4 May 2023 Afternoon Session Analysis

Euro edged up ahead of ECB’s interest rate decision.

The euro dollar, one of the most traded currencies by global investors, edged up ahead of European Central Bank (ECB) interest rate decision. The ECB had lifted the interest by a 350 basic point since July to fight against stubborn inflations. Recent data on Tuesday also showed eurozone Consumer Price Index (CPI) held at a high of 7.0%, in line with market expectations, but slightly higher than previously. However, the core CPI without the energy and food readings slightly reduced to 5.6% from 5.7%. The current CPI reading is still far from ECB’s 2% targets, and investors expect ECB will be more further tightening its next monetary policy. Besides, a survey of the first quarter Bank Lending Survey (BLS) by the ECB, unveils the ECB’s intention to further tightening on bank leading standards. The main driver of the tightening is increased risk perception and, to a lesser extent, lower risk tolerance for banks. Since the ECB had a tightening impact on credit standards for loans in Euro areas. The money liquidity supply will decrease and further cool the high inflation in the eurozone. Meanwhile, investors’ eyes on the upcoming monetary policy by ECB’s monetary policy decision. Markets are pricing in a 25-basis point rate hike after three consecutive 50 basis point hikes. As of writing, the pair of EUR/USD edged up by 0.24% to $1.1086.

In the commodities market, crude oil prices were traded up by 0.67% to $69.05 per barrel after investors were concerned about supply disruption in Russia and Iran. Besides, gold prices were down by -0.06% to $2037.53 per troy ounce amid Fed signals for a potential pause on hiking interest rates.

Today’s Holiday Market Close

Time Market Event

All Day JPY Greenery Day

Today’s Highlight Events

Time Market Event

20:15 EUR ECB Monetary Policy Statement

20:45 EUR ECB Press Conference

22:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Composite PMI (Apr) | 52.2 | 53.9 | – |

