04 Jul 2023 Afternoon Session Analysis

Euro flat as increasing gloomy economic outlook.

The Euro which traded against the dollar index flatted as euro area manufacturing data slipped, reflecting a tightening monetary policy from European Central Bank (ECB) weighs on the manufacturing market. Markit Economics published a survey on Monday that showed all four of the euro zone’s biggest economies in contraction condition. As Spanish and French manufacturing PMI released a higher-than-expected PMI reading which stood at 48.0 and 46.0 respectively, higher than the economist forecast of 47.7 and 45.5. While the Italian and German manufacturing PMI slipped to 43.8 and 40.6, lower than market expectations of 45.3 and 41.0. Therefore, the euro manufacturing PMI slipped to 43.4 from 44.8 in June. Although some countries manufacturing PMI is higher than market expectation, the reading below the 50 thresholds indicates a contraction condition. German manufacturing firms reported deeper production cuts in response to the weakening of demand. A firm in Spain also commented that the weakness in the manufacturing sector is likely to continue for a few more months. As of writing, the EURUSD ticked down by -0.05% to 1.0906.

In the commodities market, crude oil prices edged up by 0.64%% to $70.24 per barrel as market weigh on supply cuts and manufacturing slump. Elsewhere, the gold price steadily by adding 0.08% to 1923.10 ahead of crucial economic data release.

Today’s Holiday Market Close

Time Market Event

All Day USD Independence Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

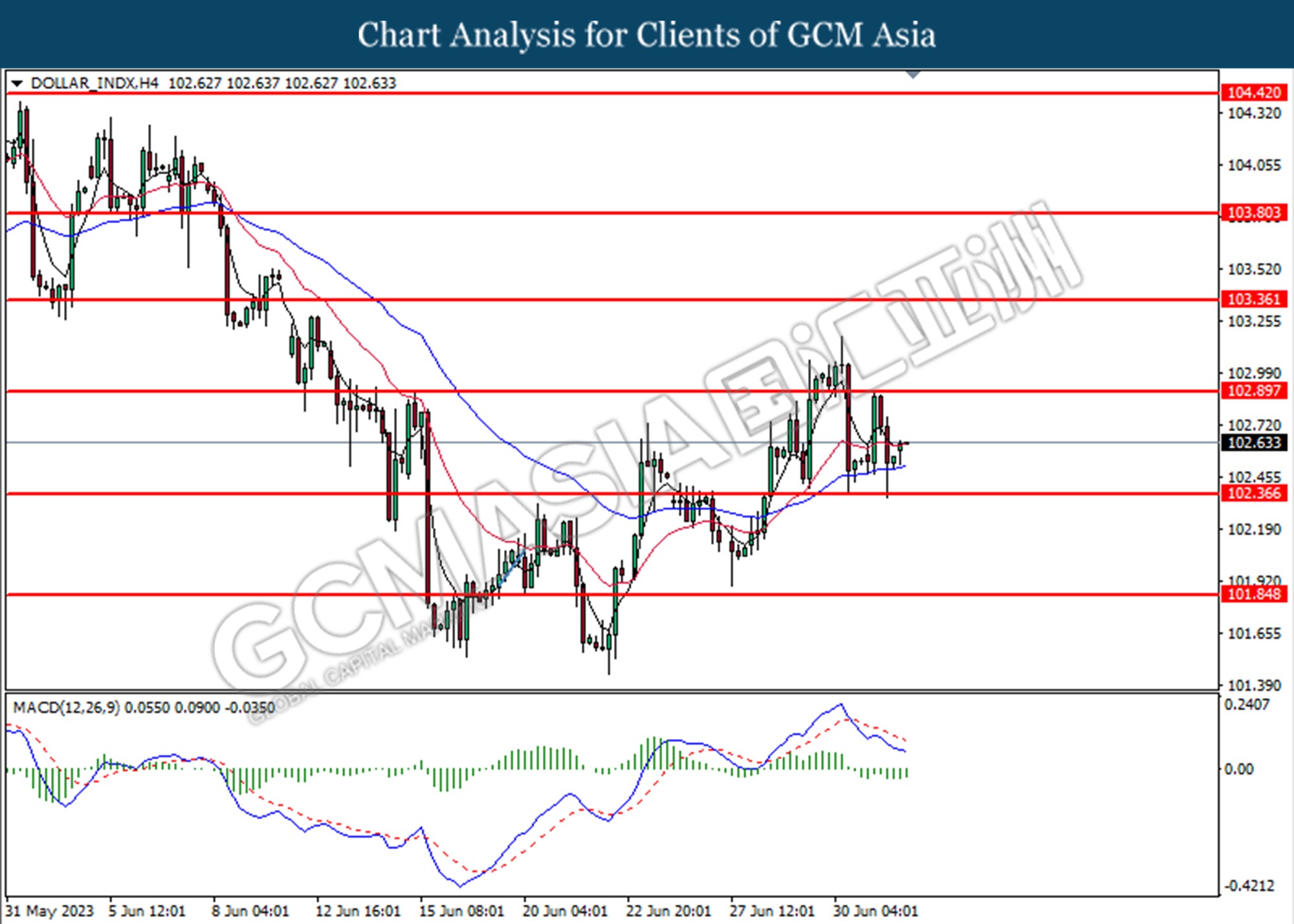

DOLLAR_INDX, H4: Dollar index was traded higher following the prior rebound from the support level at 102.35. MACD which illustrated diminishing bearish momentum suggests the index extended its gains toward the resistance level at 102.90.

