4 November 2022 Afternoon Session Analysis

Pound slumped as the economic outlook ‘remains challenging’.

The Pound Sterling, which is widely traded by global investors, lost its ground yesterday as the Bank of England (BoE) gave a dovish stance regarding the UK economic outlook. In the meeting, BoE raised interest rates to 3% from 2.25%, its biggest rate rise since 1989. Besides, the central bank forecasts inflation will hit a 40-year high of around 11% during the current quarter, but that Britain has already entered a recession that could potentially last two years – longer than during the 2008-09 financial crisis. With such a pessimistic view, the pound sold off by the market participants tremendously despite a 75-basis point of rate hike. Moreover, the fundamental problems facing the British economy remain. In September, the consumer price inflation returned to a 40-year high of 10.1%, and is likely to have risen further last month as the energy prices in UK rose. On the other side, the new UK government is still restructuring their long-term plan to calm down the market uncertainty as well as regaining the confidence of the residents. As of writing, the pair of GBP/USD rose 0.39% to 1.1210.

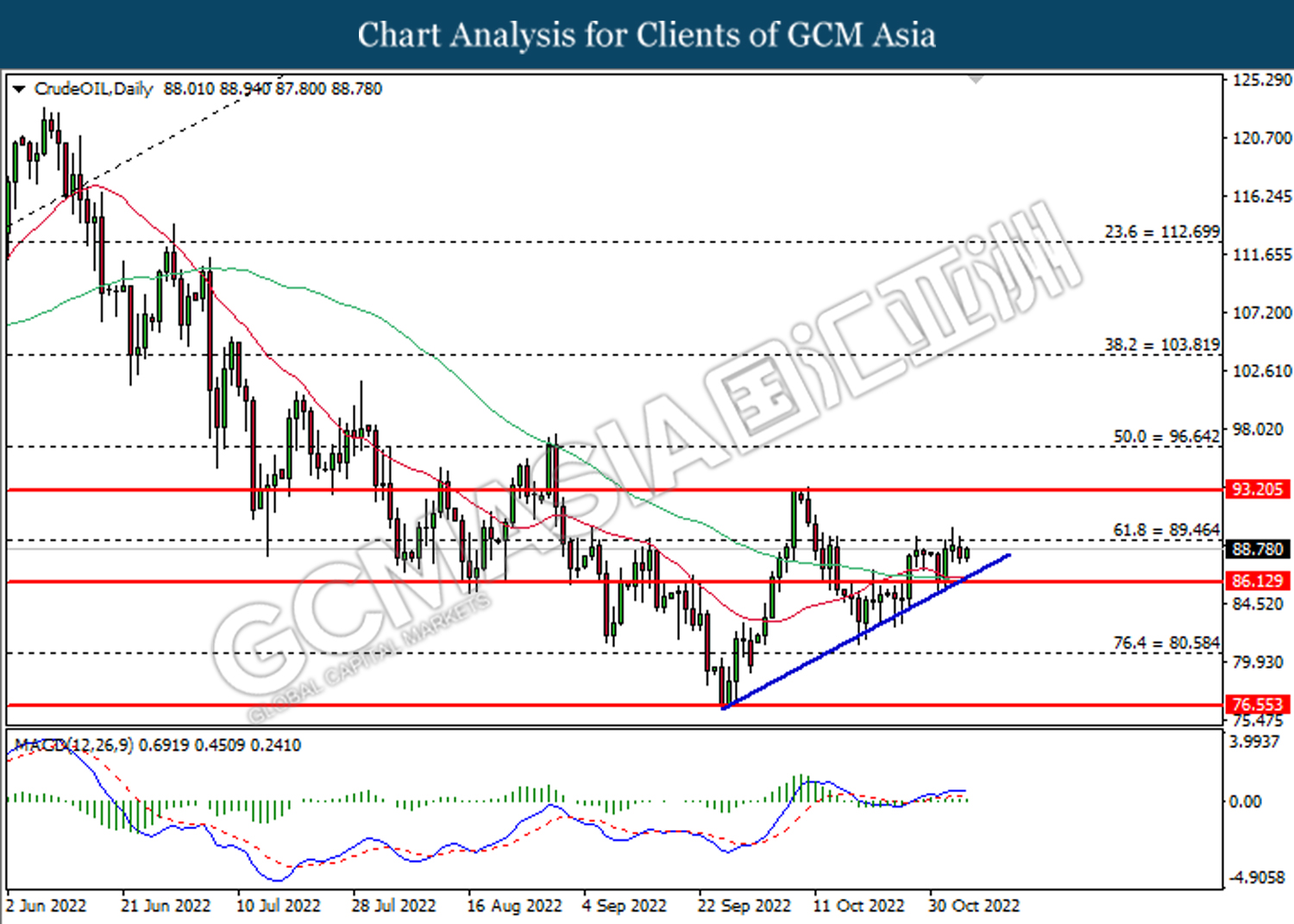

In the commodities market, the crude oil price edged up by 1.03% to $88.90 per barrel as the drop in dollar index value urged the crude oil to regain the luster. Besides, the gold price rose by 0.55% to $1638.25 per troy ounce following the slight retracement in the US dollar market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:30 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Construction PMI (Oct) | 52.3 | 48.0 | – |

