6 January 2023 Morning Session Analysis

Greenback surged amid upbeat jobs data.

The dollar index, which traded against a basket of mainstream currencies, extended its rally during the past trading session amid the US released a series of strong labor data. Yesterday, the ADP private payrolls report for the last month of 2022 showed that the number of jobs has been increased to 234K, beating the consensus forecast at 150K, signaling that the US labor market remains hot and resilient. On top of that, the Department of Labor also reported the Initial Jobless Claims data with a lower-than-expected reading, which triggered further bullish momentum in the US dollar market. According to the report, the number of American who filed for unemployment benefit came in at 204K, missing the economist forecast at 225K, refreshing the record of lowest number of claims in 14 weeks. Besides, St. Louis Federal Reserve President James Bullard presented his view on the outlook of year 2023 earlier today. In the speech, he revealed that the year 2023 may be a disinflationary year, but the policy is not sufficiently restrictive yet. With the backdrop of hot labor market and hawkish bias statement from Fed Bullard, investors exited from the riskier asset and rushed into the dollar market. As of writing, the US dollar rose by 0.84% to 105.15.

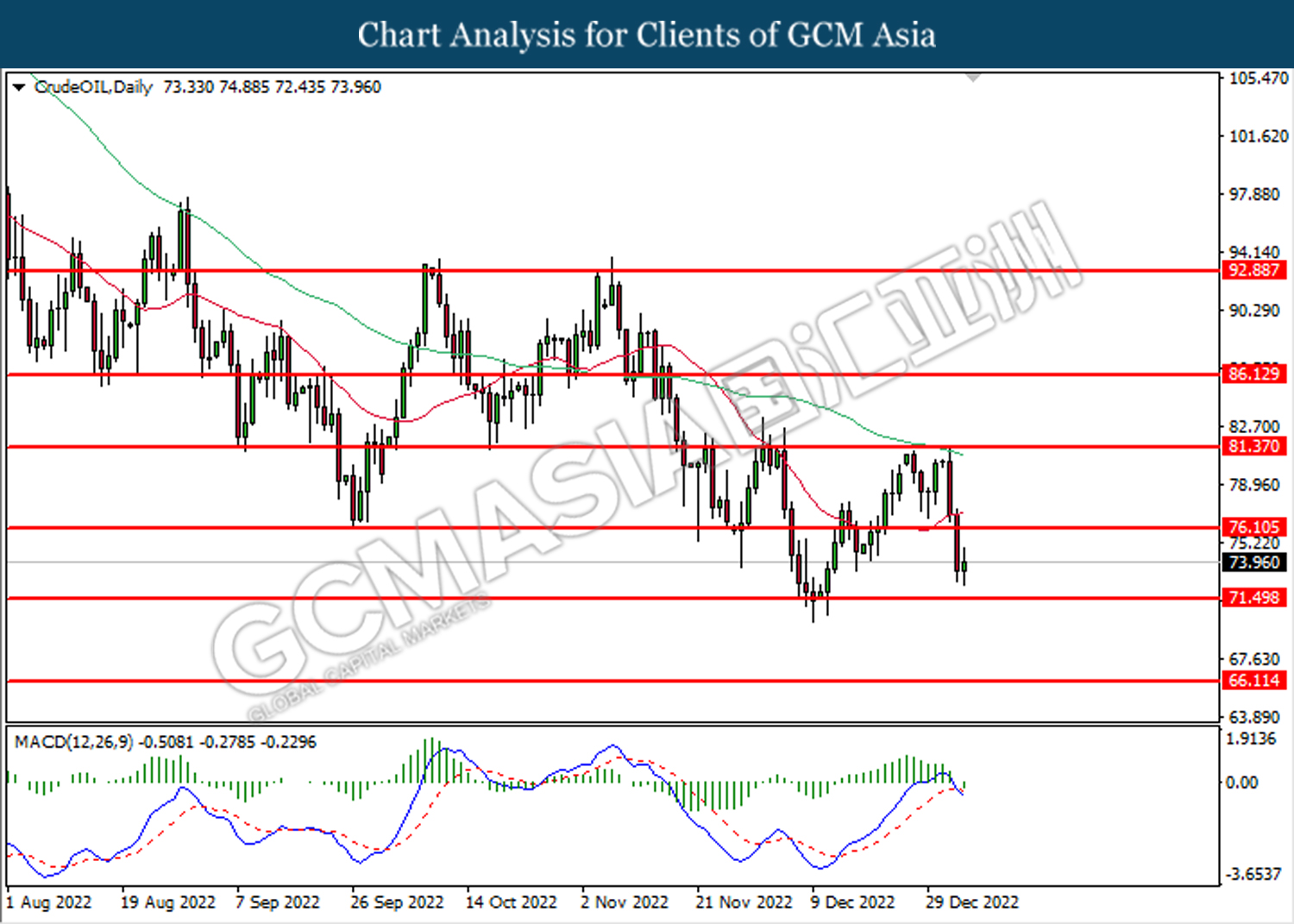

In the commodities market, crude oil prices rose by 1.02% to $74.00 per barrel after the US government reported unexpectedly high demand for diesel during the end of 2022. Besides, gold prices edged down by -1.15% to $1833.50 per troy ounce after the US labor market reported upbeat data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Construction PMI (Dec) | 0.718M | -1.520M | – |

