5 January 2023 Morning Session Analysis

Dollar jumped amid hawkish Fed minutes and hot labor data.

The dollar index, which traded against a basket of mainstream currencies, managed to hold its ground following the release of the hawkish Fed minutes. In the early morning, the Greenback received some bullish momentum as the Fed minutes showed that the officials are still committed to cooldown the overheating economy by raising the interest rate higher for a period of time ahead. Additionally, the Fed policymakers also reiterated that a restrictive monetary policy would not be unfold and need to be remained for a certain time until data showed that the inflation was on a right path to their 2% long-term target. In the meeting, the Fed’s board of members agreed to increase the official cash rate by 50 basis point to the range between 4.25 – 4.5%. The intention of maintaining the restrictive monetary policy is to avoid the risk of easing too soon, which might cause the inflation to run rampantly. Prior to the release of the Fed meeting minutes, the dollar index gotten a boost from a hot labor data. According to the Bureau of Labor Statistics, the US JOLTs Job Openings came in at 10.458M, beating the consensus forecast at 10.000M, mirroring that the US labor market remain resilient while signaling that the upcoming crucial labor data such as NFP will have an upbeat result. As of writing, the dollar index edged down by -0.28% to 104.22.

In the commodities market, crude oil prices rose by 0.27% to $73.45 per barrel after falling substantially during the previous trading session amid market concerns about global demand toward the oil market with the background of soaring Covid-19 cases in China and heightening of global recession risk. Besides, gold prices edged up by 0.02% to $1854.55 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Composite PMI (Dec) | 48.2 | 48.2 | – |

| 17:30 | GBP – Services PMI (Dec) | 48.8 | 48.8 | – |

| 21:15 | USD – ADP Nonfarm Employment Change (Dec) | 127K | 127K | – |

| 21:30 | USD – Initial Jobless Claims | 225K | 225K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 107.90

Support level: 103.15, 101.25

GBPUSD, Daily: GBPUSD was traded higher following prior rebound from the support level at 1.1940. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2105.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

