4 March 2022 Morning Session Analysis

More frequent rate hike from Fed.

Market participants feed upon Federal Reserve’s latest hawkish signal following testimony from Fed Chair Jerome Powell. During the testimony session, Powell reiterates his support for a 25-basis point interest rate hike during their next policy meeting on 16th March 2022. Powell also emphasized that the central bank’s main focus will be placed upon curbing rising inflation even though Russia-Ukraine tension may create spillover effect on US economy. Likewise, he also commented that US economy is strong enough to weather through a few rounds of rate hike due to robust hiring after the pandemic. When asked with regards to the upper limit of interest rate, Powell suggests that it may be more than their projected range of 2-2.5%, while all decisions will be based on future economic data. As of writing, the dollar index was down slightly by 0.01% to 97.68.

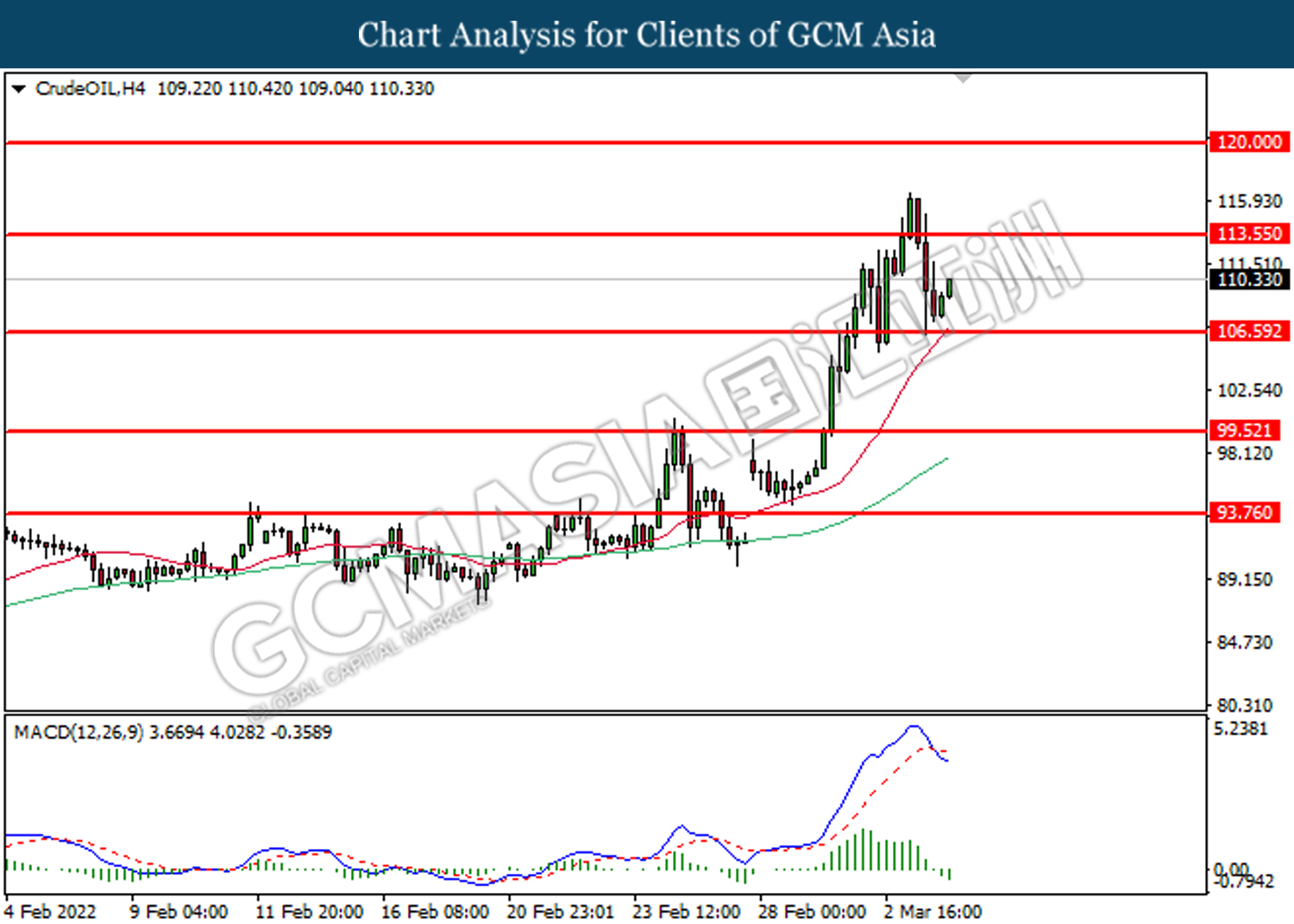

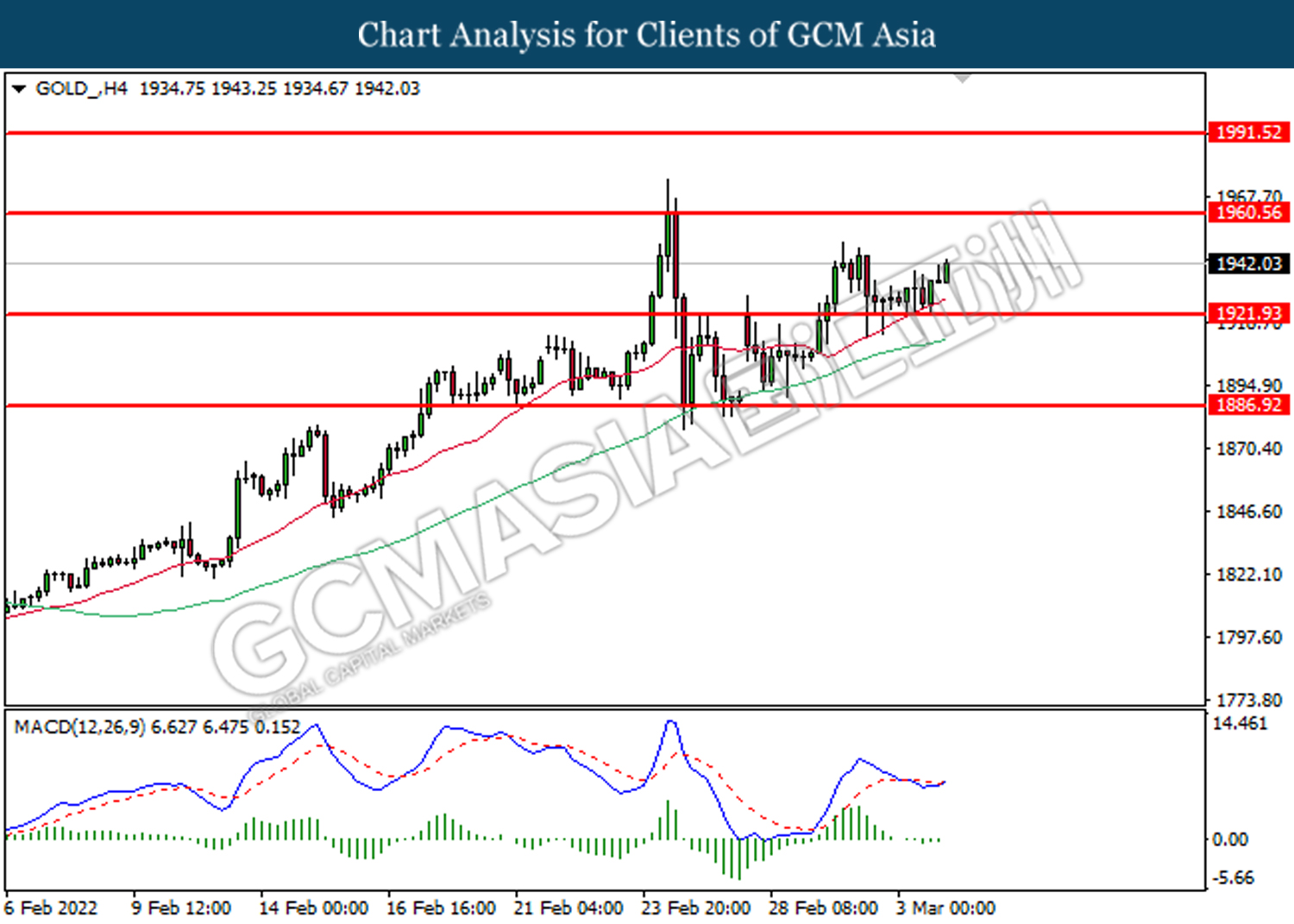

As for commodities market, crude oil price was up by 0.85% to $109.29 per barrel following a rebound from lower levels. On the other hand, gold price depreciates by 0.05% to $1,935.78 a troy ounce due to diminishing risks in between Russia and Ukraine.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | UK – Construction PMI (Feb) | 56.3 | 54.3 | – |

| 21:30 | USD – Nonfarm Payrolls (Feb) | 467K | 450K | – |

| 21:30 | USD – Unemployment Rate (Feb) | 4.00% | 3.90% | – |

| 23:00 | CAD – Ivey PMI (Feb) | 50.7 | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to be traded higher after breaking its resistance level.

