04 July 2023 Morning Session Analysis

Greenback plunged as US manufacturing sector contracted.

The dollar index, which was traded against a basket of six major currencies, failed to revive from the losses in previous trading session as the US manufacturing sector showed further sign of contraction in June. According to the Institute for Supply Management (ISM, the US Manufacturing PMI dropped from the prior month reading of 46.9 to 46.0 this month, missing the consensus forecast at 47.2, marking the 8th consecutive month below the benchmark of 50. Besides, it also showed that the economic activity in the US manufacturing sector continued to contract at an accelerating pace, reaching the levels last seen during the initial outbreak of Covid-19. Manufacturing, which accounts for 11.1% of the economy, showed a sign of weakening in the month of June mainly due to weaker demand with the backdrop higher borrowing cost. At this point in time, the market participants are not only waiting for the other major economic data such as Nonfarm Payrolls but also the FOMC meeting minutes in order to scrutinize the further direction of the currency. As of writing, the dollar index edged up by 0.06% to 102.97.

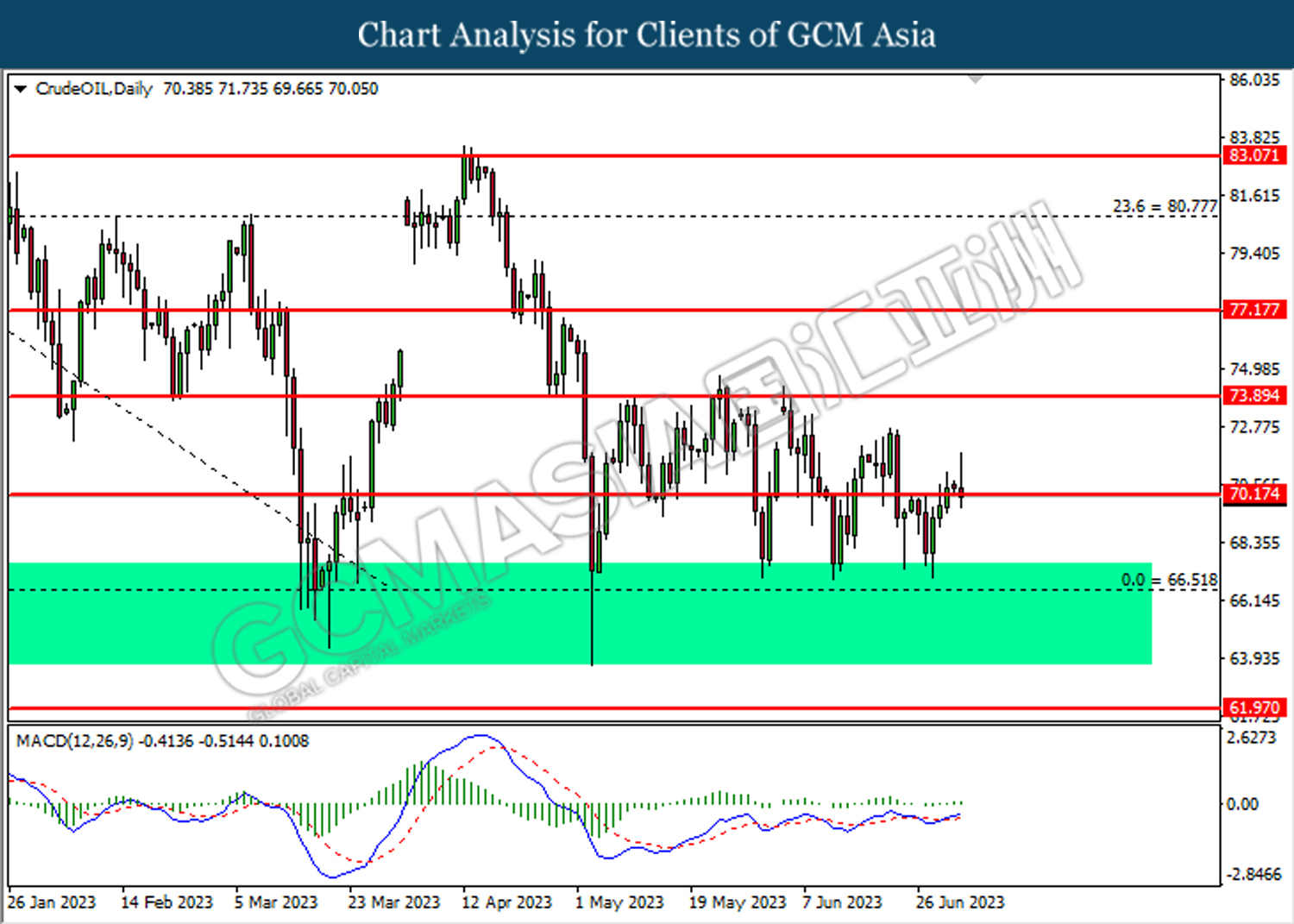

In the commodities market, crude oil prices appreciated by 0.67% to $70.10 per barrel as Saudi Arabia would extend its voluntary oil cut plan that it announced in June through at least August. Besides, the gold prices ticked up by 0.01% to $1921.50 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

