06 February 2023 Morning Session Analysis

US dollar skyrocketed amid strong labor data.

The dollar index, which traded against a basket of mainstream currencies, revived as the US labor market enjoyed the red-hot January with outstanding jobs added throughout the month. According to the US Bureau of Labor Statistics, US NonFarm Payrolls printed a stronger-than-expected reading at 517K, higher than both the previous and forecast reading at 260K and 185K respectively, while posting the strongest jobs numbers since August 2022. On top of that, the US labor market also experienced a further drop on unemployment rate from the prior month reading’s 3.5% to 3.4% in January. With that, it indicated that the US labor market remained resilience and tight despite the aggressive rate hikes by the Federal Reserve (Fed) over the past few months. Moreover, the shininess of the dollar index turned brighter after the Institute for Supply Management (ISM) reported its Non-Manufacturing PMI data for the month of January. According to the data, the Services PMI jumped from 49.2 to 55.2, beating the consensus forecast at 50.4, mirroring that the sector was generally expanding after slowing down in the last month of 2022. As of writing, the dollar index spiked 1.22% to 103.00.

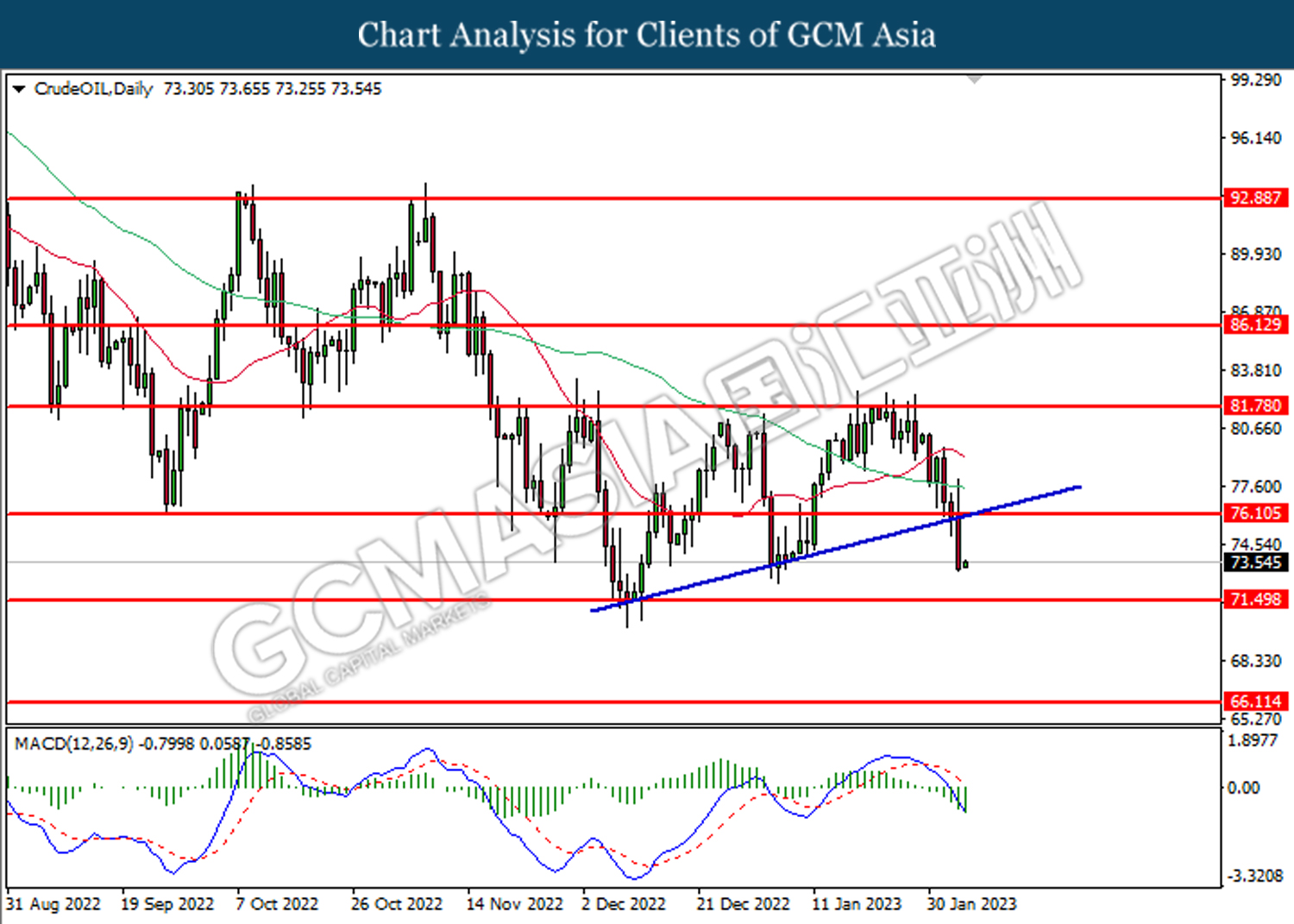

In the commodities market, crude oil price plunged by -3.61% to $73.15 per barrel as US dollar strengthened following the releases of upbeat economic data. Besides, gold prices edged down by -0.02% to $1864.95 per troy ounce amid magnificent Nonfarm Payrolls and Unemployment Rate data.