| 18:00 | EUR – CPI (YoY) (Dec) | 50.4 | – | – |

| 21:30 | USD – Nonfarm Payrolls (Dec) | 10.1% | 9.7% | – |

| 21:30 | USD – Unemployment Rate (Dec) | 263K | 200K | – |

| 21:30 | CAD – Employment Change (Dec) | 3.7% | 3.7% | – |

| 23:00 | USD – ISM Non-Manufacturing PMI (Dec) | 10.1K | 7.5 | – |

| 23:00 | CAD – Ivey PMI (Dec) | 56.5 | 55.0 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 107.90

Support level: 103.15, 101.25

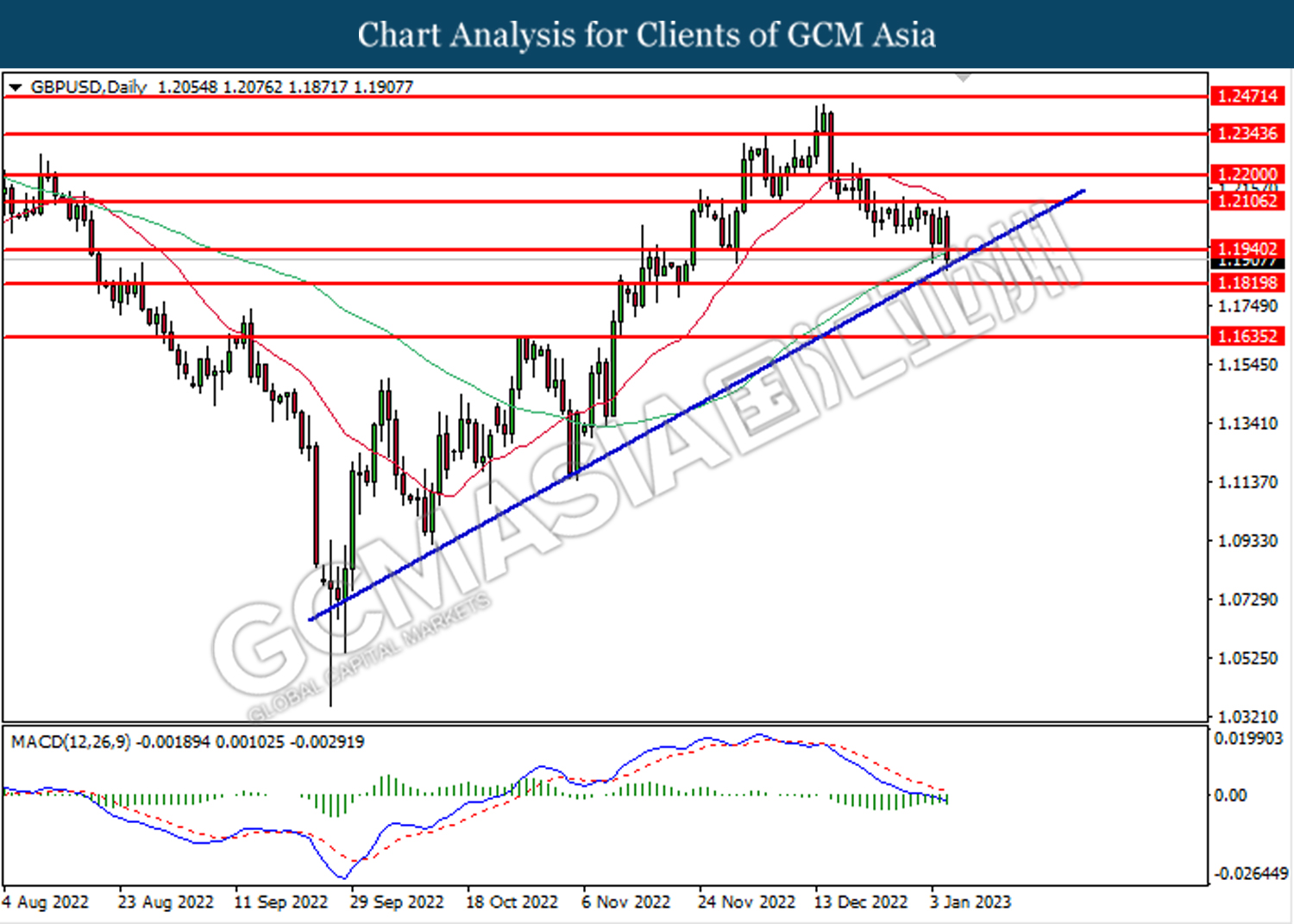

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.1940. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

