04 April 2023 Afternoon Session Analysis

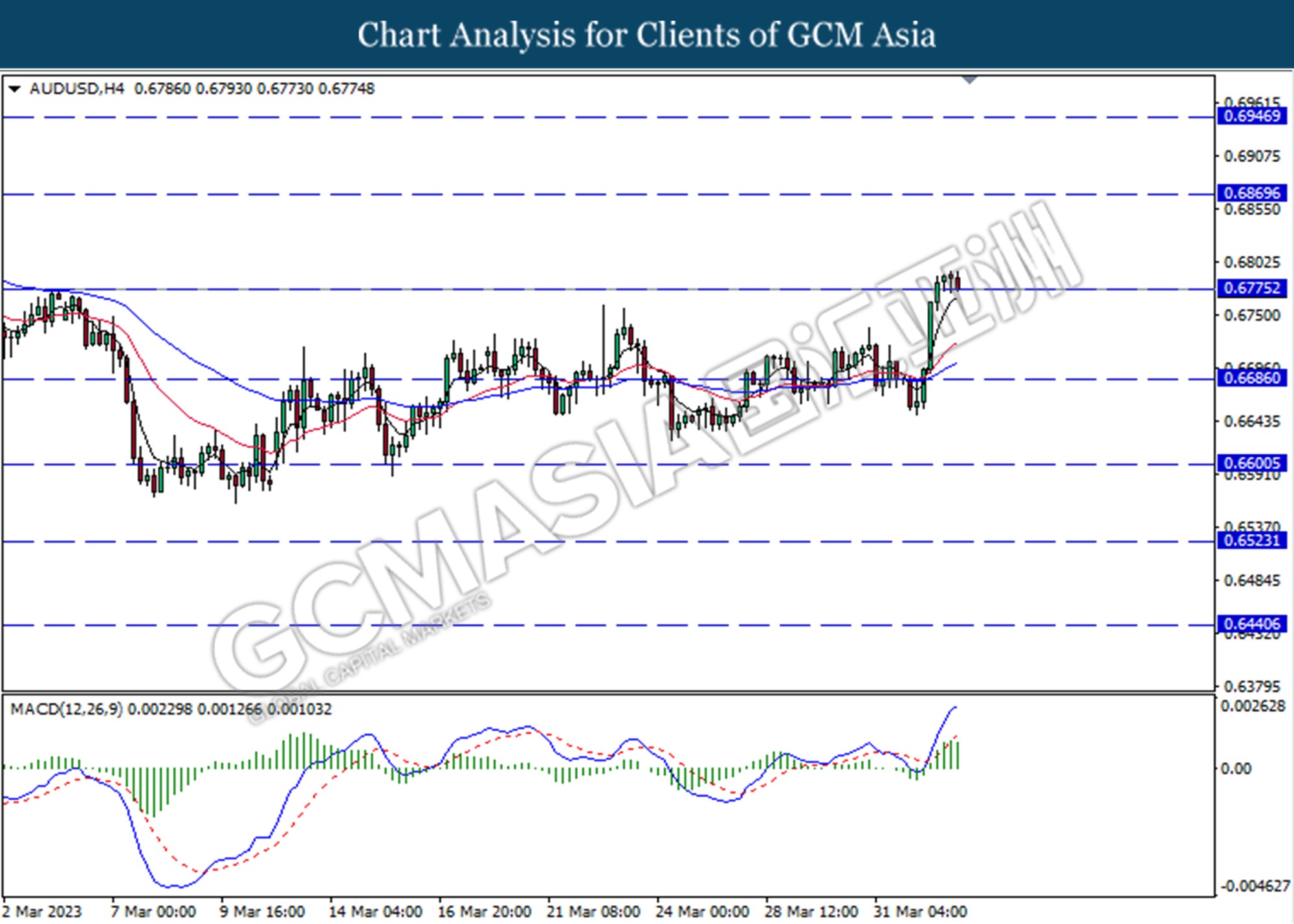

The RBA’s Philip Lowe dovish speech afterward Aussie slipped.