| 16:30 | GBP – Services PMI (Apr) | 52.9 | 54.9 | – |

| 20:15 | EUR – Deposit Facility Rate (May) | 3.00% | 3.25% | – |

| 20:15 | EUR – ECB Marginal Lending Facility | 3.75% | – | – |

| 20:15 | EUR – ECB Interest Rate Decision (May) | 3.50% | 3.75% | – |

| 20:30 | USD – Initial Jobless Claims | 230K | 240K | – |

| 22:00 | CAD – Ivey PMI (Apr) | 58.2 | 59.0 | – |

Technical Analysis

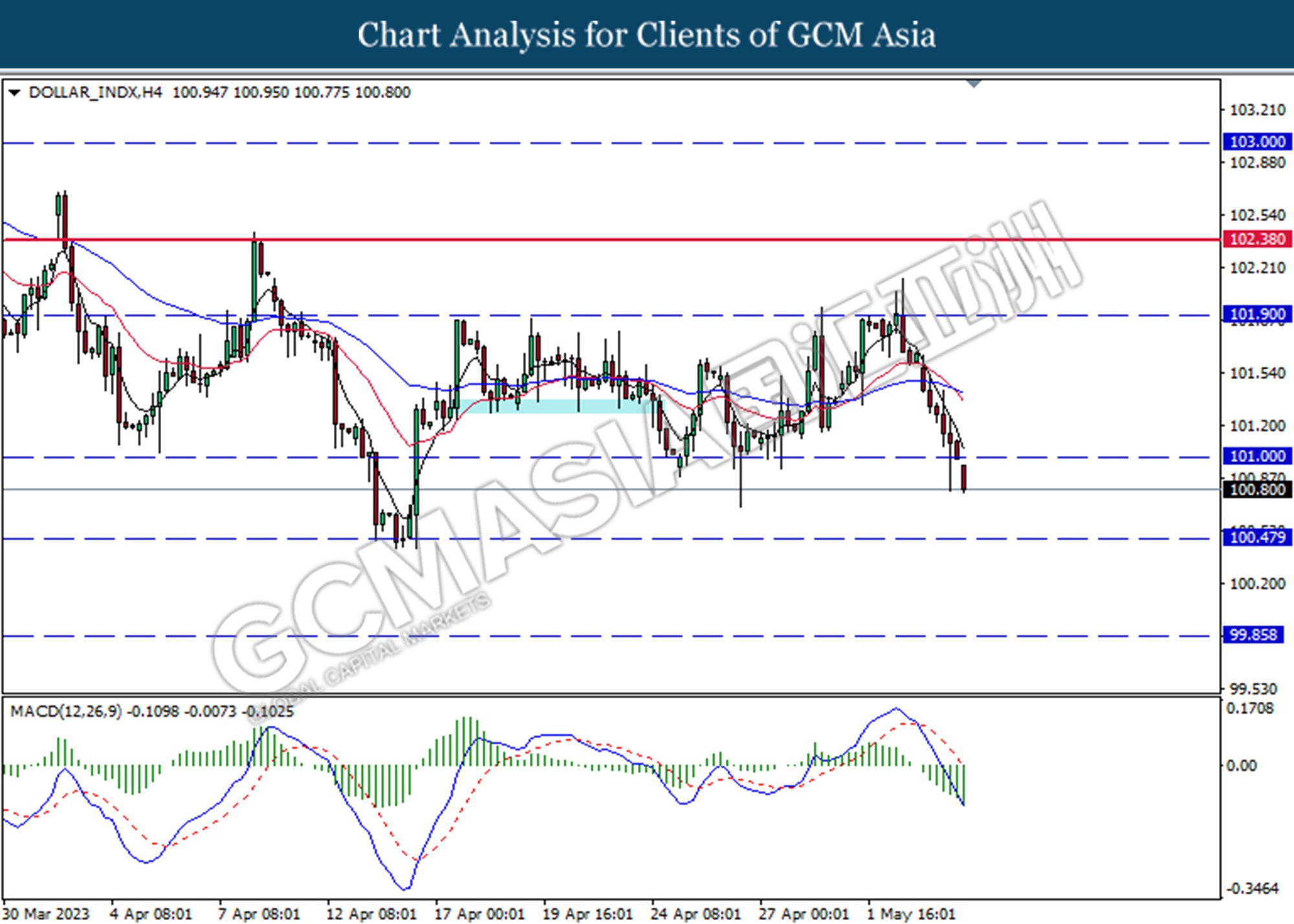

DOLLAR_INDX, H4: Dollar index was traded lower following a prior break below the previous support level at 101.00. MACD which illustrated increasing bearish momentum suggests the index extended its losses toward the support level.

Resistance level: 101.00. 101.90

Support level: 100.50, 99.85

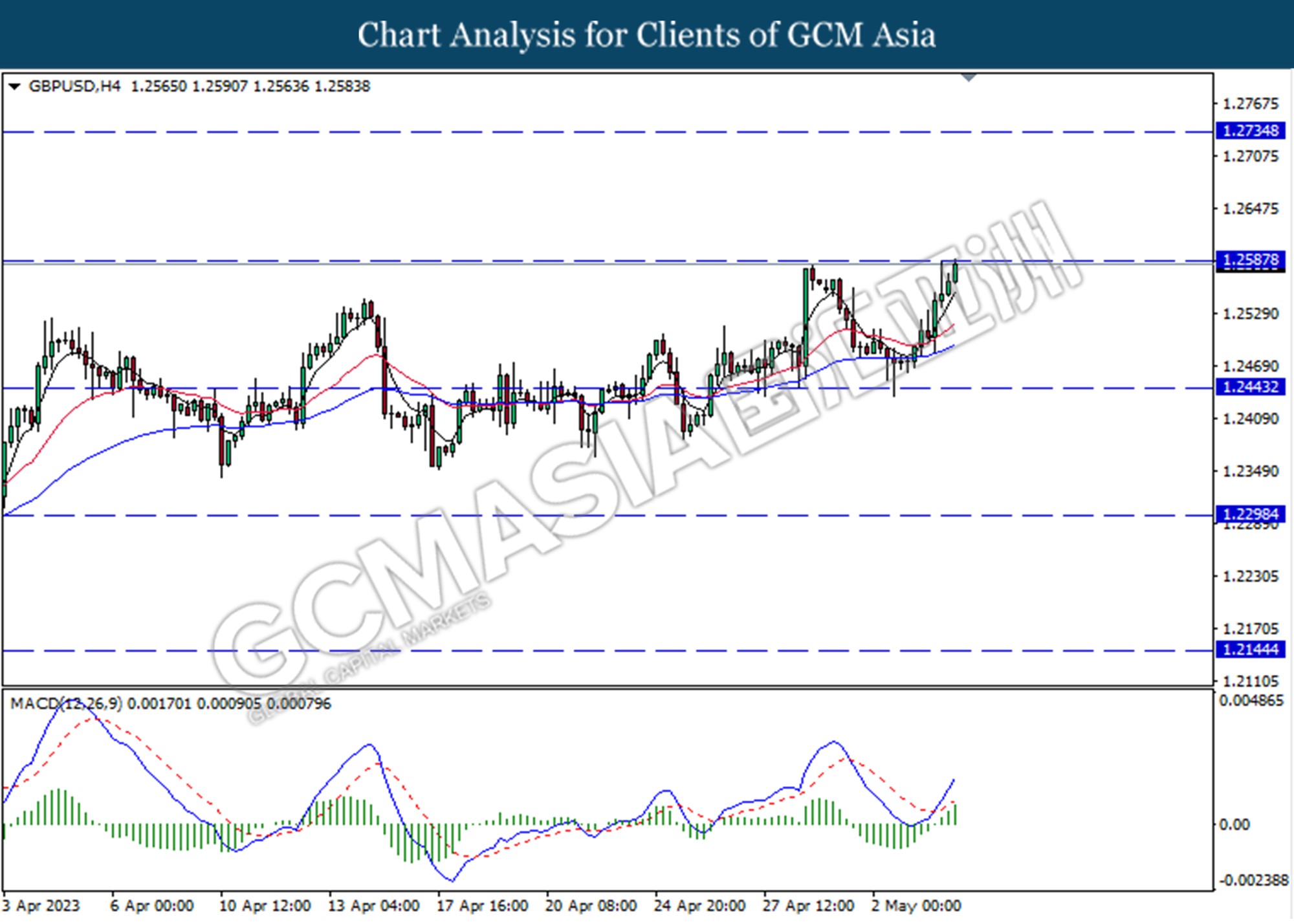

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.2590. MACD which illustrated increasing bullish momentum suggests the pair extended its gains after it successfully breakout above the resistance level.

