4 June 2018 Weekly Analysis

GCMAsia Weekly Report: June 4 – 8

Market Review (Forex): May 28 – June 1

US dollar extended gains last Friday over the backdrop of optimistic jobs report which has further cemented the course for further monetary policy tightening by the Federal Reserve. The dollar index rose 0.18% while closing the week around 94.16 during late Friday trading.

According to the Bureau of Labor Statistics, the economy has generated 223,000 jobs last month, beating economist expectation for a reading of only 189,000 jobs. Concurrently, unemployment rate fell to 18-years low of 3.8%, hinting solid hiring up ahead as the Fed tightens their policy.

In addition, wage growth rose more than expected with 0.3% versus 0.2% seen, hinting further escalation in inflationary pressure for the long-run. The data has renewed market speculation that the Fed’s would add a fourth rate hike this year if wage growth remains consistent throughout the coming months.

However, gains on the greenback were capped while market participants weighed on current trade wars between the US and other countries. Last week, Trump administration slapped hefty tariffs over steel and aluminum from Europe, Mexico and Canada, escalating the issue to the brink of trade war.

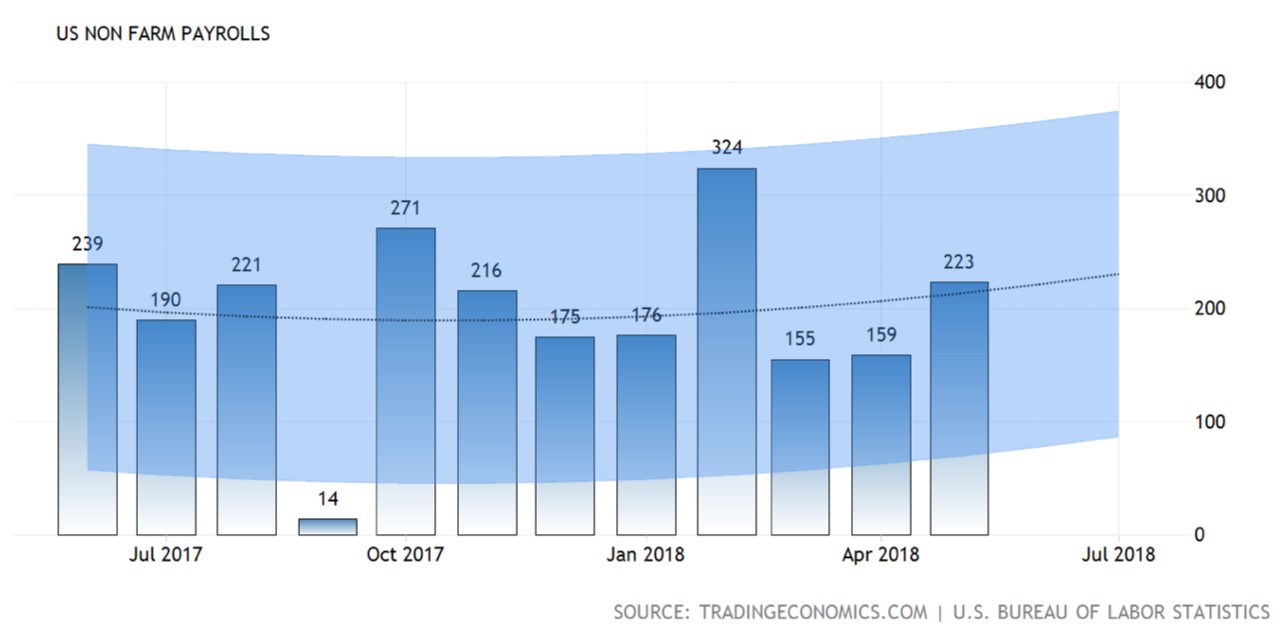

US Nonfarm Payrolls

—– Forecast

US Nonfarm Payrolls report for the month of May came in at 223,000 jobs.