Resistance level: 102.90, 103.35

Support level: 102.35, 101.85

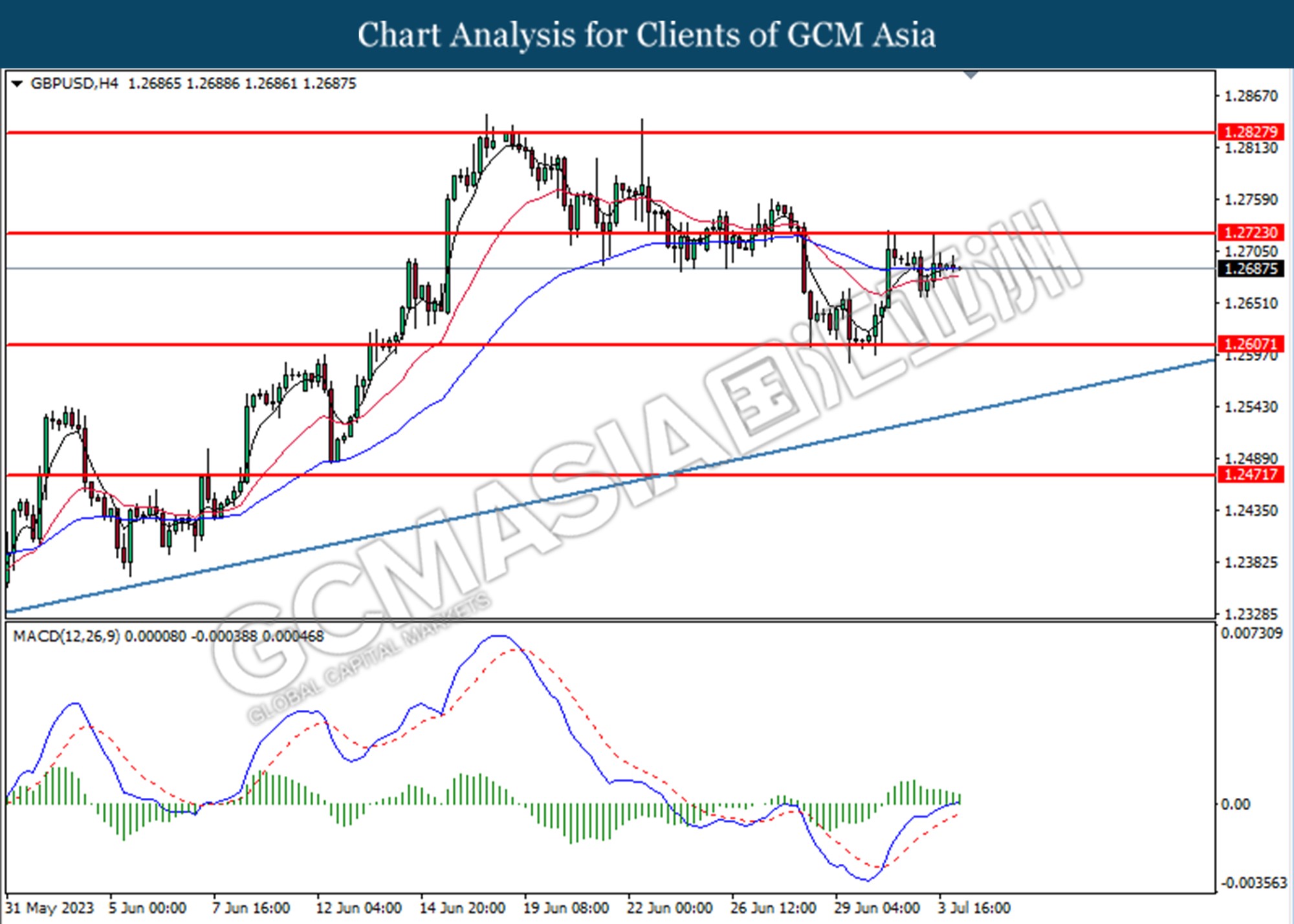

GBPUSD, H4: GBPUSD was traded lower following the prior retracement from the resistance level at 1.2725. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 1.2725, 1.2830