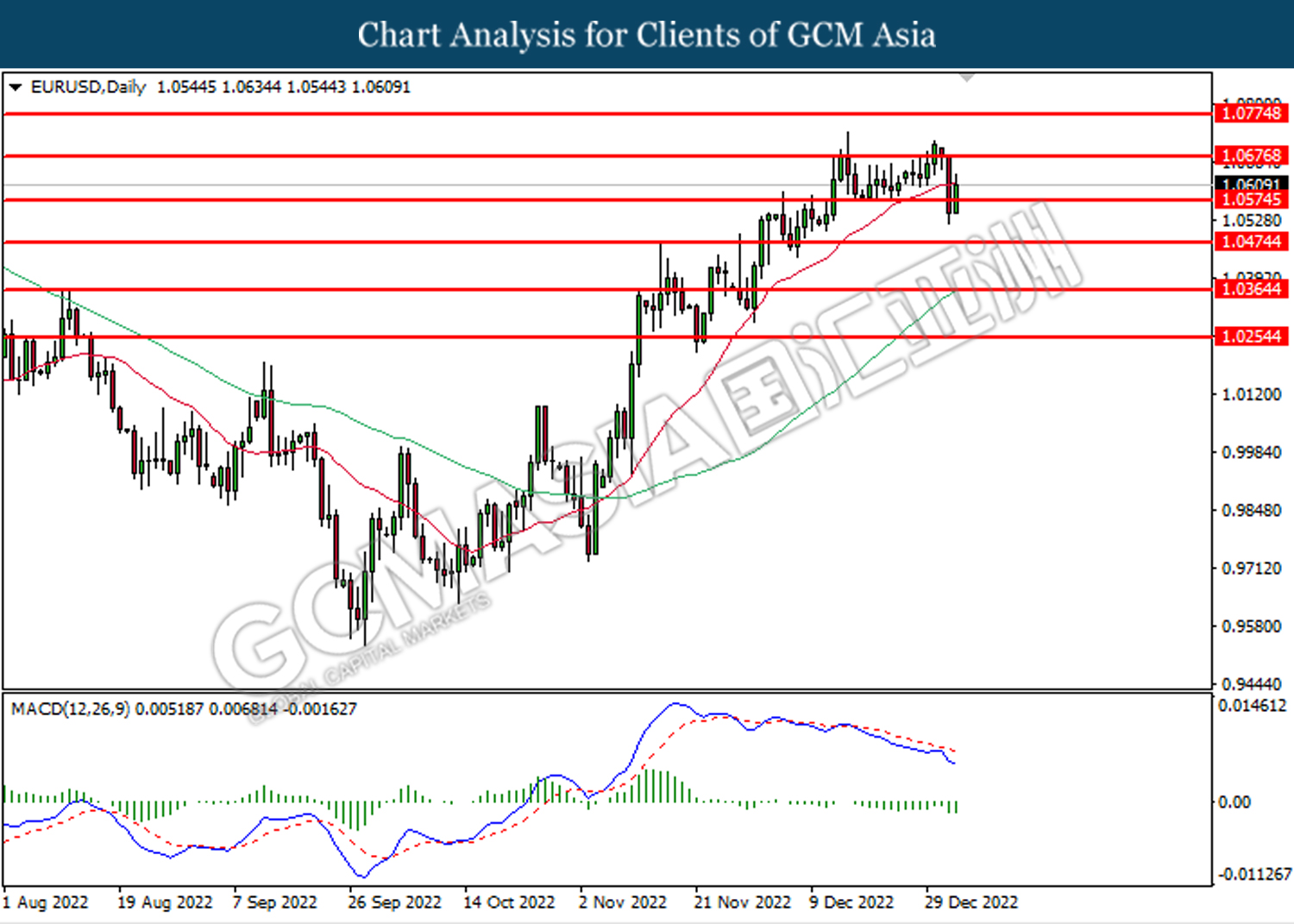

EURUSD, Daily: EURUSD was traded higher following prior rebound near the support level at 1.0575. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.0675, 1.0775

