04 April 2023 Morning Session Analysis

US Dollar sank into ‘red sea’ amid manufacturing activity weakened.

The dollar index, which is traded against a basket of six major currencies, was beaten down by huge selling pressures while re-testing the lowest level in two weeks following the release of the downbeat economic data. According to the Institute for Supply Management (ISM), the US Manufacturing PMI dropped further from 47.7 to 46.3 in March, missing the consensus forecast at 47.5, refreshing the record of contraction for the fifth consecutive month. It is noteworthy to highlight that an index level which below 50 indicates contraction in the sector, and the ISM’s index showed continuous contraction for five months in the US manufacturing sector. Heading forward, manufacturing activity is likely to sink deeper as the tighter credit conditions is expected to put pressure on investment spending. As such, it cast a shadow over the US economy and urged investors to sell off their dollar’s holdings as the further decline in the ISM figure could prompt the Federal Reserve to pause its rate hike plan earlier than expected. As of writing, the dollar index edged down by -0.45% to 102.05.

In the commodities market, crude oil prices were up by 0.02% to $80.30 per barrel as the OPEC+ surprise cut continued to hype the market sentiment. Besides, gold prices ticked up by 0.02% to $1983.90 per troy ounce as the downbeat ISM’s number exacerbated the market worries over the risk of recession.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

12:30 AUD RBA Rate Statement

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 12:30 | AUD – RBA Interest Rate Decision (Apr) | 3.60% | 3.60% | – |

| 22:00 | USD – JOLTs Job Openings (Feb) | 10.824M | 10.400M | – |

Technical Analysis

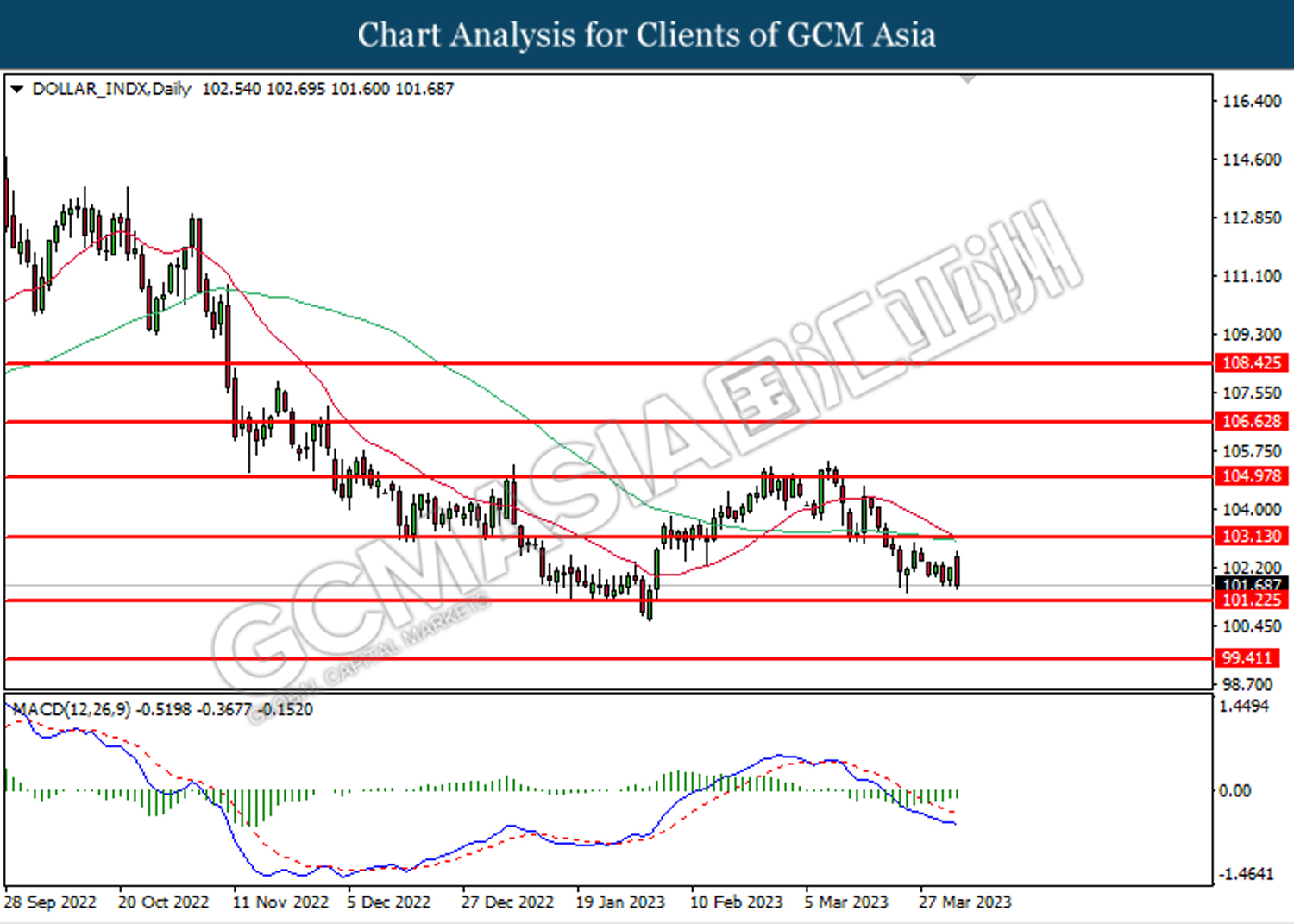

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the resistance level at 103.15. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 101.25.

