4 February 2022 Morning Session Analysis

BoE hike rates as inflation rises.

Pound sterling rebounds sharply from lower level after Bank of England delivers a rather hawkish decision during its monetary policy meeting. On yesterday, BoE initiated a 25-basis points rate hike from 0.25% to 0.50%. The decision was announced after UK government introduced a 9 billion pound sterling program which is aimed to help reduces burden from rising cost of electric in the UK. During press conference, BoE Governor Andrew Bailey stated that rising cost of commodity especially natural gas and crude oil is the main factor that drives inflation higher. Bailey also emphasized that strong economic recovery coupled with disruption upon supply chain as well as lack of raw materials contributes to rising cost of consumer products. At the same time, BoE also announced to start unwinding its 895 billion pound sterling of quantitative easing program in order to help curb rising inflation along side with interest rate hike. As of writing, pair of GBP/USD rose 0.05% to 1.3597.

In the commodities market, crude oil price rose 0.04% to $90.17 per barrel following oil supply disruption in Libya and Nigeria which may worsen global supply deficit. On the other hand, gold price was up 0.01% to $1,805.19 a troy ounce due to weaker greenback.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Construction PMI (Jan) | 54.3 | 54.3 | – |

| 21:30 | USD – Nonfarm Payrolls (Jan) | 199K | 150K | – |

| 21:30 | USD – Unemployment Rate (Jan) | 3.90% | 3.90% | – |

| 21:30 | CAD – Employment Change (Jan) | 54.7K | -117.5K | – |

| 23:00 | CAD – Ivey PMI (Jan) | 45 | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retrace from higher levels. MACD which illustrate diminished bullish signal suggests the index to be traded lower in short-term.

Resistance level: 95.80, 96.60

Support level: 94.75, 93.55

GBPUSD, H4: GBPUSD was traded higher following prior rebound from lower level. However, MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.3630, 1.3690