Support level: 1.0575, 1.0475

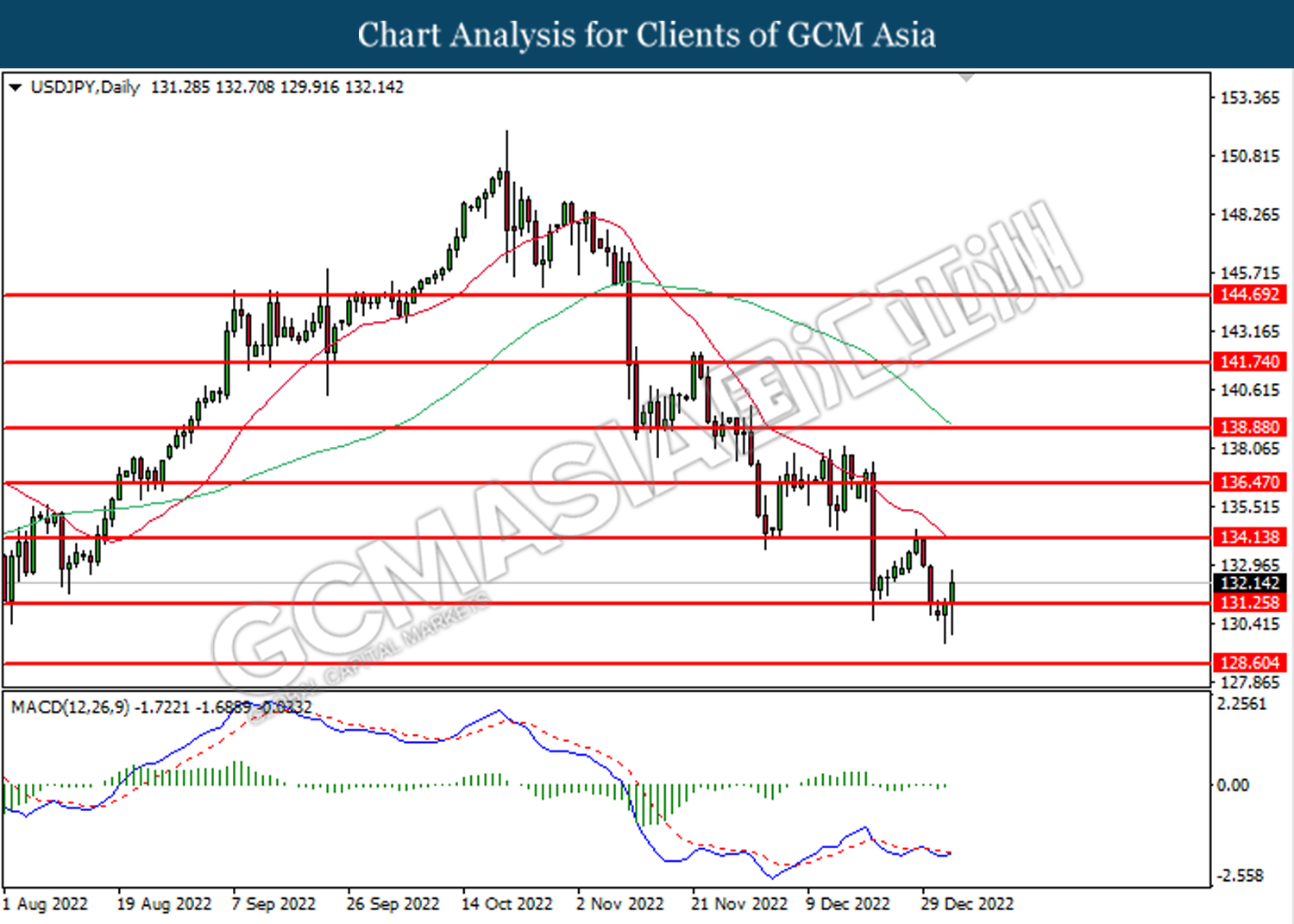

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 131.25. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 134.15.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

