4 January 2023 Afternoon Session Analysis

Euro plunged amid easing inflationary risk.

The EUR/USD, which widely traded by global investors slumped over the easing inflation risk in Eurozone country. According to Federal Statistical Office Germany, the Germany Consumer Price Index (CPI) YoY for December has notched down from the previous reading of 10.0% to 8.6%, far lower than consensus forecast of 9.1%. In fact, the slips of Germany inflationary risk would likely to bring down the inflation in Eurozone that reached double-digit, whereas decreasing the odds of aggressive rate hikes from European Central Bank (ECB). Hence, investors could their eyes toward other currencies which providing better return. On the other hand, the GBP/USD has also recorded a losses on yesterday amid the background of economic recession. The UK Manufacturing Purchasing Managers Index (PMI) in December posted at the reading of 45.3, exceeding the market expectation of 44.7. Nonetheless, the figures that less than 50 indicated a contraction in the UK manufacturing sector, which brought negative prospects toward economic progression in the UK. As of writing, the EUR/USD rose by 0.21% to 1.0568 while GBP/USD appreciated by 0.18% to 1.1987.

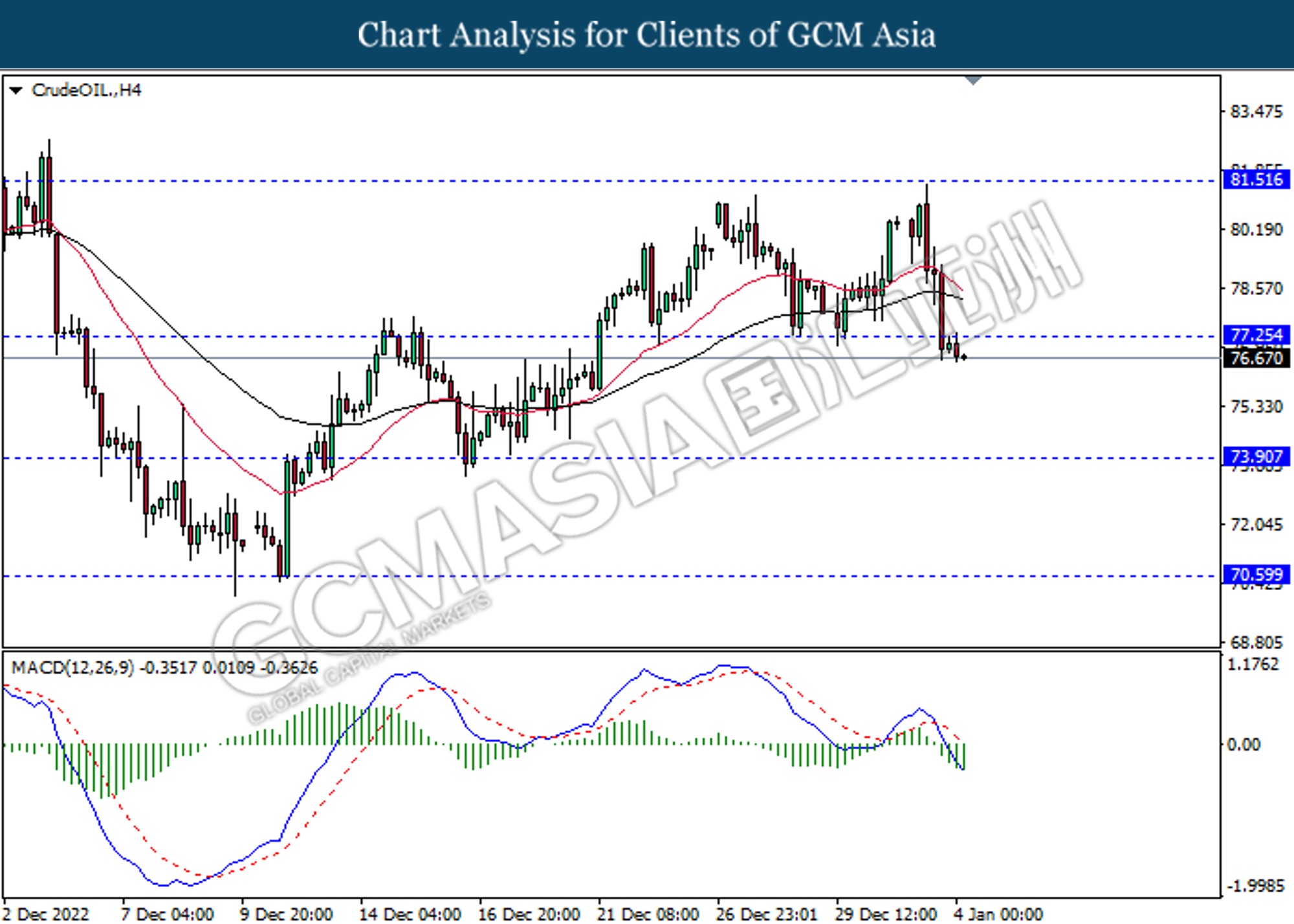

In the commodities market, the crude oil price eased by 0.21% to $76.77 per barrel as of writing following the looming global recession which warned by International Monetary Fund (IMF). In addition, the gold price appreciated by 0.29% to $1845.50 per troy ounce as of writing following the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

03:00 USD FOMC Meeting Minutes

(5th Jan)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:00 | USD – ISM Manufacturing PMI (Dec) | 49.0 | 48.5 | – |