Support level: 1.3570, 1.3510

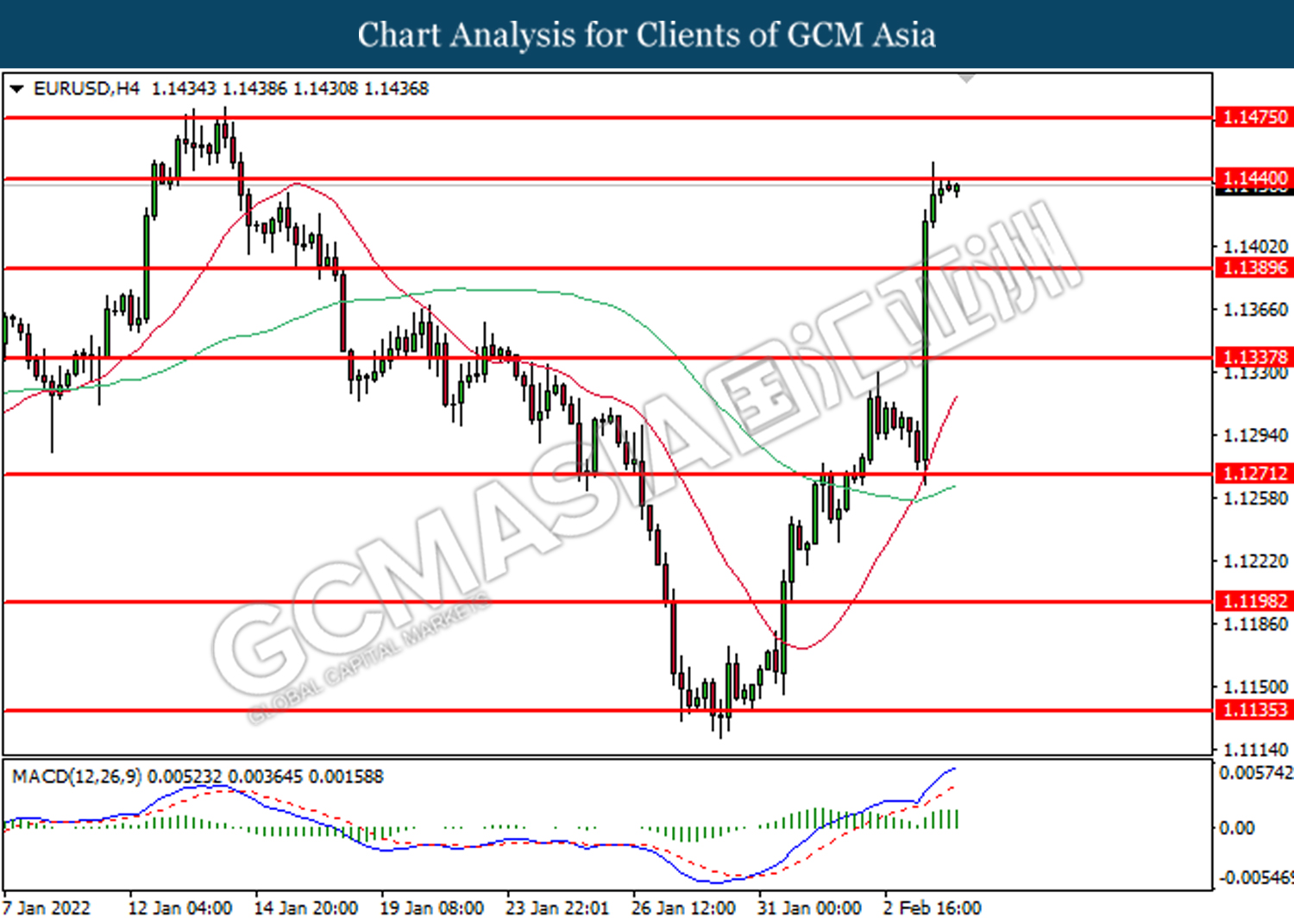

EURUSD, H4: EURUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher after breaking its resistance level.