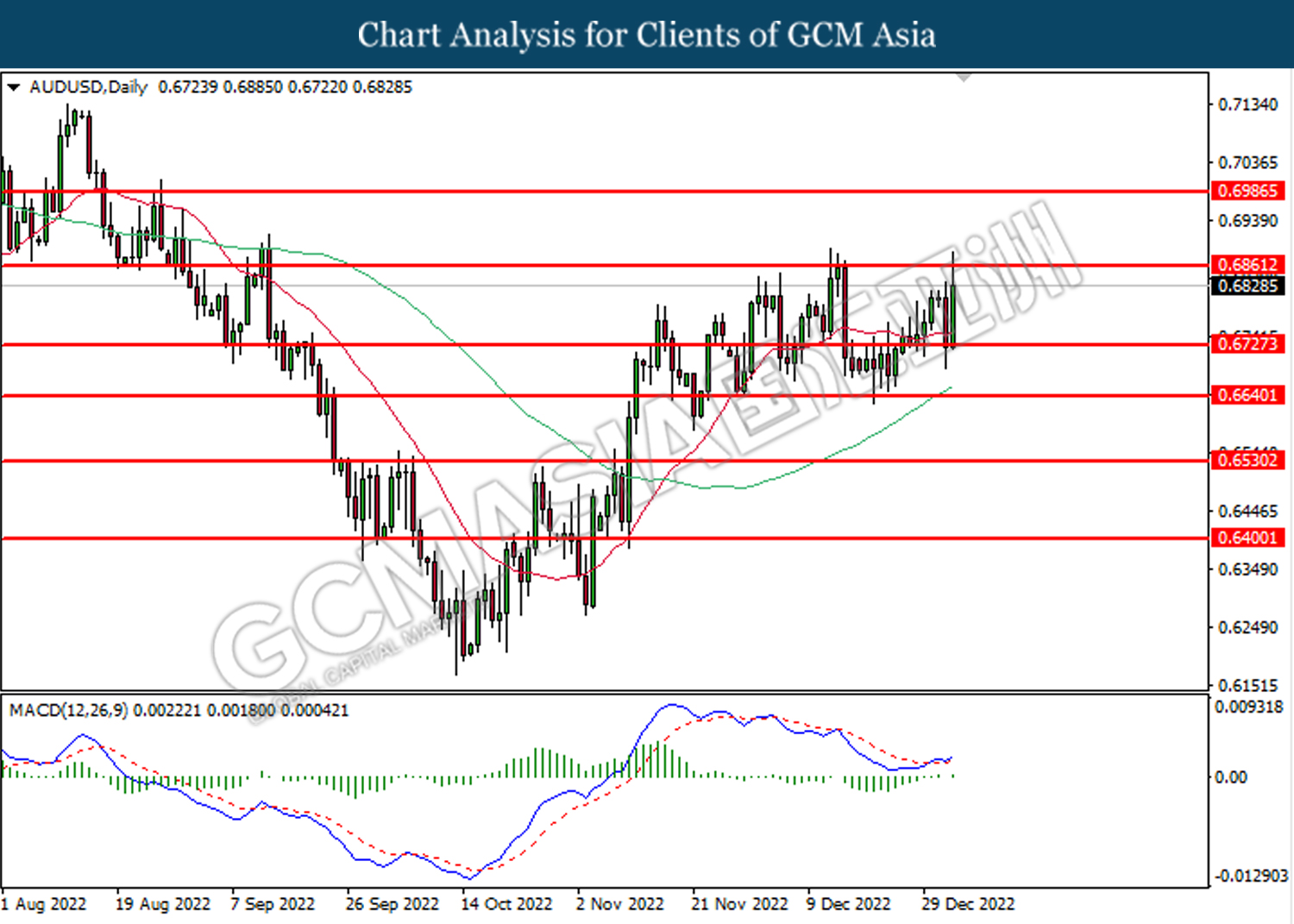

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from support level at 0.6725. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6860.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6255. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

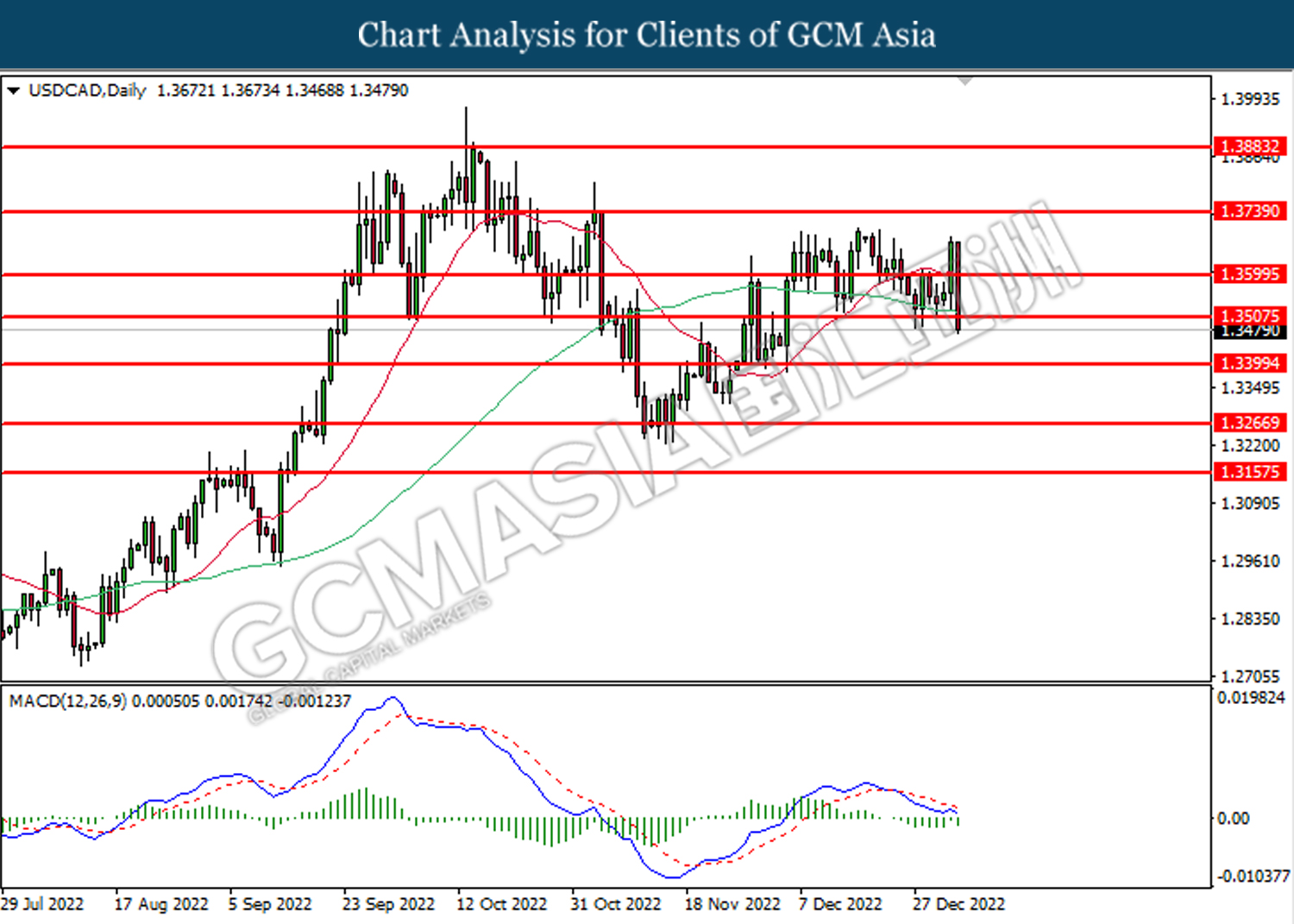

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3505. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level at 1.3505.

