3 November 2022 Afternoon Session Analysis

Pound buoyed ahead of BoE interest rate decision.

The Pound Sterling, which is widely traded by the global investors, experienced a strong rebound after plunging for more than 1.60% earlier today amid hawkish statement from the Federal Reserve Chairman Jerome Powell. However, the focus point of the investors has shifted to the upcoming Bank of England (BoE) meeting, whereby a ultra-sized of 75 basis point rate hike is expected to be carried out in the meeting. With UK inflation running at a sky-high pace of about 10.1% in September, the central bank is expected to hike the interest rate for the eight-consecutive time, with an aim to cool down the overheating economy. At the meantime, the new Prime Minister Rushi Sunak has also scrapped the controversial tax cuts plan, which rolled out by the predecessor Liz Truss. As such, the fiscal and monetary policy are now in line to tackle the high inflation. Besides, the market participants also eyeing on the other economic data such as Composite PMI and Services PMI in order to scrutinize the current economic health in UK. As of writing, the pair of GBP/USD rose 0.18% to 1.1410.

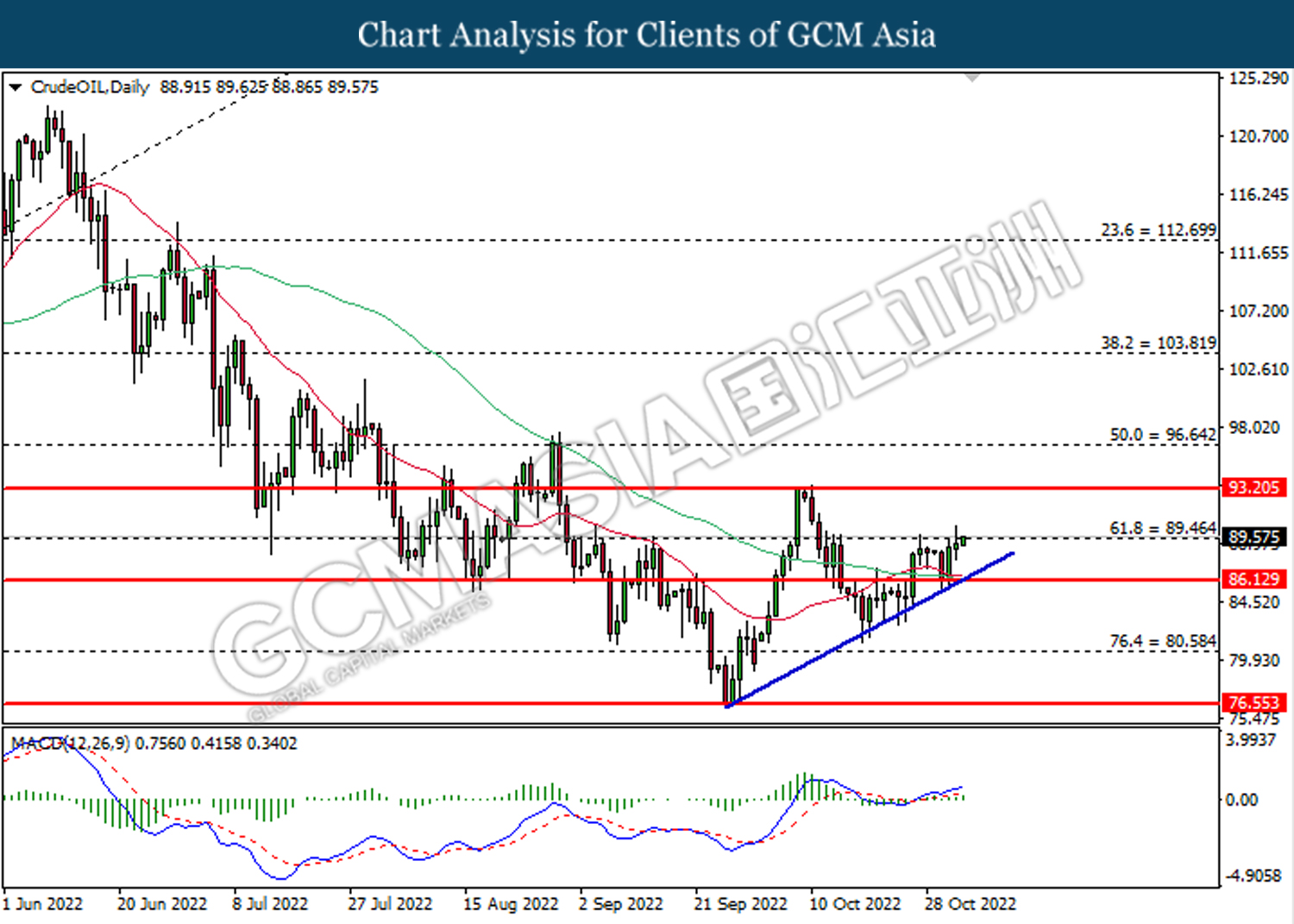

In the commodities market, the crude oil price edged up by 0.21% to $90.15 per barrel as the US inventories data showed a huge draw over the week. According to the EIA, the US crude oil inventories declined by -3.115M, missing the consensus forecast at 0.367M. Besides, the gold price rose by 0.08% to $1636.60 per troy ounce following the slight retracement in the US dollar market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:05 EUR ECB President Lagarde Speaks

