6 January 2023 Afternoon Session Analysis

Pound Sterling dipped as UK economic still hovered in recession.

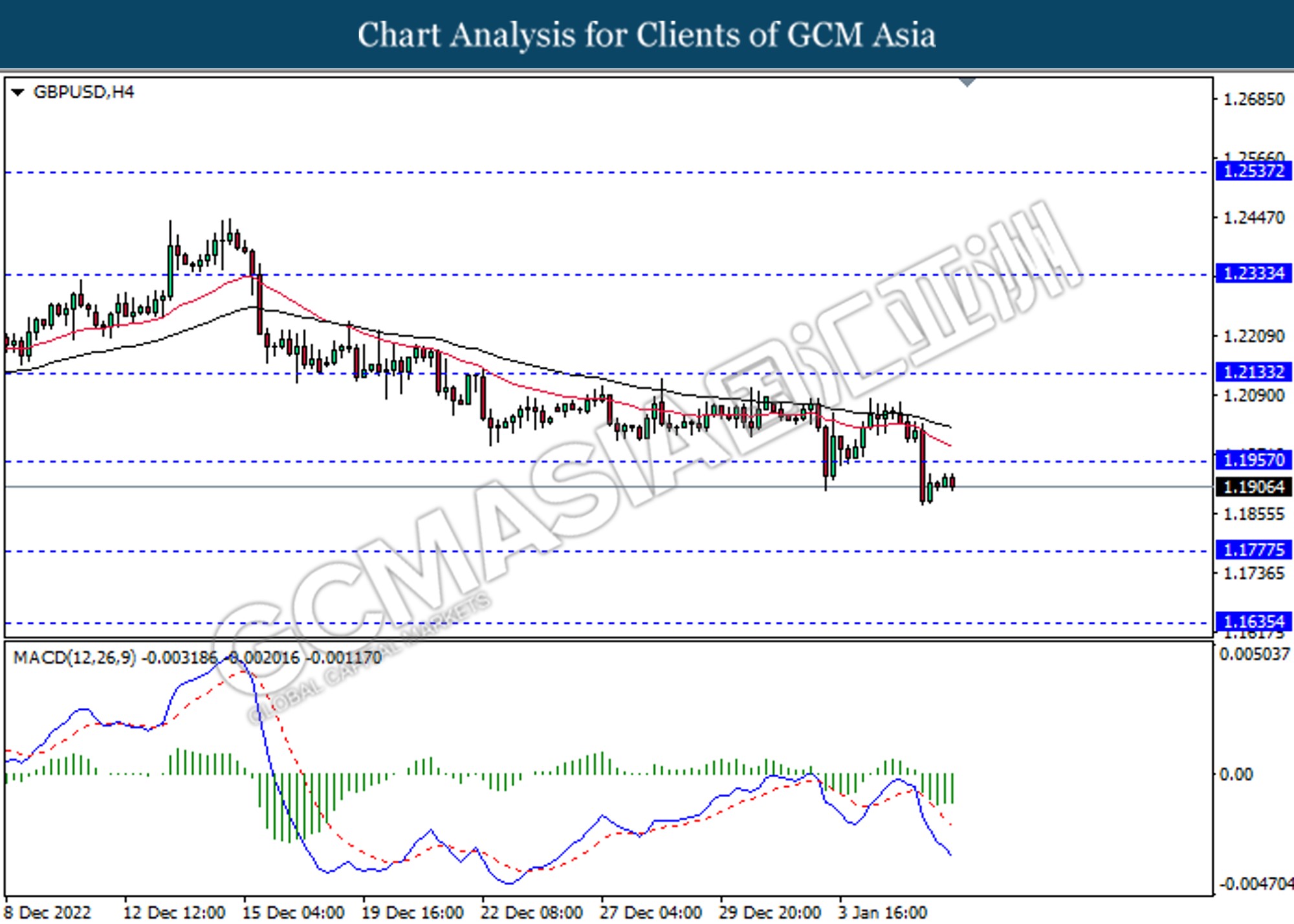

The GBP/USD, which traded widely by global investors slumped throughout yesterday trading session over the bearish economic data. According to Markit Economics, the UK Composite Purchasing Managers’ Index (PMI) in December notched up from the previous reading of 48.2 to 49.0, which met with the market expectation. Besides, the UK Services Purchasing Managers Index (PMI) had also rose slight in December. Though, these two data has posted at the reading that below 50, which indicating that the UK economic sector were still under contraction. With that, it stoked a shift in sentiment toward other currencies such as US Dollar. On the other hand, the China-proxy currency, AUD/USD dropped significantly following the slowing economy activities which driven by rising Covid infection. According to CNBC Supply Chain Heat Map data, China manufacturing orders down by 40%, with 1/2 or even 3/4 of the labor force being infected and not able to work. The current situation might be continued till 2nd half of January and early February. As of writing, the GBP/USD appreciated by 0.23% to 1.1933 while AUD/USD up by 0.40% to 0.6776.