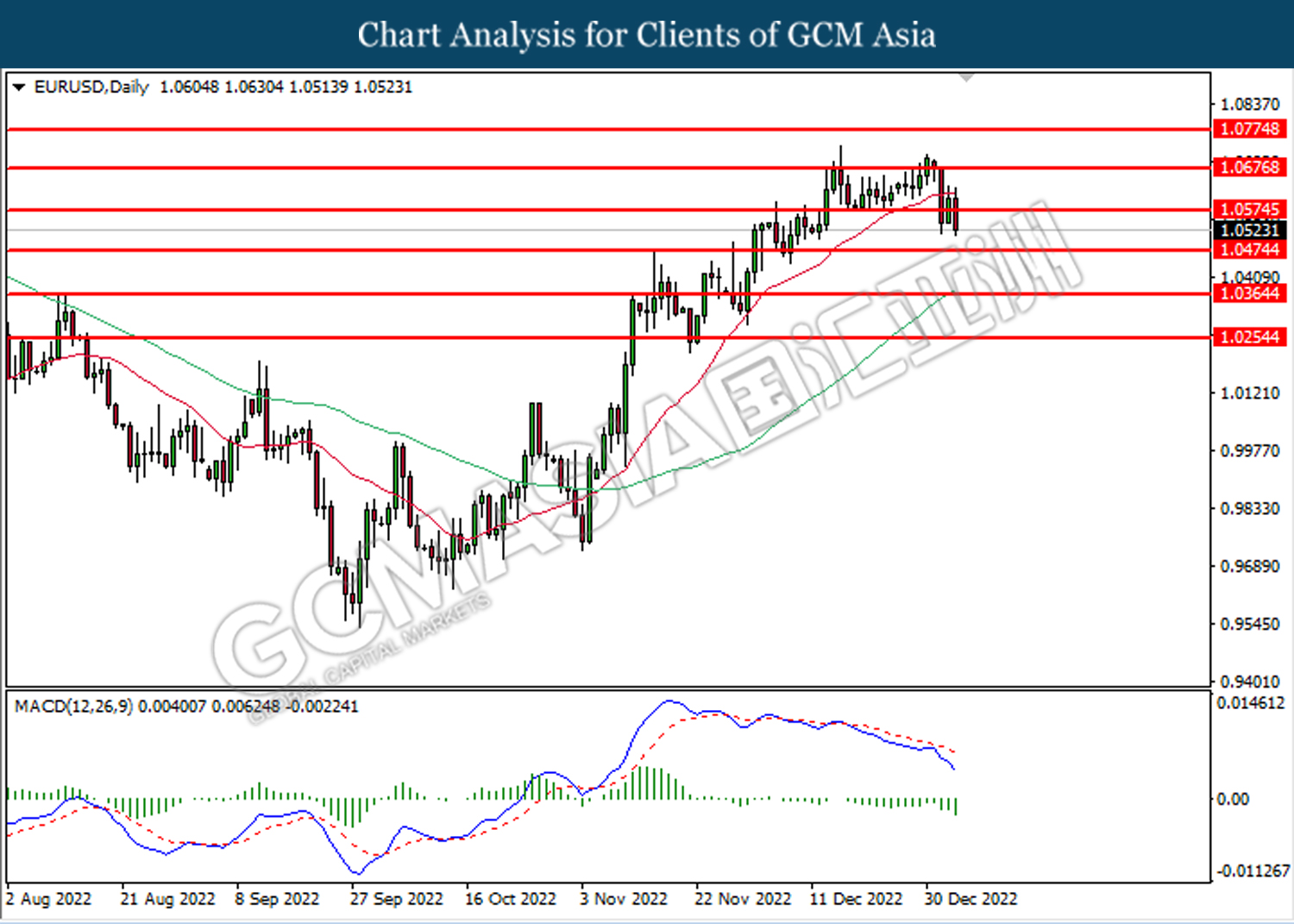

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0575. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0675, 1.0775

