5 May 2023 Afternoon Session Analysis

The Aussie rose after a series of optimistic economic data releases.

The Australian dollar, commonly known as the Aussie was edged up during Asian trading hours after a series of optimistic economic data was released. The Aussie climbs above the 0.6700 level amid a hawkish monetary policy statement by the Reserve Bank of Australia (RBA). The statements claim that more tightening moves will announce if the inflation remains persistent at a higher space. Prior to that, the recent inflation data in March showed a decline to 7% but remained well above the long-run average 2% target. Since the inflation showed some sign of easing, the market highly anticipated that the RBA would remain at a cash rate of 3.60%. However, the RBA Governor Philip Lower decided to raise the cash rate by another 25 bps to curb high inflation and the moves surprised the market. Besides, the Australian trade balance showed an increase to 15.269B from 14.151B, above the market consensus of 12.650 B. The trade balance hit its highest record since June 2022 as Reuters reported that China sucked in more iron from Australia and boosted the Australian export by 4% in March. In addition, first-home buyer loans unexpectedly rose to 6.5%, stronger than the market consensus forecast and prior reading, with -1.0% and 1.2% respectively. The reading shows that the market’s spending power is on the stronger side, as it increases the likelihood of future rate hikes by the RBA. As of writing, the pair of AUD/USD edged up by 0.64% to $0.6736.

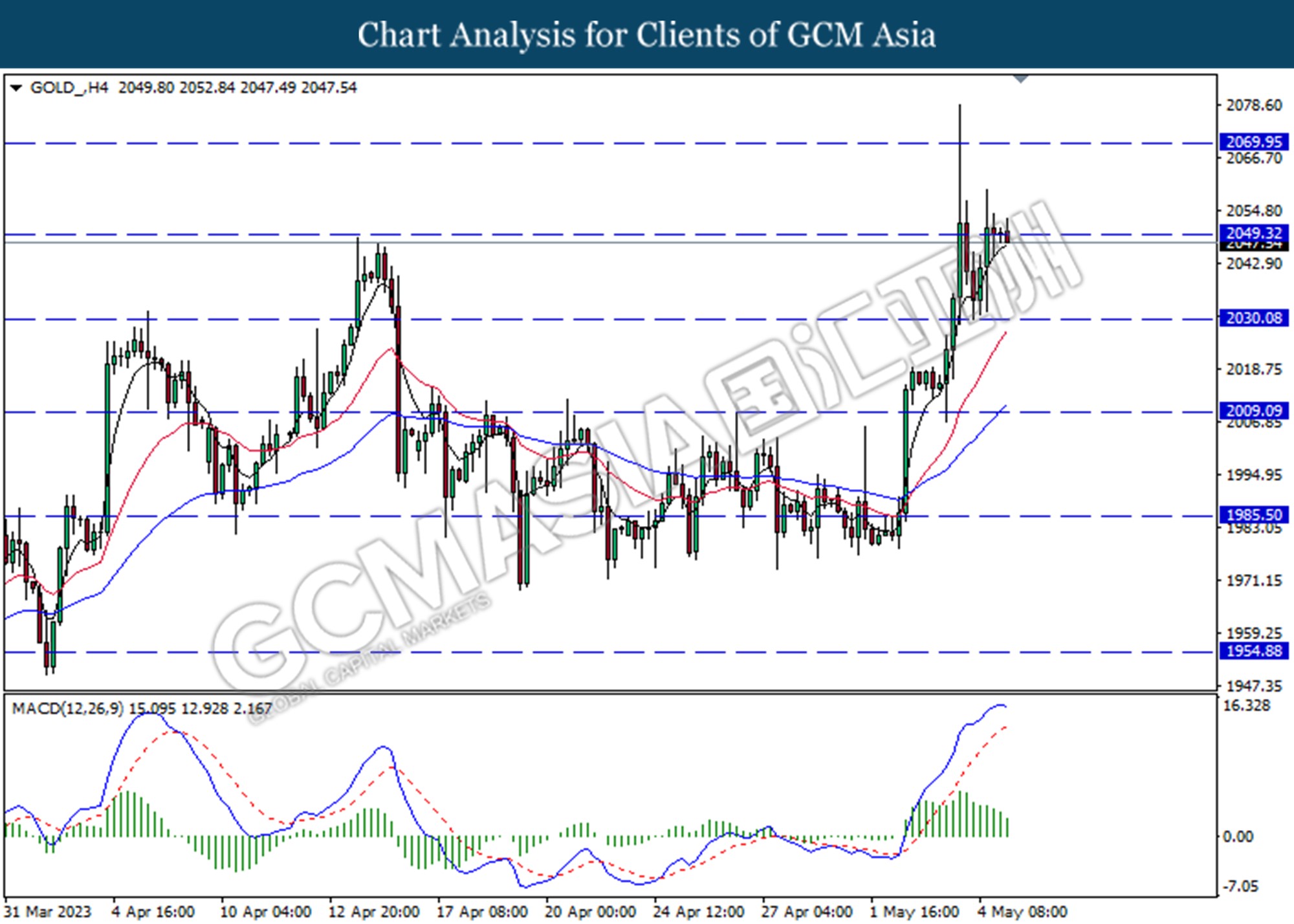

In the commodities market, crude oil prices were up by 0.80% to $ 69.11 per barrel as investors eye on the non-Farm payroll report tonight. Additionally, gold was traded higher after the US dollar weakened earlier on banking concerns. However, the price of gold was still down -0.12% at $2047.53 per troy ounce as of writing.

