05 April 2023 Morning Session Analysis

Greenback slumped amid disappointing economic data.

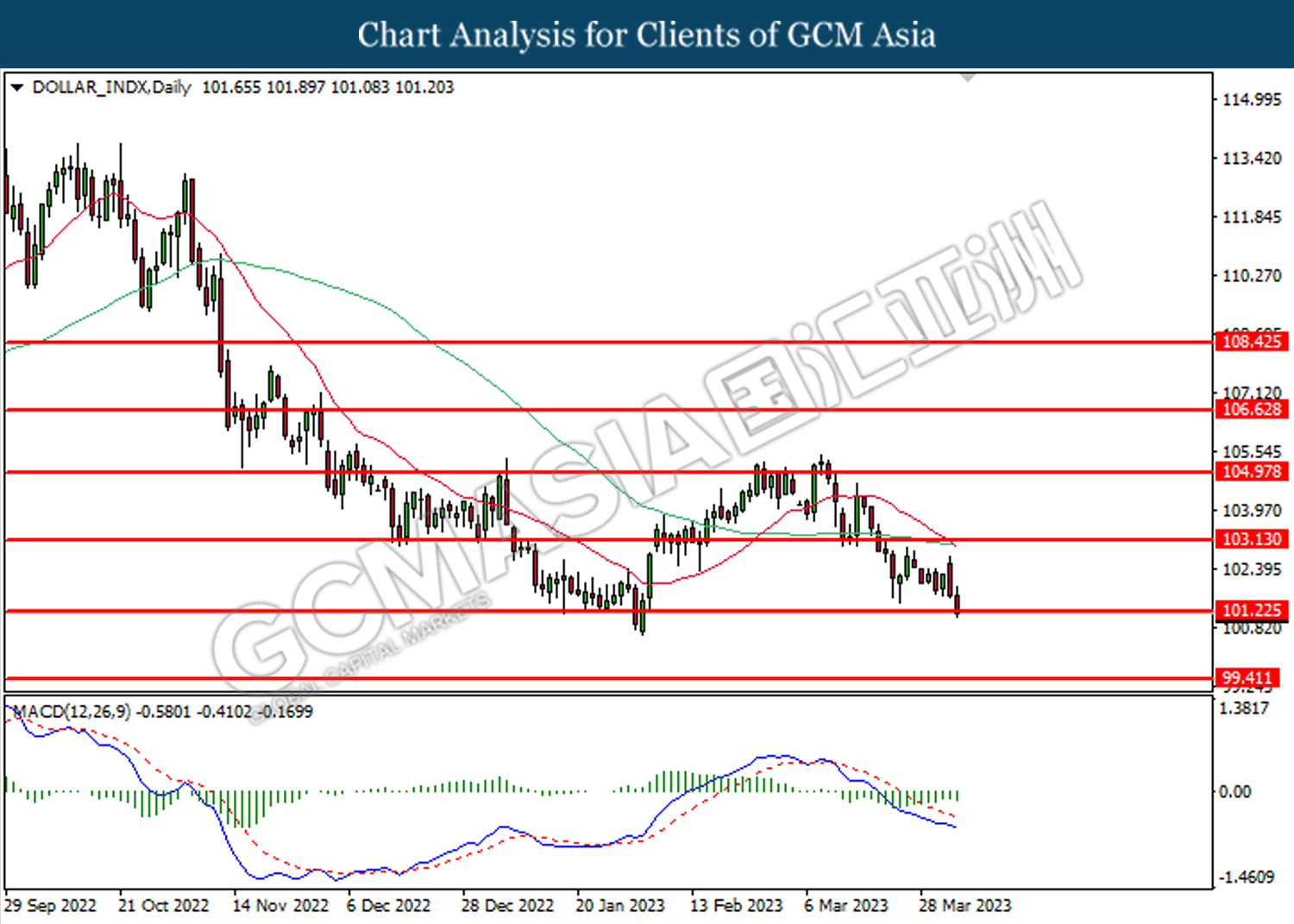

The dollar index, which is traded against a basket of six major currencies, failed to recover from its losses yesterday as downbeat data hyped the market to bet on an earlier-than-expected rate hike pause. According to the Bureau of Labor Statistics, the US JOLTS Job Openings data shrank from the prior month’s reading at 10.563M to 9.931M in February, missing the consensus forecast at 10.400M. The sharp drop in the number of job openings brought the data to the lowest level in nearly two years while signaling that the labor market was moderating following a series of rate hikes since last year. In detail, February’s JOLTS report showed that job creation dropped to 6.1 million from 6.3 million, layoffs shrank to 1.5 million from 1.7 million, and dispositions grew to 4 million from 3.9 million. With such a backdrop, the disappointing labor data triggered huge selling pressures in the dollar market, dragging the dollar index to retest the lowest level since early February now. In overall, the fall in manufacturing activity and poor labor data undermined the greenback, prompting the Federal Reserve a step closer to the end of the rate hike cycle. As of writing, the dollar index edged down -0.51% to 101.57.

