6 March 2023 Morning Session Analysis

US Dollar plunged despite of robust economic data.

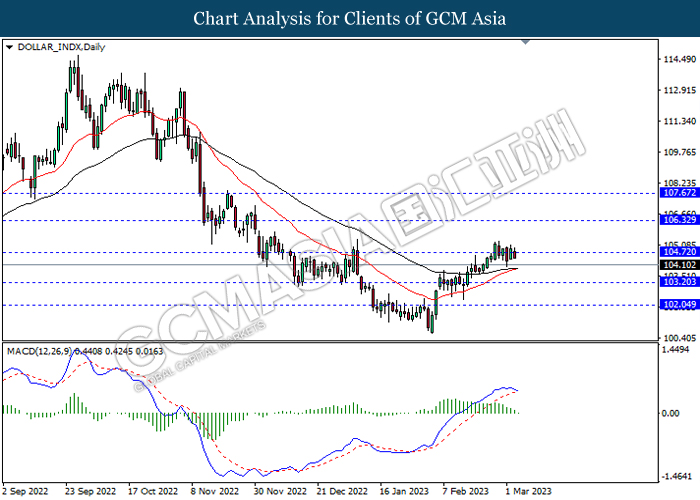

The Dollar Index which traded against a basket of six major currencies slumped on last Friday, although the optimistic economic data has been released. According to Institute for Supply Management, the US ISM Non-Manufacturing Purchasing Managers Index (PMI) posted at the reading of 55.1, which exceeding the consensus forecast of 54.5. With such background, it spurred few of bullish momentum toward US Dollar. Though, the US Dollar has retreated its previous gains following the investors was awaiting for the announcement of crucial employment data — Nonfarm Payroll (NFP). Prior to that, one of the Fed member, Atlanta Federal Reserve President Raphael Bostic suggested that a “slow and steady” rate hike path might be a more proper way to ease inflation efficiently. On the other hand, part of Fed official stick to their hawkish stance. Since the members’ opinions diverged, investors decided to step away from the market in order to gauge the path for Federal Reserve policy. As of writing, the Dollar Index appreciated by 0.07% to 104.56.

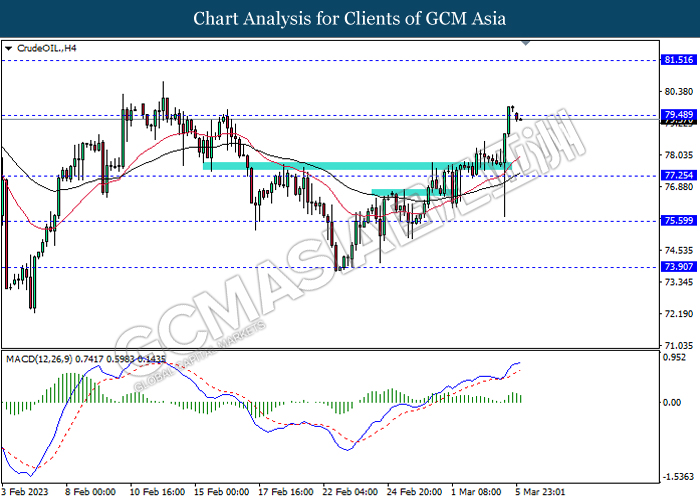

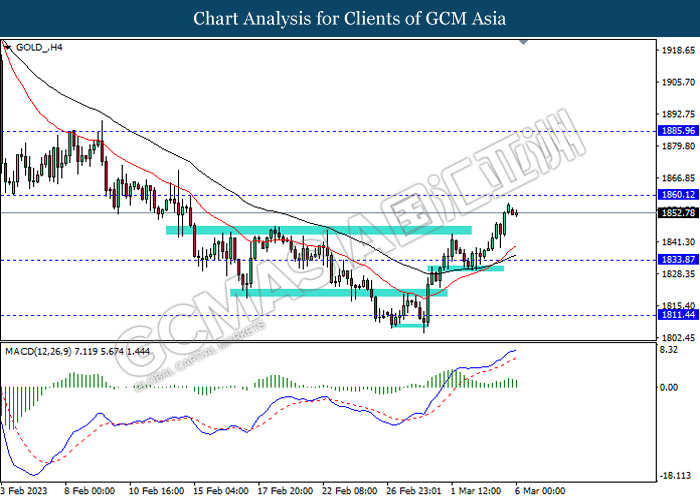

In the commodity market, the crude oil price dropped by 0.34% to $79.41 per barrel as of writing after a sharp rise throughout the last trading session following Saudi Arabia increased oil price for Asia and Europe for April. In addition, the gold price rose by 0.25% to $1853.09 per barrel as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Construction PMI (Feb) | 48.4 | 49.1 | – |

| 23:00 | CAD – Ivey PMI (Feb) | 60.1 | 55.9 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 104.70, 106.30

