03 July 2023 Morning Session Analysis

Greenback plummeted amid further easing of inflation in US.

The dollar index, which was traded against a basket of six major currencies, lost its foot of gains after hitting the 20-days high as U.S. consumer spending slowed sharply in May. According to the Bureau of Economic Analysis, the US PCE Price Index came in at 3.8%, far lower than the both prior reading and economist forecast at 4.3% and 4.6% respectively. Besides, excluding the volatile food and energy components, the PCE price index was up by 0.3% after rising 0.4% in the prior month. These data pointed to a sign of further easing in the US inflationary pressures, igniting the possibility of smaller or lesser than expected rate hikes in the remaining meeting of this year. Though, at the Fed’s meeting in early June, Fed officials said they expected at least two more quarter-point rate hikes by the end of the year. In addition, during the ECB Economic Forum, the Fed Chairman Jerome Powell mentioned that the level of their long term inflation target is not likely to be reached in several years. Therefore, the investors are now eyeing on more economic data in order to get a clearer clue if hefty rate hikes are still on the table of next Fed’s meeting. As of writing, the dollar index ticked down by -0.01% to 102.90.

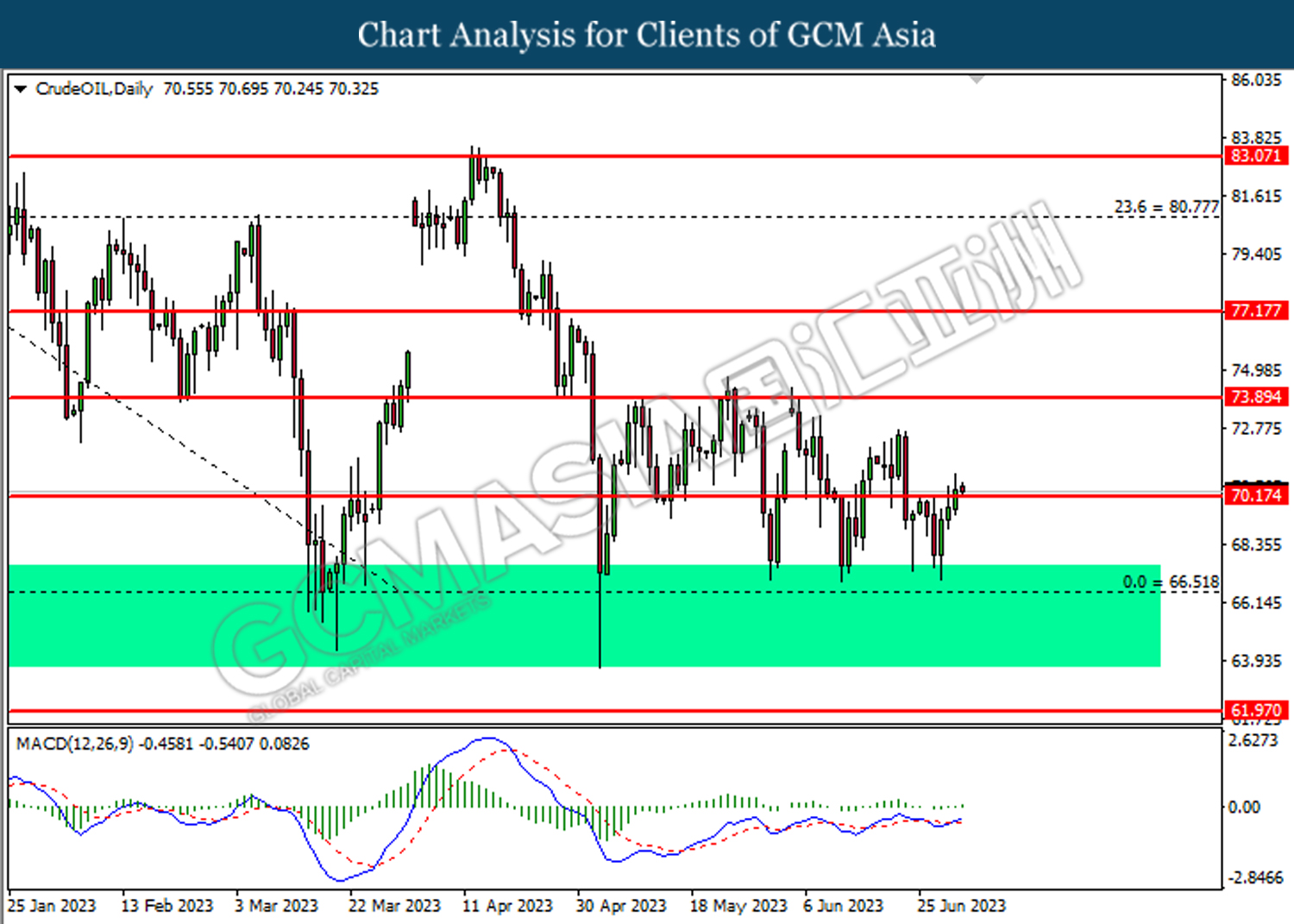

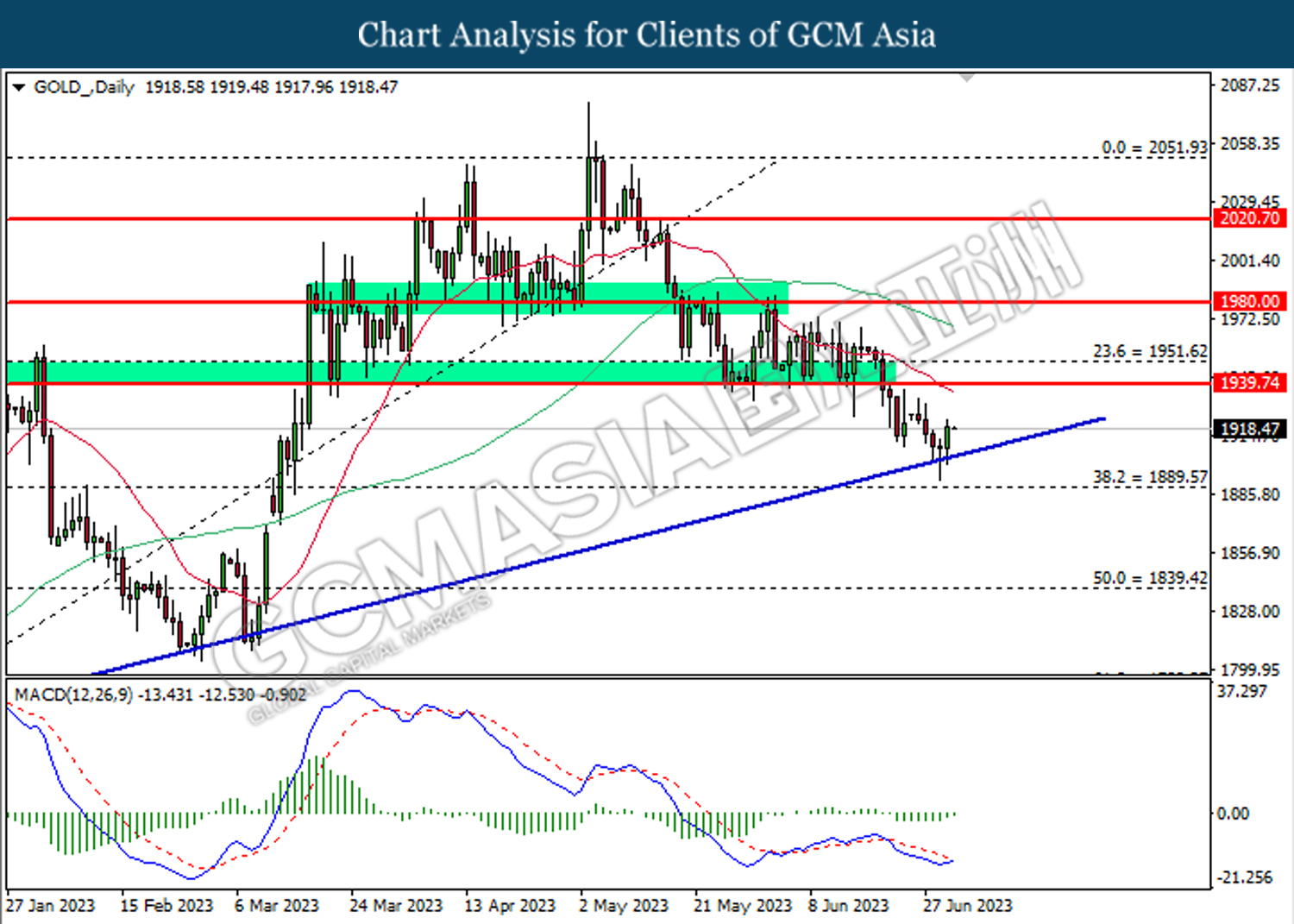

In the commodities market, crude oil prices appreciated by 0.95% to $70.30 per barrel as Saudi Arabia’s plan to cut production by 1 million barrels per day has been taken into effect since last weekend. Besides, the gold prices edged up by 0.02% to $1919.45 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

All Day CAD Canada Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | EUR – German Manufacturing PMI (Jun) | 41.0 | 41.0 | – |

| 16:30 | GBP – Manufacturing PMI (Jun) | 46.2 | 46.2 | – |

| 22:00 | USD – ISM Manufacturing PMI (Jun) | 46.9 | 47.2 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the resistance level at 103.00. However, MACD which illustrated diminishing bearish momentum suggests the index to undergo technical correction in short term.

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded higher following the prior rebound from the support level at 1.2635. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2765.