Today’s Holiday Market Close

Time Market Event

All Day JPY Children’s Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (Apr) | 50.7 | 51.0 | – |

| 20:30 | USD – Nonfarm Payrolls (Apr) | 236K | 180K | – |

| 20:30 | USD – Unemployment Rate (Apr) | 3.5% | 3.6% | – |

| 20:30 | CAD – Employment Change (Apr) | 34.7K | 20.0K | – |

Technical Analysis

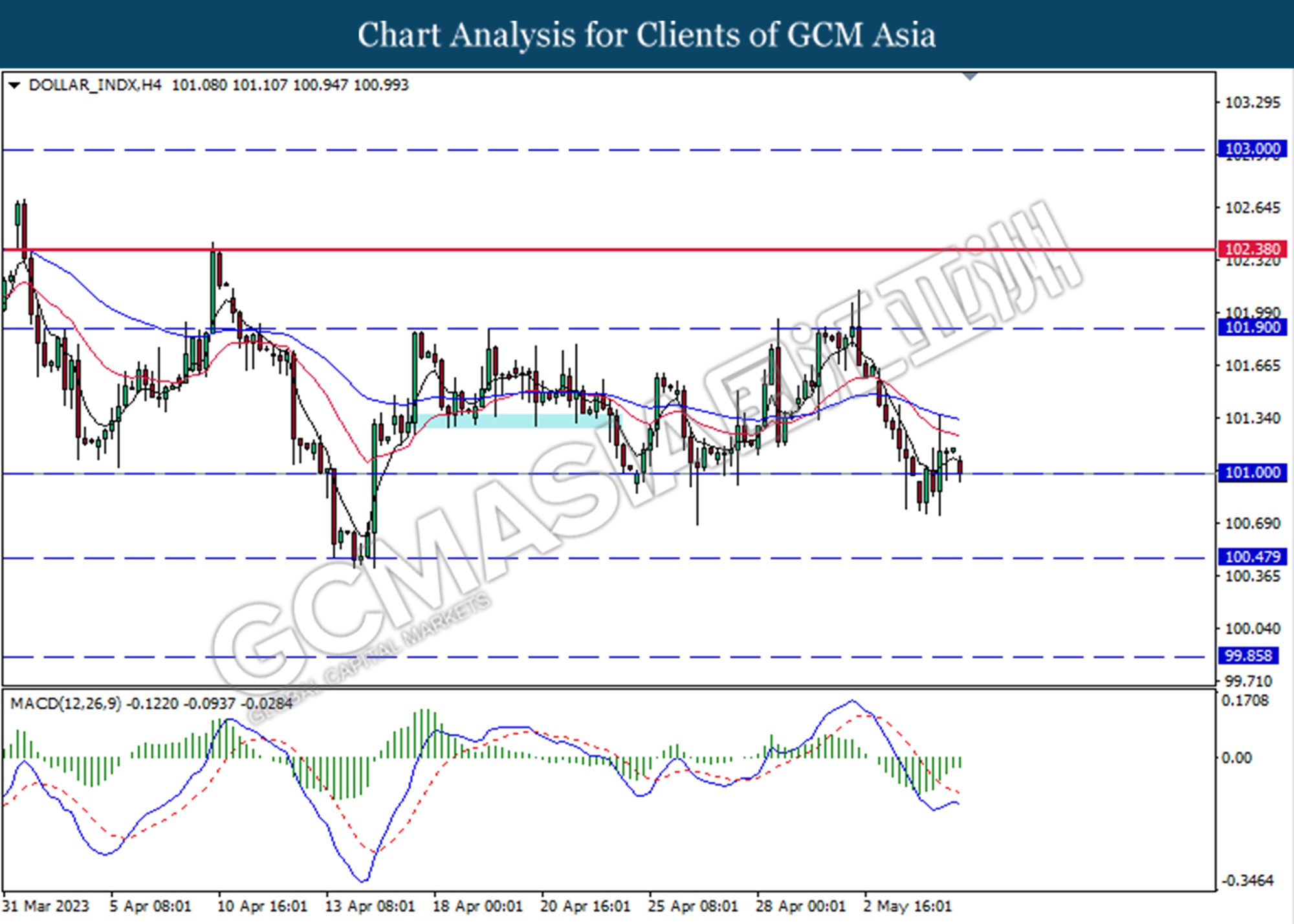

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level at 101.00. However, MACD which illustrated diminishing bearish momentum suggests the index to trade higher as a technical correction.

