4 May 2023 Morning Session Analysis

Greenback wobbled following an expected rate hike by Fed.

The dollar index, which was traded against a basket of six major currencies, teetered near the brink of collapse despite the Federal Reserve decided to increase its cash rate by another 25 basis point in the early morning meeting. As widely expected, the FOMC raised its interest rate to 5.25%. However, with the backdrop of heightening risk of crisis and sign of growth slowing down, the attention of the market was more on the future path of the monetary policy. Fed Chairman Jerome Powell said at Wednesday’s press conference that no decision was made today to pause the interest rate, but they open door to rate hike pause. While comparing to the last meeting’s statement, the Fed skipped a line that had appeared in the previous statement that “the committee anticipates that some additional policy tightening may be appropriate” to achieve the Fed’s 2% inflation target. Such a tentative hint might indicate that the current tightening cycle is at an end, dragging down the appeal of US dollar. Besides, the losses of the currency extended after a report said the PacWest Bancorp was weighing strategic options, including a possible sale. It shows that the persistent Fed’s rate hike and the prior fallout in US banks are possibly brewing a crisis, where a lot of companies are actually struggling with a risk of financial problem. As of writing, the dollar index dropped -0.72% to 101.20.

In the commodities market, crude oil prices were down by -2.55% to $66.75 per barrel amid the exacerbating of market worries against the future prospect of oil demand. Besides, gold prices ticked up by 0.83% to $2055.40 per troy ounce as PacWest Bancorp is weighing on a potential sale.

Today’s Holiday Market Close

Time Market Event

All Day JPY Greenery Day

Today’s Highlight Events

Time Market Event

20:15 EUR ECB Monetary Policy Statement

20:45 EUR ECB Press Conference

22:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Composite PMI (Apr) | 52.2 | 53.9 | – |