| 23:00 | USD – JOLTs Job Openings (Nov) | 10.334M | 10.000M | – |

Technical Analysis

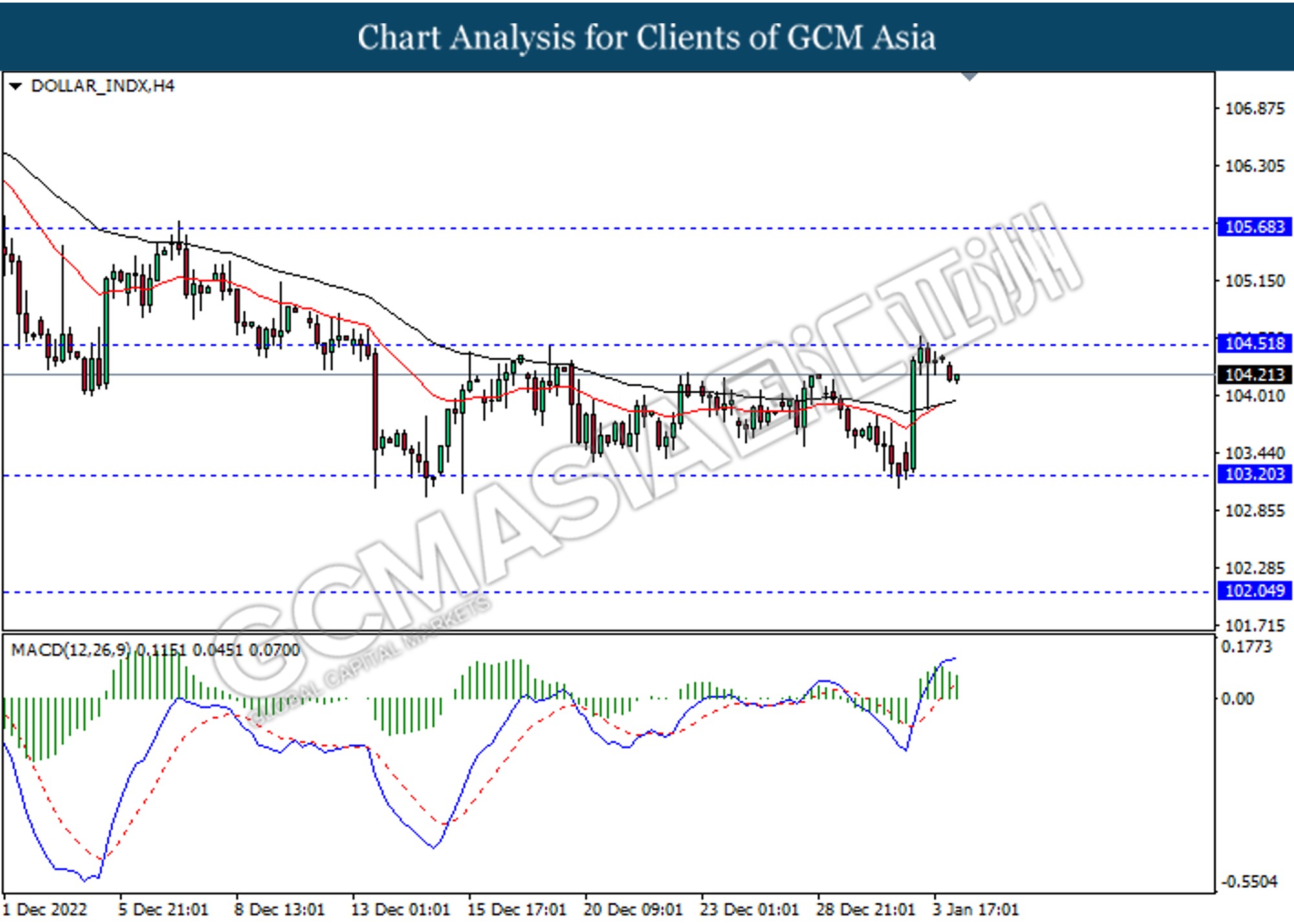

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 