Support level: 1.0575, 1.0475

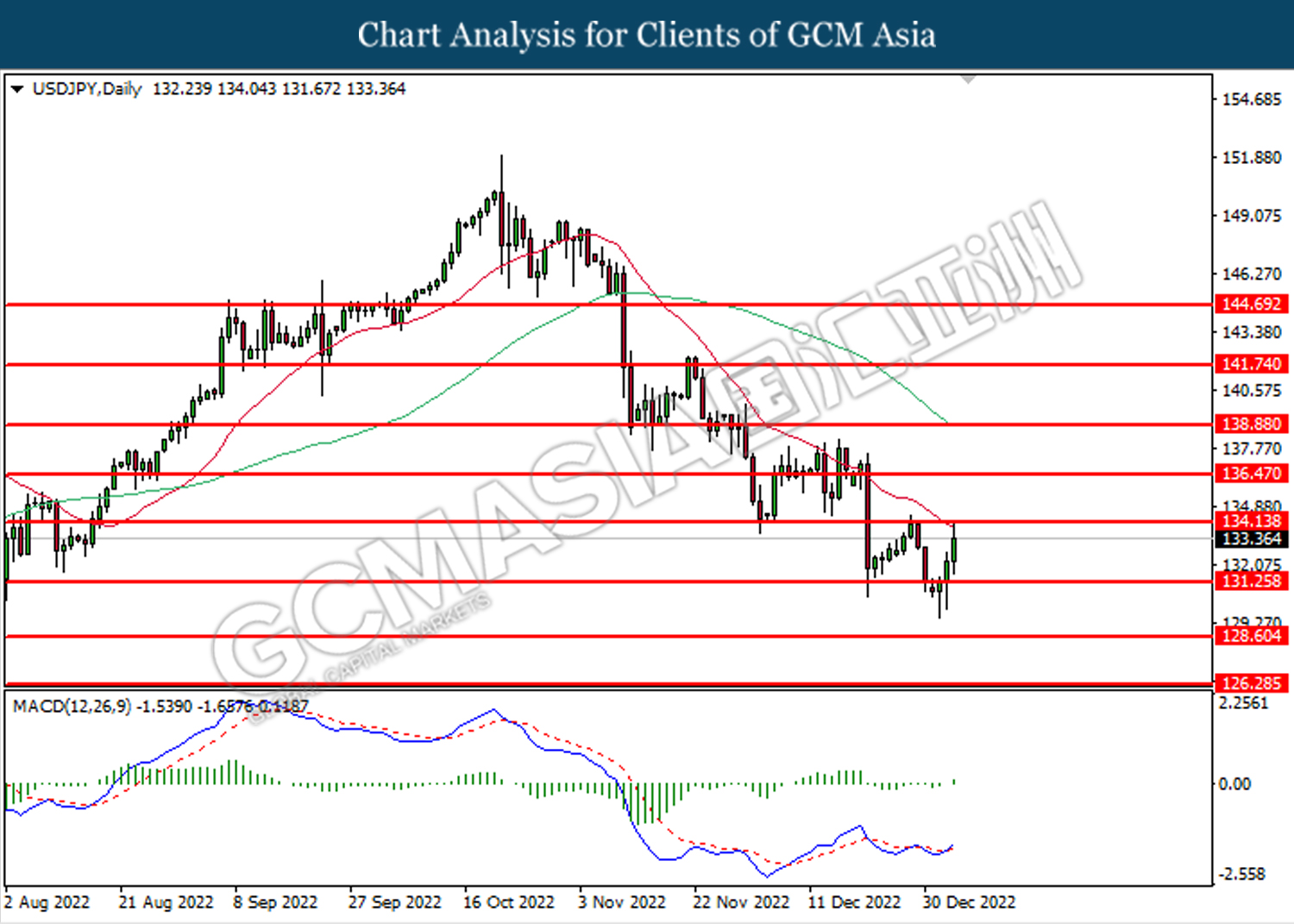

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 134.15. MACD which illustrated bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