Resistance level: 103.15, 105.00

Support level: 101.25, 99.40

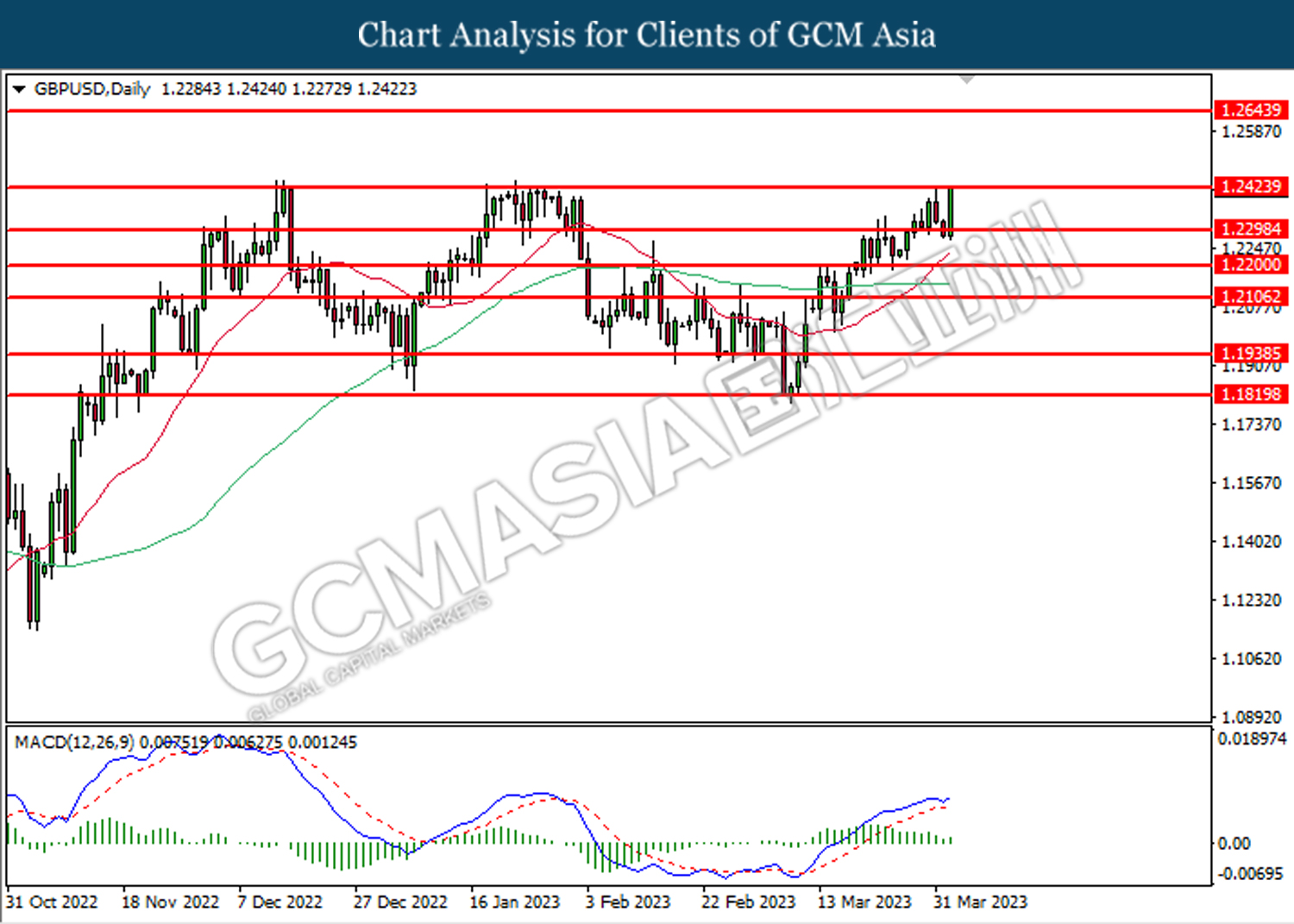

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2425. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2425, 1.2645