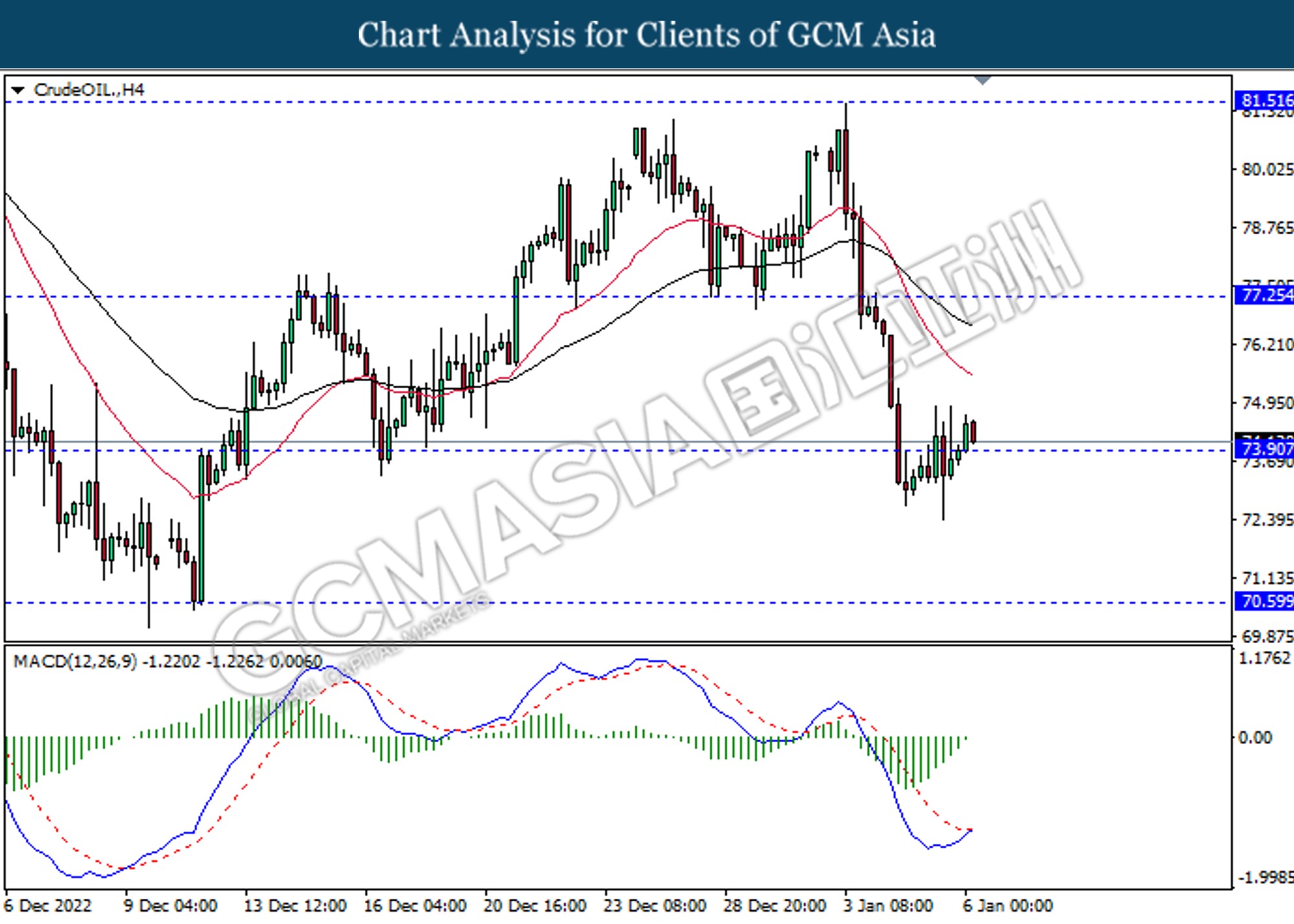

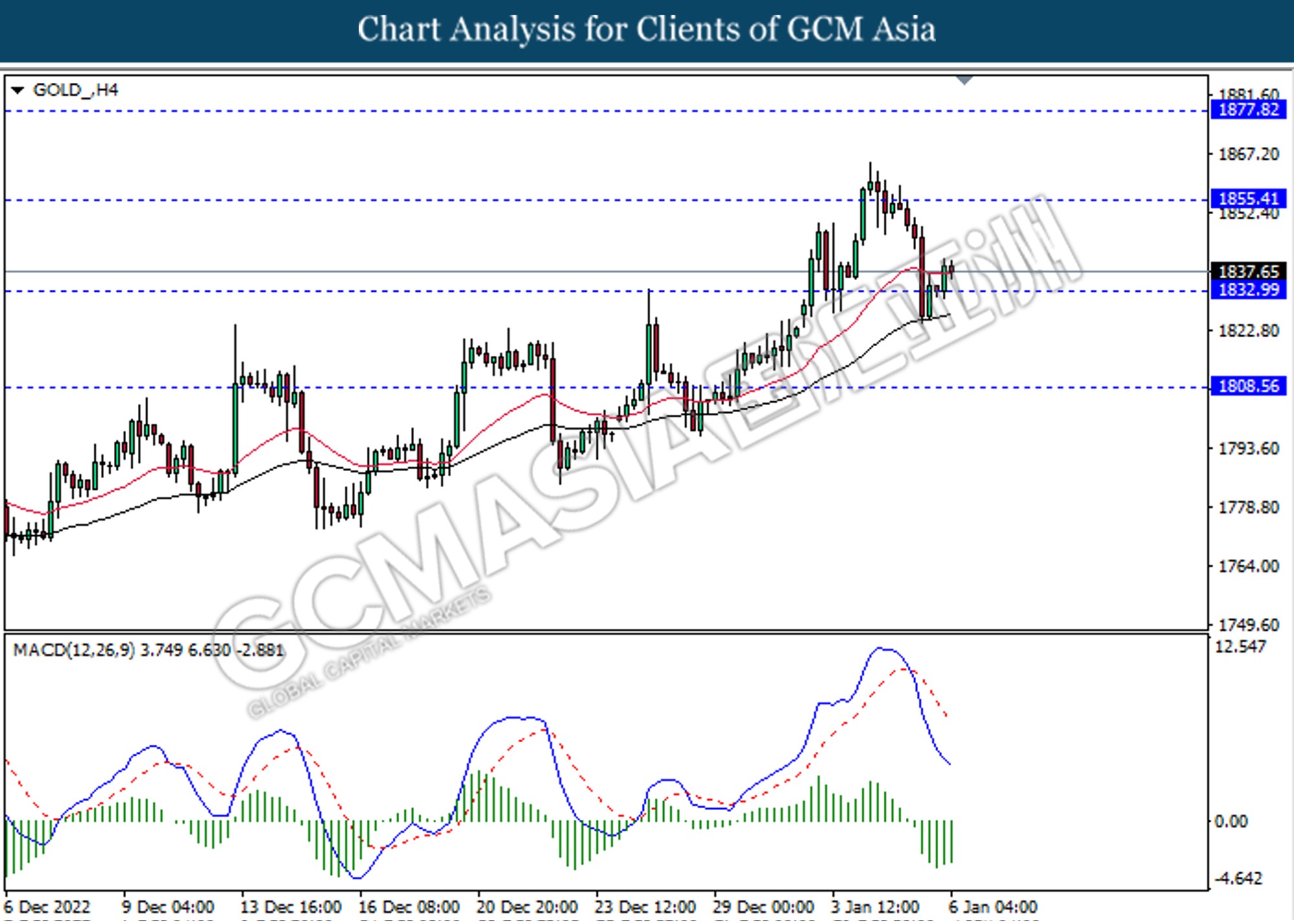

In the commodities market, the crude oil price rose by 1.24% to $74.60 per barrel as of writing following the reopening in the China-Hong Kong border spelt some demand for this black commodity. In addition, the gold price edged up by 0.19% to $1839.18 per troy ounce as of writing over the weakened US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Construction PMI (Dec) | 0.718M | -1.520M | – |