Resistance level: 101.90, 101.00

Support level: 100.50, 99.85

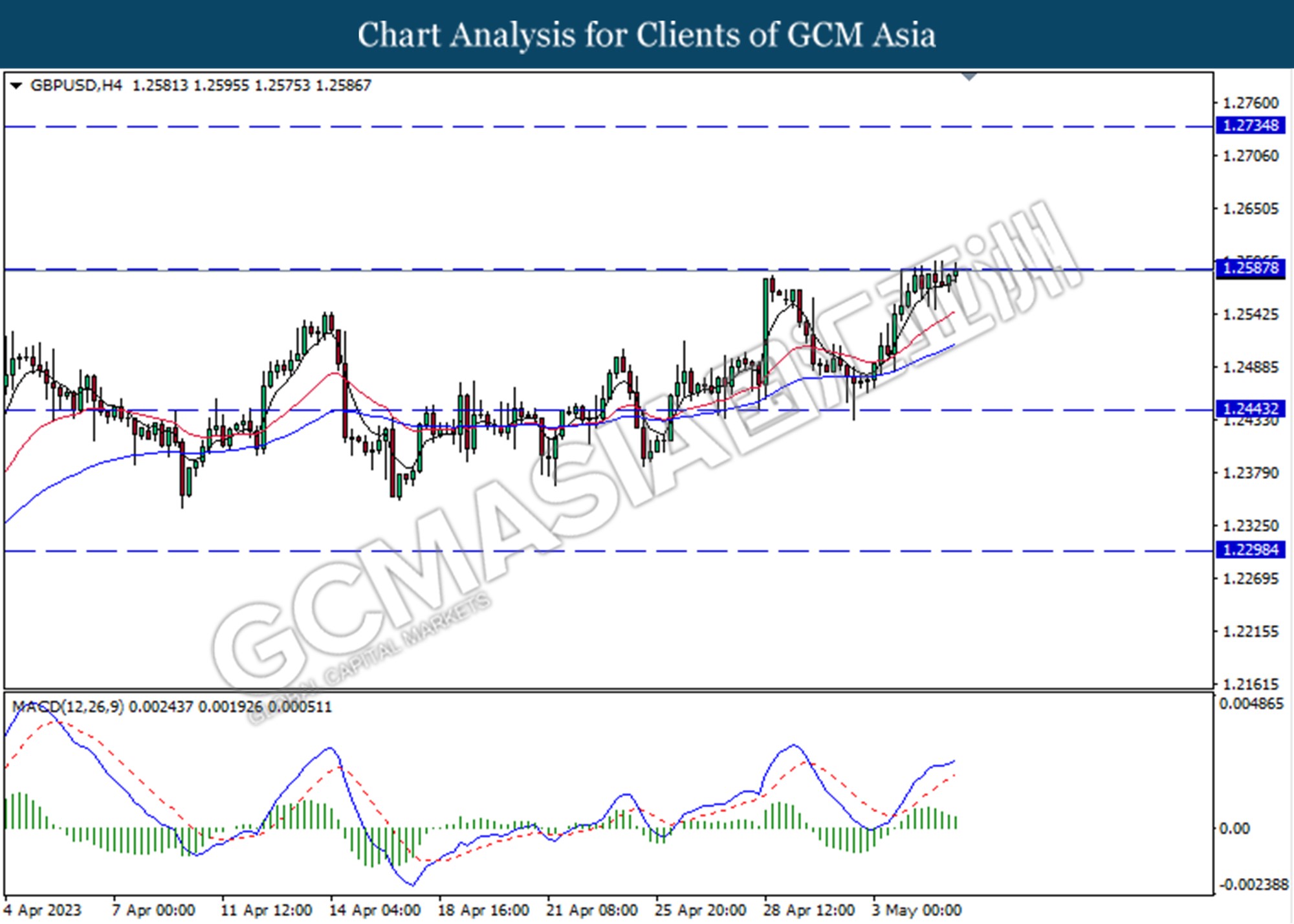

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.2590. However, MACD which illustrated diminishing bullish momentum suggests the index traded lower as a technical correction.