Resistance level: 1.2765, 1.2875

Support level: 1.2635, 1.2525

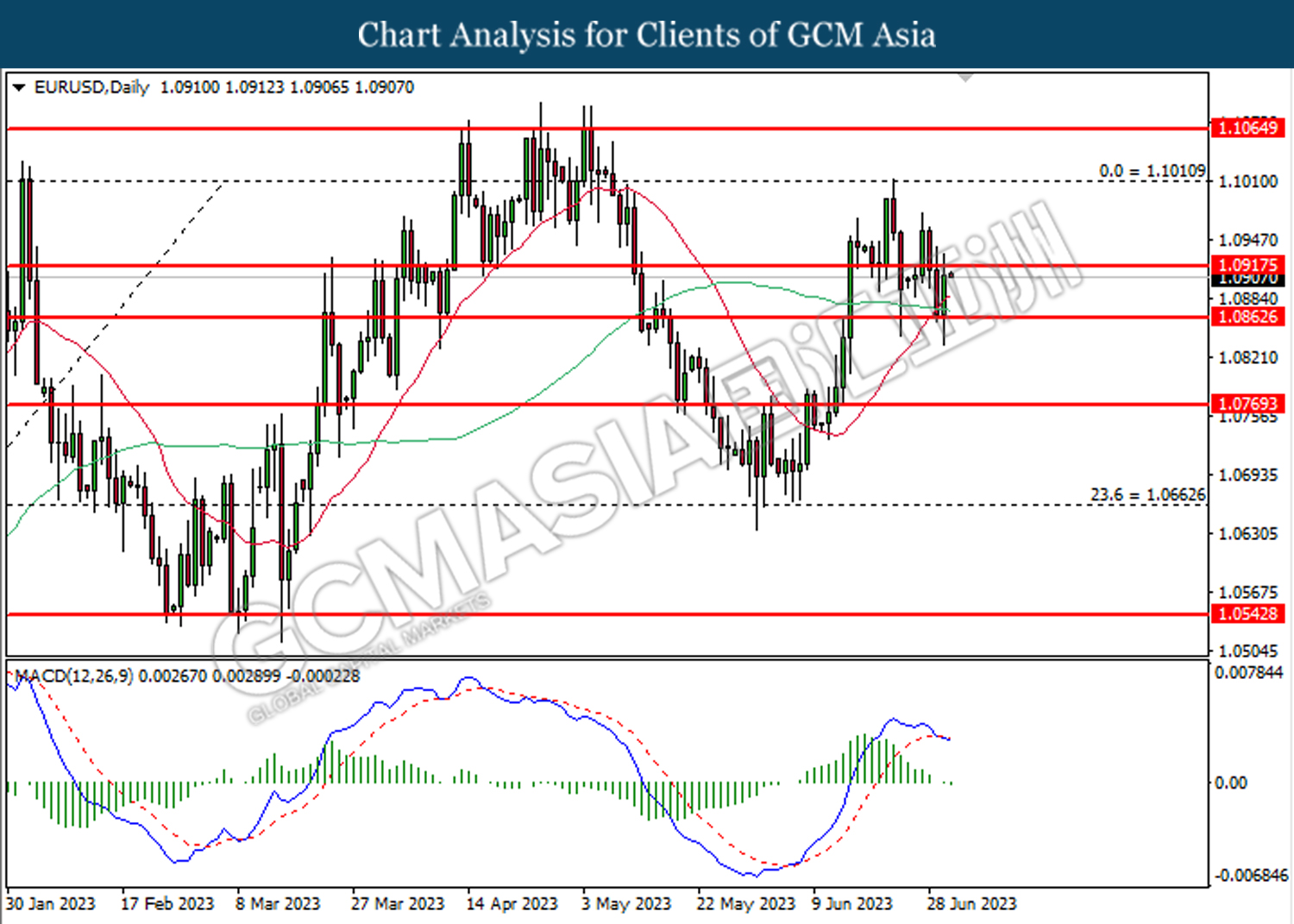

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0915. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.0915, 1.1010