| 18:00 | EUR – CPI (YoY) (Dec) | 50.4 | – | – |

| 21:30 | USD – Nonfarm Payrolls (Dec) | 10.1% | 9.7% | – |

| 21:30 | USD – Unemployment Rate (Dec) | 263K | 200K | – |

| 21:30 | CAD – Employment Change (Dec) | 3.7% | 3.7% | – |

| 23:00 | USD – ISM Non-Manufacturing PMI (Dec) | 10.1K | 7.5 | – |

| 23:00 | CAD – Ivey PMI (Dec) | 56.5 | 55.0 | – |

Technical Analysis

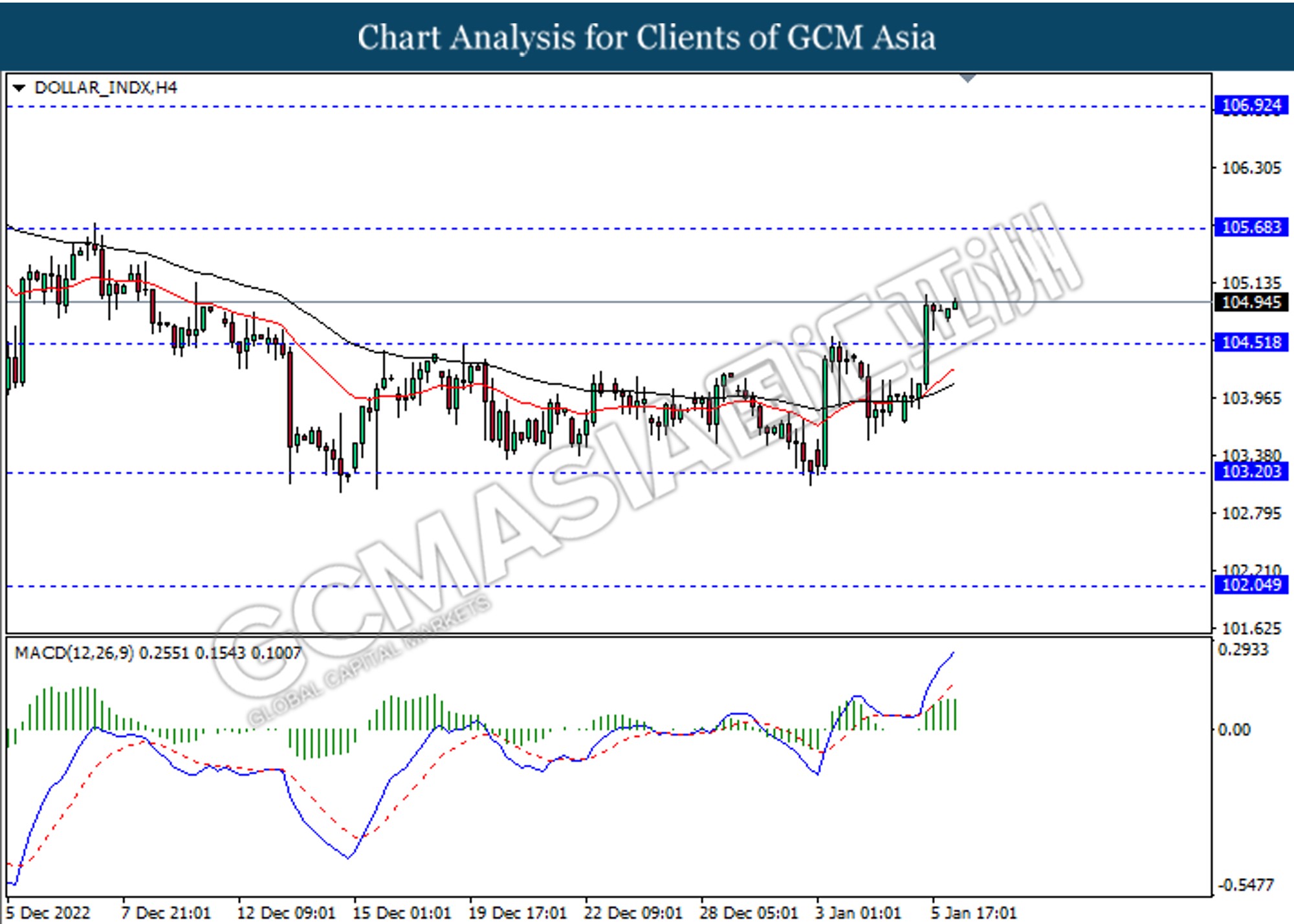

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 105.70, 106.90

Support level: 104.50, 103.20

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1955, 1.2135