Resistance level: 1.3600, 1.3740

Support level: 1.3505, 1.3400

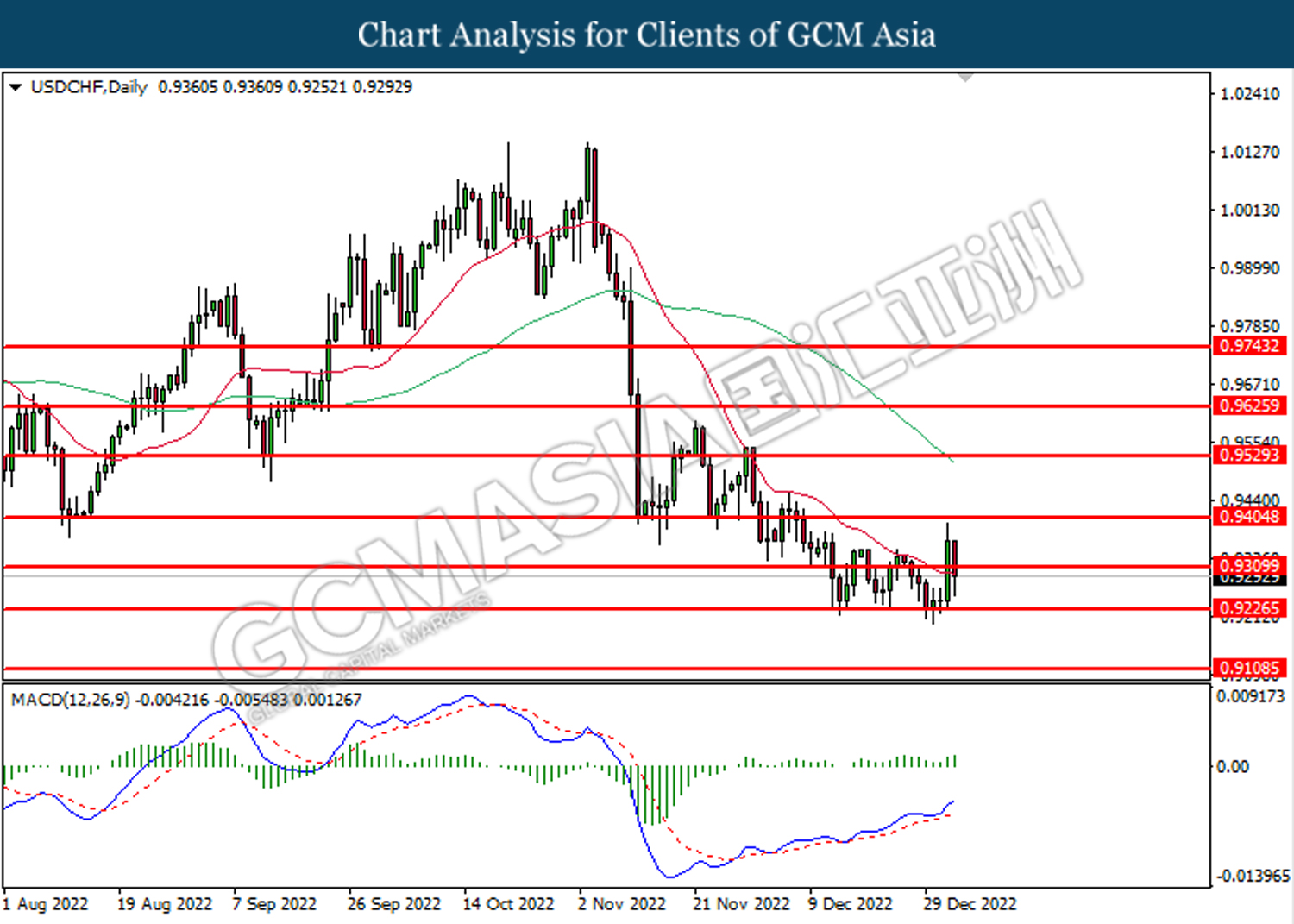

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9310. However, MACD which illustrated bullish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.9405, 0.9530

Support level: 0.9310, 0.9225

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the previous support level at 76.10. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 71.50.