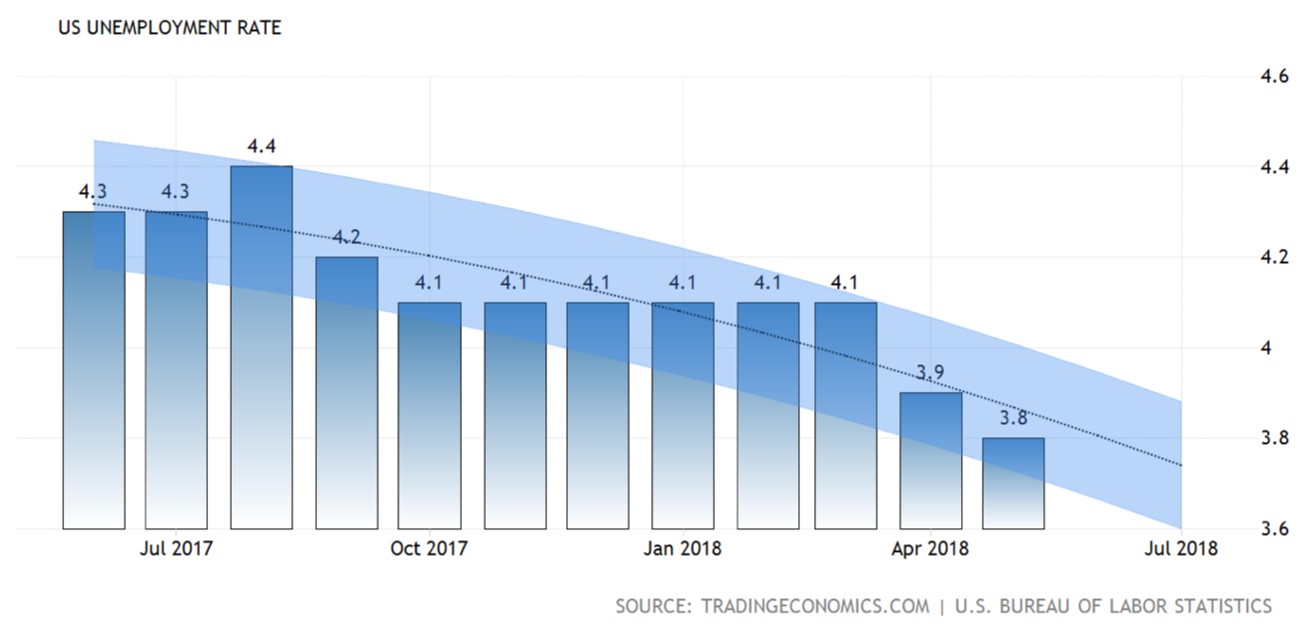

US Unemployment Rate

—– Forecast

US Unemployment rate ticked down by 0.1% to 18-years low of 3.8% for the month of May.

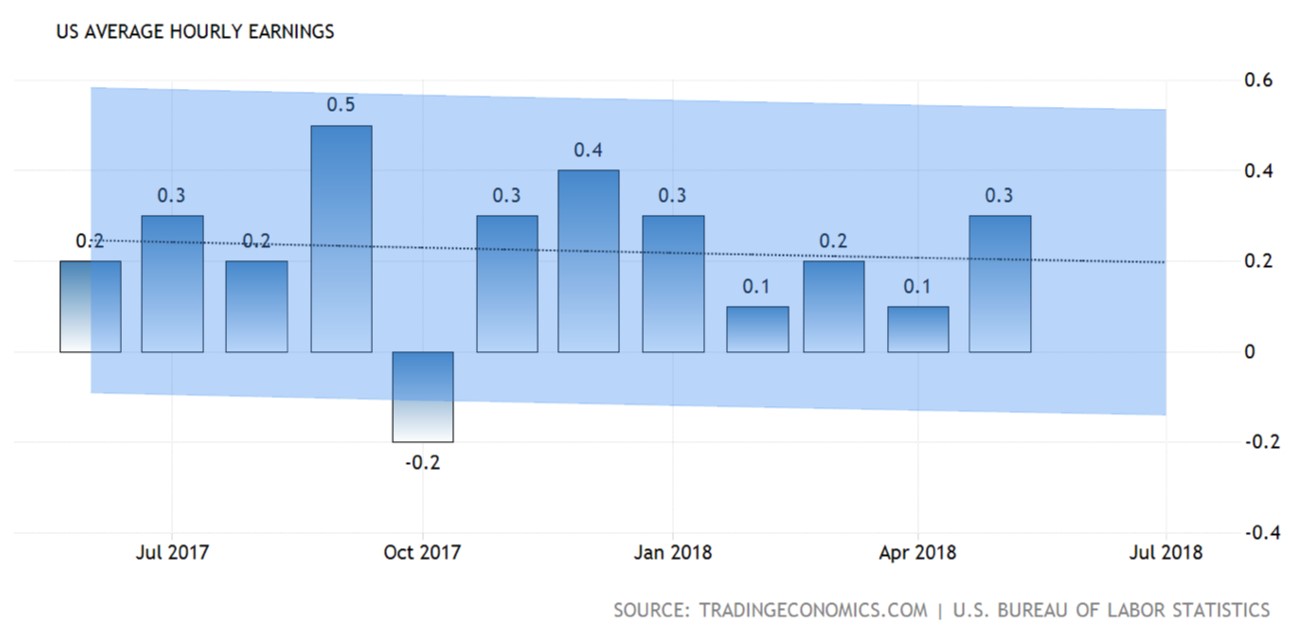

US Average Hourly Earnings

—– Forecast

US Average Hourly Earnings beats economist expectation with 0.3% versus 0.2% for the month of May.

