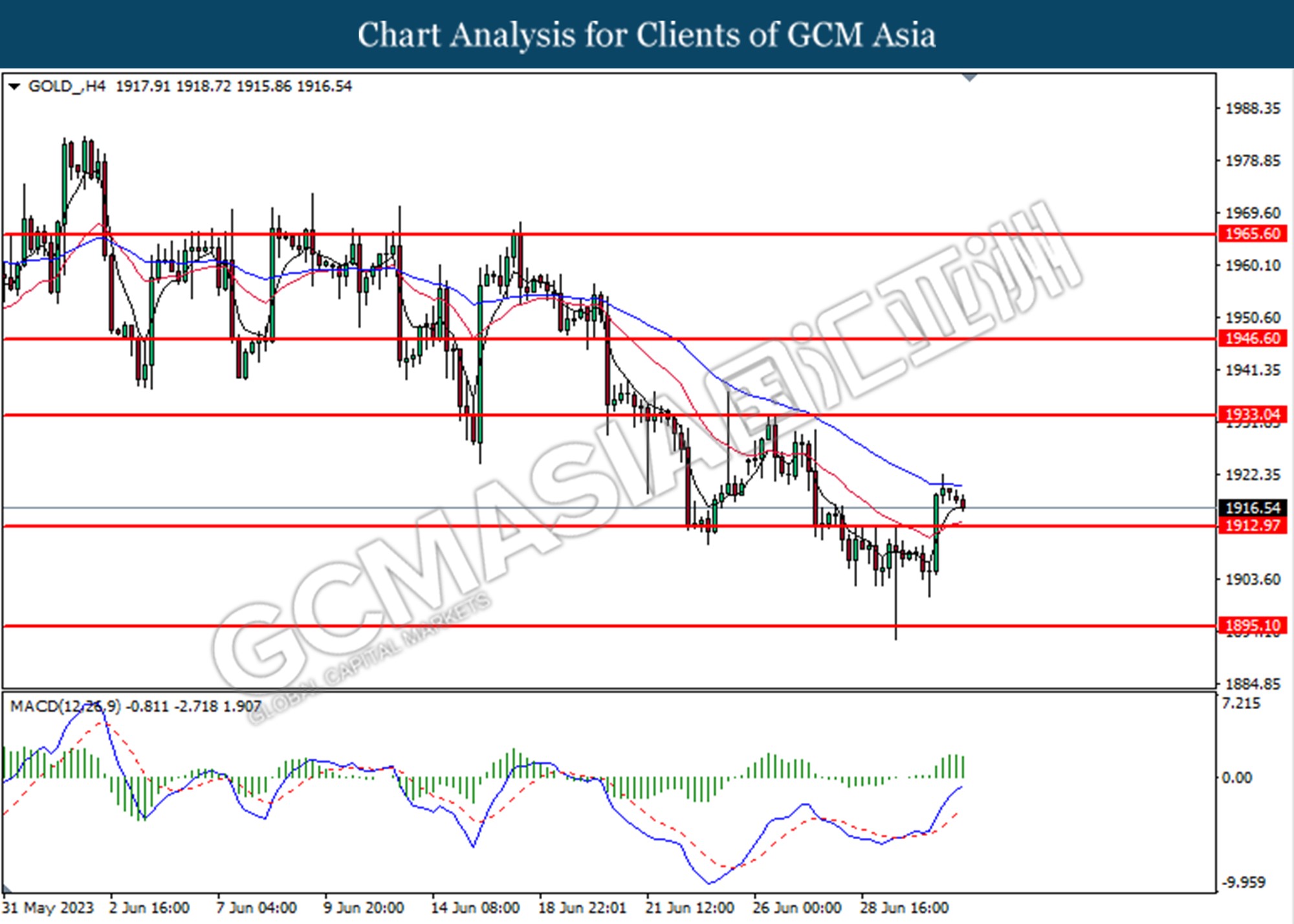

In the commodities market, crude oil prices increased by 0.03% to $70.66 per barrel after China Caixin Manufacturing PMI stood at 50.5 upbeat the estimations of 50.2. In addition, U.S. personal consumption expenditures (PCE) showed cooling inflation, allowing investors to take profits after the previous surge in gold prices, with that the gold prices falling -0.04% to 1918.90.

