04 February 2022 Afternoon Session Analysis

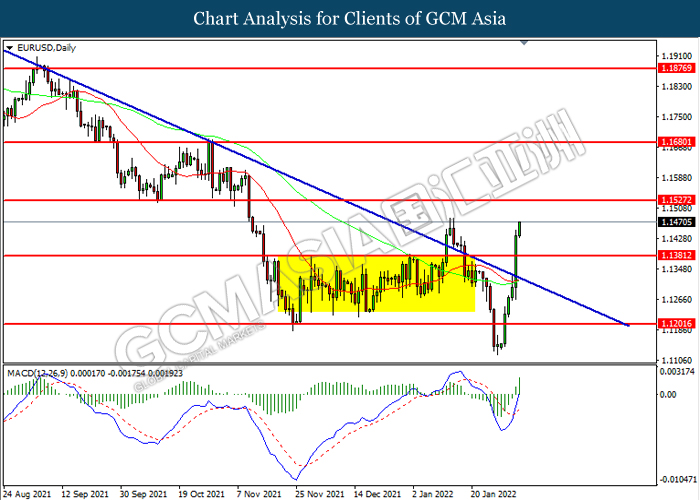

Hawkish tone from ECB increased the appeal of Euro.

The Euro received significant bullish momentum over the backdrop of hawkish tone from the European Central Bank. Yesterday, the ECB finally acknowledged mounting inflation risk would be lasted in long-term basis and signaling the possibility of rate hike this year. According to Reuters, the Monetary Policy Committee (MPC) were clear that a rate hiked this year should no longer be excluded given the spiking inflation risks in future. Nonetheless, the European Central Bank opted to maintain the deposit rate unchanged at -0.50%, aligned with market expectation at -0.50% while earlier aggressive bond buying program PEPP will be ended in March. Though, as for now investors would continue to scrutinize the crucial updates with regards of the economic data to gauge the likelihood movement for the pair of EUR/USD. As of writing, EUR/USD appreciated by 0.23% to 1.1465.