Resistance level: 1.1440, 1.1475

Support level: 1.1390, 1.1340

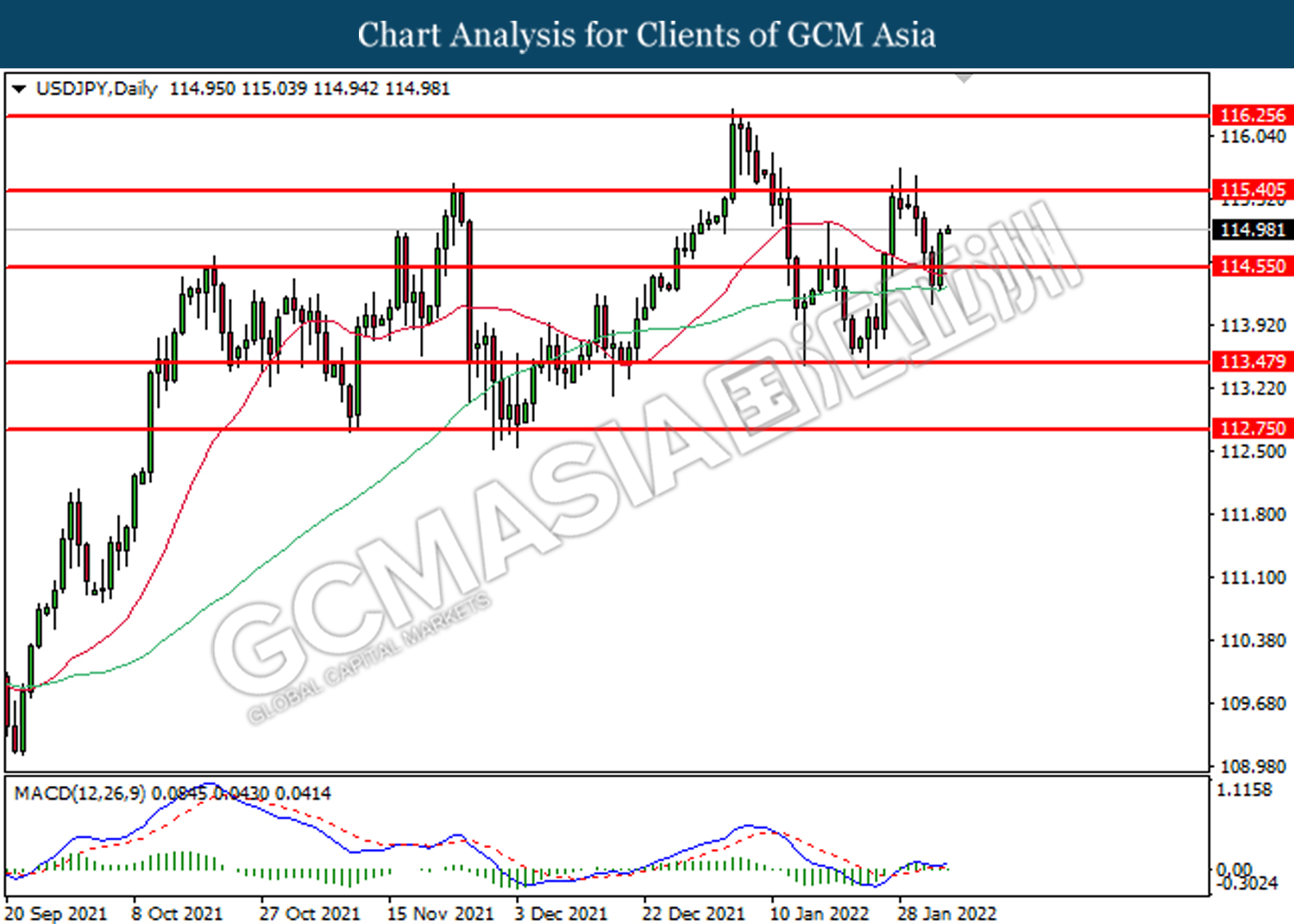

USDJPY, Daily: USDJPY was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 115.40, 116.25