Today’s Holiday Market Close

Time Market Event

All Day CAD Canada Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | EUR – German Manufacturing PMI (Jun) | 41.0 | 41.0 | – |

| 16:30 | GBP – Manufacturing PMI (Jun) | 46.2 | 46.2 | – |

| 22:00 | USD – ISM Manufacturing PMI (Jun) | 46.9 | 47.2 | – |

Technical Analysis

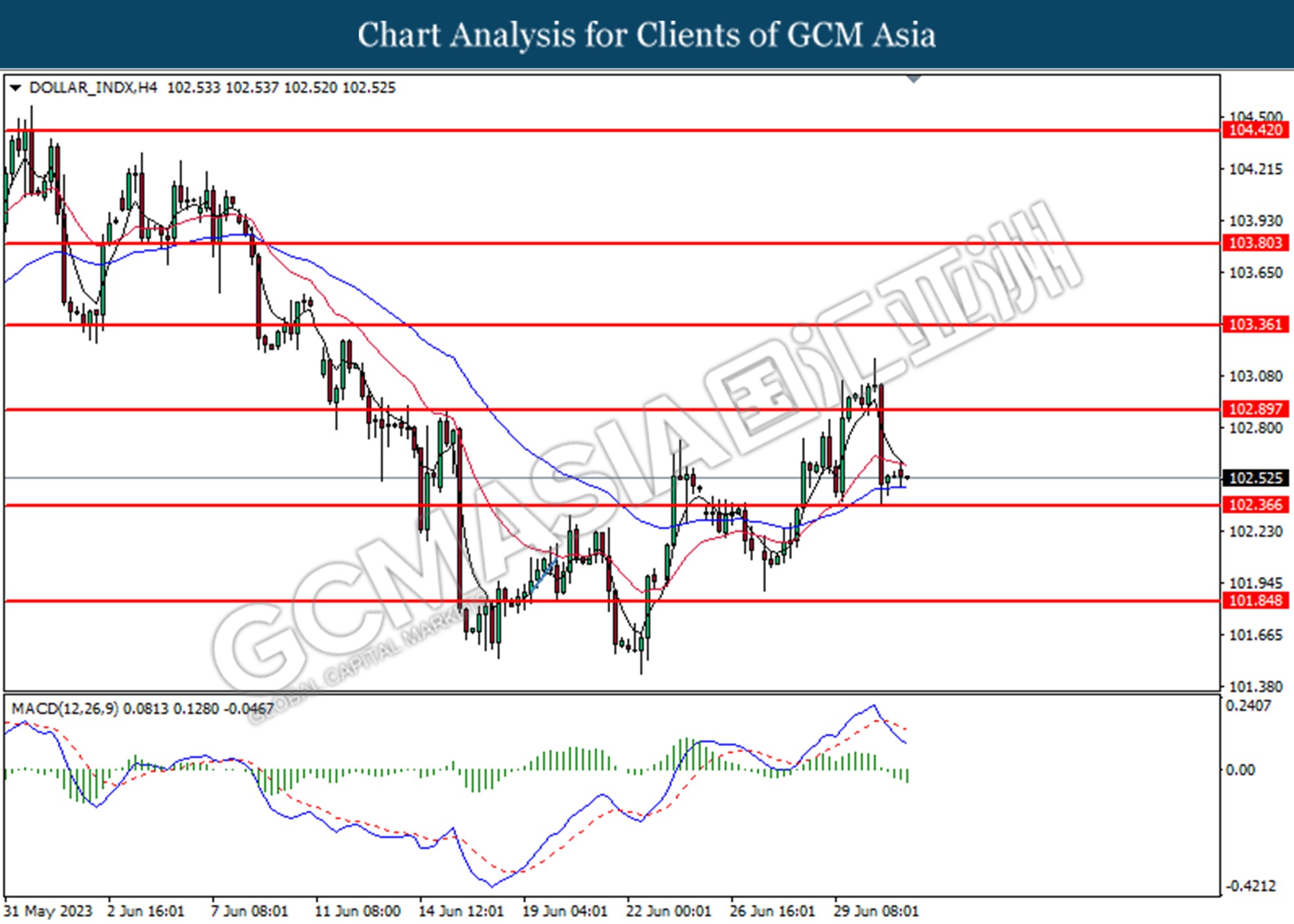

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the index extended its losses toward the support level at 102.35.