All Day USD Independence Day

Today’s Highlight Events

Time Market Event

12:30 AUD RBA Rate Statement

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 12:30 | AUD – RBA Interest Rate Decision (Jul) | 4.10% | 4.35% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the resistance level at 103.00. However, MACD which illustrated diminishing bearish momentum suggests the index to undergo technical correction in short term.

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

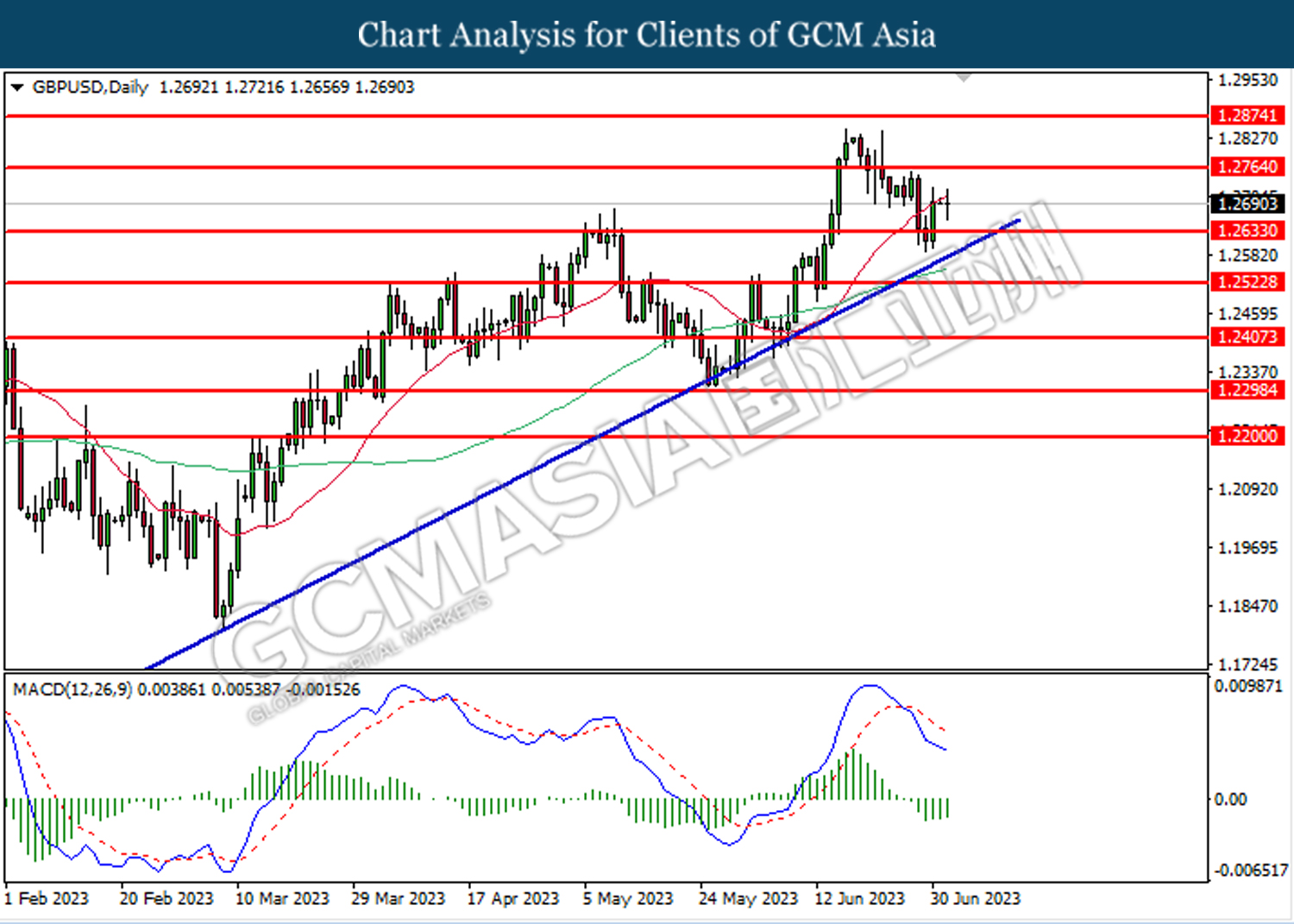

GBPUSD, Daily: GBPUSD was traded higher following the prior rebound from the support level at 1.2635. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2765.