Today’s Holiday Market Close

Time Market Event

All Day NZD National Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Construction PMI (Jan) | 48.8 | 49.6 | – |

| 23:00 | CAD – Ivey PMI (Jan) | 33.4 | 42.3 | – |

Technical Analysis

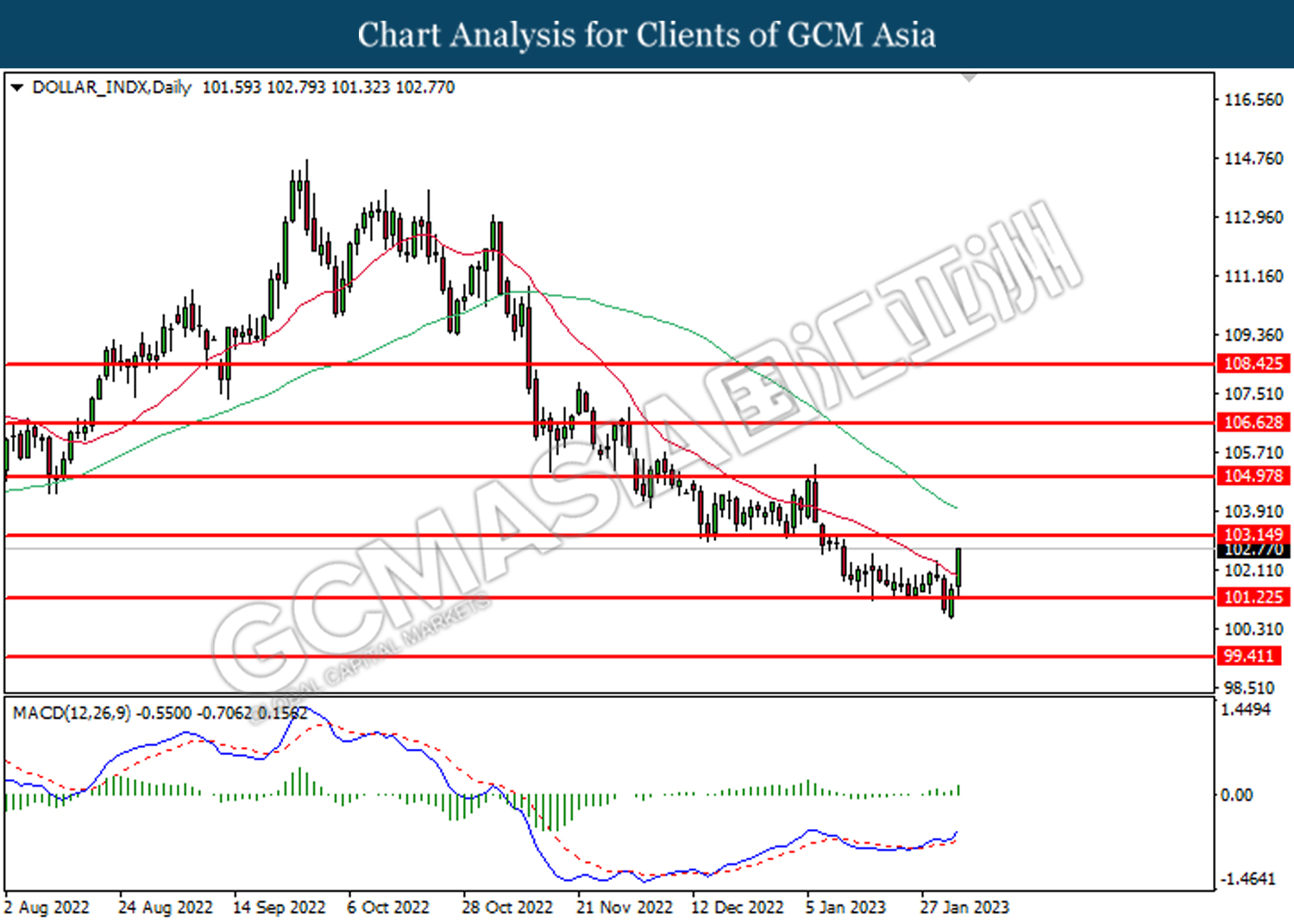

DOLLAR_INDX, Daily: Dollar index was traded higher following a prior breakout above the previous resistance level at 101.20. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 103.15.