| 16:30 | GBP – Services PMI (Apr) | 52.9 | 54.9 | – |

| 20:15 | EUR – Deposit Facility Rate (May) | 3.00% | 3.25% | – |

| 20:15 | EUR – ECB Marginal Lending Facility | 3.75% | – | – |

| 20:15 | EUR – ECB Interest Rate Decision (May) | 3.50% | 3.75% | – |

| 20:30 | USD – Initial Jobless Claims | 230K | 240K | – |

| 22:00 | CAD – Ivey PMI (Apr) | 58.2 | 59.0 | – |

Technical Analysis

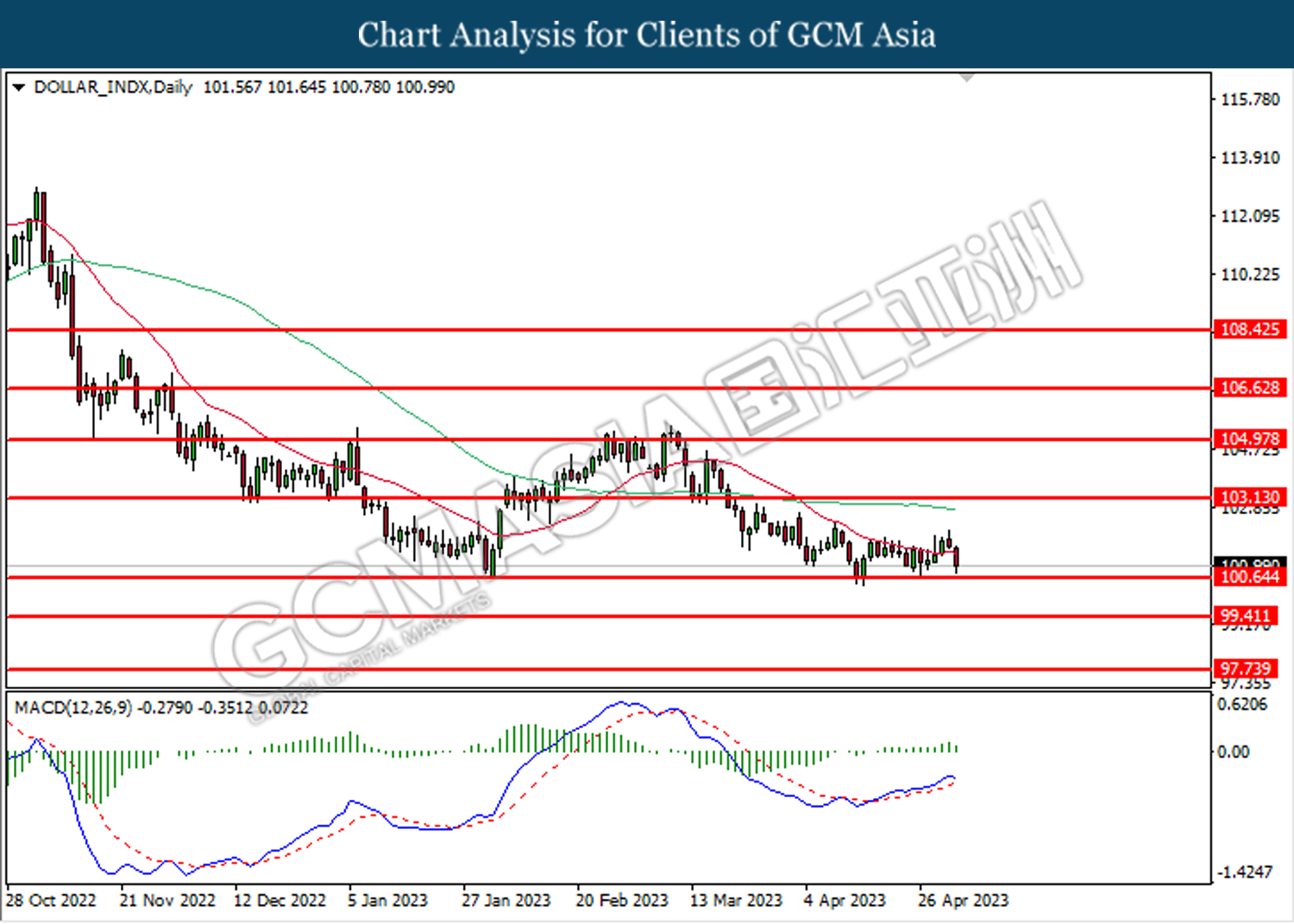

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 100.65. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 103.15, 104.95

Support level: 100.65, 99.40

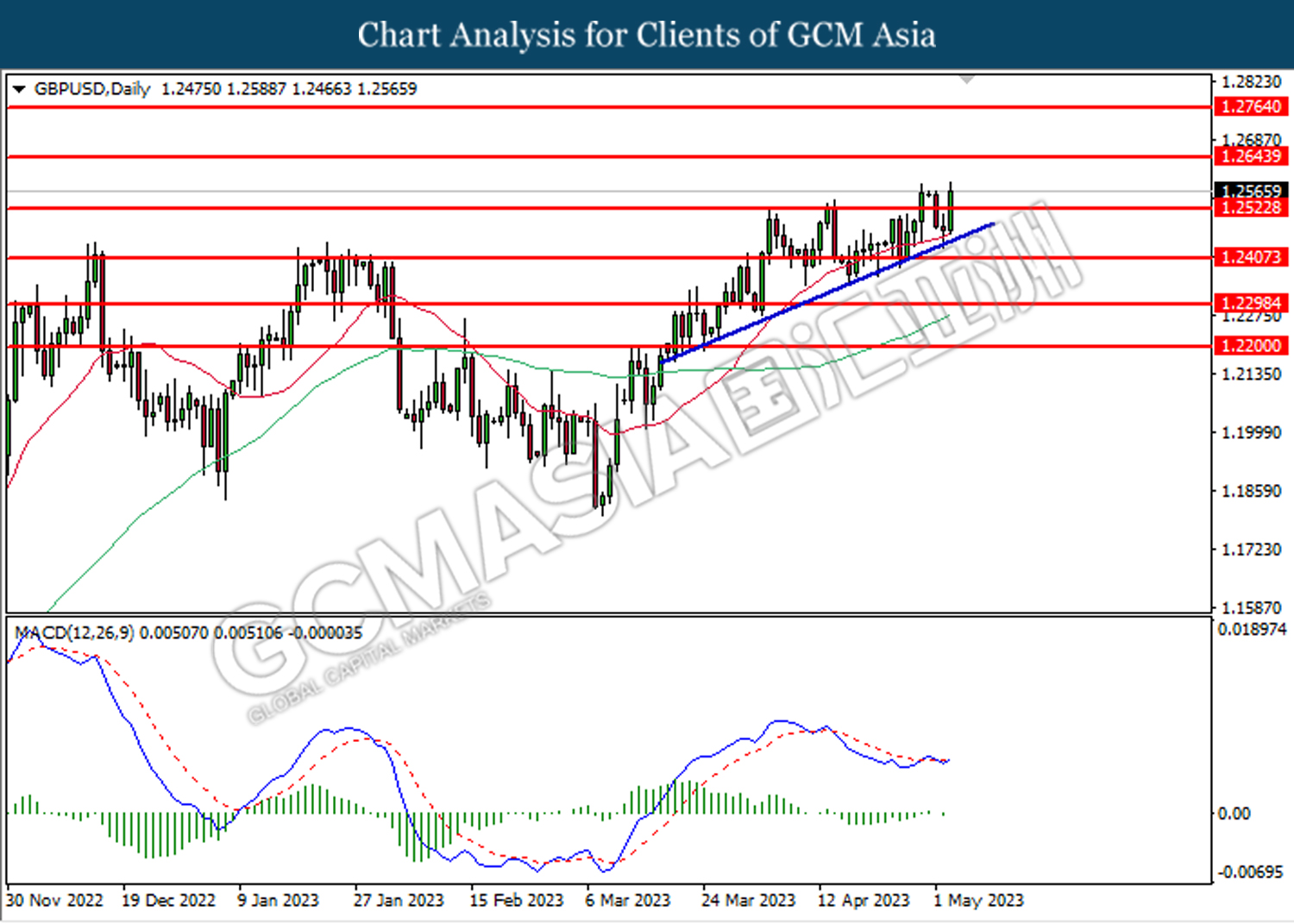

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2525. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

