5 September 2022 Morning Session Analysis

Greenback buoyed following mixed employment data.

The dollar index, which gauges its value against a basket of six major currencies, dropped significantly right after the Nonfarm Payrolls and Unemployment data were released. According to the Bureau of Labor Statistics, US Nonfarm Payrolls rose 315K in August, above the consensus expectation for 310K, but far below the previous month reading’s 526K. The upbeat Nonfarm Payrolls data indicated that the companies hiring activity remained strong throughout the month of August. On the other hand, the US Unemployment data came in at 3.7%, higher than the consensus forecast at 3.5%, largely due to a jump in the labor force participation rate to 62.4%, which is at the highest level of the year. As such, the 0.2% rise in the unemployment rate does not reflect that the labor market is at the brink of unfavorable condition. On top of that, with an overall positive labor data been released, it provided rooms for Federal Reserve to increase the rate further, tackling the sky-high inflation, which is currently encountered by the American. As of writing, the dollar index rose 0.32% to 109.90.

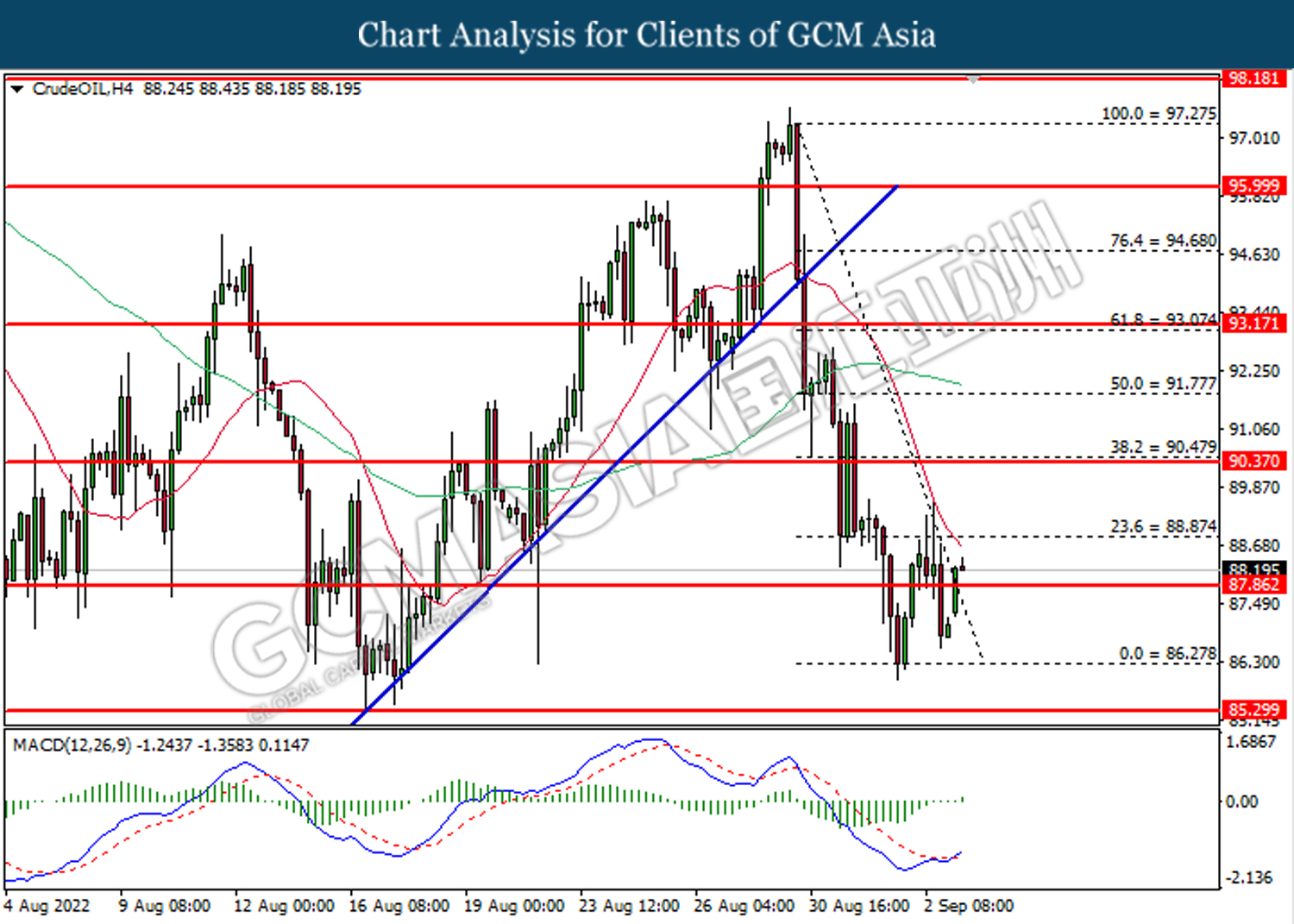

In the commodities market, the crude oil price was up by 0.50% to $87.90 a barrel after the Nord Stream 1 fully stopped the gas flow due to oil leakage. Besides, the gold prices edged down by -0.20% to $1709.40 per troy ounce following the release of the upbeat NFP data in the US.