104.50, 105.70

Support level: 103.20, 102.05

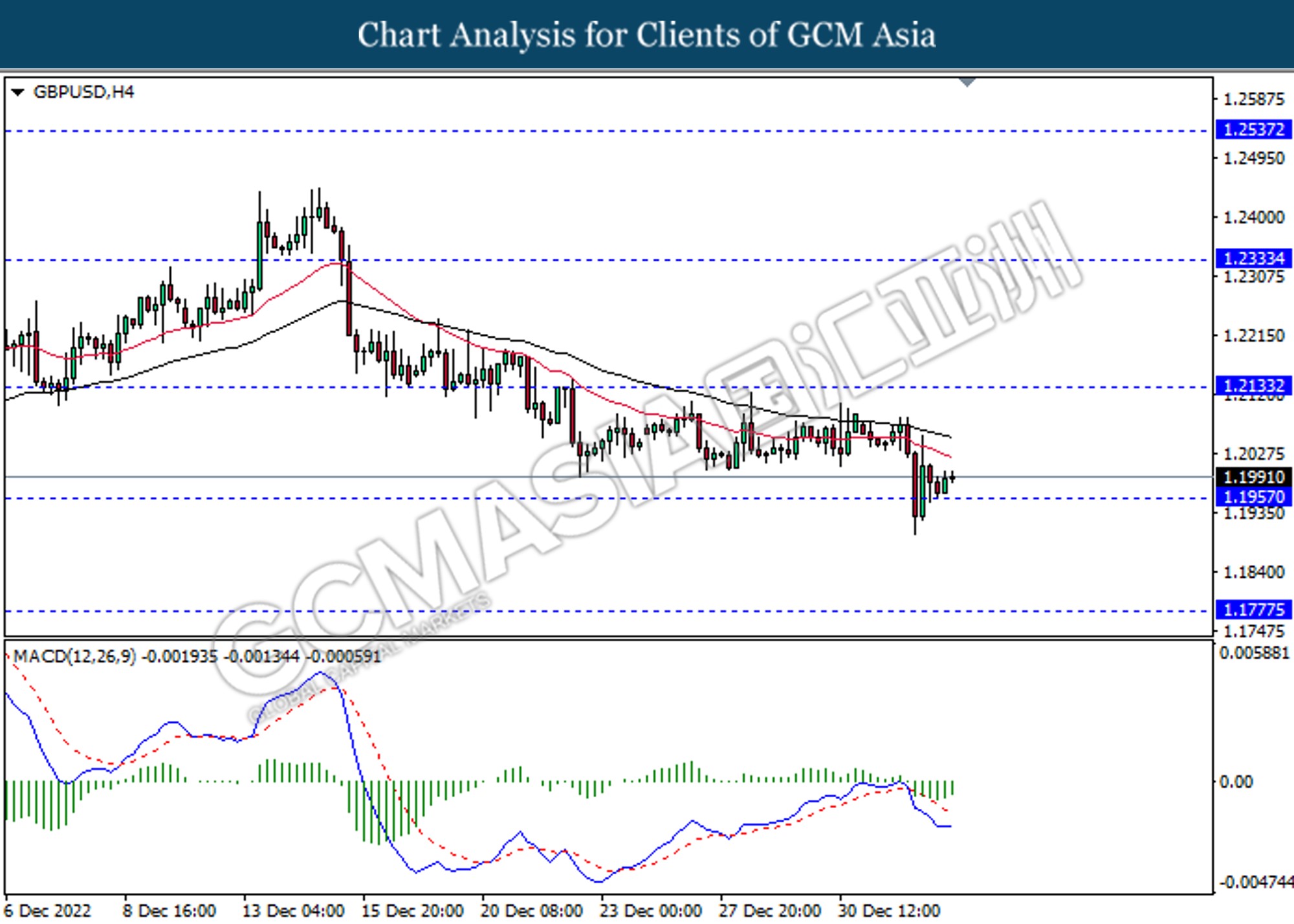

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.2135, 1.2335