Resistance level: 76.10, 81.35

Support level: 71.50, 66.10

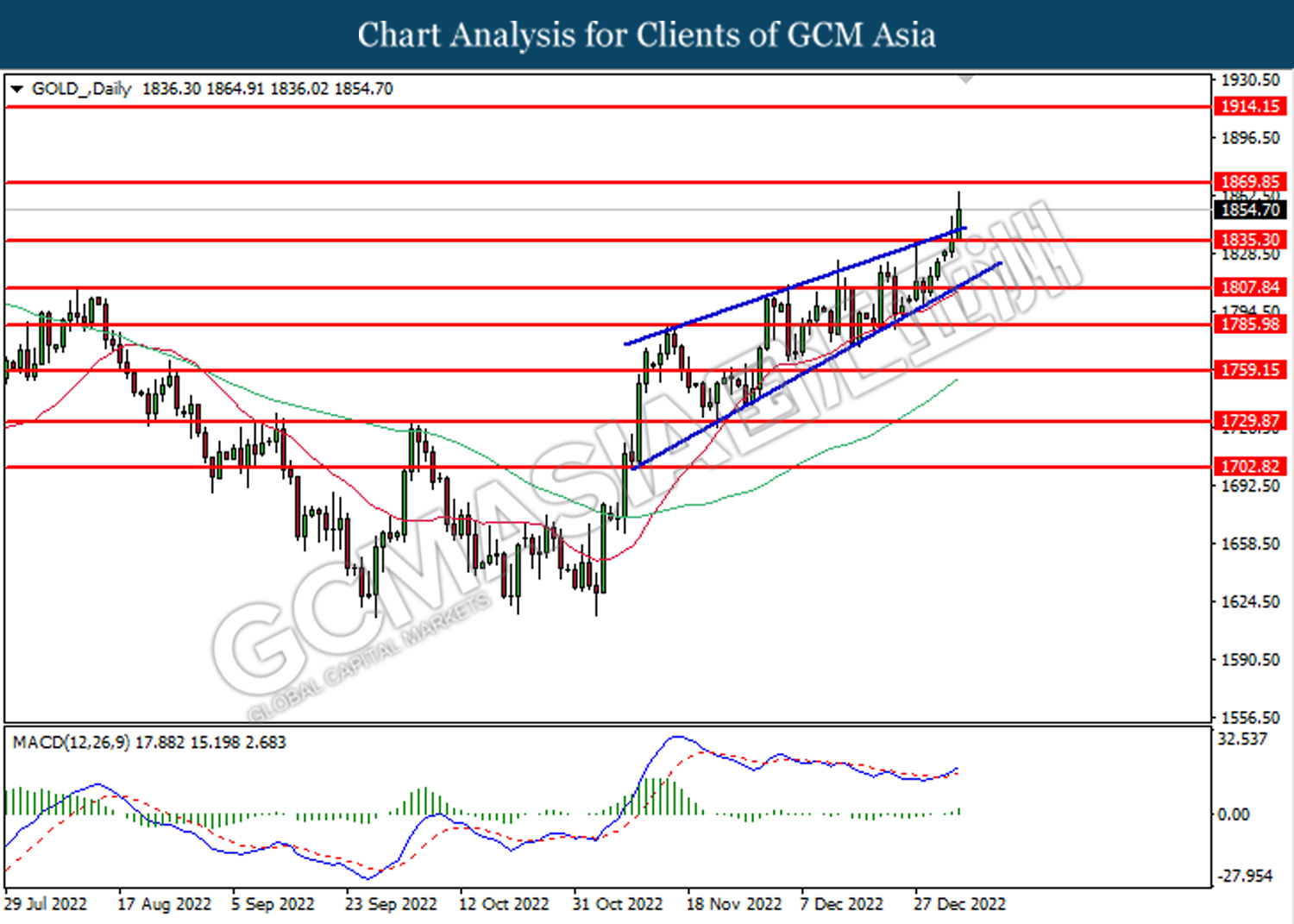

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1835.30. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1869.85.

Resistance level: 1869.85, 1914.15

Support level: 1835.30, 1807.85