4 November 2022 Morning Session Analysis

US Dollar bulls continued upon aggressive rate hike expectations.

The Dollar Index which traded against a basket of six major currencies rose significantly on yesterday, which leading by the hawkish statement from Fed. In the early Thursday, Federal Reserve Chairman Jerome Powell signaled that the US interest rates would likely to peak at a higher level than markets expected, causing the US 10-Year Treasury Yield to surge. Yesterday, the treasury yield rose as high as 4.189%, leading the investors to shift their capitals toward US Dollar. On the economic data front, the upbeat employment data has extended the gains of Dollar Index. According to the US Department of Labor, the US Initial Jobless Claims notched down from the previous reading of 218K to 217K, missing the consensus forecast of 220K. The lower-than-prior figure of the data has shown that the diminishing of unemployment rate, while it provide a positive economic outlook for the US economy. As of now, market participants would highly eye on the announcement of crucial employment data —- the US Nonfarm Payrolls and Unemployment Rate in order to gauge the likelihood movement of US Dollar. As of writing, the Dollar Index edged down by 0.06% to 112.79.

In the commodities market, the crude oil price depreciated by 0.31% to $87.85 per barrel as of writing, as the rate hike from Fed and BoE would likely to weigh down the market demand for oil. On the other hand, the gold price appreciated by 0.17% to $1631.15 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:30 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Construction PMI (Oct) | 52.3 | 48.0 | – |

| 20:30 | USD – Nonfarm Payrolls (Oct) | 263K | 200K | – |

| 20:30 | USD – Unemployment Rate (Oct) | 3.5% | 3.6% | – |

| 20:30 | CAD – Employment Change (Oct) | 21.1K | 5.0K | – |

| 22:00 | CAD – Ivey PMI (Oct) | 59.5 | – | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 113.15, 114.50