Resistance level: 97.65, 98.80

Support level: 96.60, 95.80

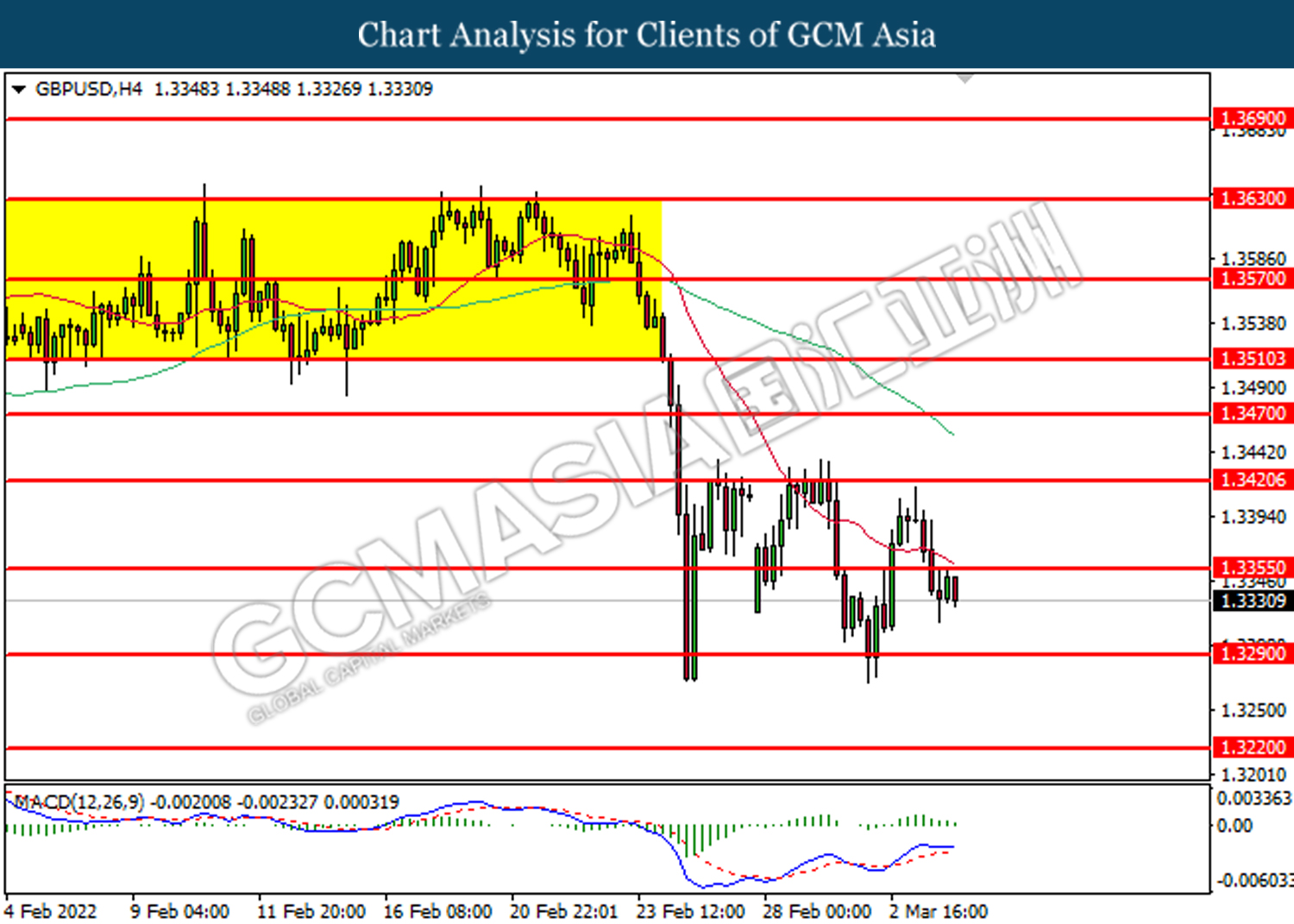

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which diminished illustrate bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.3355, 1.3420

Support level: 1.3290, 1.3220

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.1065, 1.1130

Support level: 1.0985, 1.0860

USDJPY, Daily: USDJPY was traded lower following prior retracement from higher level. MACD which bearish momentum suggests the pair to be traded lower in short-term.