20:30 GBP BoE Gov Bailey Speaks

22:15 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Composite PMI (Oct) | 47.2 | 47.2 | – |

| 17:30 | GBP – Services PMI (Oct) | 47.5 | 47.5 | – |

| 20:00 | GBP – BoE Interest Rate Decision (Nov) | 2.25% | 3.00% | – |

| 20:30 | USD – Initial Jobless Claims | 217K | 220K | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Oct) | 56.7 | 55.4 | – |

Technical Analysis

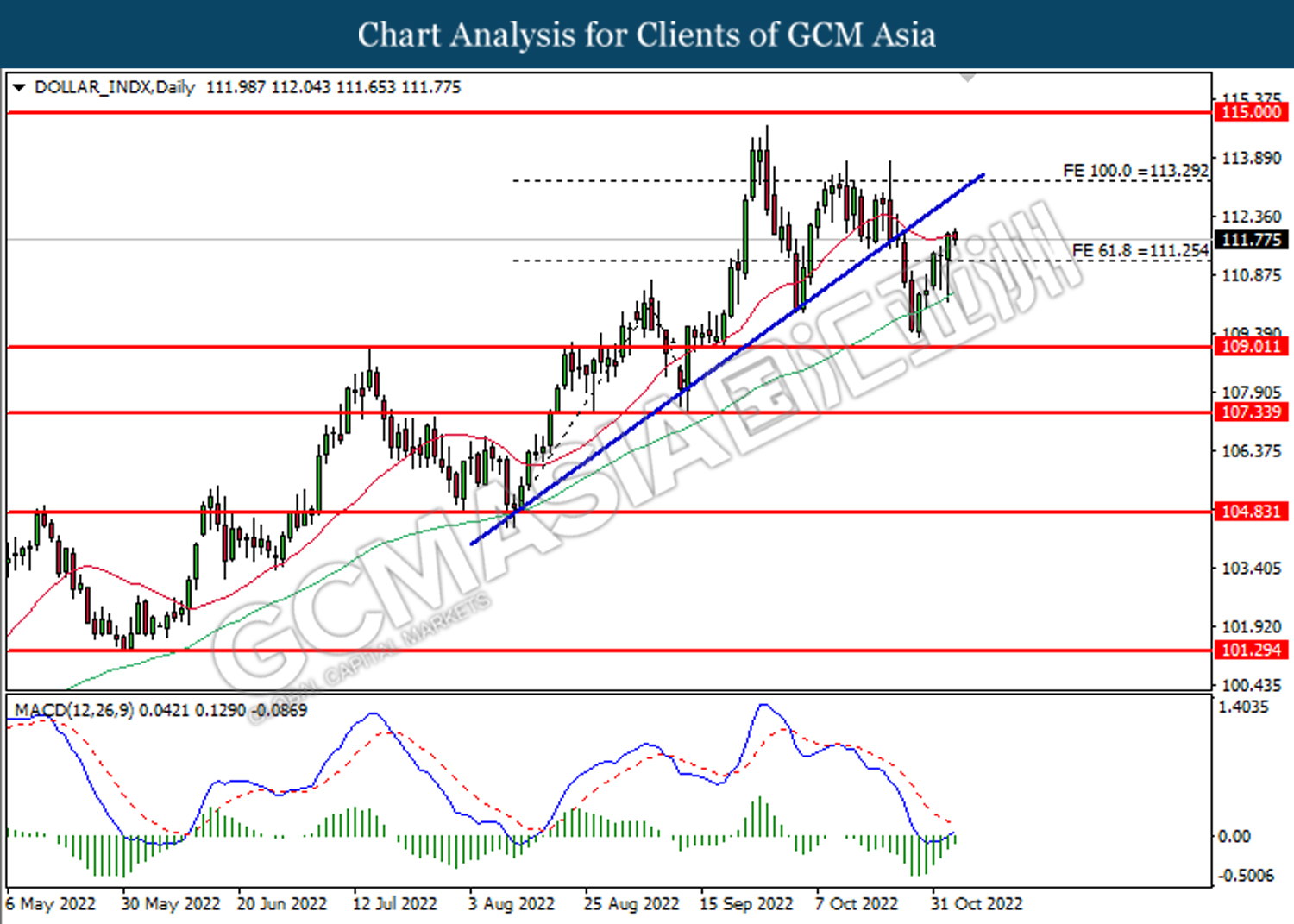

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level at 111.25. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 113.30.