Resistance level: 103.15, 105.00

Support level: 101.20, 99.40

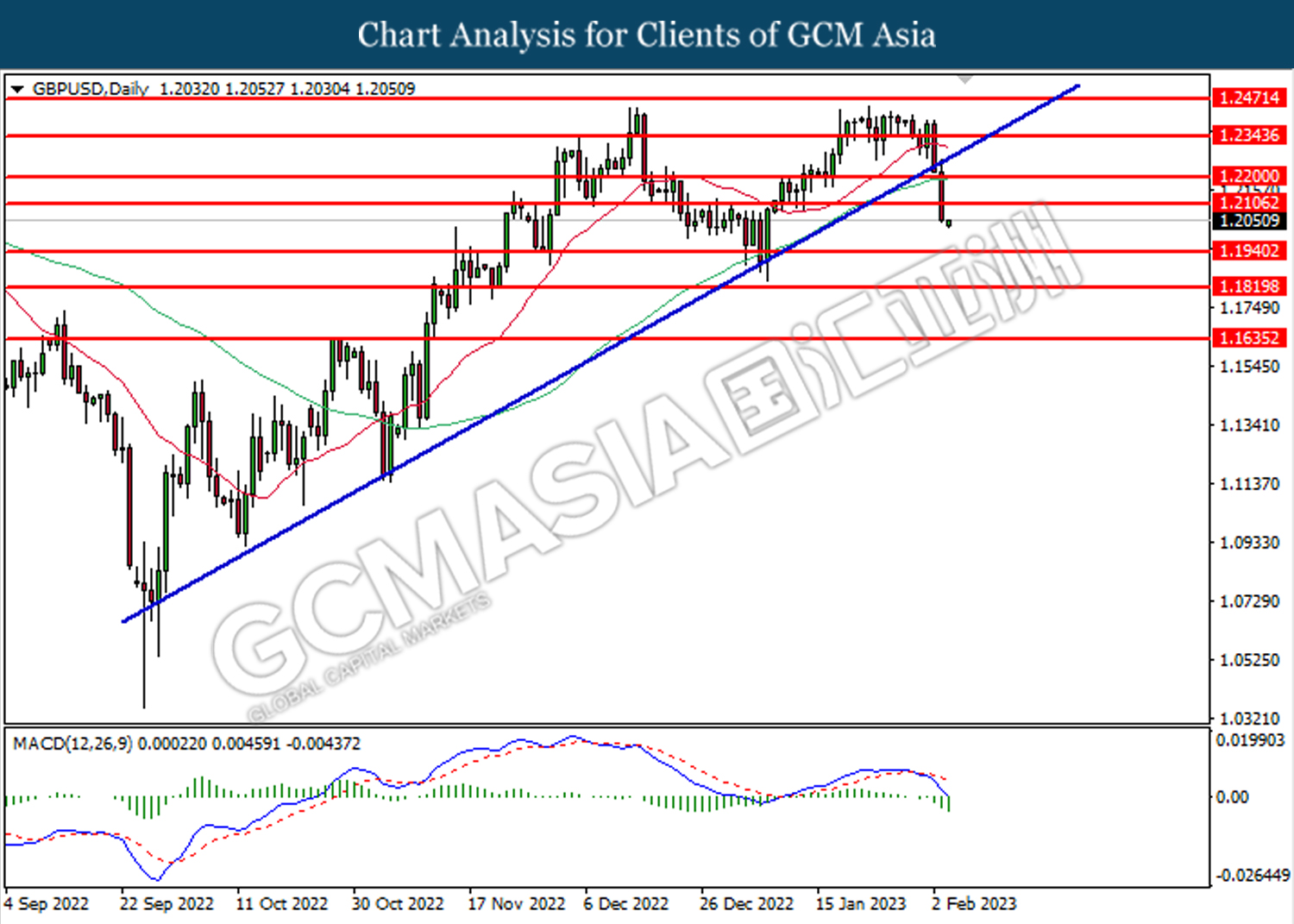

GBPUSD, Daily: GBPUSD was traded lower following a prior breakout below the previous support level at 1.2105. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1940.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

