4 January 2023 Morning Session Analysis

US dollar surged ahead of Fed meeting minutes.

The dollar index, which traded against a basket of mainstream currencies, managed to regain its luster in the previous trading session while the market participants were waiting for the Fed’s Meeting Minutes. The December FOMC Meeting Minutes are expected to shed some additional light on Fed officials’ policy view for 2023. It is noteworthy to highlight that the Fed’s members broadly agreed to go for a higher terminal rate this year, despite a slower pace of rate hikes. In the recent Fed meeting, the board of members delivered a 50-basis point of rate hikes after raising the interest rate for four consecutive 75 basis points. The slower rate hike was mainly attributed to the sign of inflation easing in the nation. Besides, the market risk-off mood turned on right after China’s manufacturing data showed a sharp drop in December amid the resurgence of Covid-19 cases, which had disrupted the production of the country after the lockdown measure was implemented. As of writing, the dollar index rose 1.11% to 104.65.

In the commodities market, crude oil prices depreciated by -0.26% to $77.10 per barrel as the China Caixin Manufacturing PMI data showed a sharp drop in December reading as compared to the prior months. Besides, gold prices edged down by -0.05% to $1838.60 per troy ounce as the IMF’s pessimistic forecast about global economic growth sparked the market risk-off mood.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

03:00 USD FOMC Meeting Minutes

(5th Jan)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:00 | USD – ISM Manufacturing PMI (Dec) | 49.0 | 48.5 | – |