Resistance level: 1.2765, 1.2875

Support level: 1.2635, 1.2525

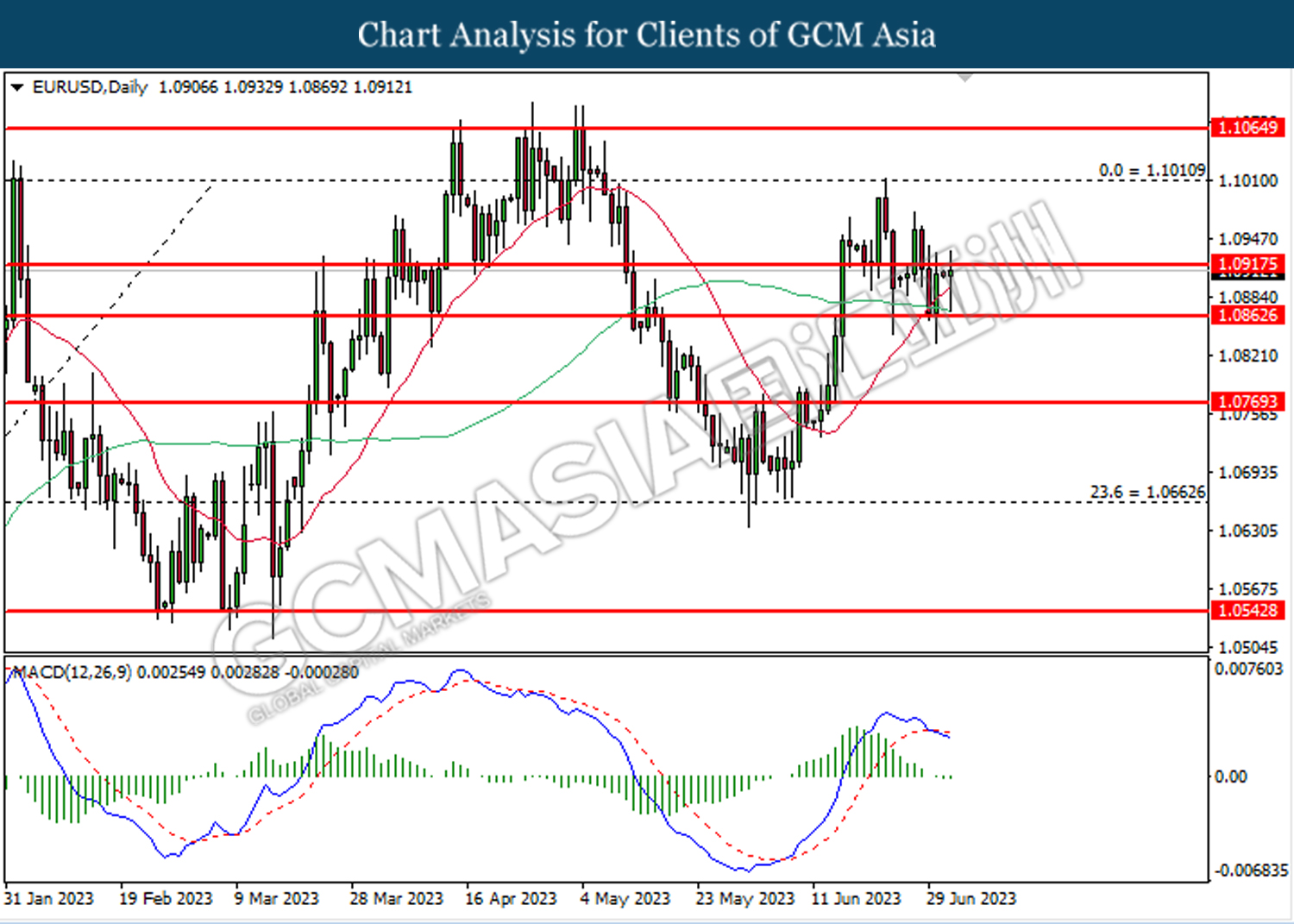

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0915. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.0915, 1.1010

