5 May 2022 Morning Session Analysis

US Dollar beaten down following dovish tone from Federal Reserve.

The Dollar Index which traded against a basket of six major currencies slumped on Thursday amid the backdrop of dovish speech from Federal Reserve. According to Reuters, Federal Reserve Chairman Jerome Powell played down the prospect of a 75 basis point rate hike, even as he said the U.S. central bank will act aggressively to stamp out inflation. Nonetheless, he reiterated that additional 50 basis point jumps should be on the table for the next couple of meetings. The diminishing of rate hike from Fed would likely to reduce the risk-free return of investors, stoked a shift sentiment toward other currencies which having better prospects. Besides, the war-driven inflation risk is unraveling whatever policy consensus there was between the world’s major central banks since the Great Financial Crisis and global markets could buckle under resulting waves of stress and volatility. The strengthening US Dollar which often both reflects and fuels financial market stress, risks a vicious cycle as a scramble for dollars intensifies, tightens global financial conditions and increases volatility, according to Reuters. It dialed down the market optimism toward US Dollar, which spurring further bearish momentum on it. As of writing, the Dollar Index eased by 0.93% to 102.53.

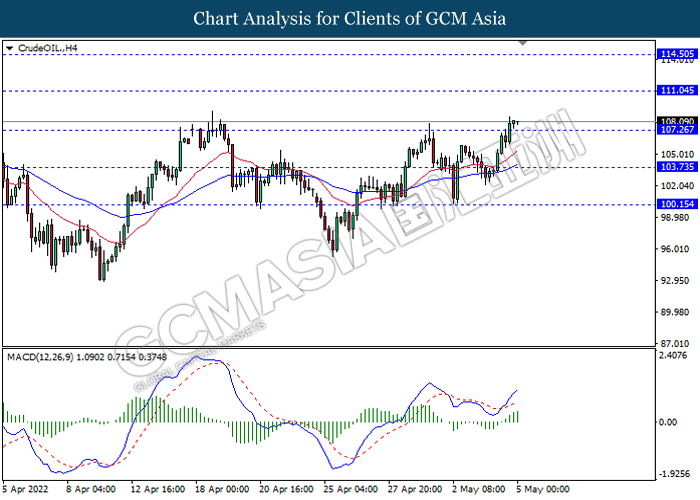

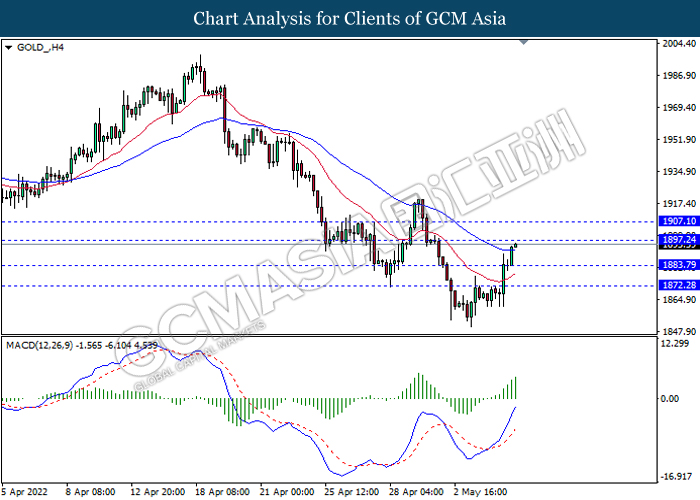

In commodities market, crude oil price appreciated by 0.33% to $108.17 per barrel as of writing over EU proposed a phase of sanction on Russian oil. On the other hand, gold price rallied by 1.02% to $1887.92 per troy ounces as of writing following the US Dollar was dragged down.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:00 GBP BoE Inflation Report

