2 June 2022 Afternoon Session Analysis

Canadian dollar lingered near the ‘ceiling’ following the BoC interest rate decision.

The Canadian dollar, which widely traded by the global investors, hovered near the high level after Bank of Canada increased its interest rate by 50 basis points to 1.50%, as widely expected. Besides, BoC also revealed that the board of members agreed to maintain their tightening policy going forward. Based on the BoC conference, Canadian economic activity is strong and the inflation persisting well above target. On top of that, the inflationary pressures are expected to move higher in near term, where it justified the interest rate will need to rise further. Nonetheless, the bank reiterated that they are still sticking to their commitment, where the inflation should hover near the target of 2%. However, the losses of USD/CAD were limited by the rebound of dollar index. The dollar index managed to regain the upward momentum following the spike in 10-Year US Treasury Yield. As of writing, the pair of USD/CAD rose 0.13% to 1.2670.

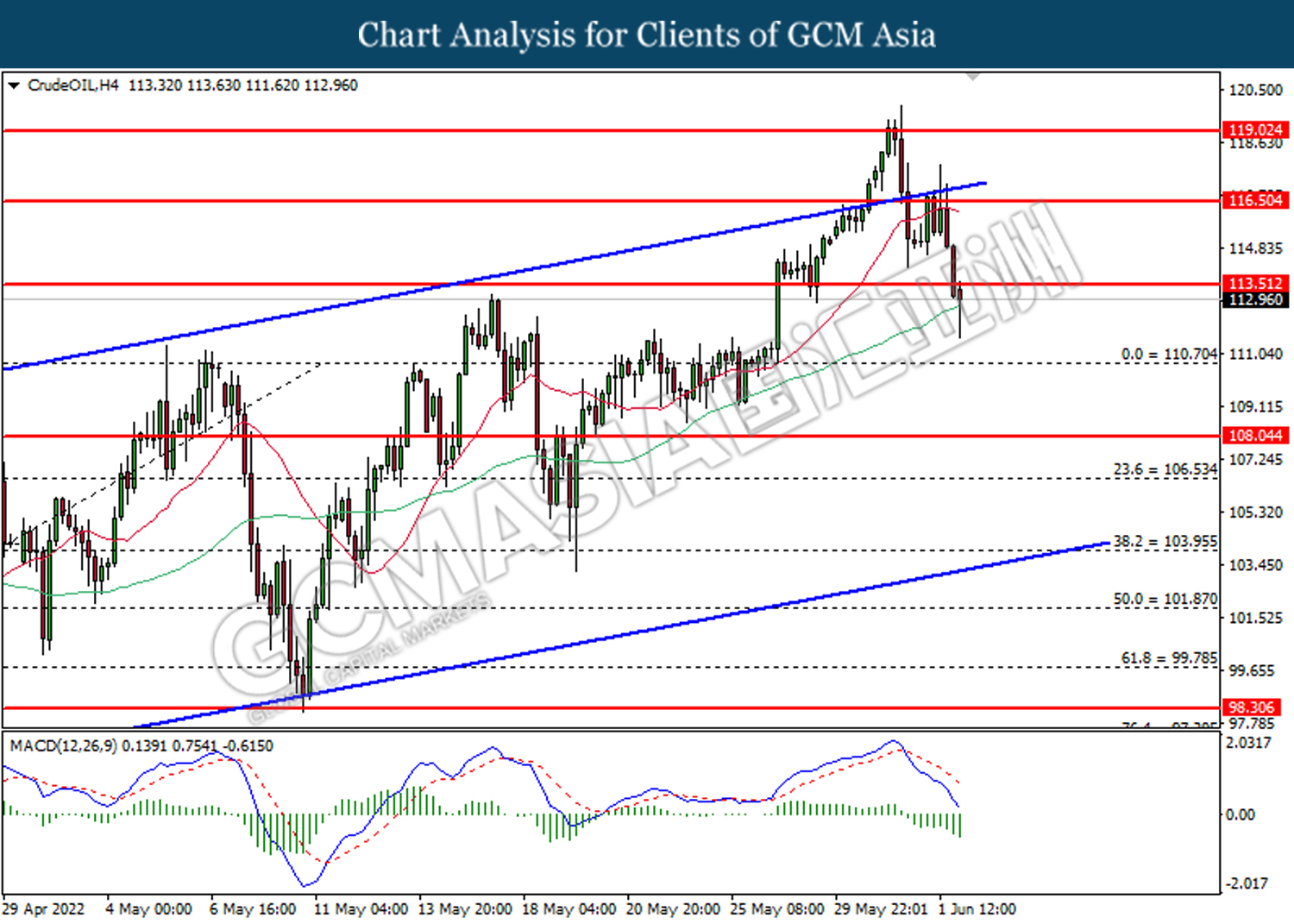

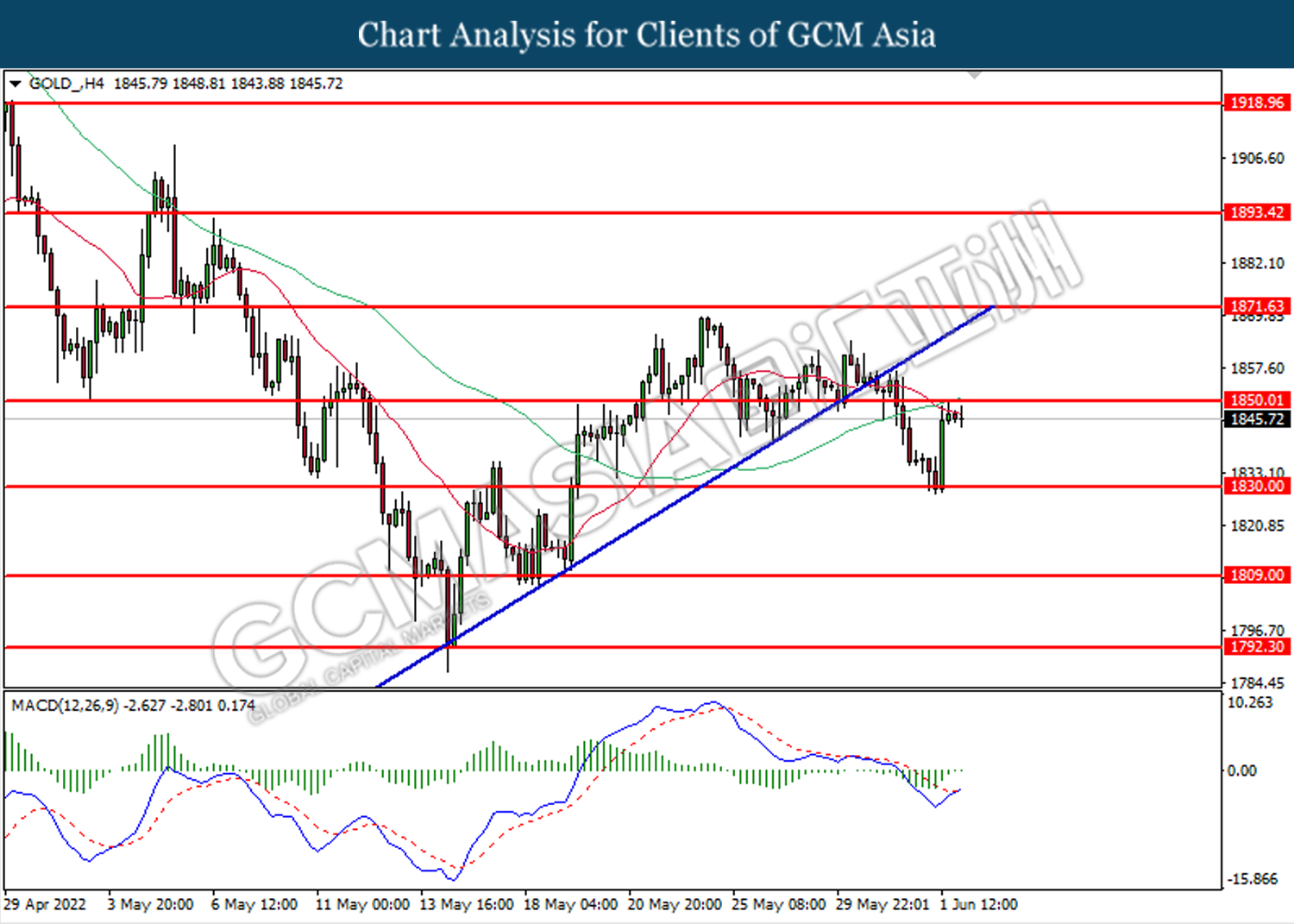

In the commodities market, crude oil prices down by -1.64% to $114.00 per barrel ahead of the OPEC meeting as the market uncertainty heightened. Besides, gold prices retraced -0.05% to $1845.30 per troy ounce amid the strengthening of dollar index.