Support level: 1.1775, 1.1635

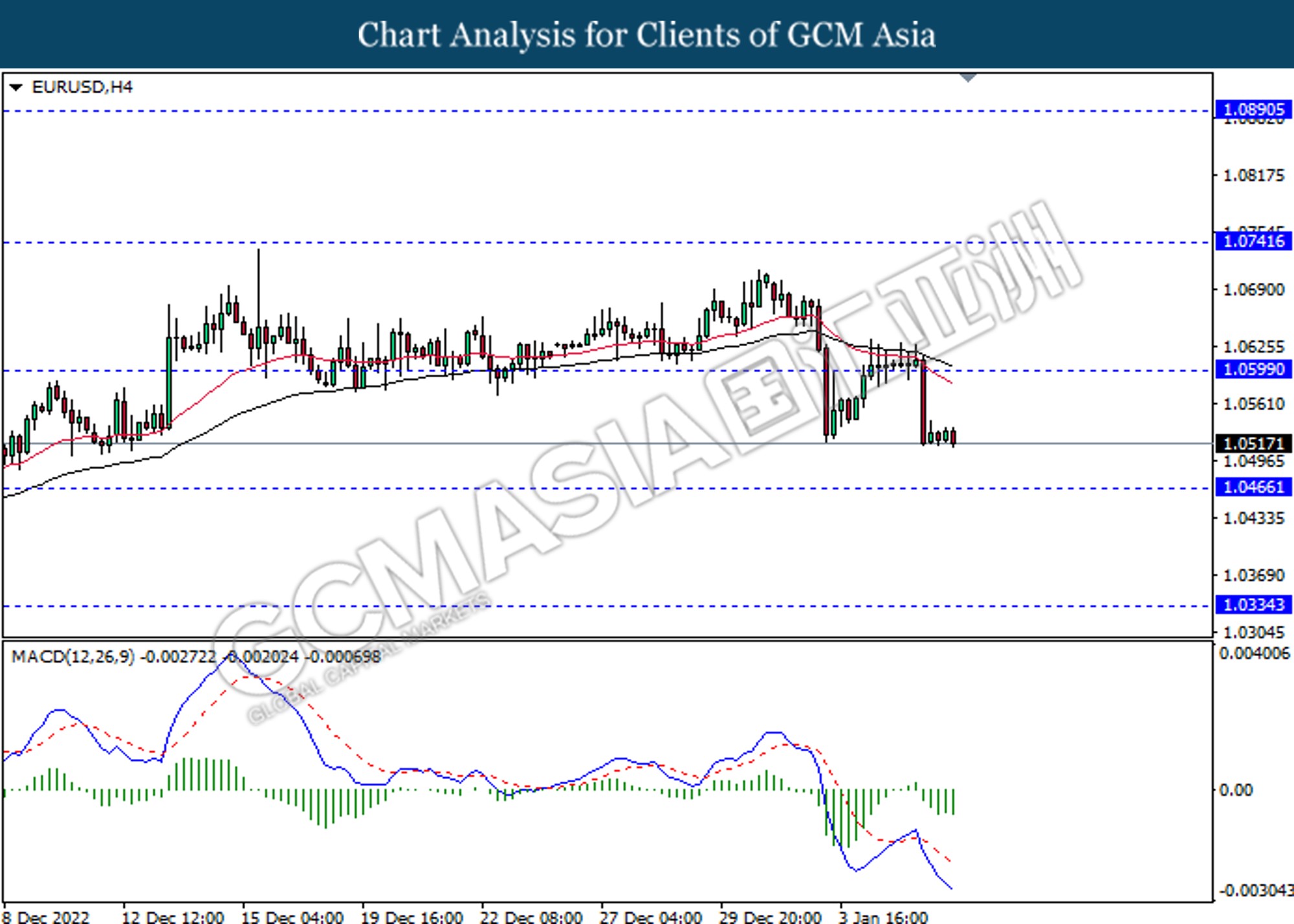

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0600, 1.0740

Support level: 1.0465, 1.0335

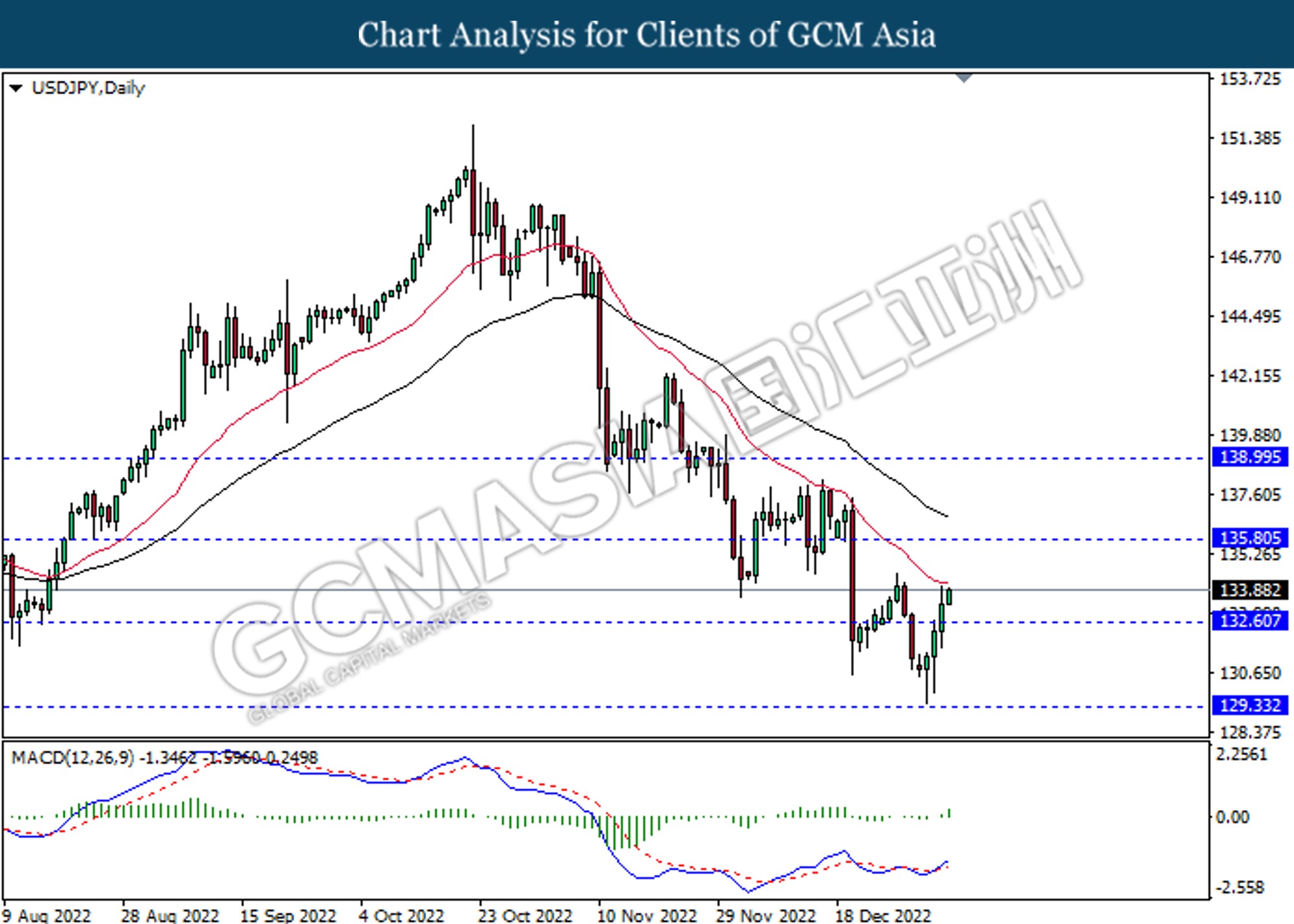

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 135.80, 139.00

Support level: 132.60, 129.35