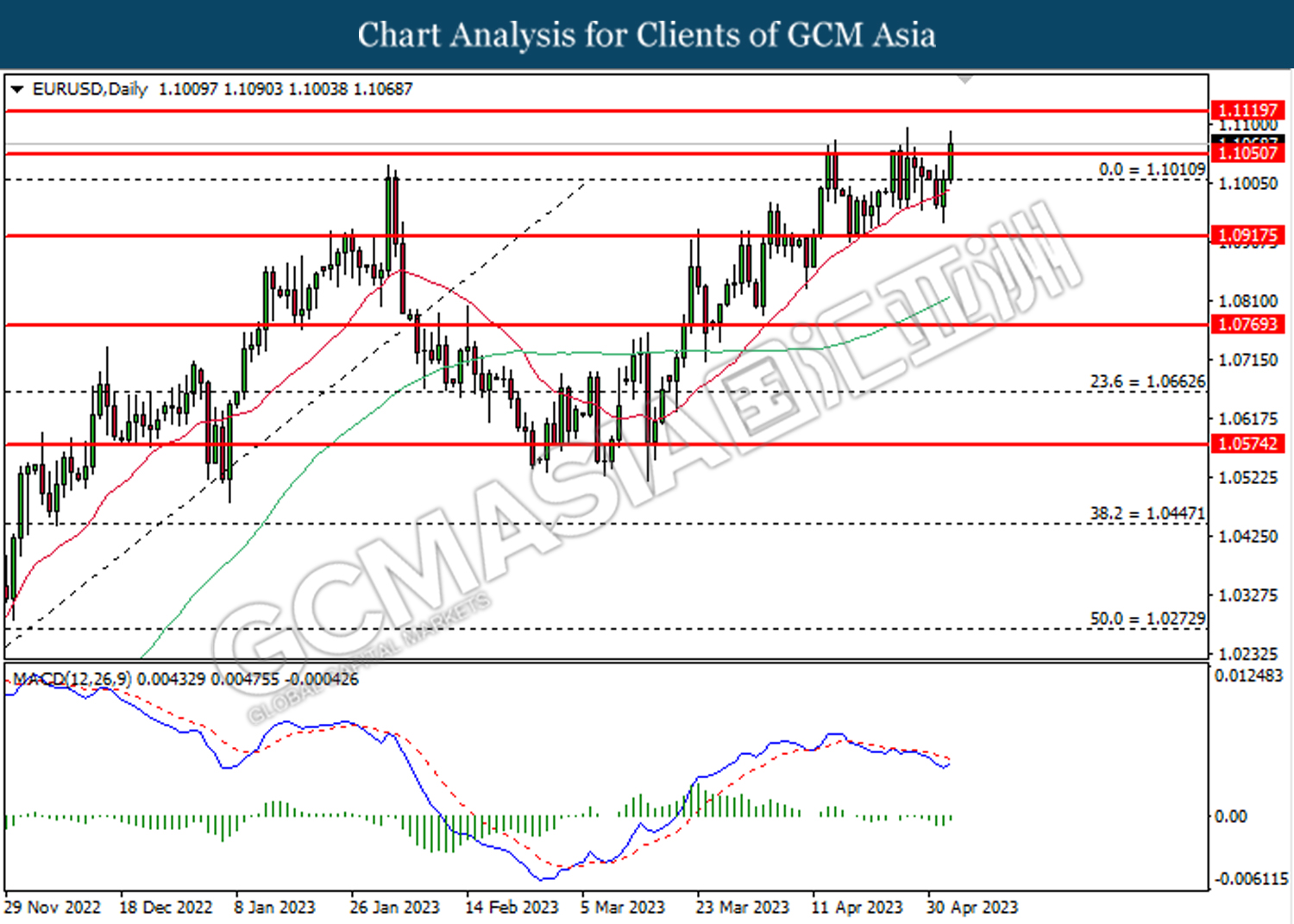

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.1050. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1050, 1.1120

Support level: 1.1010, 1.0915

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 135.20. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 136.30, 137.60