Resistance level: 1.2590, 1.2735

Support level: 1.2445, 1.2300

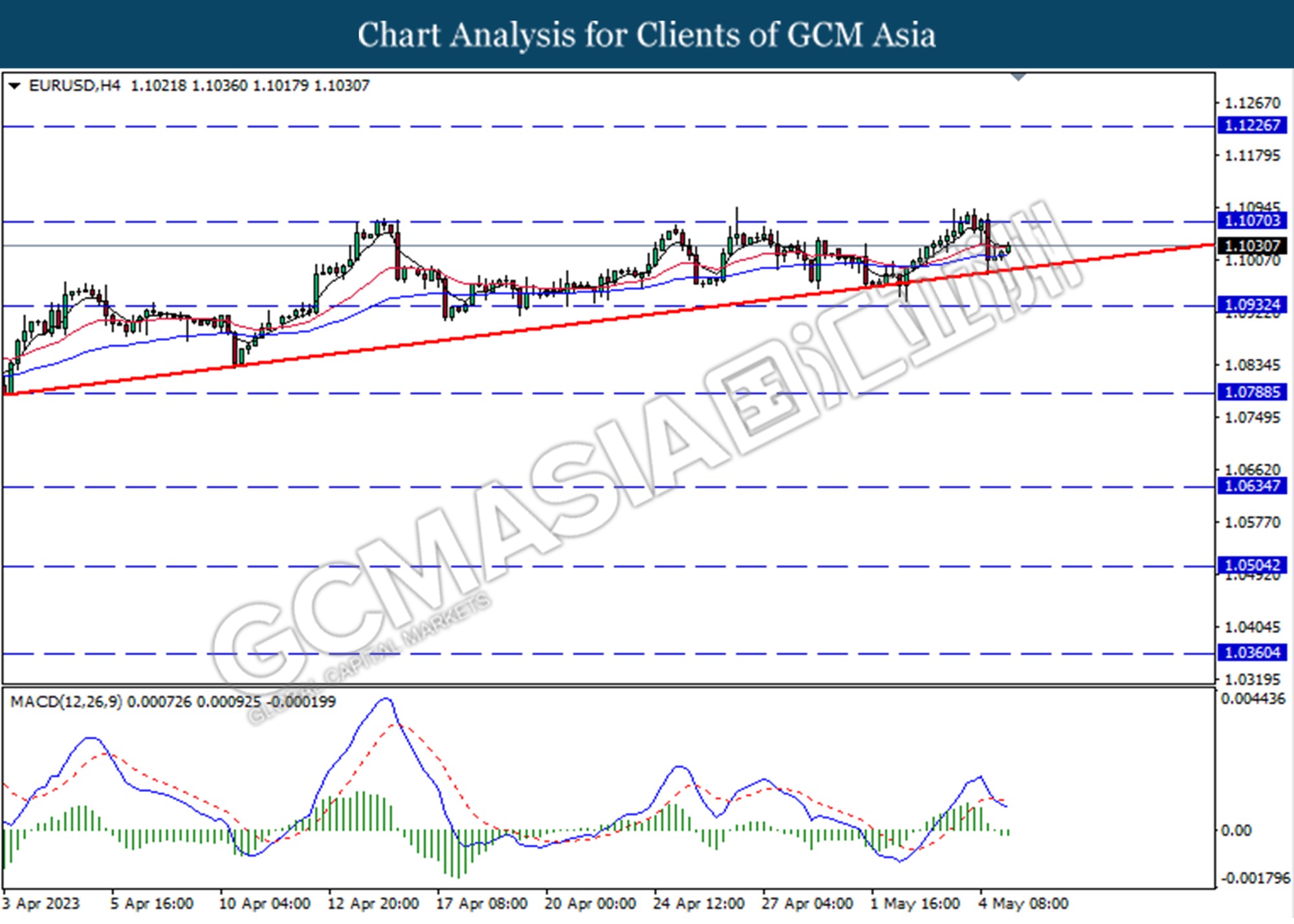

EURUSD, H4: EURUSD was traded lower following the prior retracement from the resistance level at 1.1070. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 1.0930.