Resistance level: 113.30, 115.00

Support level: 111.25, 109.00

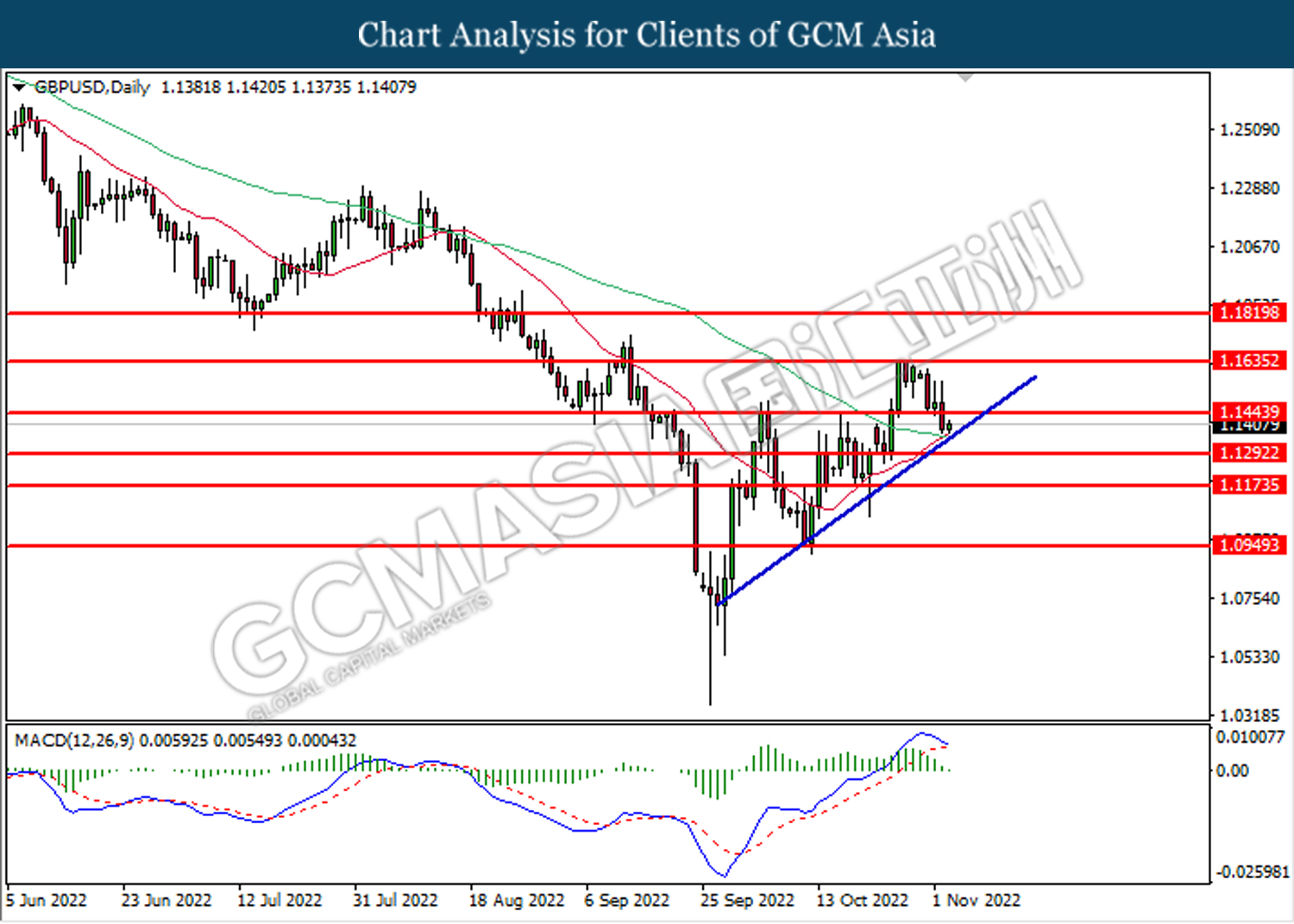

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.1445. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.1290.

