3 November 2022 Morning Session Analysis

US Dollar revived as aggressive rate hike path might be continued.

The Dollar Index which traded against a basket of six major currencies surged significantly in the early session trading session amid the background of hawkish statement from Fed. The US central bank has implemented a fourth consecutive 75 basis point rate hike to 4.00% on Wednesday, which bringing the rate to the highest level since January 2008. After that, Fed Chairman Jerome Powell reiterated on the FOMC Press Conference that the central bank will continue the path of aggressive rate hike in order to bring down the inflationary risk to 2% target, which sparked the appeal of US Dollar. The US CPI, which gauge the inflationary risk was running at an 8.2% annual pace in September. On the other hand, the US labor market that remained strong has also brought further bullish momentum toward US currency. The U.S. ADP Nonfarm Employment Change has notched up from the previous reading of 192K to 239K, exceeding the market expectation of 195K. As of writing, the Dollar Index appreciated by 0.06% to 112.06.

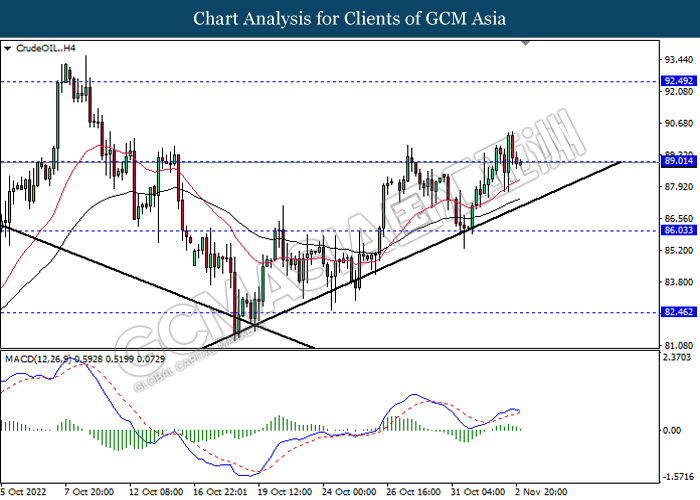

In the commodities market, the crude oil price depreciated by 1.12% to $88.99 per barrel as of writing following the aggressive rate hike expectation from Fed would likely to threaten the demand of oil. On the other hand, the gold price eased by 0.78% to $1634.90 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:05 EUR ECB President Lagarde Speaks

20:30 GBP BoE Gov Bailey Speaks

22:15 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Composite PMI (Oct) | 47.2 | 47.2 | – |

| 17:30 | GBP – Services PMI (Oct) | 47.5 | 47.5 | – |

| 20:00 | GBP – BoE Interest Rate Decision (Nov) | 2.25% | 3.00% | – |

| 20:30 | USD – Initial Jobless Claims | 217K | 220K | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Oct) | 56.7 | 55.4 | – |