Support level: 1.0865, 1.0770

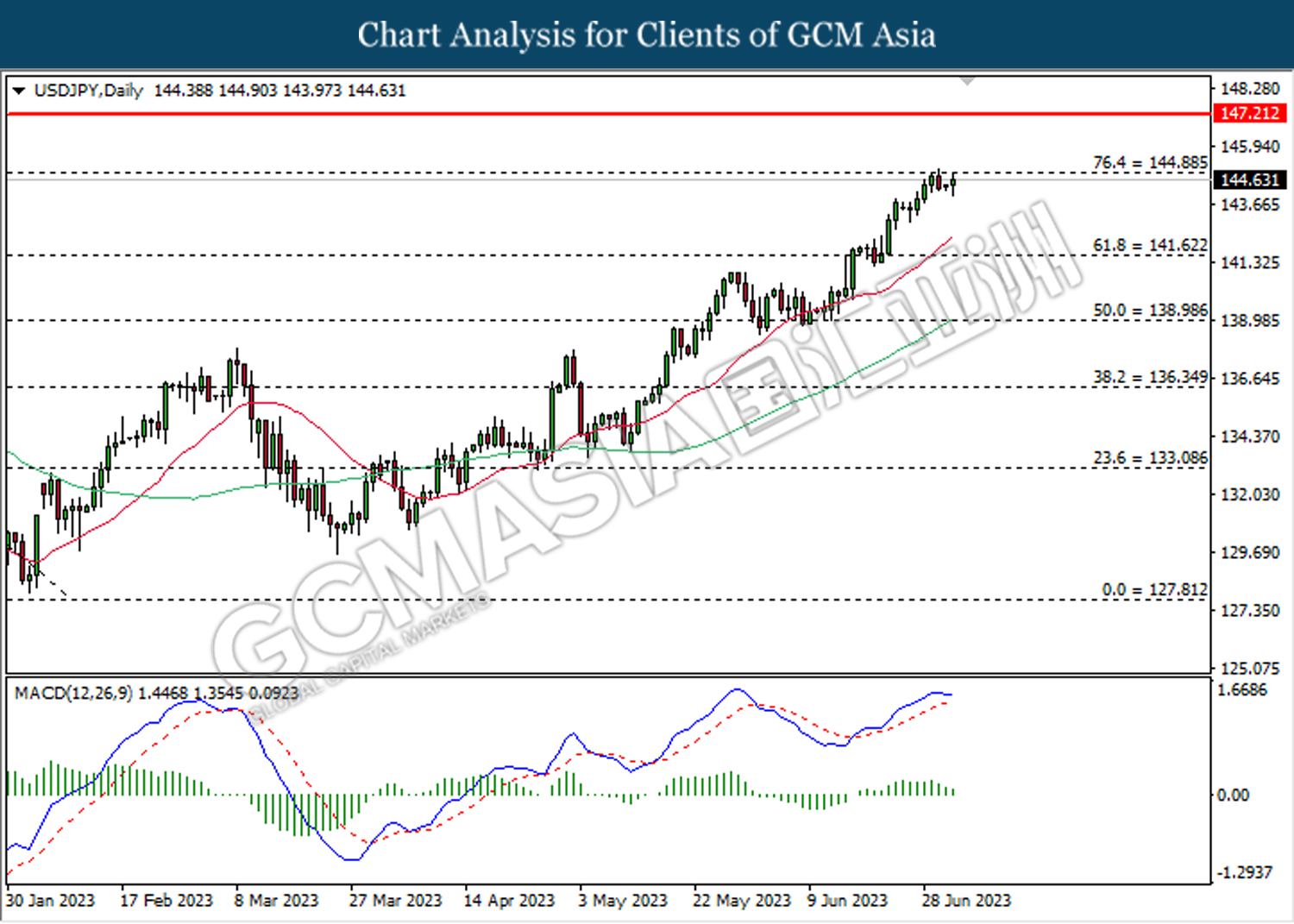

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 144.90. However, MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 141.60.

