4 July 2022 Morning Session Analysis

Inflation keep hovering in Eurozone, EURUSD surged.

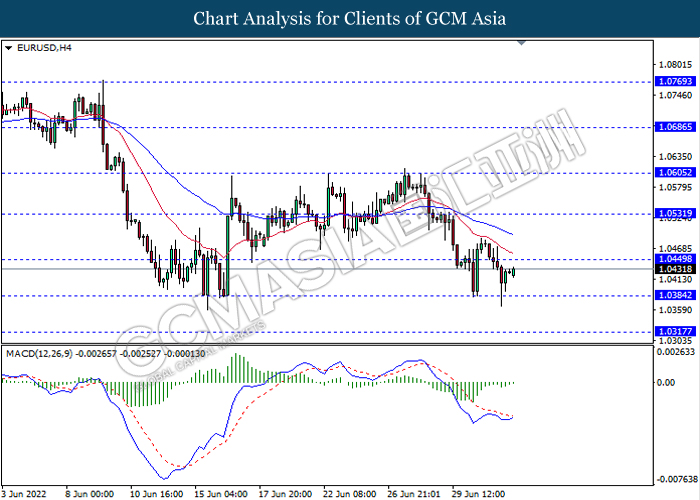

EURUSD, which traded by major investors rebounded from its recent low on last Friday amid the backdrop of bullish economic data. According to Eurostat, the Eurozone Consumer Price Index (CPI) YoY for June notched up from the previous reading of 8.1% to 8.6% while exceeding the market forecast of 8.4%. The CPI data was used as an indicator to determine the inflation rate in certain region, and the higher-than-expected reading had showed that the inflation risk still linger in the European. The European Central Bank (ECB) would likely to implement aggressive contractionary monetary policy in order to bring down the soaring inflation, sparkling the appeal of Euro. Last week, ECB President Christine Lagarde vowed that the central bank would increase interest rate for the first in 11 years to combat inflation risk. Investors would continue to focus on the latest updates with regards of rate hike decision from ECB in order to gauge the likelihood movement of EURUSD. As of writing, EURUSD appreciated by 0.06% to 1.0434.

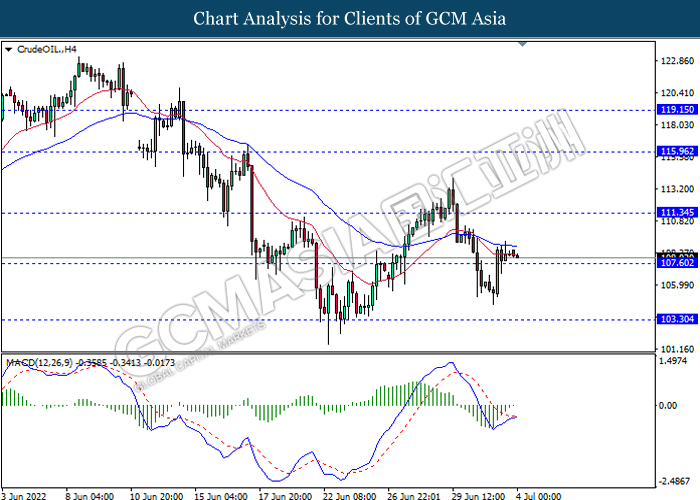

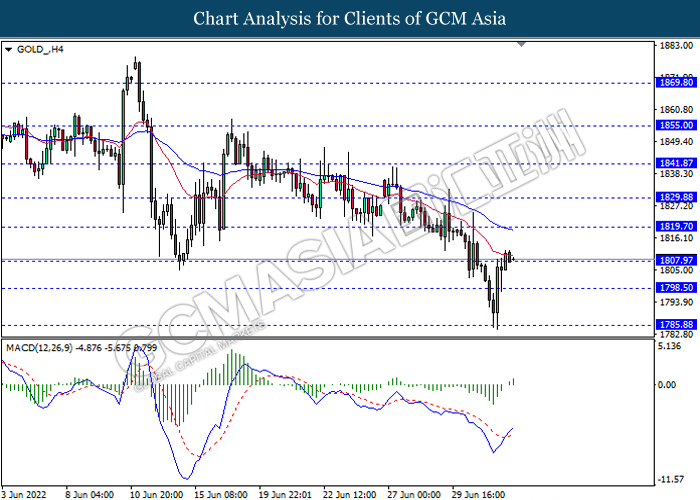

In the commodities market, crude oil price eased by 0.08% to $108.35 per barrel as of writing. Nonetheless, the overall trend of oil price remained bullish over the rising concerns on oil supply tightness. On the other hand, gold price rallied by 0.52% to $1810.90 per troy ounces as of writing following the depreciation of US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day USD United States – Independence Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