Today’s Holiday Market Close

Time Market Event

All Day GBP United Kingdom – Bank Holiday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:15 | USD – ADP Nonfarm Employment Change (May) | 247K | 280K | – |

| 20:30 | USD – Initial Jobless Claims | 210K | 210K | – |

| 23:00 | USD – Crude Oil Inventories | -1.019M | -0.737M | – |

Technical Analysis

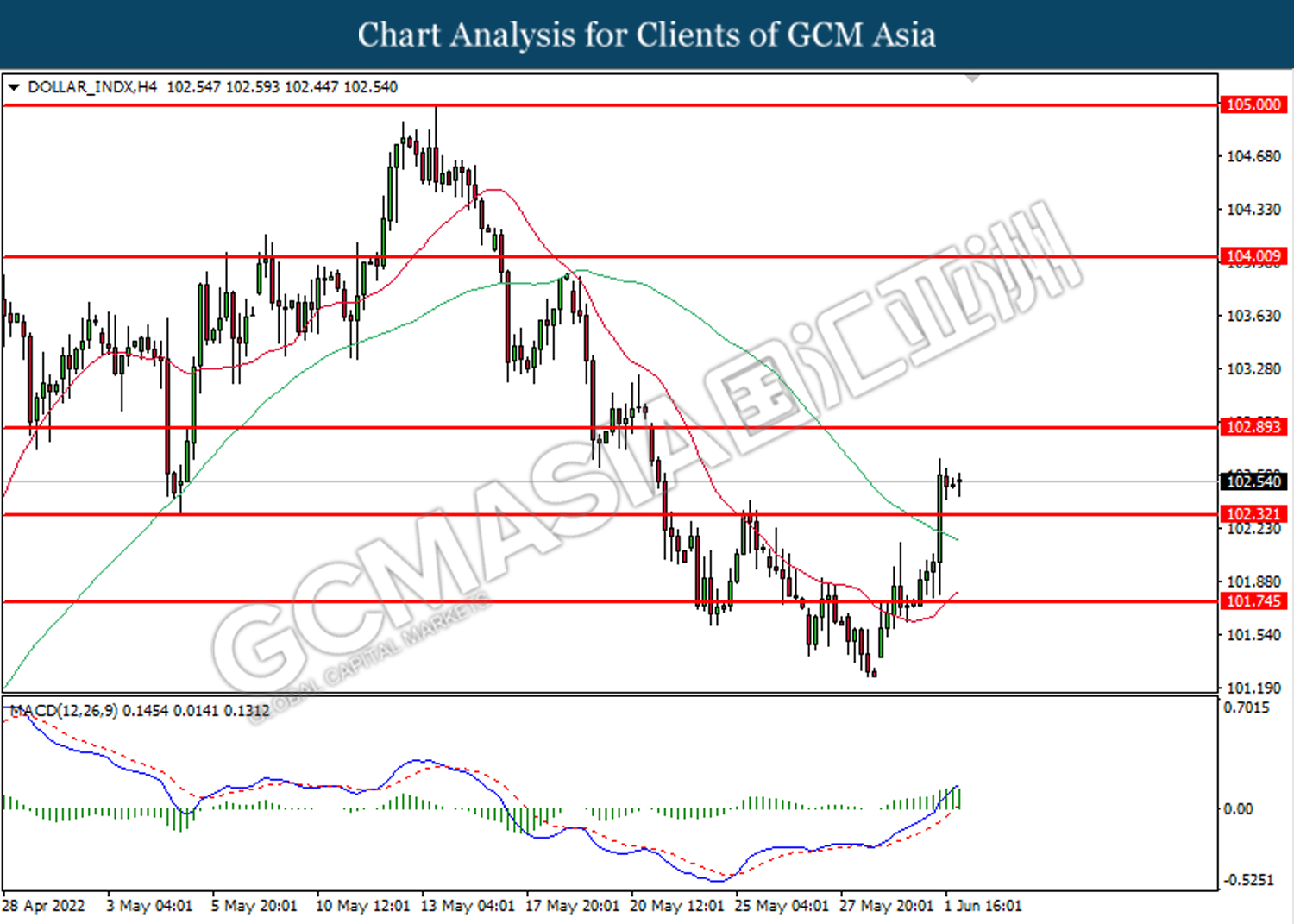