The Reserve Bank of Australia (RBA) Governor Philip Lowe had announced that the RBA decided to maintain the interest rate at 3.60%, and the Aussie slipped afterward. At its meeting today, RBA board members recognize that monetary policy operates with a lag, and the full effect of an interest rate hike is yet to be felt. Therefore, RBA decided to hold the interest rate steady this month. Meanwhile, the RBA’s Lowe mentioned that the global economy remains subdued and the central bank needs to reassess the outlook for monetary policy decisions following turmoil in the banking systems in the US and Switzerland. The central forecast is that inflation in Australia is likely to peak and back to 3% in the mid of 2025. The growth of Australia’s economy is expected to grow slowly over the next couple of years, as the high-interest rate environment and softer demand. According to Australian Bureau of Statistics, the average housing price data declined from 889.80 to 881.20. It indicates that a decline in house prices is leading to a substantial slowing in household spending. The decline in house prices will cause house owners less confident to spend as overall wealth is reduced. As economic growth slows, unemployment is expected to increase to 4% at mid of 2024. Since the economic outlook remains subdued, the RBA decide to soft-land on its monetary policy today. As of writing, the AUD/USD slipped -0.43% to $0.6755.

In the commodities market, crude oil prices edged up by 0.42% to $80.76 per barrel following a prior OPEC+ production cut. Besides, gold also edged down 0.19 per cent to $1,996.55 a troy ounce as investors digested the weak ISM manufacturing data and the US dollar rebounded.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – JOLTs Job Openings (Feb) | 10.824M | 10.400M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following the prior rebound from the support level at 101.70. However, MACD which illustrated bearish momentum suggests the index undergoes technical correction in the short term.