Support level: 111.55, 109.95

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1370, 1.1635

Support level: 1.1165, 1.0940

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9810, 0.9905

Support level: 0.9730, 0.9650

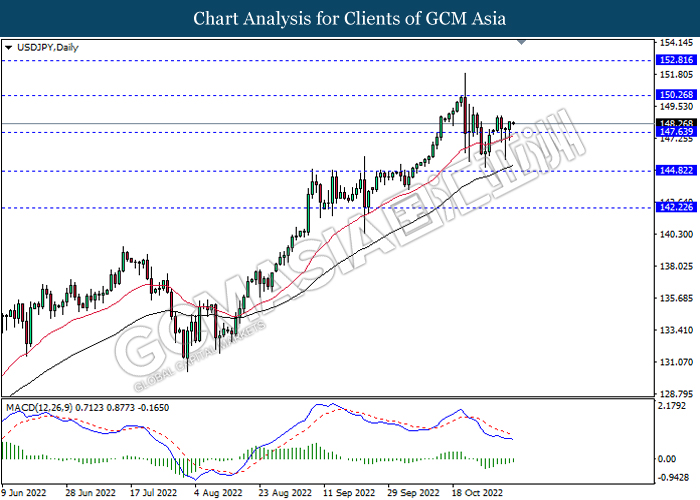

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 150.25, 152.80

Support level: 147.65, 144.80

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6370, 0.6470

Support level: 0.6265, 0.6170

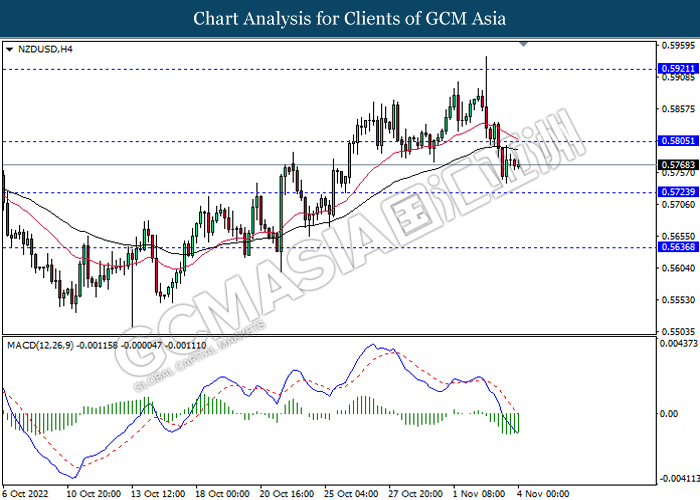

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.5805, 0.5920

Support level: 0.5725, 0.5635

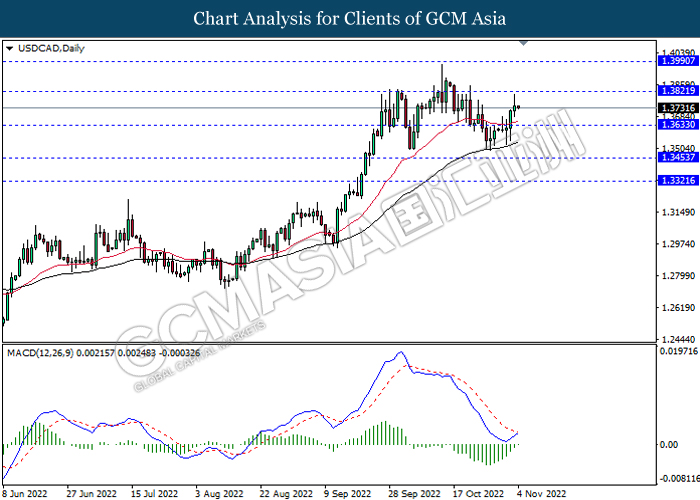

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3820, 1.3990

Support level: 1.3635, 1.3455

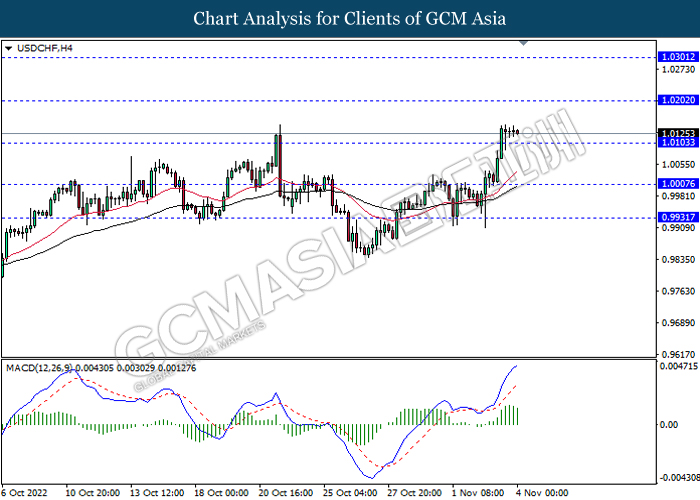

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0200, 1.0300

Support level: 1.0105, 1.0005

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 89.00, 92.50

Support level: 86.05, 82.45

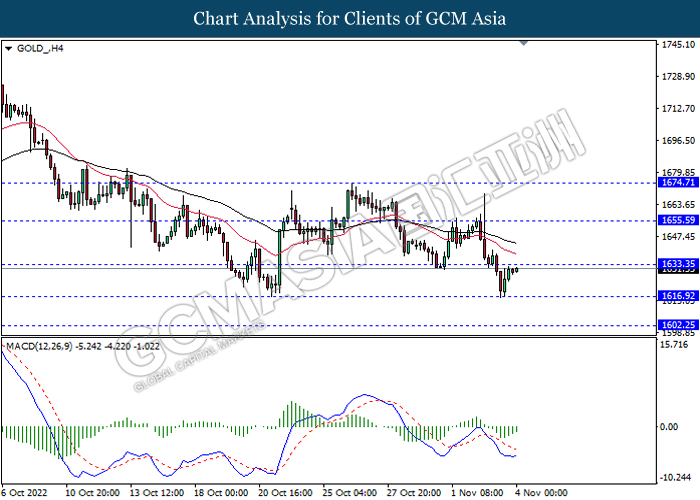

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1633.35, 1655.60

Support level: 1616.90, 1602.25