Support level: 1.2300, 1.2200

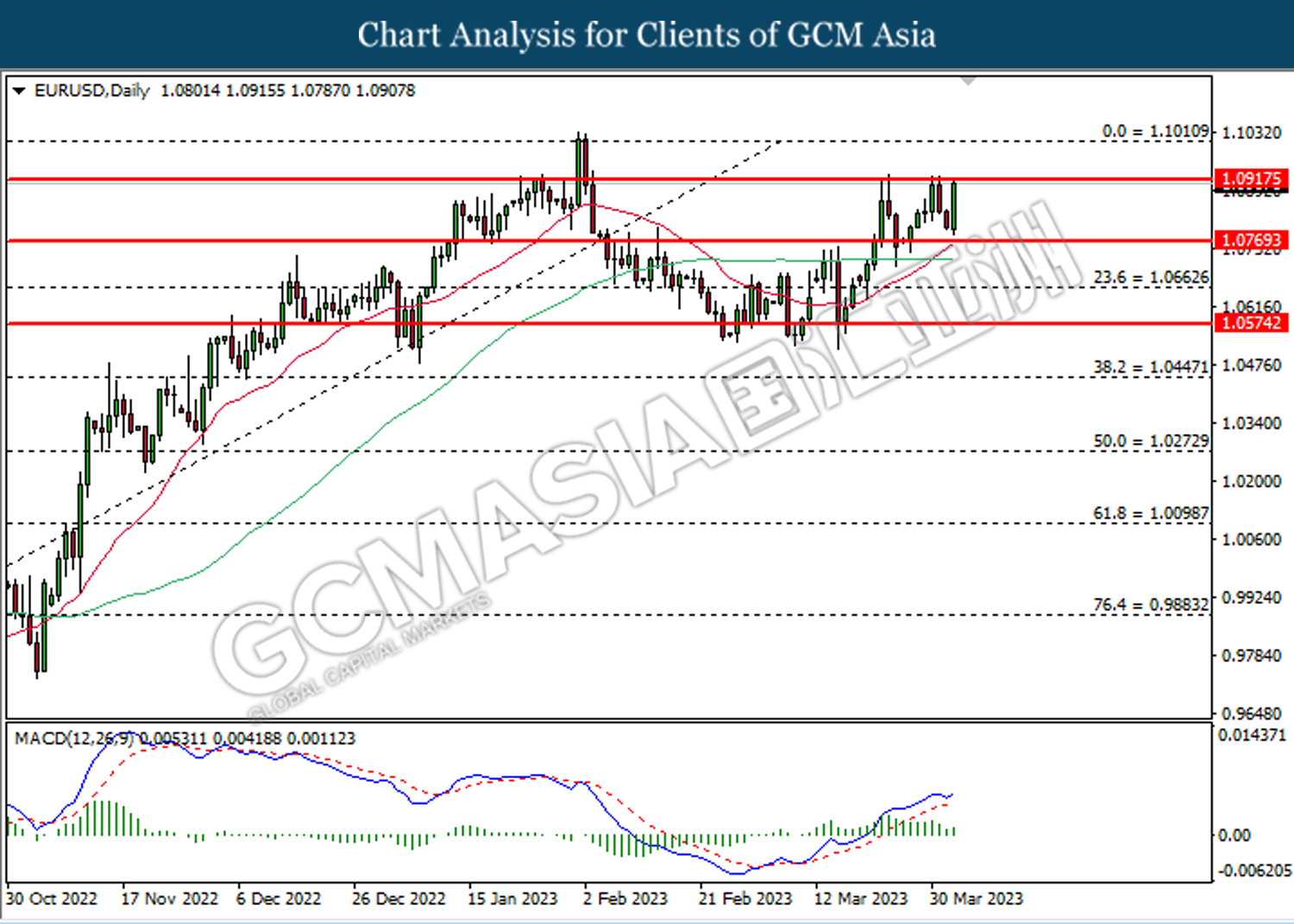

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0915 MACD which illustrated bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0915, 1.1010