| 23:00 | USD – JOLTs Job Openings (Nov) | 10.334M | 10.000M | – |

Technical Analysis

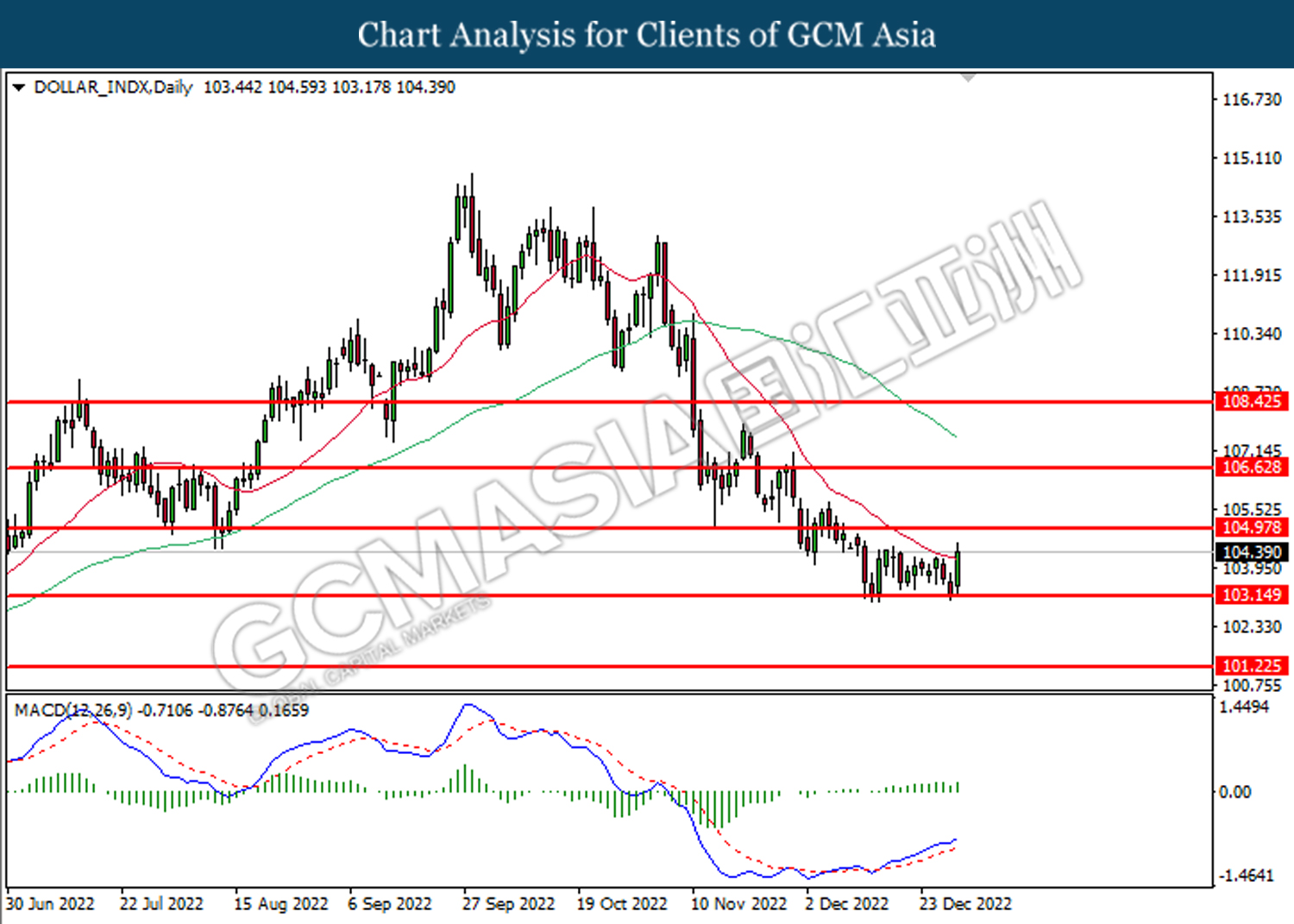

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 107.90

Support level: 103.15, 101.25

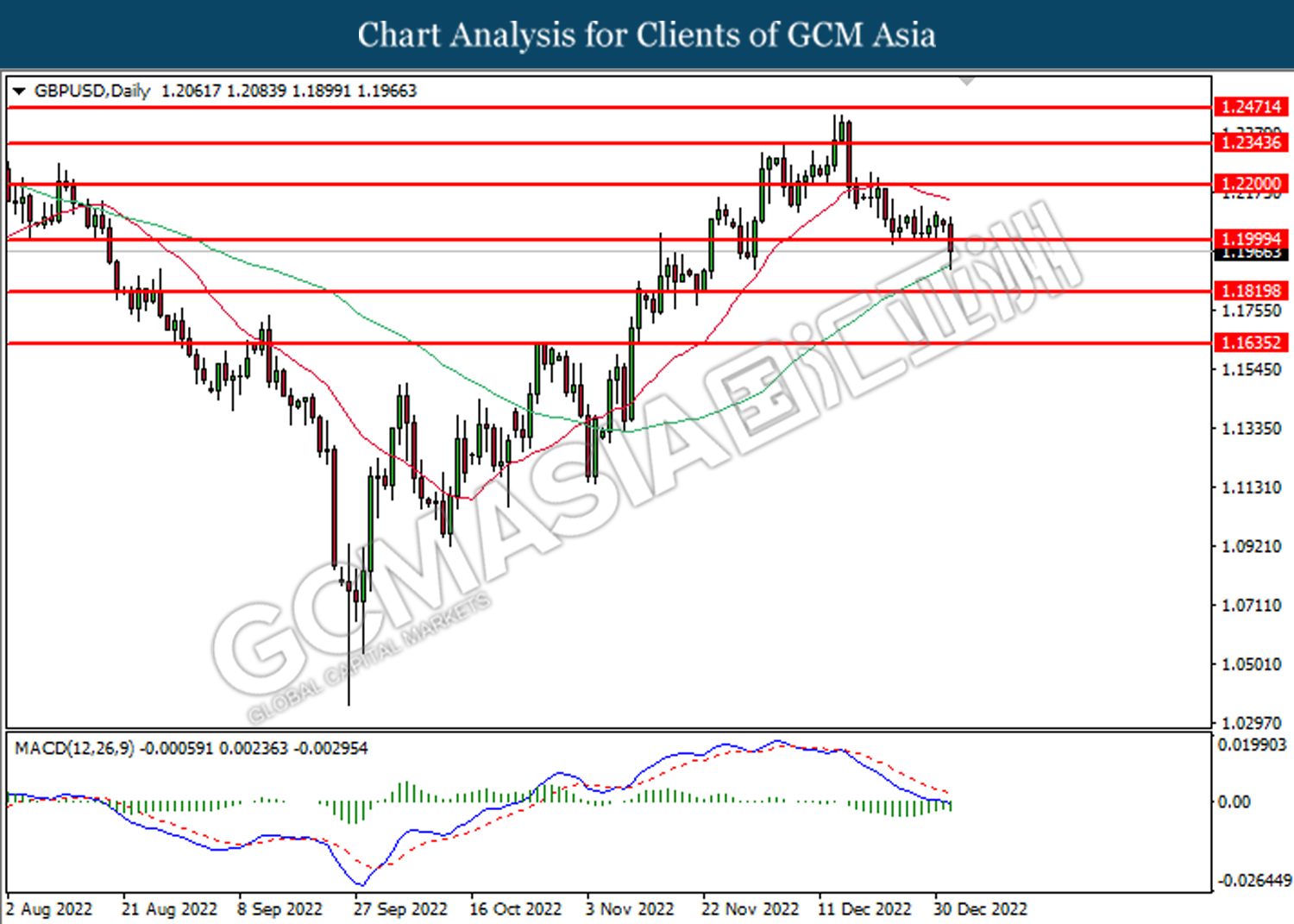

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2000. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2200, 1.2345