Today’s Holiday Market Close

Time Market Event

All Day USD Labor Day

All Day CAD Labor Day

Today’s Highlight Events

Time Market Event

18:00 CrudeOIL OPEC Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Composite PMI (Aug) | 50.9 | 50.9 | – |

| 16:30 | GBP – Services PMI (Aug) | 52.5 | 52.5 | – |

Technical Analysis

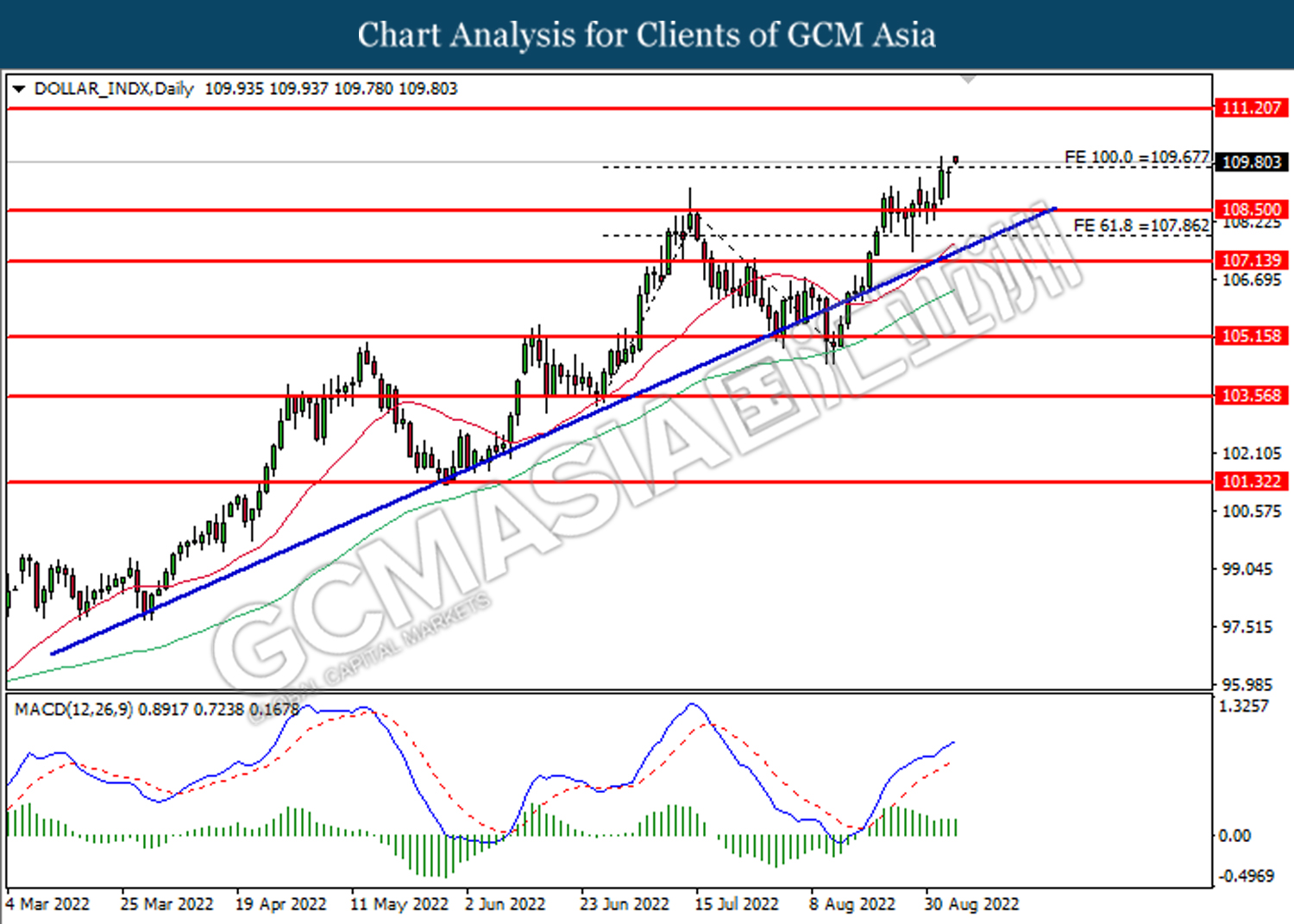

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level at 109.65. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the next resistance level at 111.20.