Support level: 1.1955, 1.1775

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0600, 1.0740

Support level: 1.0465, 1.0335

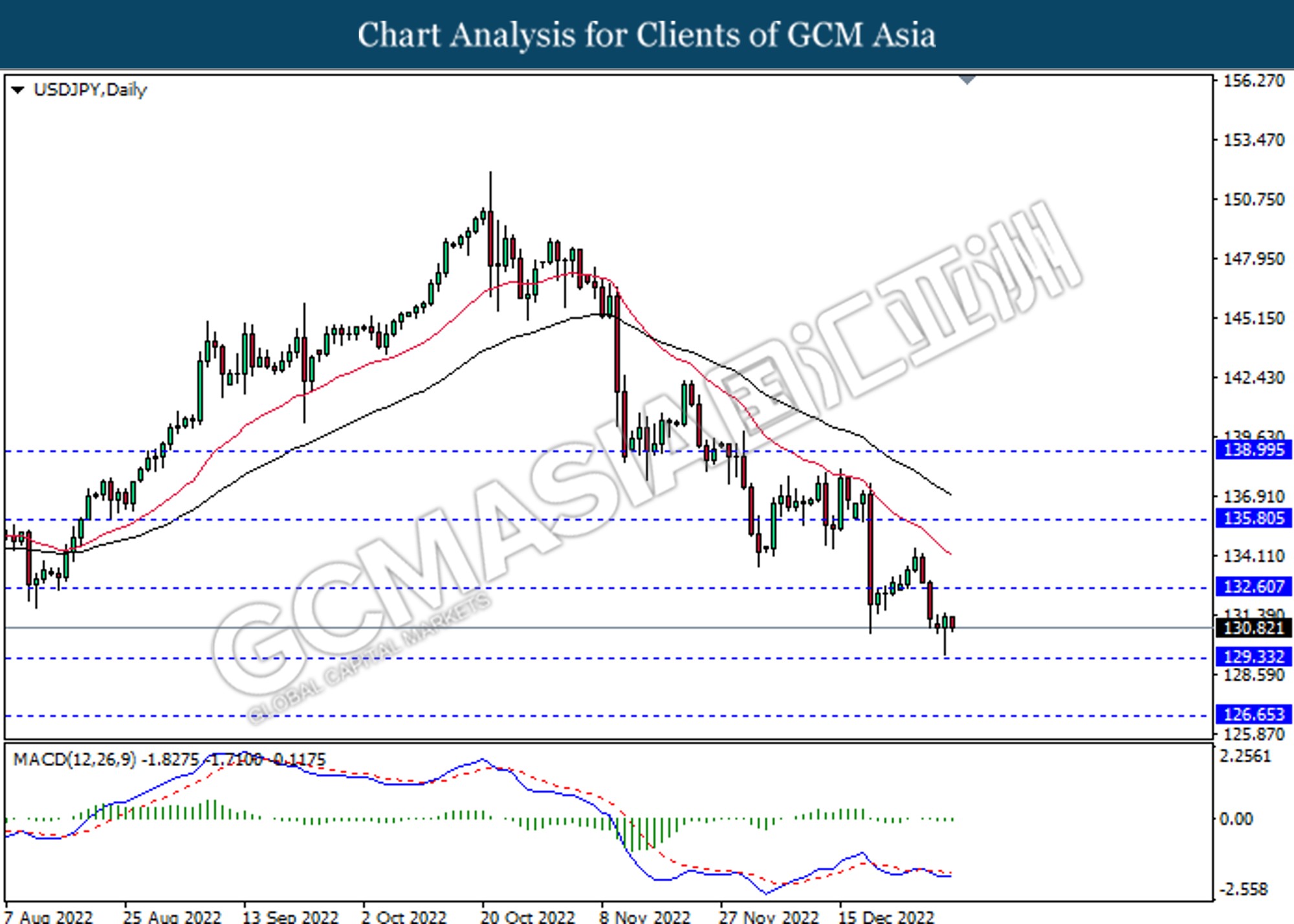