Support level: 1.2000, 1.1820

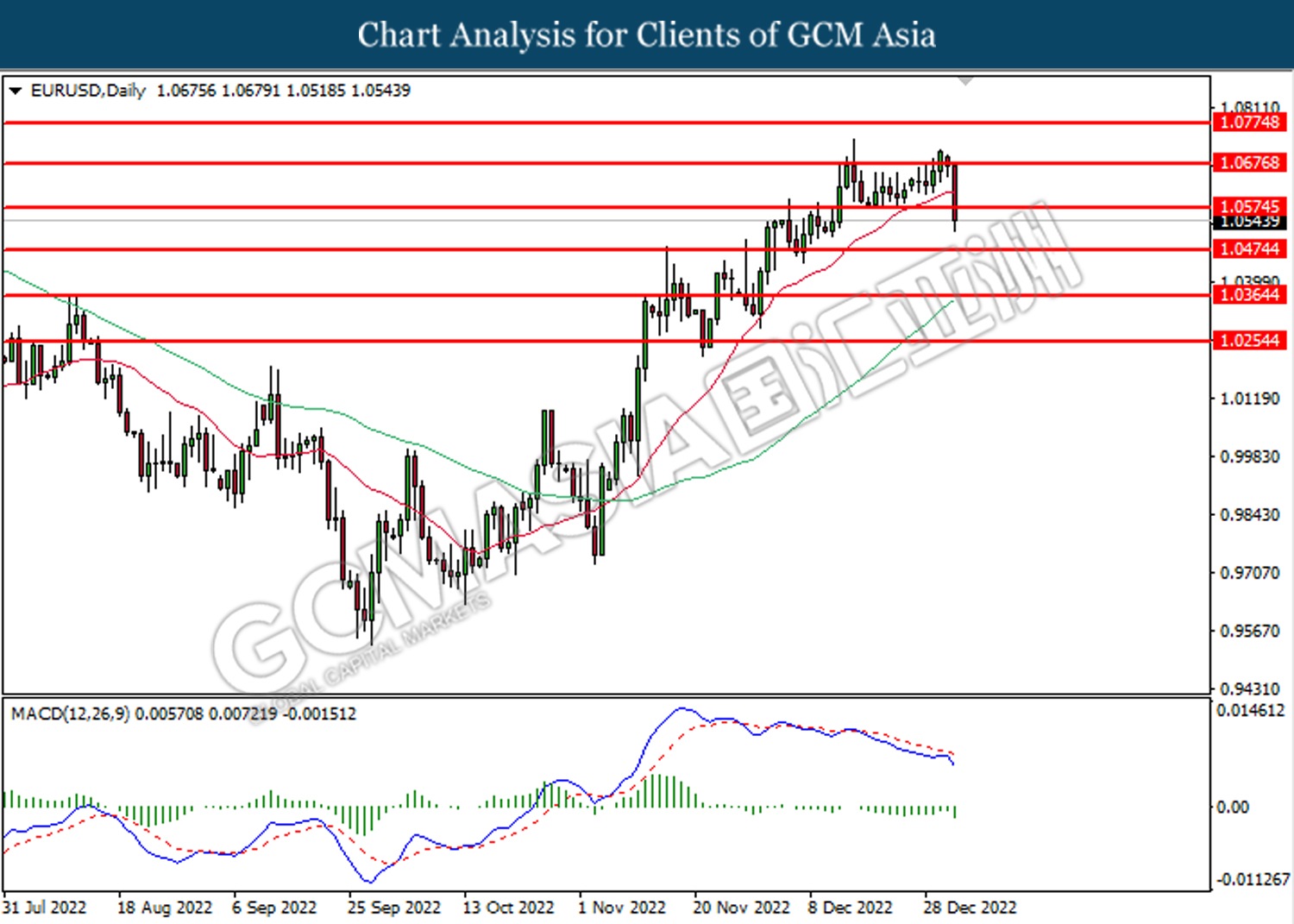

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0575. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0775, 1.0935