Resistance level: 111.20, 112.60

Support level: 109.65, 108.50

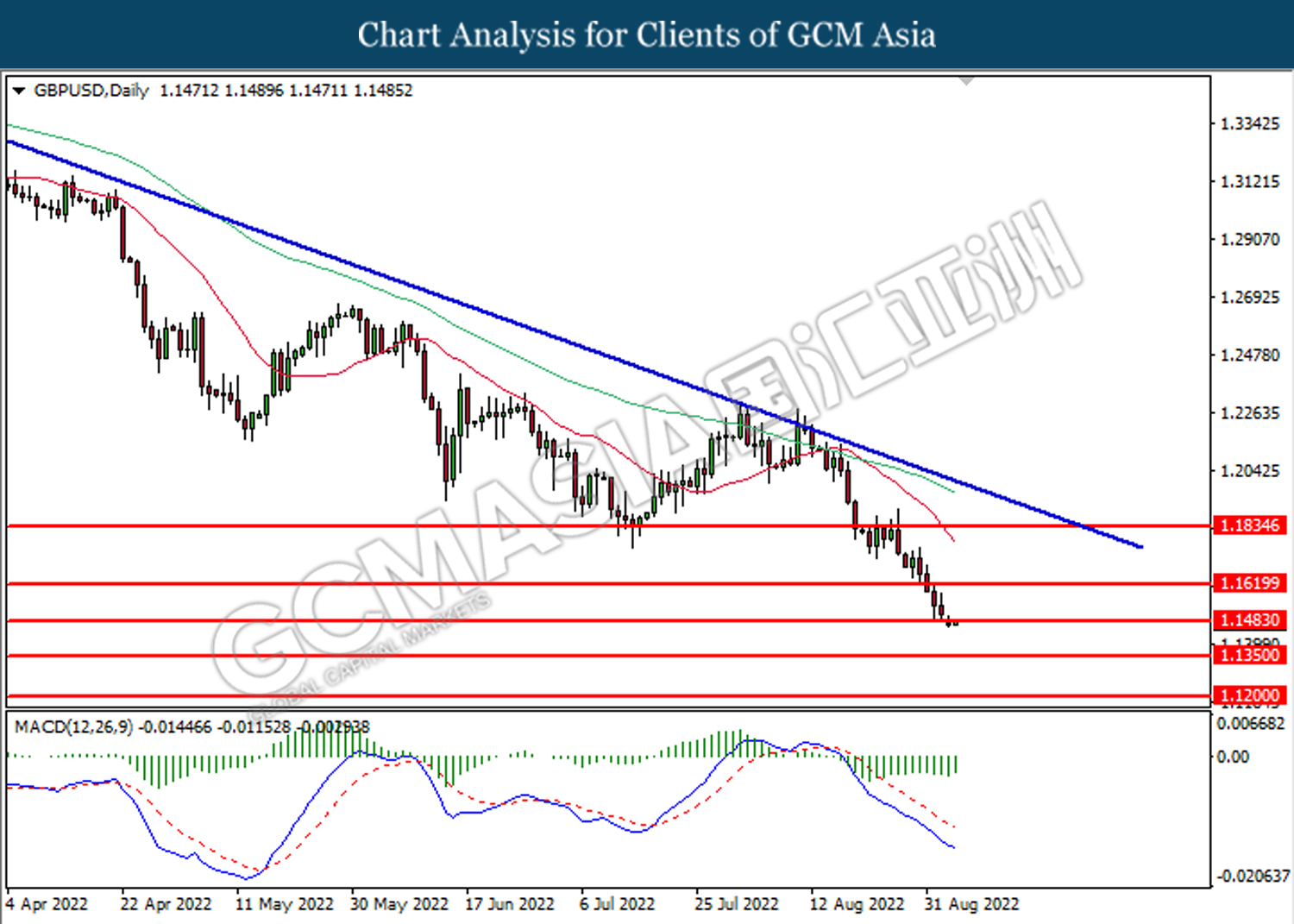

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.1485. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the next support level.