| 20:30 | USD – Nonfarm Payrolls (Oct) | 263K | 200K | – |

| 20:30 | USD – Unemployment Rate (Oct) | 3.5% | 3.6% | – |

| 20:30 | CAD – Employment Change (Oct) | 21.1K | 5.0K | – |

| 22:00 | CAD – Ivey PMI (Oct) | 59.5 | – | – |

Technical Analysis

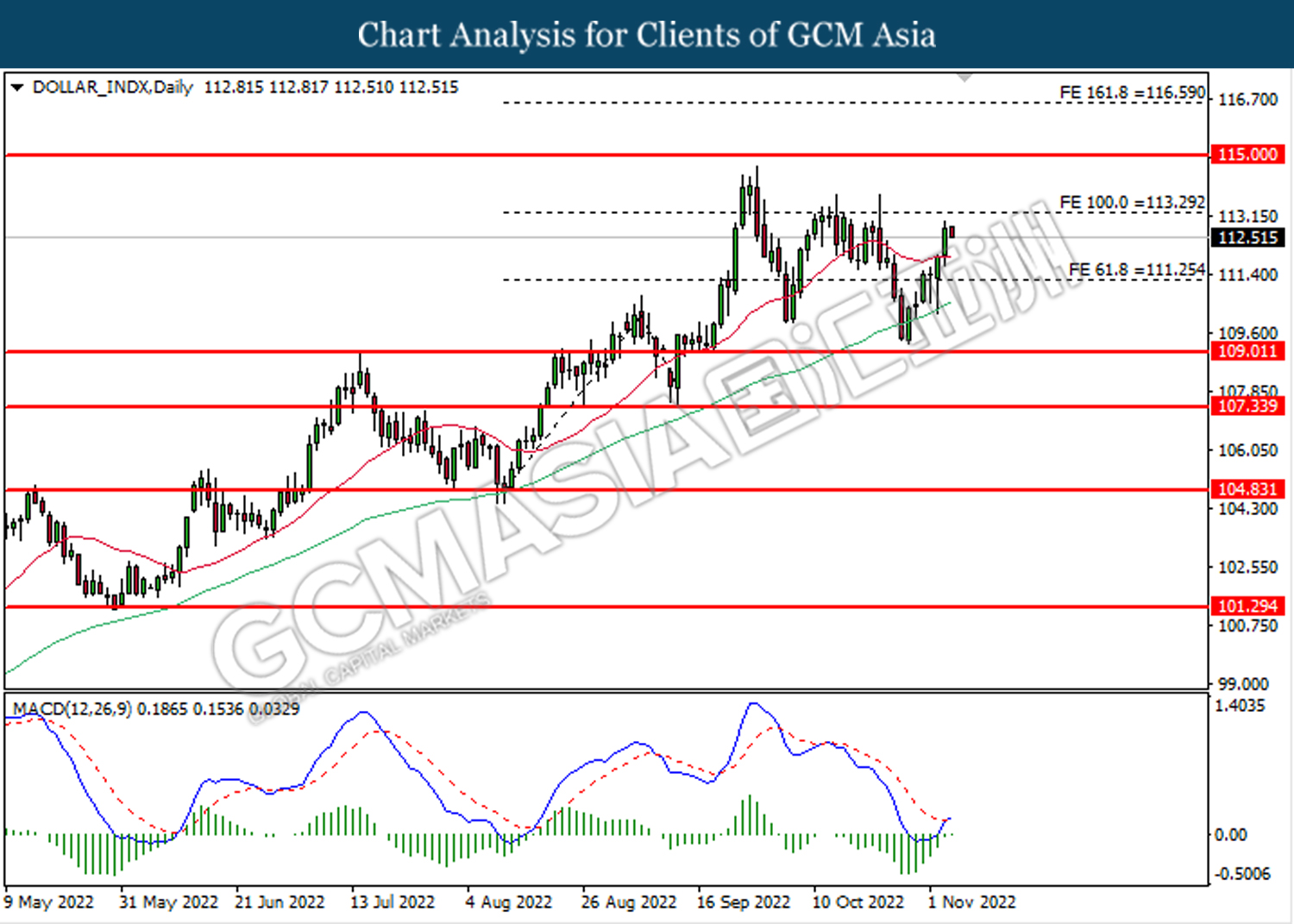

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level at 111.25. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 113.30.