Support level: 1.0770, 1.0665

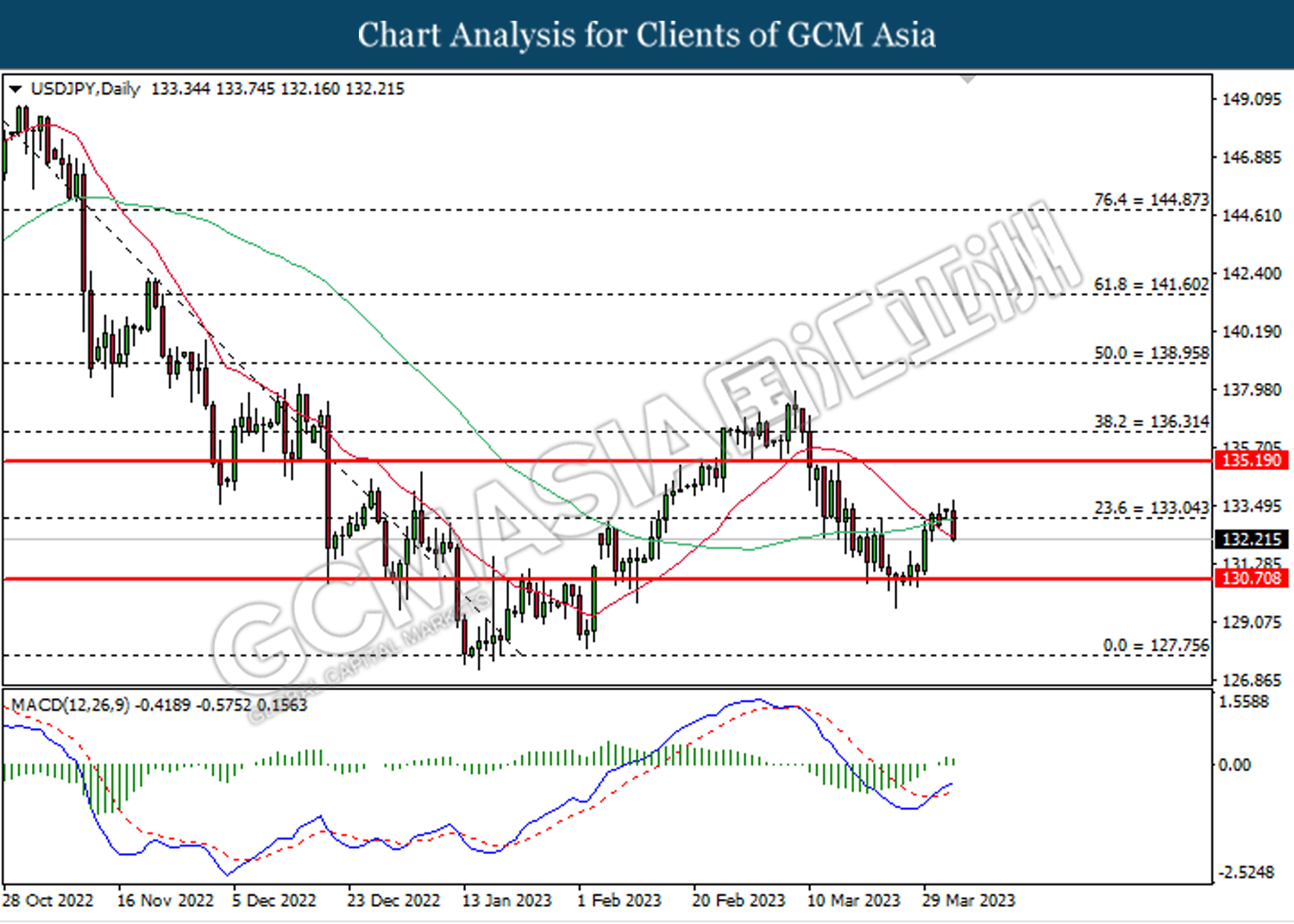

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 133.05. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

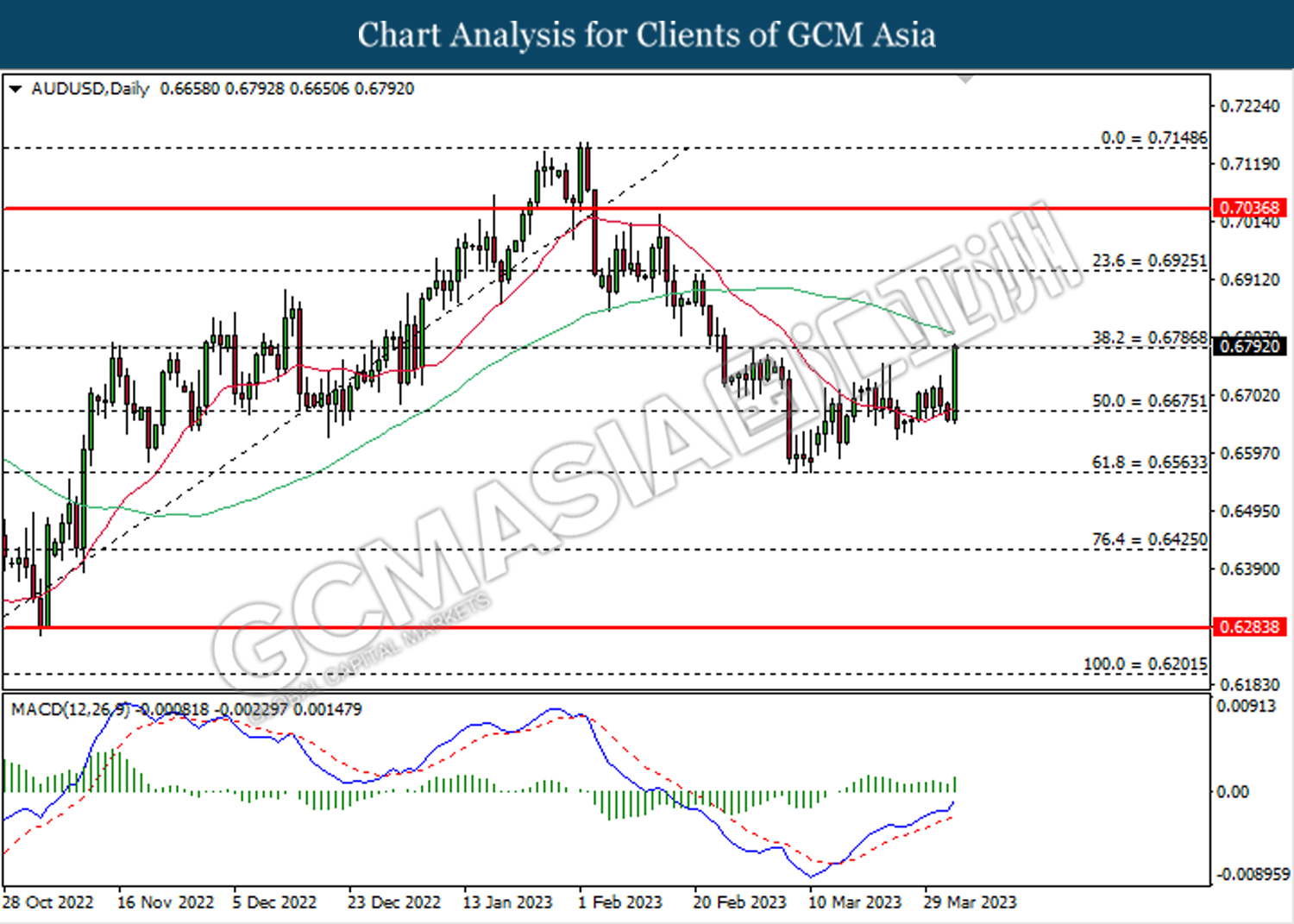

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6785. MACD which illustrated bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