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 132.60, 135.80

Support level: 129.35, 126.65

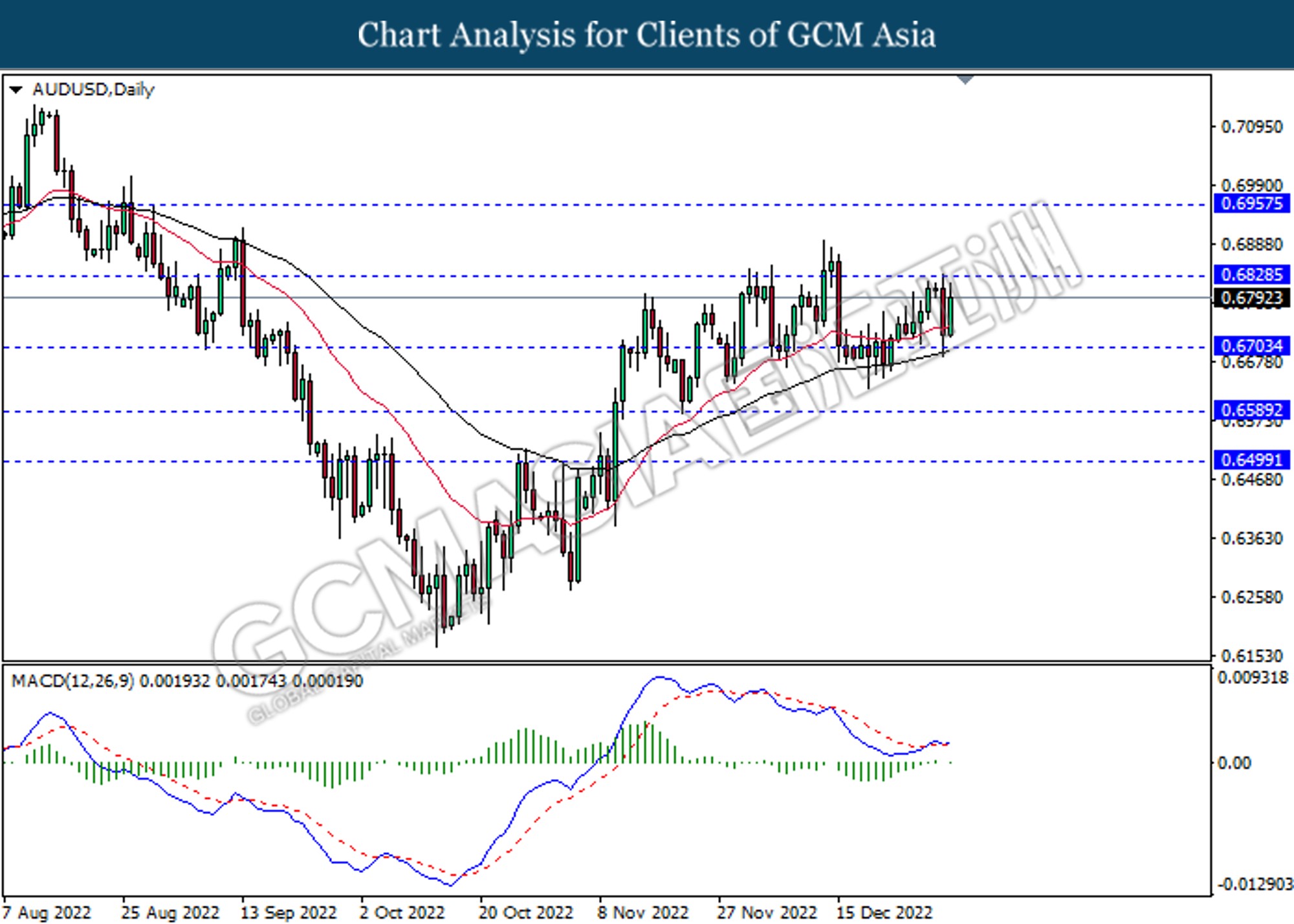