Support level: 1.2610, 1.2470

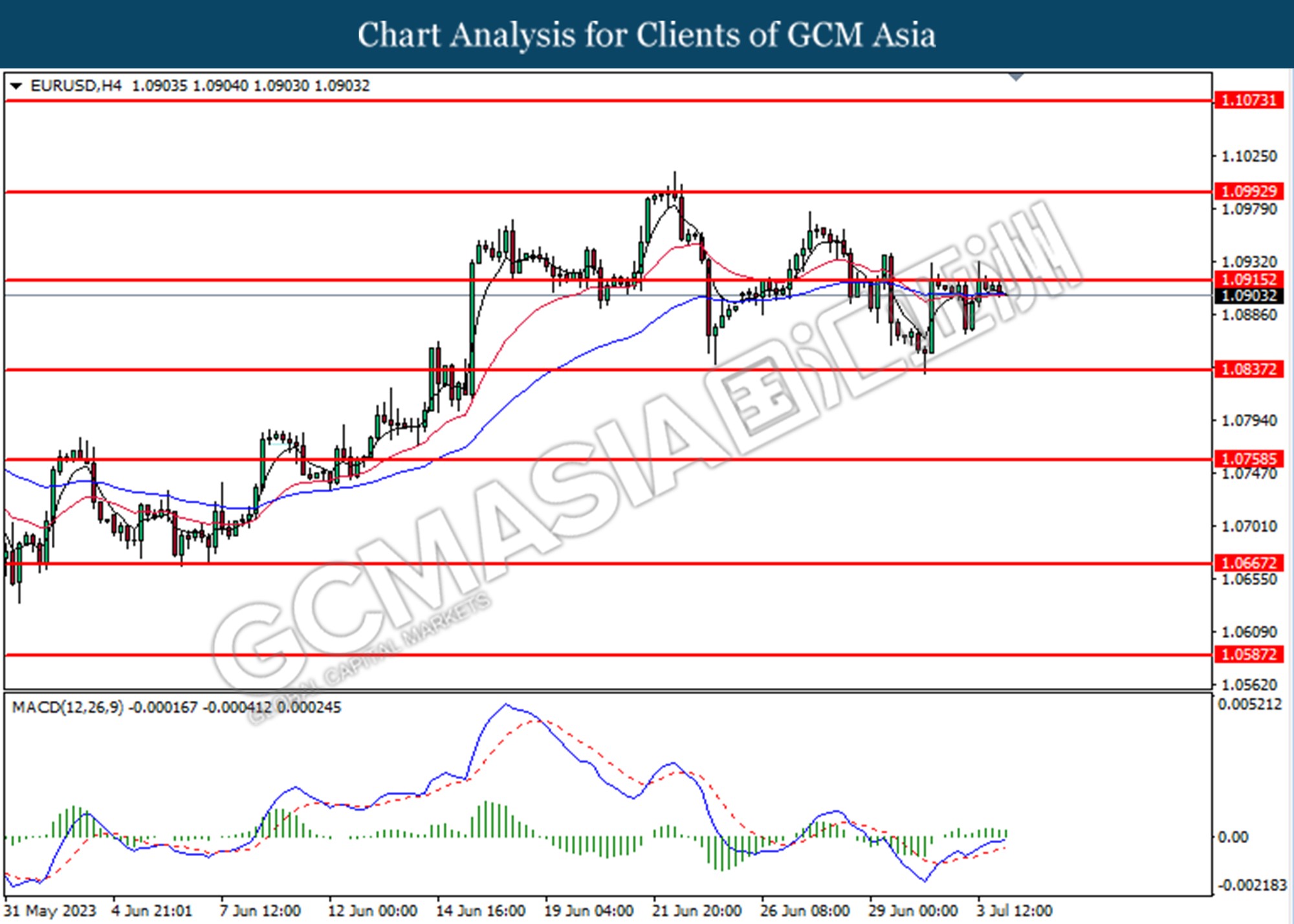

EURUSD, H4: GBPUSD was traded lower following the prior retracement from the resistance level at 1.0915. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 1.0915, 1.0990