Resistance level: 1.1070, 1.1225

Support level: 1.0930, 1.0790

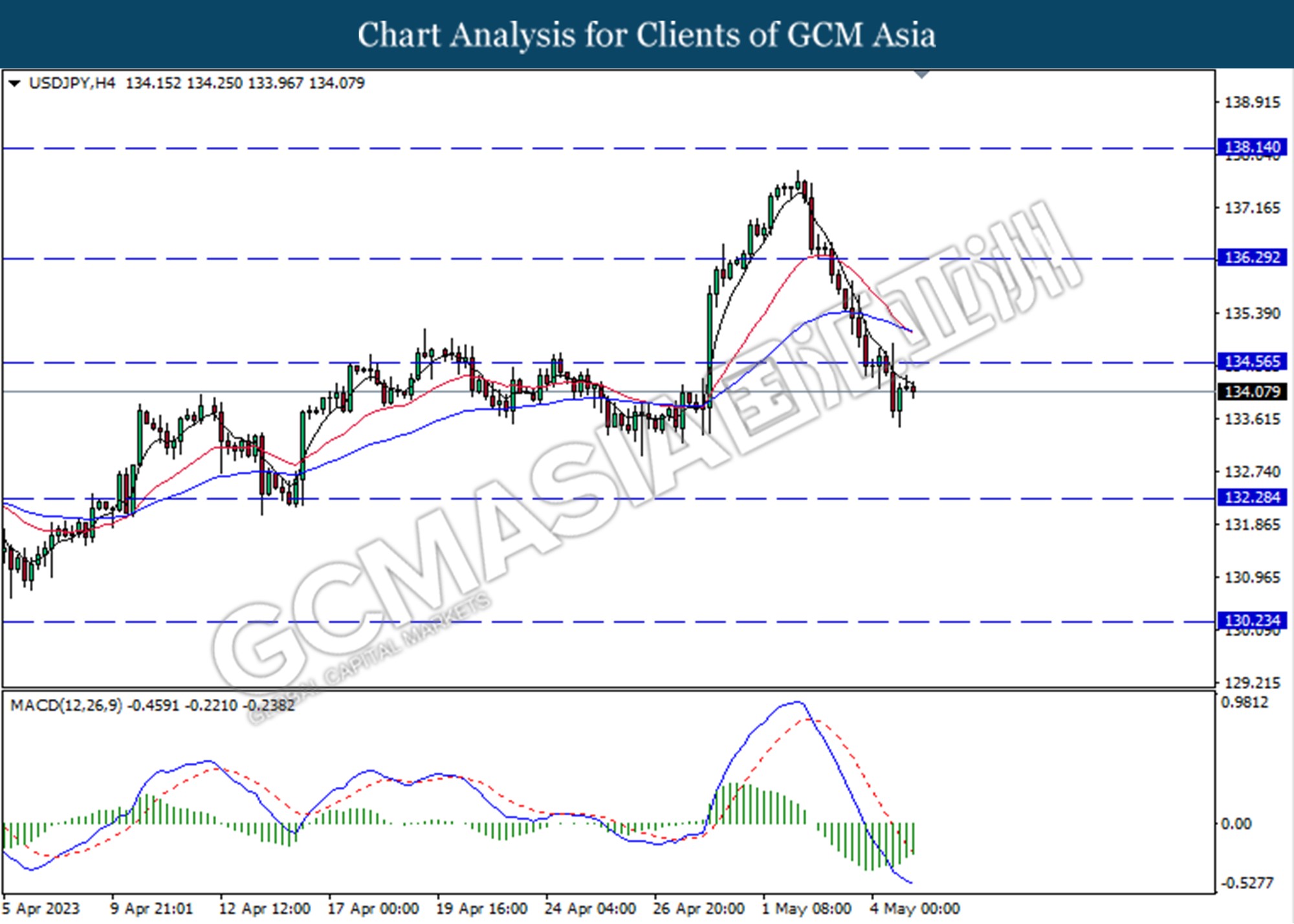

USDJPY, H4: USDJPY was traded lower following the prior breakout below the previous support level at 134.55. However, MACD which illustrated diminishing bearish momentum suggests the pair to traded higher as a technical correction.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