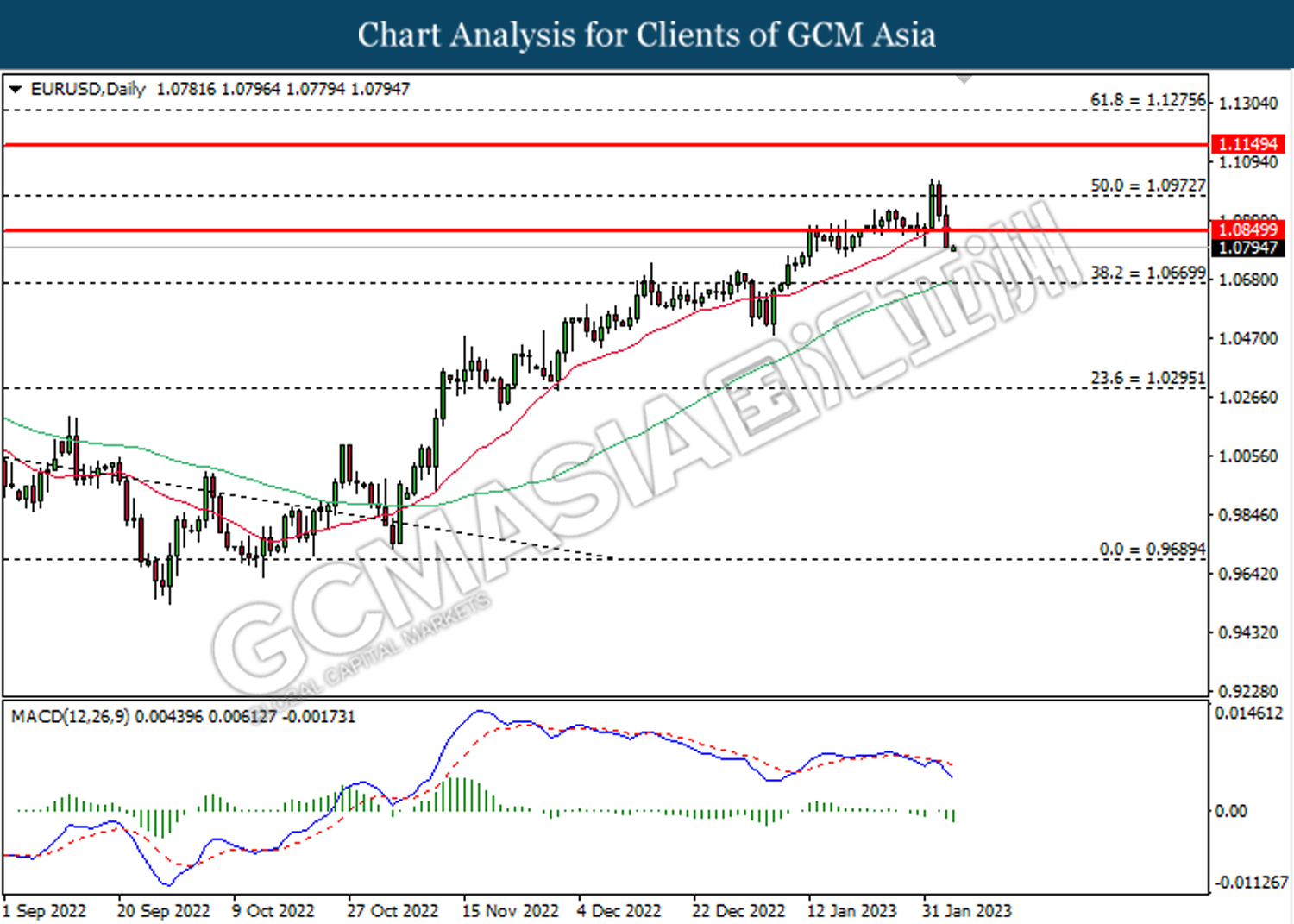

EURUSD, Daily: EURUSD was traded lower following a prior breakout below the previous support level at 1.0850. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0670.

Resistance level: 1.0850, 1.0975

Support level: 1.0670, 1.0295

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 131.25. However, MACD which illustrated bullish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