Resistance level: 1.1445, 1.1635

Support level: 1.1290, 1.1175

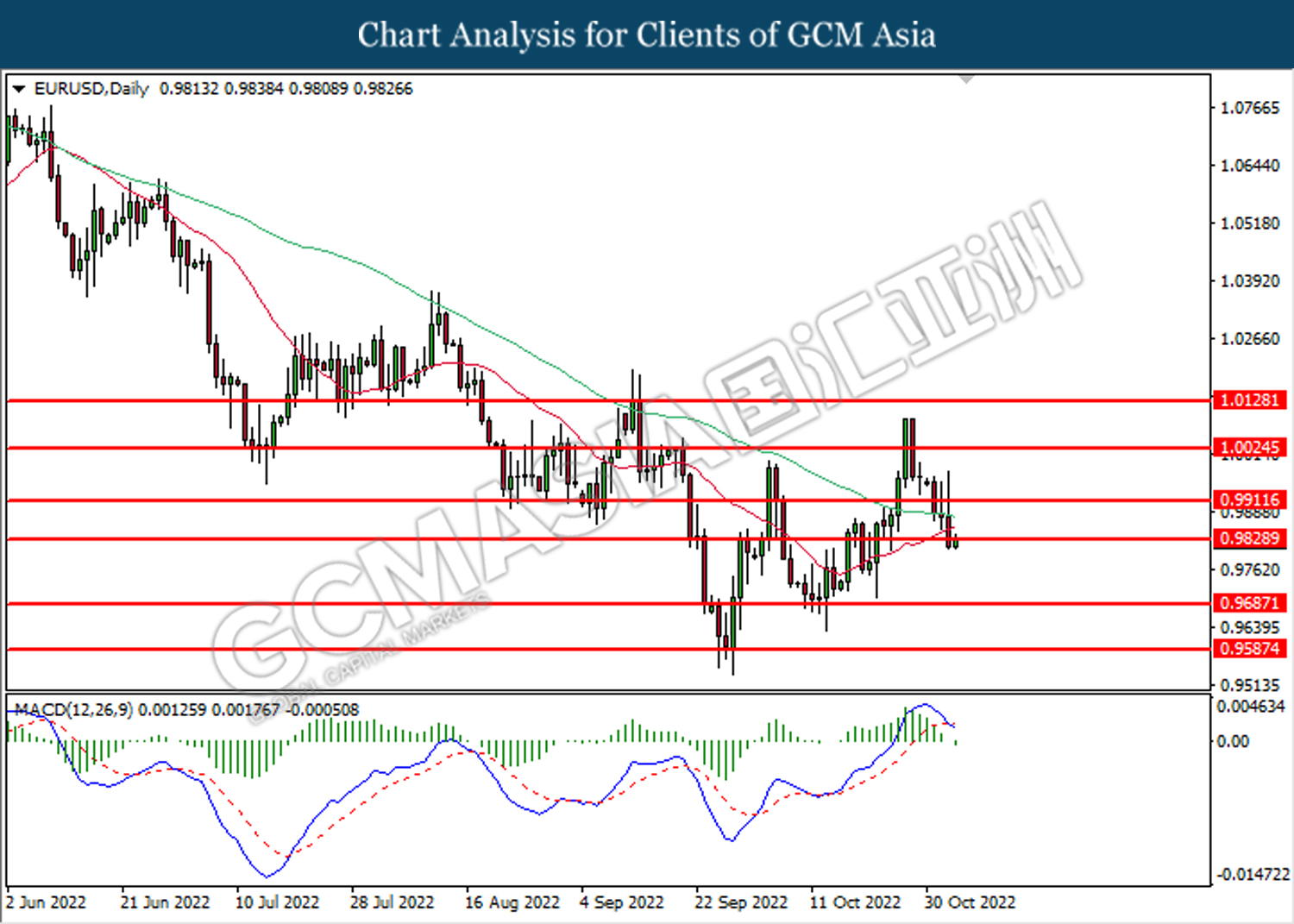

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 0.9830. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.9685.