Resistance level: 144.90, 147.20

Support level: 141.60, 139.00

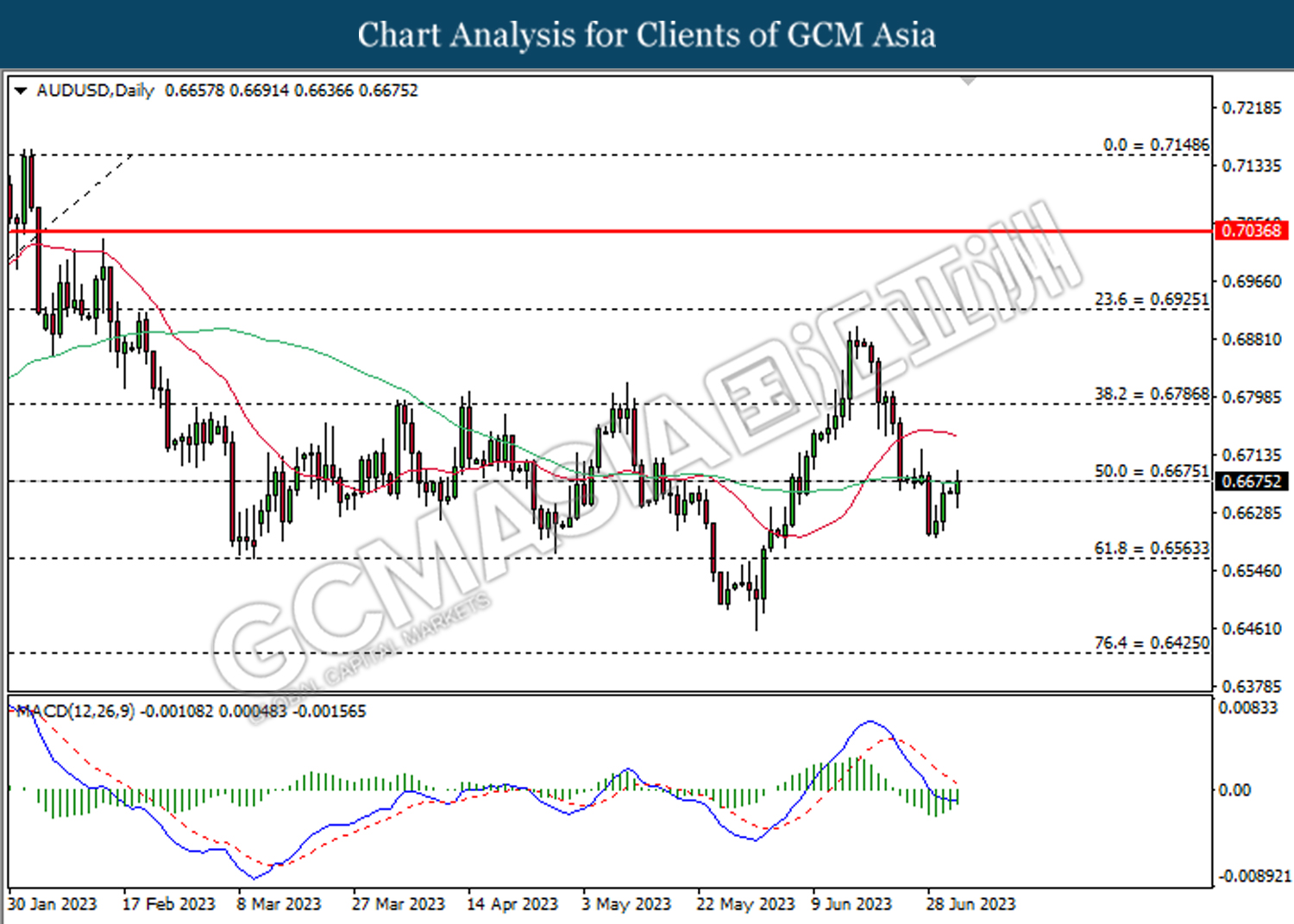

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6675. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6675.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