Support level: 1.0675, 1.0575

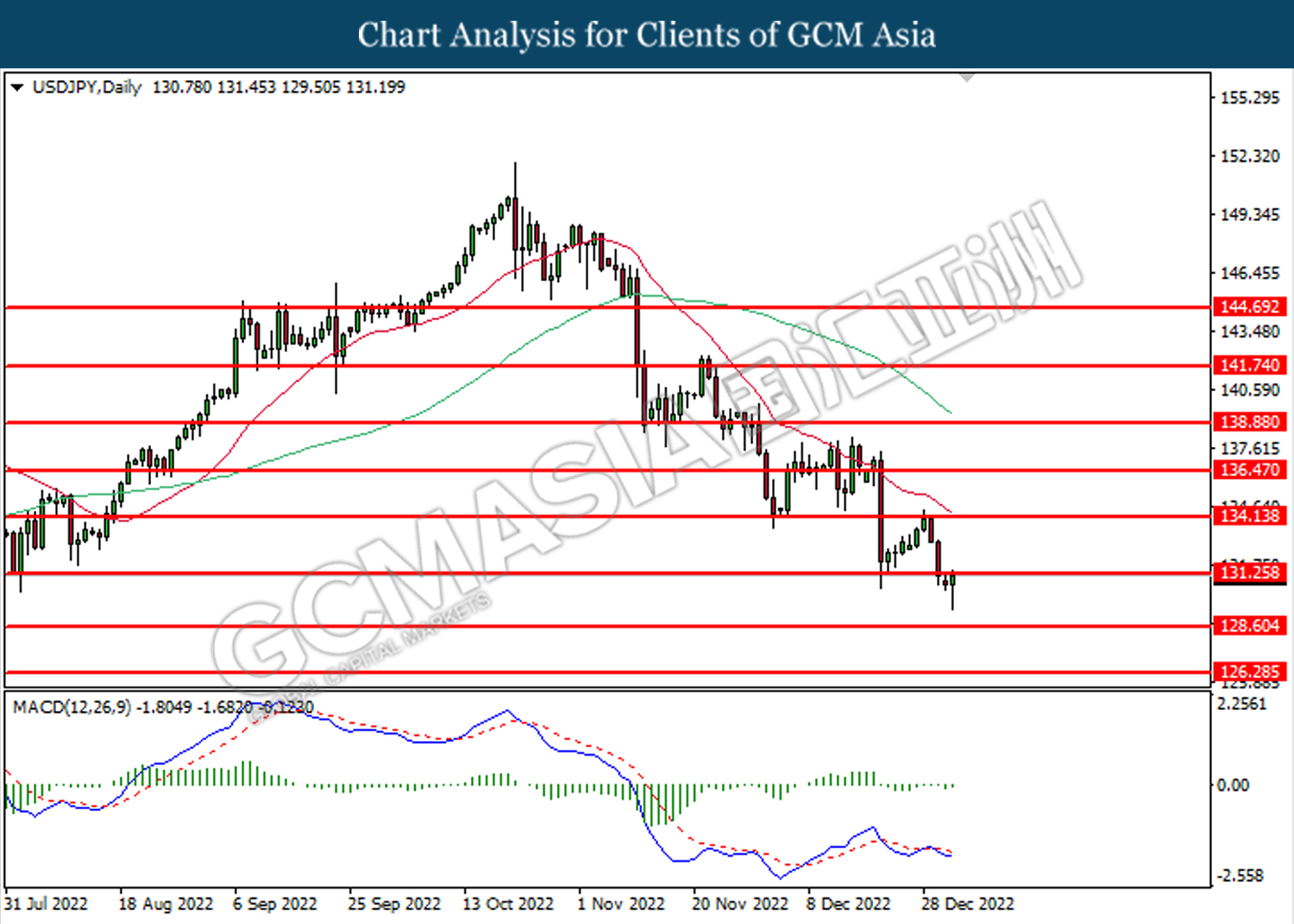

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 131.25. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 131.25, 134.15