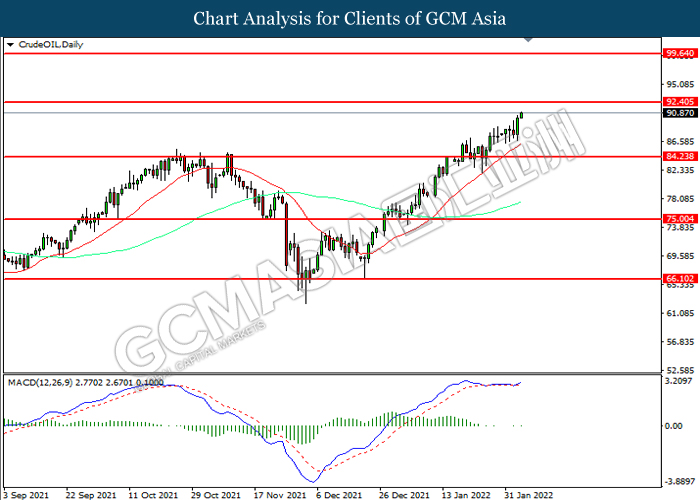

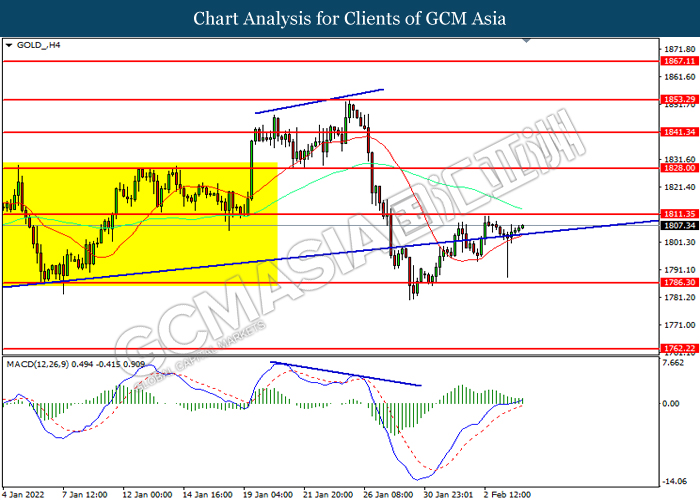

In the commodities market, the crude oil price appreciated by 0.76% to $91.25 per barrel as of writing. The oil market extends its gains amid the massive winter storm across the central and Northeast United States on Thursday was threatening to further disrupt oil supplies in future, spurring bullish momentum on this black-commodity. On the other hand, the gold price surged 0.07% to $1806.20 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Construction PMI (Jan) | 54.3 | 54.3 | – |

| 21:30 | USD – Nonfarm Payrolls (Jan) | 199K | 150K | – |

| 21:30 | USD – Unemployment Rate (Jan) | 3.90% | 3.90% | – |

| 21:30 | CAD – Employment Change (Jan) | 54.7K | -117.5K | – |

| 23:00 | CAD – Ivey PMI (Jan) | 45 | – | – |

Technical Analysis

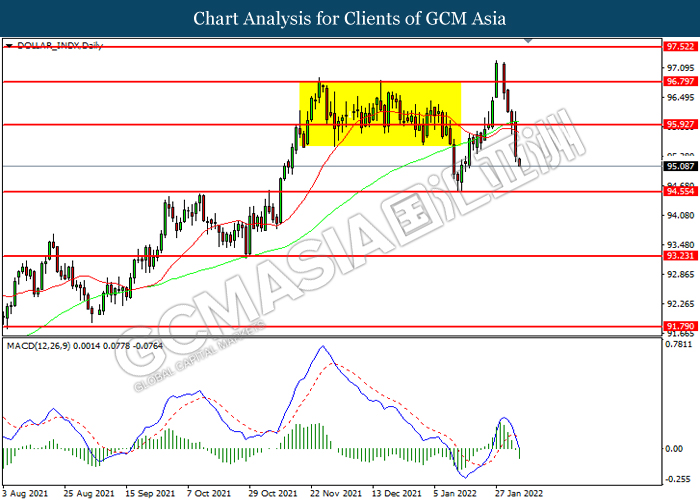

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 95.95. MACD which illustrated increasing bearish momentum suggest the index to extend its losses towards support level at 94.55.

Resistance level: 95.95, 96.80

Support level: 94.55, 93.25

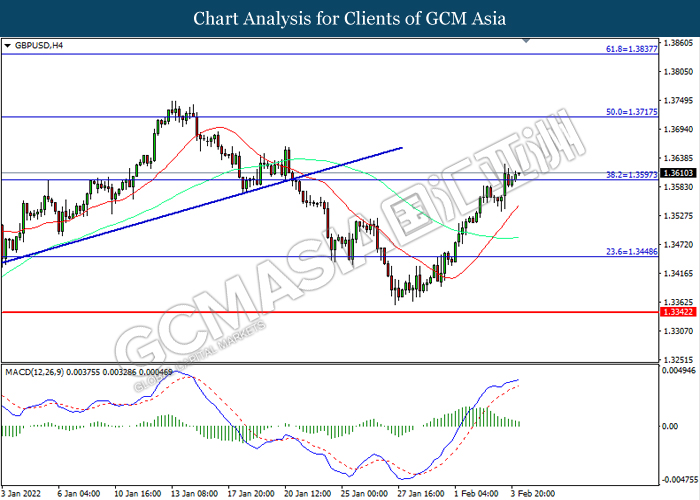

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.3595. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.3595, 1.3715

Support level: 1.3450, 1.3340

EURUSD, Daily: EURUSD was traded higher following breakout above the previous resistance level at 1.1380. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 1.1525.