Technical Analysis

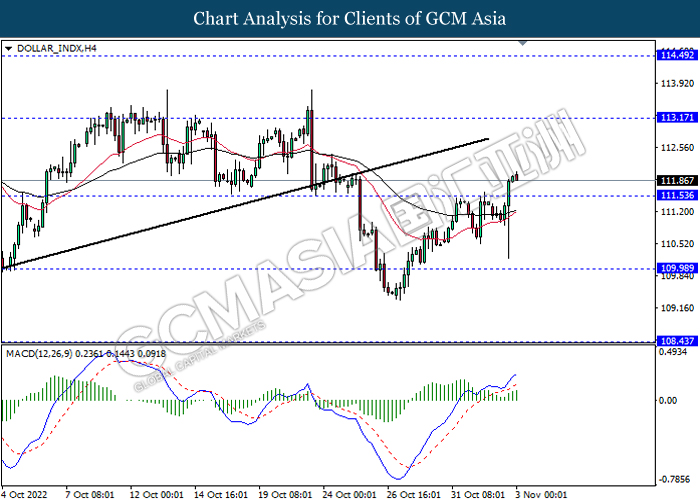

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 113.15, 114.50

Support level: 111.55, 109.95

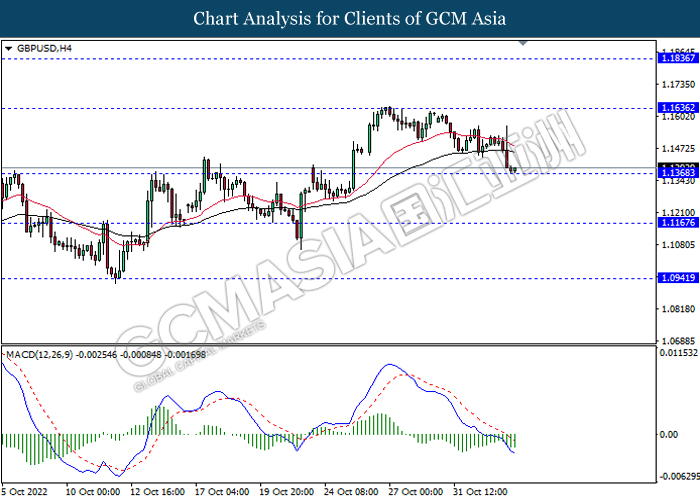

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.1635, 1.1835

Support level: 1.1370, 1.1165

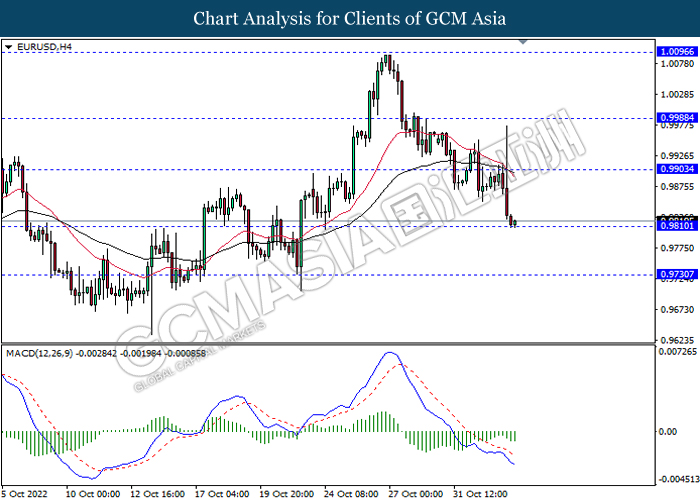

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9905, 0.9990

Support level: 0.9810, 0.9730

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 147.65, 150.25

Support level: 144.80, 142.20

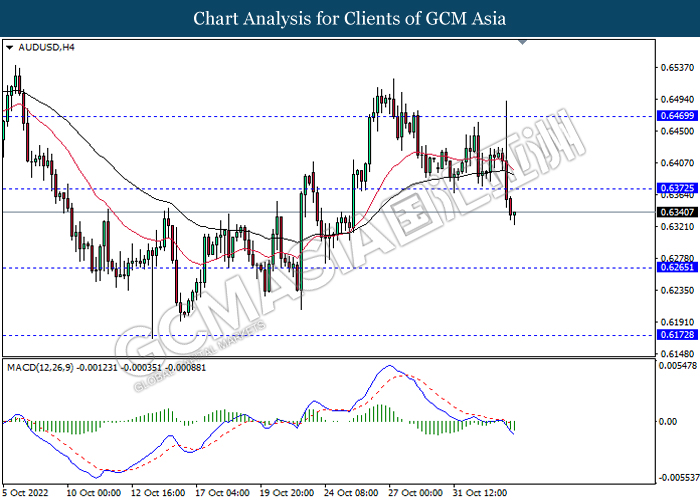

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6370, 0.6470

Support level: 0.6265, 0.6170