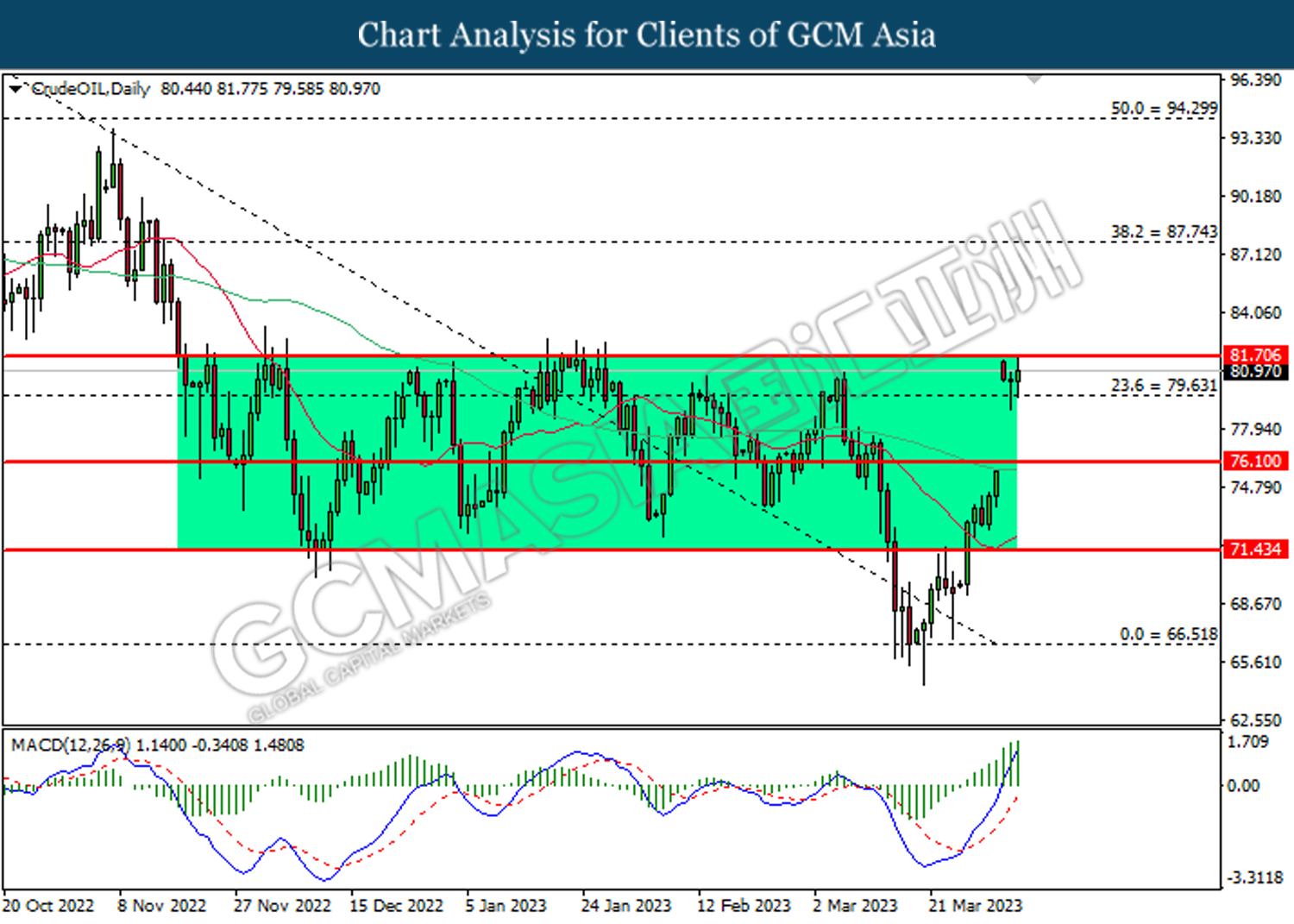

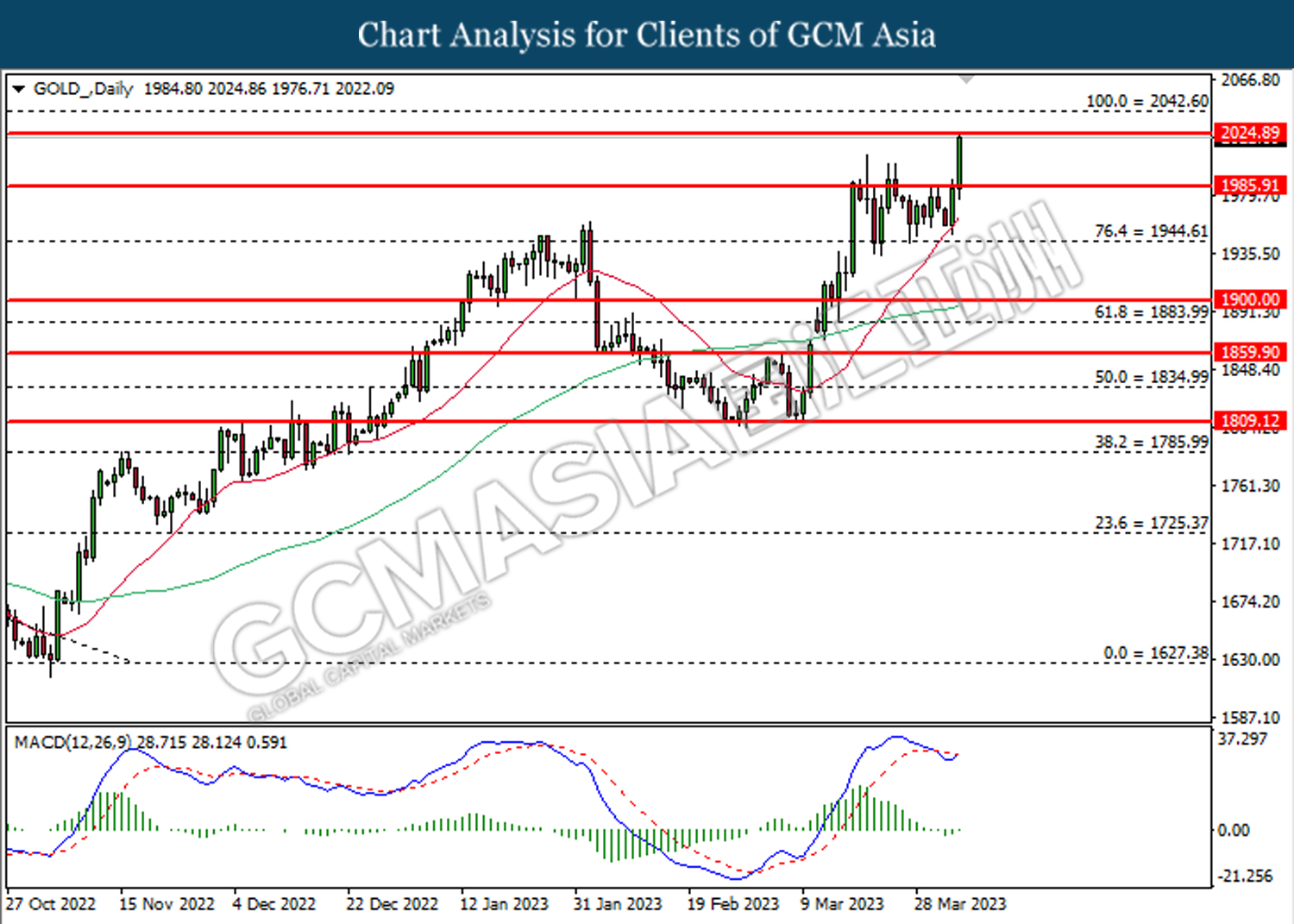

In the commodities market, crude oil prices ticked up by 0.01% to $80.86 per barrel as US crude oil inventories fell by a big number, according to the data from API. Besides, gold prices ticked up by 0.02% to $2020.70 per troy ounce amid the sign of moderating in the US labor market appeared.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Composite PMI (Mar) | 52.2 | 52.2 | – |

| 16:30 | GBP – Services PMI (Mar) | 52.8 | 52.8 | – |

| 20:15 | USD – ADP Nonfarm Employment Change (Mar) | 242K | 242K | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Mar) | 55.1 | 55.1 | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -7.489M | -7.489M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 101.25. MACD which illustrated bearish bias momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 103.15, 105.00