Resistance level: 0.9830, 0.9910

Support level: 0.9685, 0.9585

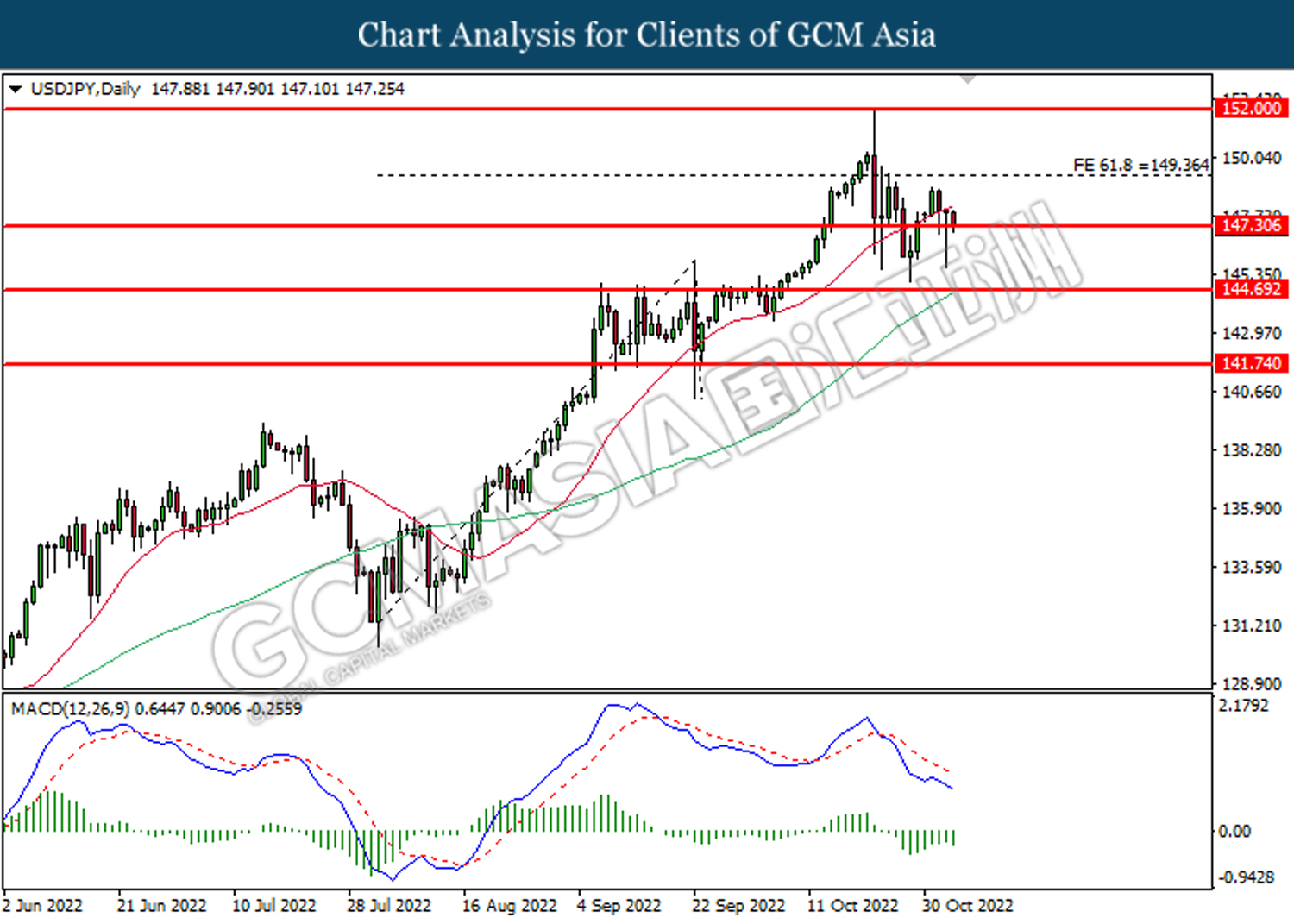

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 147.30. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 149.35, 152.00

Support level: 147.30, 144.70

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6400. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6285.