USD/JPY

Pair of USD/JPY rose 0.65% to 109.53 during late Friday trading.

EUR/USD

Euro was down 0.27% to $1.1660 against the US dollar. The single common currency received further bearish pressure following political turmoil in Italy and Spain which may hinder economic progression and monetary policy tightening of the economic zone.

GBP/USD

Pairing of GBP/USD extended gains by 0.38% to $1.3348 after Chancellor Hammond suggests that the Bank of England will continue to normalize their policy as inflation hovers above their target of 2%.

Market Review (Commodities): May 28 – June 1

GOLD

Gold price fell sharply following the release of US NFP report last Friday while market participants continues to weigh between greenback’s appreciation and ongoing political turmoil in the EU zone. Price of the yellow metal settled down 0.39% while closing the week at $1,293.29 a troy ounce.

The precious metal came under pressure following large selloffs in the safe-haven assets mainly gold and Japanese yen while investors flock to US dollar following better-than-expected jobs report. However, losses on the commodity were capped as EU political turmoil continues to lend some support towards the safe-haven asset.

Crude Oil

Crude oil price extended its losses last Friday while posting its second weekly losses due to ongoing signs of US oil expansion and uncertainty over OPEC’s decision to ease their production limit. Price of the black commodity plunged 1.97% while ended the week at $65.71 per barrel.

According to the US services provider, Baker Hughes reported that the number of US oil rigs increased by 2 to 861, its highest level since March 13, 2015. An uptick in drilling activities came in tandem with Energy Information Administration’s report on Thursday which shows US oil production rose 215,000 barrels per day to a staggering record high of 10.47 million barrels per day in March.

Oil prices took a back foot for almost two weeks after OPEC and Russia suggested to increase their oil production in order to offset supply shortage from Venezuela and Iran. However, OPEC’s stance over the suggestion were still unknown as it will only be discussed during a meeting scheduled on 22nd of June.

Weekly Outlook: June 4 – 8

For the week ahead, investors will continue to scrutinize major economic release from the United States especially ISM Non-Manufacturing data in order to gauge current economic progression in the region. Otherwise, they will also place their attention over ECB President Mario Draghi’s speech on Tuesday to attain further clues with regards to the central bank’s monetary policy tightening and tapering plans.

As for oil traders, they will be eyeing on US inventories level reported by API and EIA to gauge the strength of crude demand for world’s largest oil consumer.

Highlighted economy data and events for the week: June 4 – 8

| Monday, June 4 |

Data AUD – Retail Sales (MoM) (Apr) GBP – Construction PMI (May) USD – Durable Goods Orders (MoM) USD – Factory Orders (MoM) (Apr)

Events N/A

|

| Tuesday, June 5 |

Data JPY – Household Spending (YoY) (Apr) AUD – RBA Interest Rate Decision (Jun) EUR – German Services PMI (May) GBP – Services PMI (May) USD – ISM Non-Manufacturing PMI (May) USD – ISM Non-Manufacturing Employment (May) USD – JOLTs Job Openings

Events AUD – RBA Rate Statement EUR – ECB President Draghi Speaks

|

| Wednesday, June 6 |

Data CrudeOIL – API Weekly Crude Oil Stock AUD – GDP (QoQ) (Q1) USD – Trade Balance (Apr) USD – Unit Labor Costs (QoQ) (Q1) CAD – Trade Balance (Apr) CAD – Ivey PMI (May) CrudeOIL – Crude Oil Inventories CrudeOIL – Gasoline Inventories

Events N/A

|

| Thursday, June 7 |

Data AUD – Trade balance (Apr) EUR – German Factory Orders (MoM) (Apr) GBP – Halifax House Price Index (MoM) (May) EUR – GDP (QoQ) (Q1) USD – Initial Jobless Claims