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6830, 0.6955

Support level: 0.6705, 0.6590

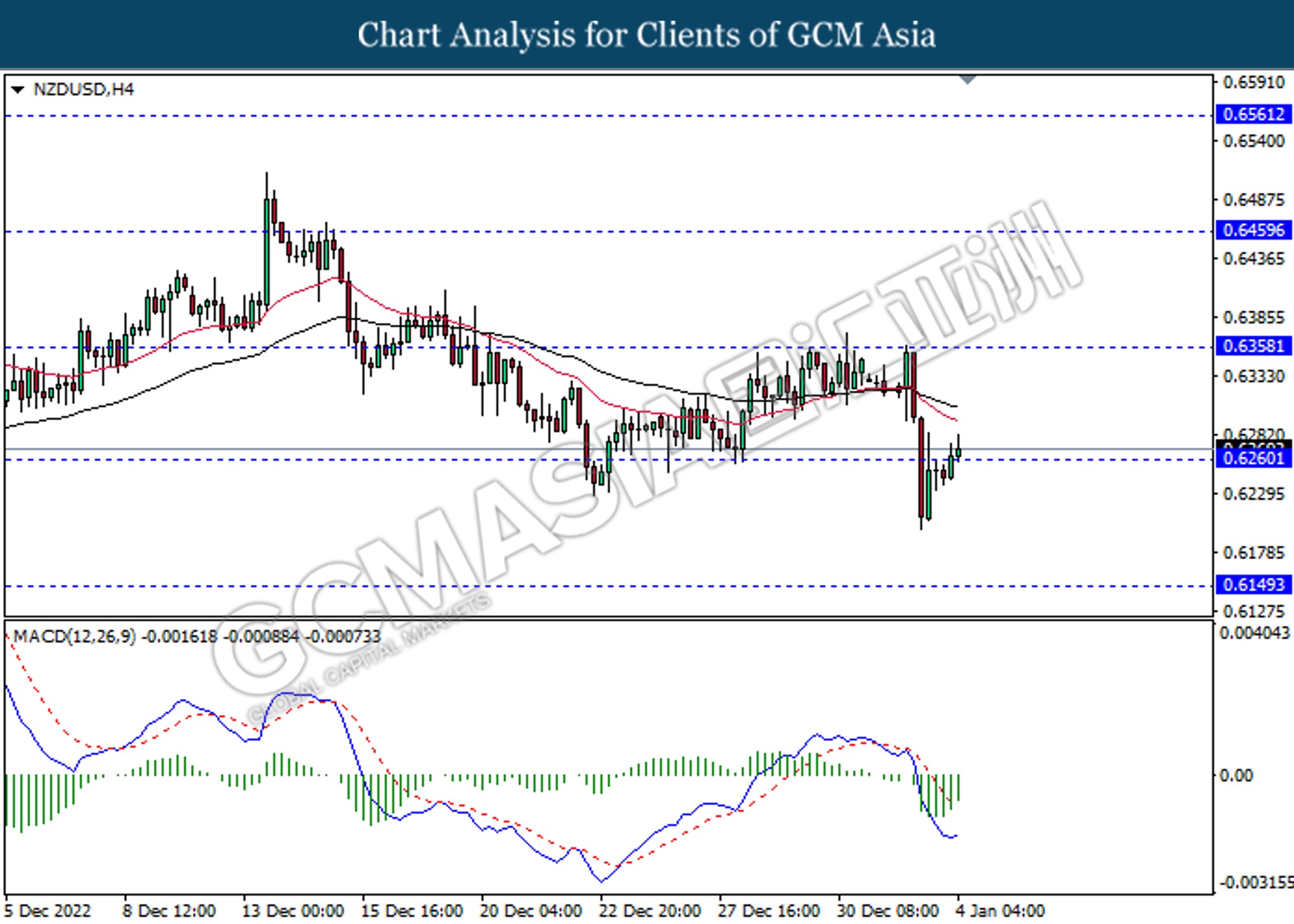