Support level: 1.0865, 1.0770

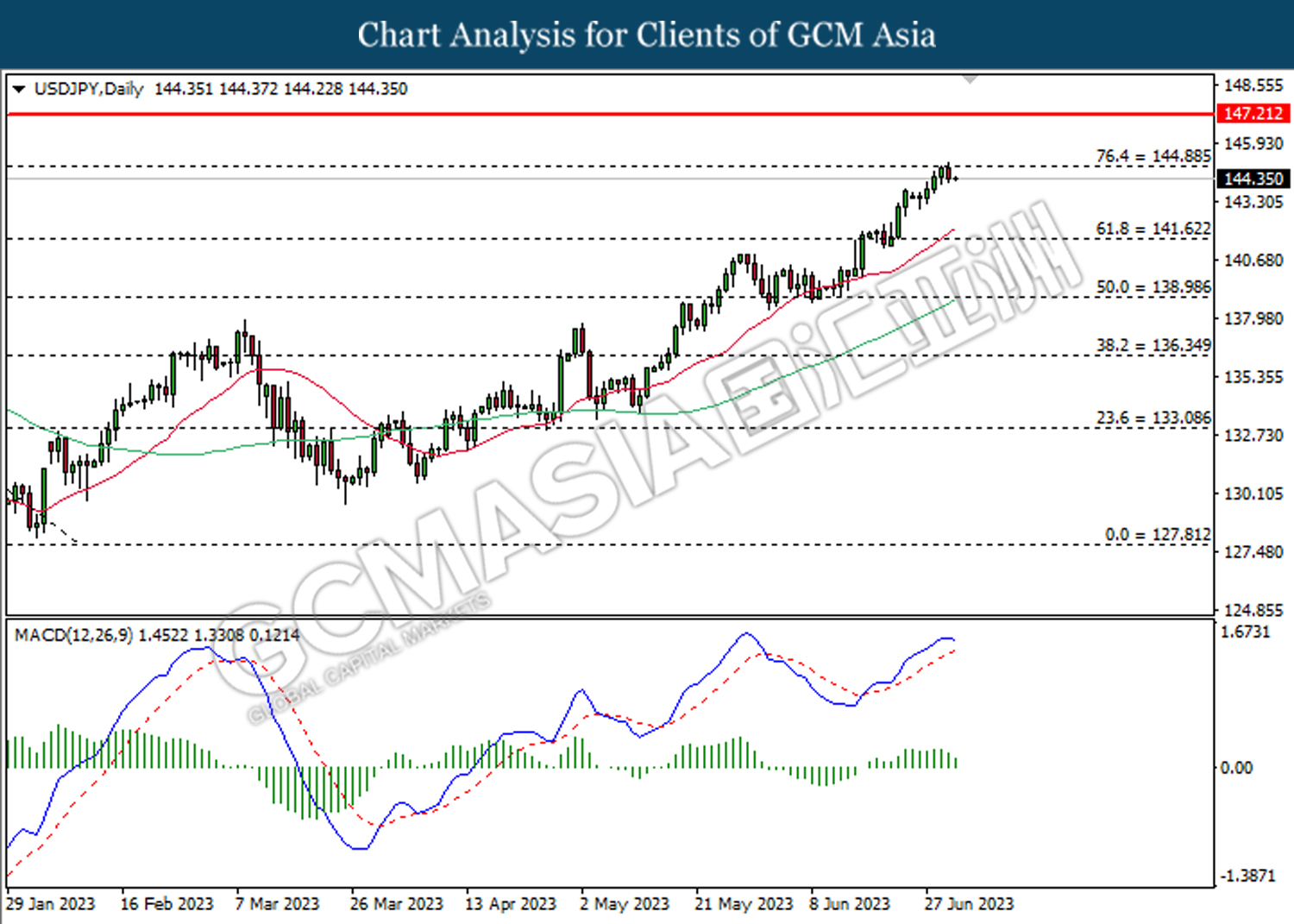

USDJPY, Daily: USDJPY was traded lower following the prior retracement from the resistance level at 144.90. However, MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 141.60.