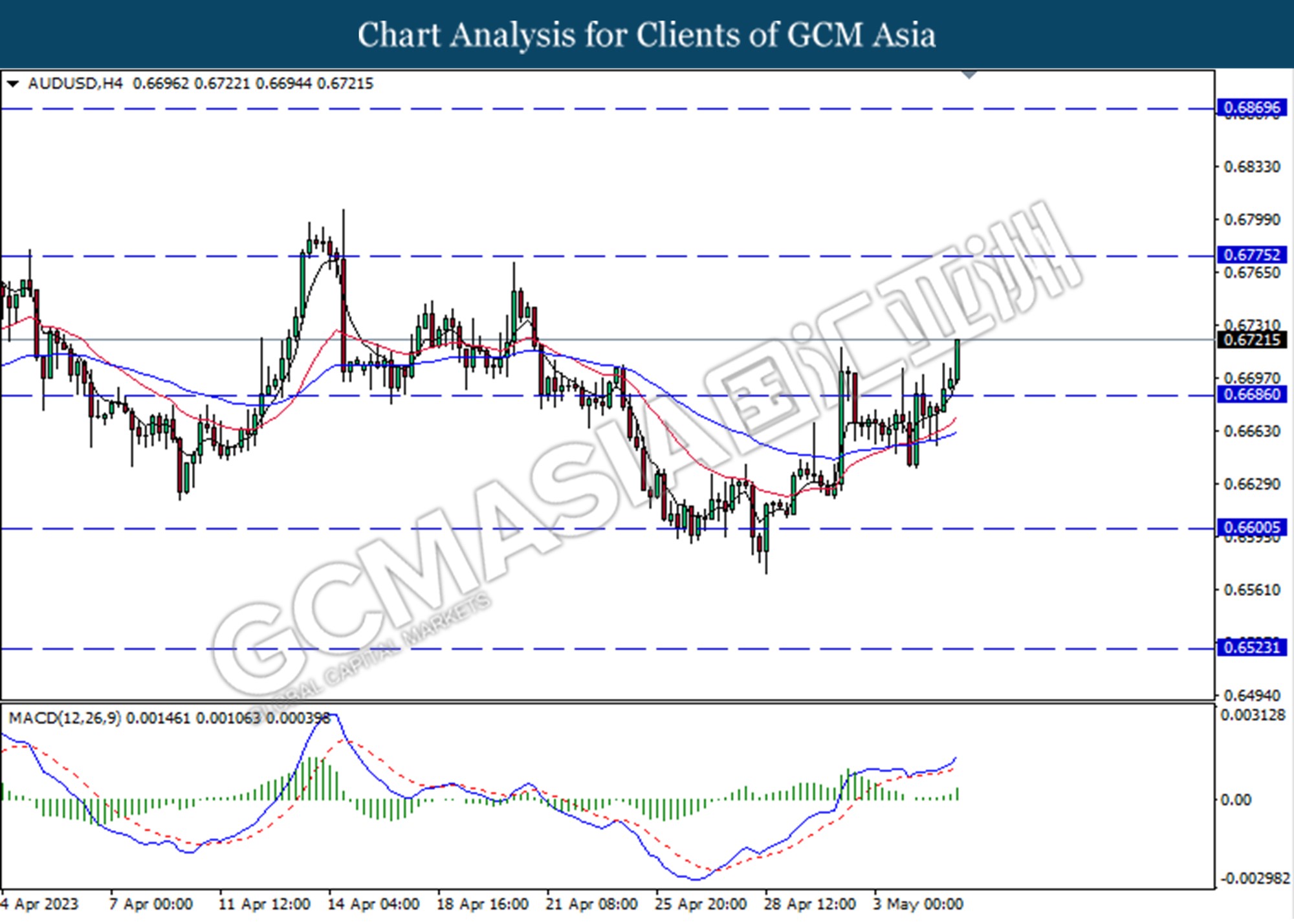

AUDUSD, H4: AUDUSD was traded higher following a prior break above the previous resistance level at 0.6685. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

NZDUSD, H4: NZDUSD was traded higher following a prior break above the previous resistance level at 0.6265. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 0.6325.