Resistance level: 102.90, 103.35

Support level: 102.35, 101.85

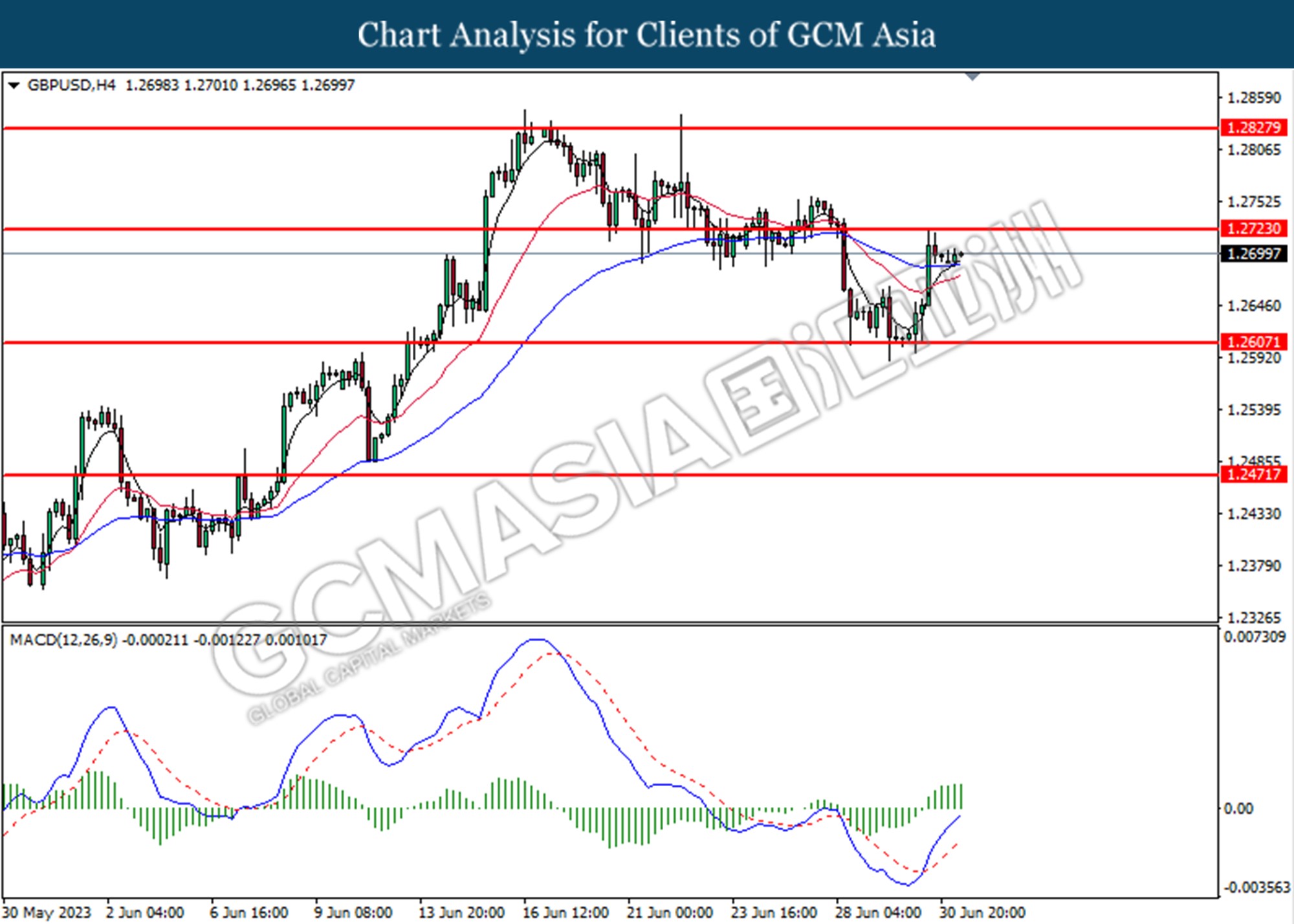

GBPUSD, H4: GBPUSD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 1.2725.