Support level: 114.55, 113.50

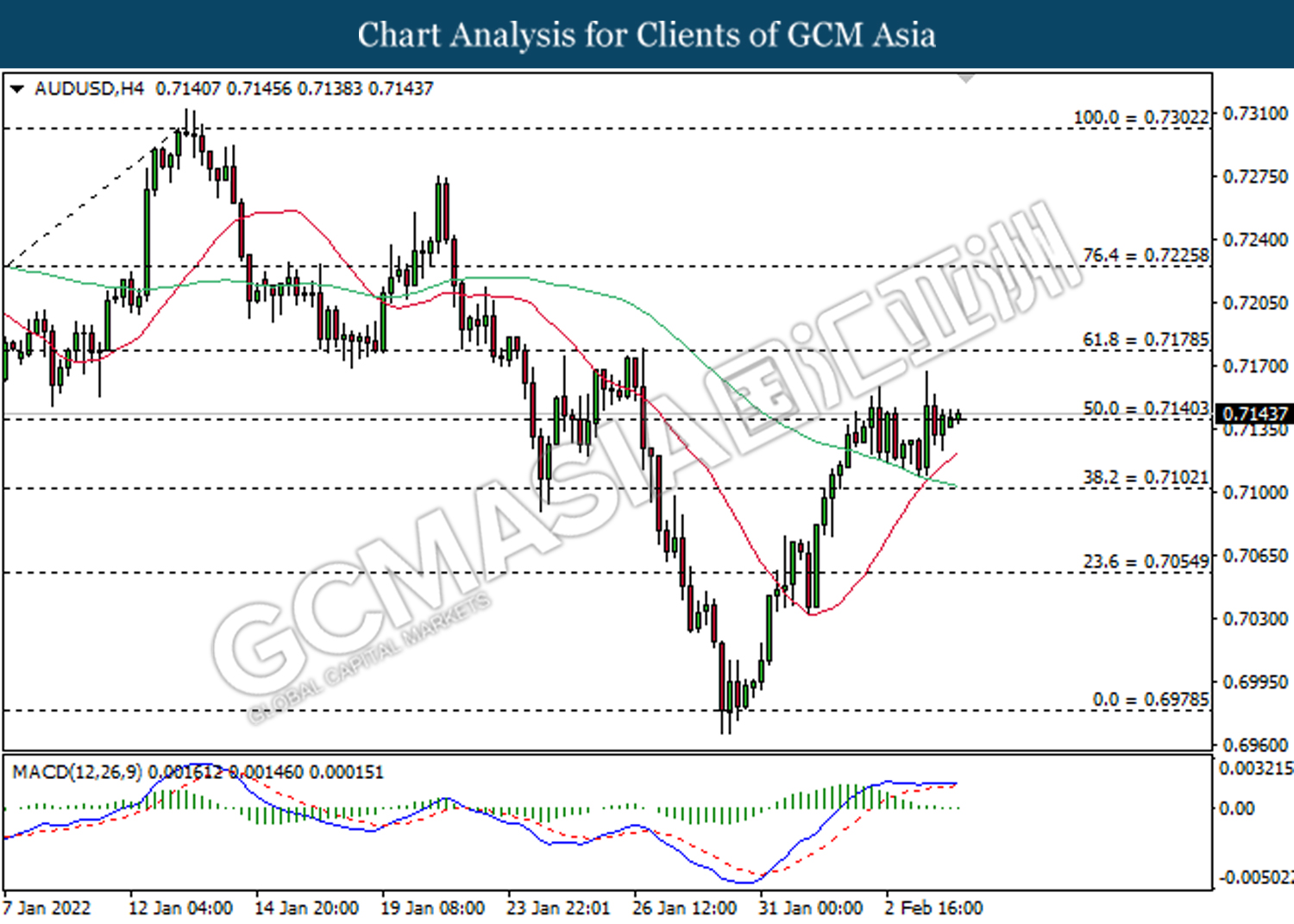

AUDUSD, H4: AUDUSD was traded higher following prior rebound from lower level. However, MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.7180, 0.7225

Support level: 0.7140, 0.7100

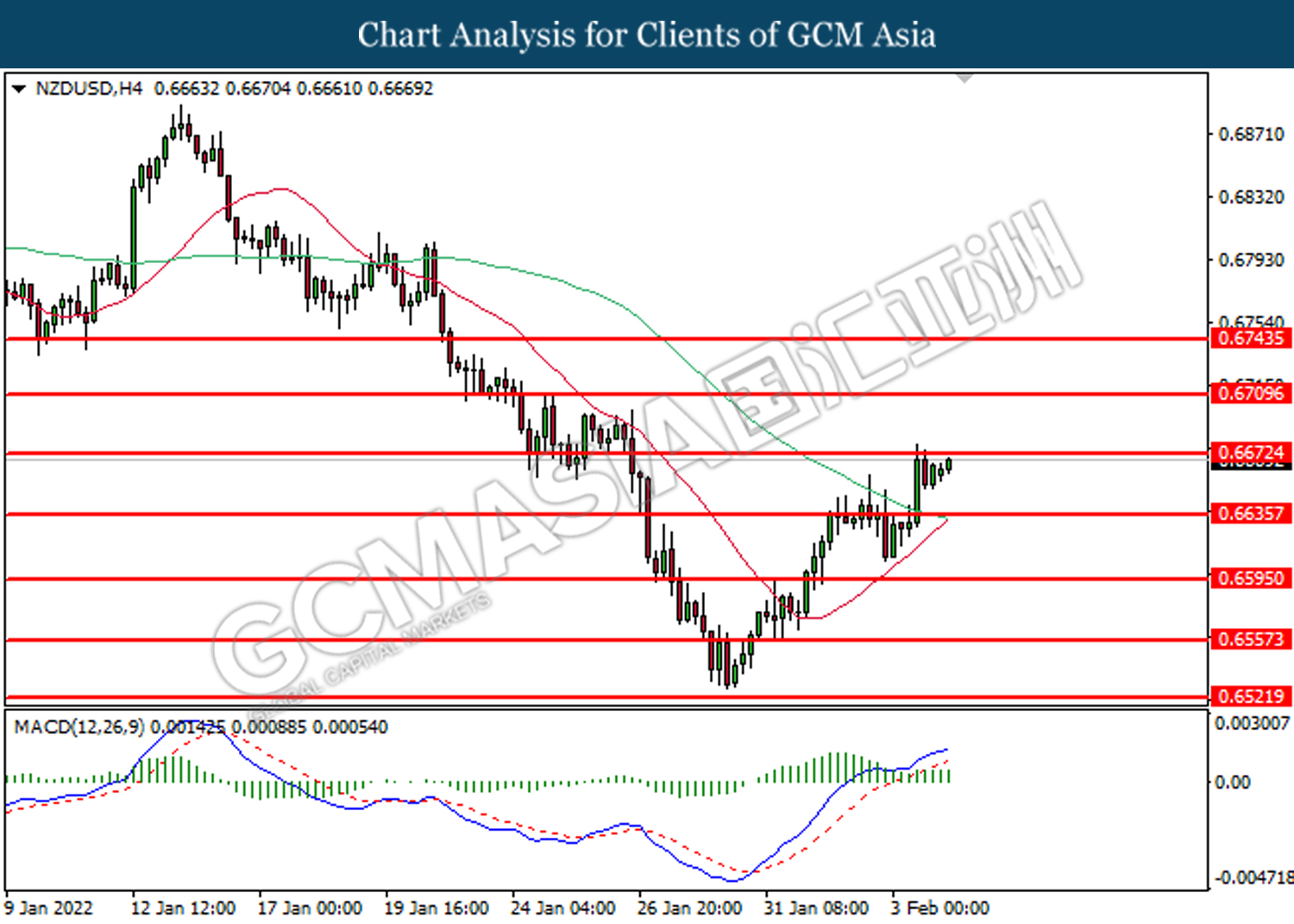

NZDUSD, H4: NZDUSD was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher after breaking the resistance level.