19:00 GBP BoE MPC Meeting Minutes

21:15 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | Composite PMI (Apr) | 57.6 | 57.6 | – |

| 16:30 | Services PMI (Apr) | 58.3 | 58.3 | – |

| 19:00 | BoE Interest Rate Decision (May) | 0.75% | 1.00% | – |

| 20:30 | Initial Jobless Claims | 180K | 182K | – |

Technical Analysis

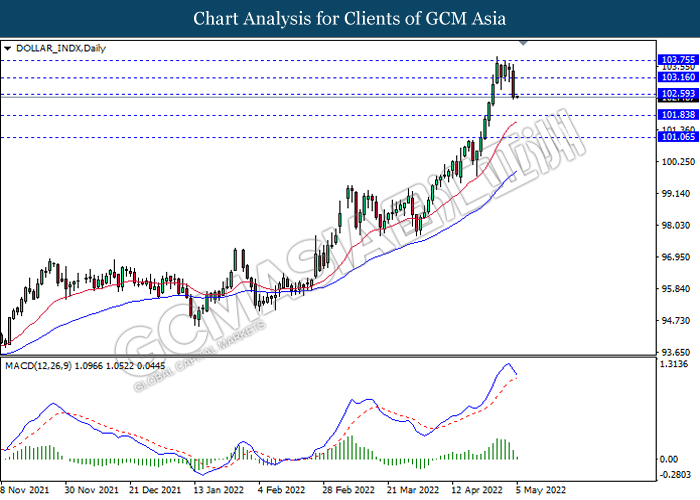

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bearish momentum suggest the index to extend its losses.

Resistance level: 105.60, 103.15

Support level: 101.85, 101.05

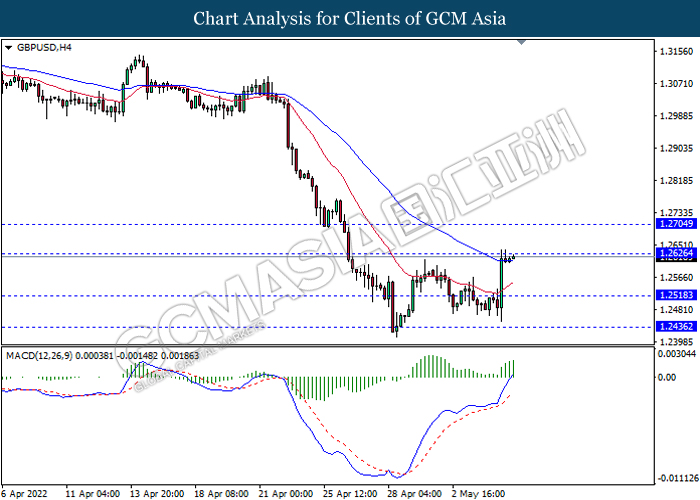

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2625, 1.2705

Support level: 1.2520, 1.2435

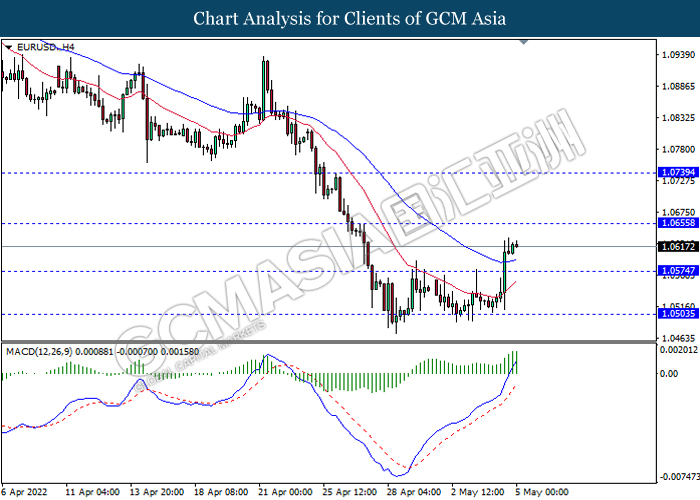

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0655, 1.0740

Support level: 1.0575, 1.0505

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to be extend its losses if successfully breakout the support level.