Support level: 103.20, 102.05

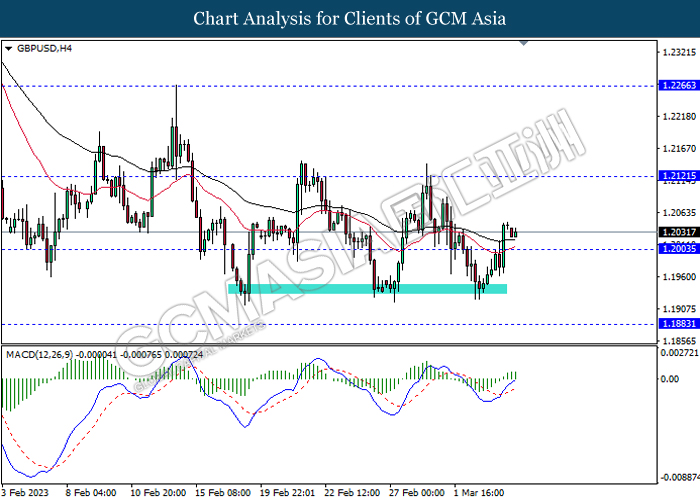

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2120, 1.2265

Support level: 1.2005, 1.1885

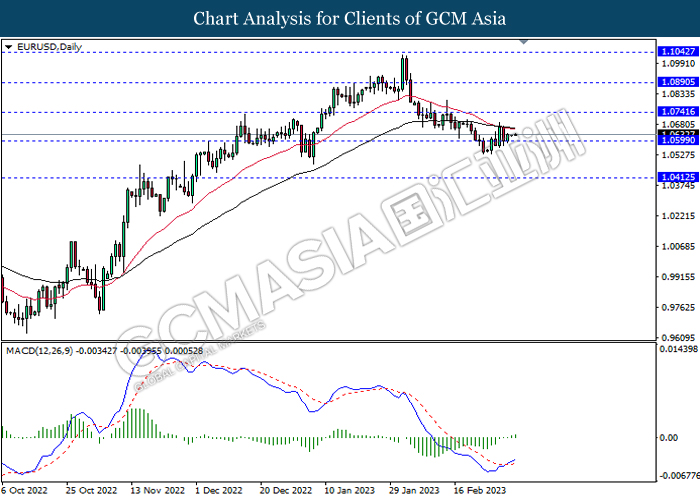

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0410

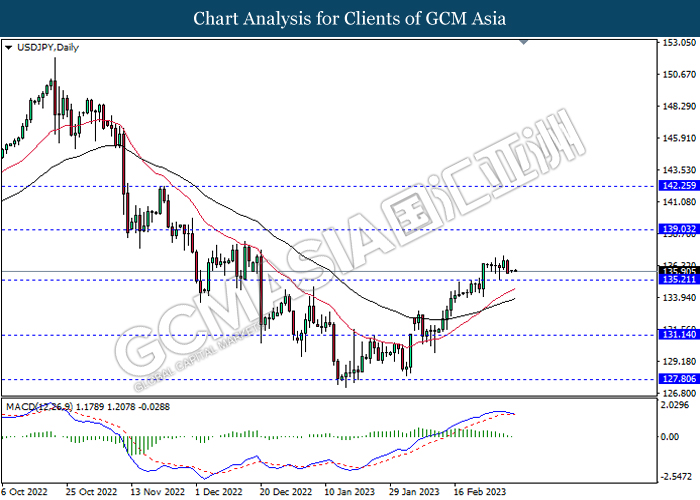

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 139.05, 142.25

Support level: 135.20, 131.15

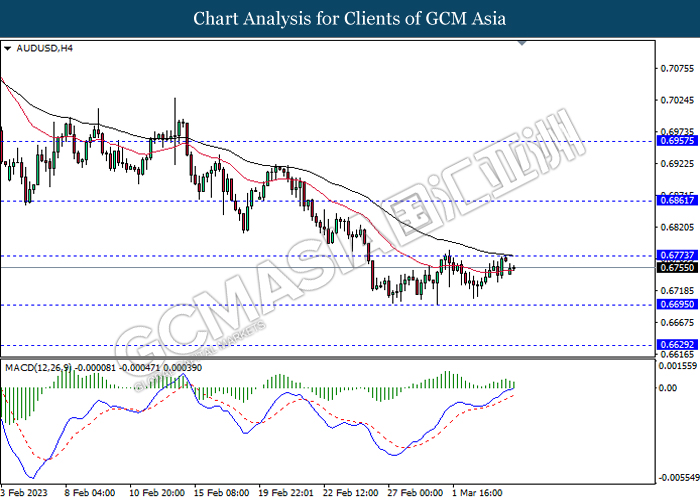

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6775, 0.6860

Support level: 0.6695, 0.6630