Resistance level: 1.2590, 1.2735

Support level: 1.2445, 1.2300

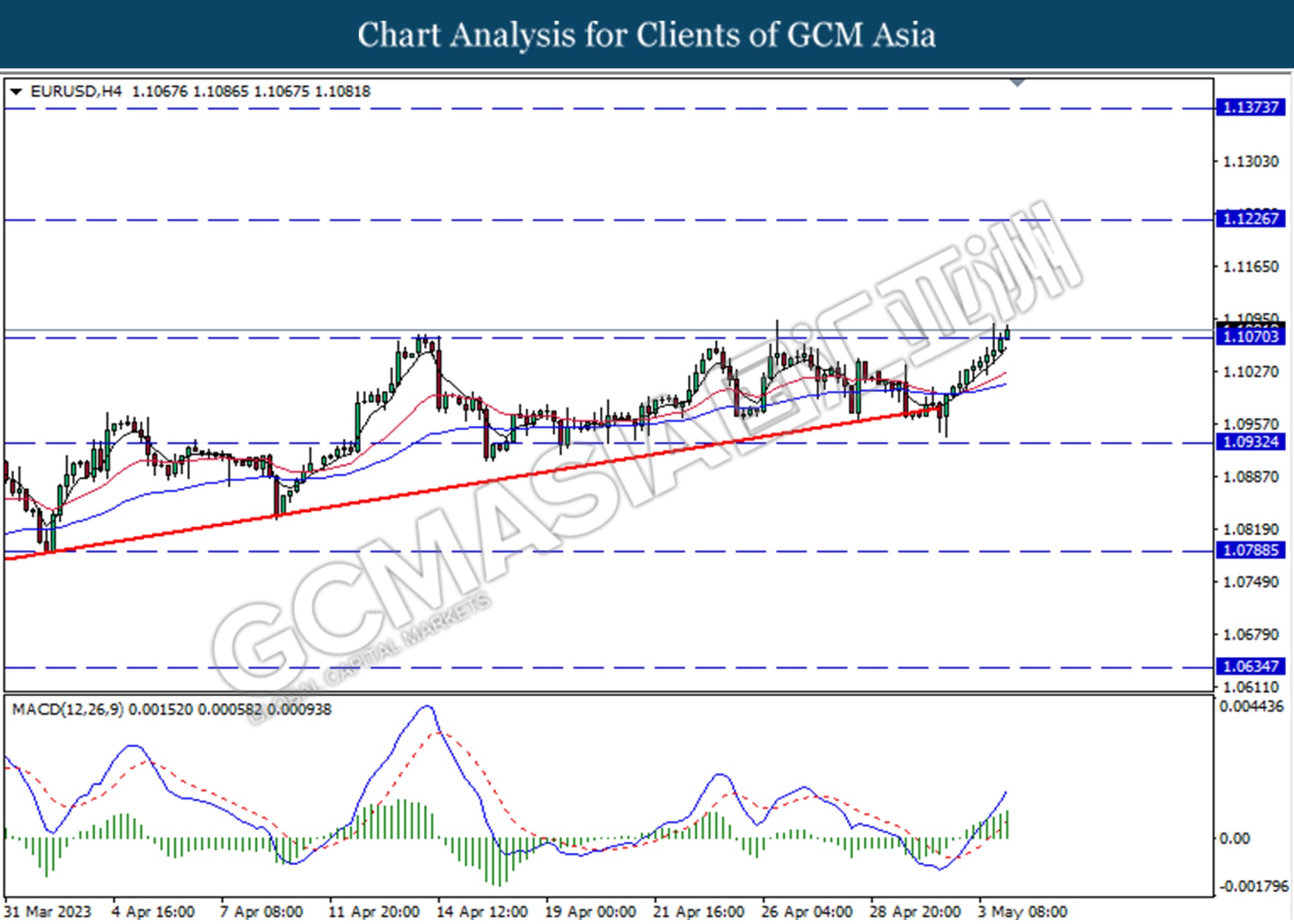

EURUSD, H4: EURUSD was traded higher following a prior break above the previous resistance level at 1.1070. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.1225, 1.1375