Support level: 128.60, 126.30

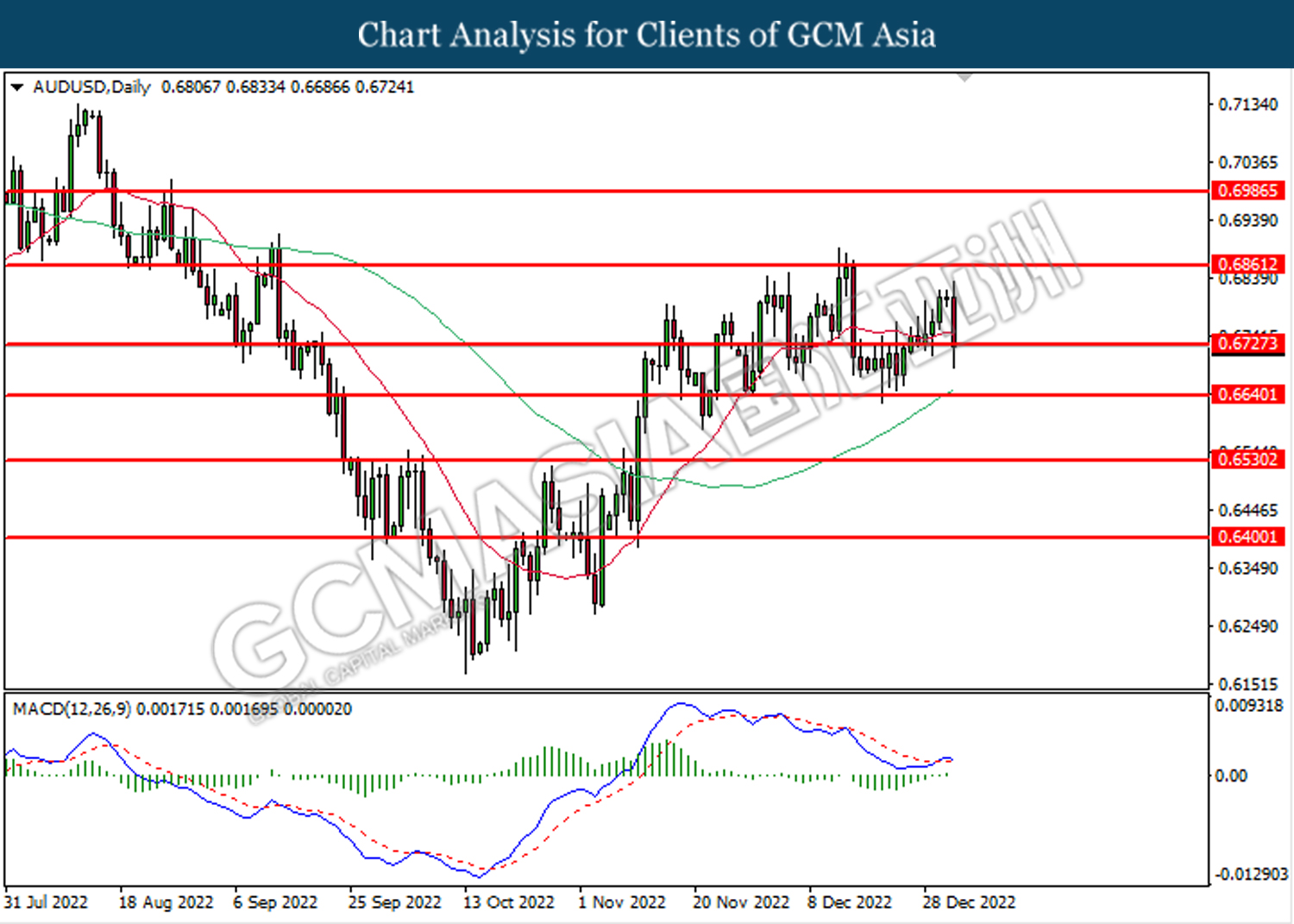

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6730. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical rebound in short term.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