DOLLAR_INDX, H4: Dollar index was traded higher after it successfully breakout above the previous resistance level at 102.30. MACD which illustrated bullish bias momentum suggest the index to extend its gains toward the resistance level at 102.90.

Resistance level: 102.90, 104.00

Support level: 102.30, 101.75

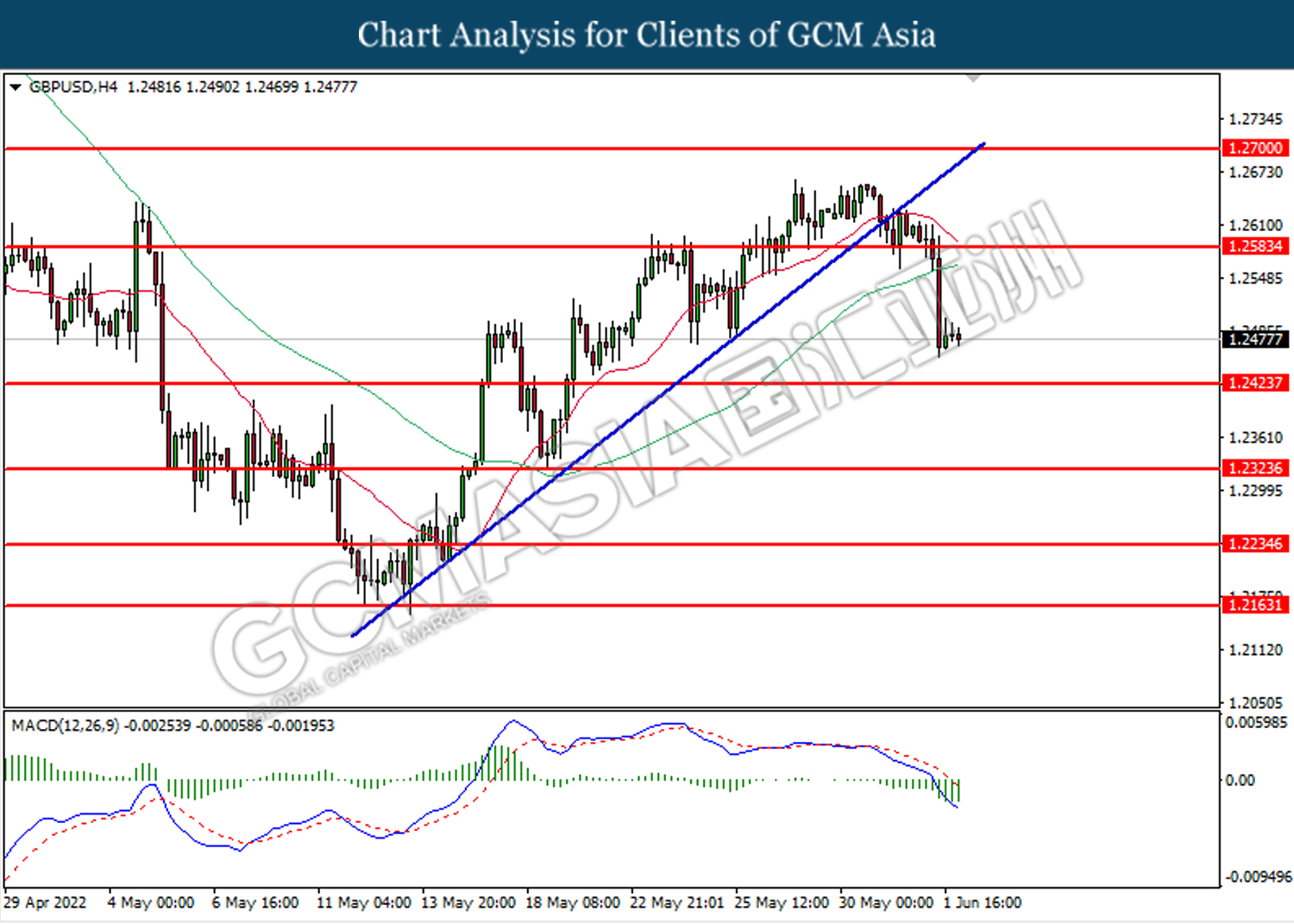

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level at 1.2585. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2425.