Resistance level: 113.30, 115.00

Support level: 111.25, 109.00

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.1175. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1290, 1.1445

Support level: 1.1175, 1.0950

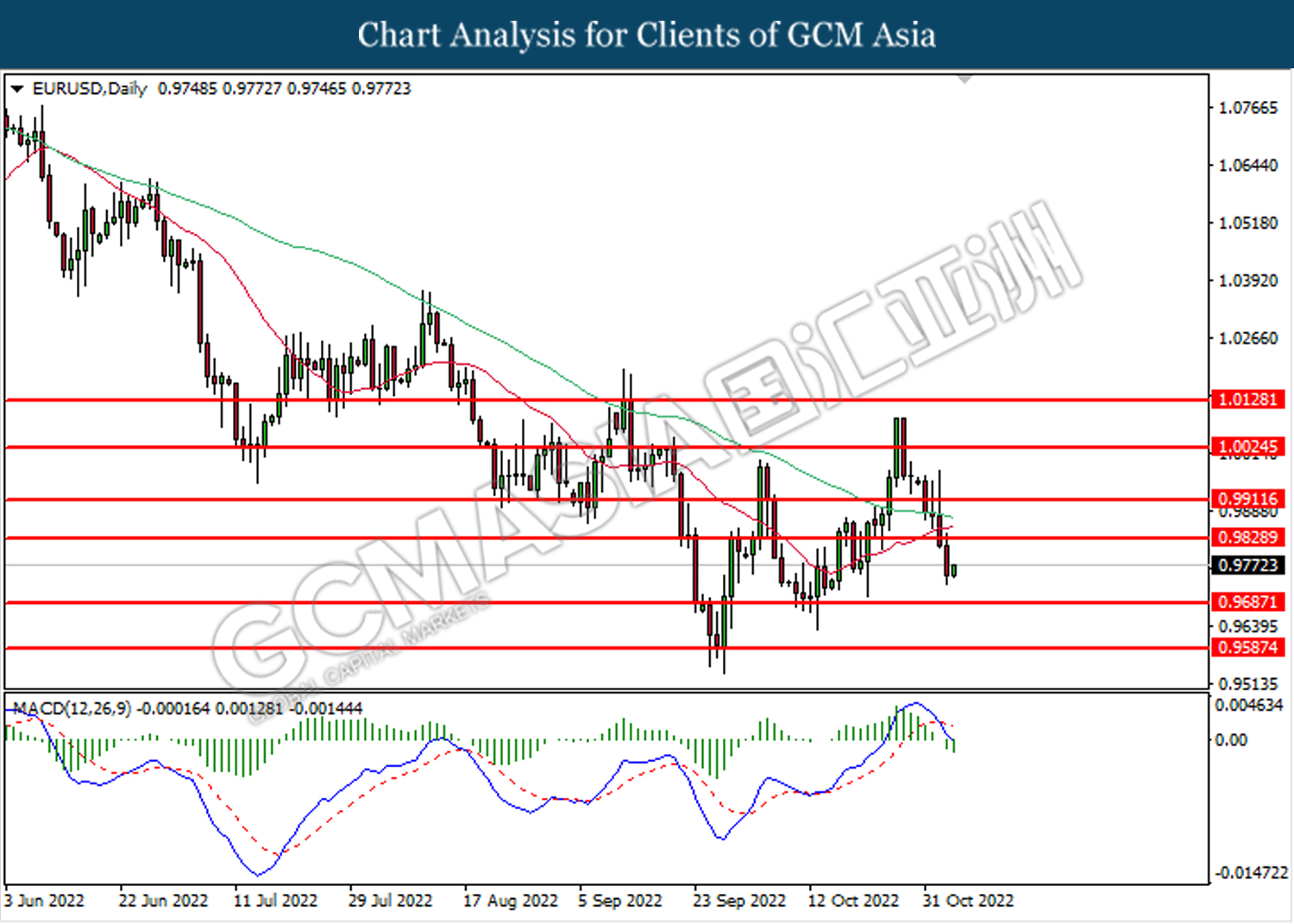

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 0.9830. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.9685.