Resistance level: 103.00, 104.45

Support level: 101.70, 100.35

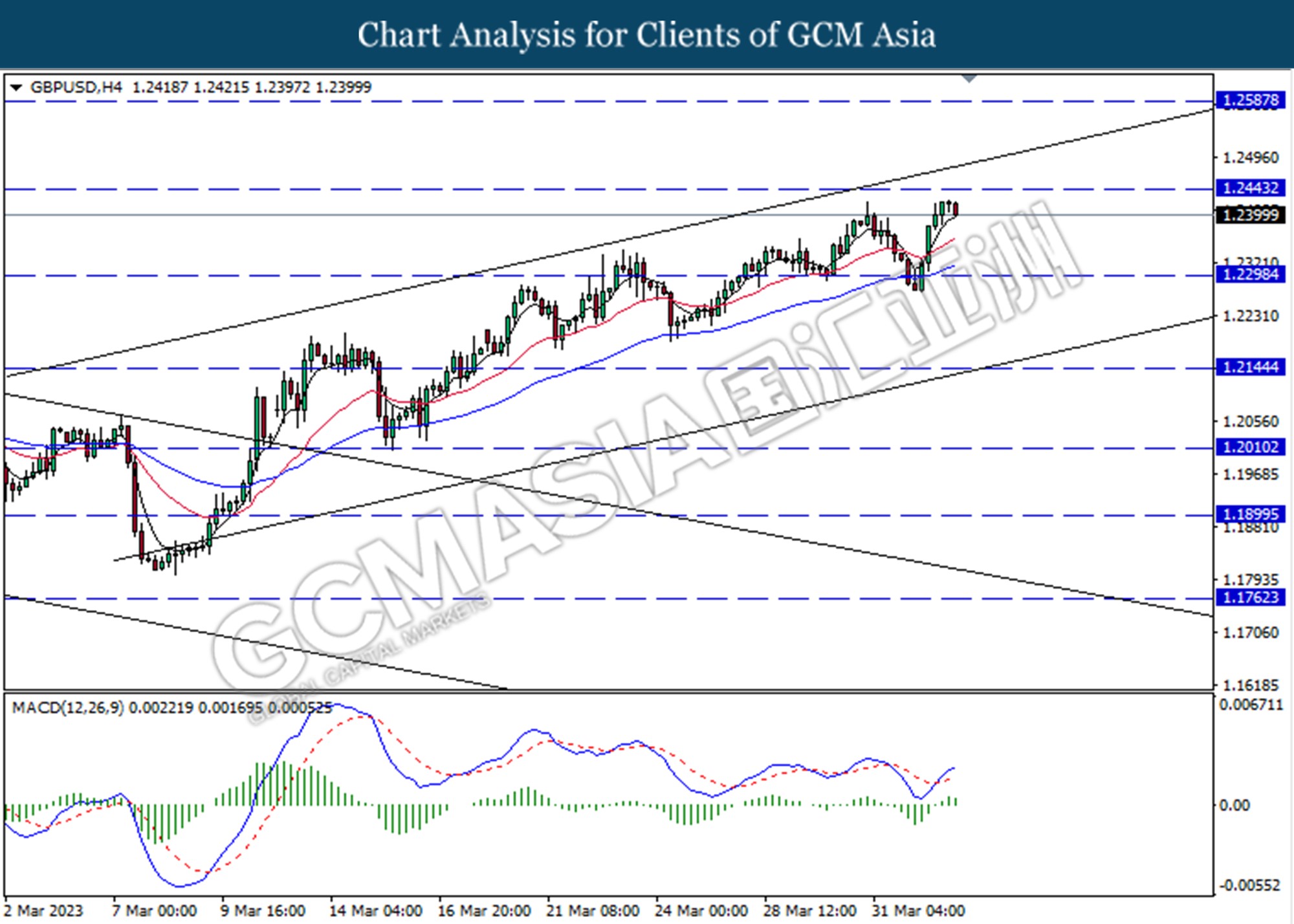

GBPUSD, H4: GBPUSD was traded lower following a prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 1.2445, 1.2590