Resistance level: 1.1485, 1.1620

Support level: 1.1350, 1.1200

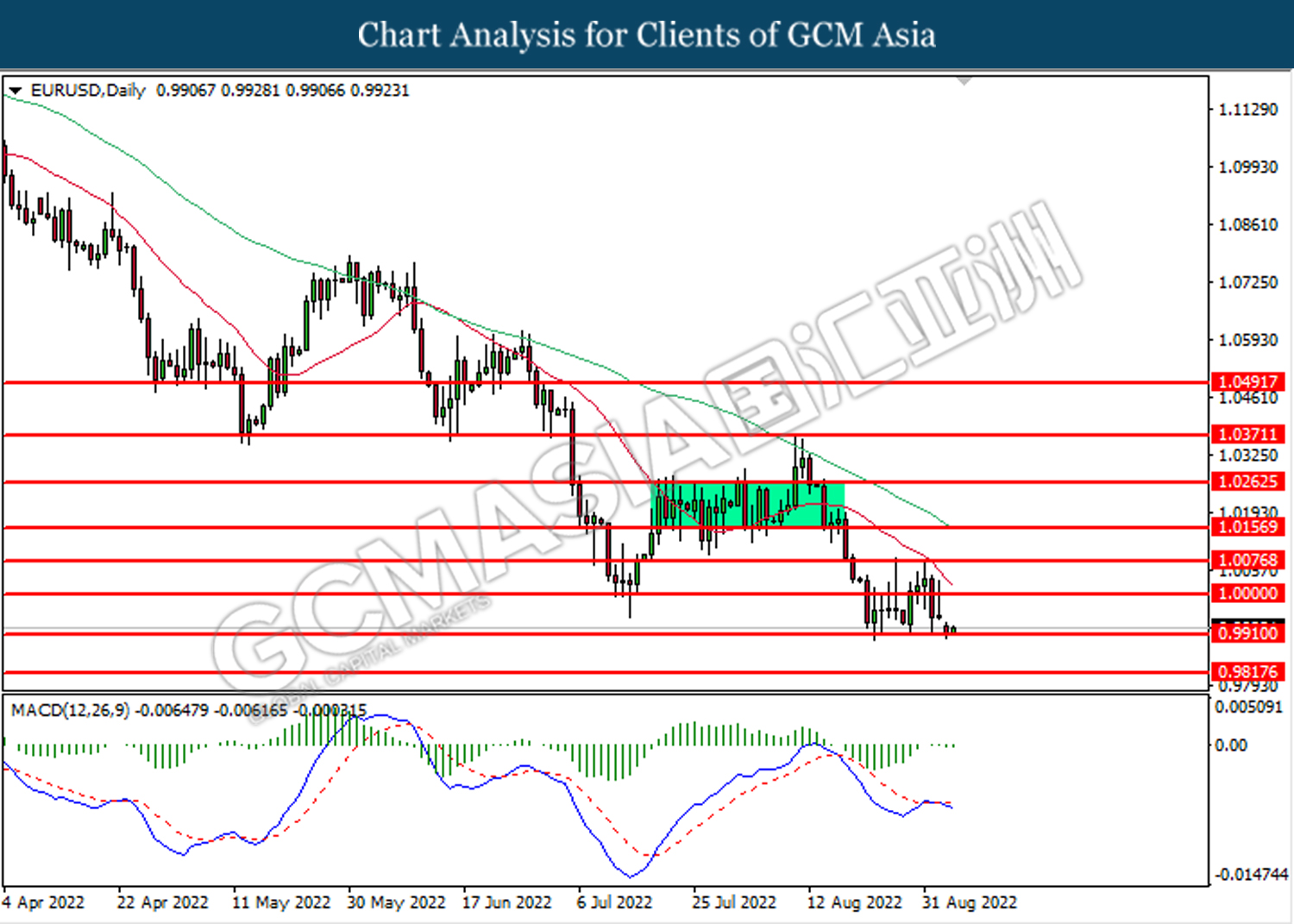

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 0.9910. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0000, 1.0075

Support level: 0.9910, 0.9820

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 139.25. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 141.50.