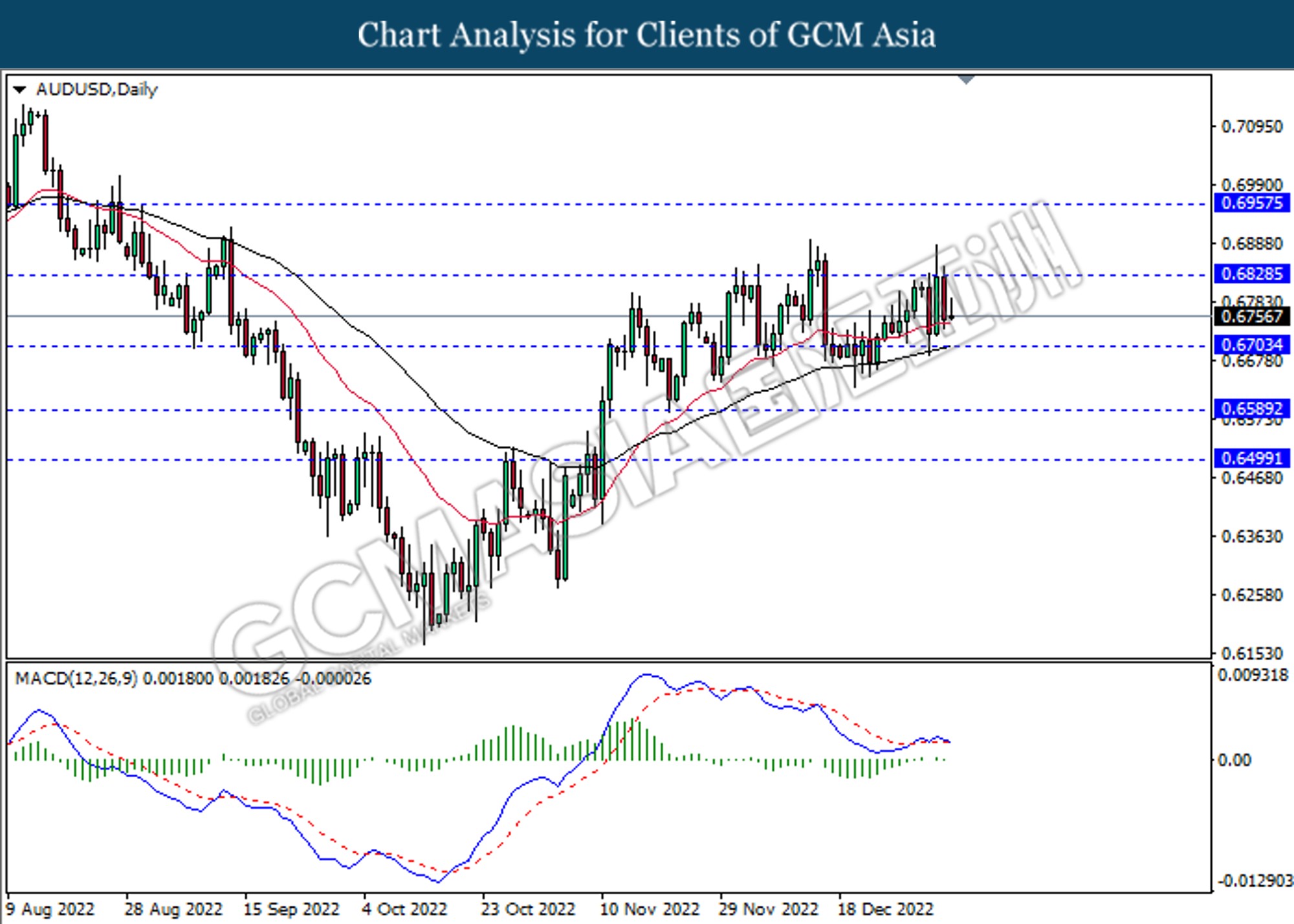

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6830, 0.6955

Support level: 0.6705, 0.6590

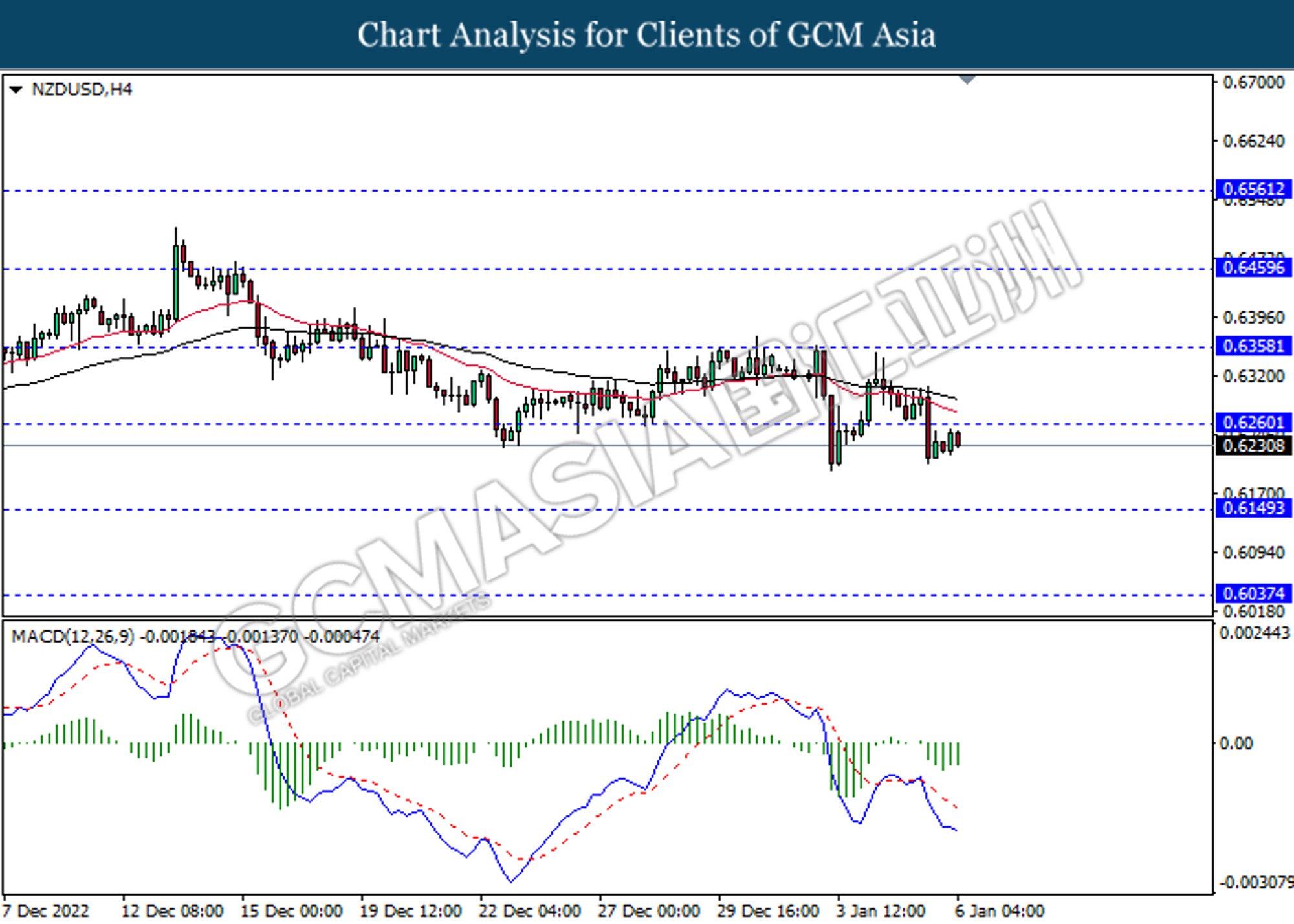

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6260, 0.6360

Support level: 0.6150, 0.6035

