3 August 2022 Afternoon Session Analysis

Aussie beaten down despite the rate hikes from RBA.

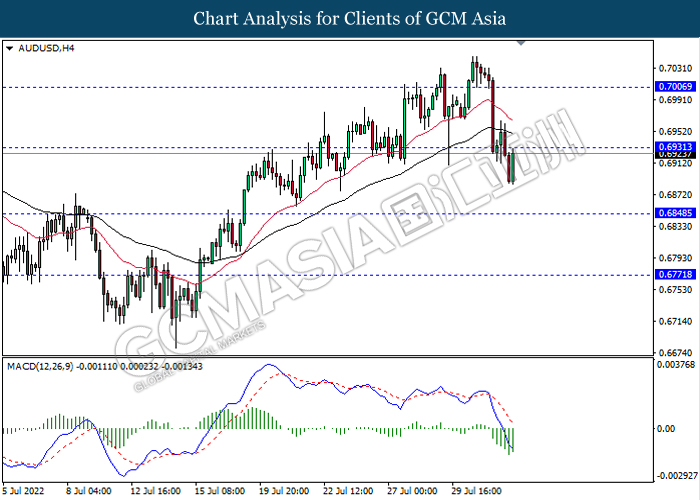

The AUD/USD which well known by majority of investors slumped on yesterday after Reserve Bank of Australia (RBA) released its interest rate decision. RBA has raised its interest rate by 50 basis point to 1.85%, which meet the market expectations. As the rate hikes did not surprise market participants and they had already digested the information about rate hikes, investors are turning their eyes to other products with better prospects. Besides, RBA Governor Philip Lowe claimed that the central bank are targeting to tamp down the inflation to the range of 2% – 3%, but the path is “clouded and uncertainty”. He also reiterated that the inflation in Australia would likely to reach its peak at the end of year, and he expected the inflation rate would ease in the coming year. The dovish statement from RBA had reduced the interest of market participants upon Aussie. As of writing, AUD/USD edged up by 0.13% to 0.6928.

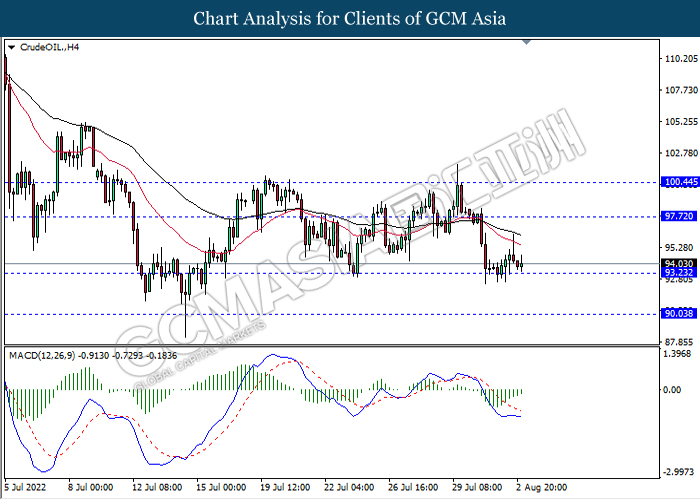

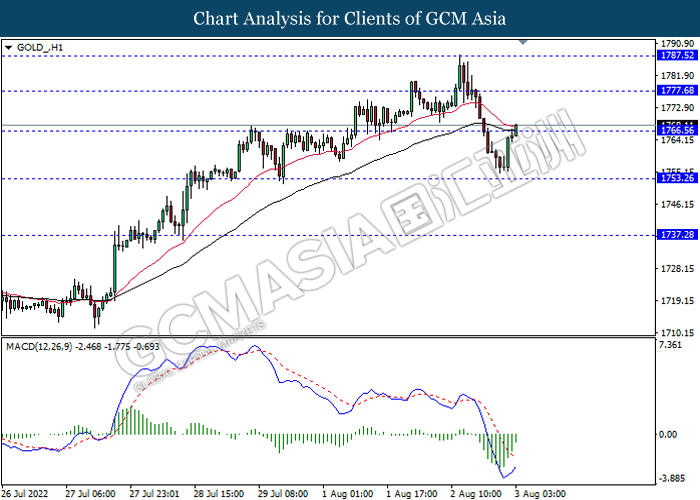

In the commodities market, the crude oil price depreciated by 0.25% to $94.17 per barrel as of writing amid the rising concerns on global economy recession. On the other hand, the gold price eased by 0.34% to $1783.70 per troy ounce over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Composite PMI (Jul) | 52.8 | 52.8 | – |

| 16:30 | GBP – Services PMI (Jul) | 53.3 | 53.3 | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Jul) | 55.3 | 53.5 | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -4.523M | – | – |