Resistance level: 0.6670, 0.6710

Support level: 0.6635, 0.6595

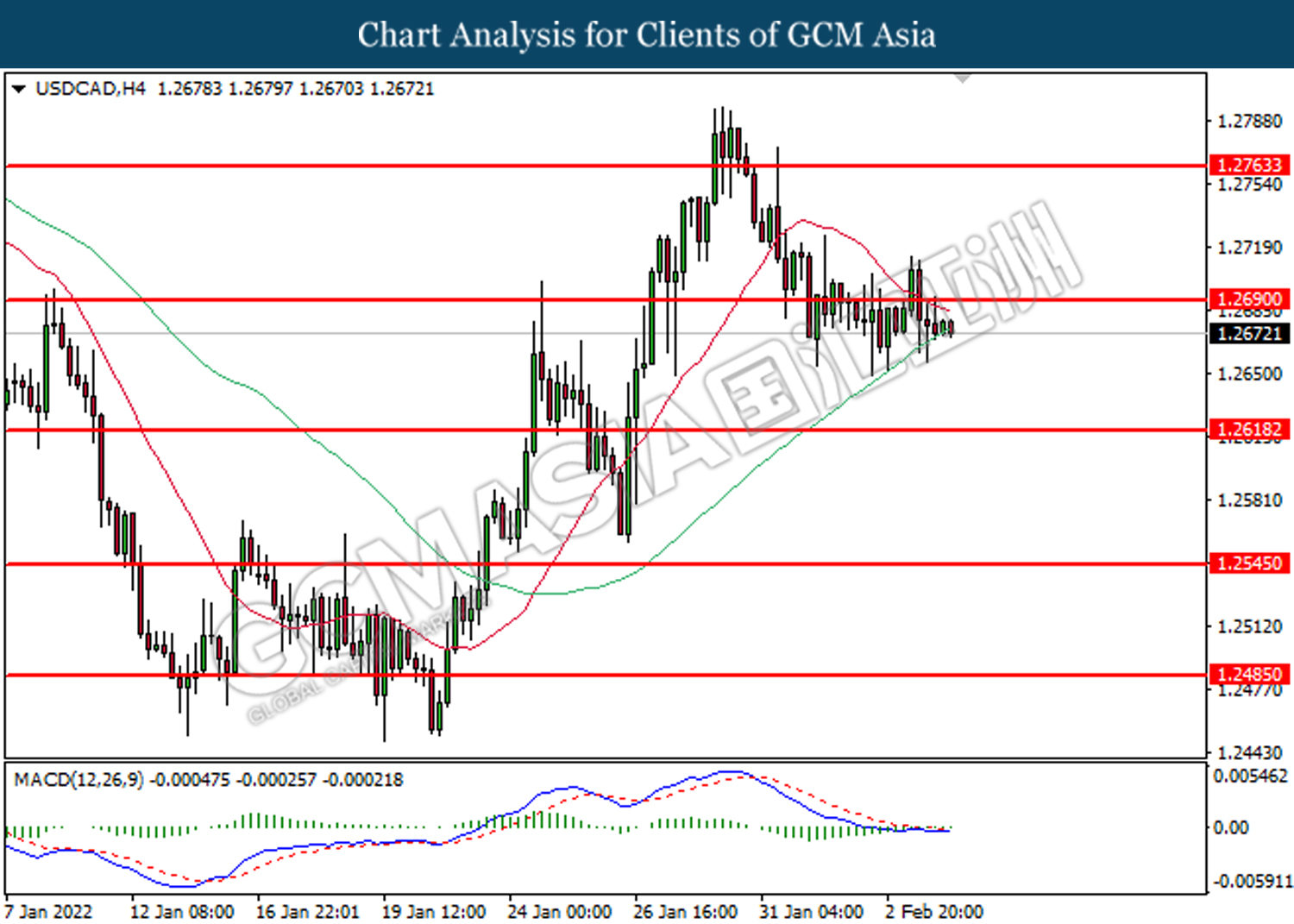

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate bearish momentum suggests the pair to be traded lower in short-term.