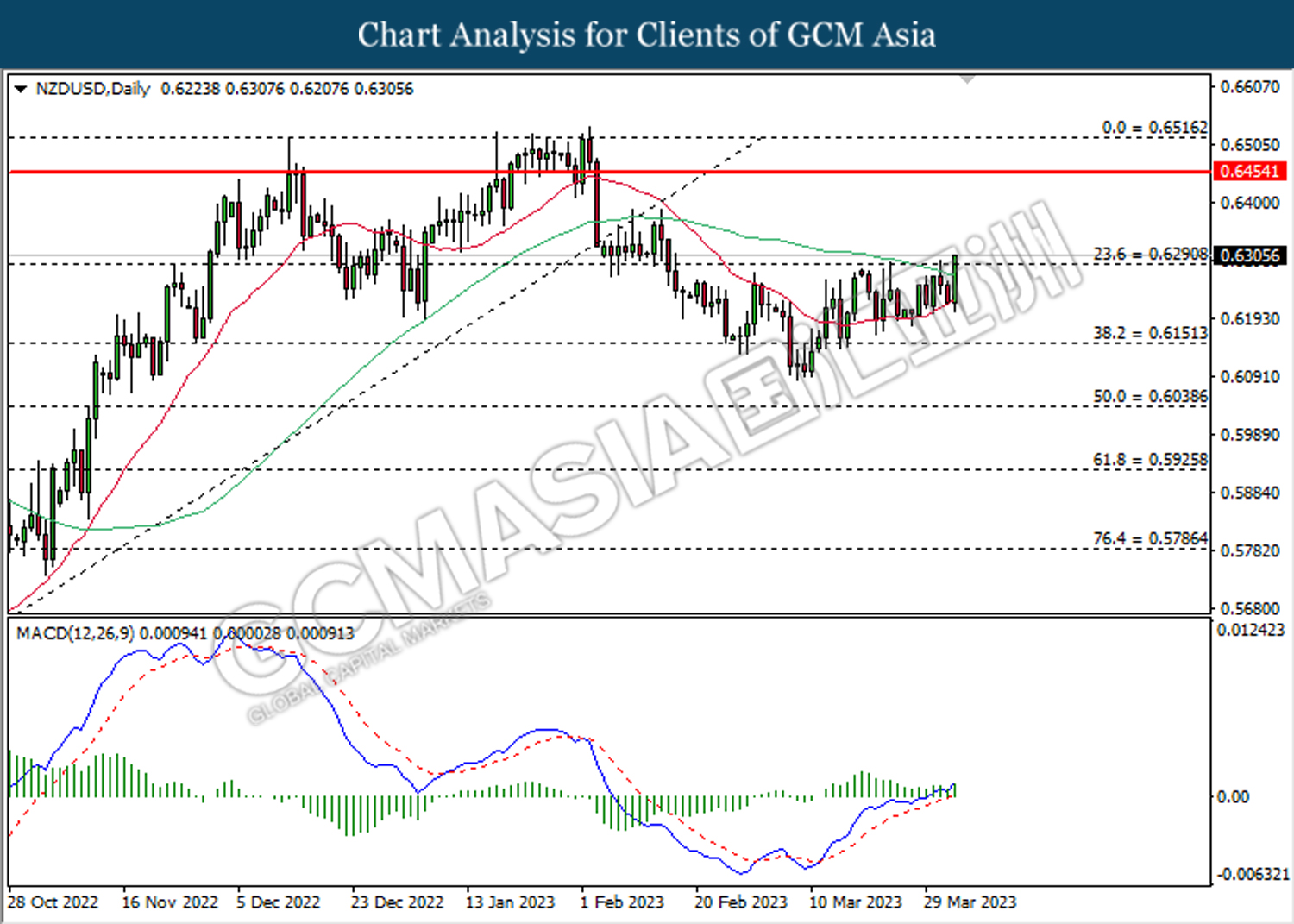

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6290. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