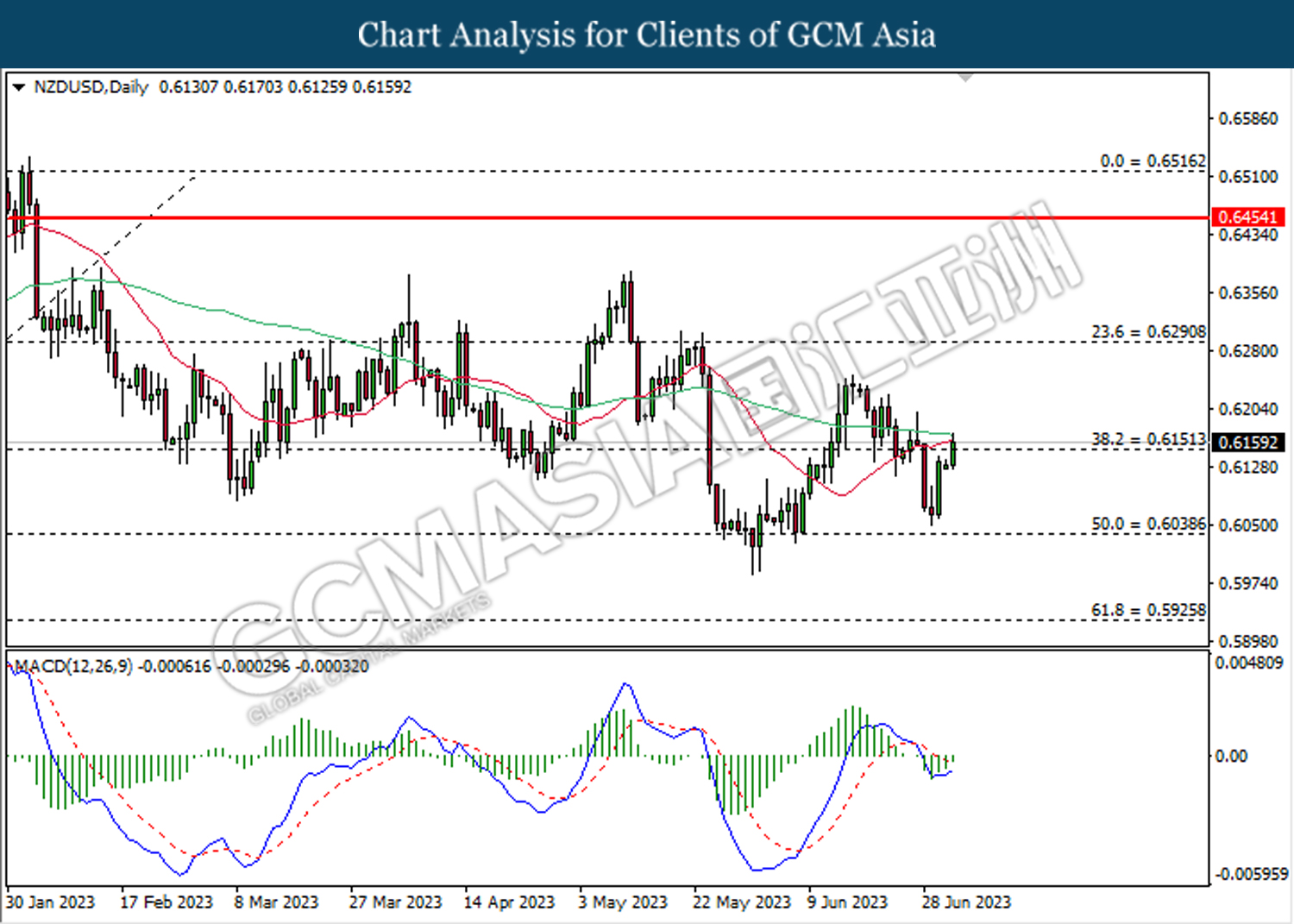

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6150. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6150.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