Resistance level: 141.50, 144.15

Support level: 139.25, 136.65

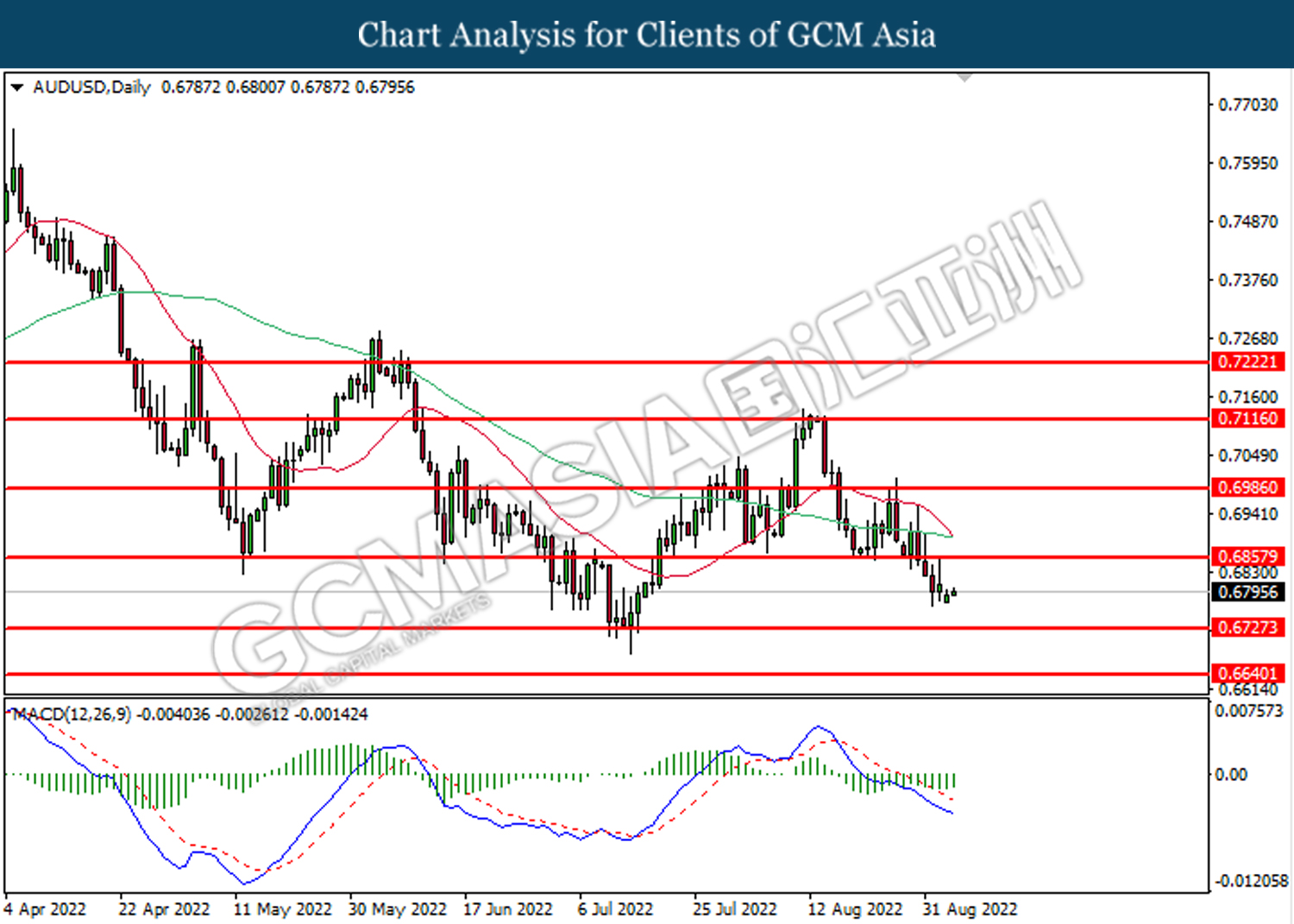

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6860. MACD which illustrated bearish bias momentum suggest the pair to extend its to extend its losses toward the support level at 0.6725.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