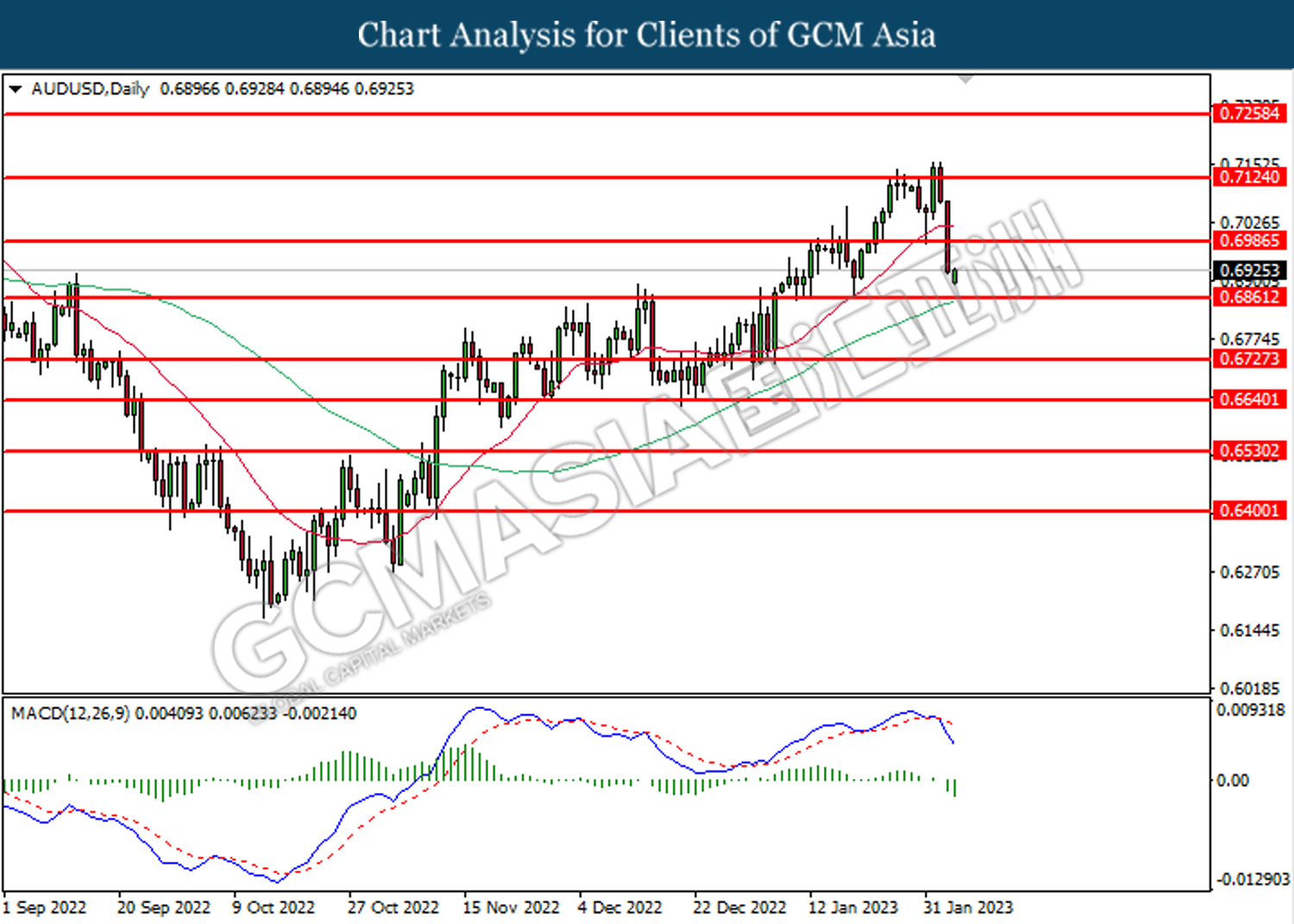

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6985. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6860.