Resistance level: 0.6400, 0.6530

Support level: 0.6285, 0.6165

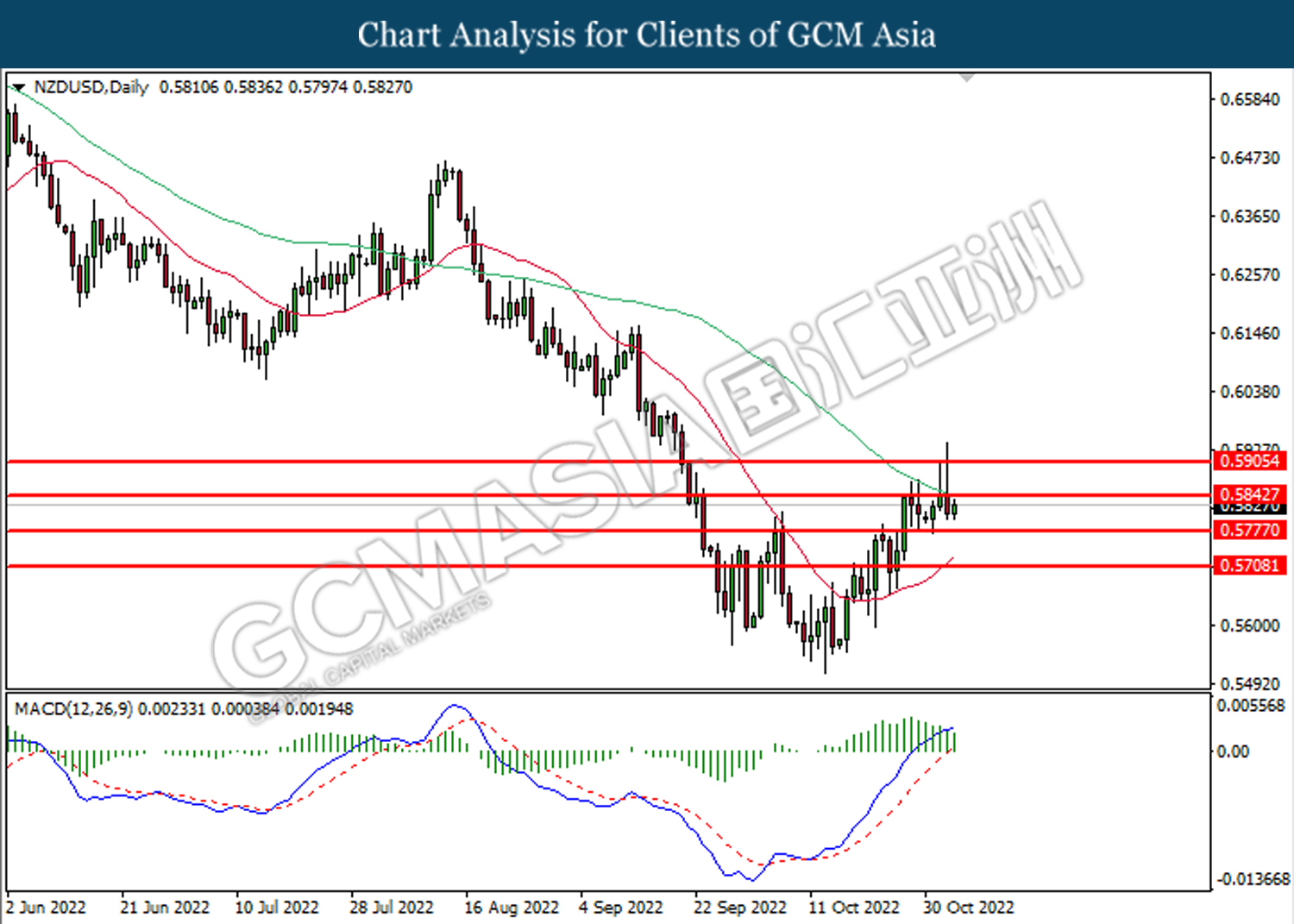

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.5845. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.5845, 0.5905