Resistance level: 1.2585, 1.2700

Support level: 1.2425, 1.2325

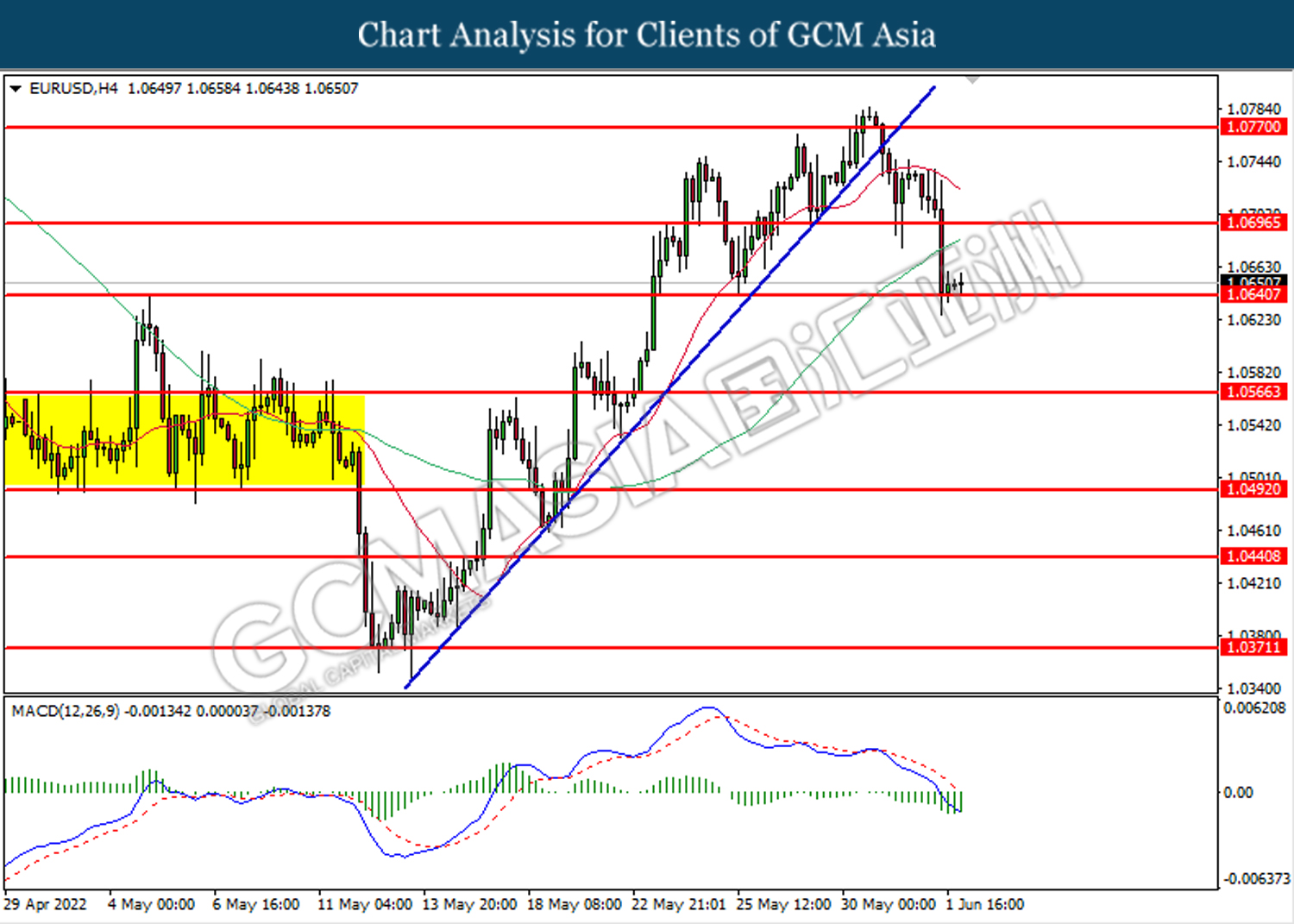

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.0640. MACD which illustrated bearish bias momentum suggest the losses after it successfully breakout below the support level.

