5 April 2022 Morning Session Analysis

US Dollar surged amid rising tensions between Russia-Ukraine.

The Dollar Index which traded against a basket of six major currencies surged over the backdrop of risk-off sentiment in the global financial market following the Europe leaders called for more sanction against Russia after war crimes allegations in Ukraine. Germany and its international partner will agree further sanctions on Russia in the coming days, a government spokesperson said on Monday, adding that he was confident that European Union would remain united on fresh measures. Besides that, the Dollar Index extend its gains as market participants continue to digest a strong economy recovery and tight labor market in United States. Currently, market participants speculated that there would be a very strong chance of 50 basis point rate hike by next month. 2-year Treasury yields continue to climb into recent high at 2.5%. As of writing, the Dollar Index appreciated by 0.31% to 98.95.

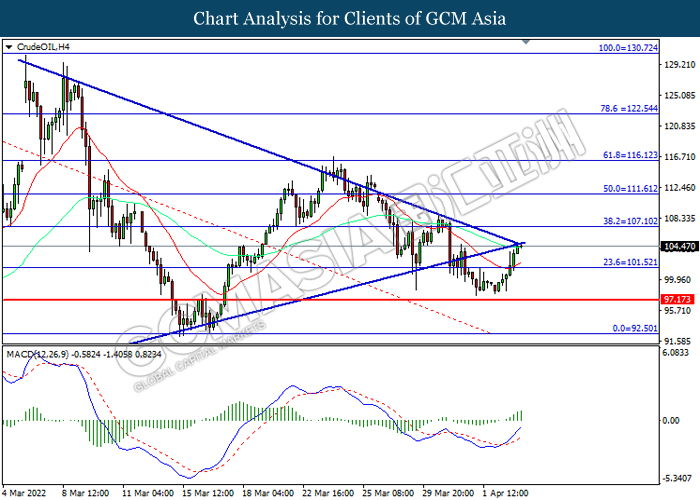

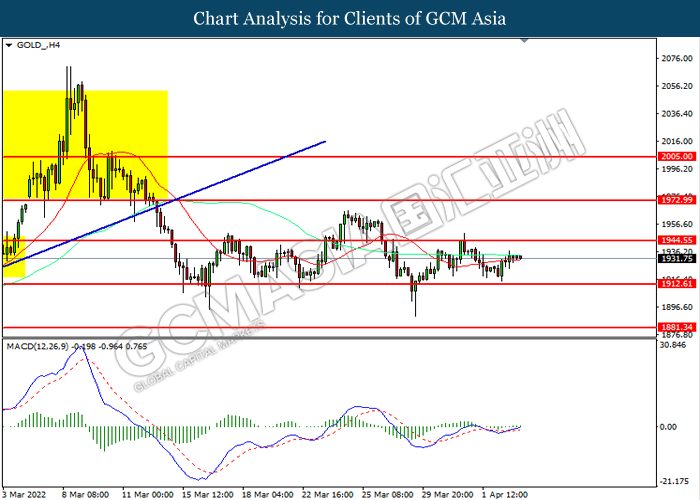

In the commodities market, the crude oil price surged 3.82% to $103.05 per barrel as of writing amid the fresh implementation of sanctions toward Russia oil and gas industry continue to spur bullish momentum on this black commodity. On the other hand, the gold price surged 0.30% to $1931.40 per troy ounces as of writing amid diminishing risk appetite in the global financial market as the fresh sanction expectation from the Western countries.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 12:30 | AUD – RBA Interest Rate Decision (Apr) | 0.10% | 0.10% | – |

| 12:30 | AUD – RBA Rate Statement | – | – | – |

| 16:30 | GBP – Composite PMI (Mar) | 59.7 | 59.7 | – |

| 16:30 | GBP – Services PMI (Mar) | 61 | 61 | – |

| 18:00 | USD – ISM Non-Manufacturing PMI (Mar) | 56.5 | 58 | – |

Technical Analysis

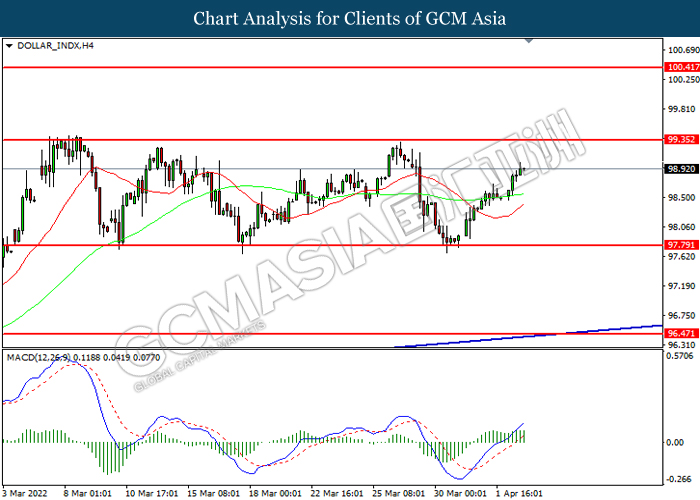

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains toward resistance level.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

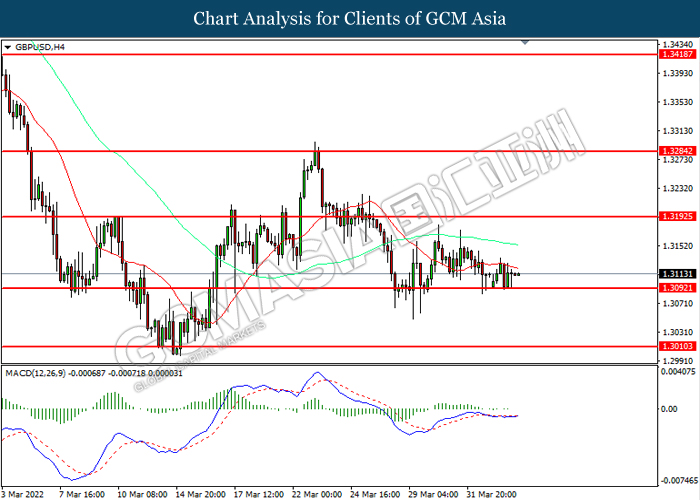

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it breakout.