Support level: 135.20, 133.05

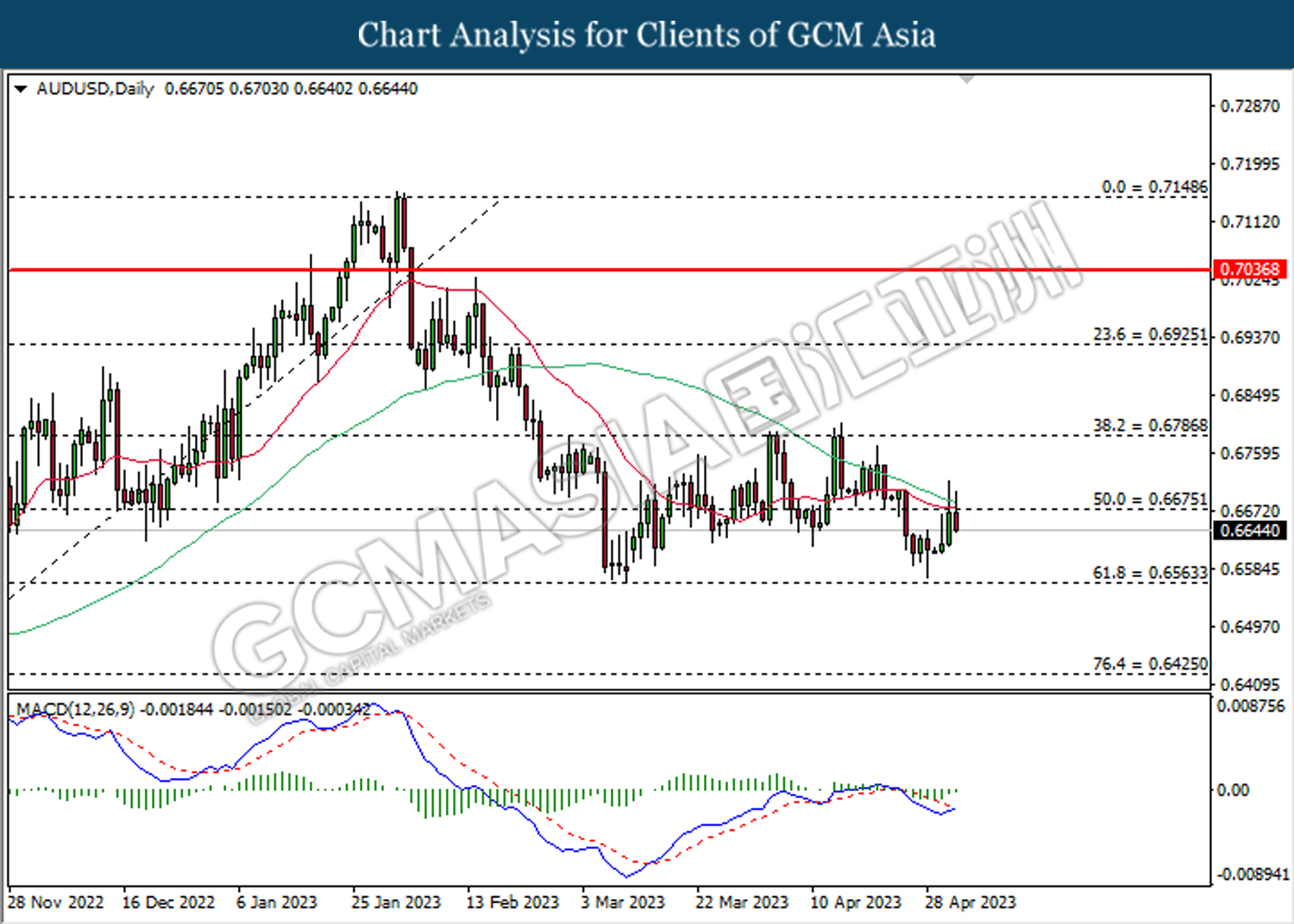

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6675. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