Resistance level: 0.9830, 0.9910

Support level: 0.9685, 0.9585

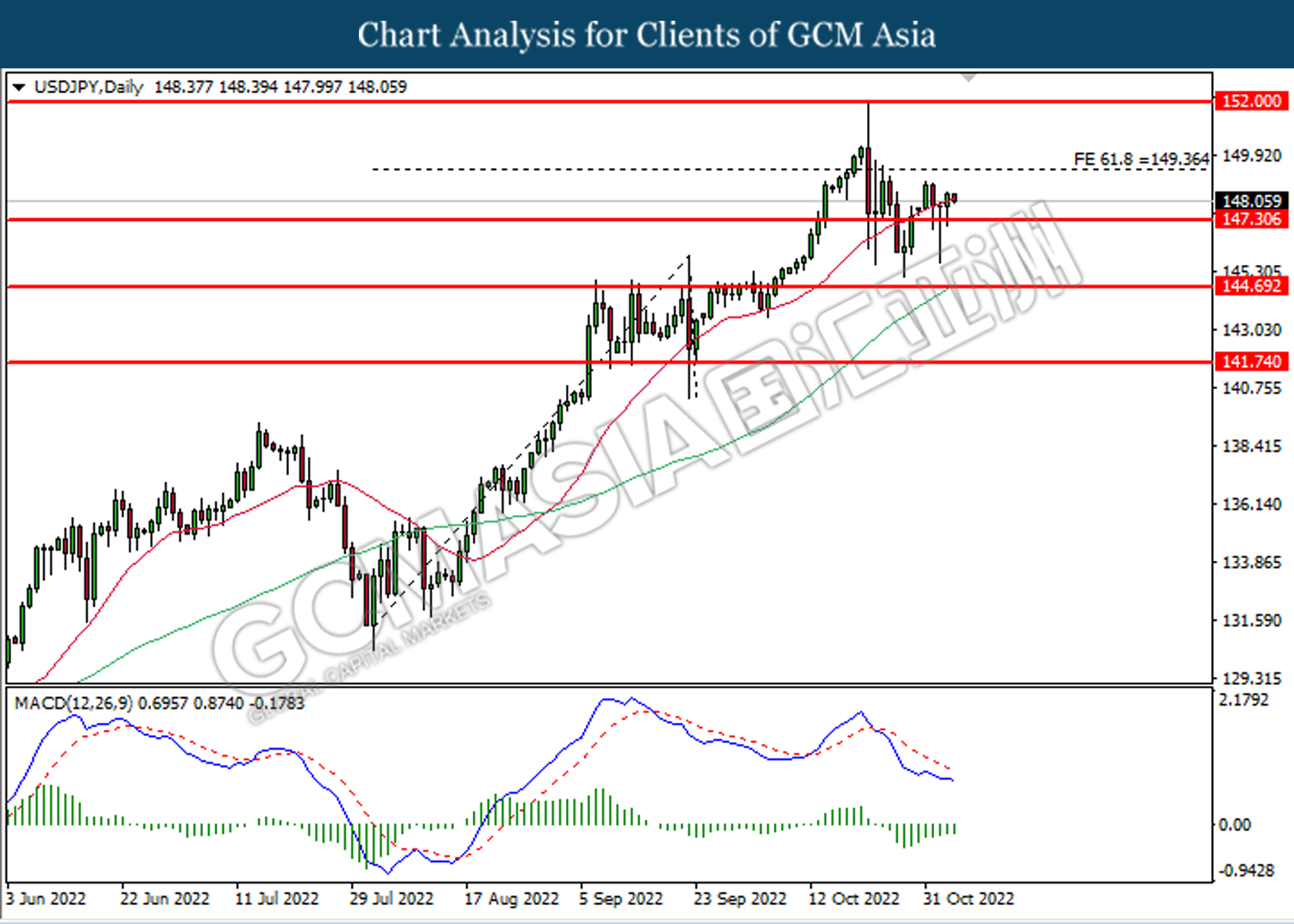

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 147.30. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 149.35.