Resistance level: 1.3195, 1.3285

Support level: 1.3090, 1.3010

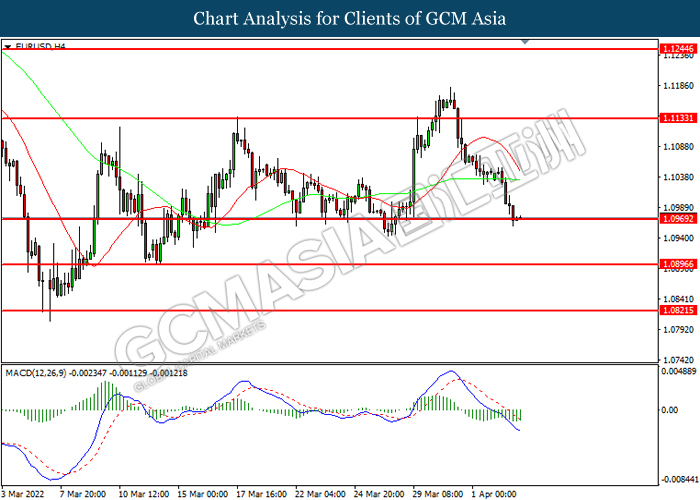

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1135, 1.1245

Support level: 1.0970, 1.0895

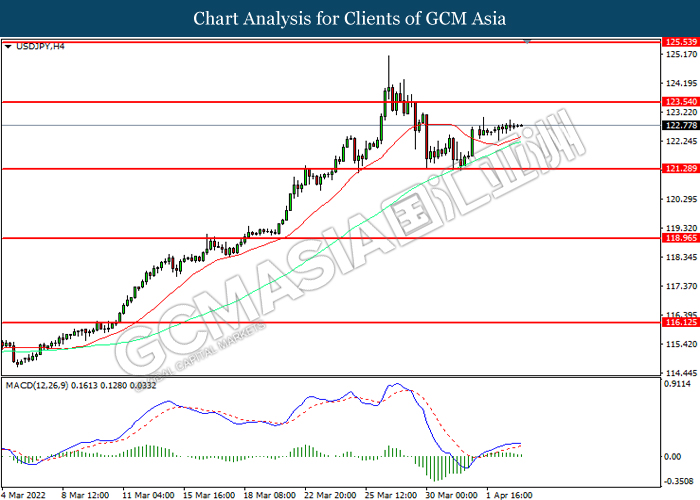

USDJPY, H4: USDJPY was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 123.55, 125.55

Support level: 121.30, 118.95

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7550, 0.7660

Support level: 0.7395, 0.7280

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6975, 0.7045

Support level: 0.6900, 0.6800

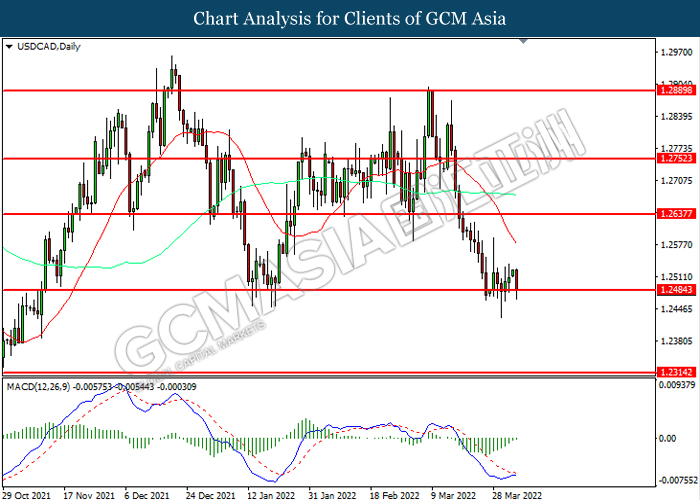

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

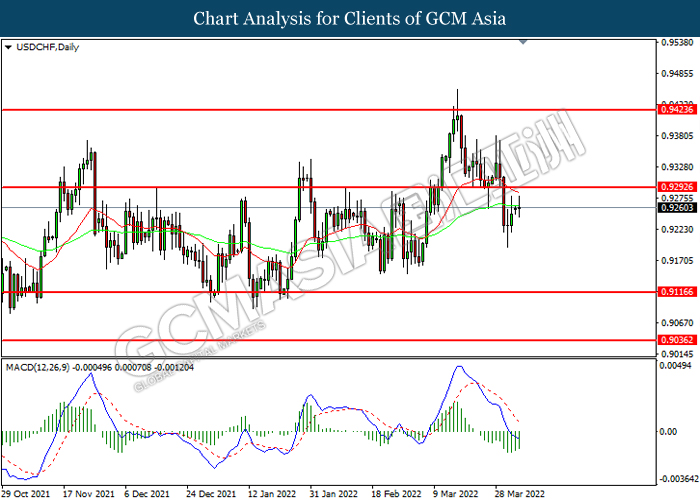

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9295. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9295, 0.9425

Support level: 0.9115, 0.9035

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 107.10, 111.60

Support level: 101.50, 97.15

GOLD_, H4: Gold price was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1944.55, 1973.00

Support level: 1912.60, 1881.35