Support level: 101.25, 99.40

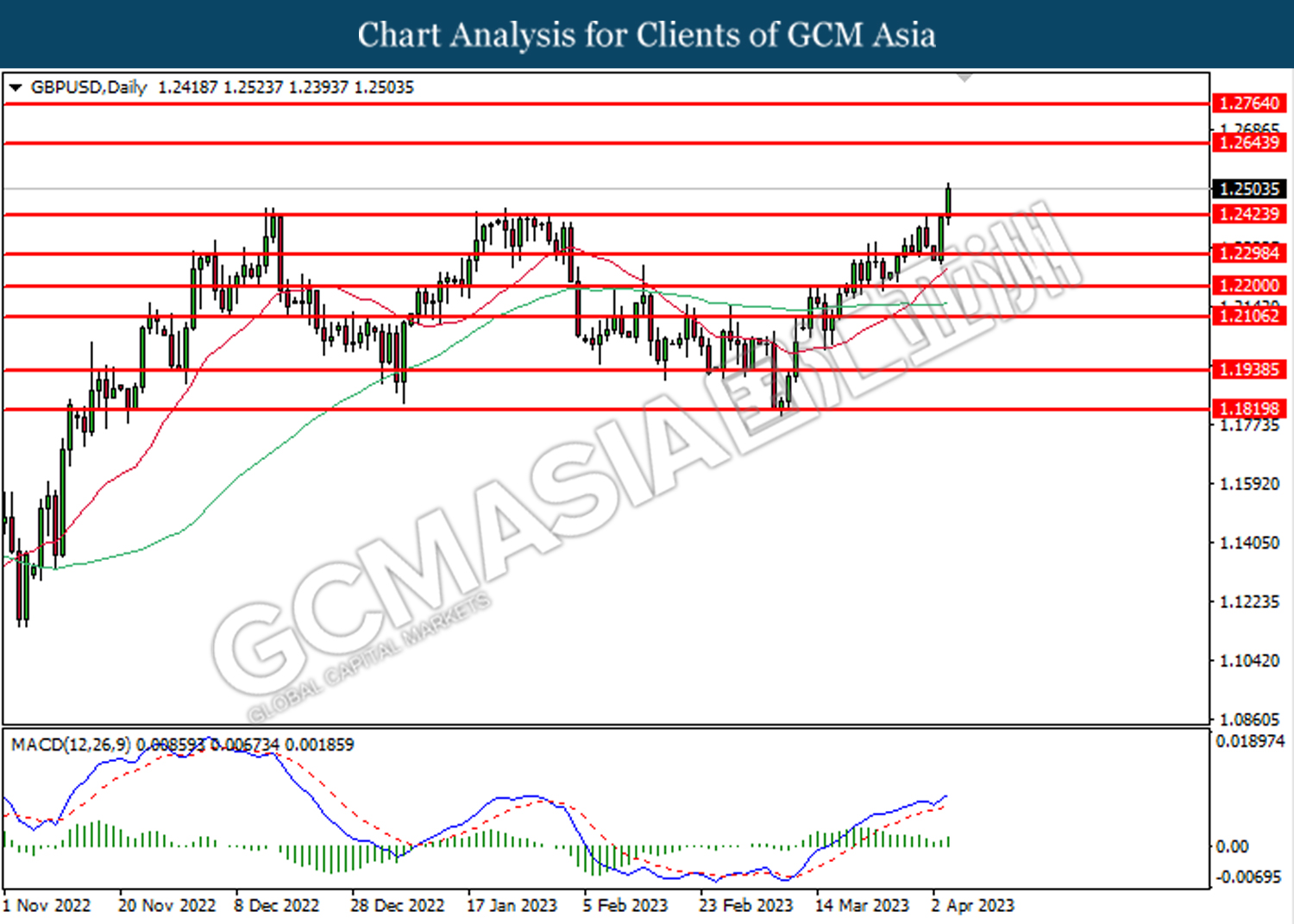

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2425. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2425, 1.2645

Support level: 1.2300, 1.2200

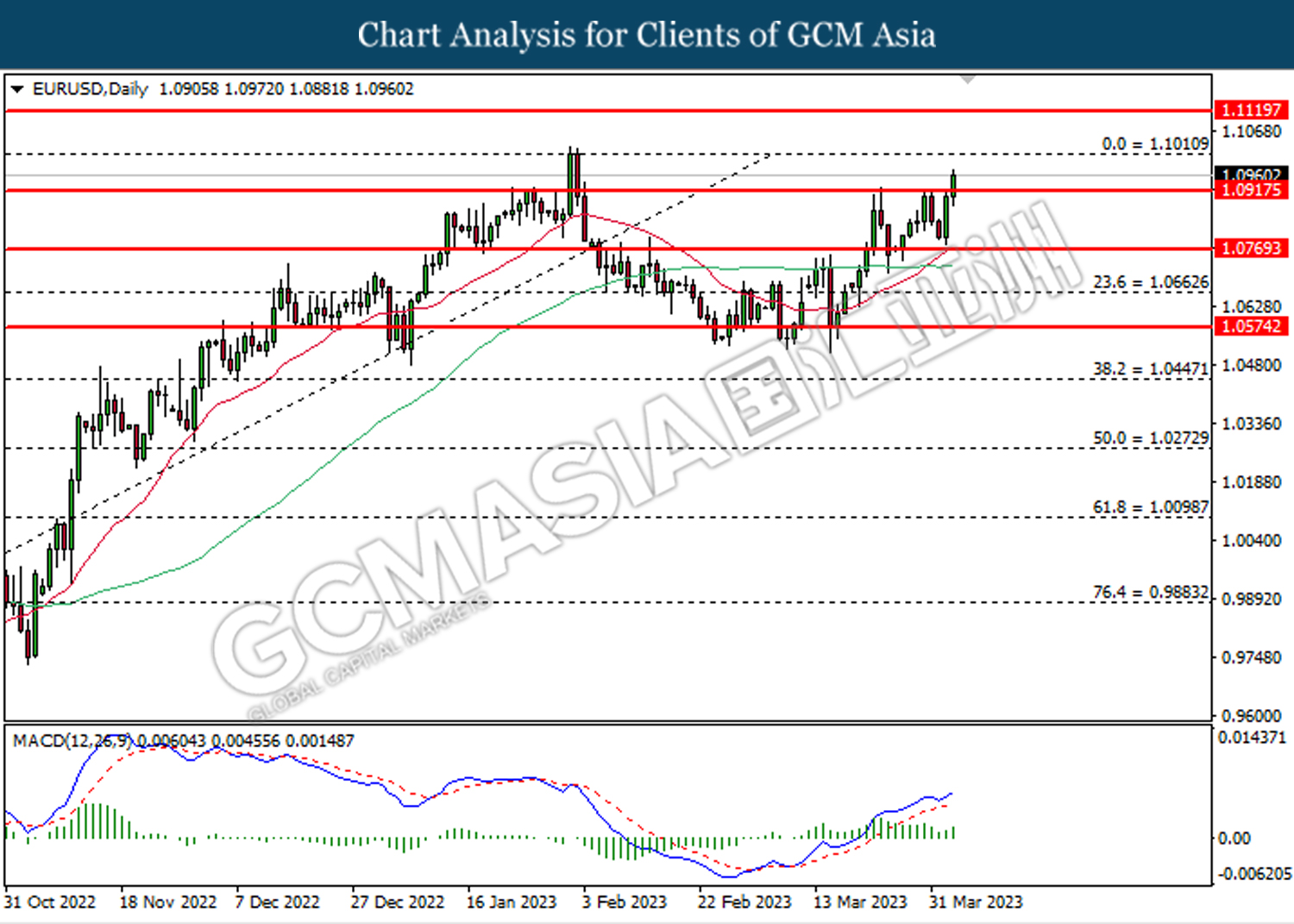

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0915 MACD which illustrated bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0915, 1.1010