Resistance level: 1.2725, 1.2830

Support level: 1.2610, 1.2470

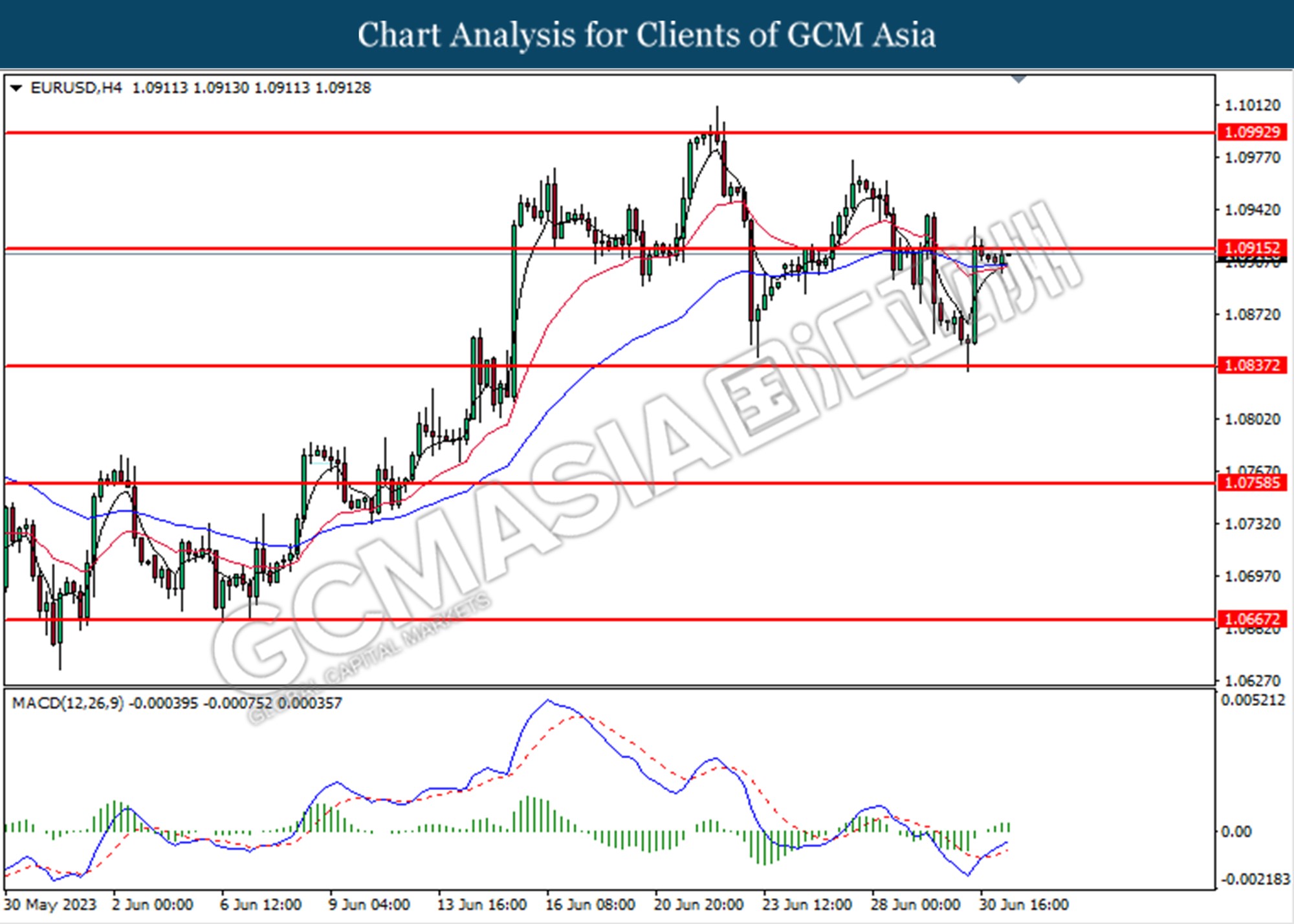

EURUSD, H4: EURUSD was traded higher while currently testing for the resistance level at 1.0915. MACD which illustrated increasing bullish momentum suggests the pair extended its gains after it successfully breaks above the resistance level.