Resistance level: 144.90, 147.20

Support level: 141.60, 139.00

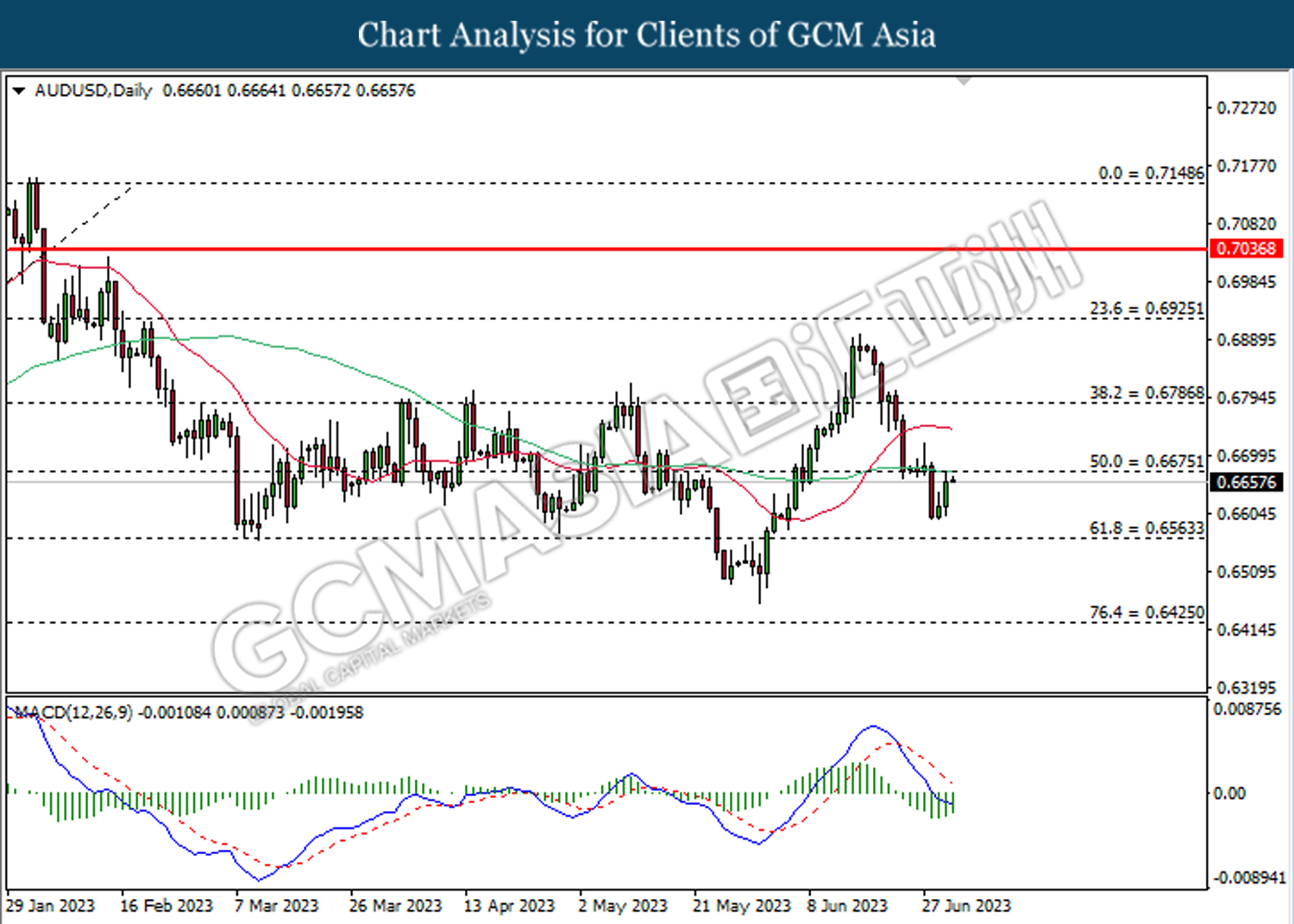

AUDUSD, Daily: AUDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6675.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

