5 April 2022 Afternoon Session Analysis

Euro slumped on prospect of more sanctions over Russia-Ukraine issues.

The Euro extends its losses yesterday amid escalation of Russia-Ukraine tensions continue to spur negative prospect toward the economic momentum in European region. According to Reuters, German Defense Minister Christine Lambrecht claimed that the European Union would talk about the implementation of aggressive sanction on Russia, considering to end Russian gas and oil imports from Russia. Market participants concerned that such move would have severe economic ramifications on the Eurozone, as Russia supplies more than 40% of Europe’s gas demand. Besides, French President Macron claimed that he would also support a total ban on Russia oil exports to the EU as soon as this week. The sanction would likely to increase the cost for the raw materials in the European region, affecting the company’s profit margin while sparkling significant inflation risk in future while lowering the purchasing powers of the consumer. As of writing, EUR/USD depreciated by 0.03% to 1.0977.

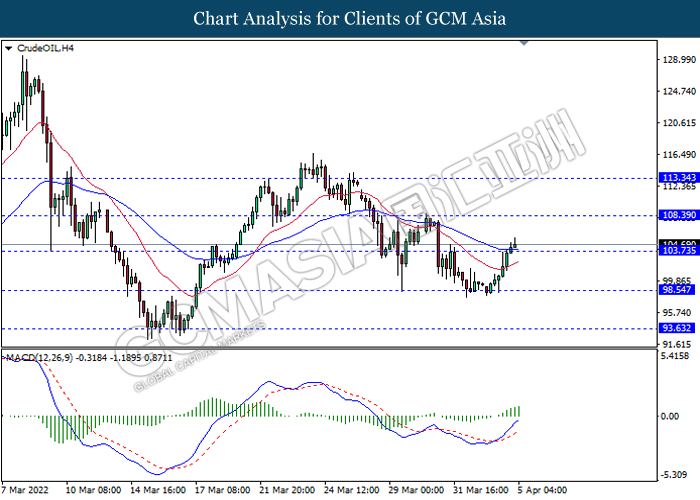

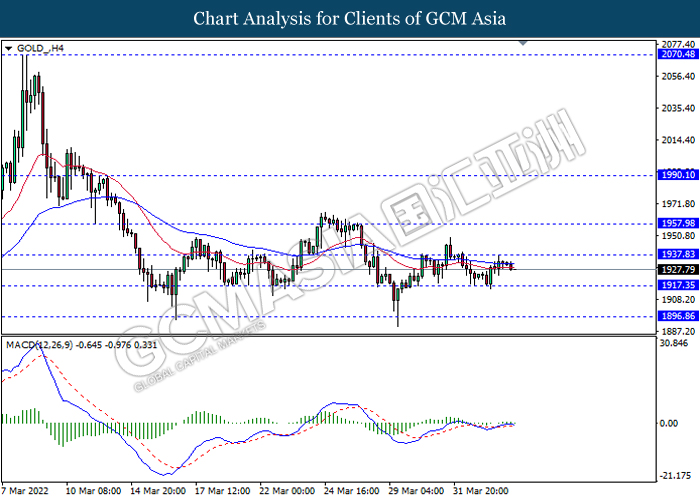

In the commodities market, the crude oil price extends its gains by 0.92% to 105.75 per barrel as of writing amid the fears upon the supply disruption for the oil persisted in the market. On the other hand, the gold price depreciated by 0.24% to $1928.05 per troy ounces amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 12:30 | AUD – RBA Interest Rate Decision (Apr) | 0.10% | 0.10% | – |