Resistance level: 116.25, 117.00

Support level: 115.40, 114.55

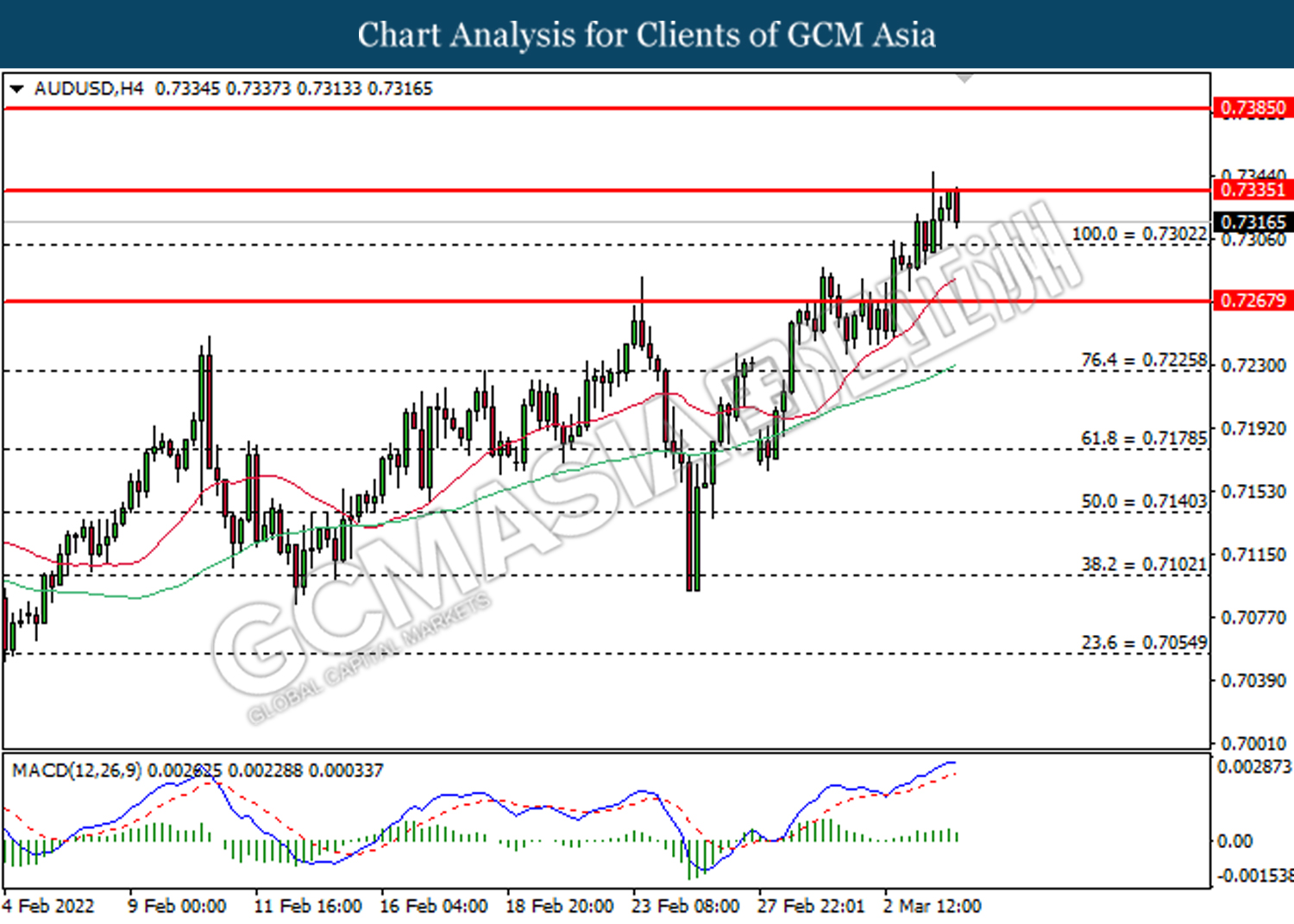

AUDUSD, H4: AUDUSD was traded lower following prior retracement from higher level. MACD which diminished illustrate bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.7335, 0.7385