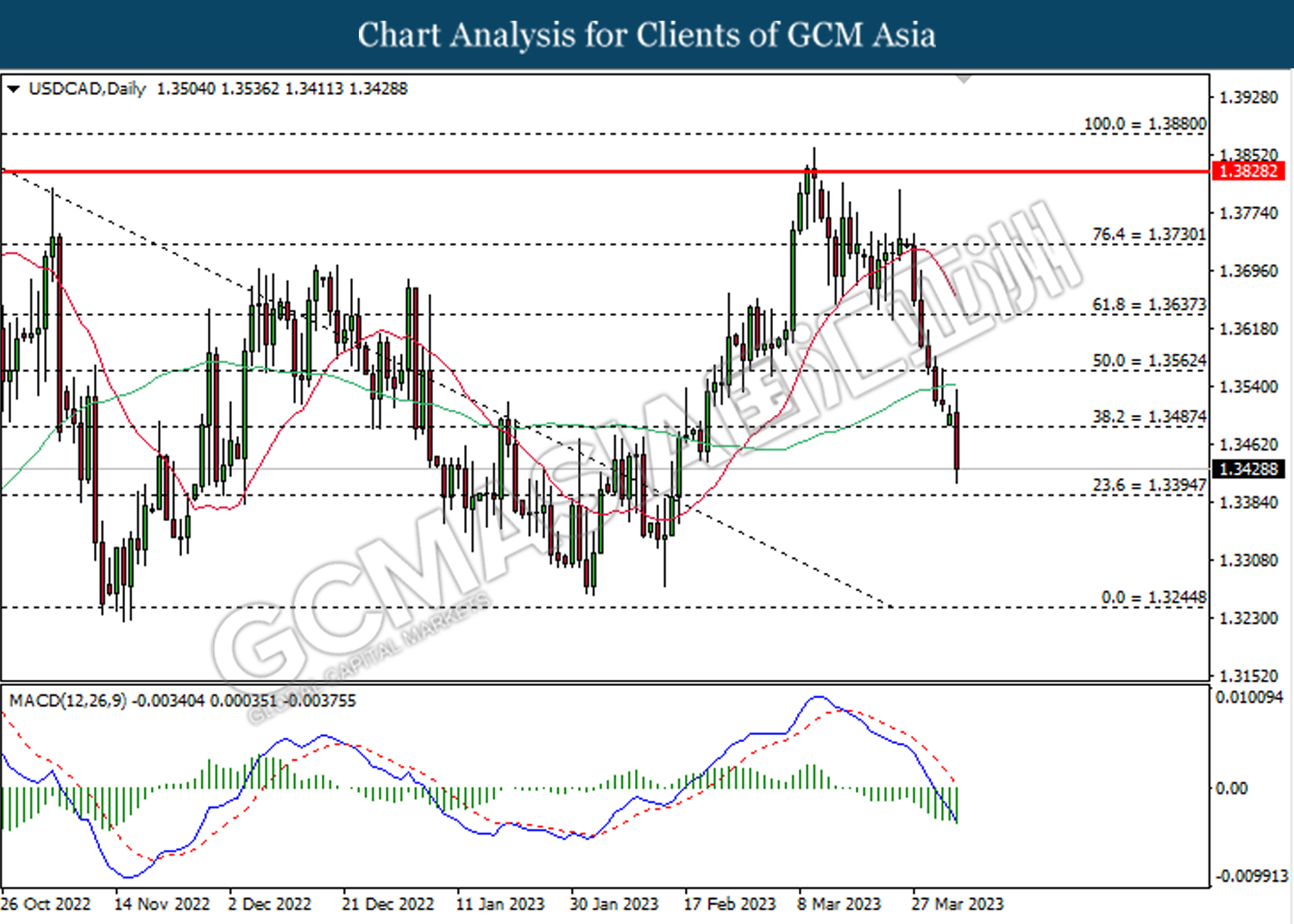

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3485. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3560, 1.3635