Support level: 1.2300, 1.2145

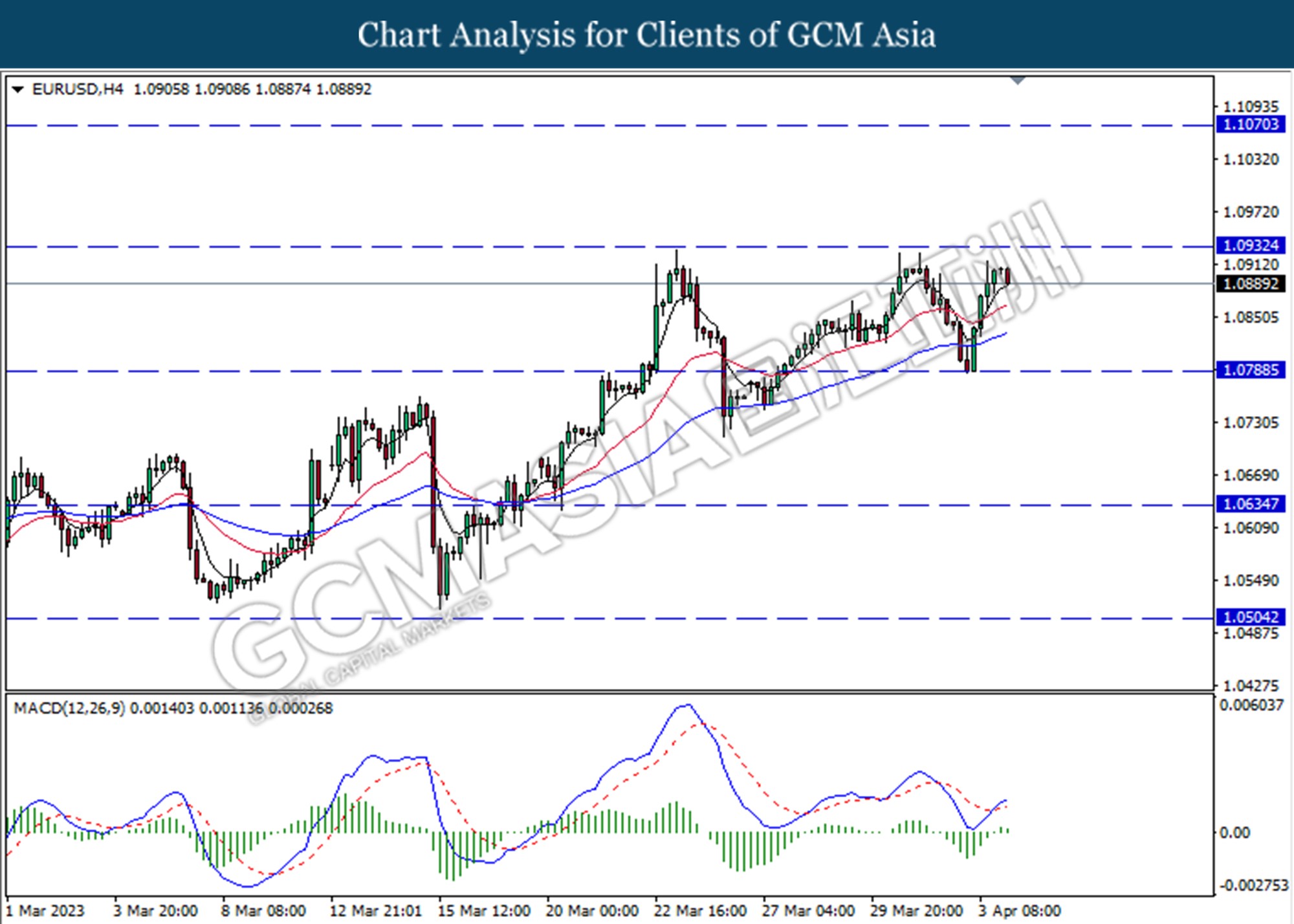

EURUSD, H4: EURUSD was traded lower following a prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 1.0930, 1.1070

Support level: 1.0790, 1.0635

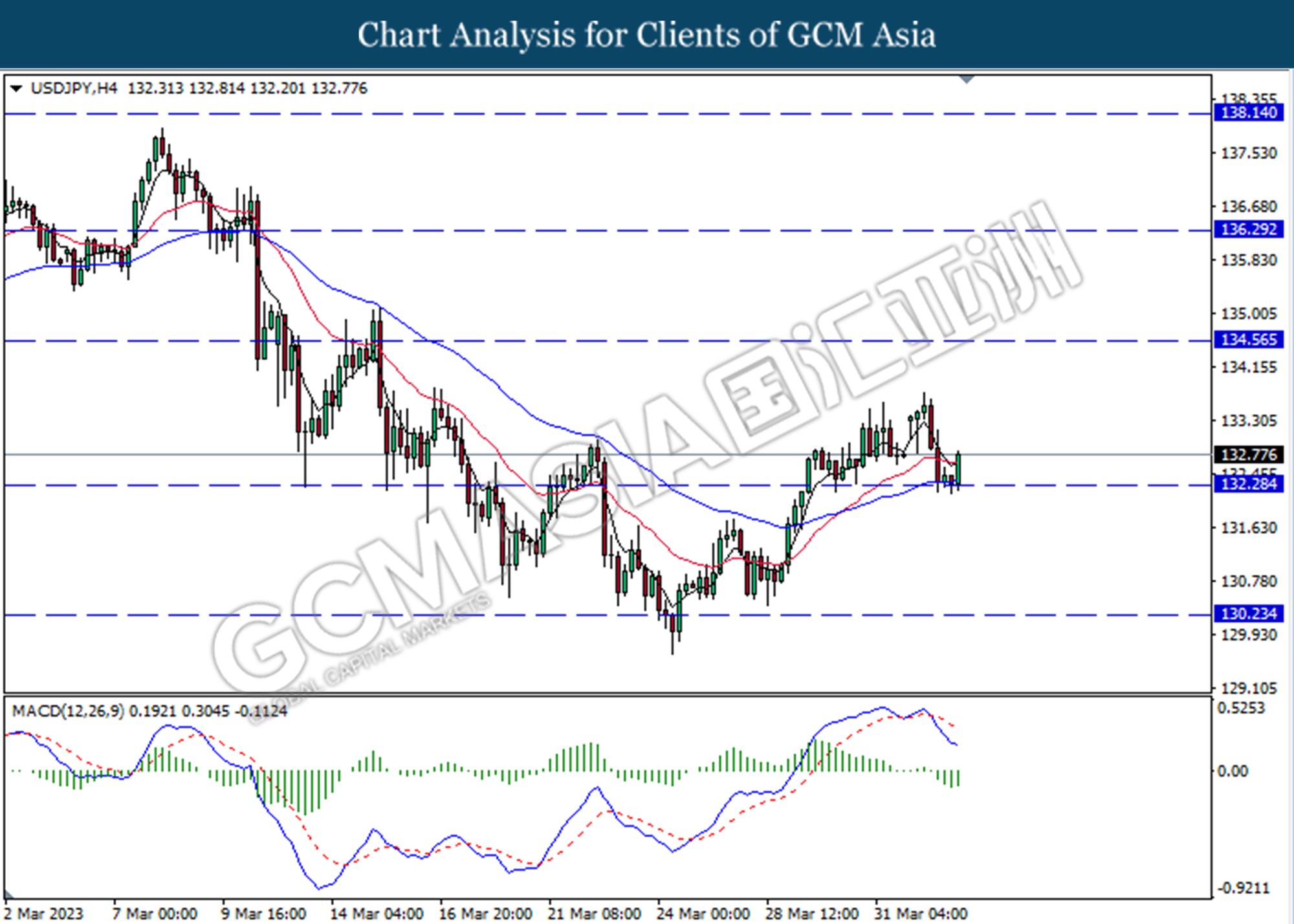

USDJPY, H4: USDJPY was traded higher following a prior rebounded from the support level at 133.30. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

AUDUSD, H4: AUDUSD was traded lower while currently testing for the support level at 0.6775. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses after it successfully breakout below the support level.