Resistance level: 0.6325, 0.6400

Support level: 0.6265, 0.6195

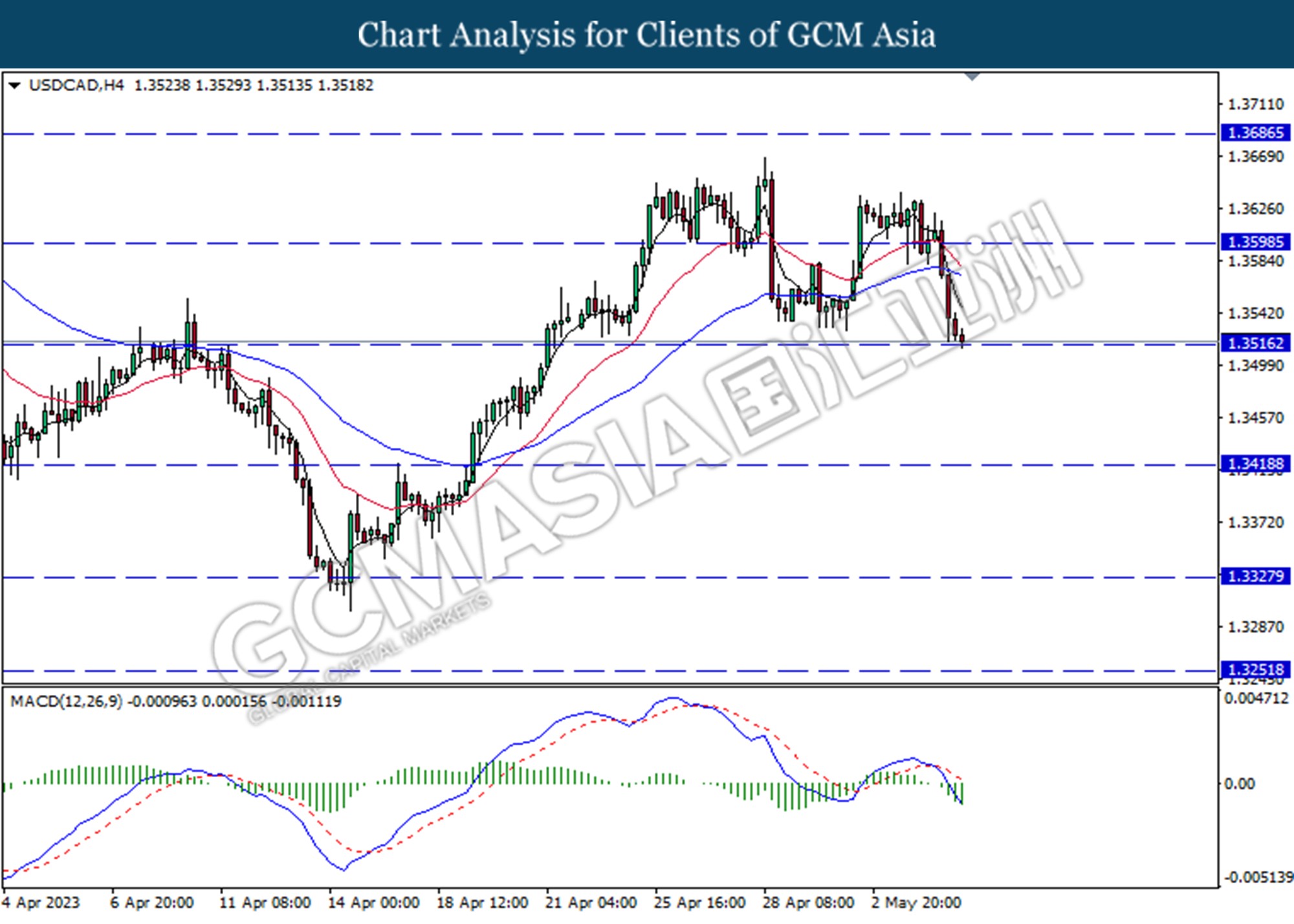

USDCAD, H4: USDCAD was traded lower while currently testing the support level at 1.3515. MACD which illustrated increasing bearish momentum suggests the pair extended its losses after it successfully breakout below the support level.

Resistance level: 1.3600, 1.3685

Support level: 1.3515, 1.3420

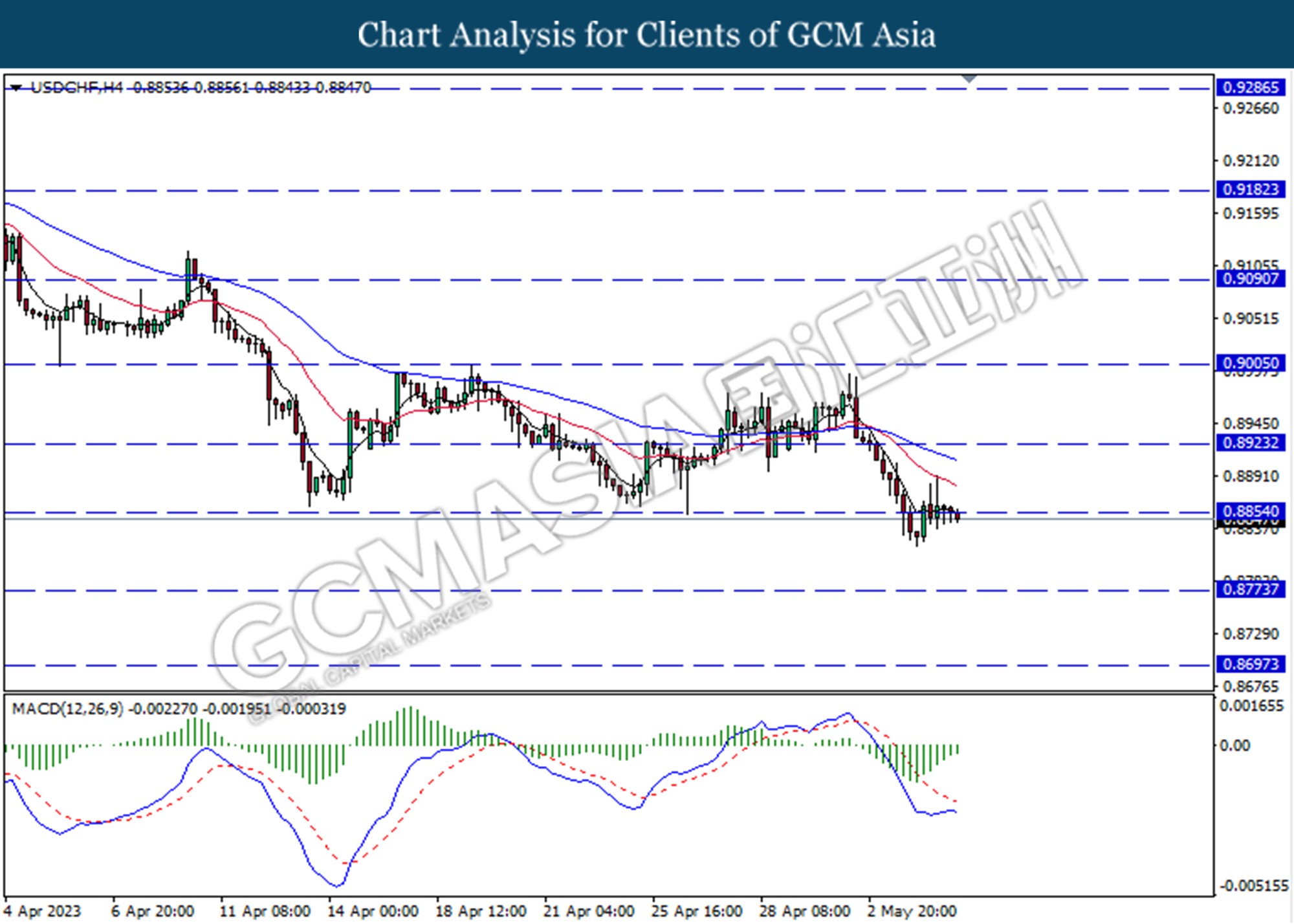

USDCHF, H4: USDCHF was traded lower following the prior breakout below the previous support level at 0.8855. MACD which illustrated diminishing bearish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 0.8855, 0.8925