Resistance level: 1.2690, 1.2765

Support level: 1.2620, 1.2545

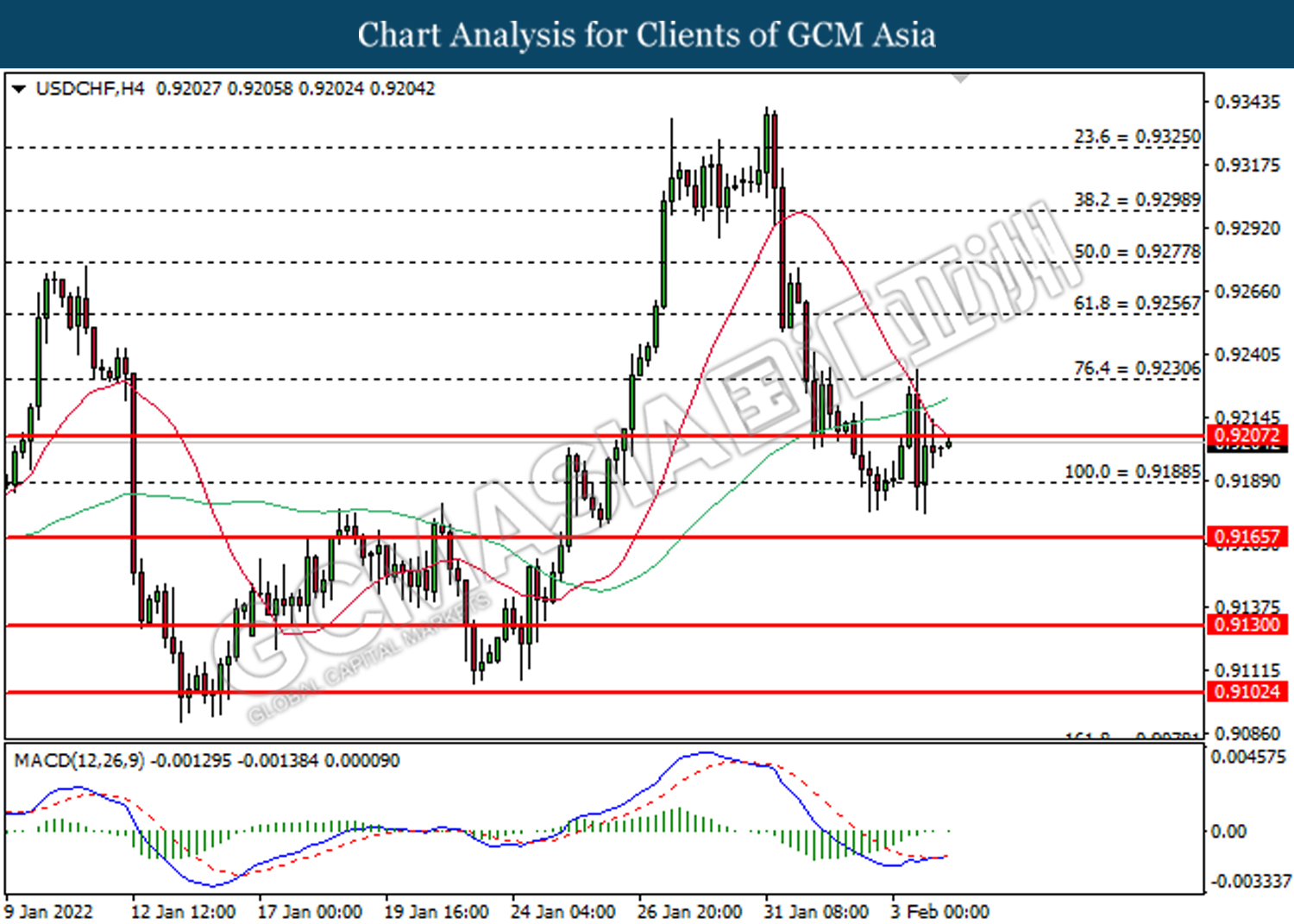

USDCHF, H4: USDCHF was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9210, 0.9230

Support level: 0.9190, 0.9165

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher in short-term.

Resistance level: 91.00, 93.15

Support level: 89.50, 87.40

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. However, MACD which illustrate diminished bullish signal suggests its price to be traded lower in short-term.

Resistance level: 1812.80, 1830.20

Support level: 1797.60, 1784.90