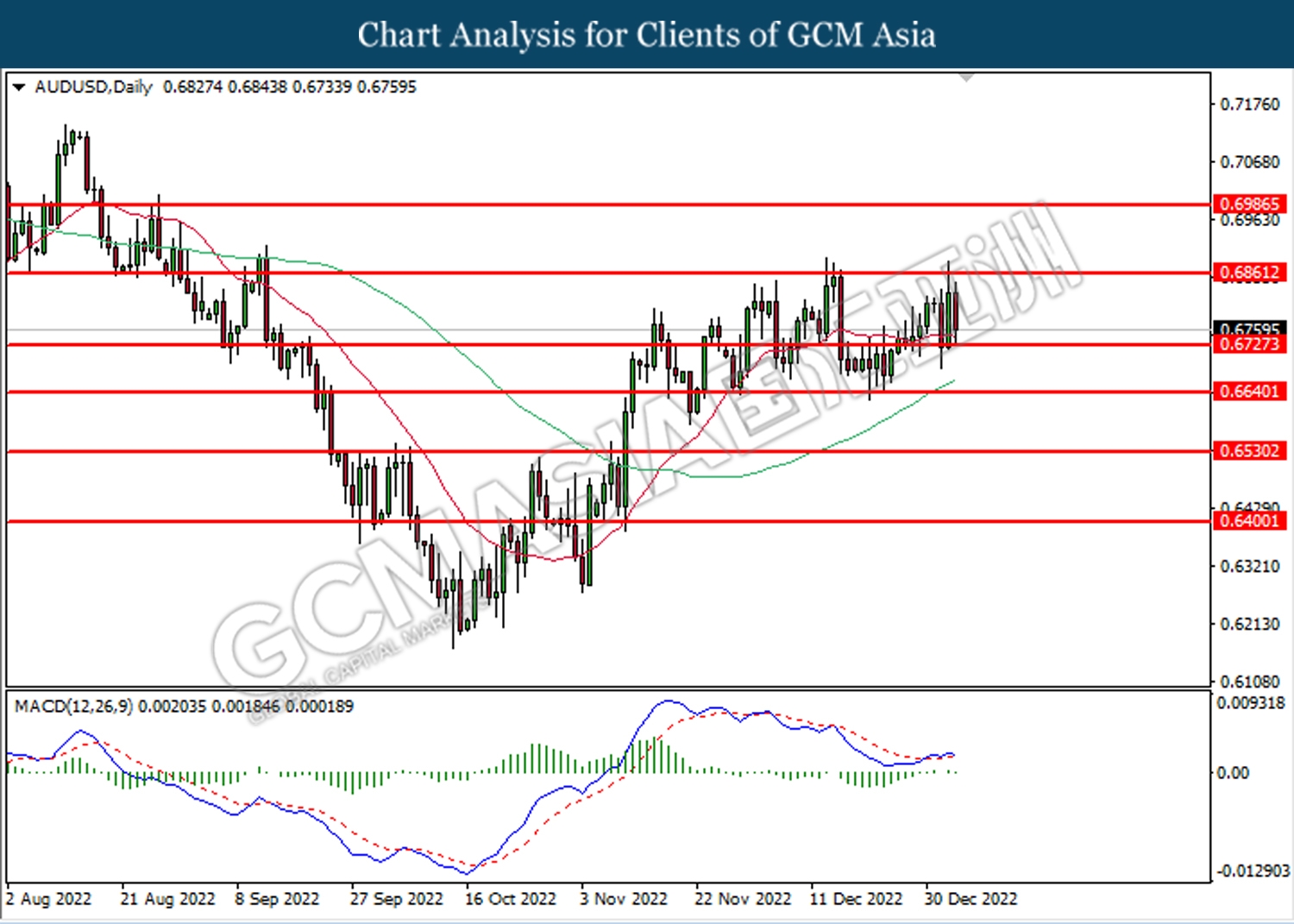

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6730. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical rebound in short term.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