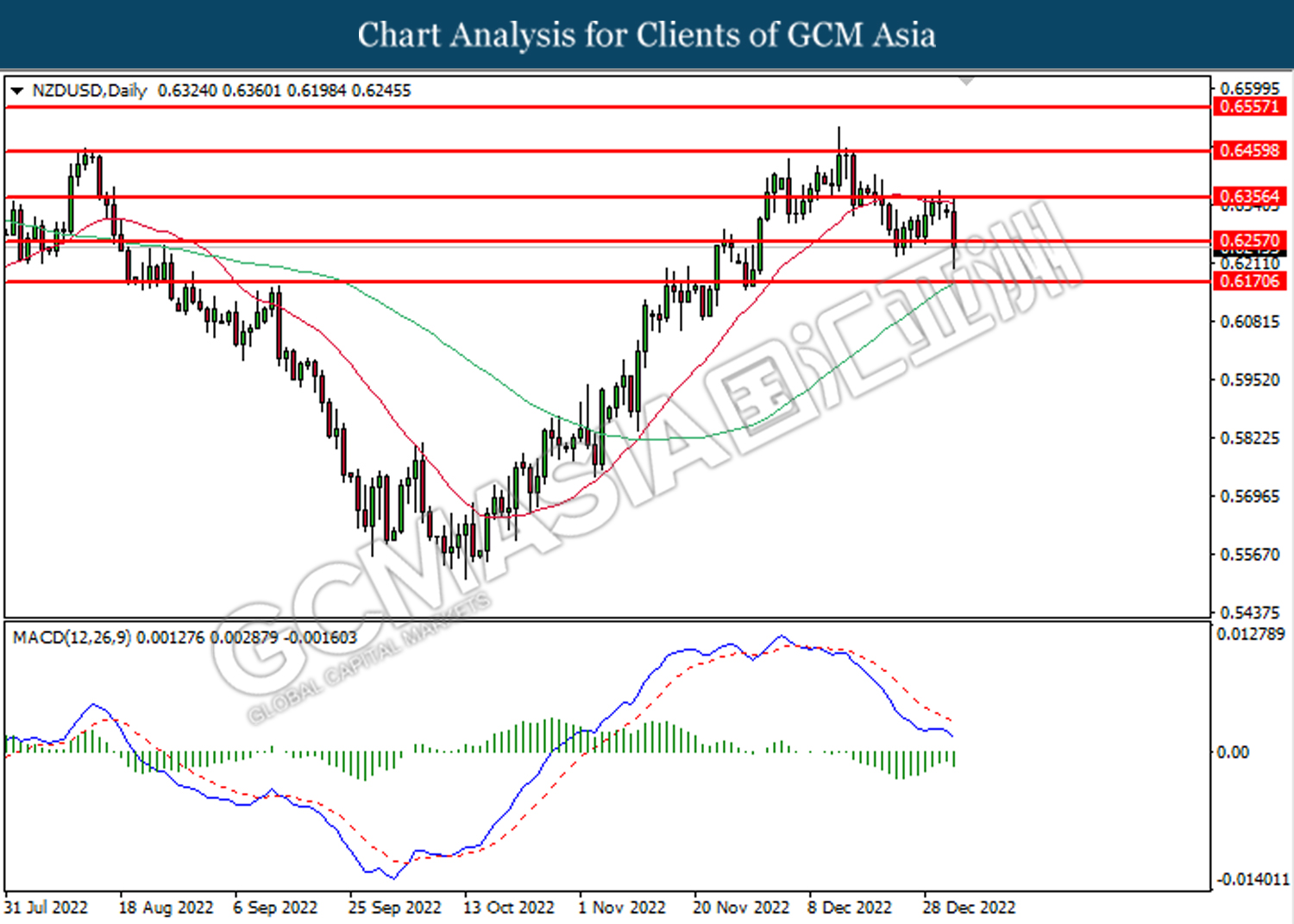

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6255. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