Support level: 1.1070, 1.0930

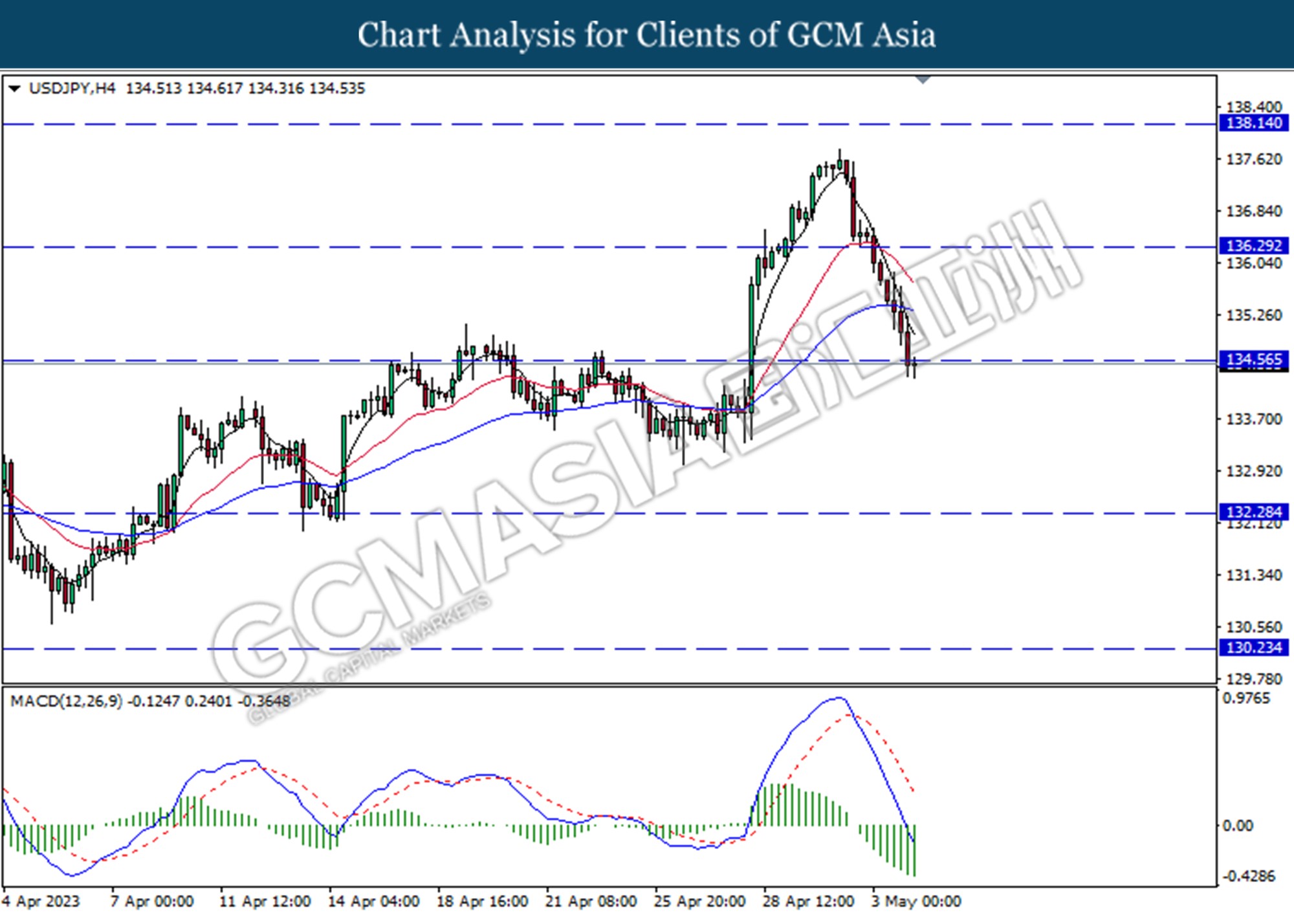

USDJPY, H4: USDJPY was traded lower following the prior break below the previous support level at 134.55. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