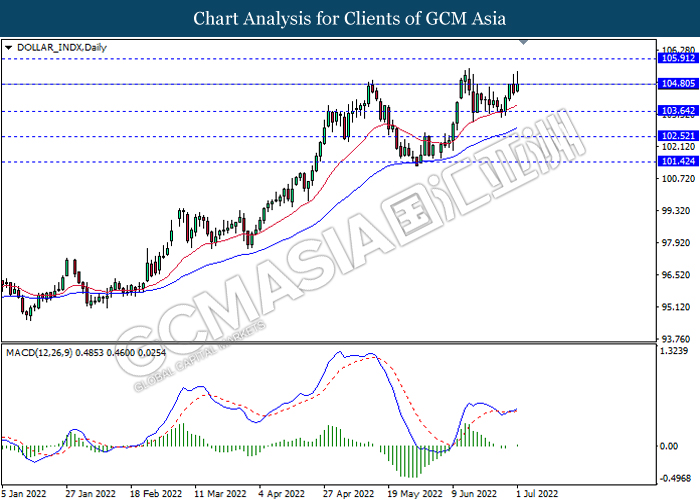

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 104.80, 105.90

Support level: 103.65, 102.50

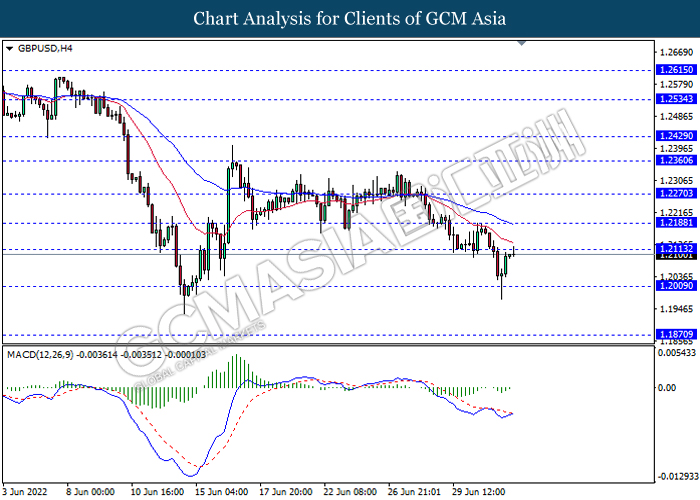

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2115, 1.2190

Support level: 1.2010, 1.1870

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0450, 1.0530

Support level: 1.0385, 1.0315

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 135.55, 136.65

Support level: 134.25, 133.10

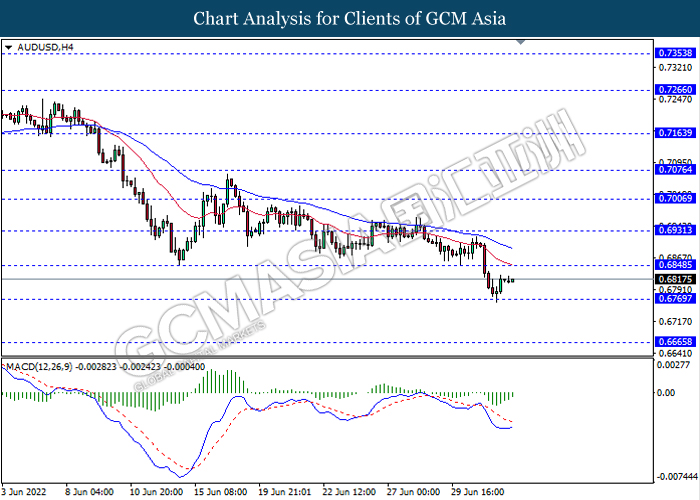

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend it gains.

Resistance level: 0.6850, 0.6910

Support level: 0.6770, 0.6665

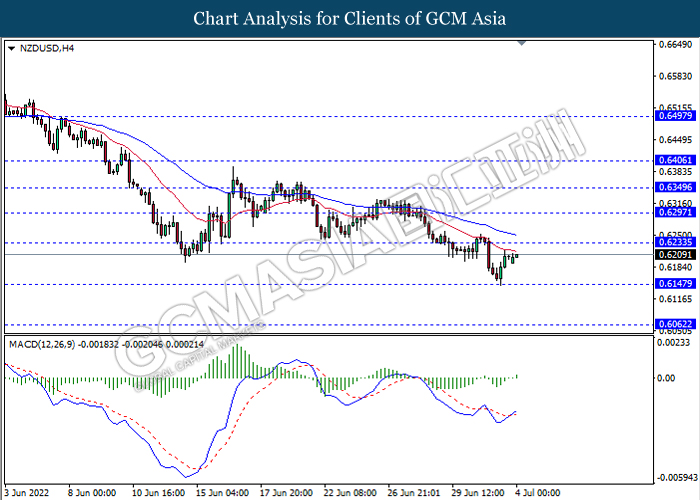

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6235, 0.6295

Support level: 0.6145, 0.6060

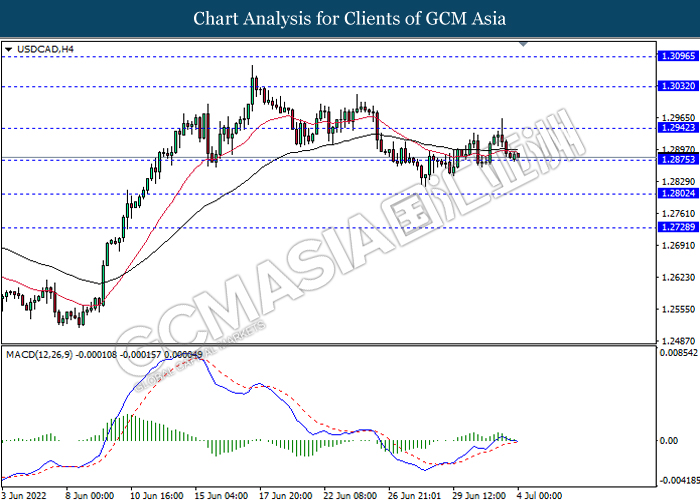

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2940, 1.3030

Support level: 1.2875, 1.2800

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9595, 0.9675

Support level: 0.9520, 0.9455

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 111.35, 115.95

Support level: 107.60, 103.30

GOLD_, H4: Gold price was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1819.70, 1829.90

Support level: 1807.95, 1798.50