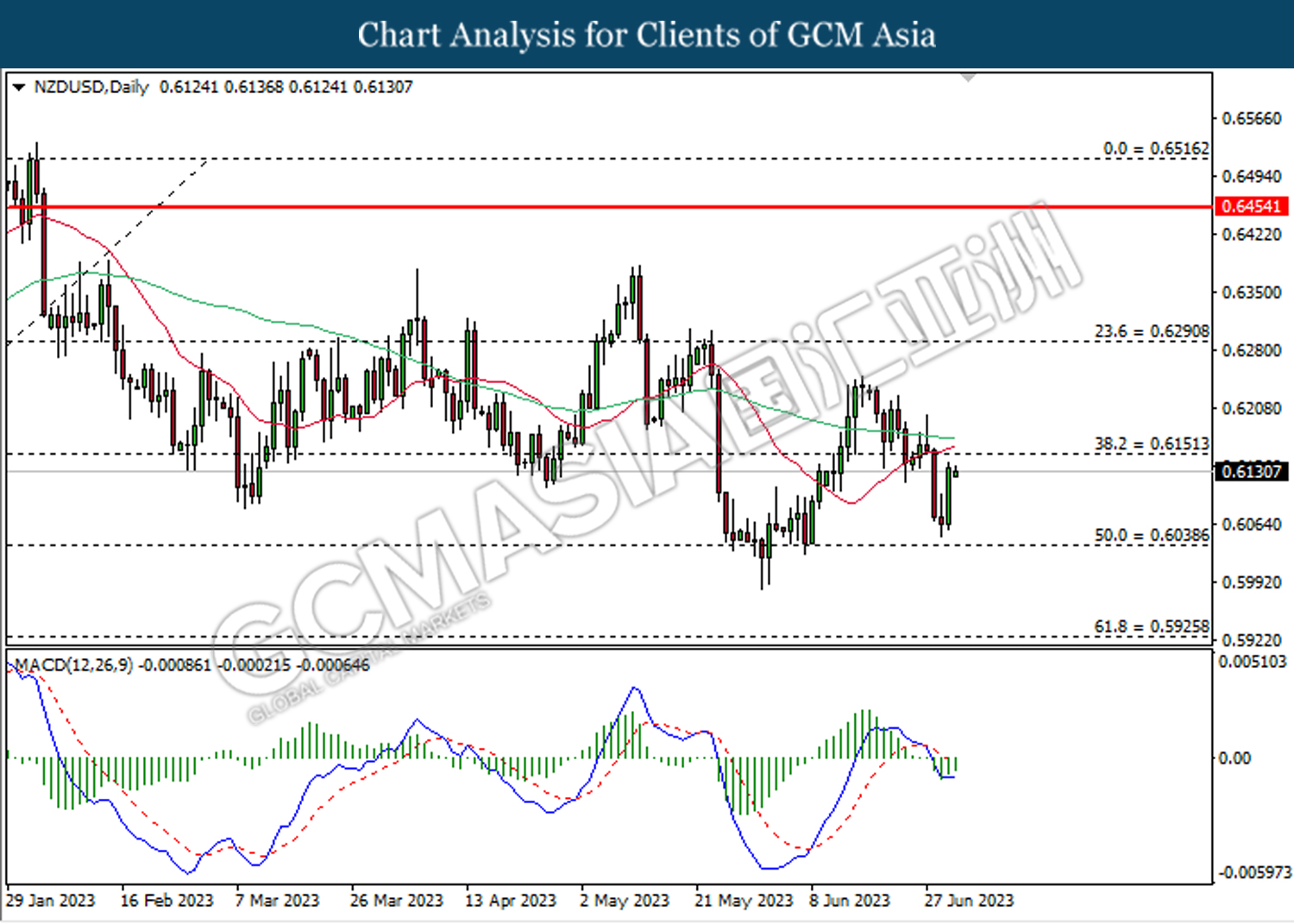

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6040. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6150.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