Resistance level: 149.35, 152.00

Support level: 147.30, 144.70

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6285. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6400, 0.6530

Support level: 0.6285, 0.6165

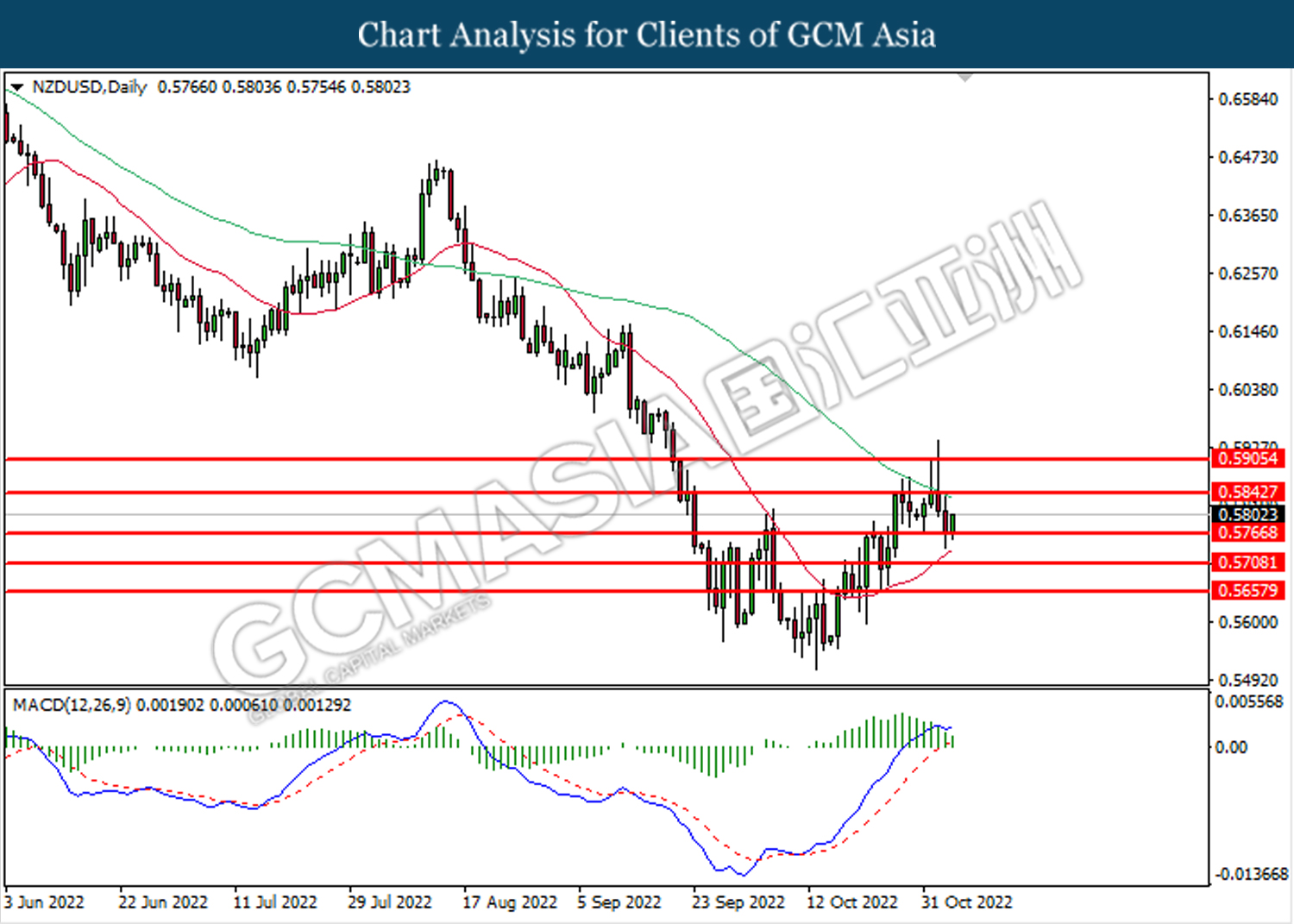

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.5765. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.5845.

Resistance level: 0.5845, 0.5905

Support level: 0.5765, 0.5710

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level at 1.3715. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3875.