Support level: 1.0840, 1.0760

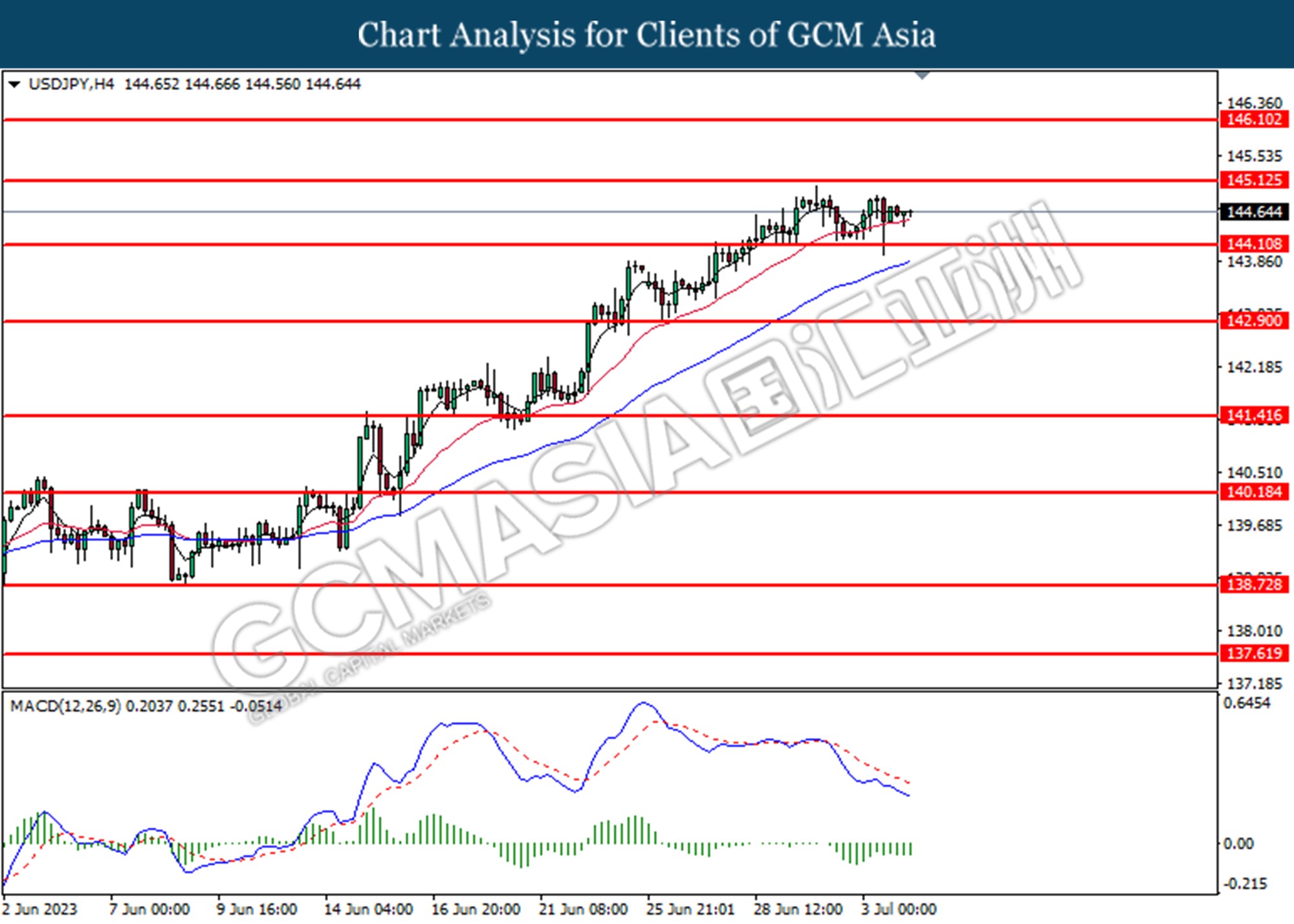

USDJPY, H4: USDJPY was traded lower following the prior retracement from the higher level. MACD which illustrated bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 145.10, 146.10