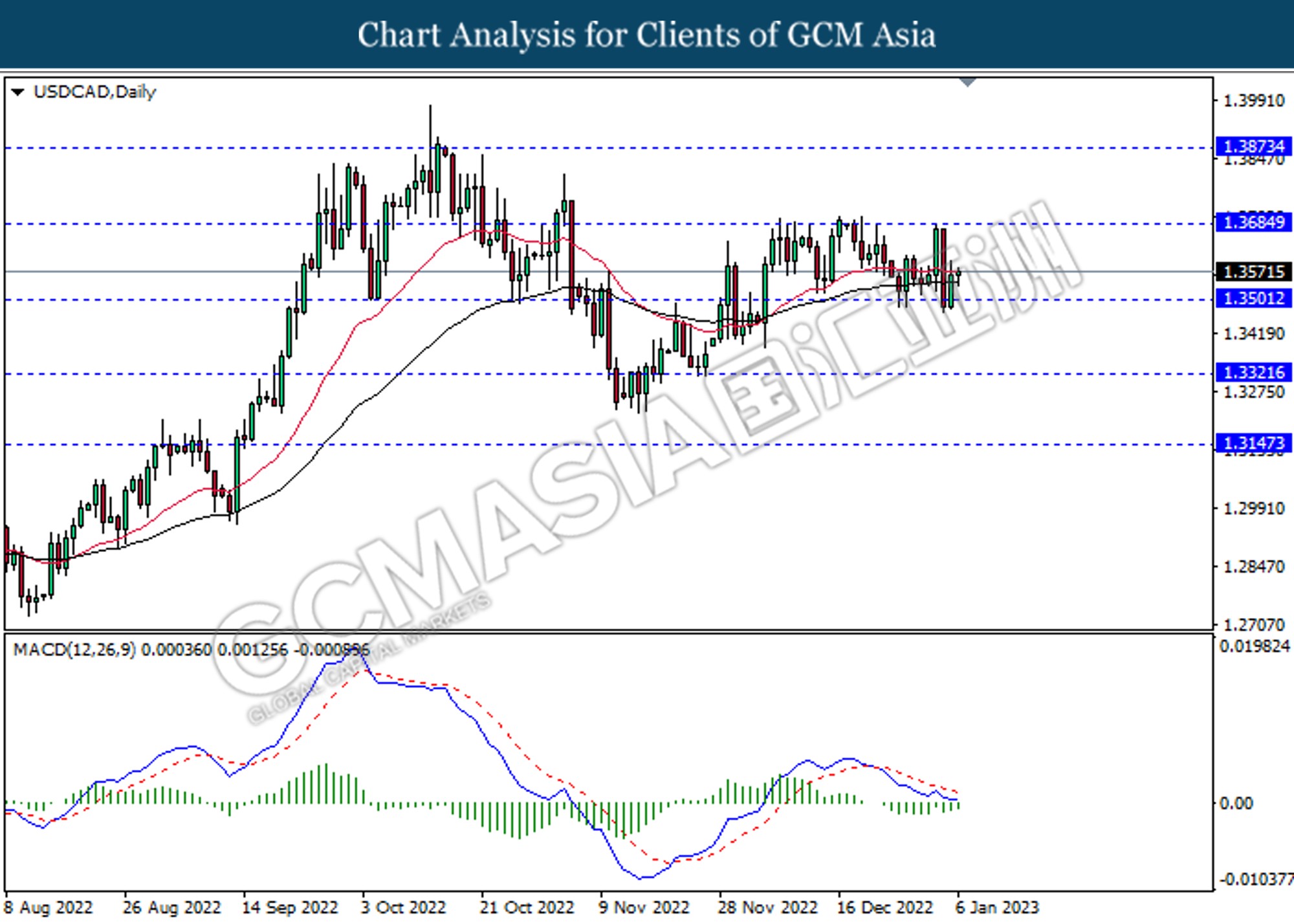

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

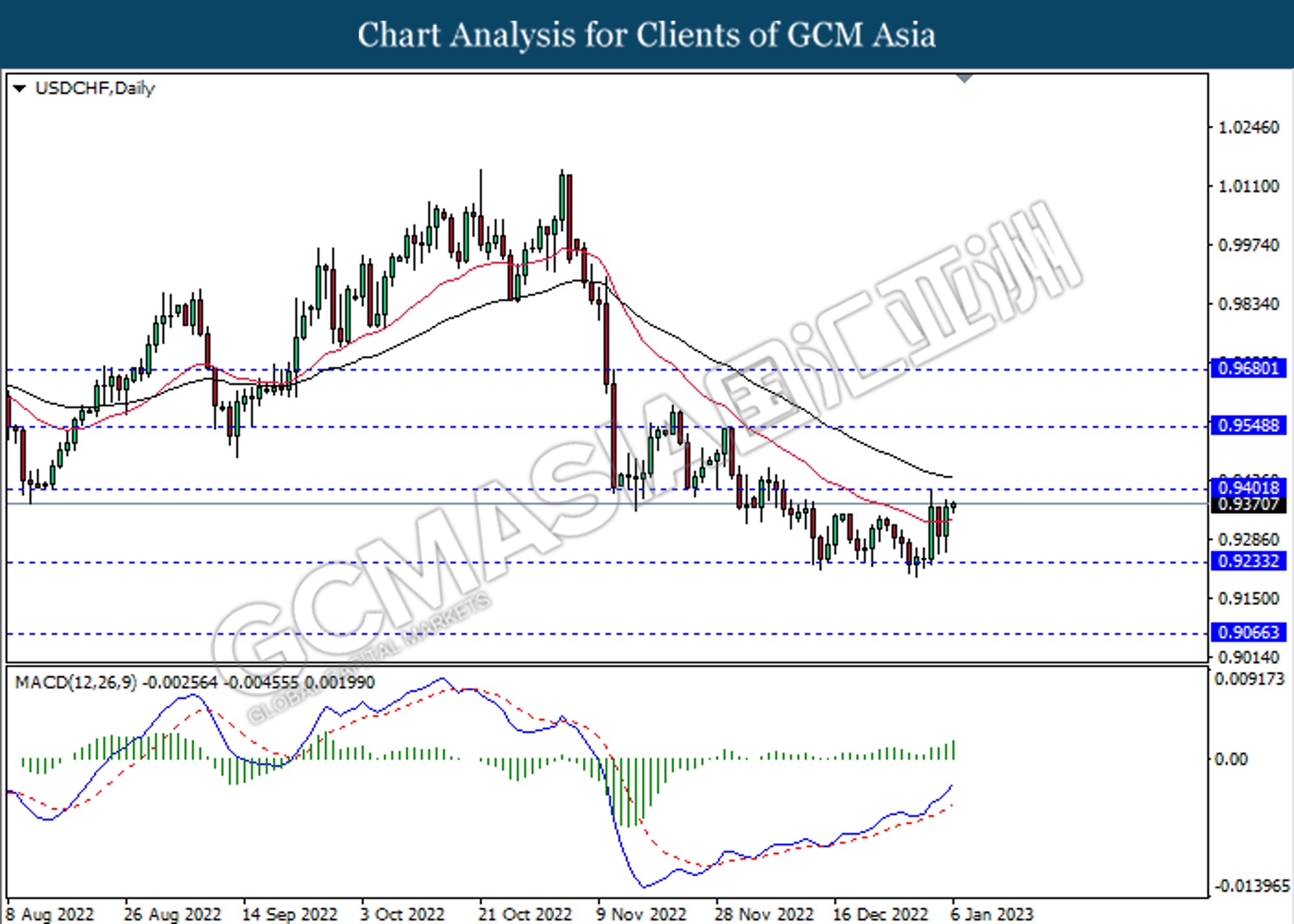

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.60

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 1855.40, 1877.80

Support level: 1833.00, 1808.55