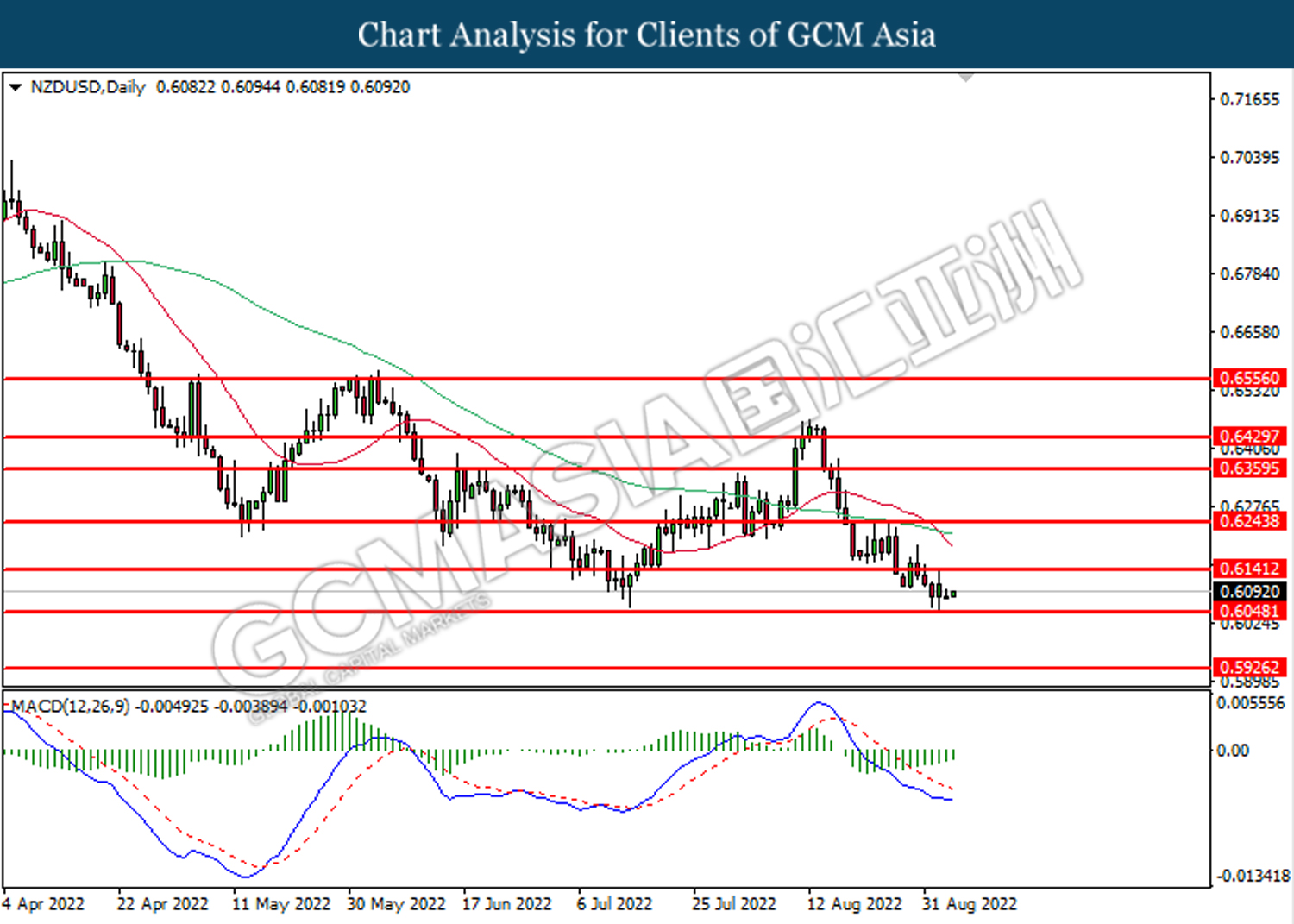

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6140. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6050.