Support level: 0.8775, 0.8700

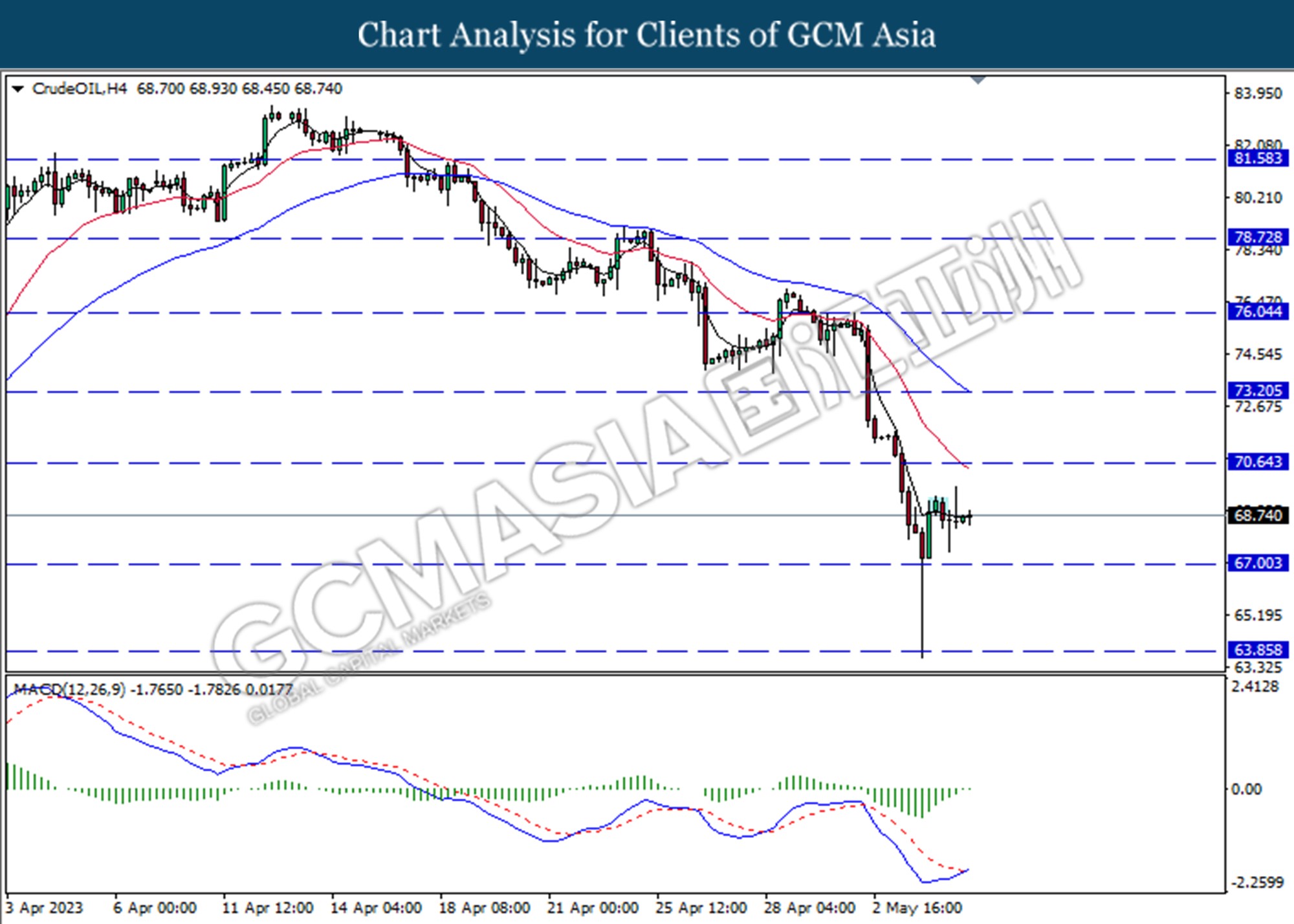

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the commodity extended its gains toward the resistance level.

Resistance level: 70.65, 73.20

Support level: 67.00, 63.85

GOLD_, H4: Gold price was traded lower following a previous break below the previous support level at 2049.30. MACD which illustrated diminishing bullish momentum suggests the commodity extended its losses toward the support level.

Resistance level: 2049.30, 2069.95

Support level: 2030.10, 2009.10