Resistance level: 1.0695, 1.0770

Support level: 1.0640, 1.0565

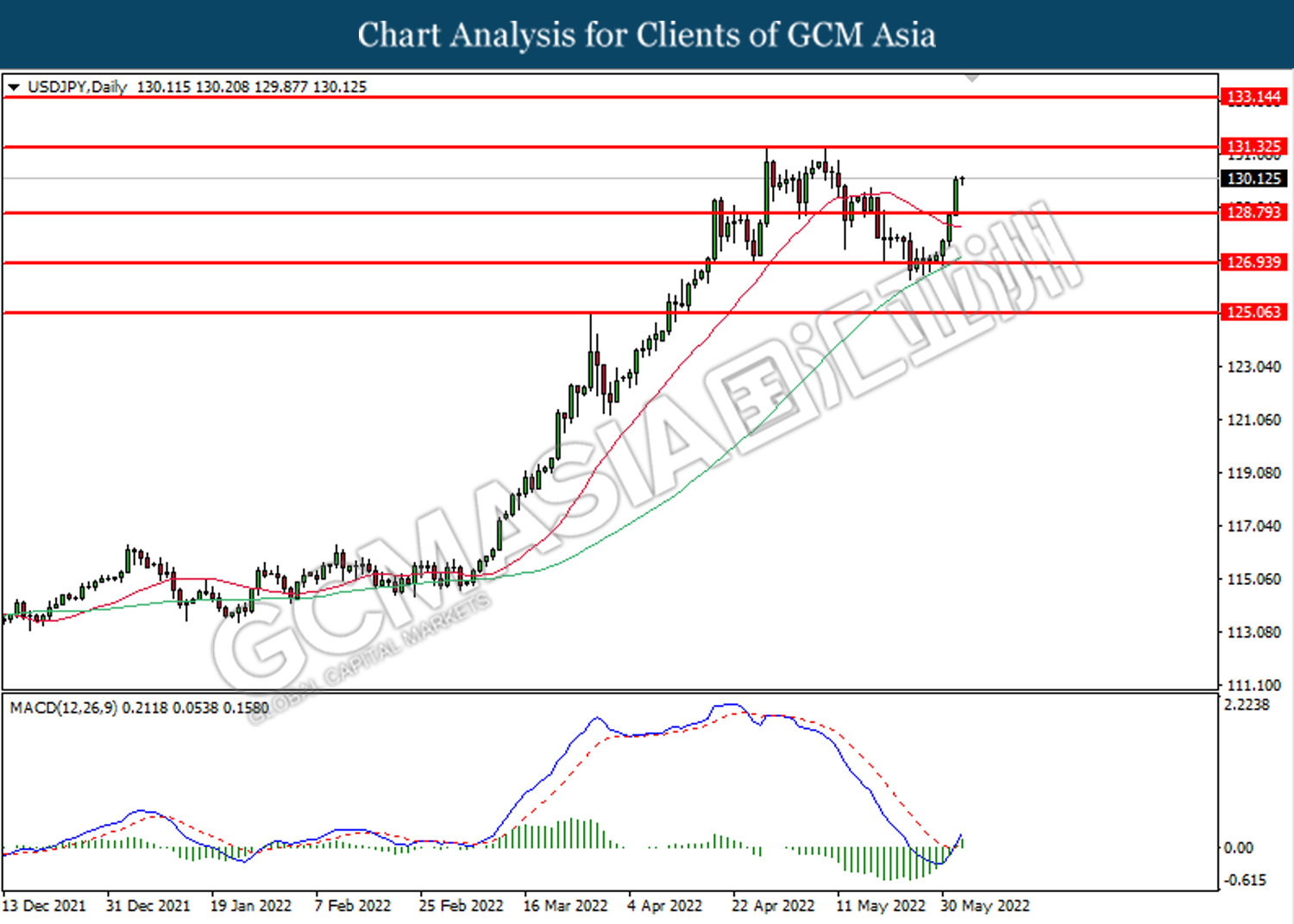

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 128.80. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the next resistance level.