Resistance level: 129.95, 130.75

Support level: 129.05, 128.00

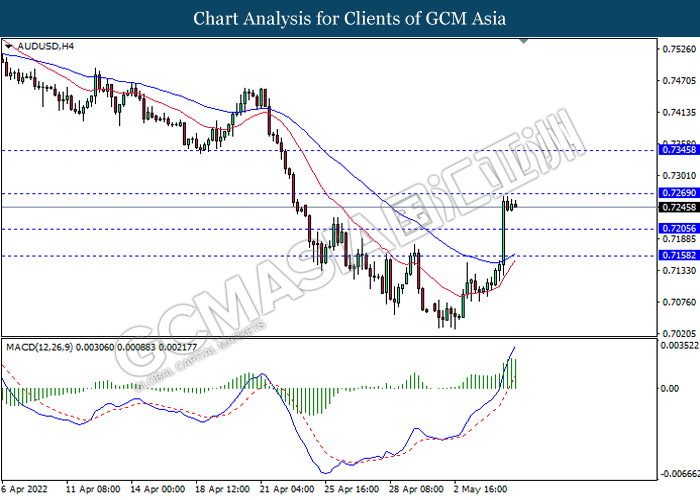

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.7270, 0.7345

Support level: 0.7205, 0.7160

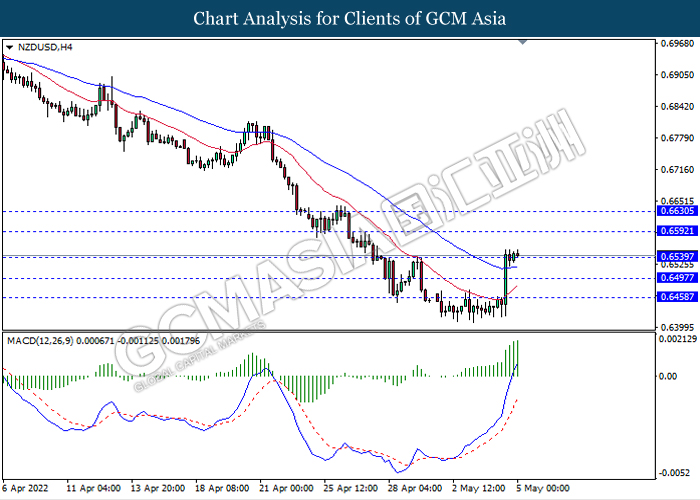

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6590, 0.6630

Support level: 0.6540, 0.6495

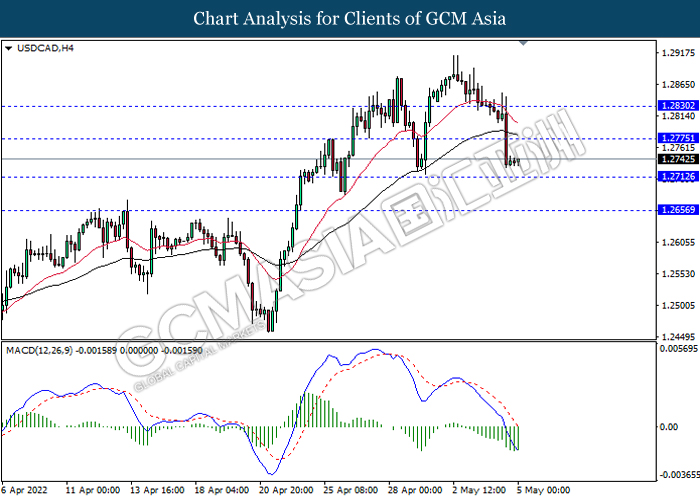

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2775, 1.2830

Support level: 1.2710, 1.2655

USDCHF, H1: USDCHF was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9745, 0.9780

Support level: 0.9715, 0.9680

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 111.05, 114.50

Support level: 107.25, 103.75

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1897.25, 1907.10

Support level: 1883.80, 1872.30