Support level: 0.7300, 0.7270

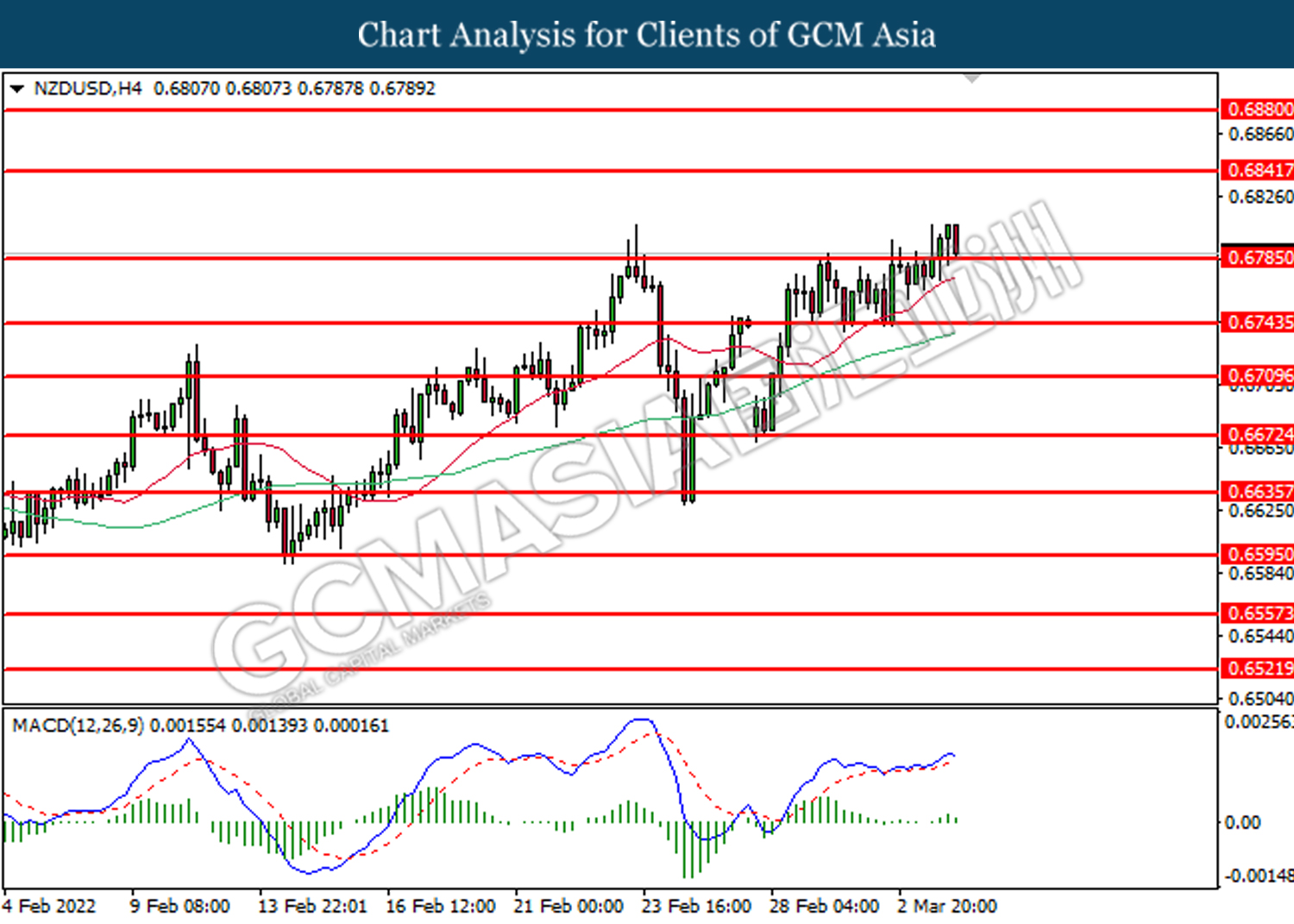

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.6840, 0.6880

Support level: 0.6785, 0.6745

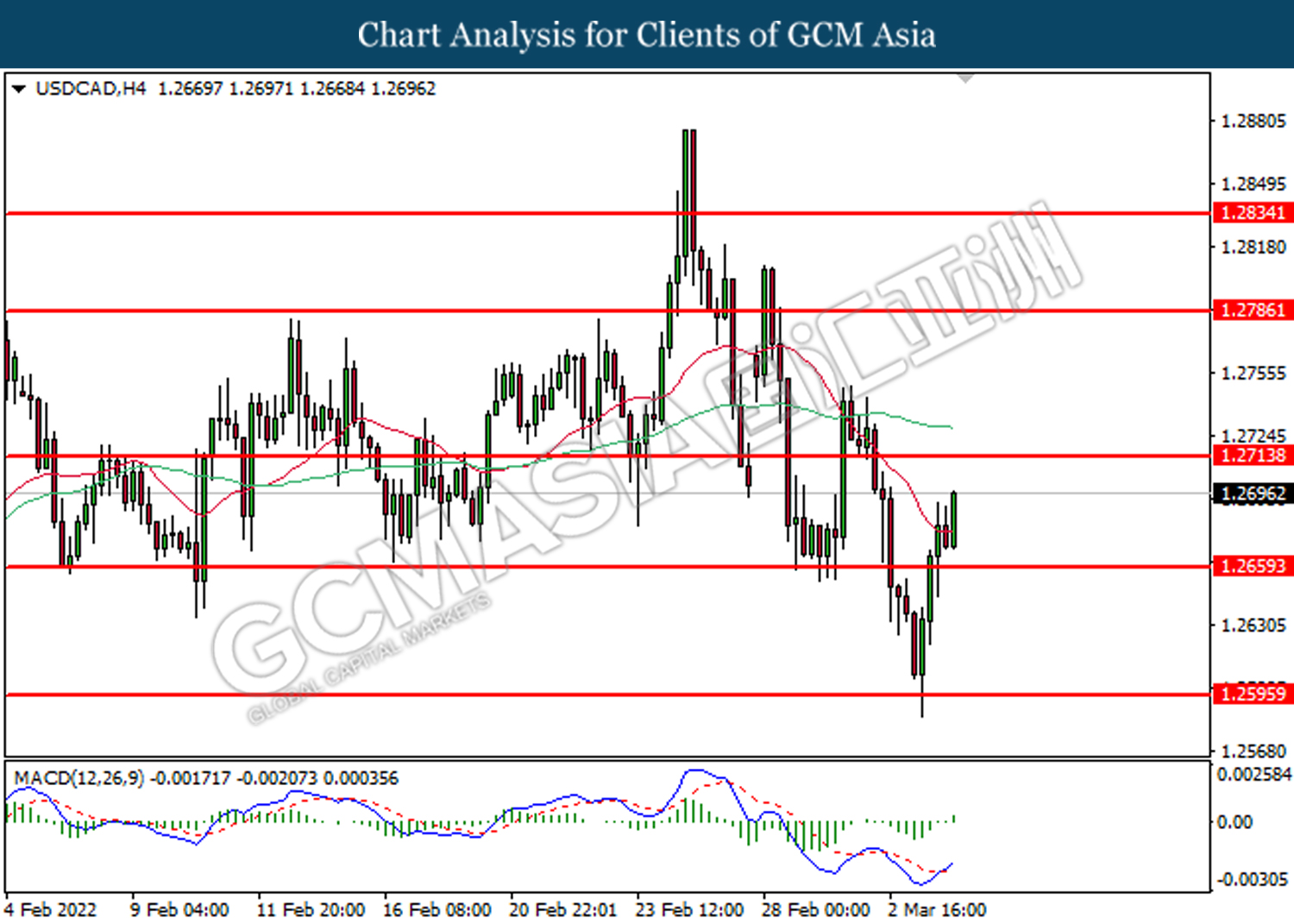

USDCAD, H4: USDCAD was traded higher following prior rebound from lower levels. MACD which illustrate bullish momentum suggests the pair to be traded higher in short-term.

Resistance level: 1.2715, 1.2785

Support level: 1.2660, 1.2595

USDCHF, H4: USDCHF was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.9190, 0.9210

Support level: 0.9165, 0.9130

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. MACD which illustrate diminished bullish signal suggests its price to be traded higher in short-term.

Resistance level: 113.55, 120.00

Support level: 106.60, 99.50

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests its price to be traded higher in short-term.

Resistance level: 1960.55, 1991.50

Support level: 1921.95, 1886.90