Support level: 144.10, 142.90

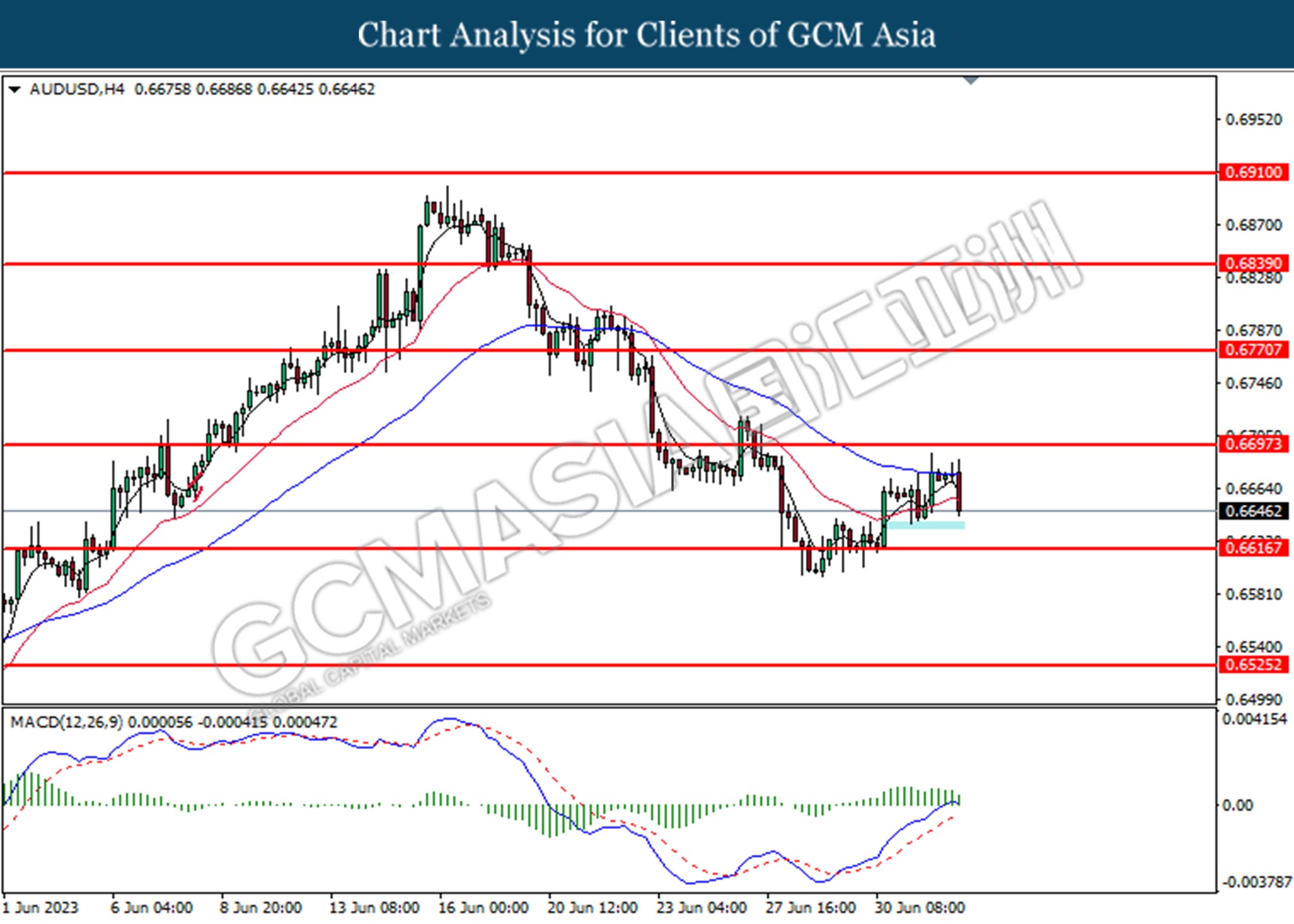

AUDUSD, H4: AUDUSD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 0.6615.