Resistance level: 0.6870, 0.6945

Support level: 0.6775, 0.6685

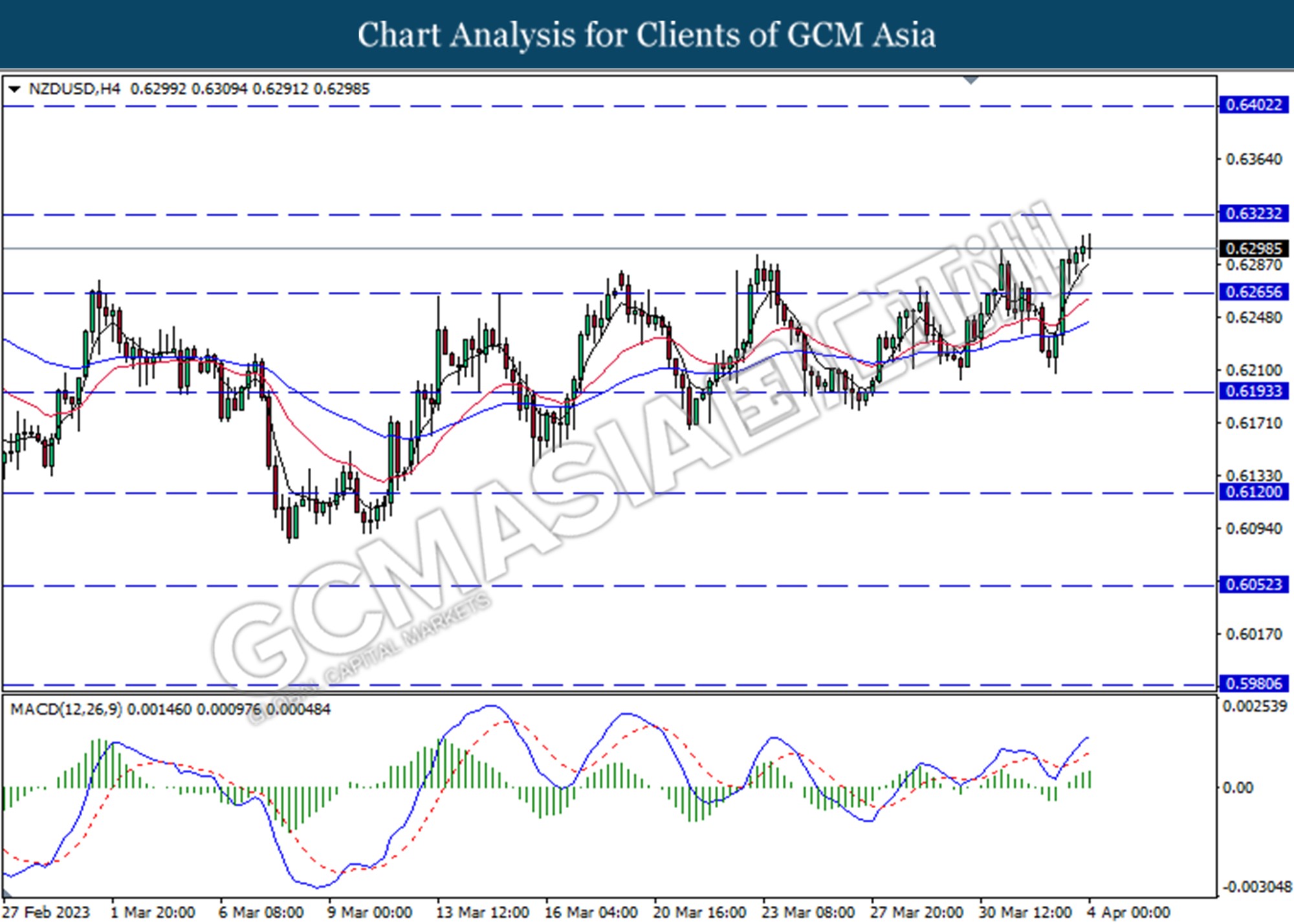

NZDUSD, H4: NZDUSD was traded higher following a prior break above the resistance level at 0.6265. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 0.6325