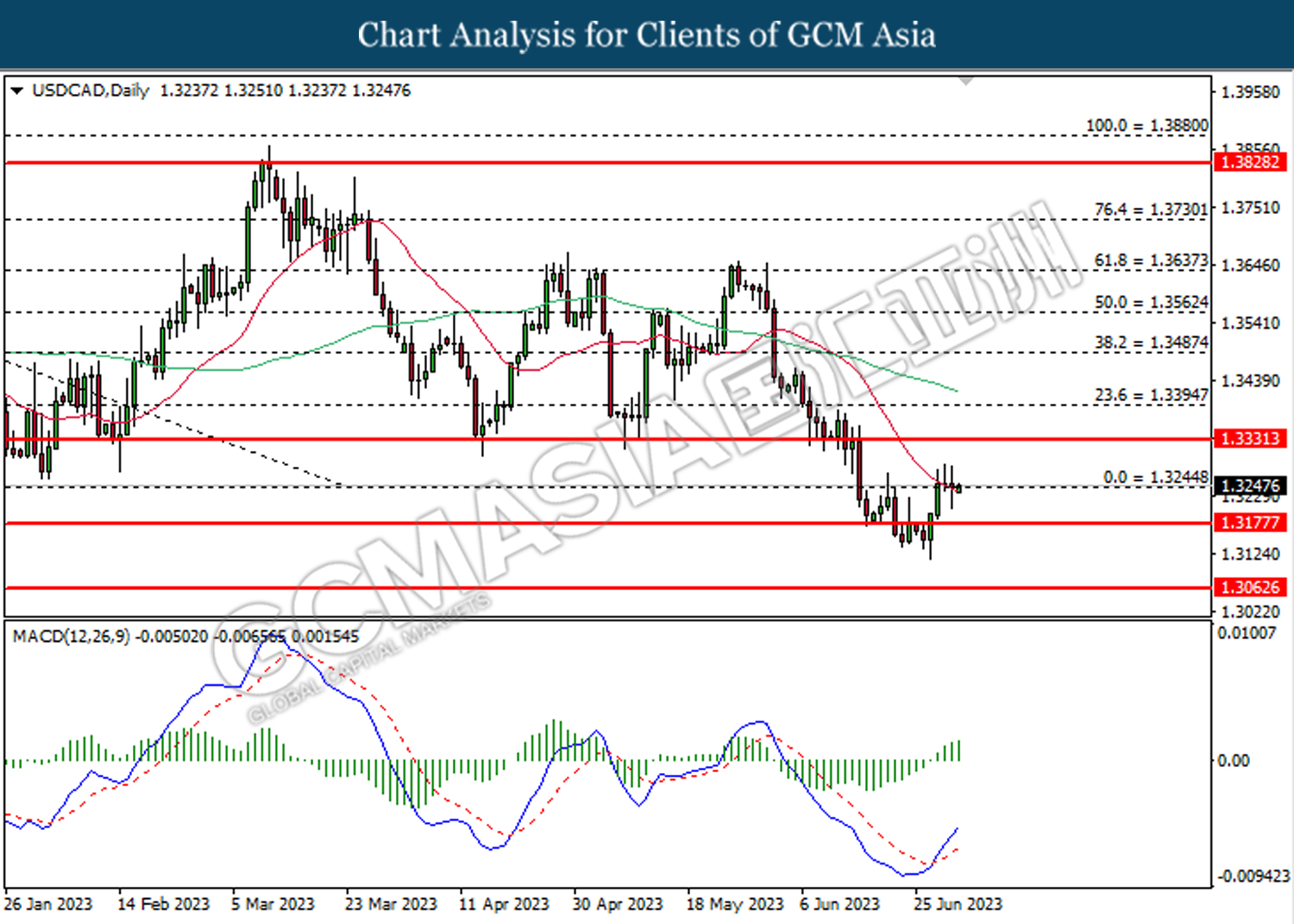

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3245. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3245, 1.3330