Events CAD – BoC Gov Poloz Speaks

|

|

Friday, June 8

|

Data JPY – GDP (QoQ) (Q1) CNY – Trade Balance (USD) (May) EUR – German Industrial Production (MoM) (Apr) EUR – German Trade Balance (Apr) GBP – Manufacturing Production (MoM) (Apr) CAD – Employment Change (May) CAD – Unemployment Rate (May) CrudeOIL – US Baker Hughes Oil Rig Count

Events N/A

|

Technical Weekly Outlook: June 4 – 8

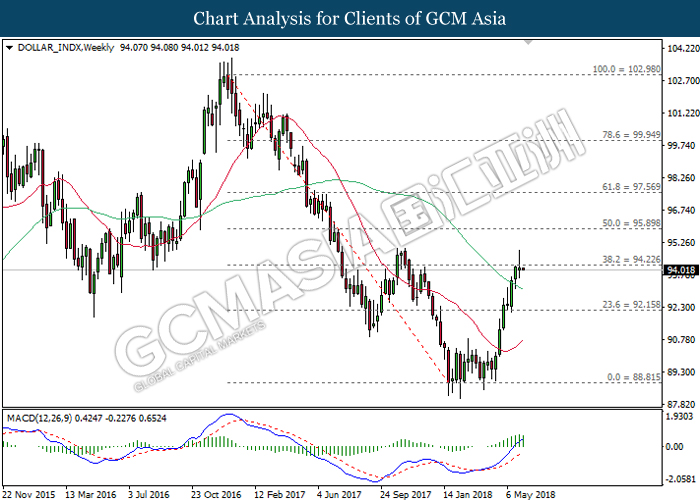

Dollar Index

DOLLAR_INDX, Weekly: Dollar index extended gains following prior closure above the 60-MA line (green). However, diminishing upward momentum from MACD histogram may suggests the index to be traded lower in short-term as technical correction before continuing its bullish bias thereafter.

Resistance level: 94.20, 95.90

Support level: 92.15, 88.80

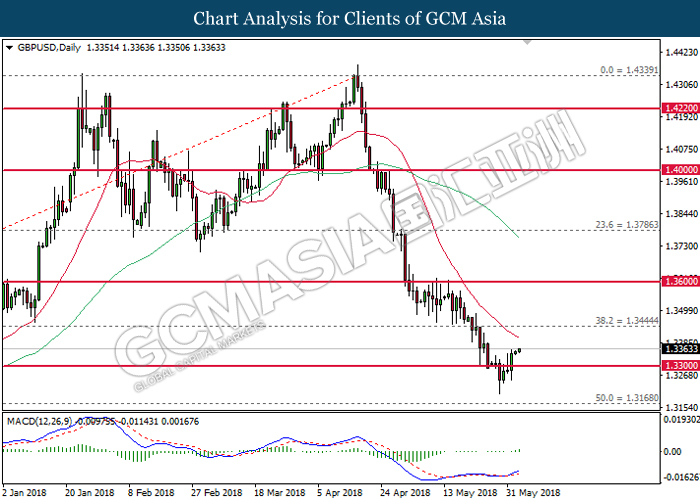

GBPUSD

GBPUSD, Daily: GBPUSD advance further up following prior rebound and closure above the threshold at 1.3300. MACD histogram which begins to form a golden cross signal suggests the pair to extend its bullish bias after closing above the 20-MA line (red).

Resistance level: 1.3445, 1.3600

Support level: 1.3300, 1.3170

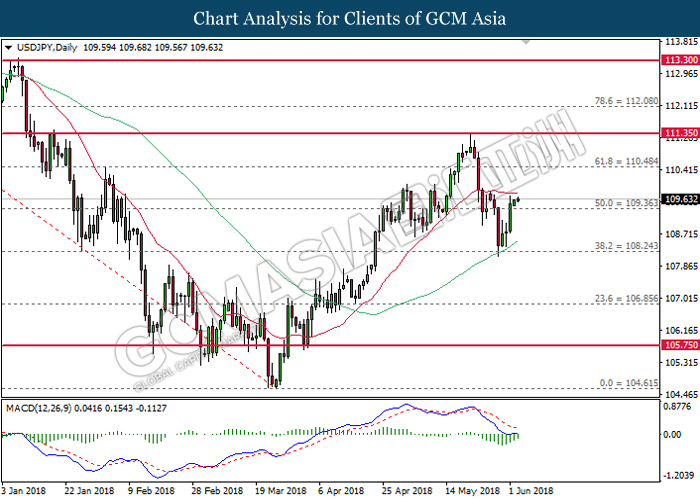

USDJPY

USDJPY, Daily: USDJPY pared its prior losses following a rebound from the 60-MA line (green) near 108.25. MACD histogram which illustrate diminishing downward momentum suggests the pair to extend its gains after closing above the 20-MA line (red).