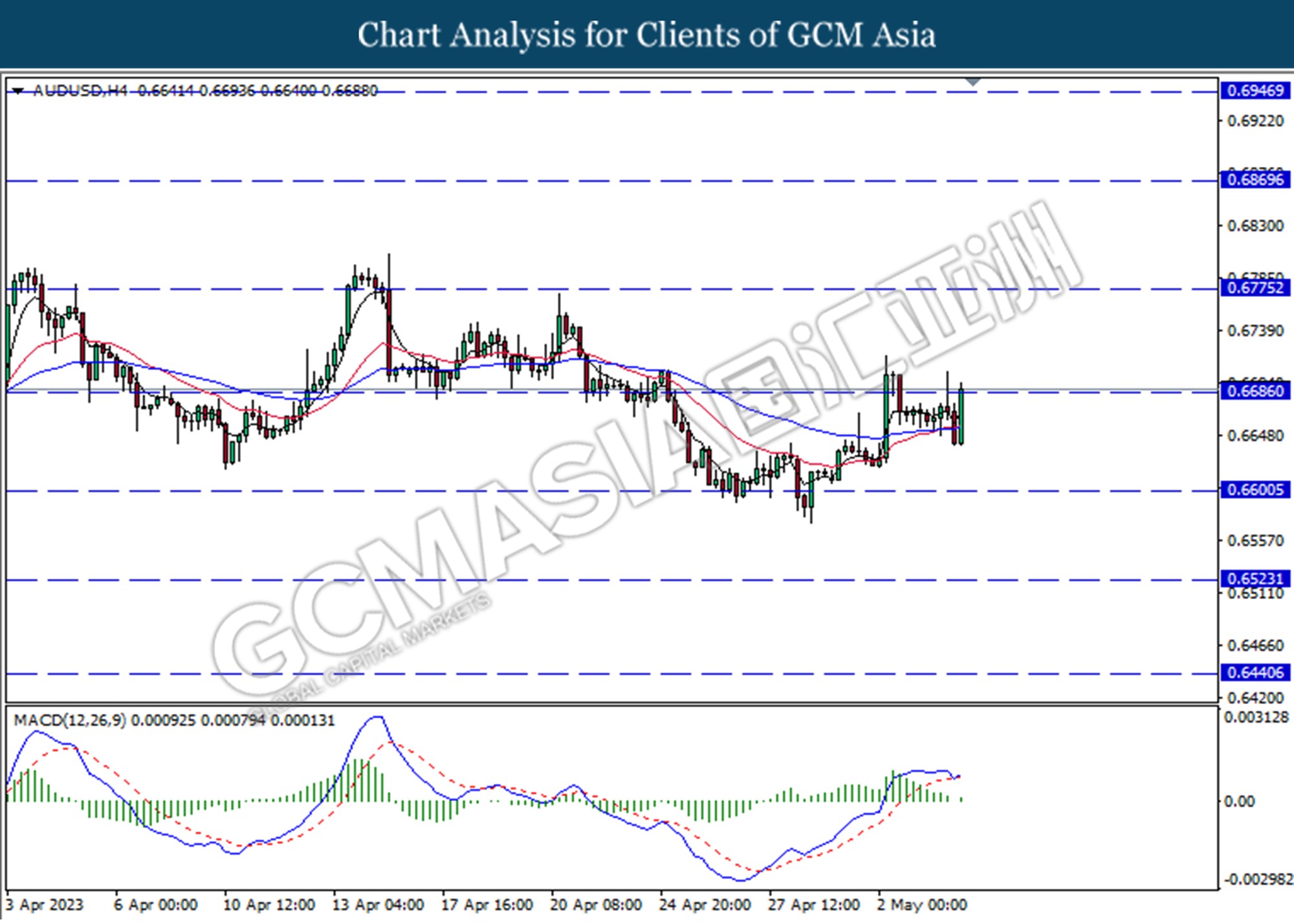

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level at 0.6685. MACD which illustrated increasing bullish momentum suggests the pair extended its gains after it successfully breakout above the resistance level.

Resistance level: 0.6685, 0.6775

Support level: 0.6600, 0.6525

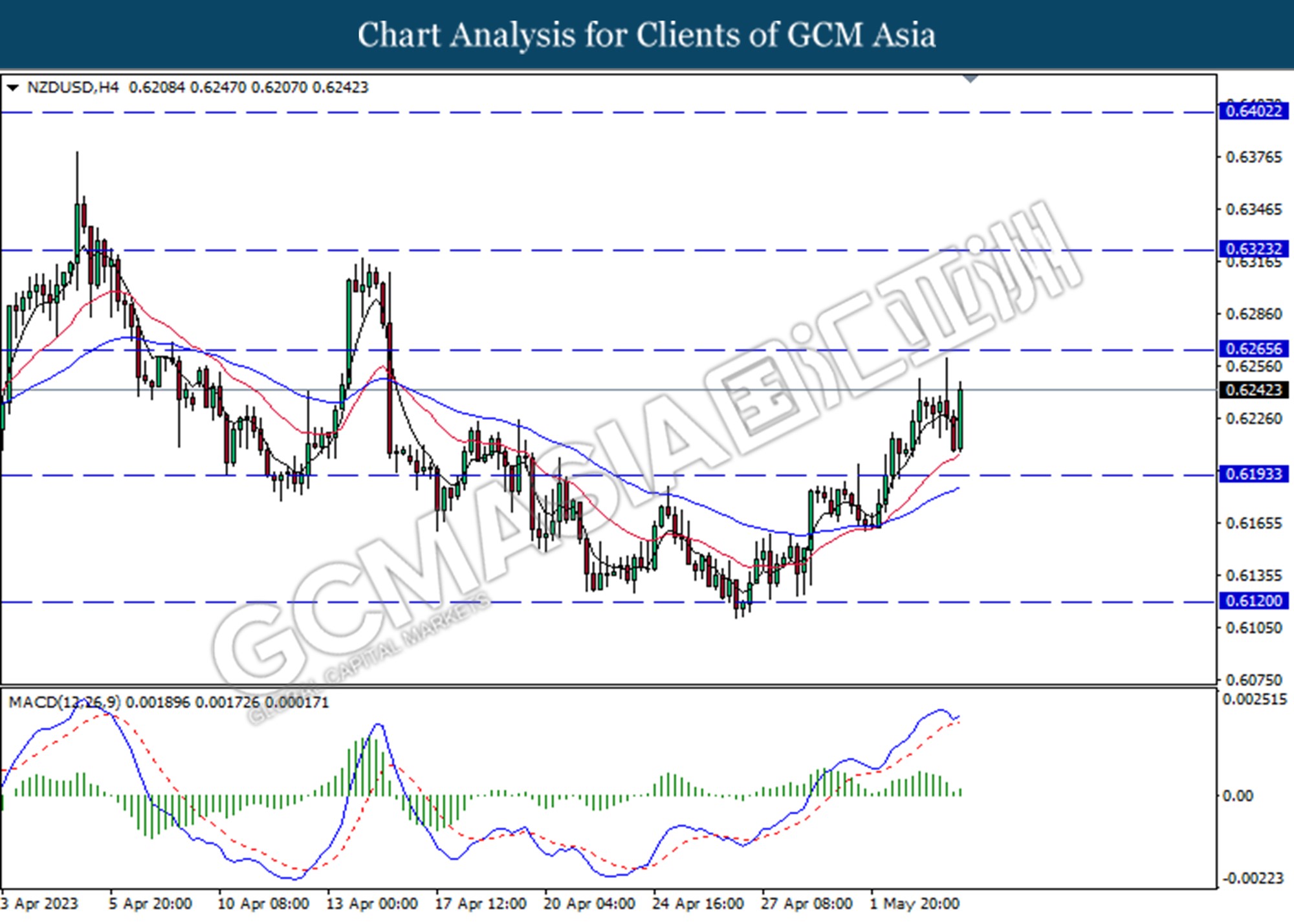

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 0.6265.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