Resistance level: 1.0915, 1.0990

Support level: 1.0840, 1.0760

USDJPY, H4: USDJPY was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 145.10.

Resistance level: 145.10, 146.10

Support level: 144.10, 142.90

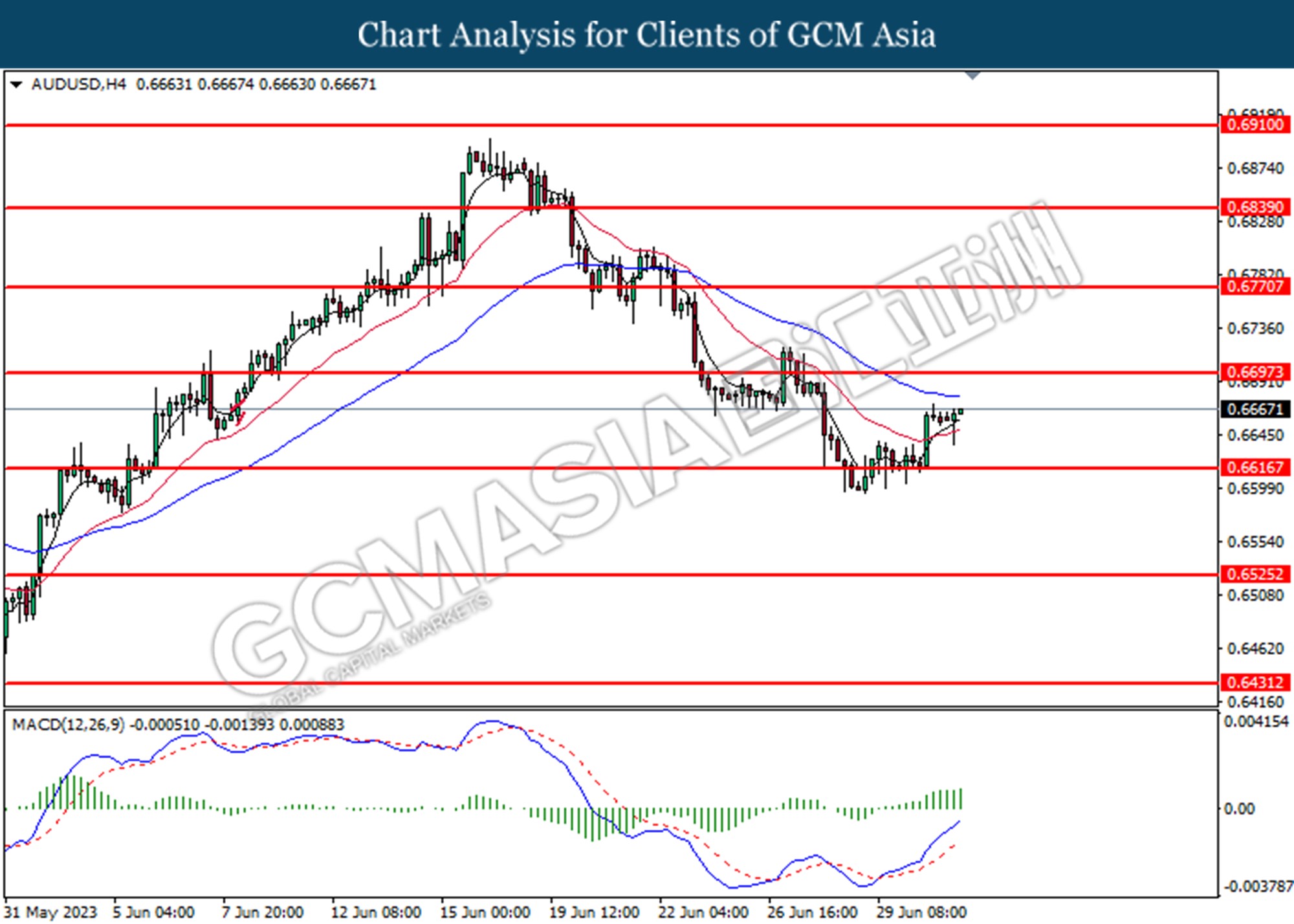

AUDUSD, H4: AUDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 0.6700.