Resistance level: 110.50, 111.35

Support level: 109.35, 108.25

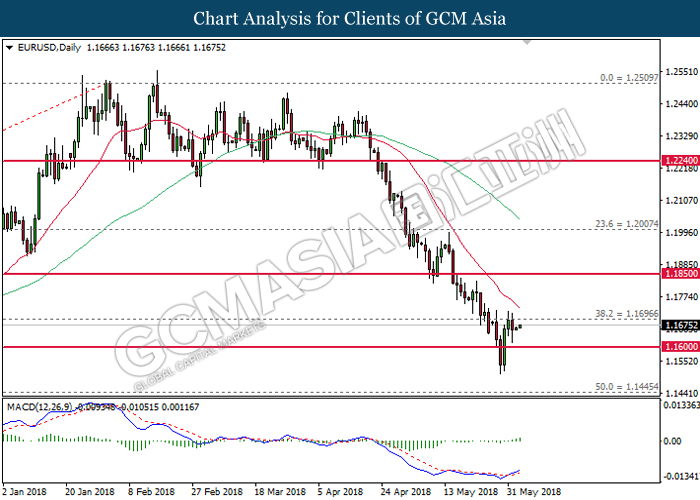

EURUSD

EURUSD, Daily: EURUSD pared its losses following prior rebound while closing above the resistance level at 1.1600. MACD histogram has begin to form an upward signal suggests the pair to extend its gains after closing above the resistance level near 1.1700 and 20-MA line (red).

Resistance level: 1.1700, 1.1850

Support level: 1.1600, 1.1445

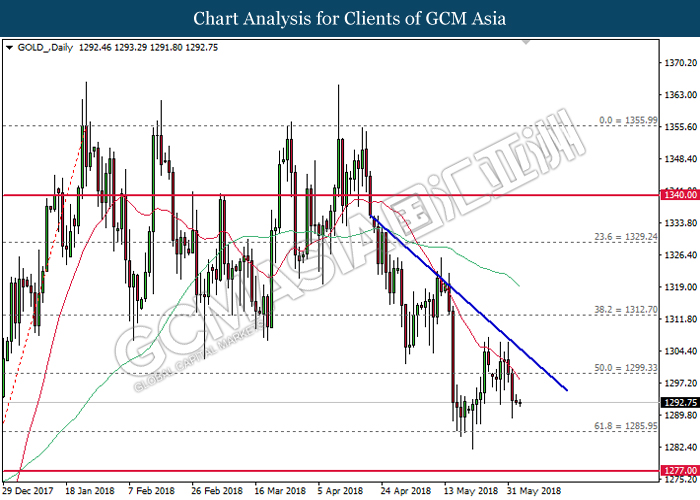

GOLD

GOLD_, Daily: Gold price remained under pressure following prior retracement from the downward trendline. Both MA lines which continues to expand downwards suggests its prices to extend its losses, towards the support level at 1285.95.

Resistance level: 1300.00, 1312.70

Support level: 1285.95, 1266.90

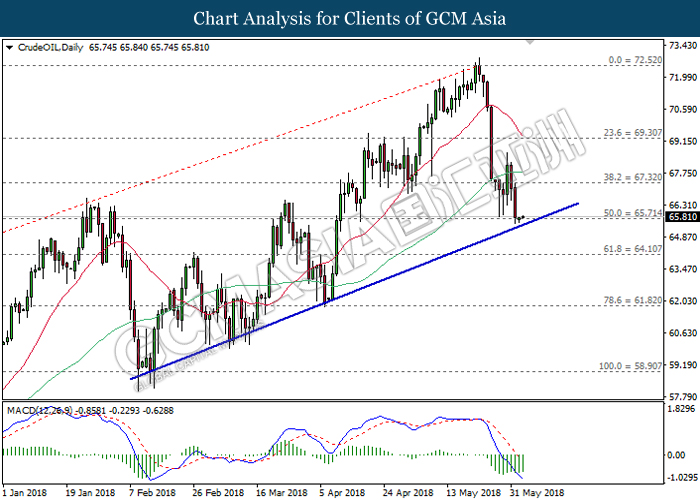

Crude Oil

CrudeOIL, Daily: Crude oil price extended its losses following prior retracement from the 60-MA line (green). MACD histogram which illustrate downward signal suggests further bearish bias. However, a breakout from the upward trendline is required to attain further confirmation.

Resistance level: 67.30, 69.30

Support level: 65.70, 64.10