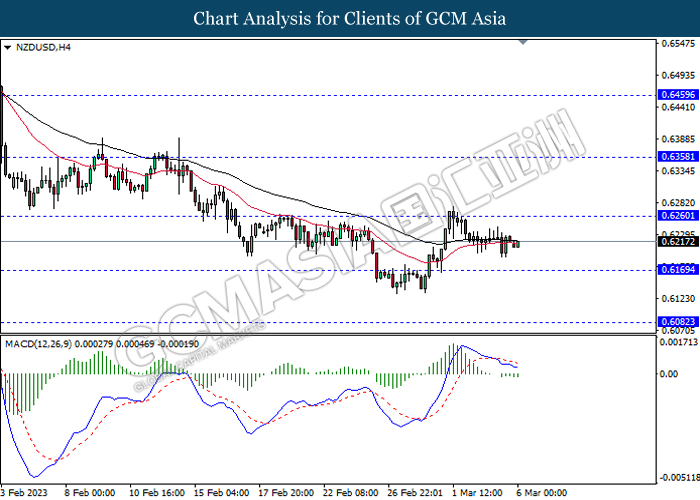

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6260, 0.6360

Support level: 0.6170, 0.6080

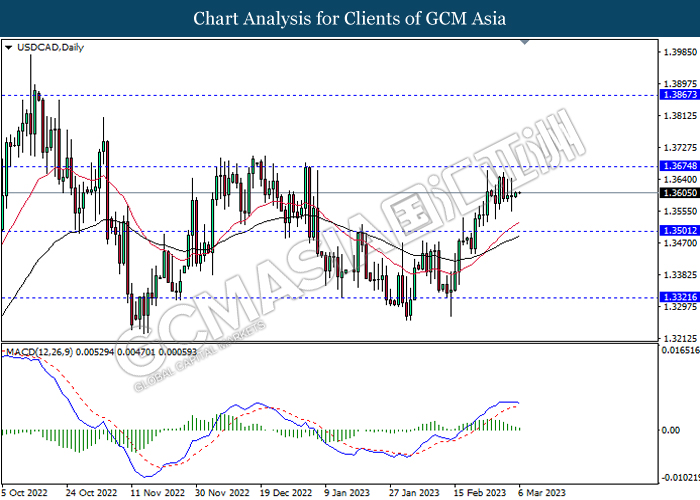

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3675, 1.3865

Support level: 1.3500, 1.3320

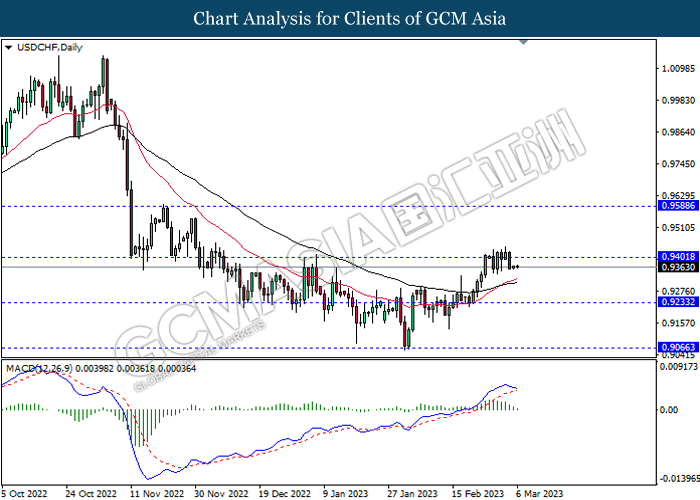

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9400, 0.9590

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 79.50, 81.50

Support level: 77.25, 75.60

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1860.10, 1885.95

Support level: 1833.85, 1811.45