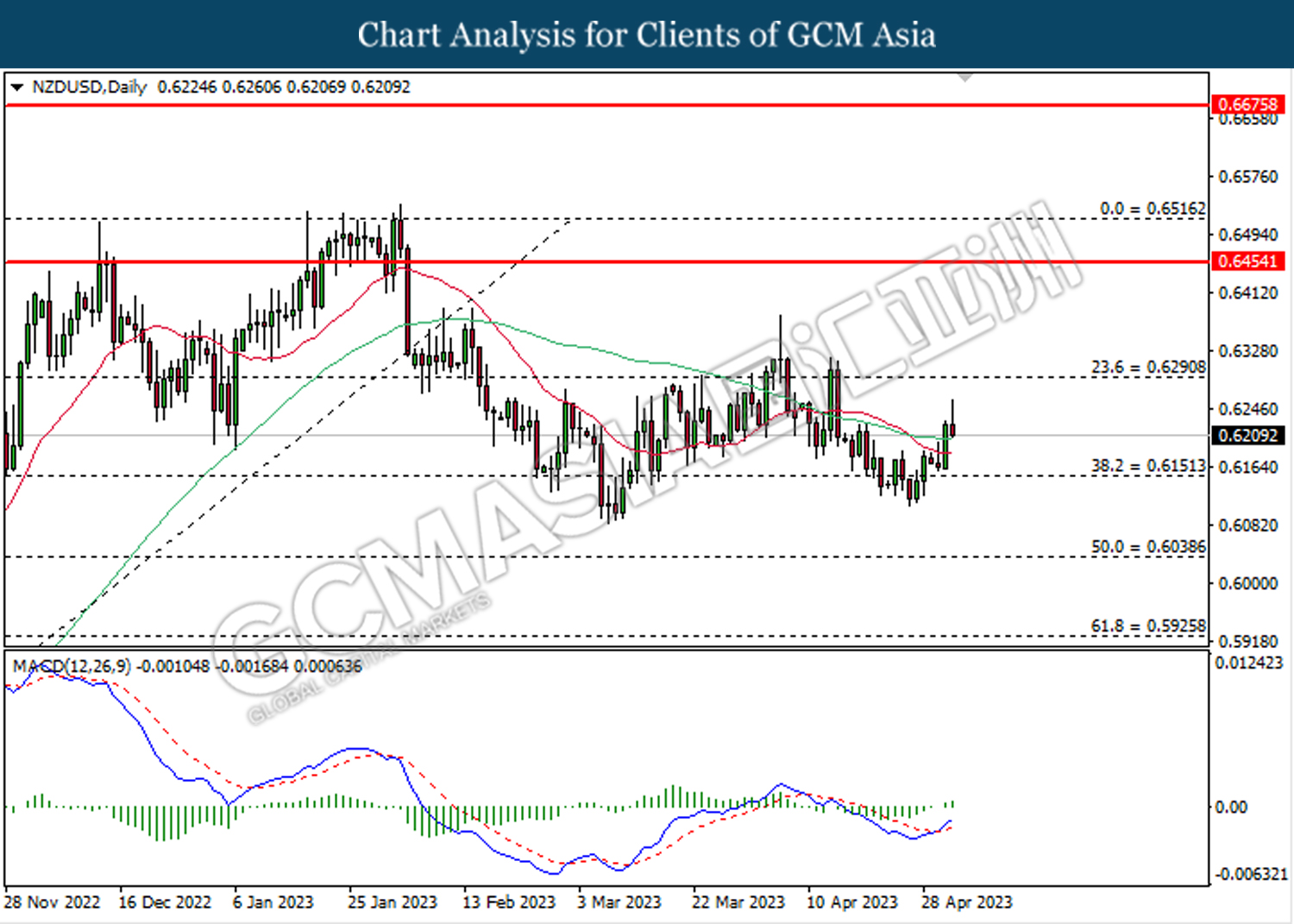

NZDUSD, Daily: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6150. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