Resistance level: 0.6985, 0.7125

Support level: 0.6860, 0.6725

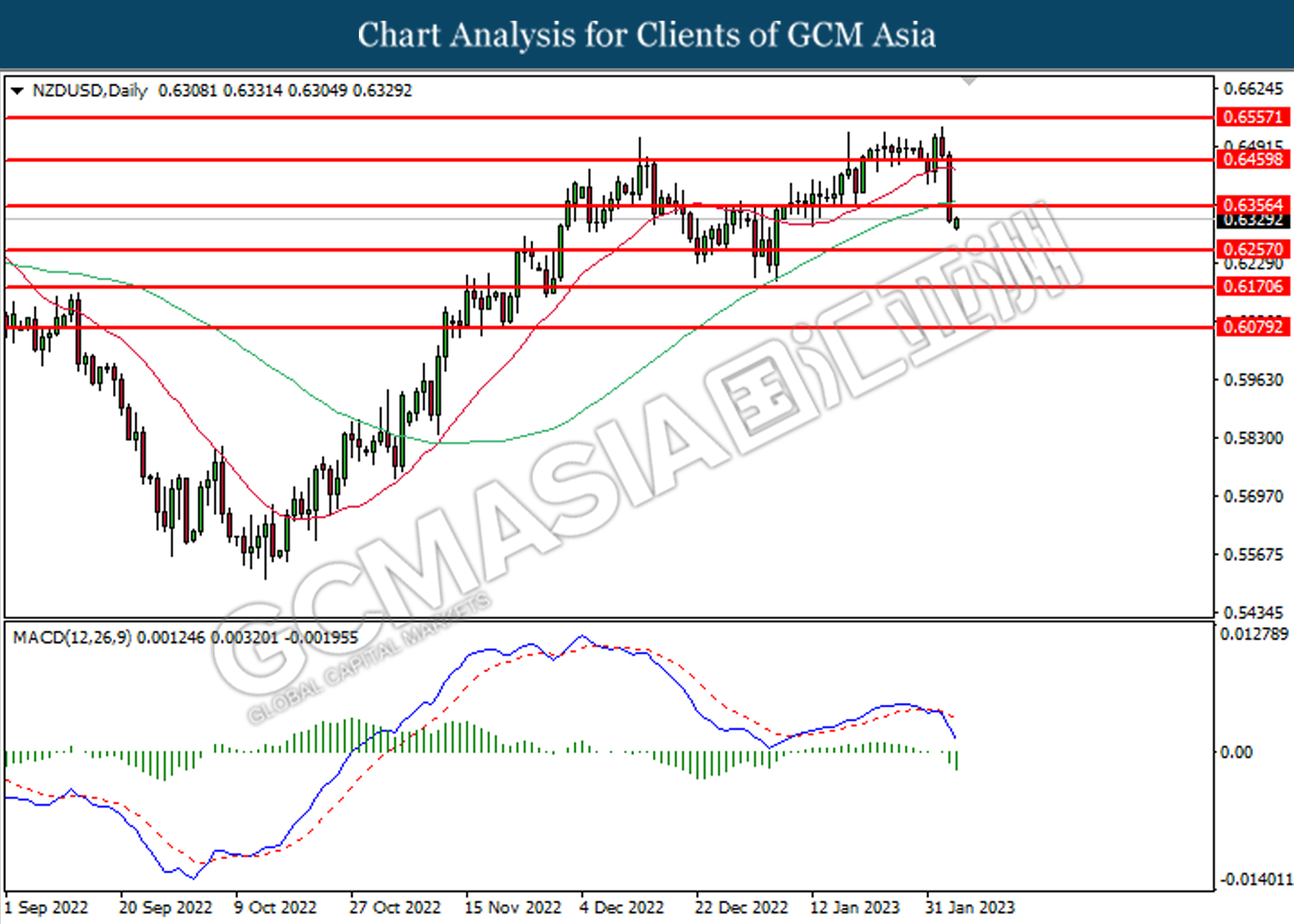

NZDUSD, Daily: NZDUSD was traded lower following the prior breakout below the previous support level at 0.6355. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6255.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