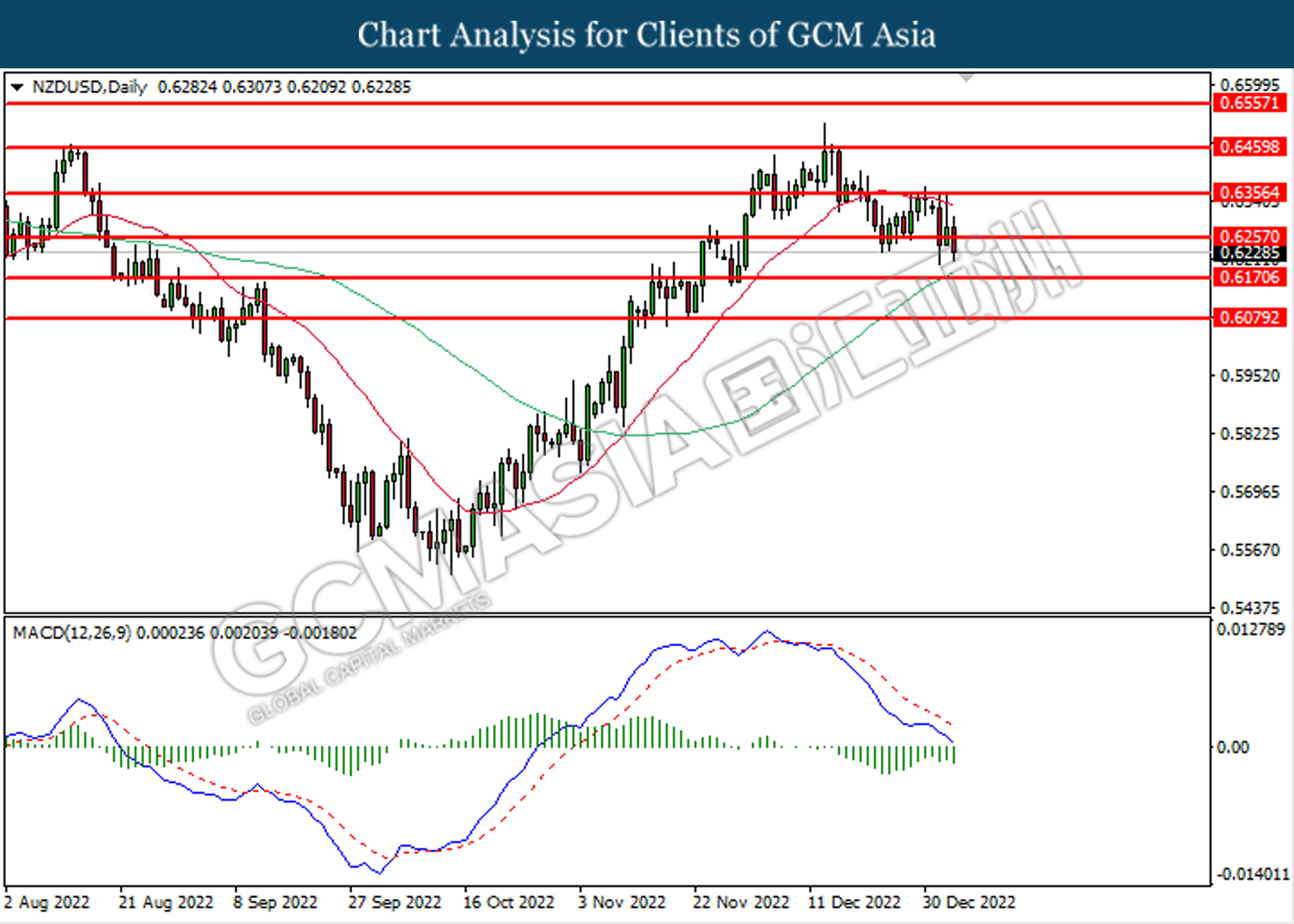

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6255. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