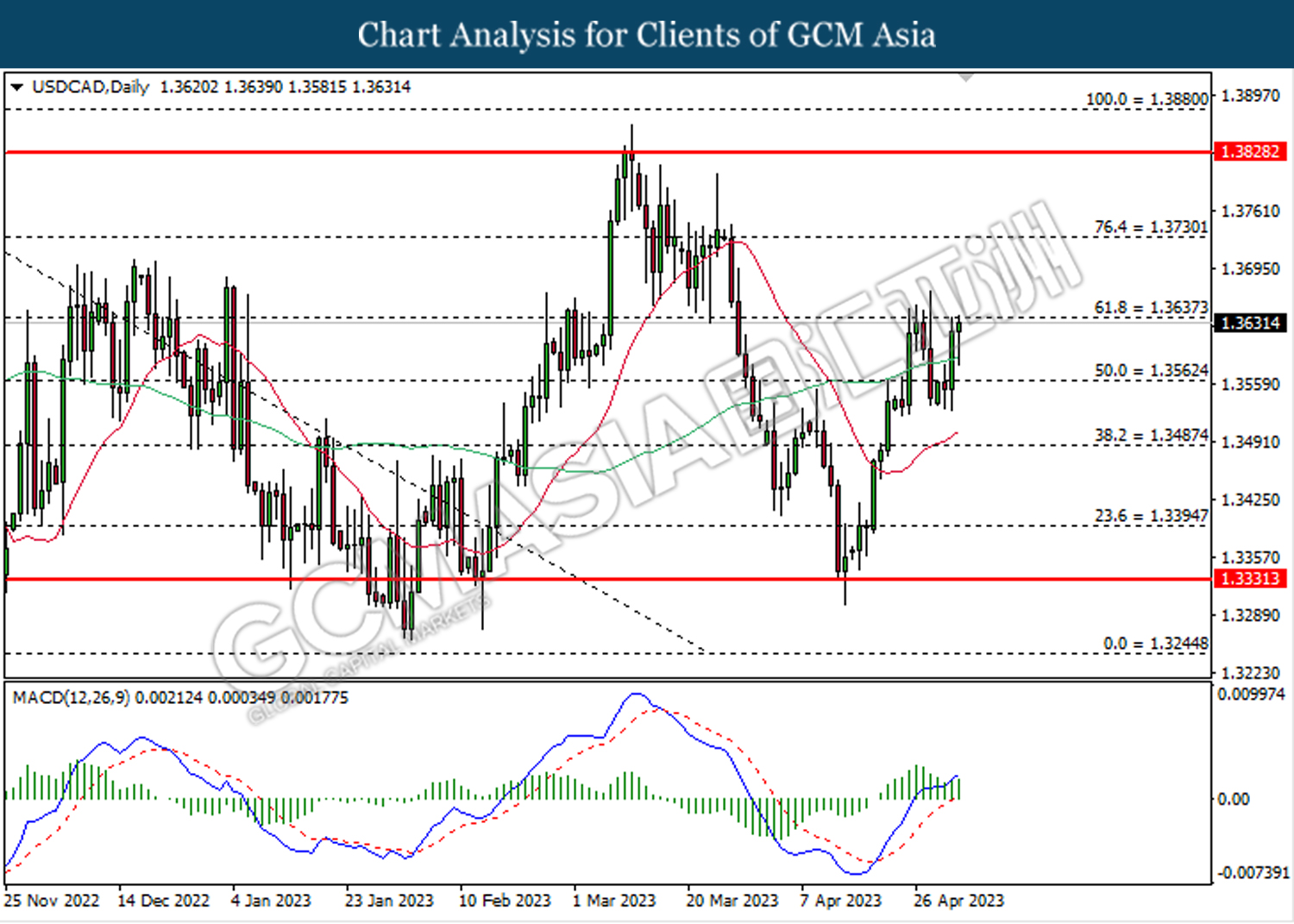

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3635. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3635, 1.3730