Resistance level: 1.1525, 1.1680

Support level: 1.1380, 1.1200

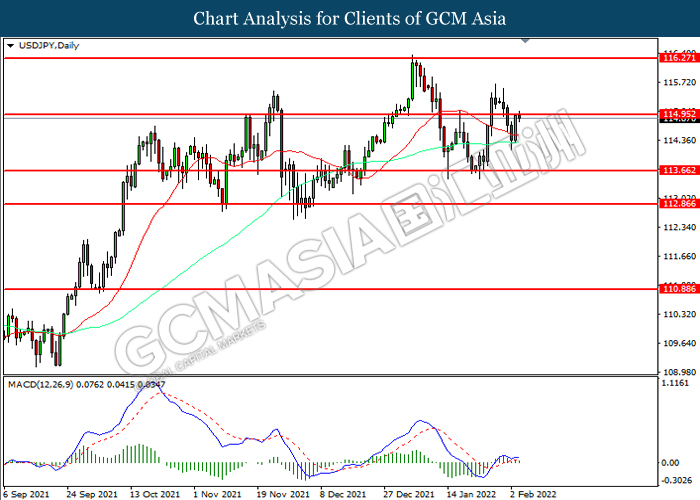

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level at 114.95. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 113.65.

Resistance level: 114.95, 115.65

Support level: 113.65, 112.85

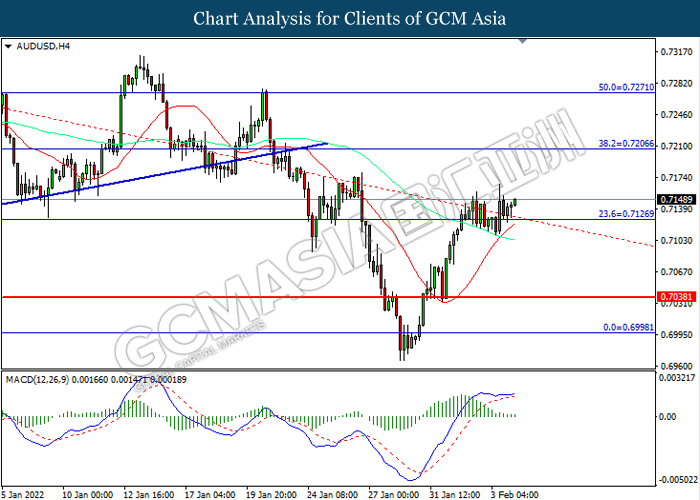

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.7125. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7065

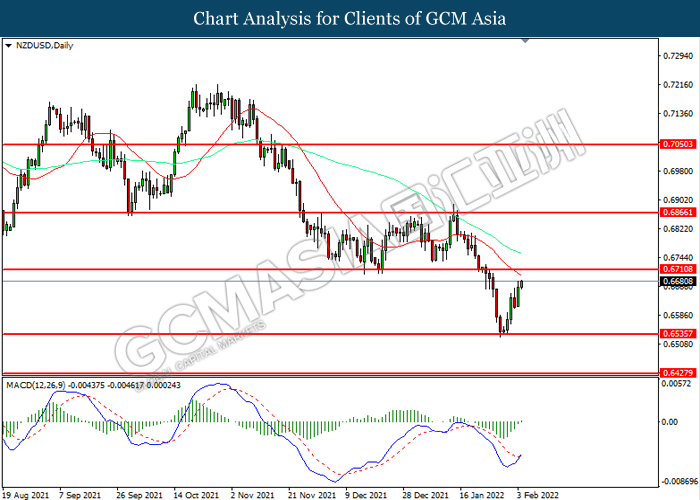

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.6550. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 0.6710.

Resistance level: 0.6710, 0.6865

Support level: 0.6550, 0.6430

USDCAD, Daily: USDCAD was traded lower while currently near the support level at 1.2625. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2825, 1.2950

Support level: 1.2625, 1.2475

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9180. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9270, 0.9345

Support level: 0.9180, 0.9095

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 92.40. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 92.40, 99.65

Support level: 84.25, 75.00

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1811.35. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 1811.35, 1828.00

Support level: 1786.30, 1762.20