Support level: 1.3485, 1.3395

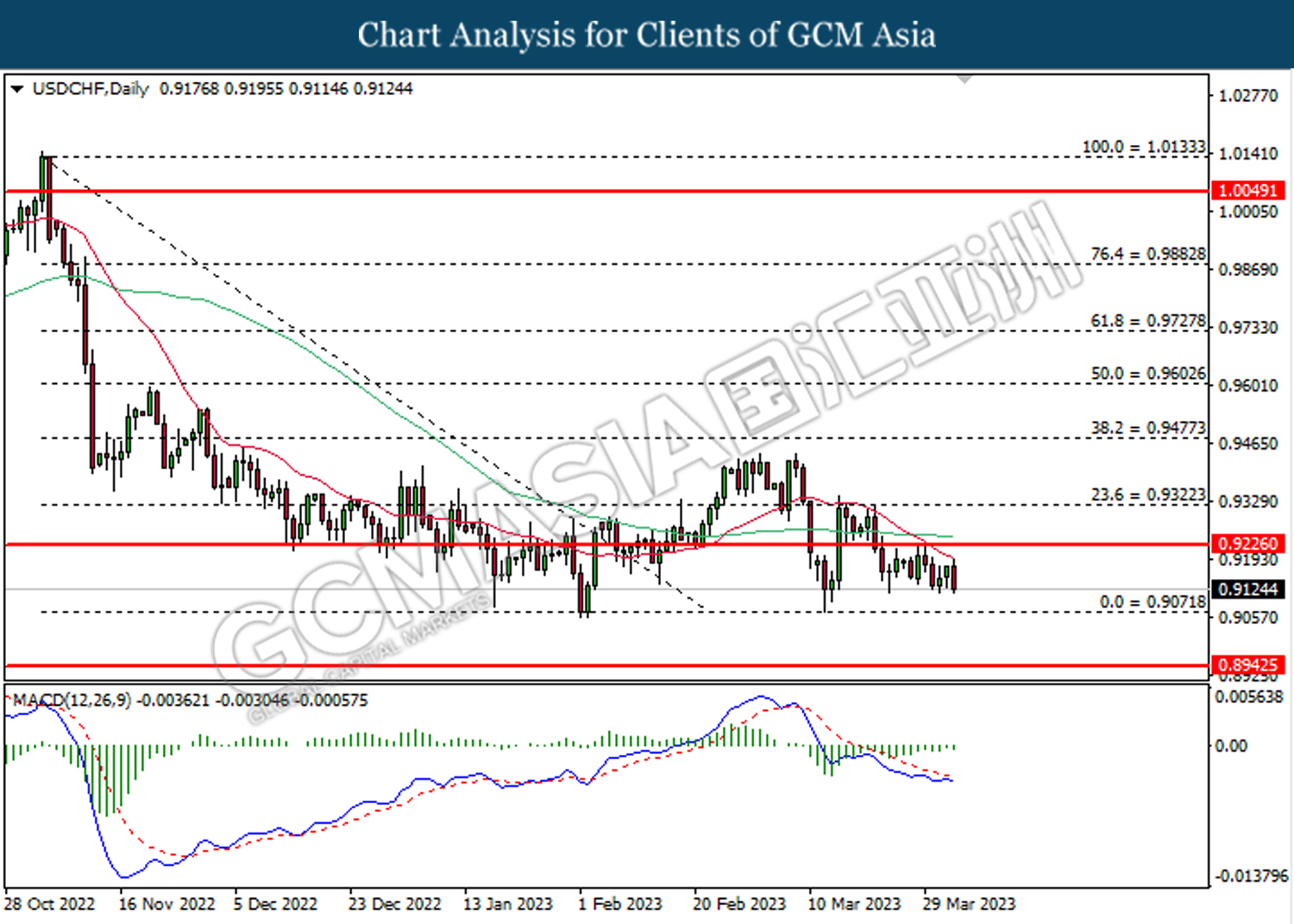

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the resistance level at 0.9225. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.9070.