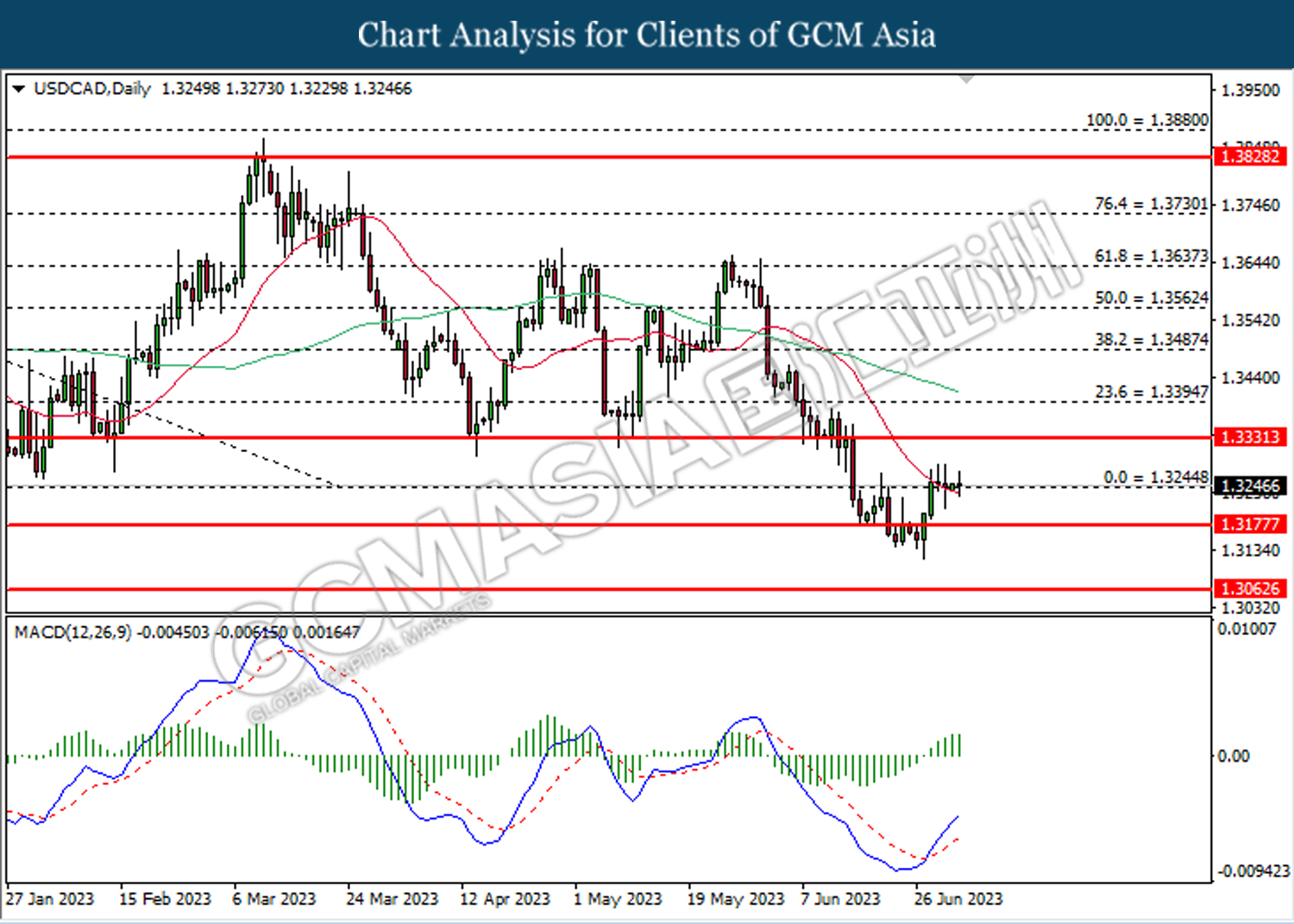

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3245. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3245, 1.3330

Support level: 1.3175, 1.3065

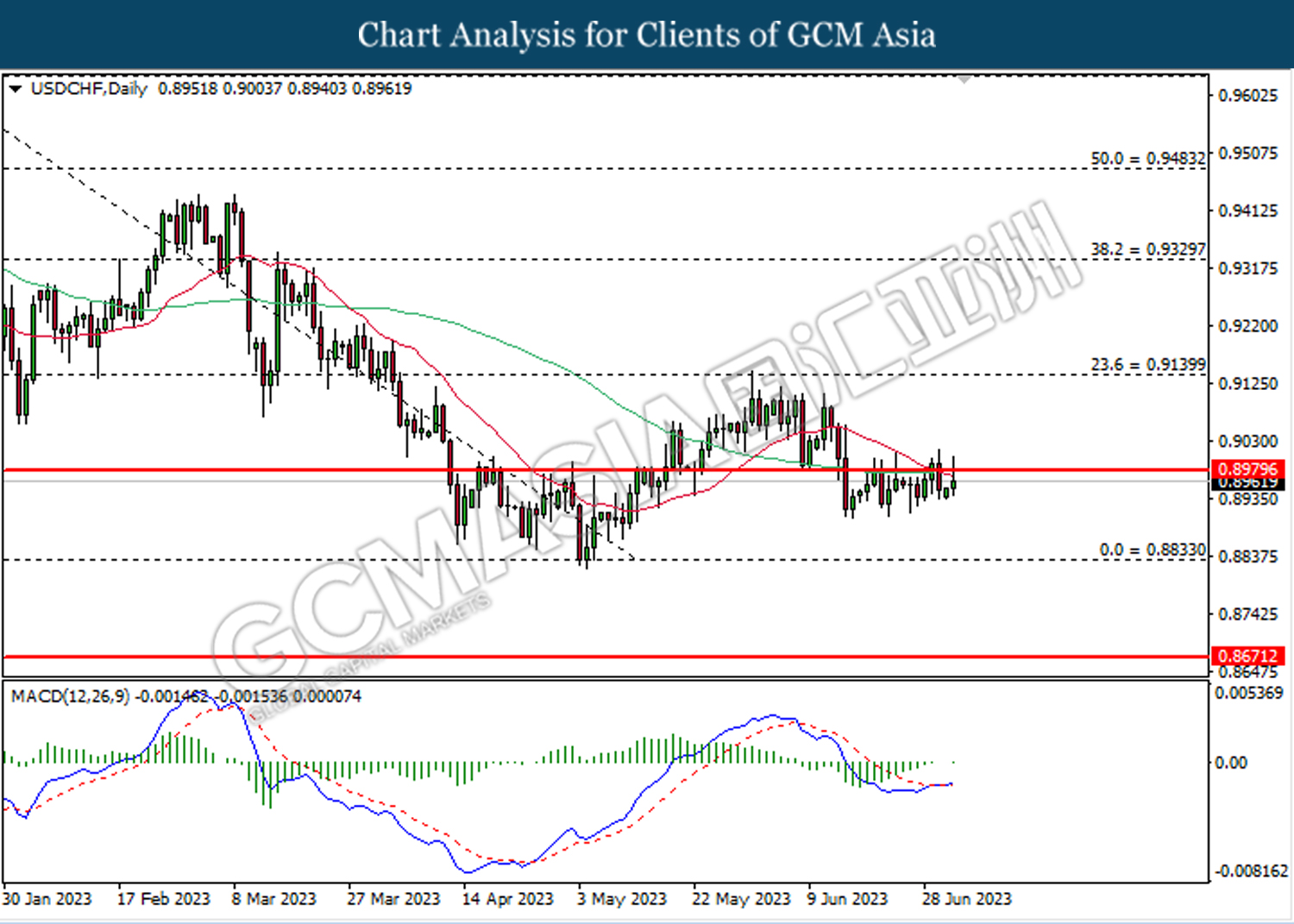

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.8980. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.8980, 0.9140