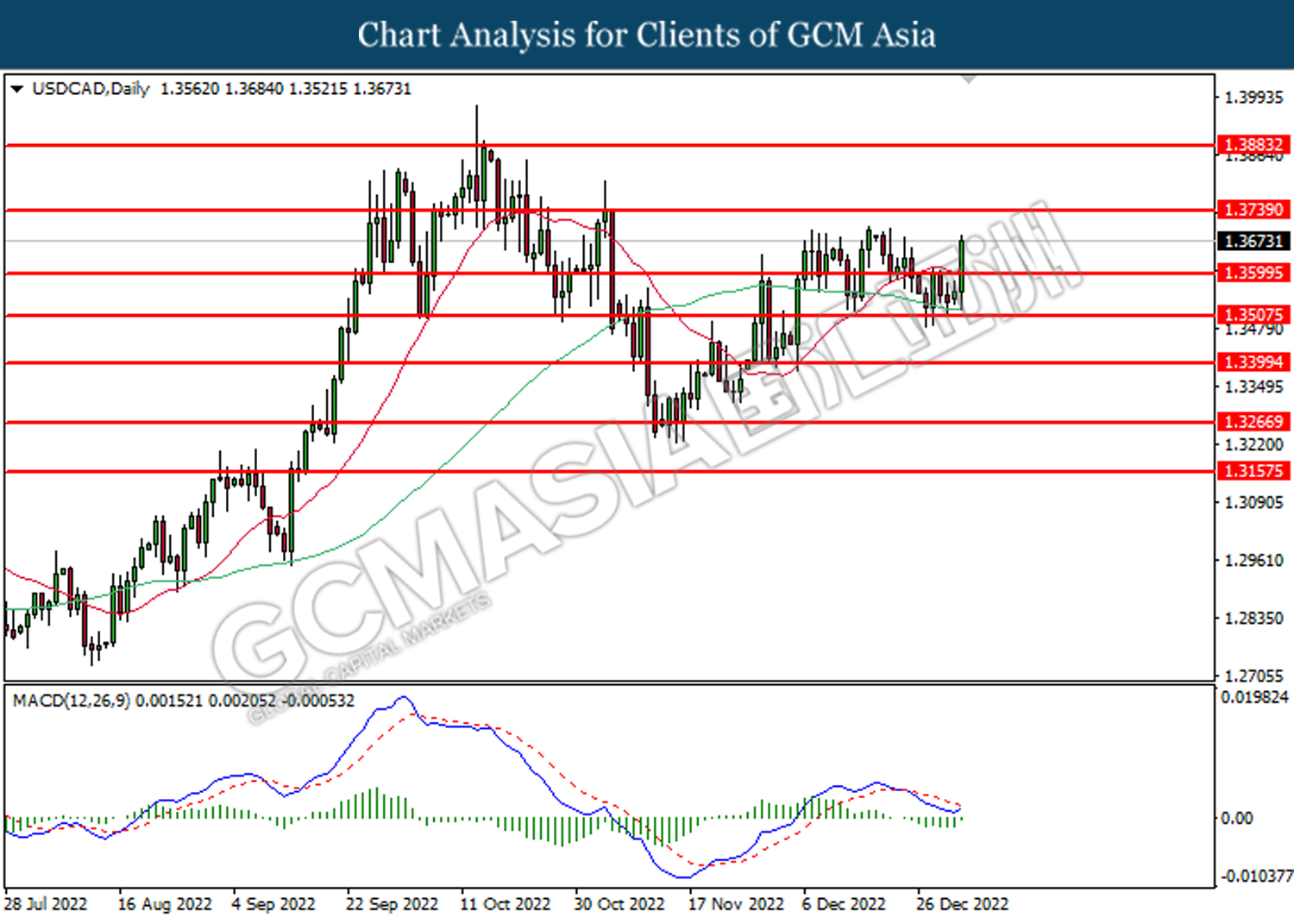

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3600. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3600, 1.3740

Support level: 1.3505, 1.3400

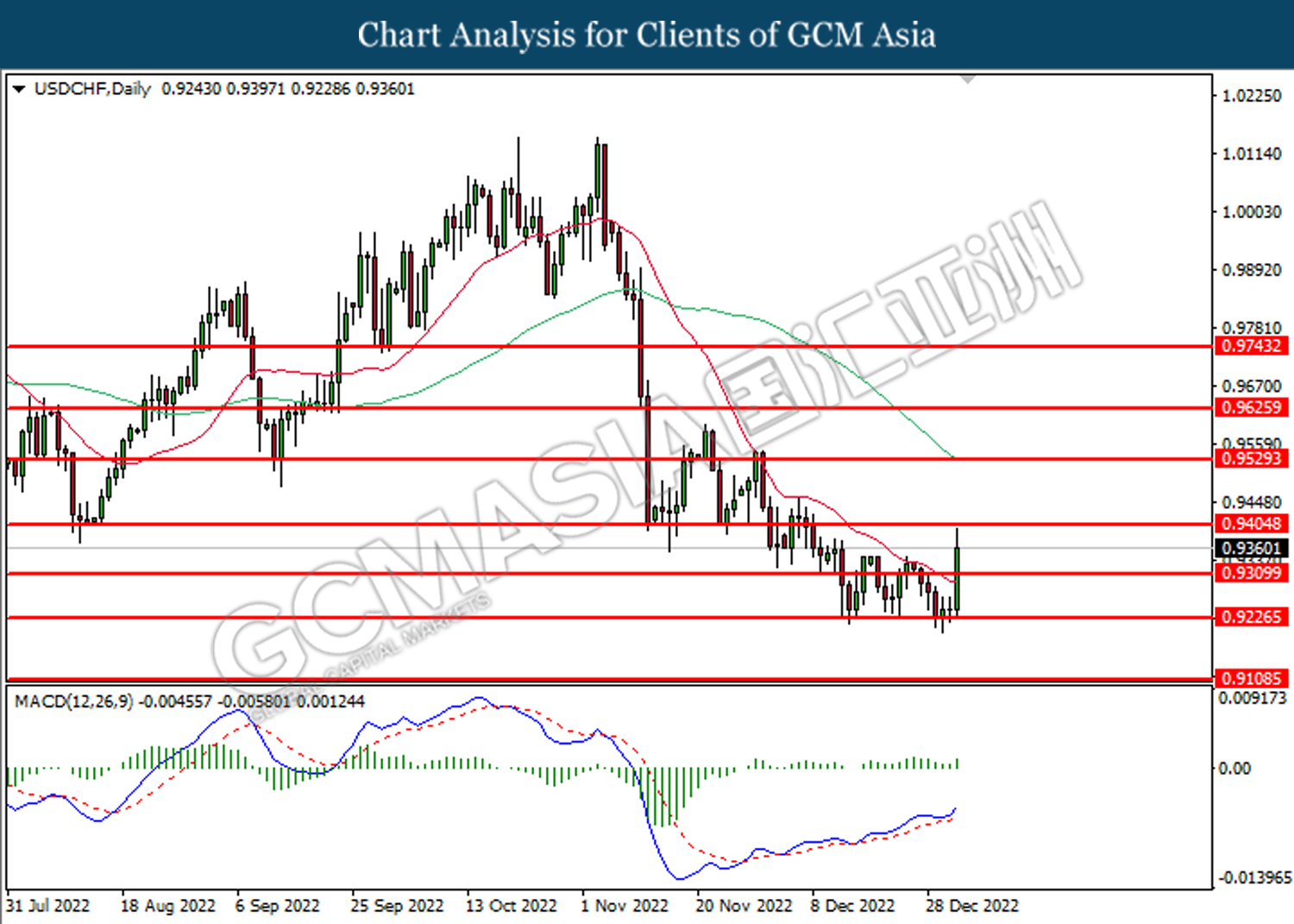

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9310. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