Resistance level: 131.35, 133.15

Support level: 128.80, 126.95

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.7120. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.7260.

Resistance level: 0.7260, 0.7345

Support level: 0.7120, 0.7035

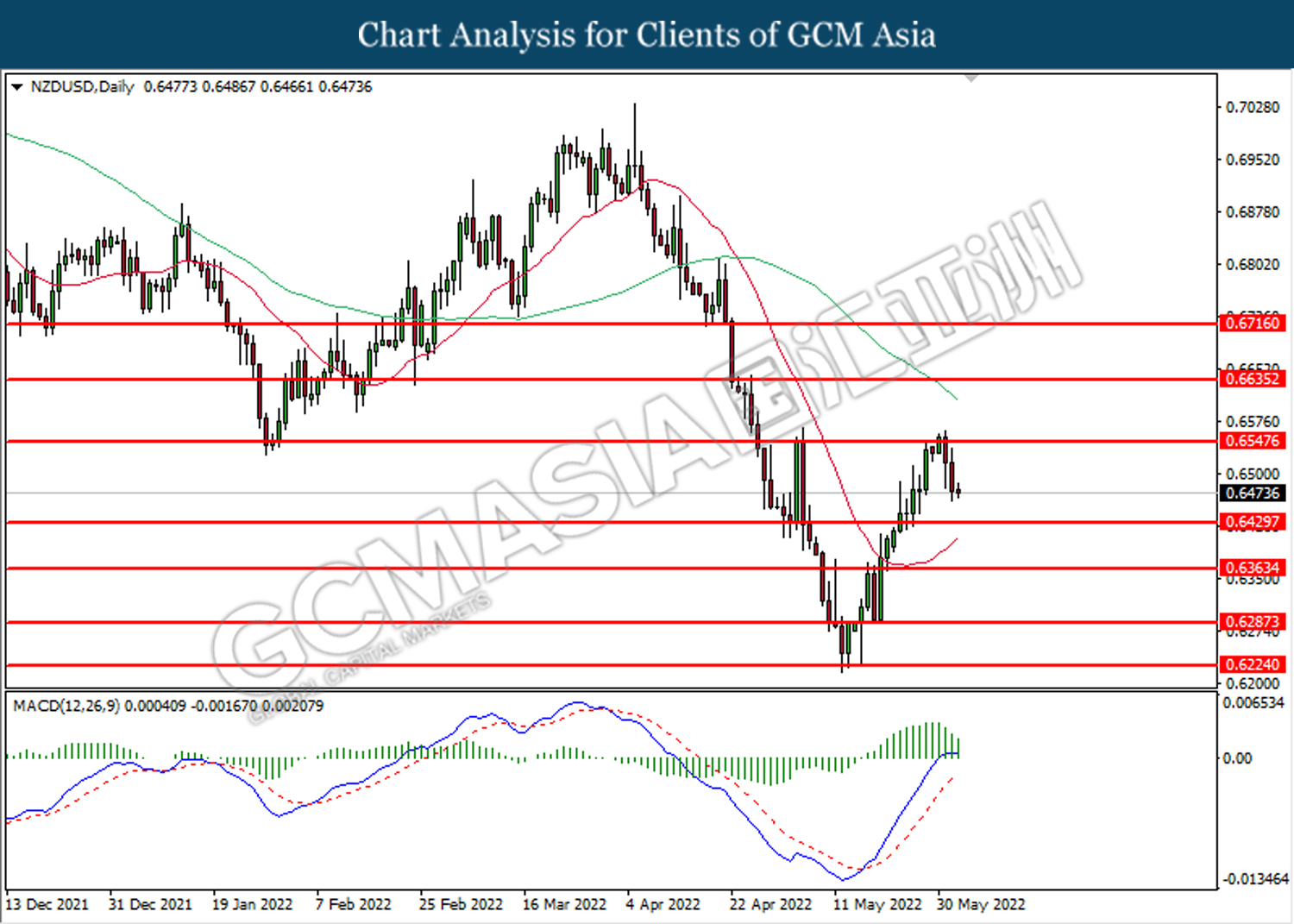

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.6545. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6430.

Resistance level: 0.6545, 0.6635

Support level: 0.6430, 0.6365

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level at 1.2655. MACD which illustrated diminishing bearish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2715.