Support level: 0.8830, 0.8670

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 70.15. However, MACD which illustrated bullish bias momentum suggest the commodity to undergo technical correction in short term.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

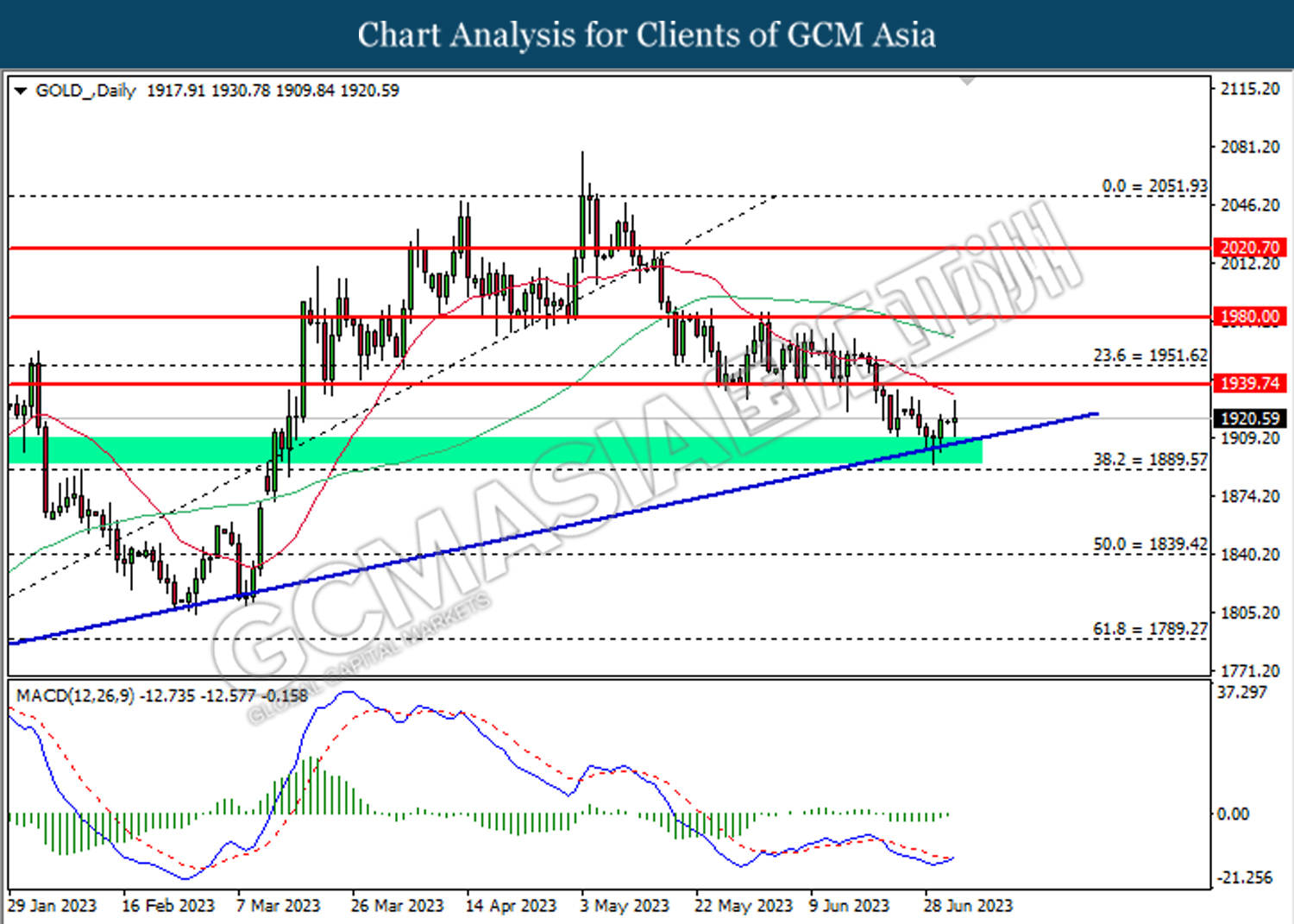

GOLD_, Daily: Gold price was traded higher following the prior rebound from the upward trend line. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 1939.75.

Resistance level: 1939.75, 1951.60

Support level: 1889.55, 1839.40