Support level: 1.0770, 1.0665

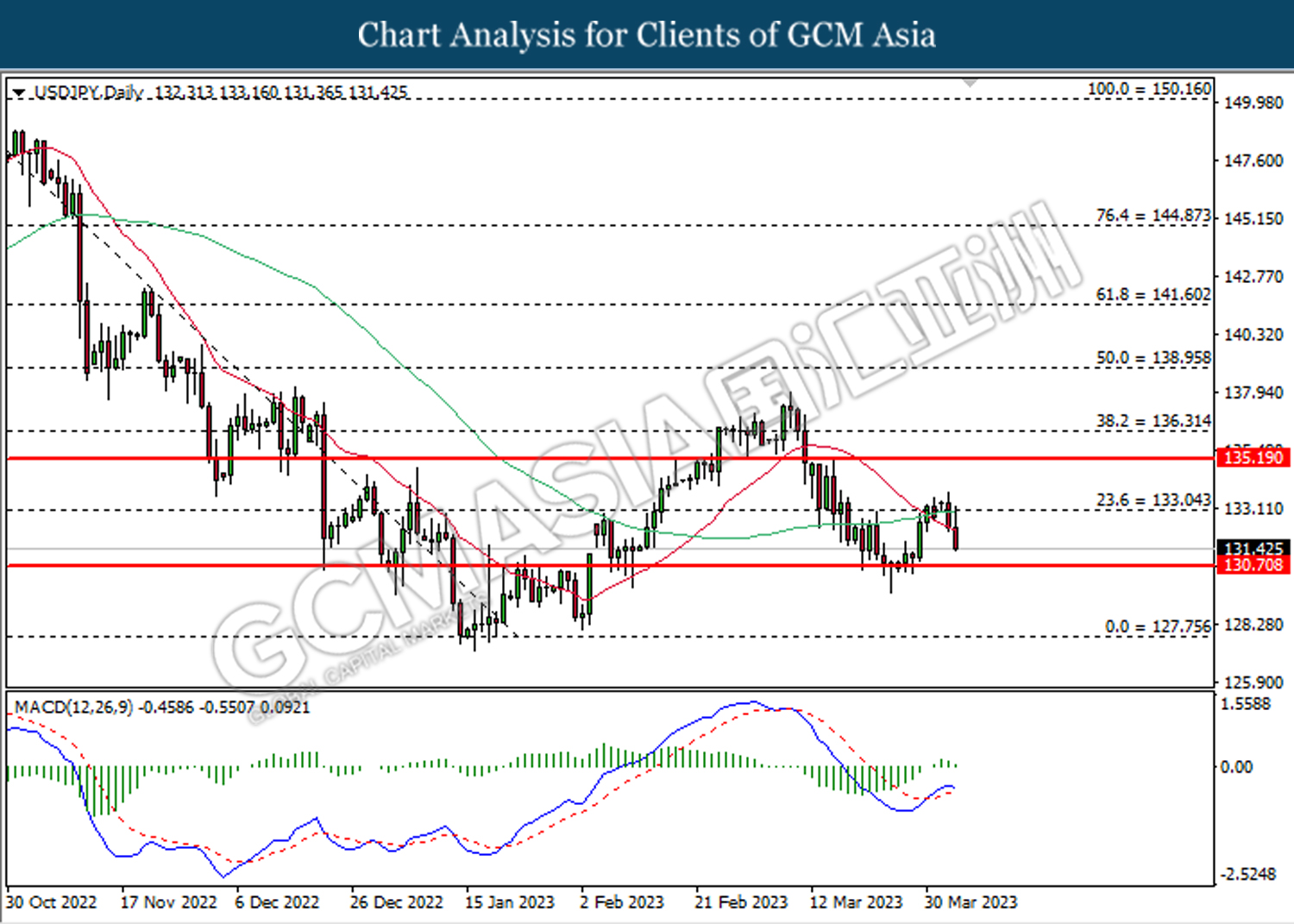

USDJPY, Daily: USDJPY was traded lower following the prior breakout below the previous support level at 133.05. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 130.70.