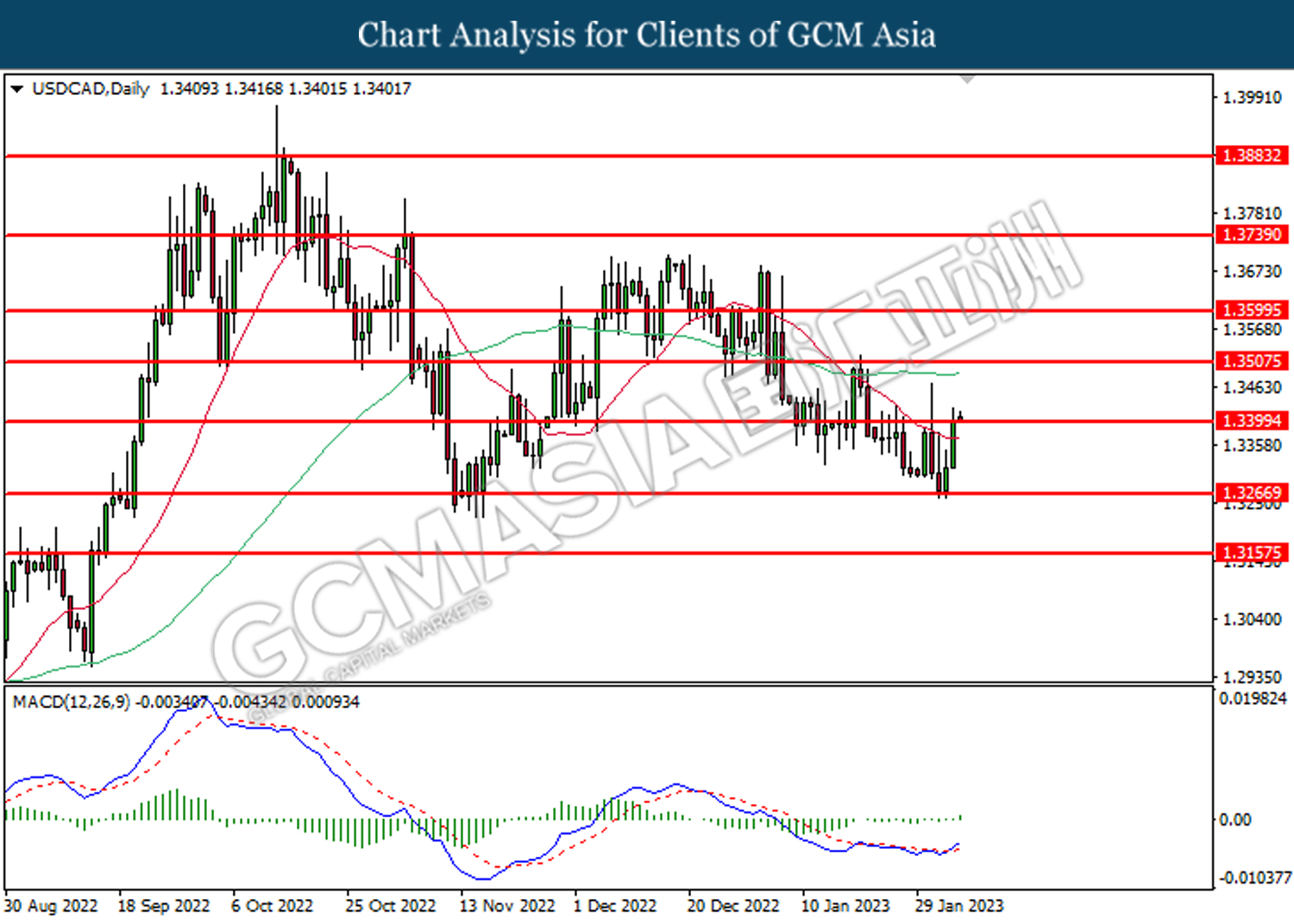

USDCAD, Daily: USDCAD was traded higher following the prior breakout above the previous resistance level at 1.3400. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 1.3505.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

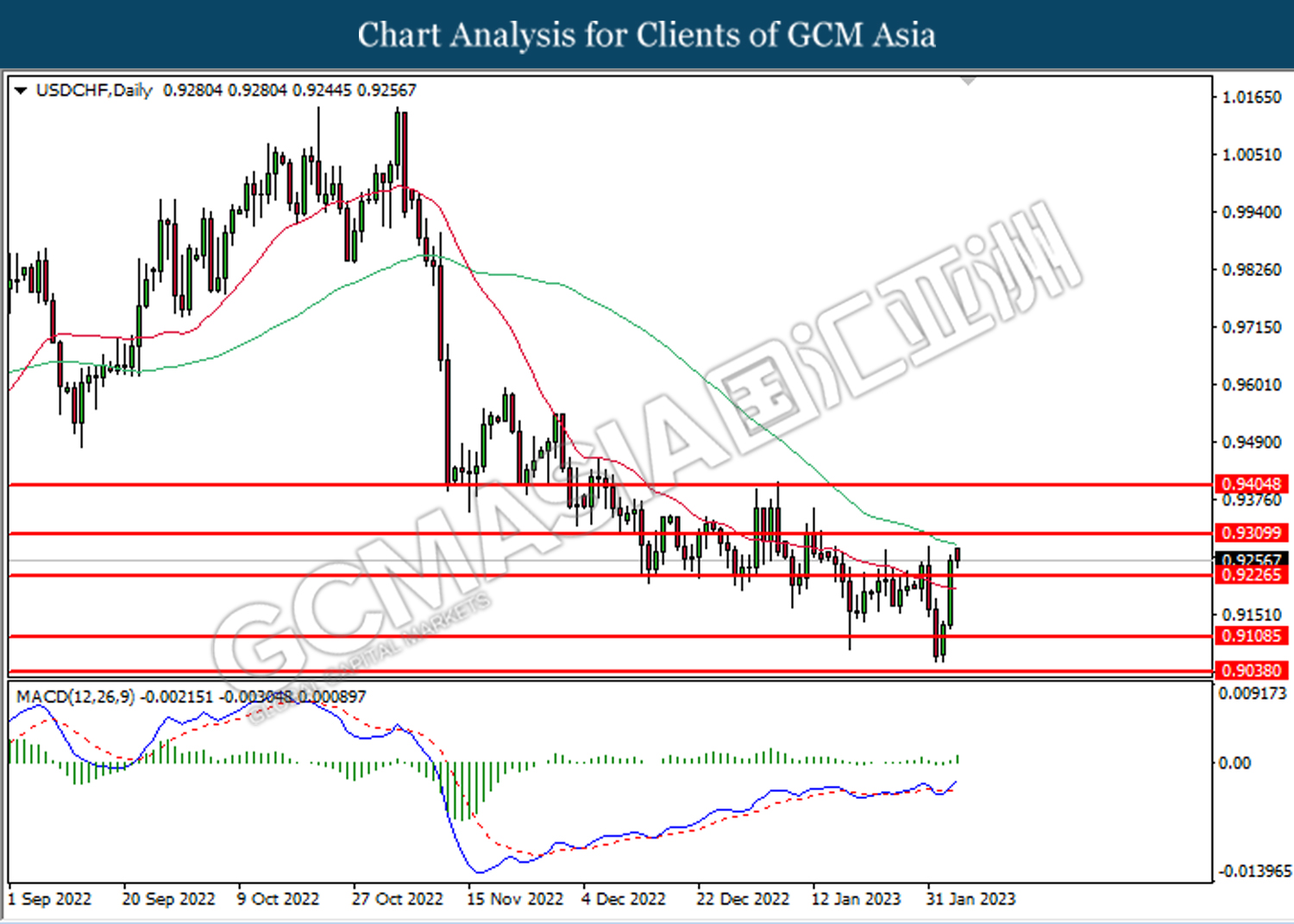

USDCHF, Daily: USDCHF was traded higher following a prior breakout above the previous resistance level at 0.9225. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9310.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

CrudeOIL, Daily: Crude oil price was traded lower following the prior breakout below the trendline. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 71.50.