Resistance level: 0.9225, 0.9325

Support level: 0.9070, 0.8945

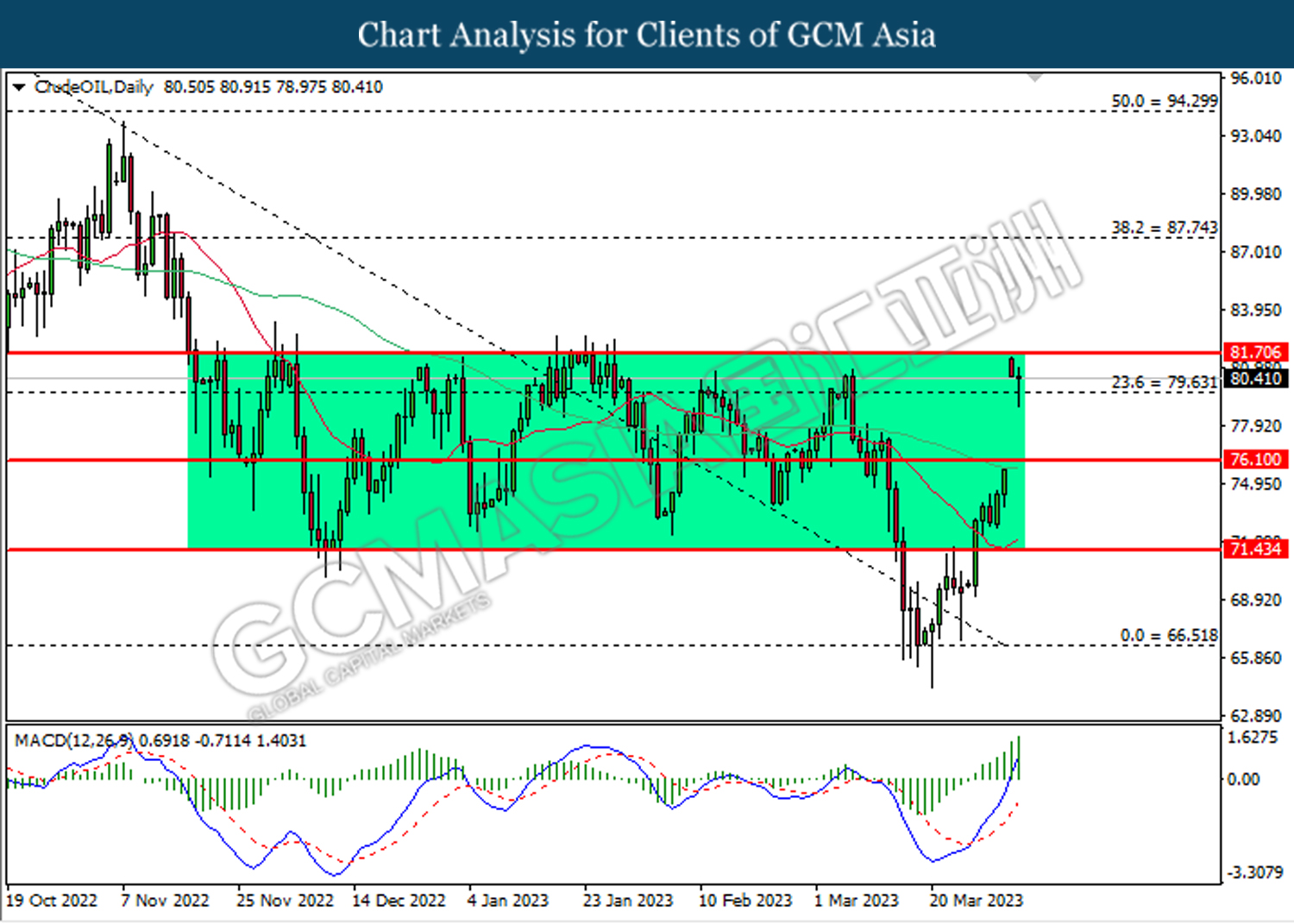

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 79.65. However, MACD which illustrated bullish bias momentum suggest the commodity to undergo technical correction in short term.

Resistance level: 81.70, 87.75

Support level: 79.65, 76.10

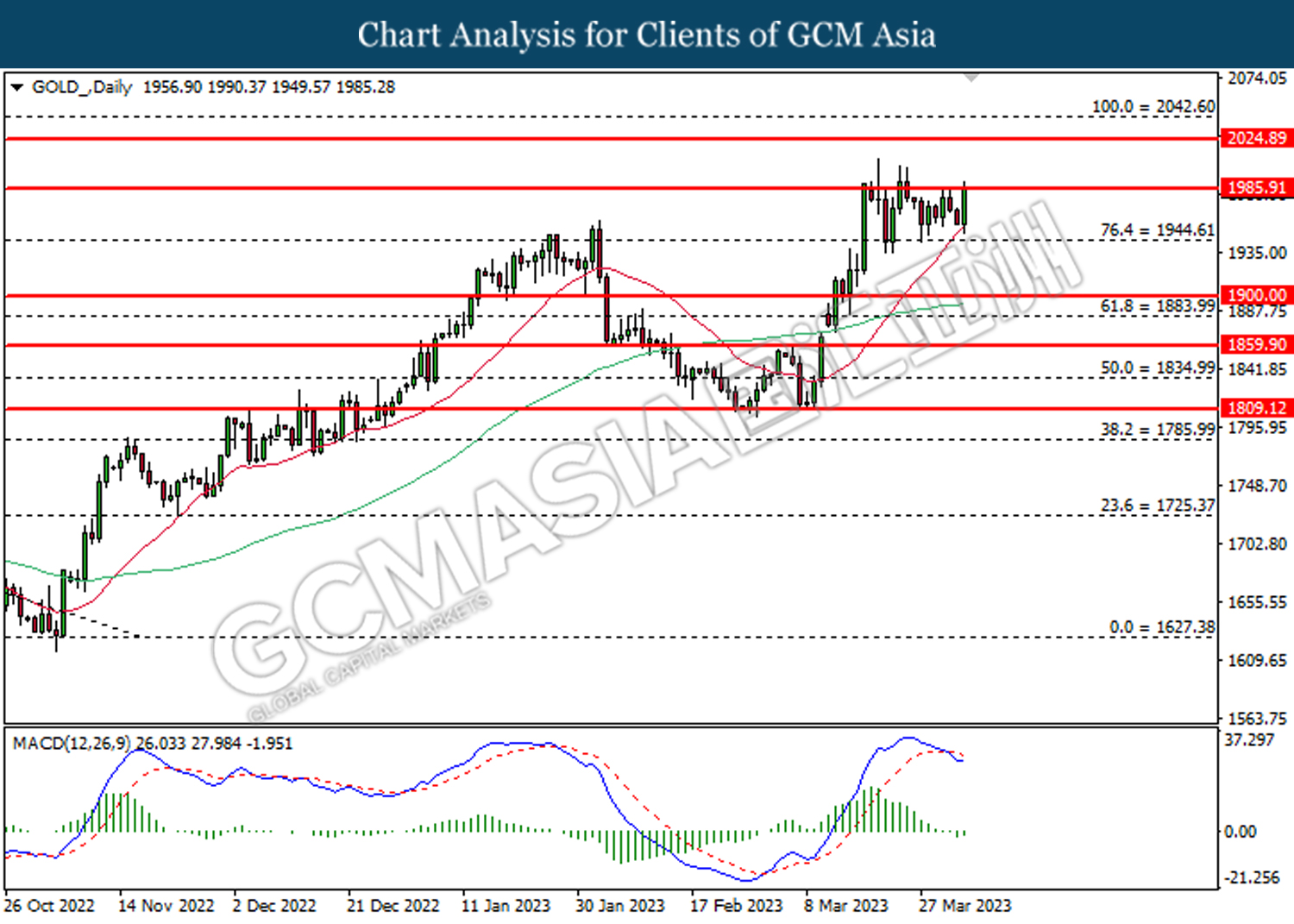

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1985.90. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1985.90, 2024.90

Support level: 1944.60, 1900.00