Resistance level: 133.05, 135.20

Support level: 130.70, 127.75

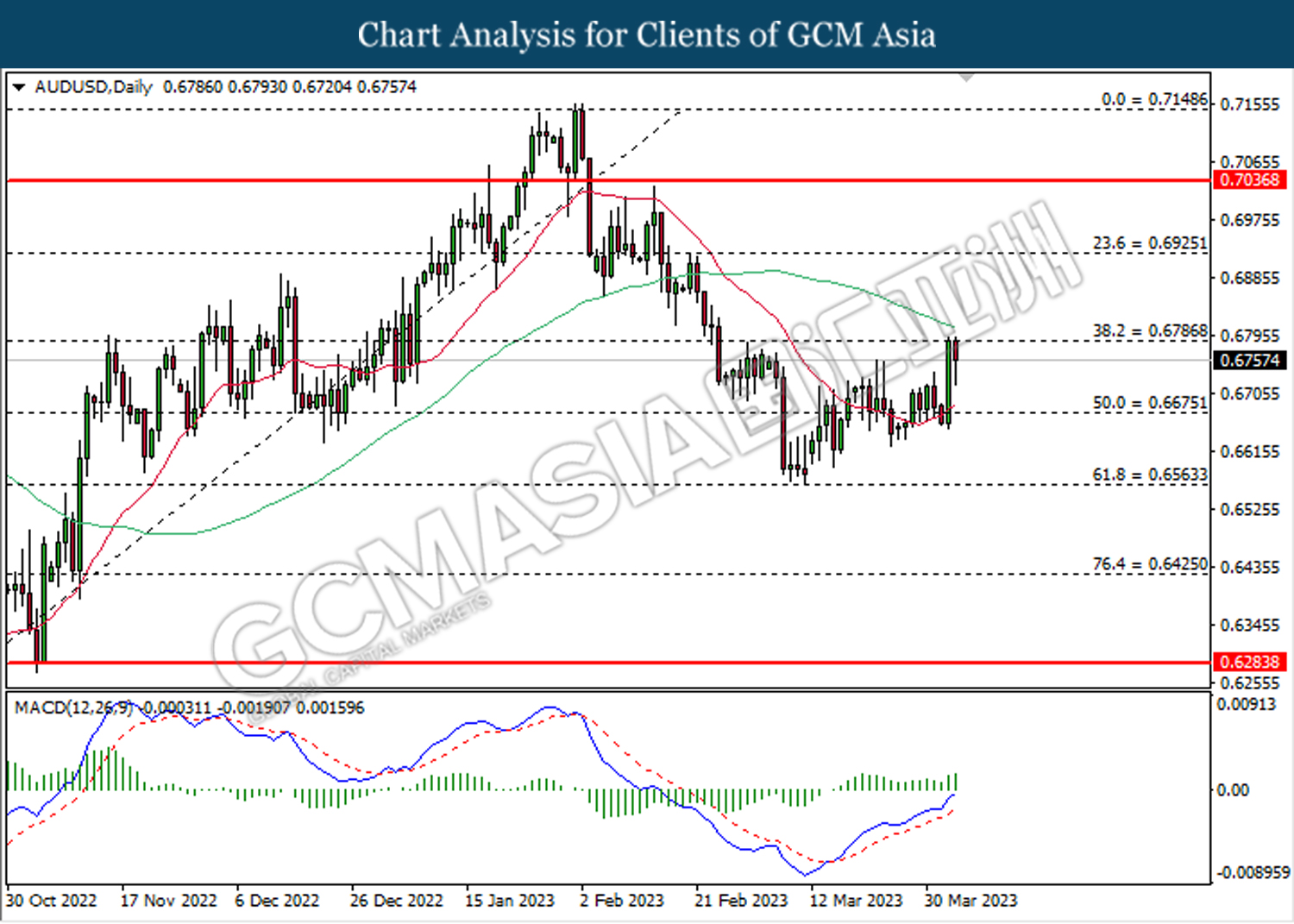

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6785. MACD which illustrated bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