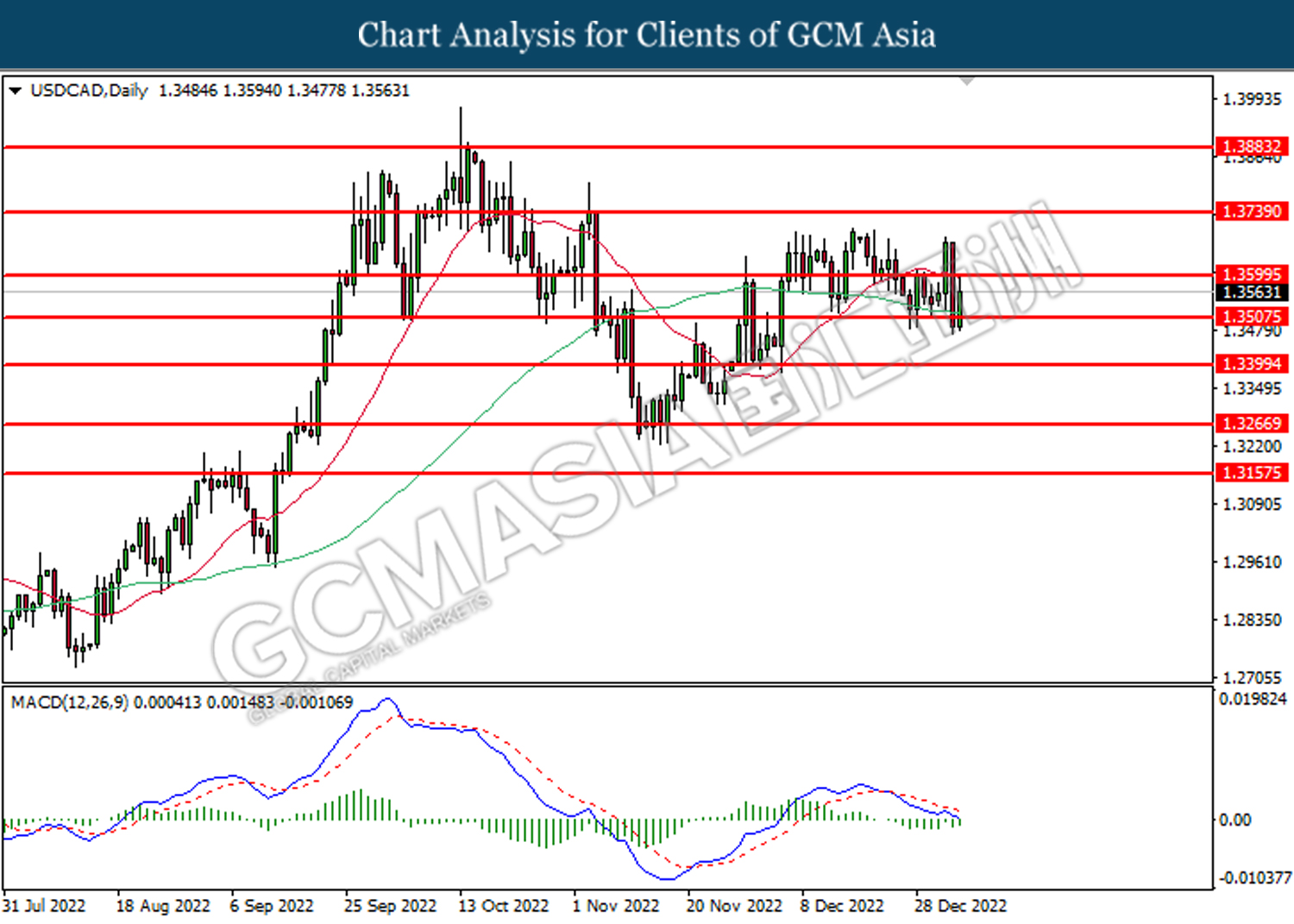

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3600. However, MACD which illustrated bearish bias momentum suggests the pair to undergo technical correction in short term.

Resistance level: 1.3600, 1.3740

Support level: 1.3505, 1.3400

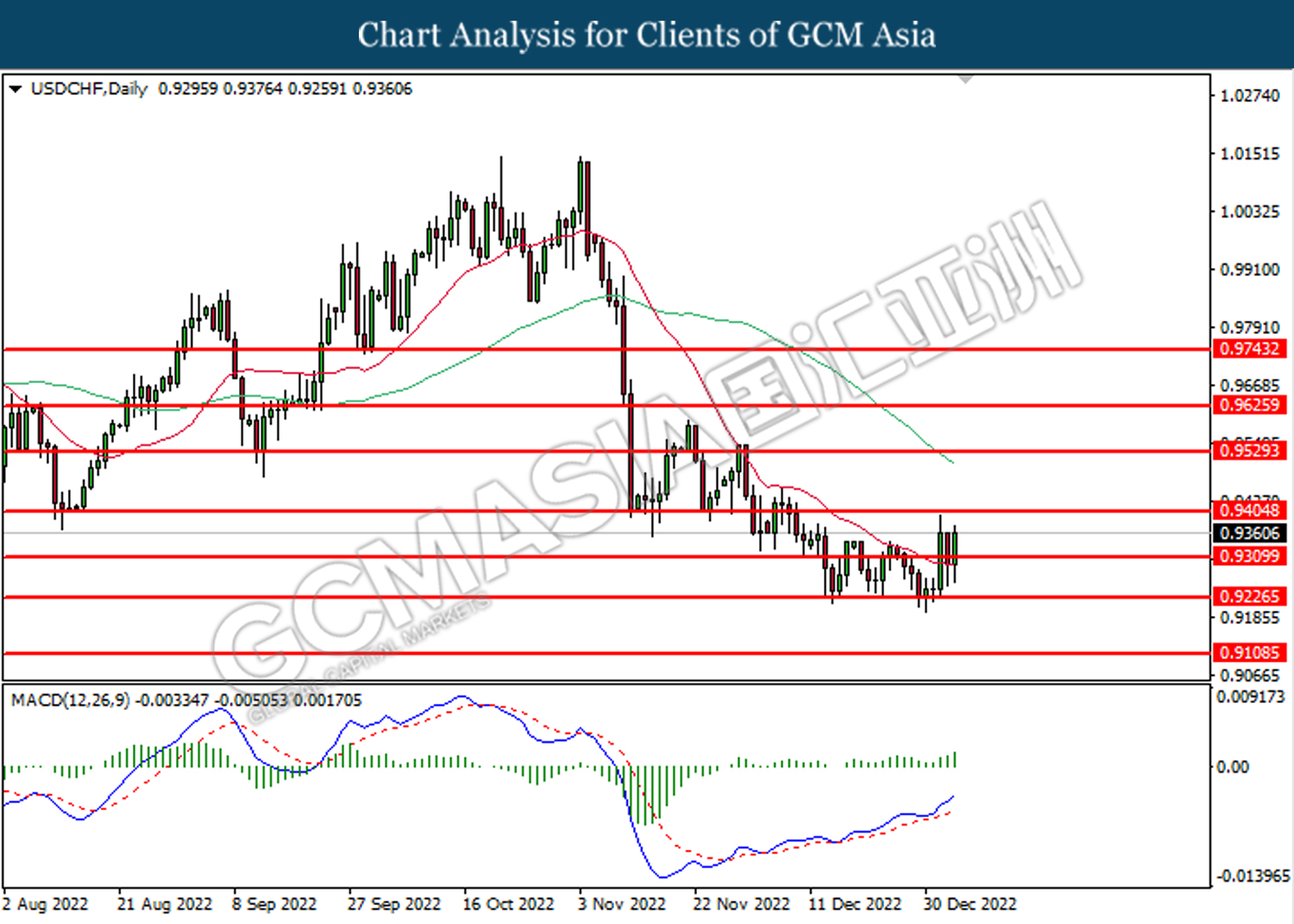

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9310. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the previous support level at 76.10. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 71.50.