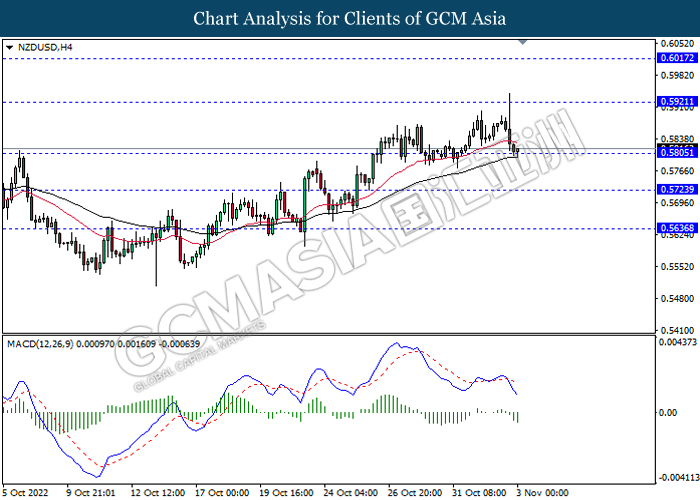

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.5920, 0.6015

Support level: 0.5805, 0.5725

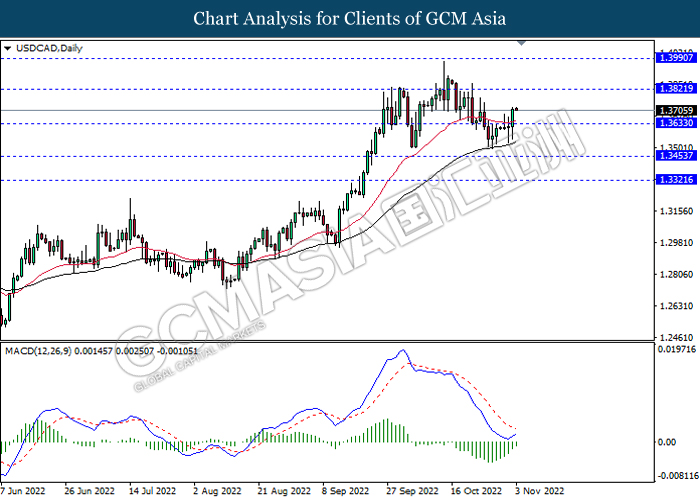

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3820, 1.3990

Support level: 1.3635, 1.3455

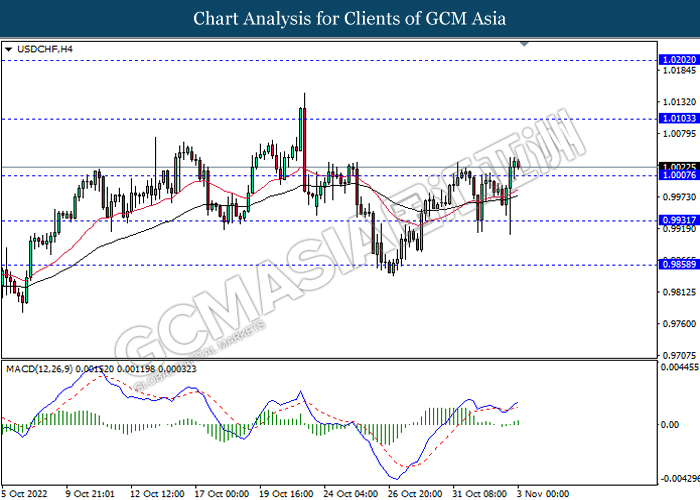

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0105, 1.0200

Support level: 1.0005, 0.9930

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 89.00, 92.50

Support level: 86.05, 82.45

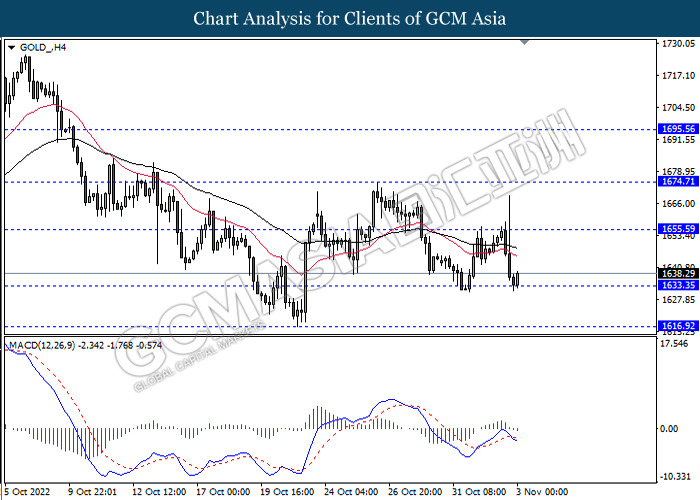

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1655.60, 1674.70

Support level: 1633.35, 1616.90