Resistance level: 1.3875, 1.4000

Support level: 1.3715, 1.3600

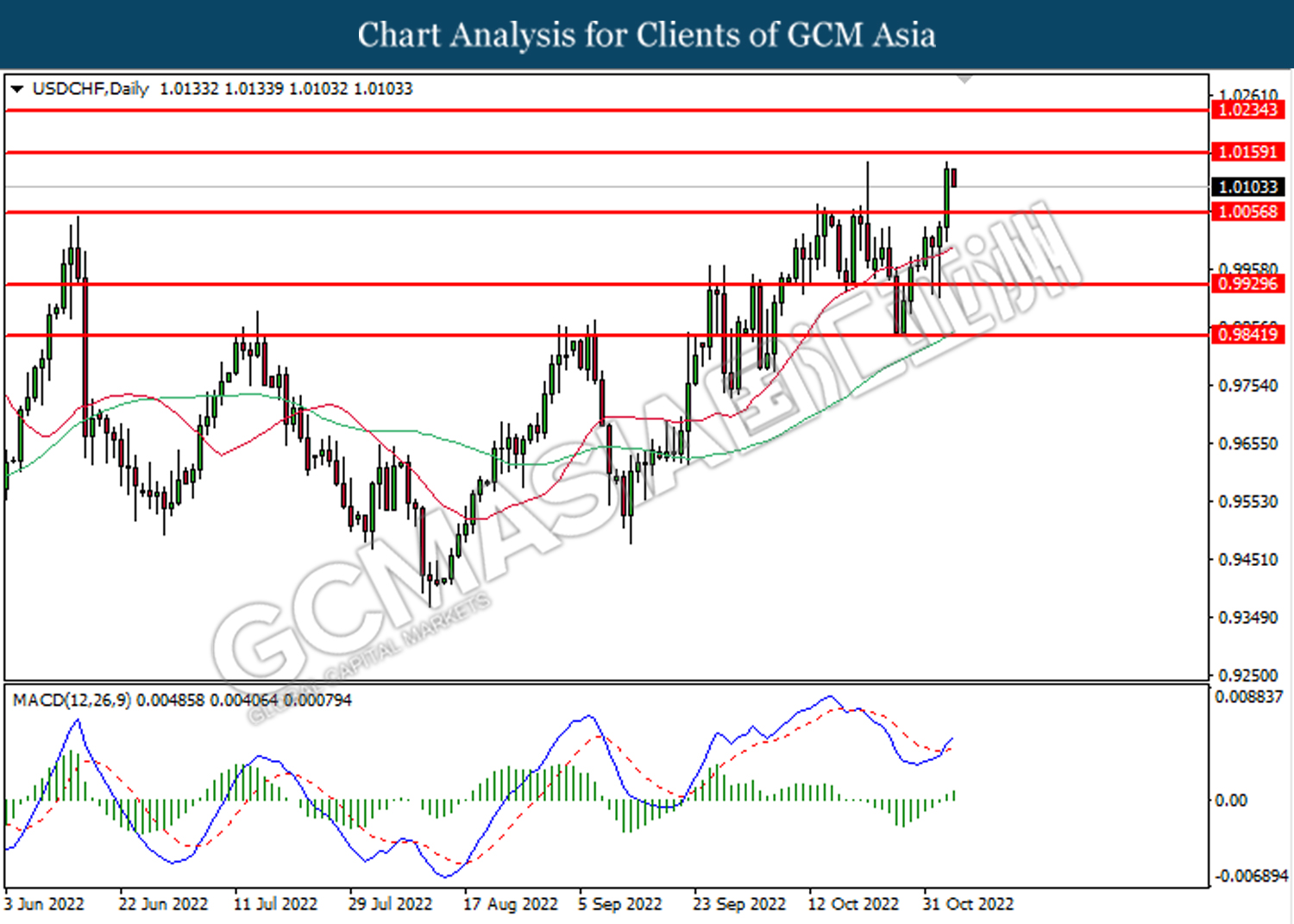

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 1.0055. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0055.

Resistance level: 1.0155, 1.0235

Support level: 1.0055, 0.9930

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 89.45. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 89.45, 93.20

Support level: 86.15, 80.60

GOLD_, Daily: Gold price was traded lower while testing near the support level at 1627.60. Due to lack of signal from MACD, it is suggested to wait for further confirmation before entering into the market.

Resistance level: 1661.40, 1693.35

Support level: 1627.60, 1600.00