Support level: 1.3175, 1.3065

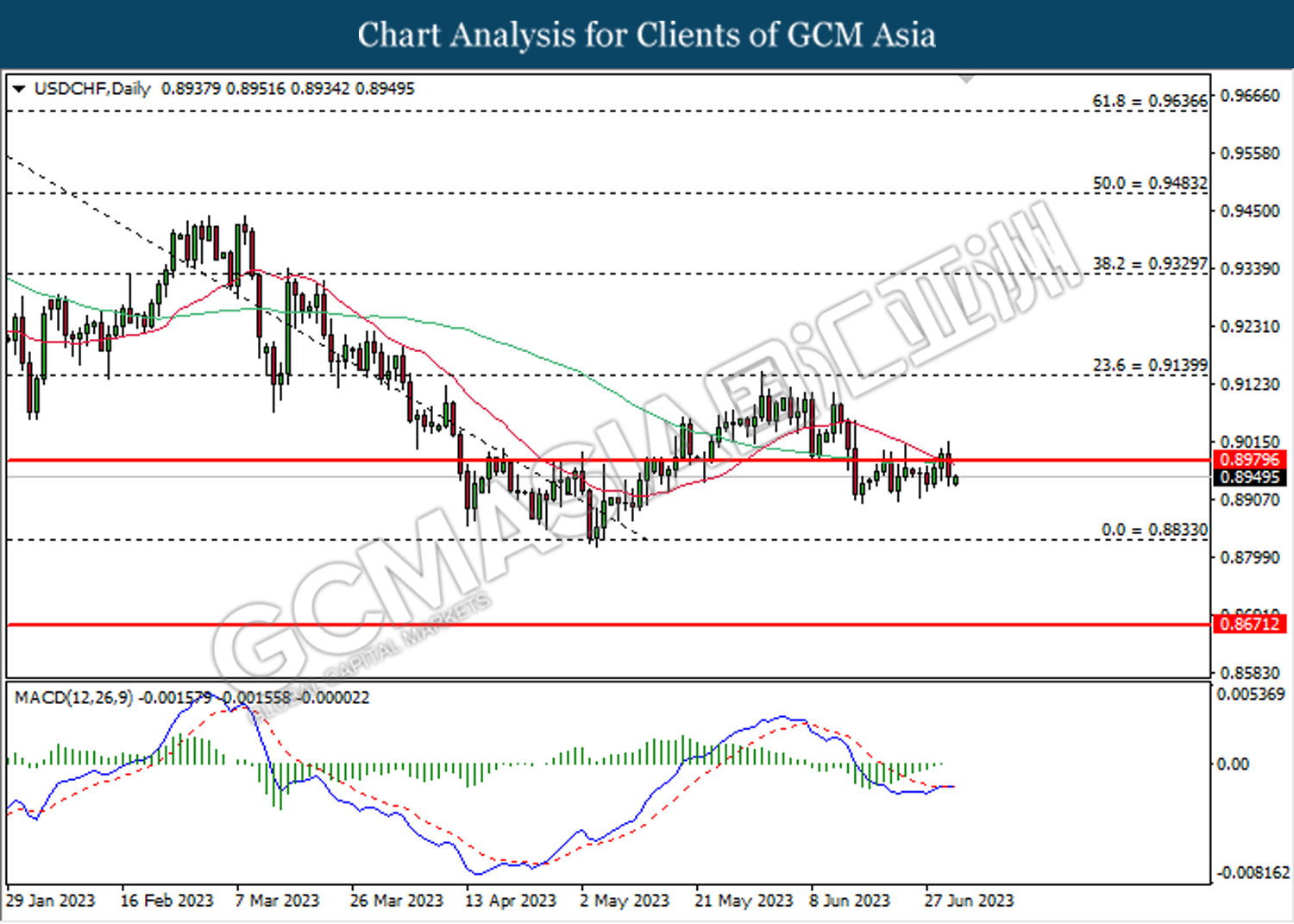

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.8980. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.8980, 0.9140

Support level: 0.8830, 0.8670

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 70.15. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded higher following the prior rebound from the upward trend line. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 1939.75.

Resistance level: 1939.75, 1951.60

Support level: 1889.55, 1839.40