Resistance level: 0.6700, 0.6770

Support level: 0.6615, 0.6525

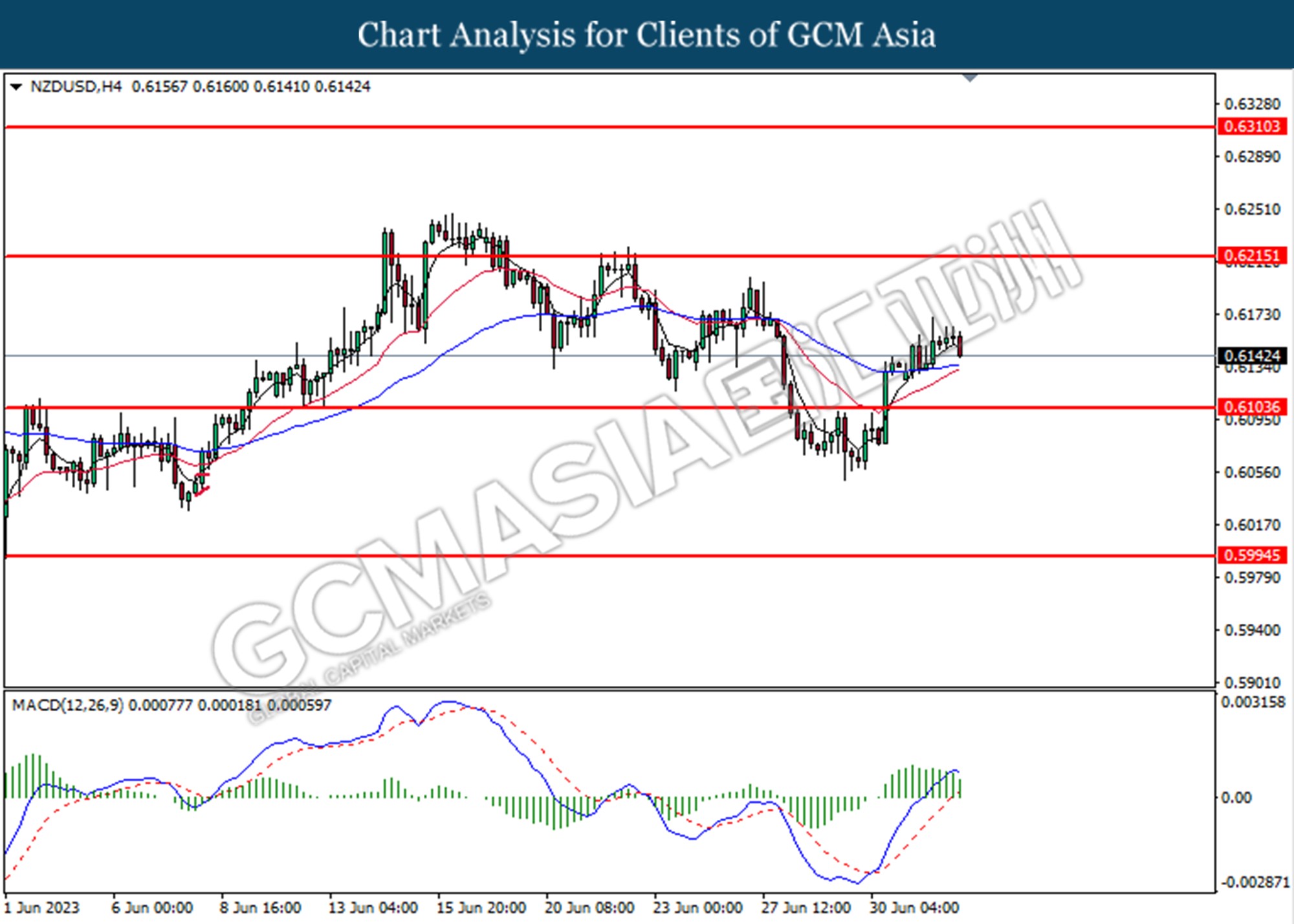

NZDUSD, H4: NZDUSD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 0.6105.