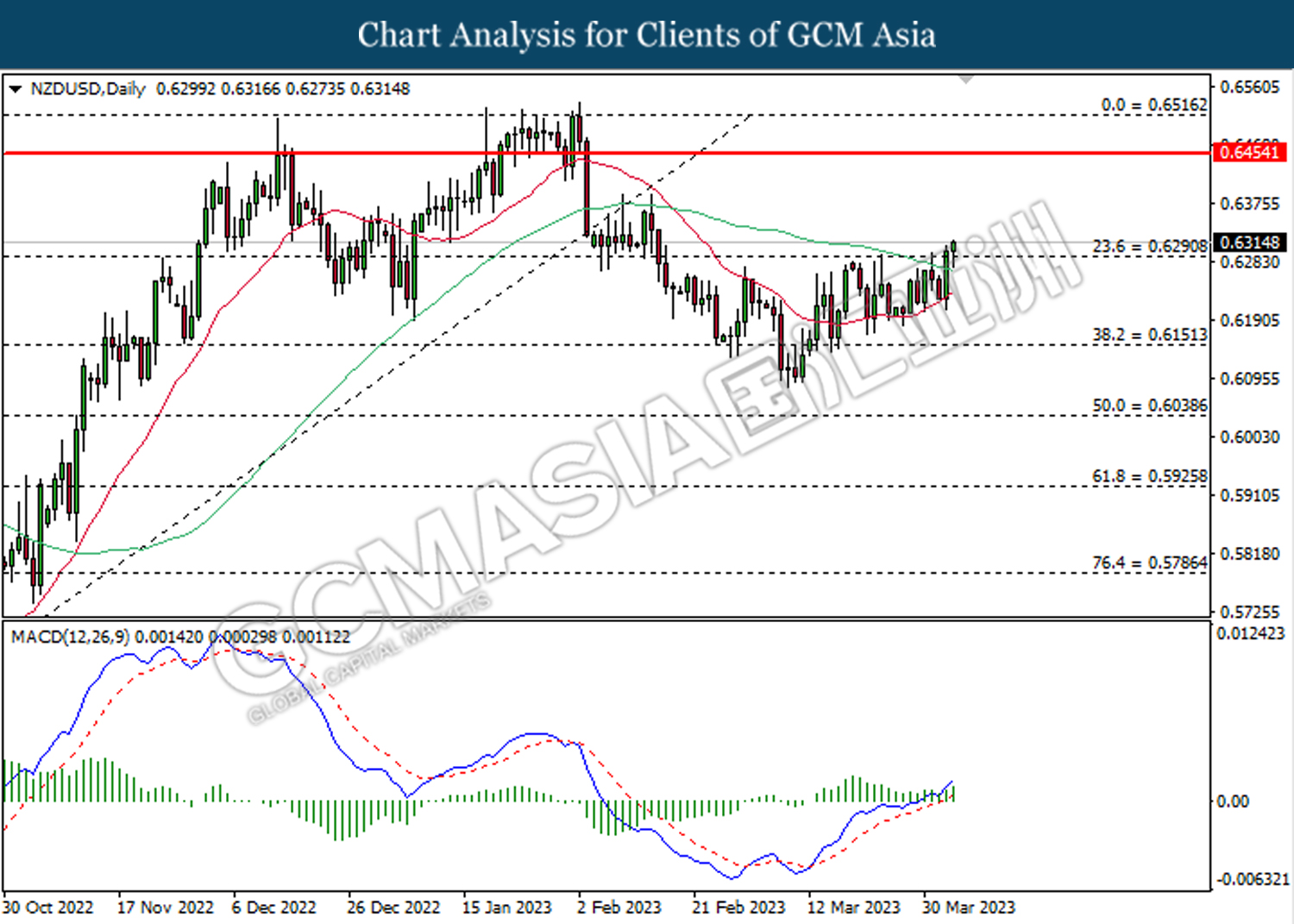

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6290. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