Support level: 1.3565, 1.3485

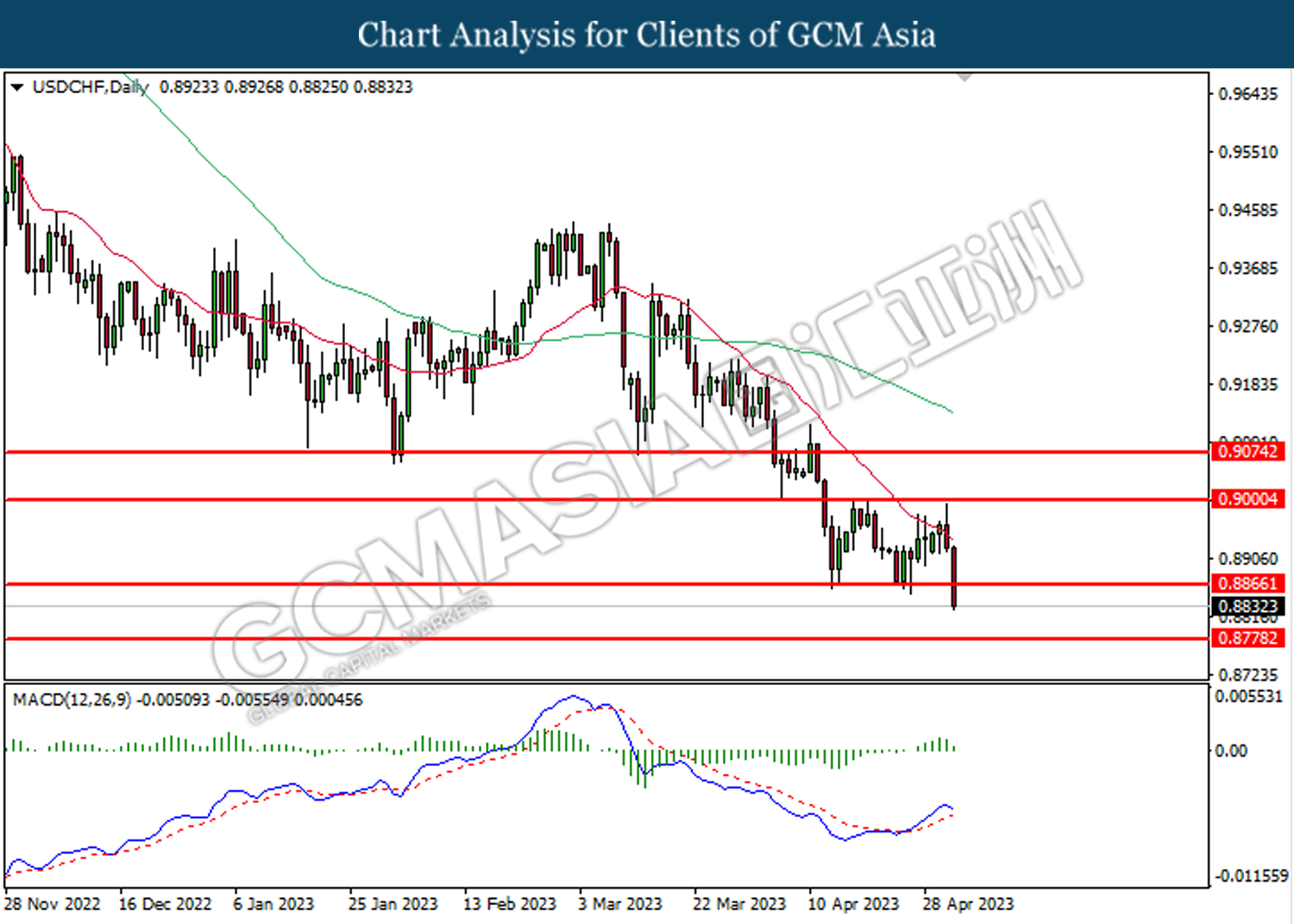

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.8855. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9000, 0.9075

Support level: 0.8865, 0.8780

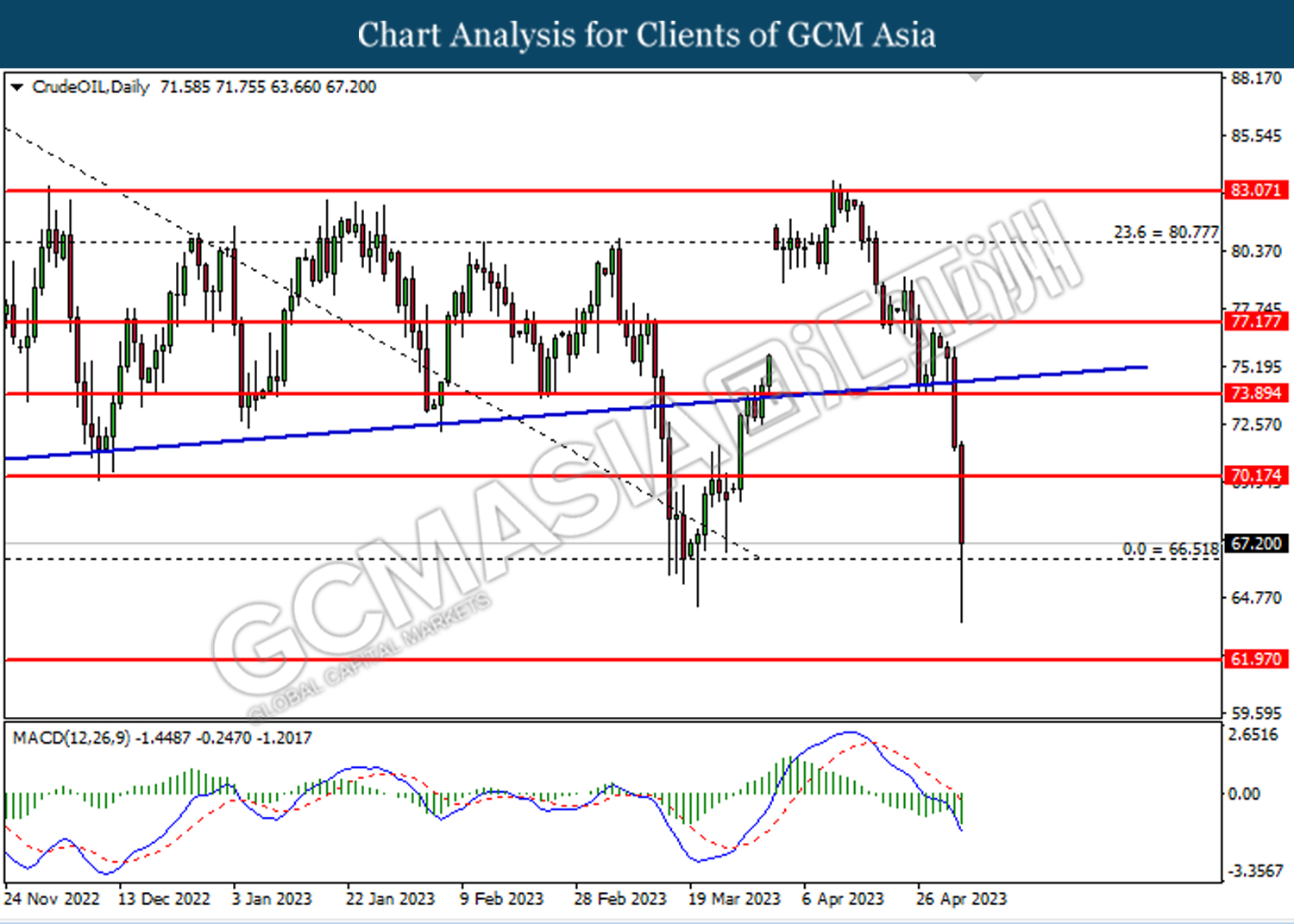

CrudeOIL, Daily: Crude oil price was traded lower following the prior breakout below the previous support level at 70.15. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 66.50.