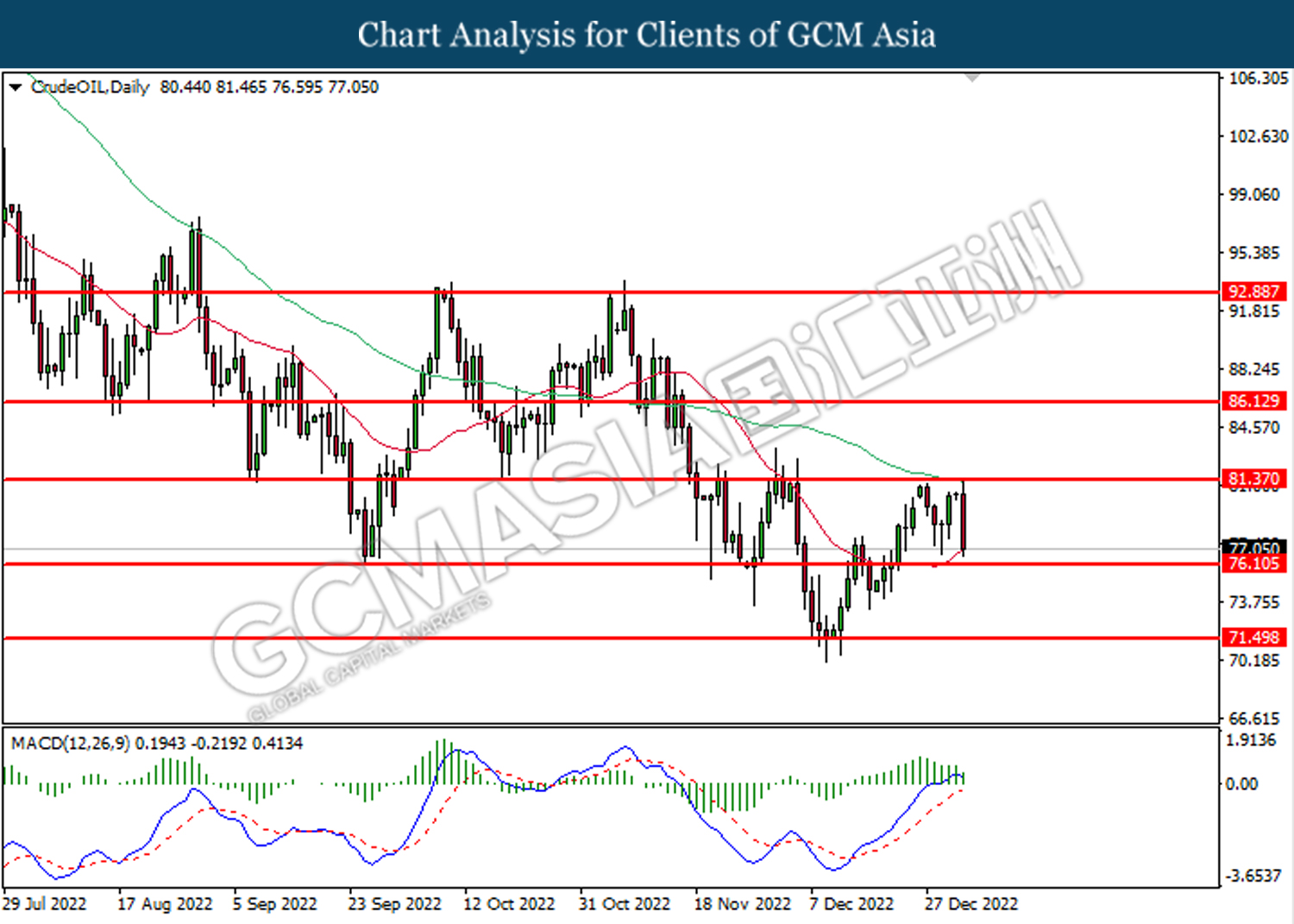

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level at 81.35. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 76.10.

Resistance level: 81.35, 86.15

Support level: 76.10, 71.50

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1835.30. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1835.30, 1869.85

Support level: 1807.85, 1786.00