Technical Analysis

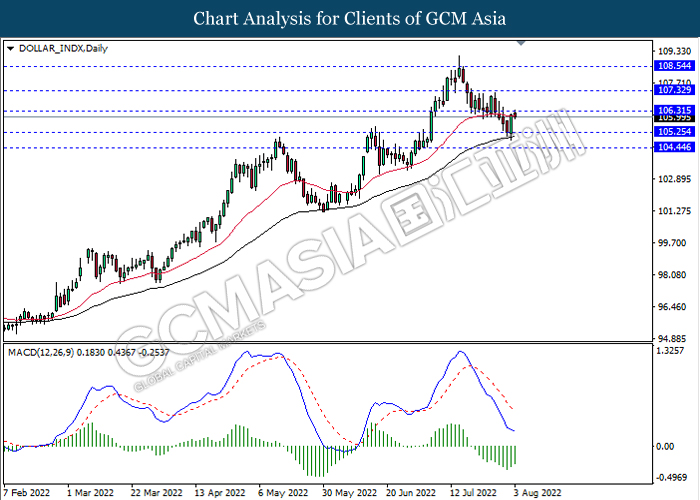

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 106.30, 107.30

Support level: 105.25, 104.45

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2170, 1.2320

Support level: 1.2030, 1.1870

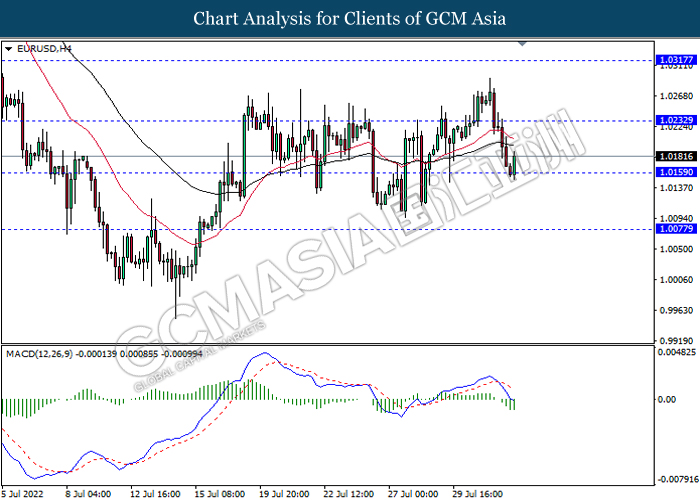

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0230, 1.0315

Support level: 1.0160, 1.0075

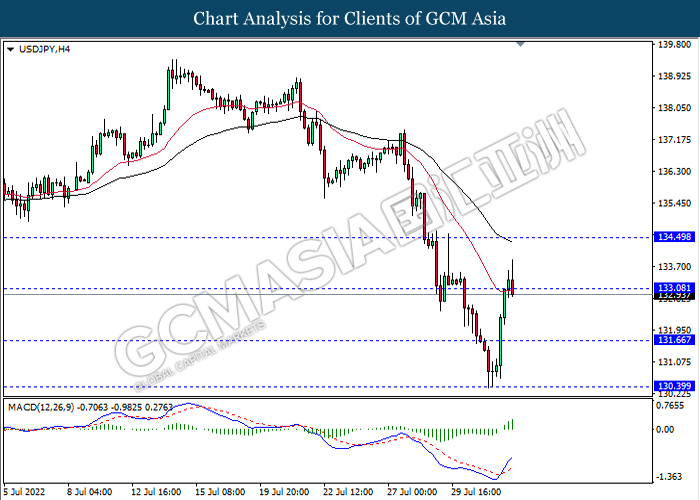

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 133.10, 134.50

Support level: 131.65, 130.40

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6930, 0.7005

Support level: 0.6850, 0.6770

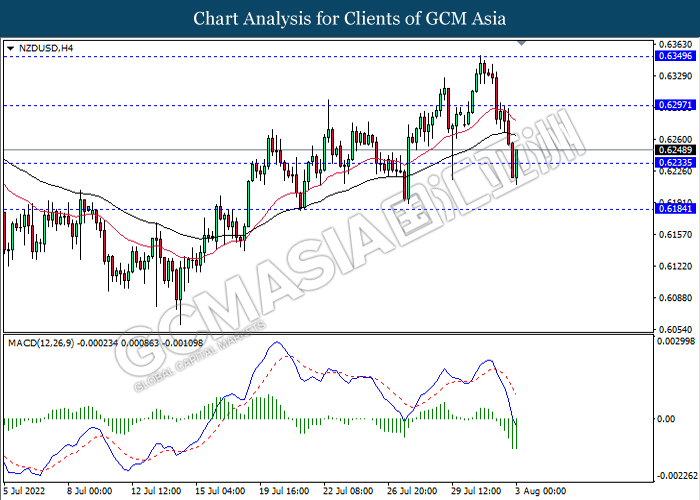

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6295, 0.6350

Support level: 0.6235, 0.6185

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2935, 1.3030

Support level: 1.2825, 1.2700

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9595, 0.9675

Support level: 0.9520, 0.9455

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 97.70, 100.45

Support level: 93.30, 90.05

GOLD_, H1: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 1777.70, 1787.50

Support level: 1766.55, 1753.25