Resistance level: 76.10, 81.35

Support level: 71.50, 66.10

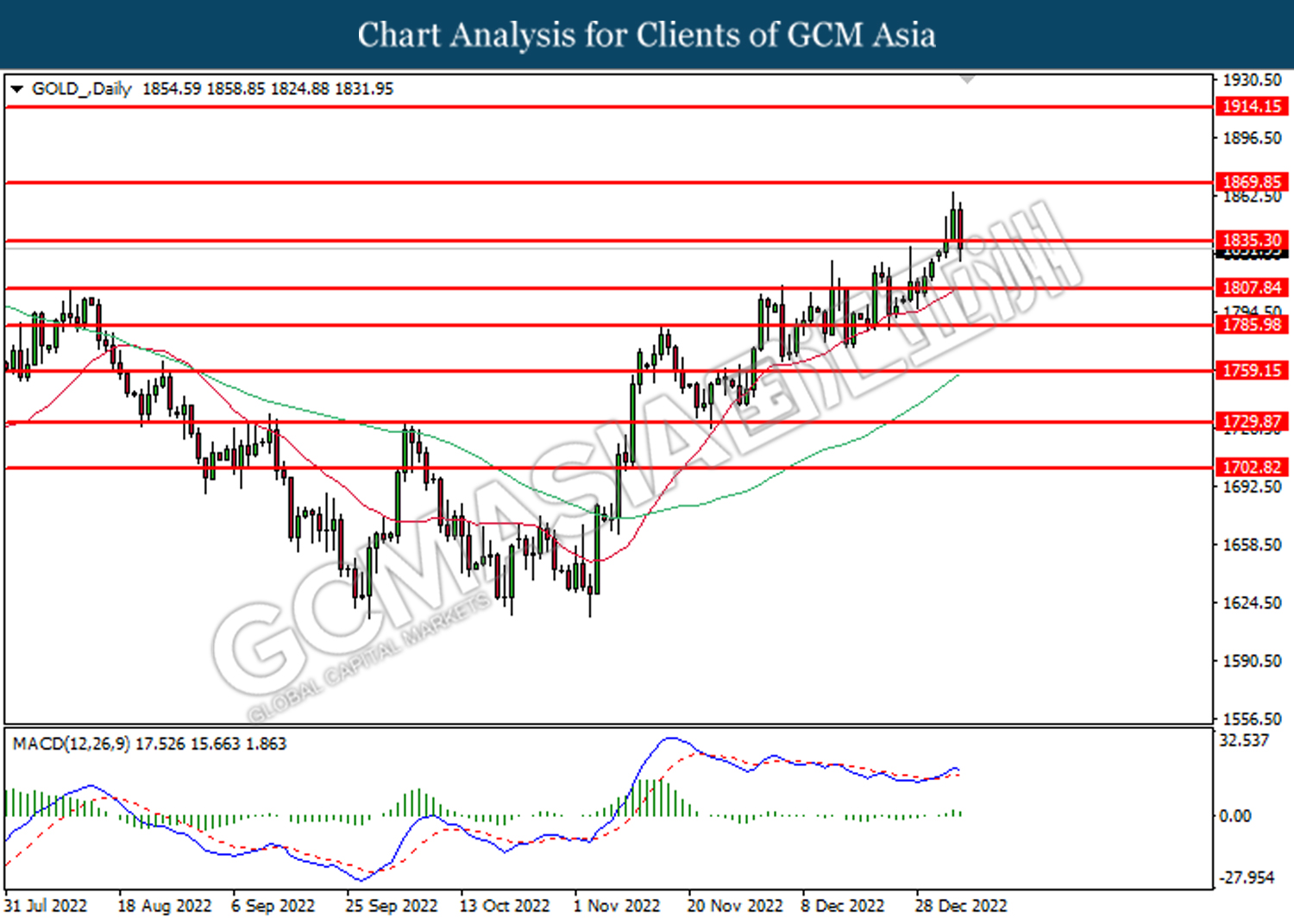

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1835.30. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1869.85, 1914.15

Support level: 1835.30, 1807.85