Resistance level: 1.2715, 1.2775

Support level: 1.2655, 1.2590

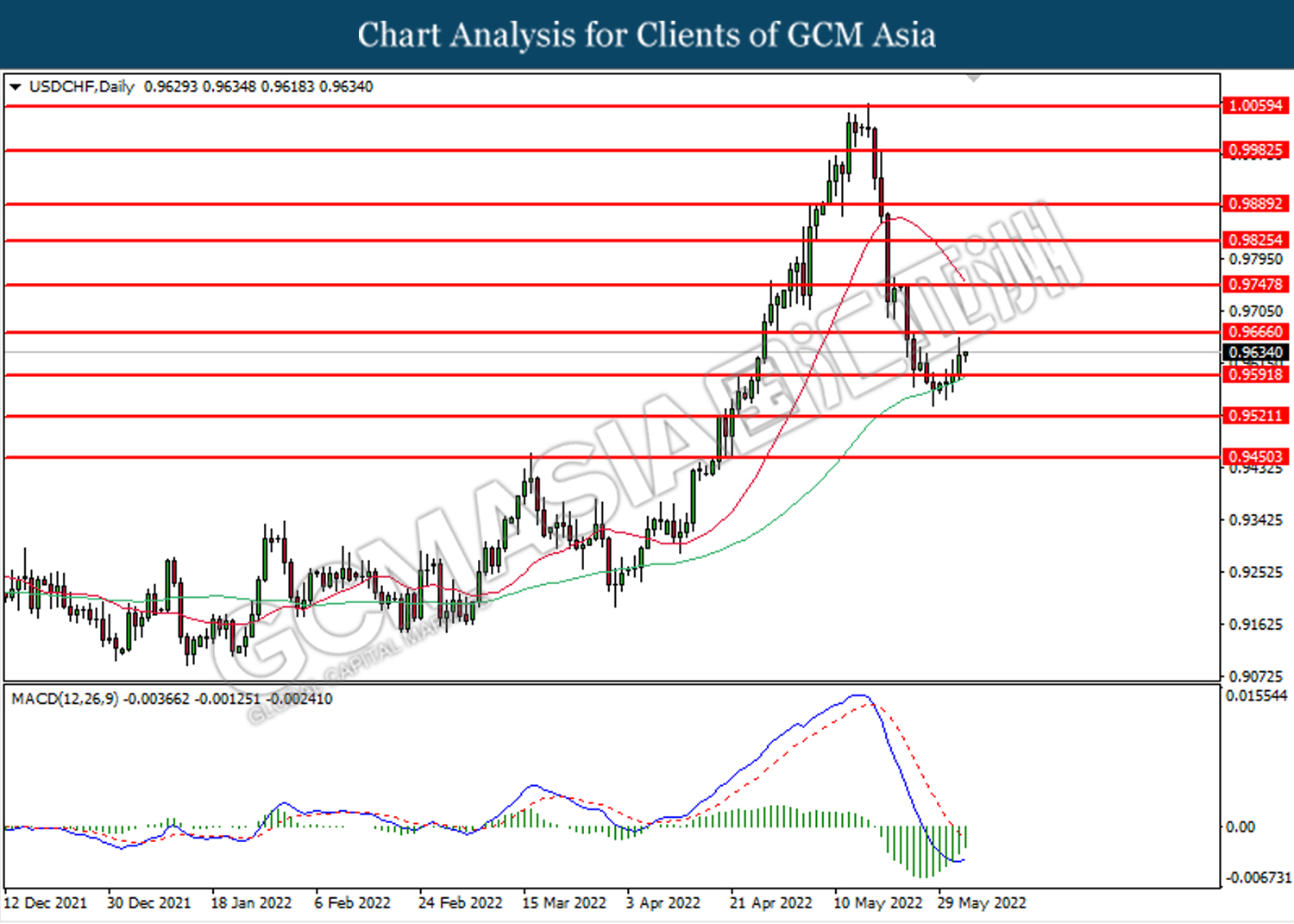

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9590. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9665.

Resistance level: 0.9665, 0.9745

Support level: 0.9590, 0.9520

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level at 113.50. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 110.70.

Resistance level: 113.50, 116.50

Support level: 110.70, 108.05

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1850.00. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1850.00, 1871.65

Support level: 1830.00, 1809.00