Resistance level: 0.6700, 0.6770

Support level: 0.6615, 0.6525

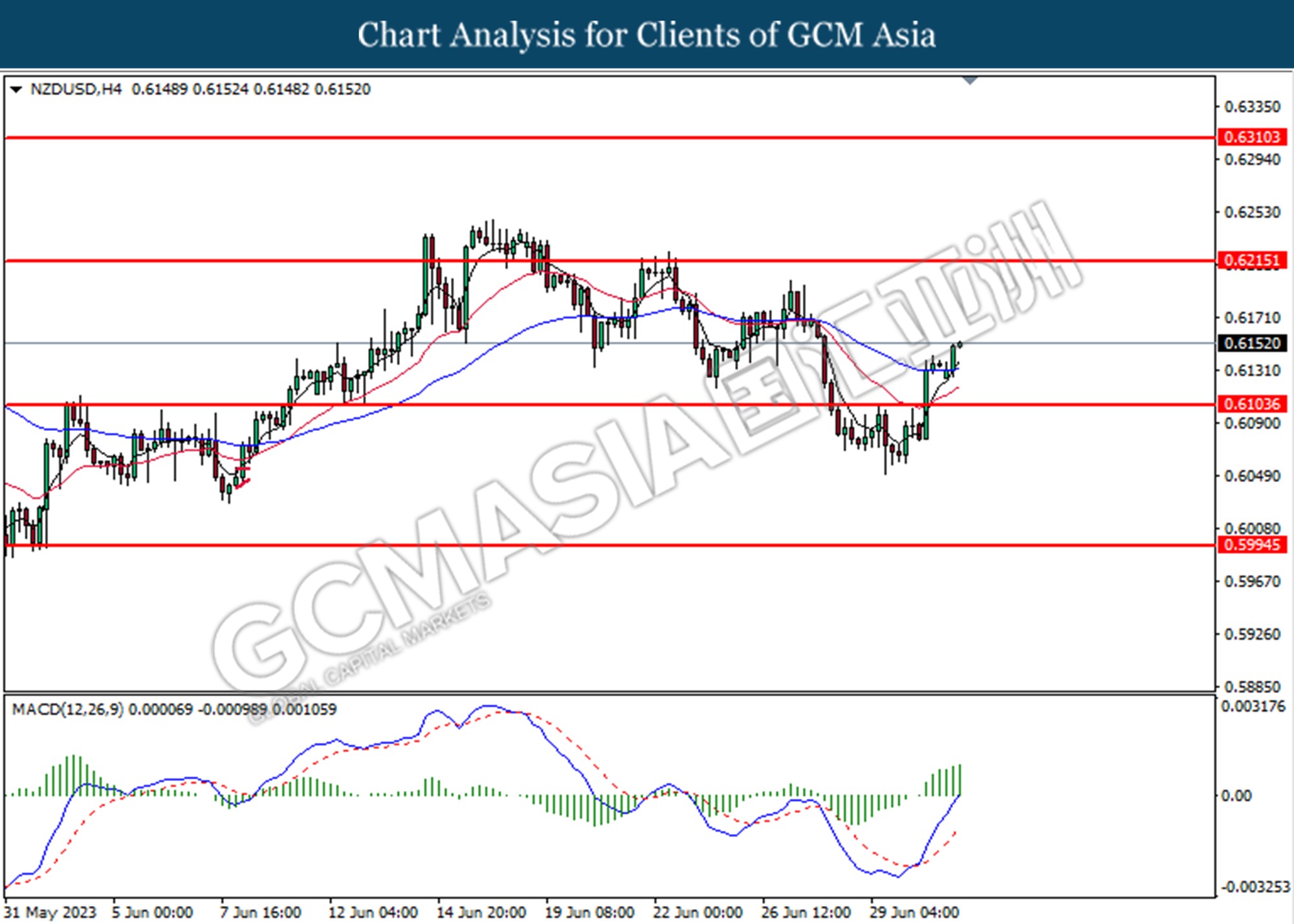

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

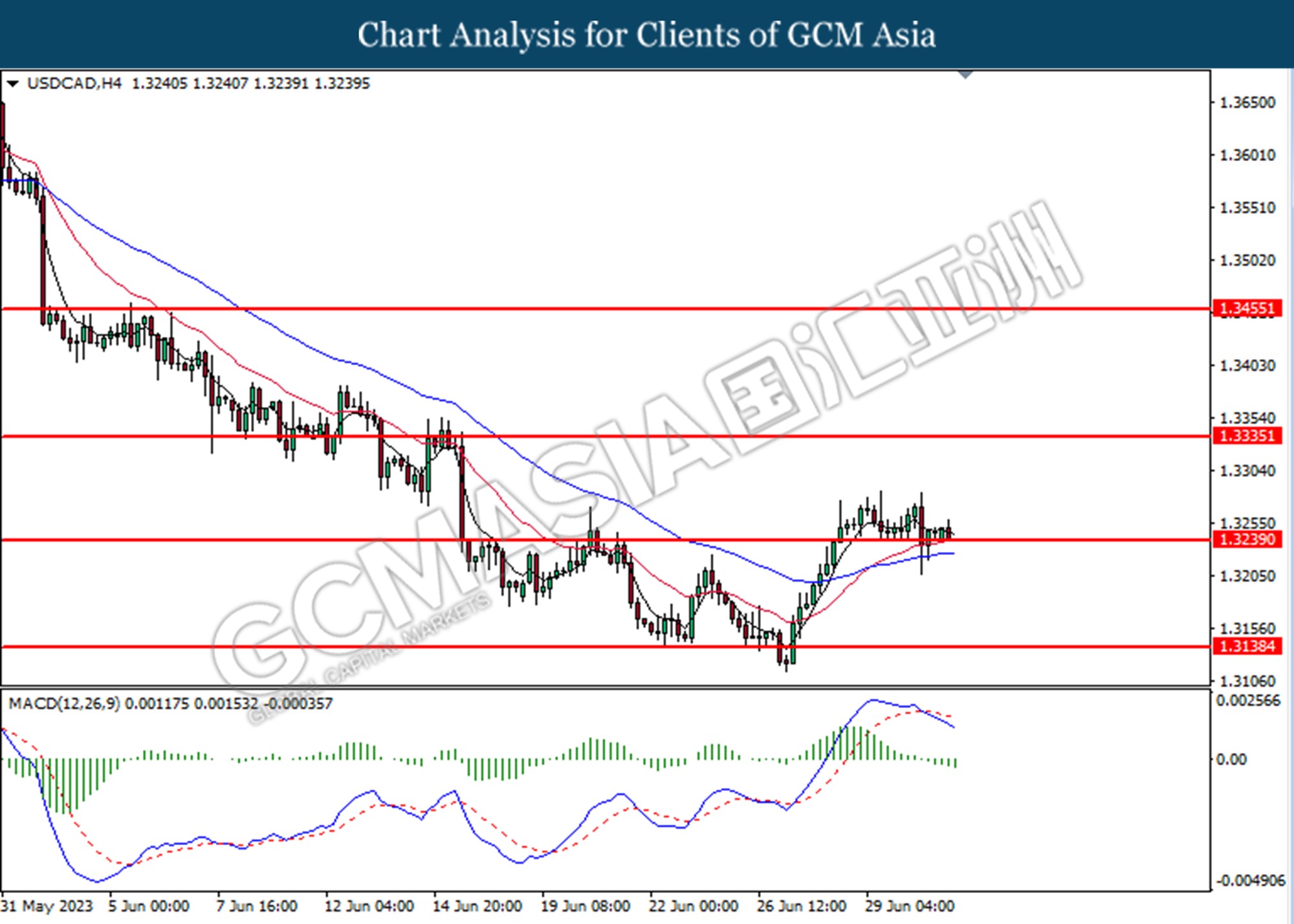

USDCAD, H4: USDCAD was traded lower while currently testing for the support level at 1.3240. MACD which illustrated increasing bearish momentum suggests the pair extended its losses after if successfully break below the support level.