Resistance level: 0.6325, 0.6400

Support level: 0.6265, 0.6195

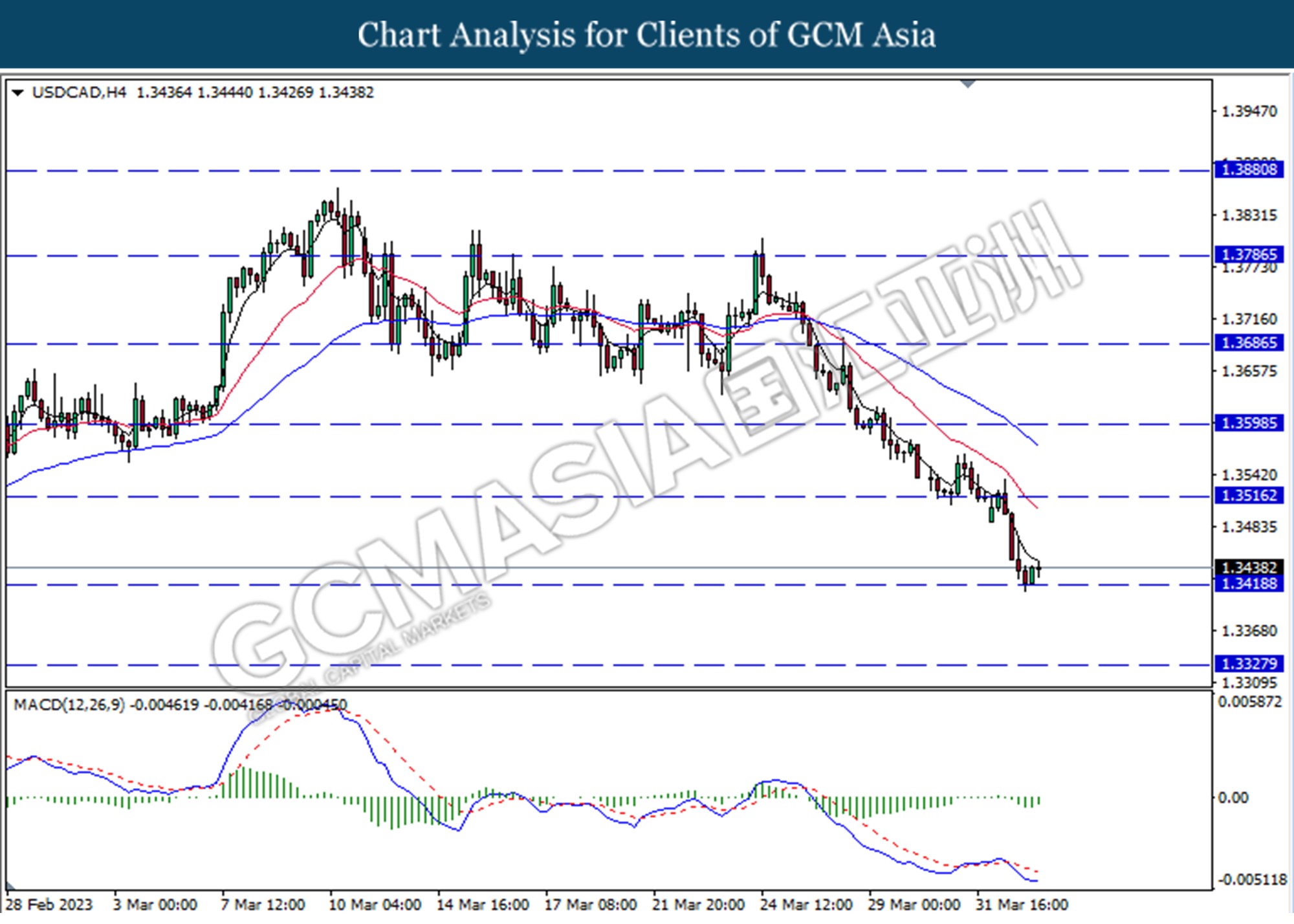

USDCAD, H4: USDCAD was traded higher following rebound from the support level at 1.3420. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 1.3520.