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

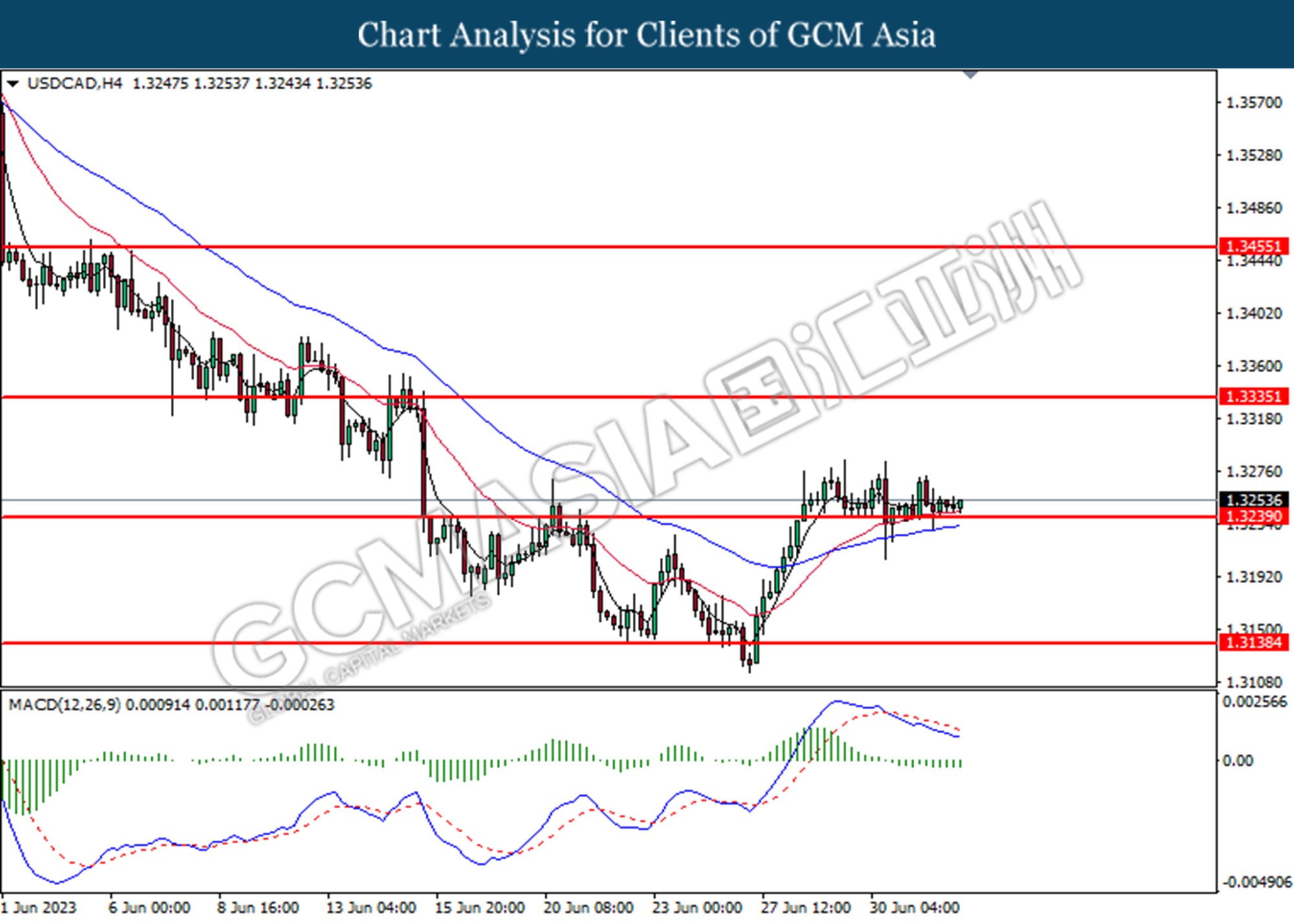

USDCAD, H4: USDCAD was traded higher following the prior rebound from the support level at 1.3240. However, MACD which illustrated bearish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 1.3335, 1.3455

Support level: 1.3240, 1.3140

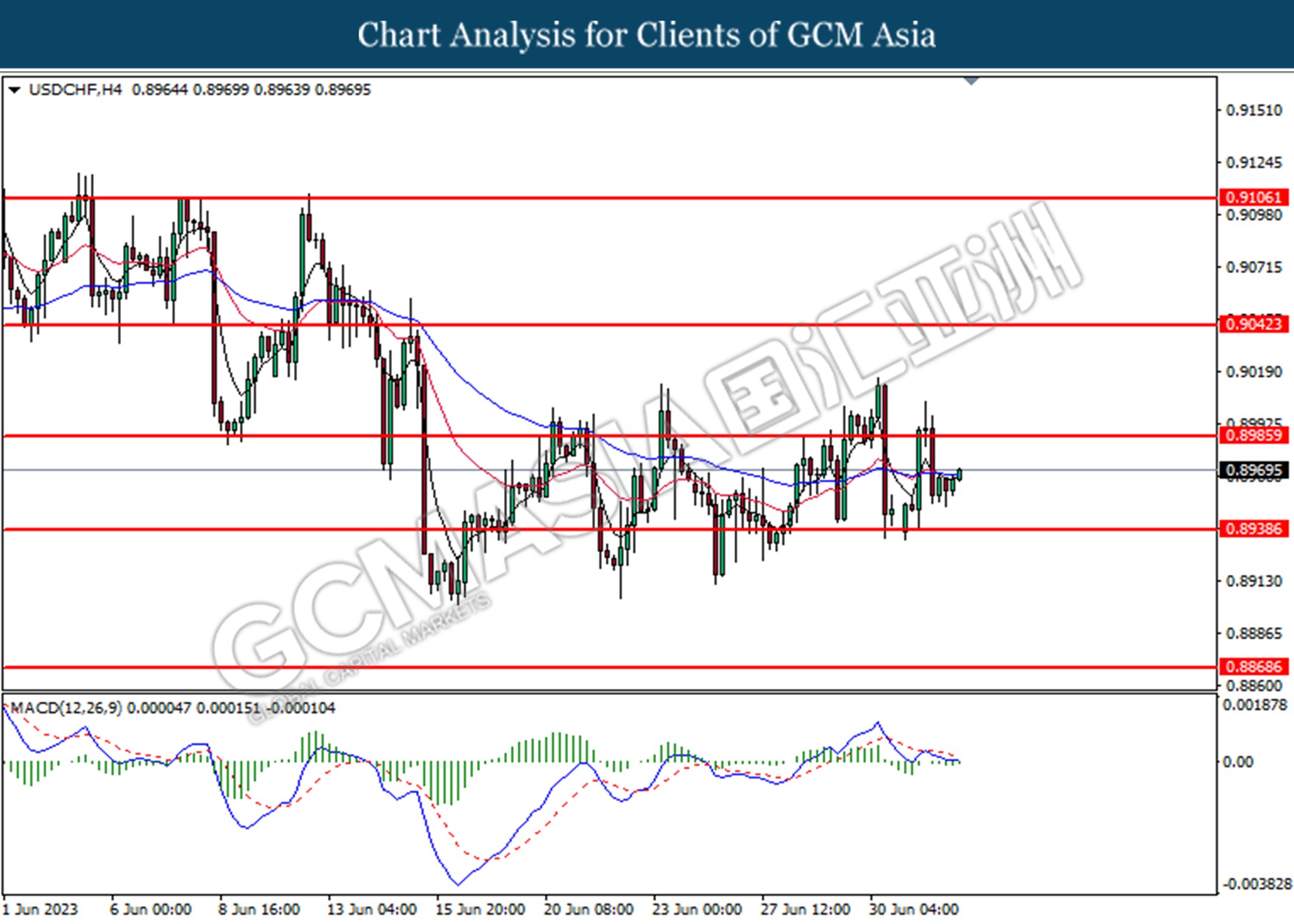

USDCHF, H4: USDCHF was traded higher following the prior rebound from the lower level. However, MACD which illustrated bearish momentum suggests the pair undergoes a technical correction in the short term,