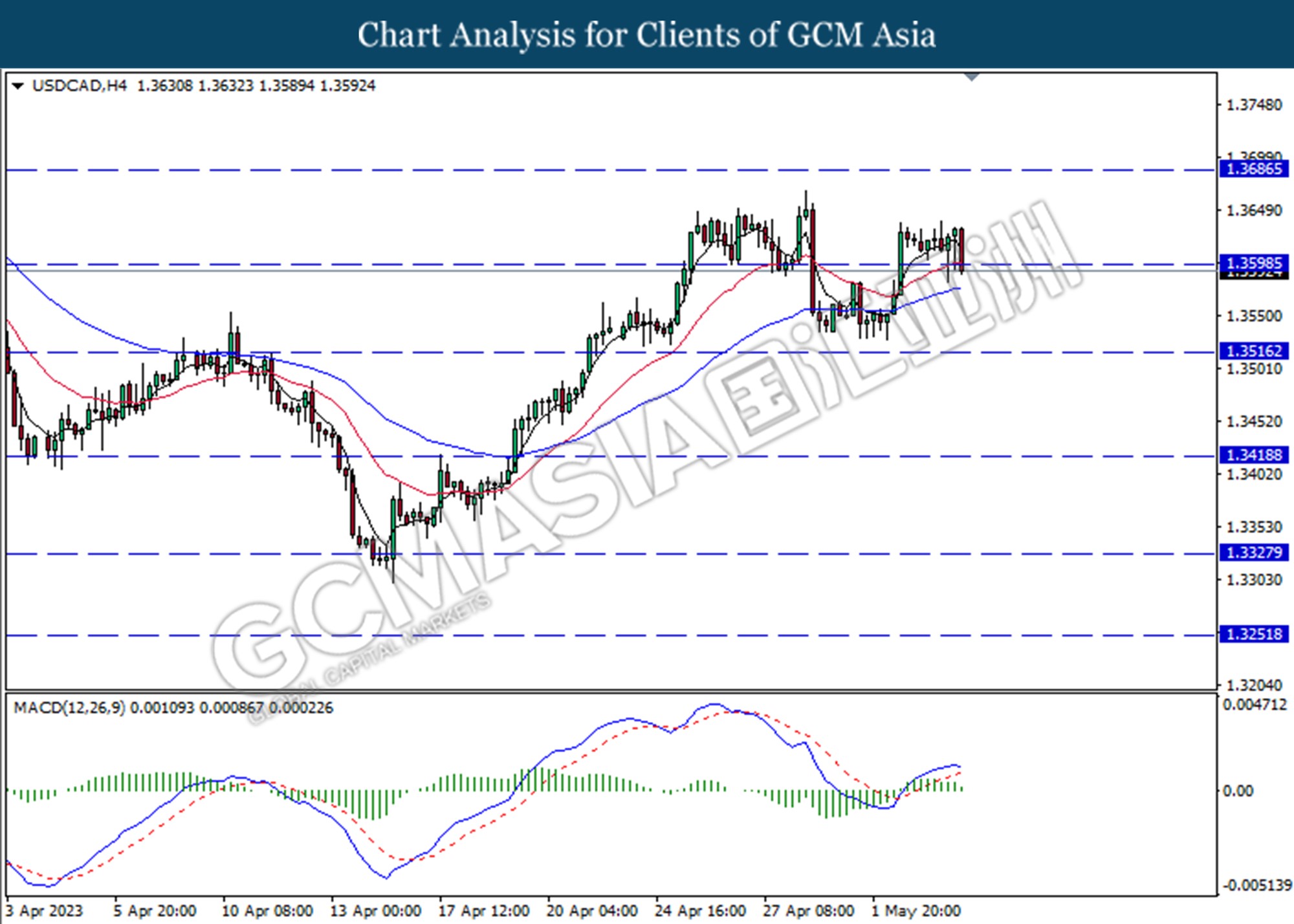

USDCAD, H4: USDCAD was traded lower following a prior break below the previous support level at 1.3600. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 1.3515.

