06 March 2023 Afternoon Session Analysis

Pound jumped amid upbeat economic data.

The Pound Sterling, which is majorly traded by global investors, took over the crown from other currencies last Friday following the release of a series of upbeat economic data. According to The Chartered Institute of Purchasing & Supply and the NTC Economics, UK Services PMI increased from the prior month’s reading of 48.7 to 53.5 in the month of February, slightly higher than the consensus forecast at 53.3. Besides, Markit Economics also posted UK Composite PMI data at 53.1, similarly higher than the consensus expectation of 53.0. With that, the investors finally see some light at the end of the tunnel, whereby the stronger business confidence and improved business outlook boosted the overall economic activity in the UK. Also, the market worries over the recession risk in the nation waned, despite the policymakers still holding pessimistic views against the economic outlook. On the other side, the less-hawkish comment from the Atlanta Fed President Raphael Bostic calmed down the bullish momentum in the US dollar market, lifting the pair of GBP/USD to a higher level. As of writing, the pair of GBP/USD rose 0.01% to 1.2041.

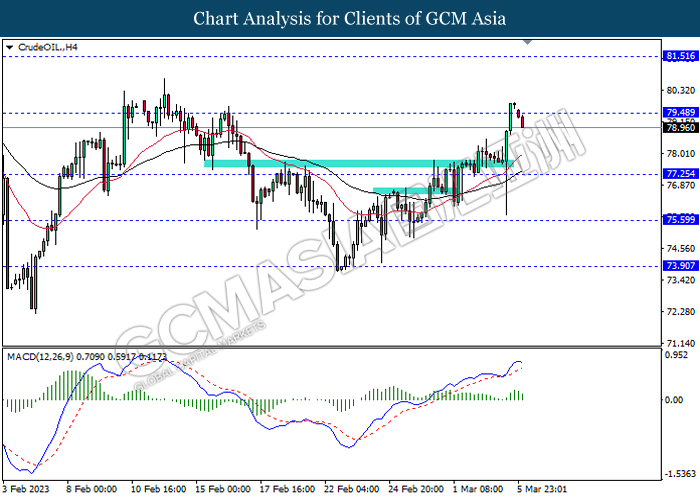

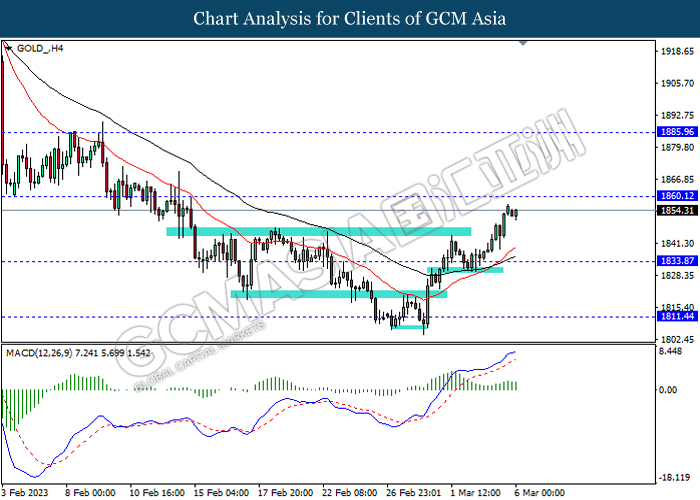

In the commodities market, crude oil prices plummeted by 1.04% this morning as China set a slightly lower annual GDP target at about 5.0%, while the last year’s target was about 5.5%. Besides, gold prices edged down 0.09% to $1855.15 per troy ounce amid a technical correction after a huge surge in the previous trading session.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Construction PMI (Feb) | 48.4 | 49.1 | – |