Support level: 0.5775, 0.5710

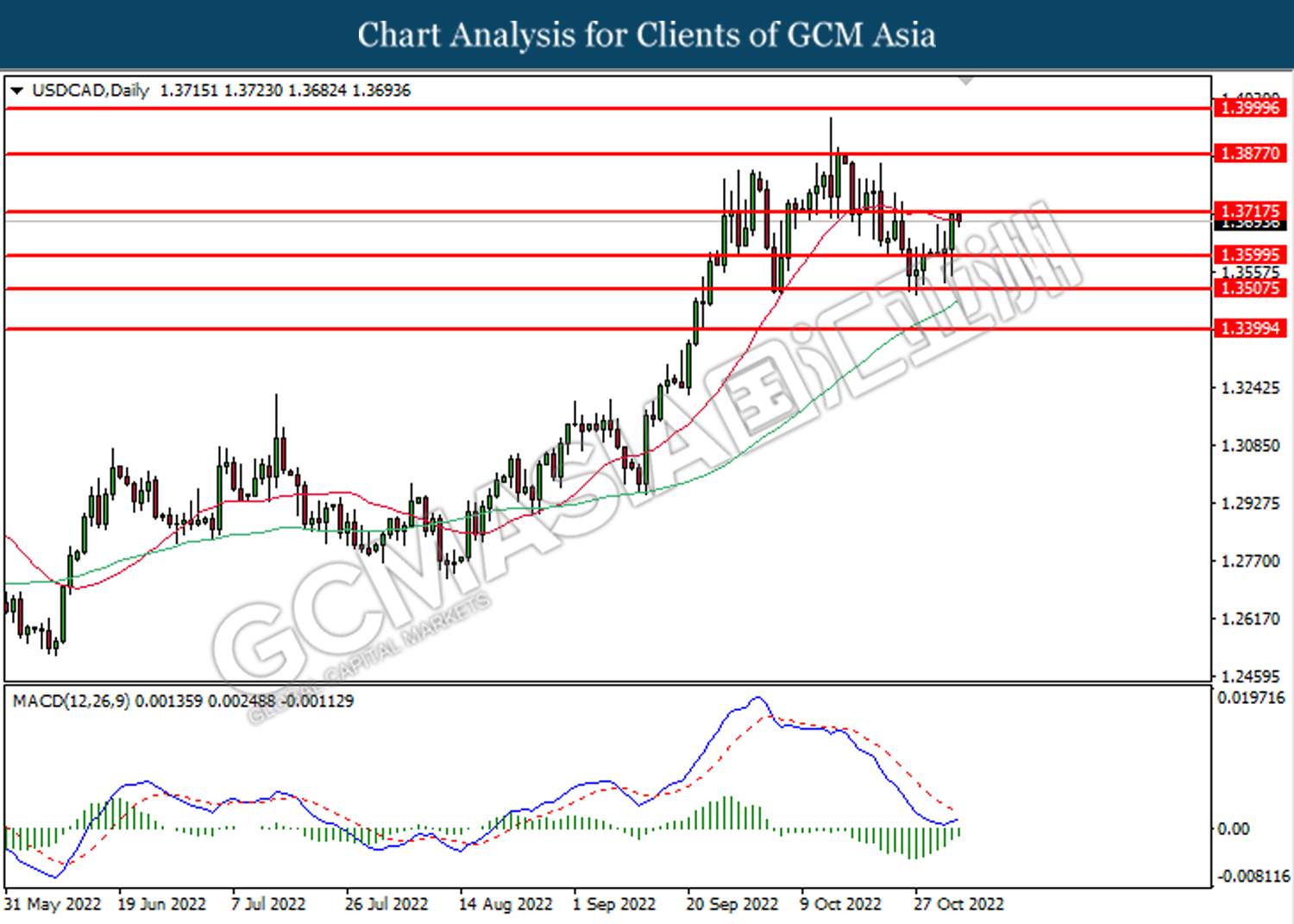

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3715. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level at 1.3715.

Resistance level: 1.3715, 1.3875

Support level: 1.3600, 1.3505

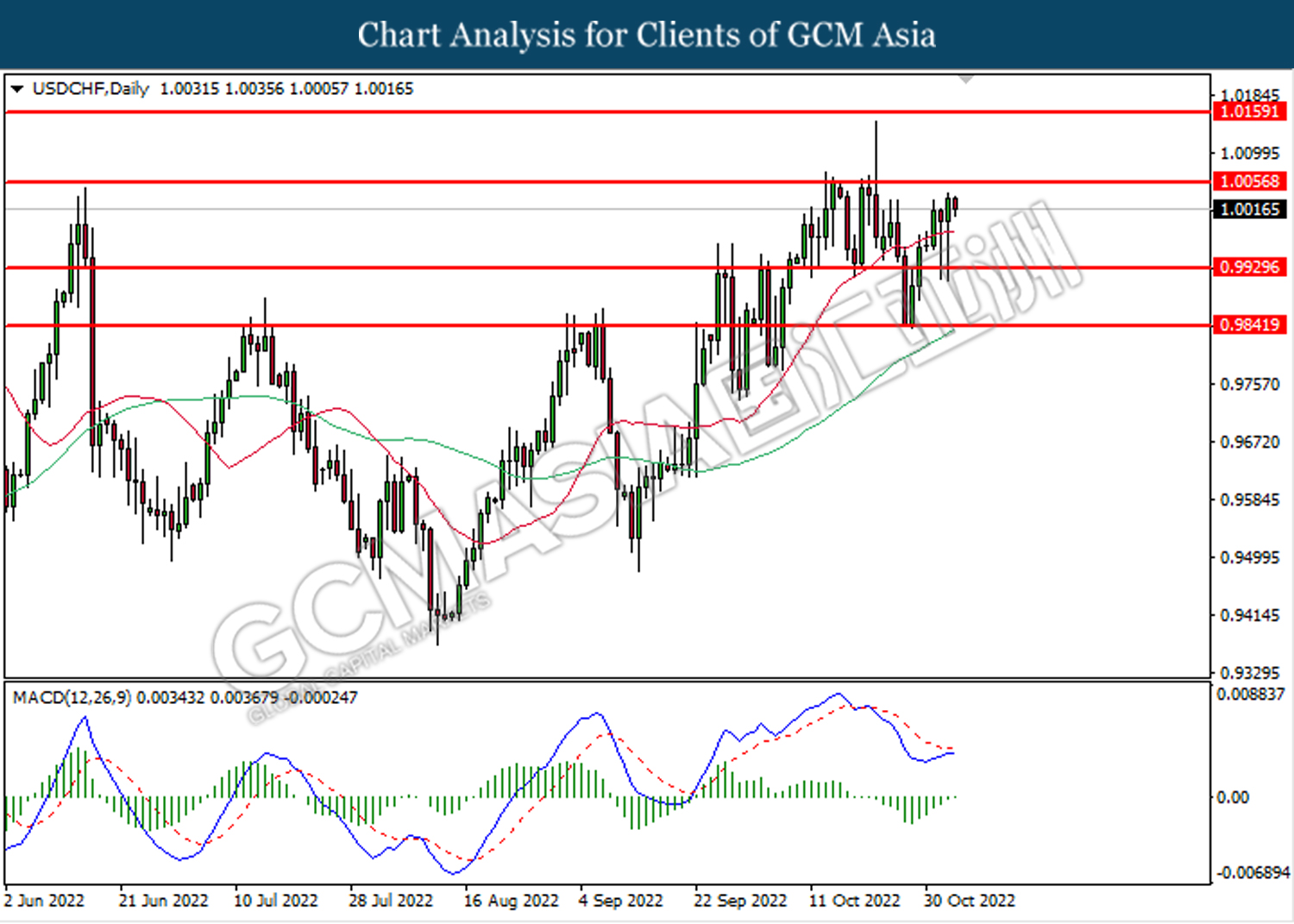

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9930. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0055.