Resistance level: 1.3600, 1.3685

Support level: 1.3515, 1.3420

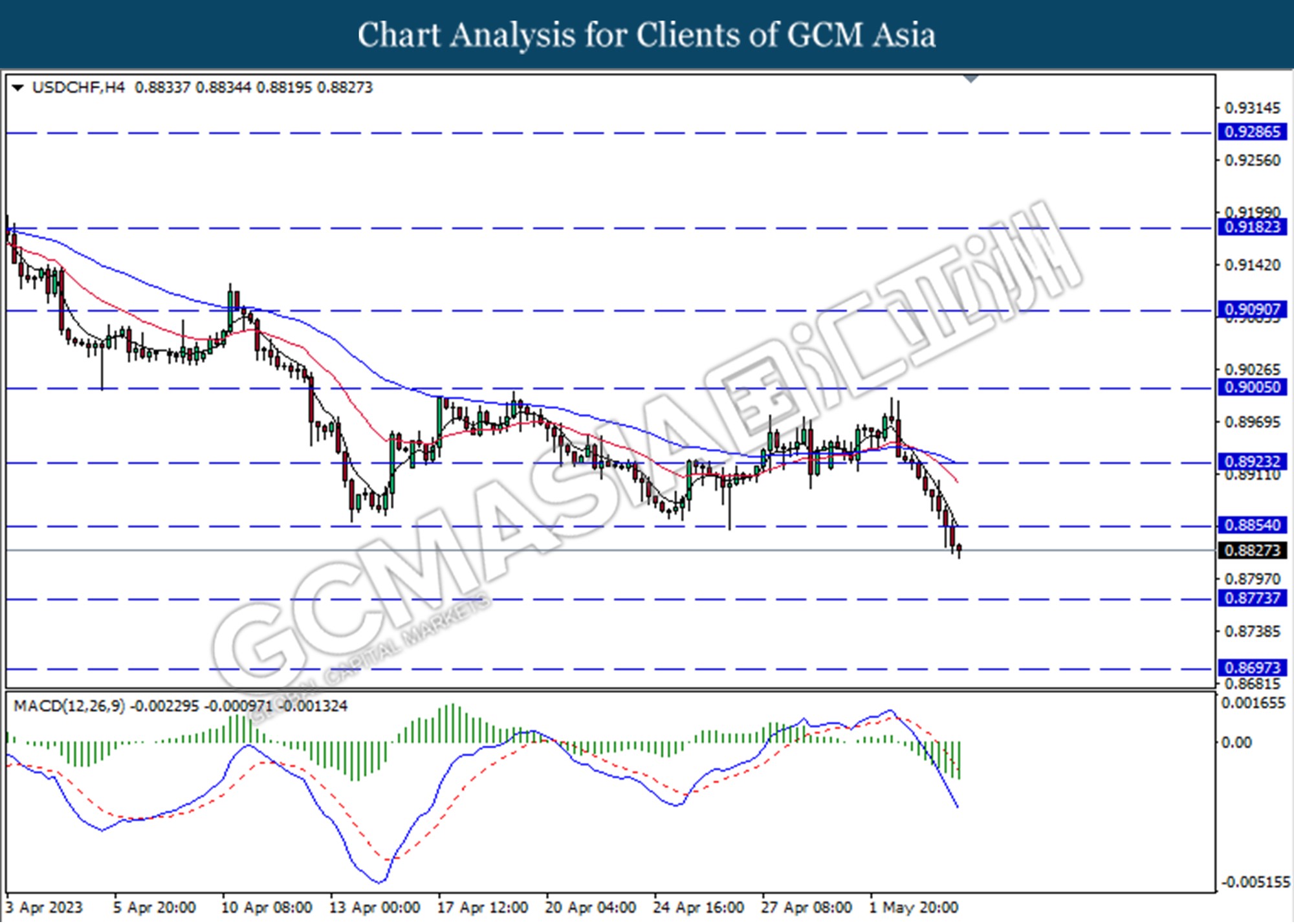

USDCHF, H4: USDCHF was traded lower following a prior break below the previous support level at 0.8855. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.8855, 0.8925