| 12:30 | AUD – RBA Rate Statement | – | – | – |

| 16:30 | GBP – Composite PMI (Mar) | 59.7 | 59.7 | – |

| 16:30 | GBP – Services PMI (Mar) | 61 | 61 | – |

| 18:00 | USD – ISM Non-Manufacturing PMI (Mar) | 56.5 | 58 | – |

Technical Analysis

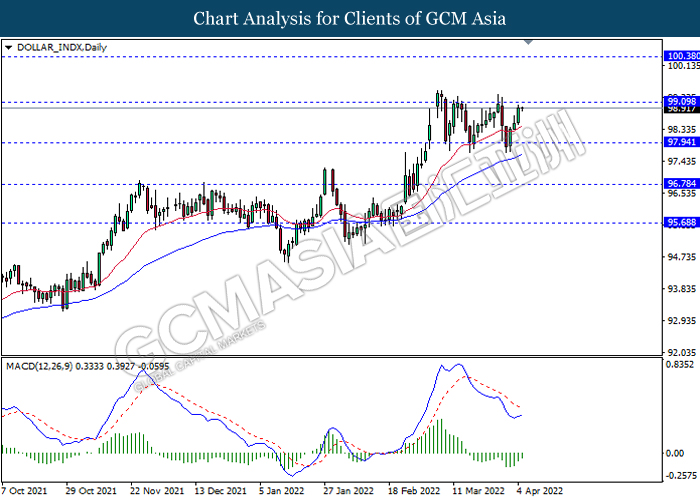

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 99.10, 100.40

Support level: 97.95, 96.80

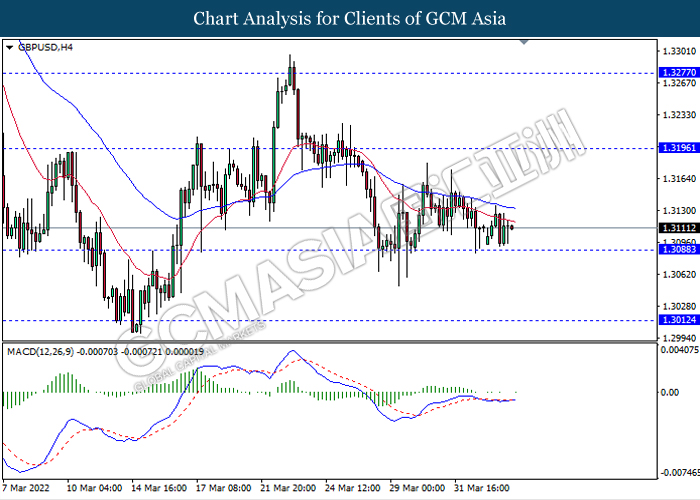

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.3195, 1.3275

Support level: 1.3090, 1.3010

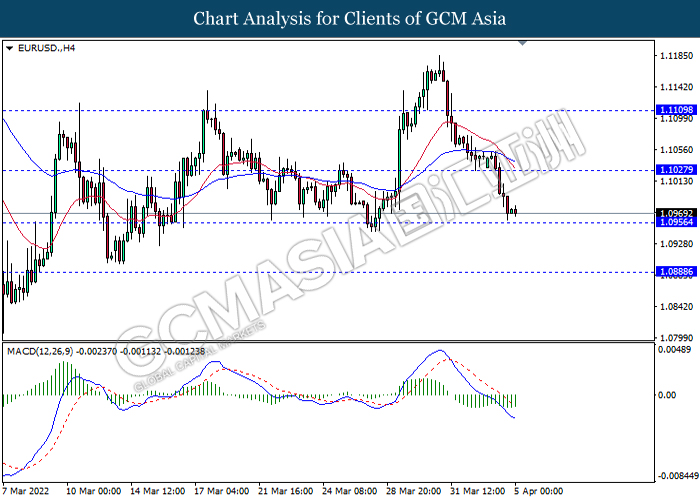

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1025, 1.1110

Support level: 1.0955, 1.0890

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 124.05, 125.20

Support level: 122.35, 121.30

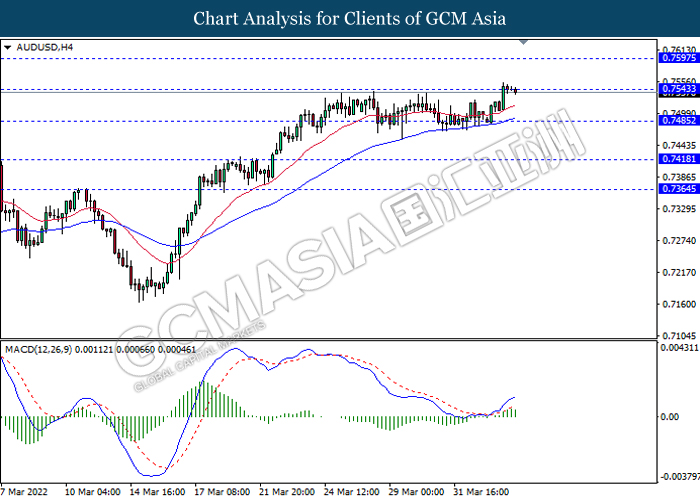

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7545, 0.7595

Support level: 0.7485, 0.7420

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6980, 0.7075

Support level: 0.6890, 0.6800

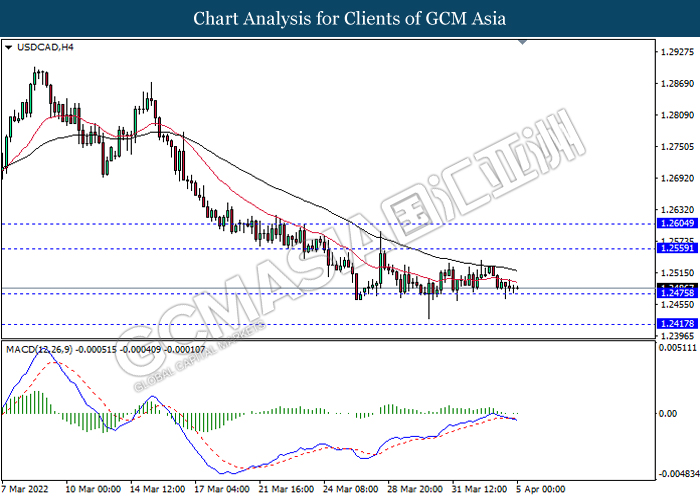

USDCAD, H4: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2560, 1.2605

Support level: 1.2475, 1.2415

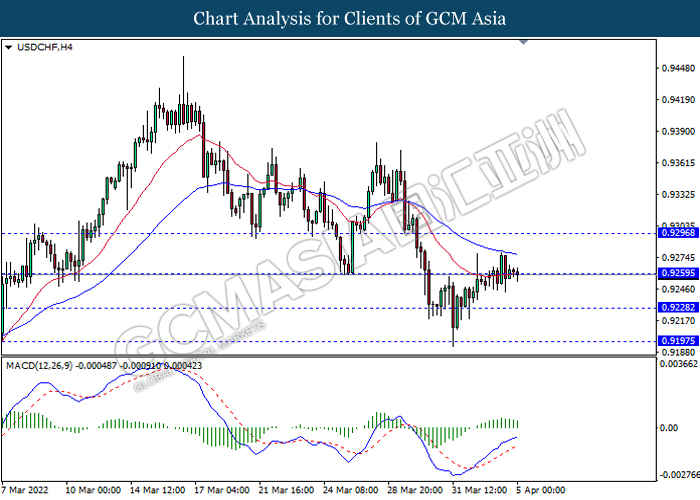

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9260, 0.9295

Support level: 0.9230, 0.9195

CrudeOIL, H4: Crude oil price was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 108.40, 113.35

Support level: 103.75, 98.55

GOLD_, H4: Gold price was traded lower following prior retracement from resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1937.85, 1958.00

Support level: 1917.35, 1896.85