Resistance level: 1.0055, 1.0160

Support level: 0.9930, 0.9840

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 89.45. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 89.45, 93.20

Support level: 86.15, 80.60

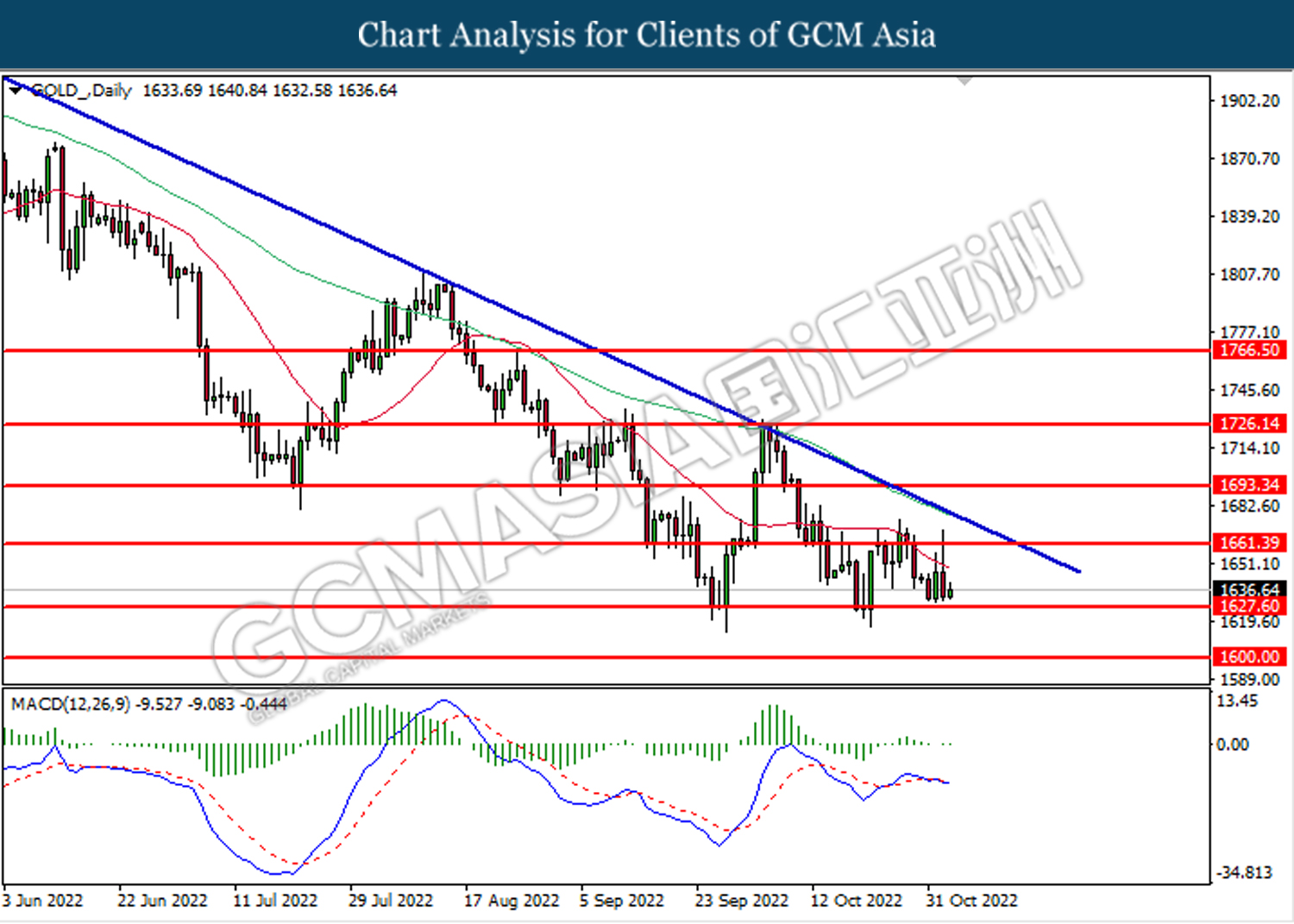

GOLD_, Daily: Gold price was traded lower while testing near the support level at 1627.60. Due to lack of signal from MACD, it is suggested to wait for further confirmation before entering into the market.

Resistance level: 1661.40, 1693.35

Support level: 1627.60, 1600.00