Resistance level: 76.10, 81.80

Support level: 71.50, 66.10

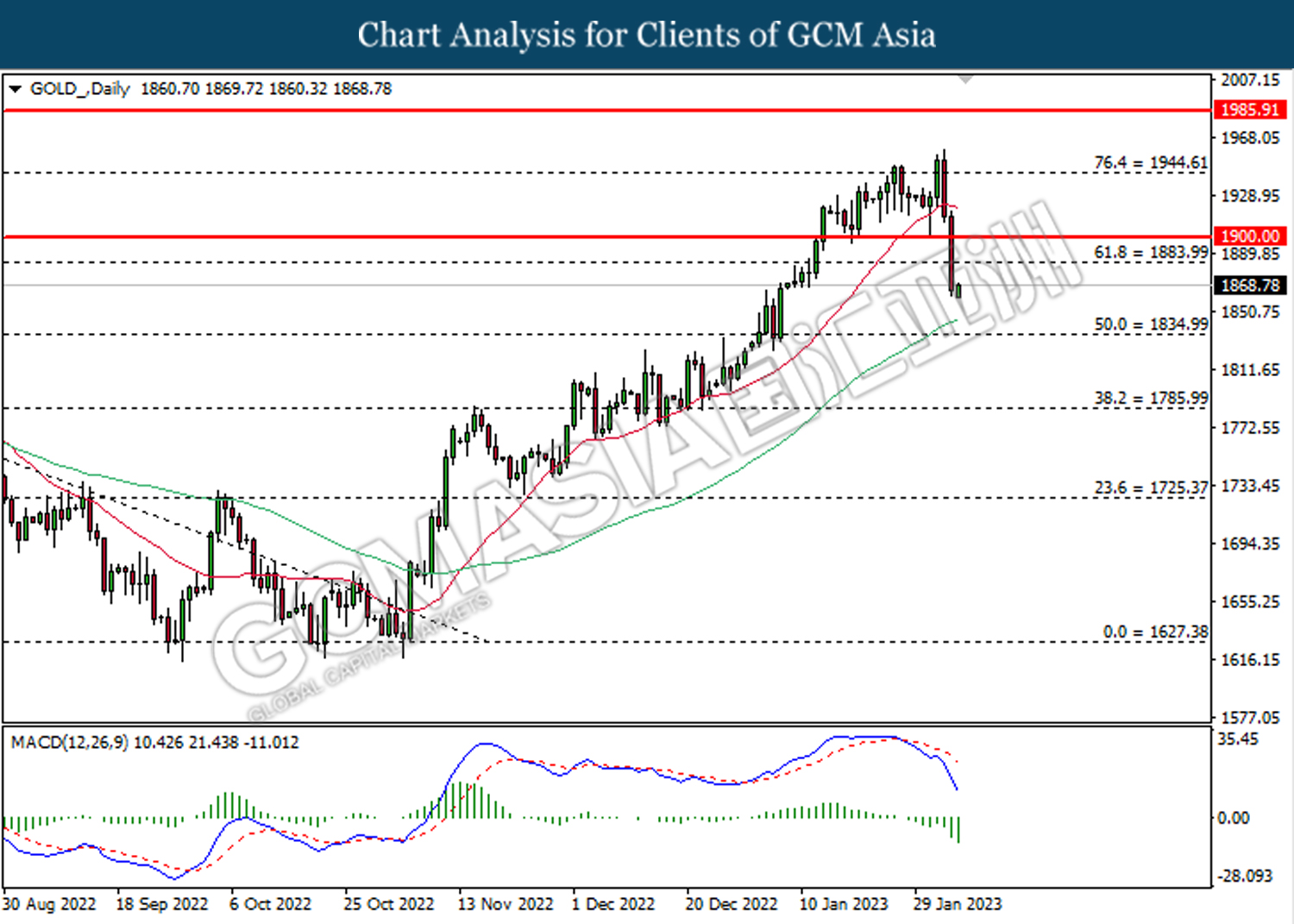

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 1884.00. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1835.00

Resistance level: 1884.00, 1900.00

Support level: 1835.00, 1786.00