Resistance level: 0.6140, 0.6245

Support level: 0.6050, 0.5925

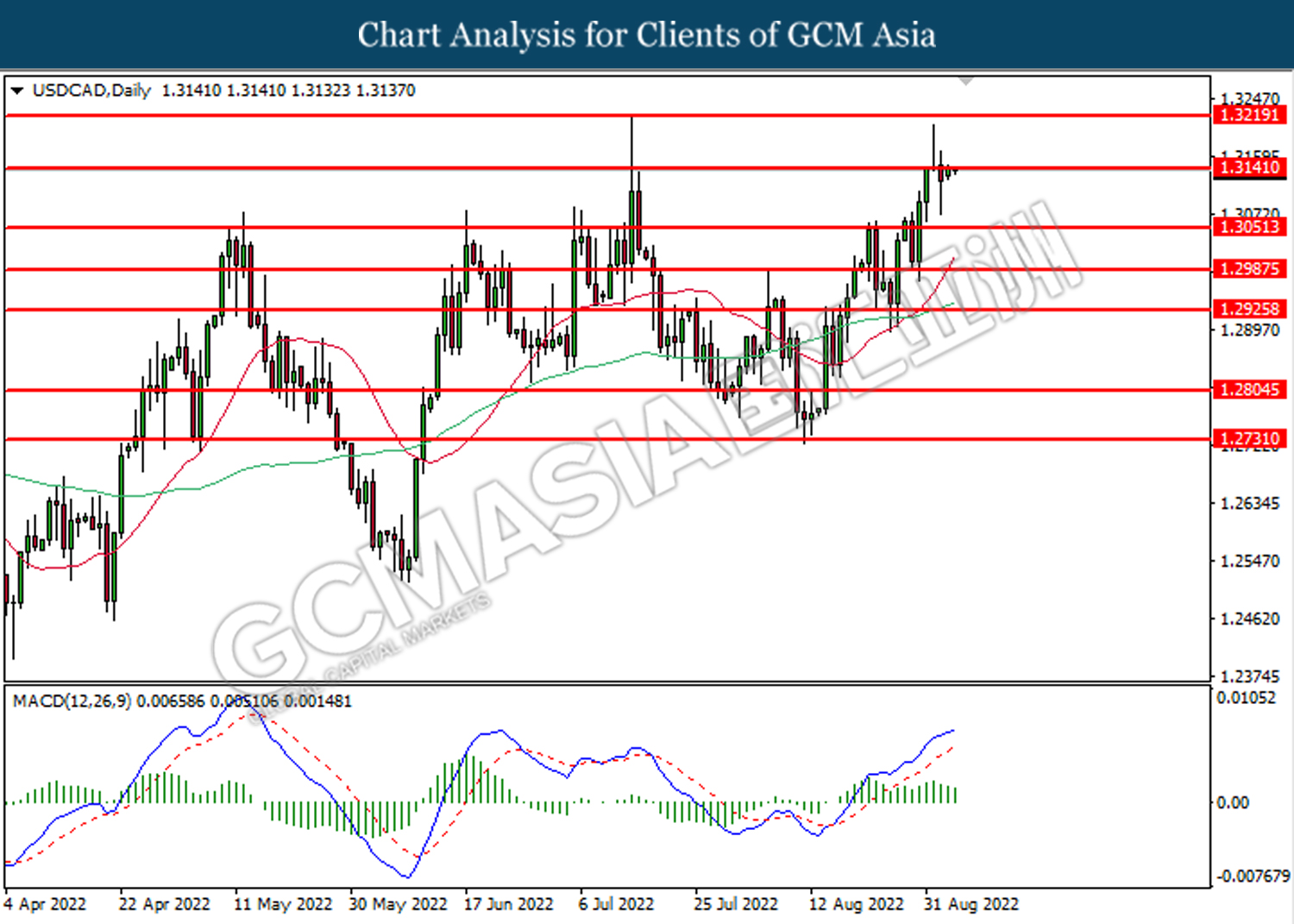

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3140. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3140, 1.3220

Support level: 1.3050, 1.2985

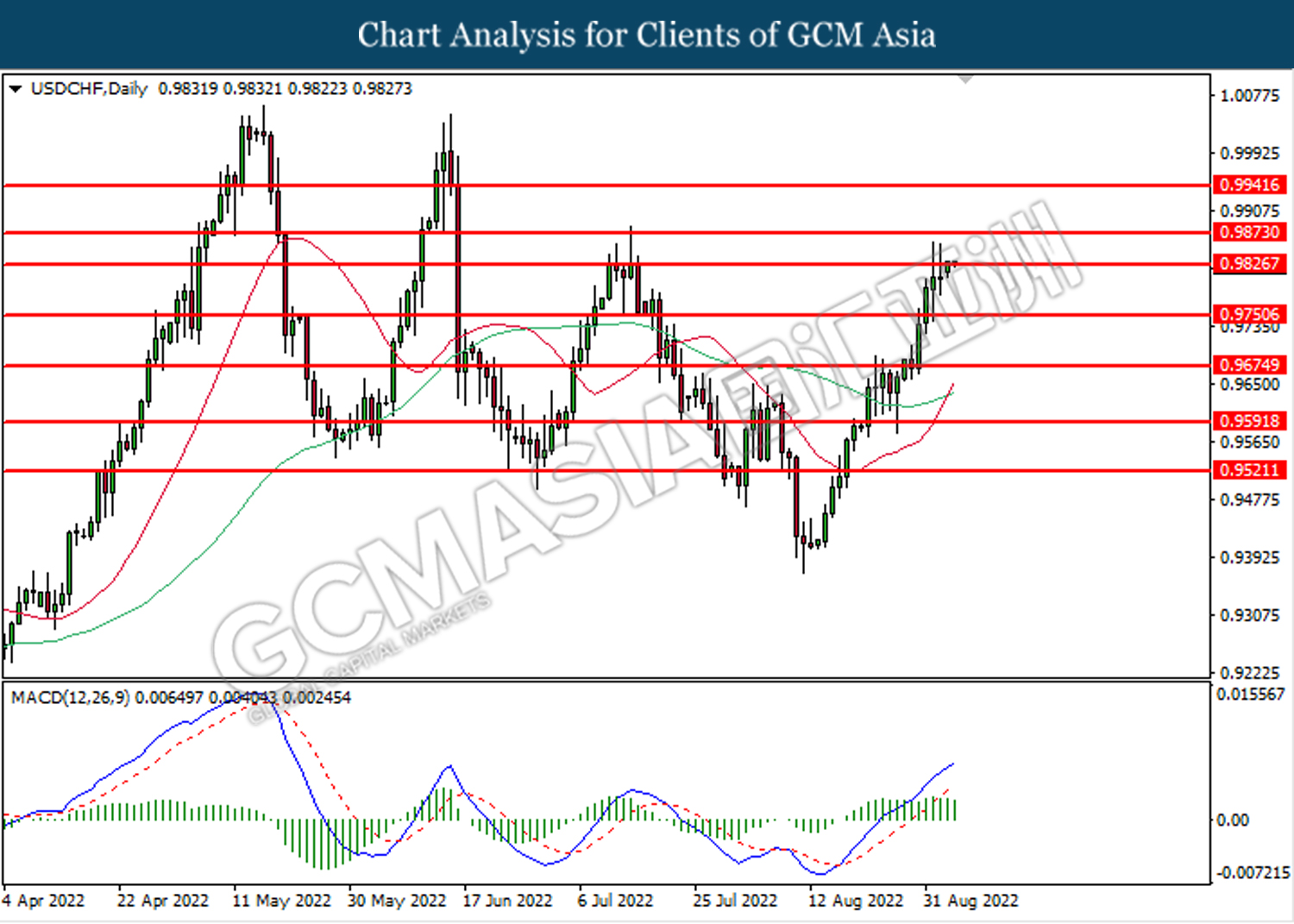

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9825. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9825, 0.9875

Support level: 0.9750, 0.9675

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 87.85. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 88.85.