Support level: 0.8775, 0.8700

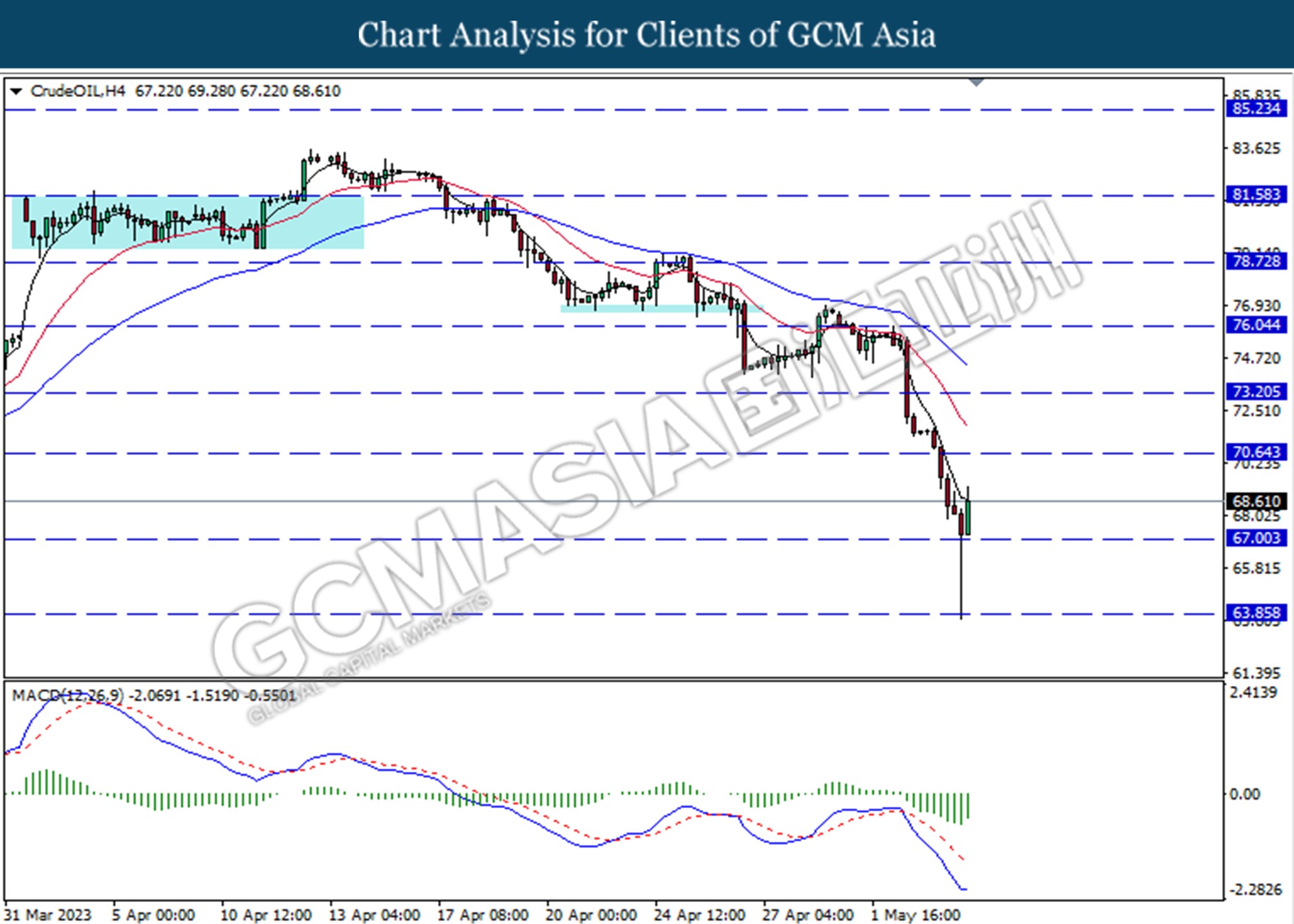

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the support level at 67.00. MACD which illustrated diminishing bearish momentum suggests the commodity extended its gains toward the resistance level at 70.65.

Resistance level: 70.65, 73.20

Support level: 67.00, 63.85

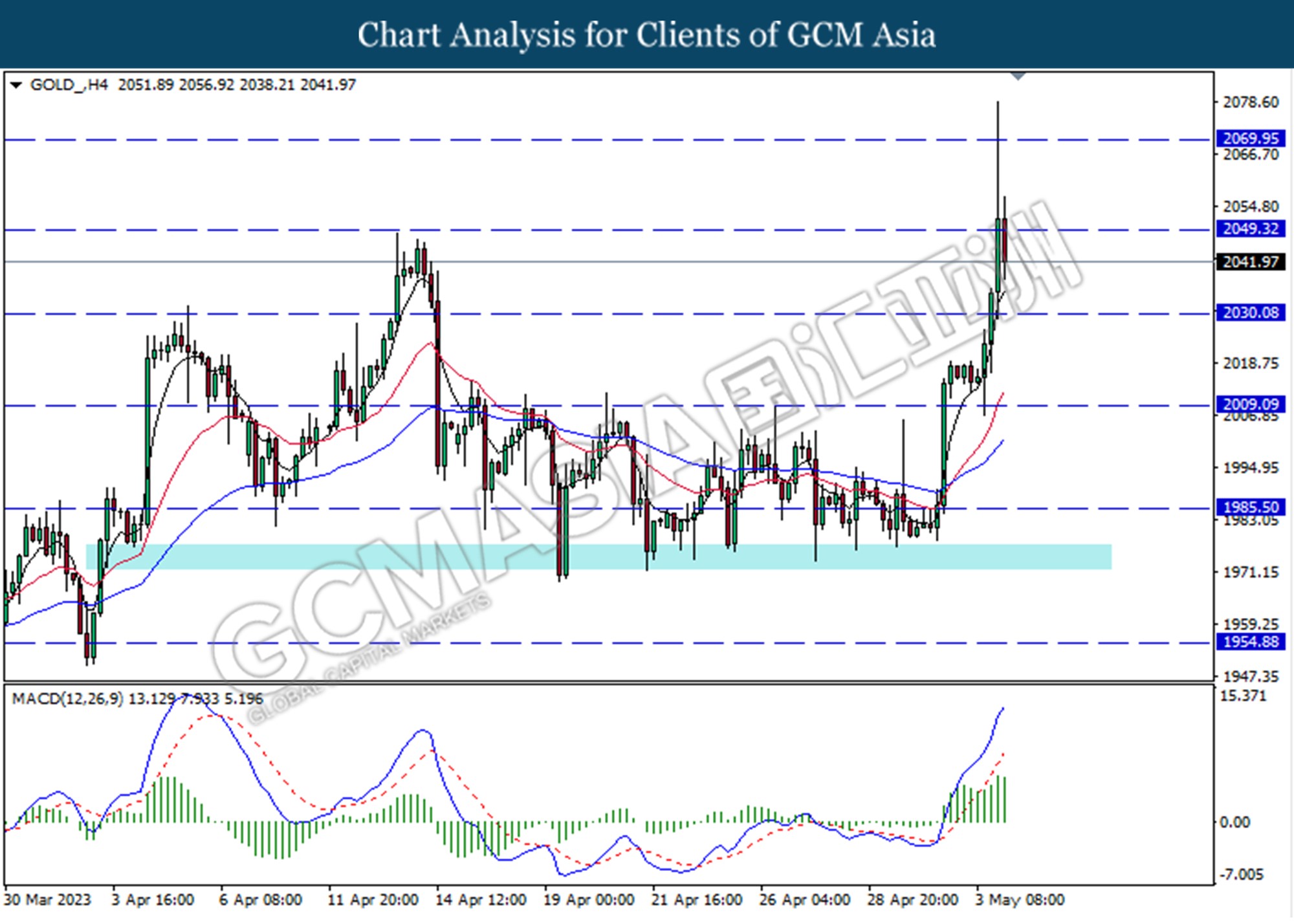

GOLD_, H4: Gold price was traded lower following the prior break below the previous resistance level at 2049.30. However, MACD which illustrated bullish momentum suggests the commodity undergoes a technical correction in the short term.

Resistance level: 2049.30, 2069.95

Support level: 2030.10, 2009.10