Resistance level: 0.8985, 0.9040

Support level: 0.8940, 0.8870

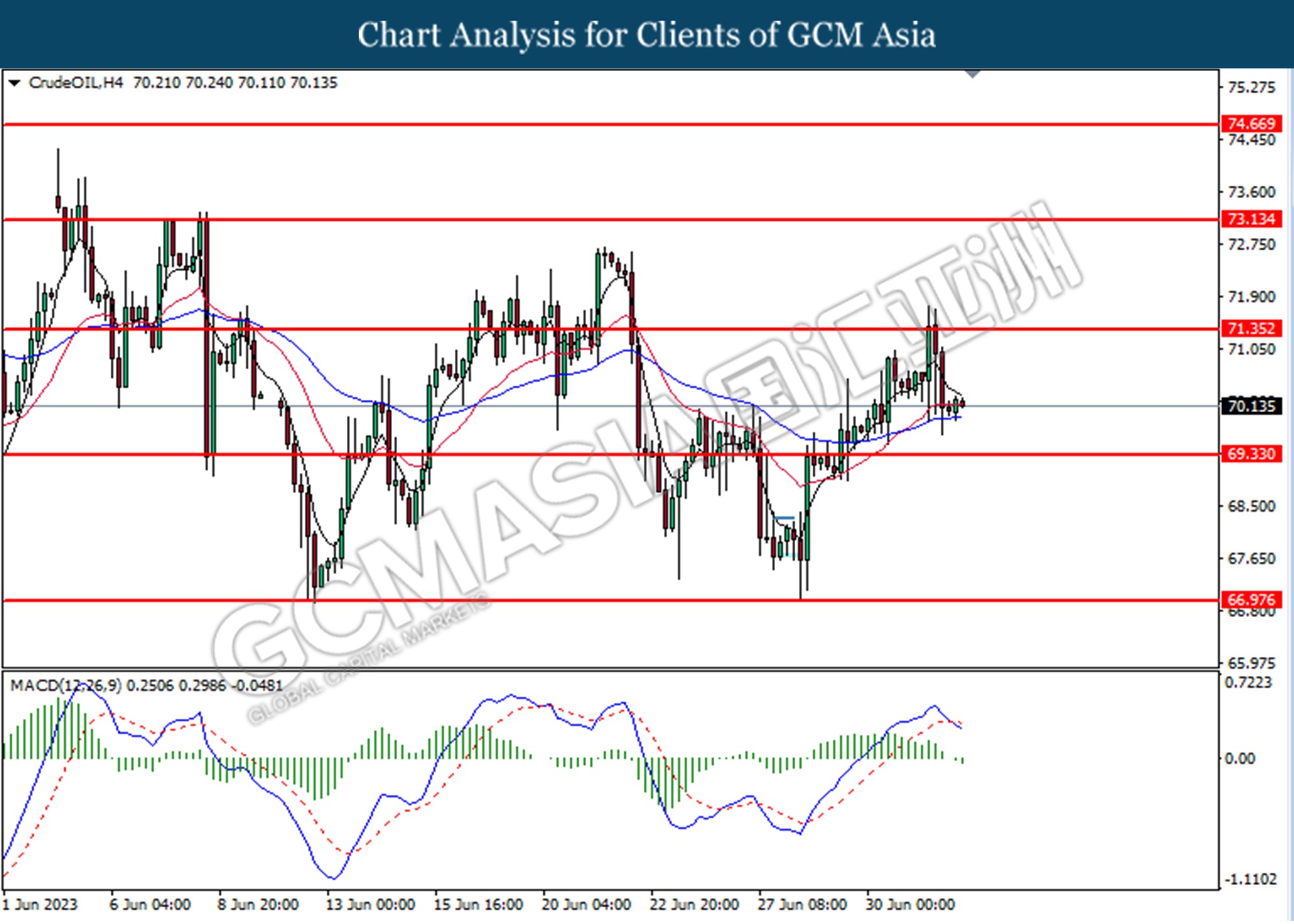

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the lower level. However, MACD which illustrated increasing bearish momentum suggests the commodity undergoes a technical correction in the short term.

Resistance level: 71.35,73.15

Support level: 69.30, 67.55

GOLD_, H4: Gold price was traded higher following the prior rebound from the lower level. MACD which illustrated bullish momentum suggests the commodity extended its gains toward the resistance level at 1933.05.

Resistance level: 1933.05, 1946.60

Support level: 1913.00, 1895.10