Resistance level: 88.85, 90.35

Support level: 87.85, 86.30

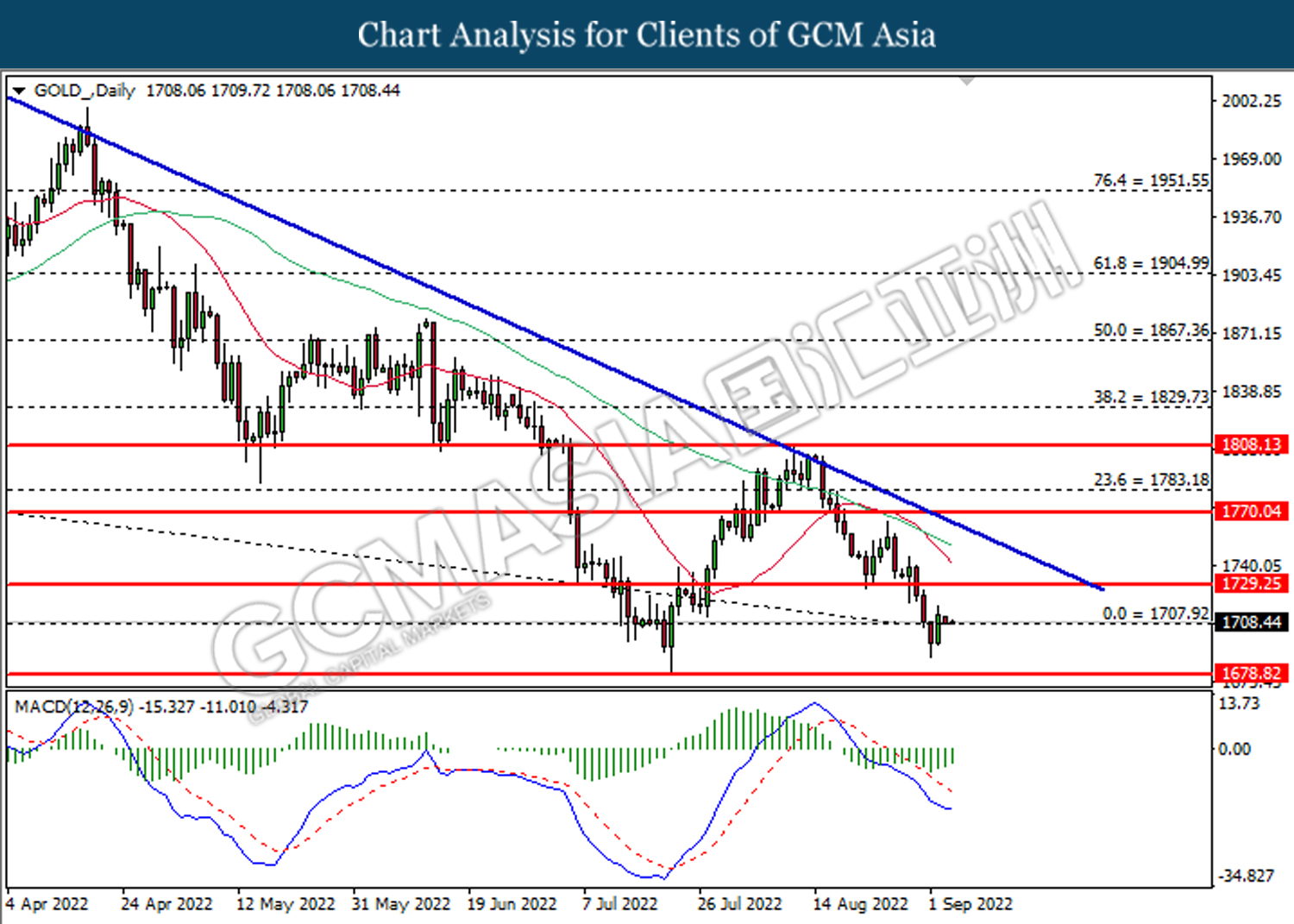

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1707.90. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 1729.25.

Resistance level: 1729.25, 1770.05

Support level: 1707.90, 1678.80