Resistance level: 70.15, 73.90

Support level: 66.50, 61.95

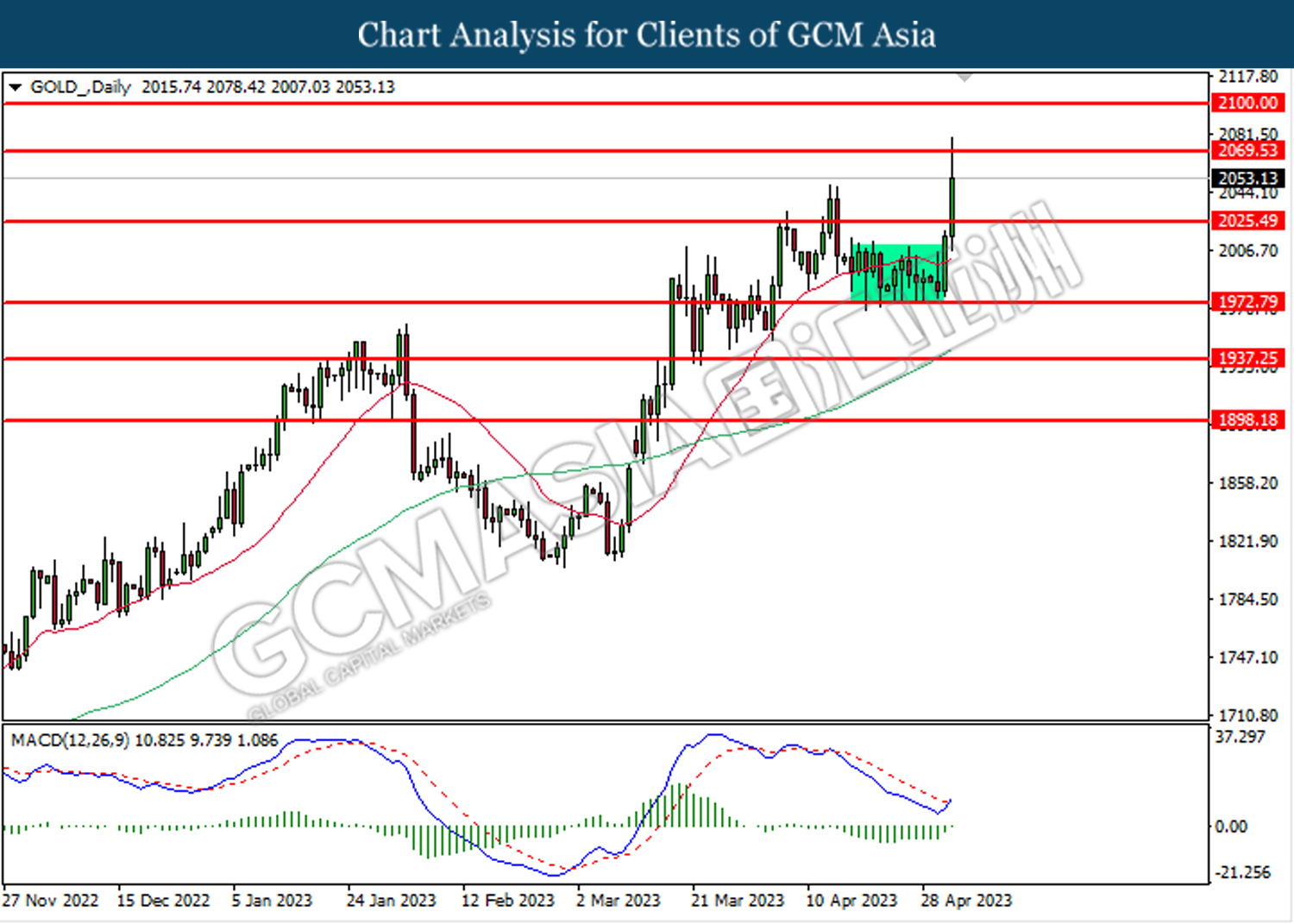

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 2069.55. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 2069.55, 2100.00

Support level: 2025.50, 1972.80