Resistance level: 1.3335, 1.3455

Support level: 1.3240, 1.3140

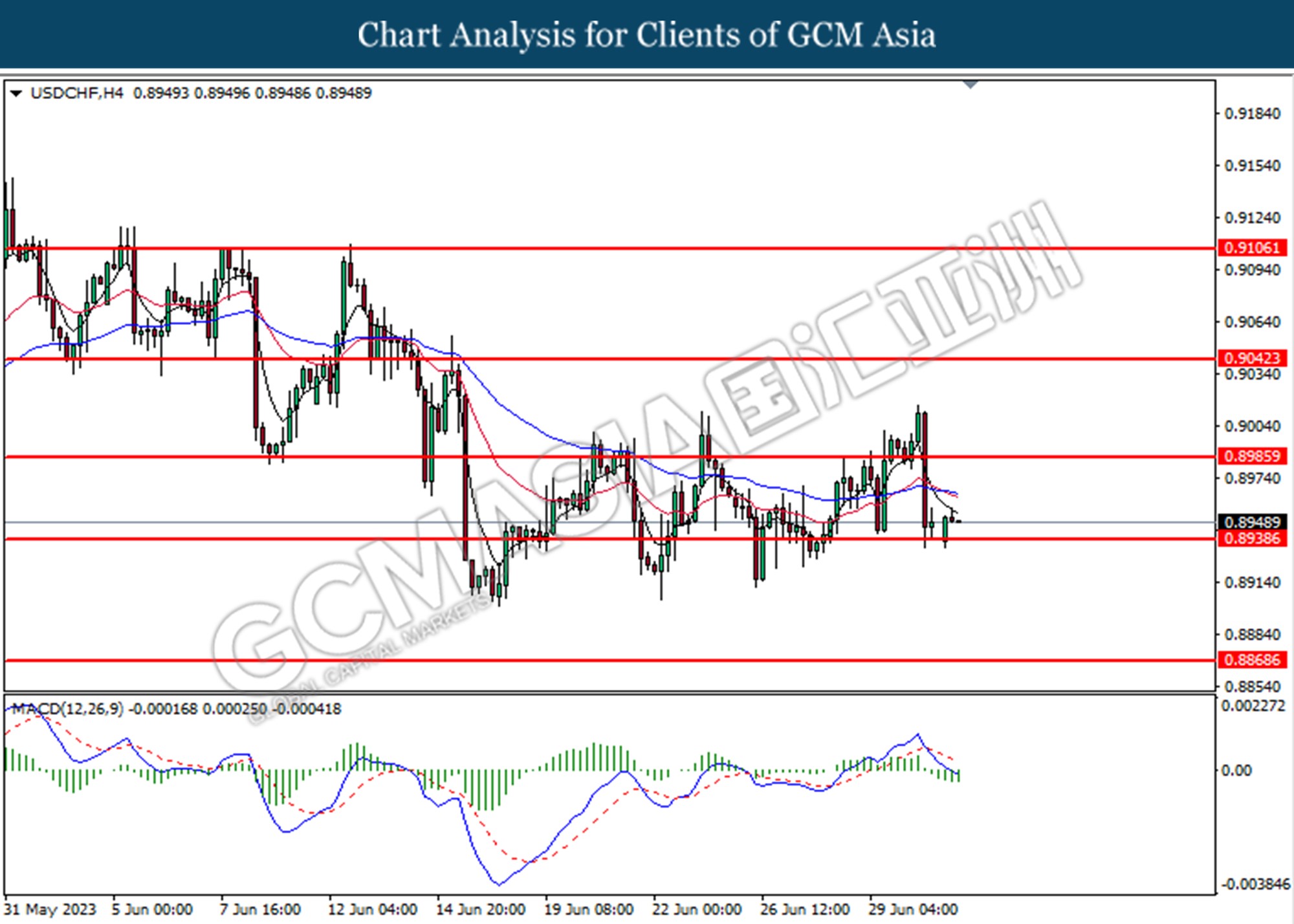

USDCHF, H4: USDCHF was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 0.8940.

Resistance level: 0.8985, 0.9040

Support level: 0.8940, 0.8870

CrudeOIL, H4: Crude oil price was traded higher following the prior breaks rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggests the commodity undergoes a technical correction in the short term.

Resistance level: 71.35,73.15

Support level: 69.30, 67.55

GOLD_, H4: Gold price was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the commodity extended its losses toward the support level at 1913.00.

Resistance level: 1933.00, 1946.60

Support level: 1913.00, 1895.10