Resistance level: 1.3520, 1.3560

Support level: 1.3420, 1.3330

USDCHF, H4: USDCHF was traded higher following the prior rebound from the lower level. MACD which illustrated bullish momentum suggests the pair extended its gains toward the resistance level at 0.9180.

Resistance level: 0.9180, 0.9285

Support level: 0.9090, 0.9005

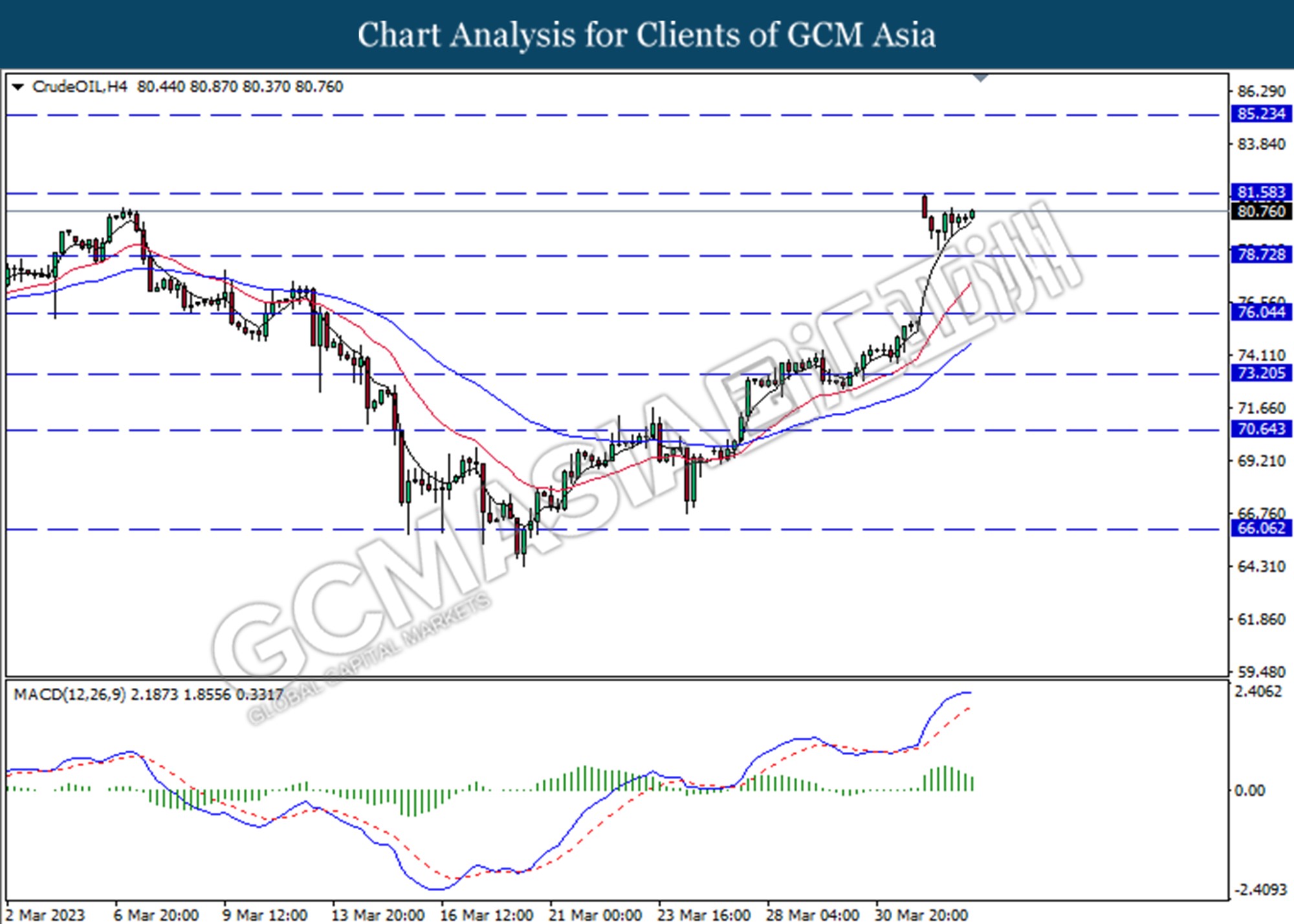

CrudeOIL, H4: Crude oil price was traded higher following rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 81.60, 85.25