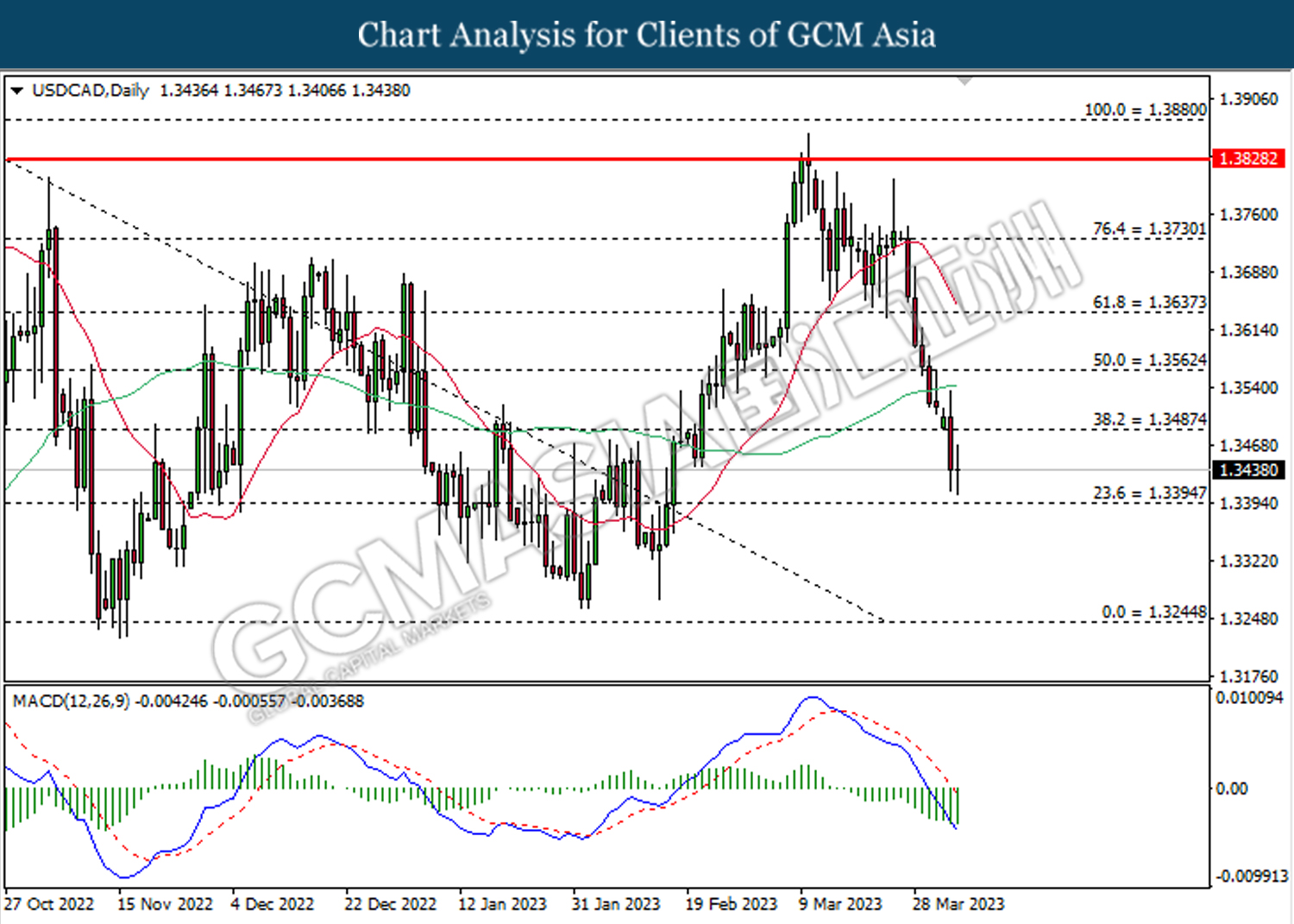

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3395. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3485, 1.3565

Support level: 1.3395, 1.3245

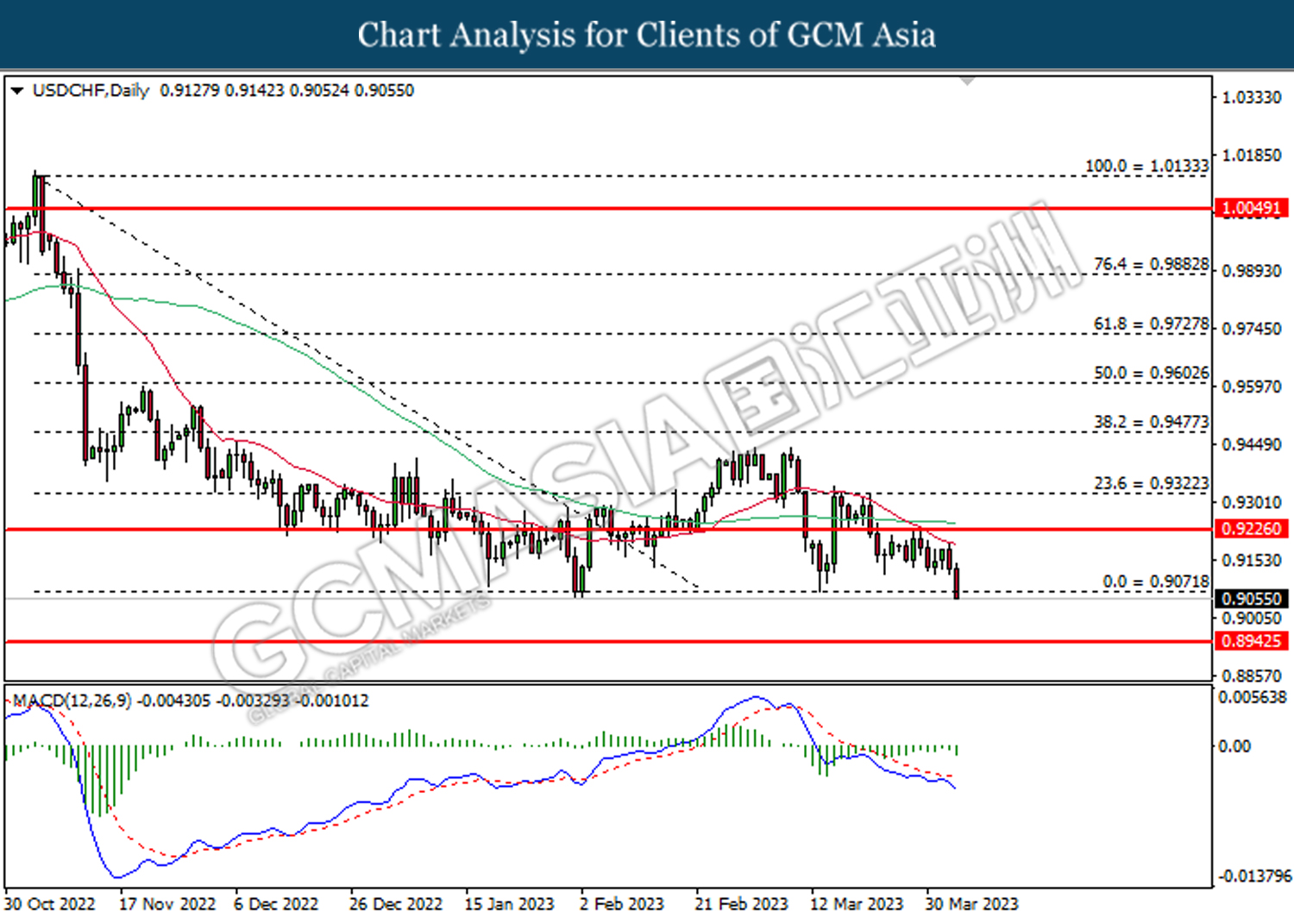

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9070. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9225, 0.9325

Support level: 0.9070, 0.8945

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 81.70. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 81.70, 87.75

Support level: 79.65, 76.10

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 2024.90. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 2024.90, 2042.60

Support level: 1985.90, 1944.60