| 23:00 | CAD – Ivey PMI (Feb) | 60.1 | 55.9 | – |

Technical Analysis

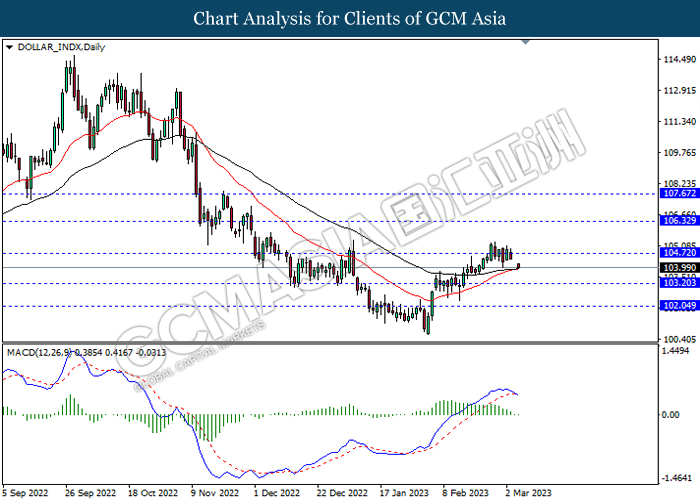

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 104.70, 106.30

Support level: 103.20, 102.05

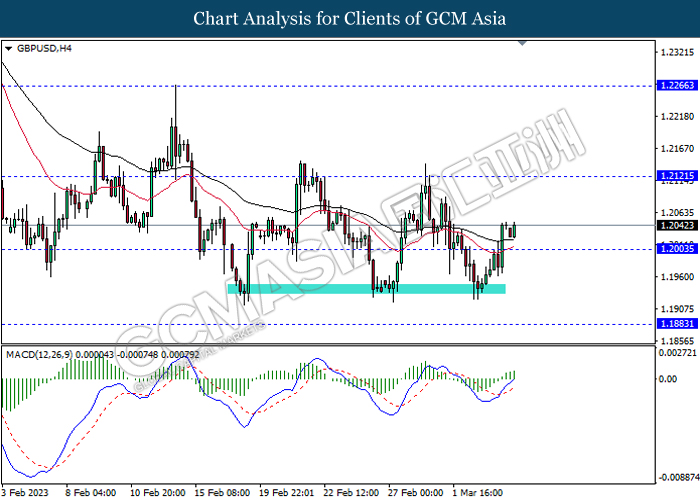

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2120, 1.2265

Support level: 1.2005, 1.1885

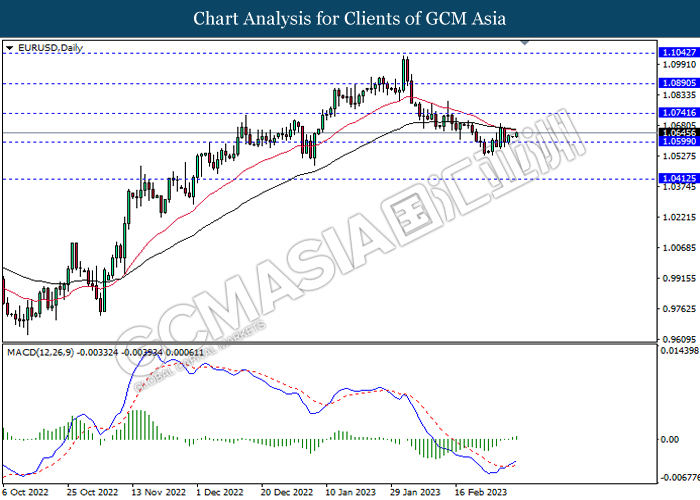

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0410

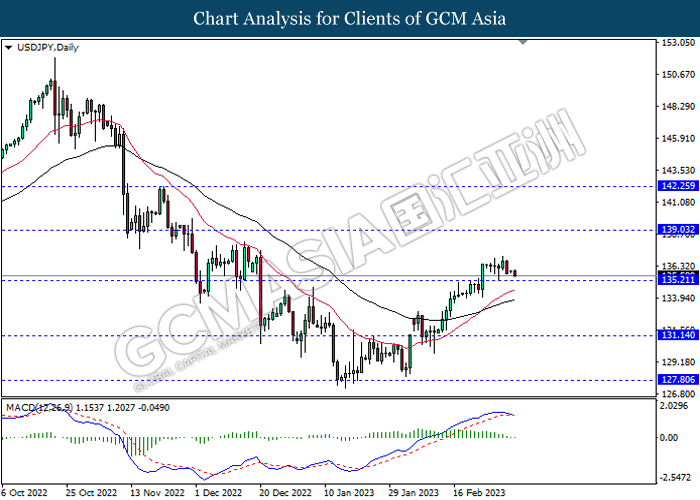

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses of successfully breakout the support level.