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

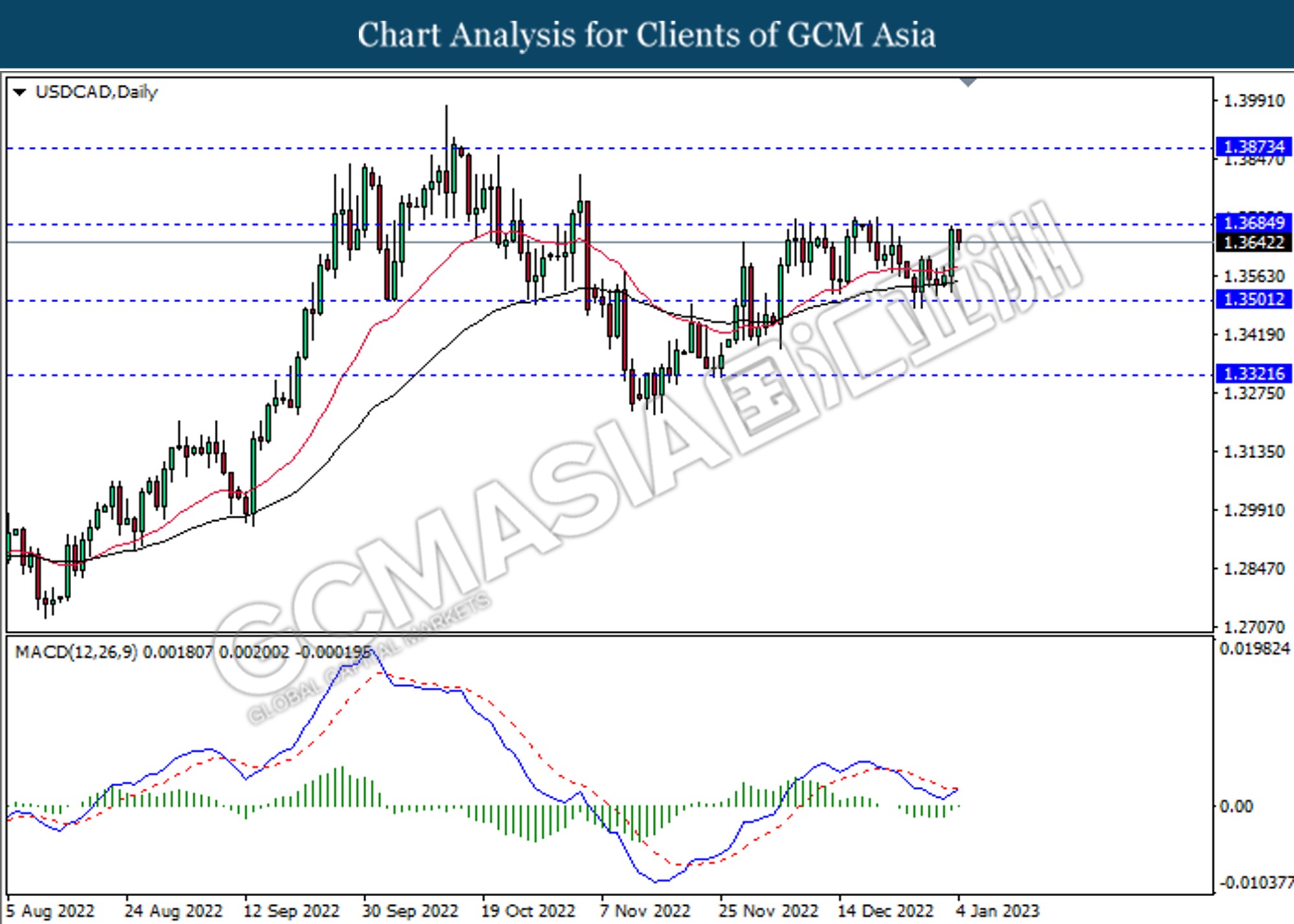

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

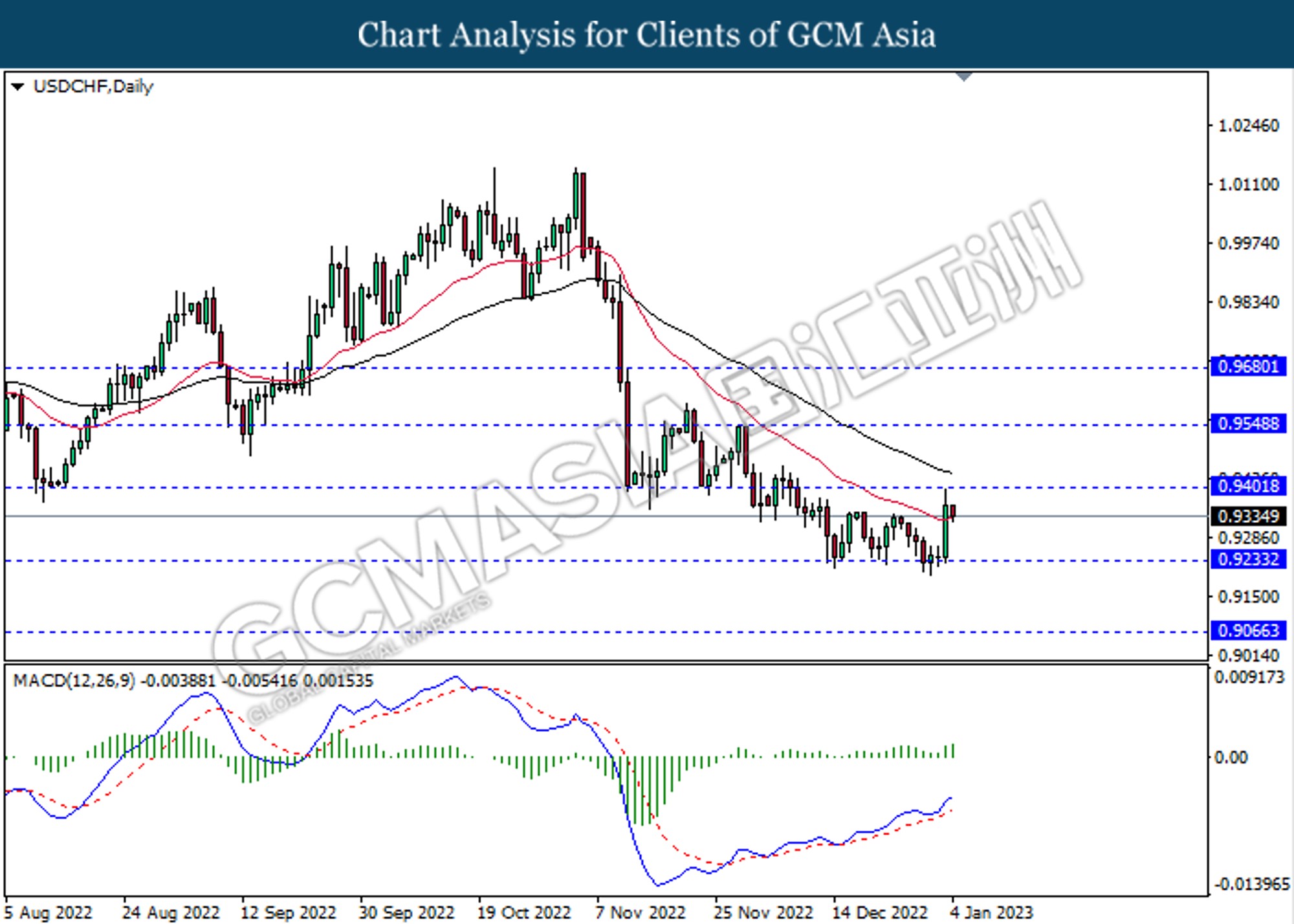

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.60

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1855.40, 1877.80

Support level: 1833.00, 1808.55