Support level: 78.70, 76.05

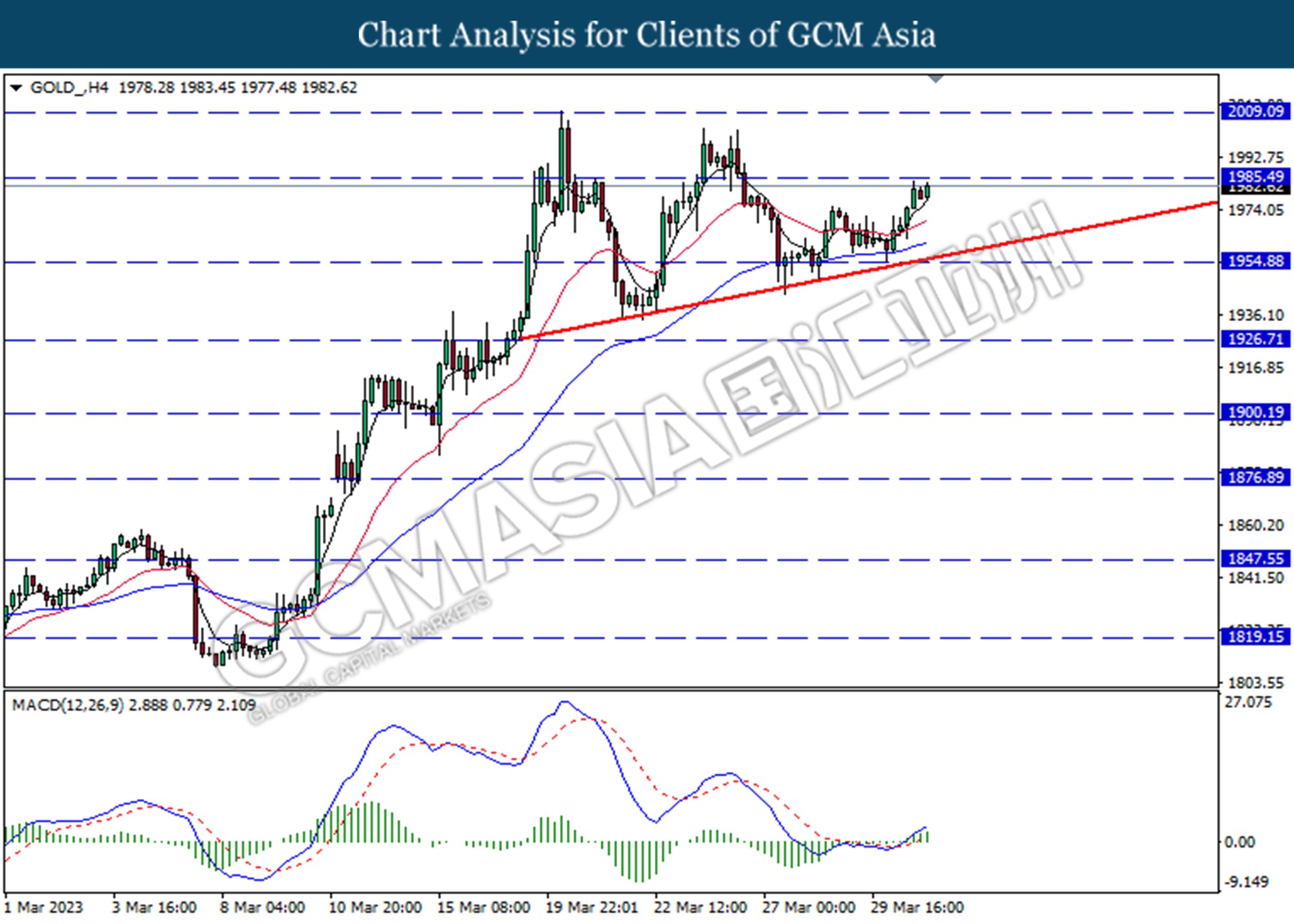

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1985.50. MACD which illustrated increasing bearish momentum suggests the commodity extended its gains after it successfully breakout above the resistance level.

Resistance level: 1985.50, 2009.10

Support level: 1954.90, 1926.70