Resistance level: 139.05, 142.25

Support level: 135.20, 131.15

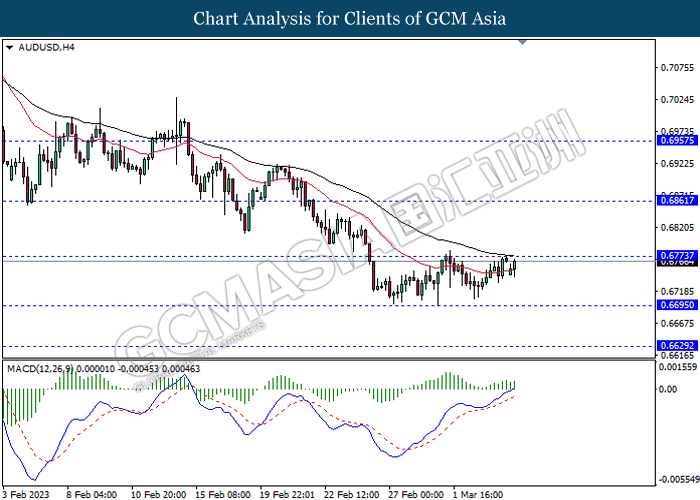

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6775, 0.6860

Support level: 0.6695, 0.6630

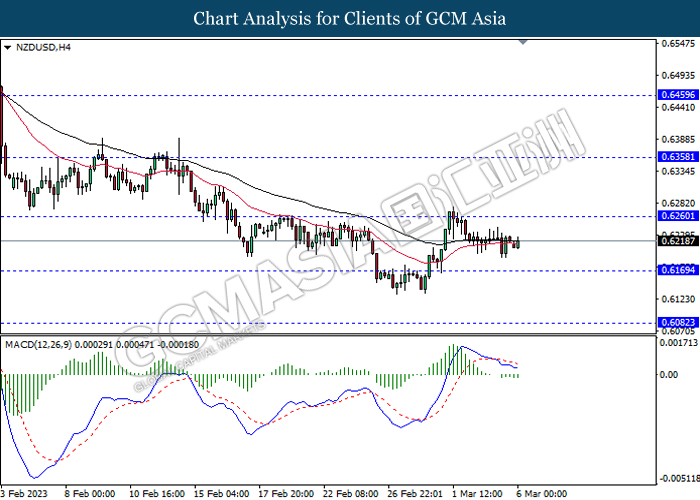

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6260, 0.6360

Support level: 0.6170, 0.6080

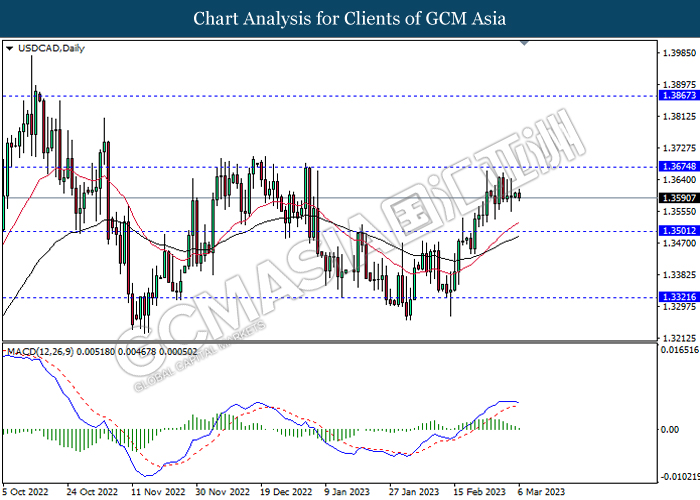

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3675, 1.3865

Support level: 1.3500, 1.3320

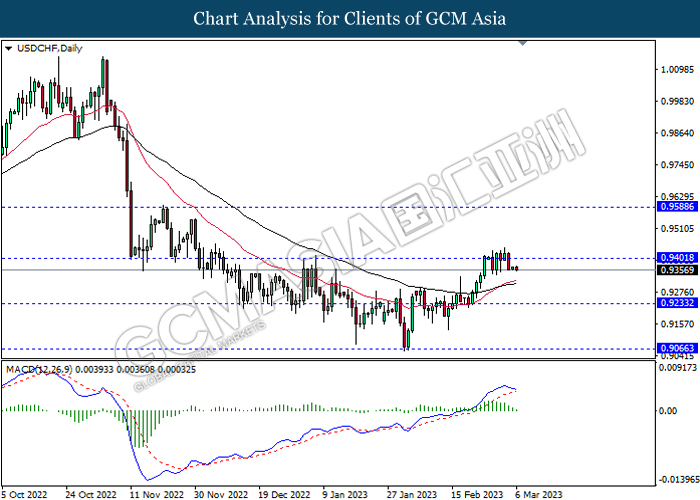

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9400, 0.9590

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 79.50, 81.50

Support level: 77.25, 75.60

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1860.10, 1885.95

Support level: 1833.85, 1811.45