06 April 2023 Afternoon Session Analysis

Euro slipped despite the strongest pace of economic growth.

The Eurodollar slipped despite the strongest pace of economic in the Eurozone. Referring to S&P Global, the Eurozone composite PMI grew from 52.0 to 53.7, primarily contributed by Spain’s business activity. Spain’s economic output was the top performing country in March with a 58.2 composite PMI Output index and hit the 16-month high. However, Germany and France, the euro zone’s two largest economies, lagged at 52.6 and 52.7 respectively but still hit the fresh 10-month highs. As result, the eurozone economy rounded off in the first quarter with a third consecutive monthly expansion in the private sector, signaling a marked improvement in the overall economy. Manufacturing activity picked up slightly, but the service sector had the strongest influence in the overall economy. Meanwhile, the eurozone business remains optimistic on the following 12-month outlook with outstanding confidence level. However, the optimistic economic outlook did not support the pair of EUR/USD to spike as the US dollar rebounded yesterday. The US dollar rebounded as investors secured their profit ahead of the Non-Farm Payroll report. As of writing, the EUR/USD slipped by -0.11% to $1.0891.

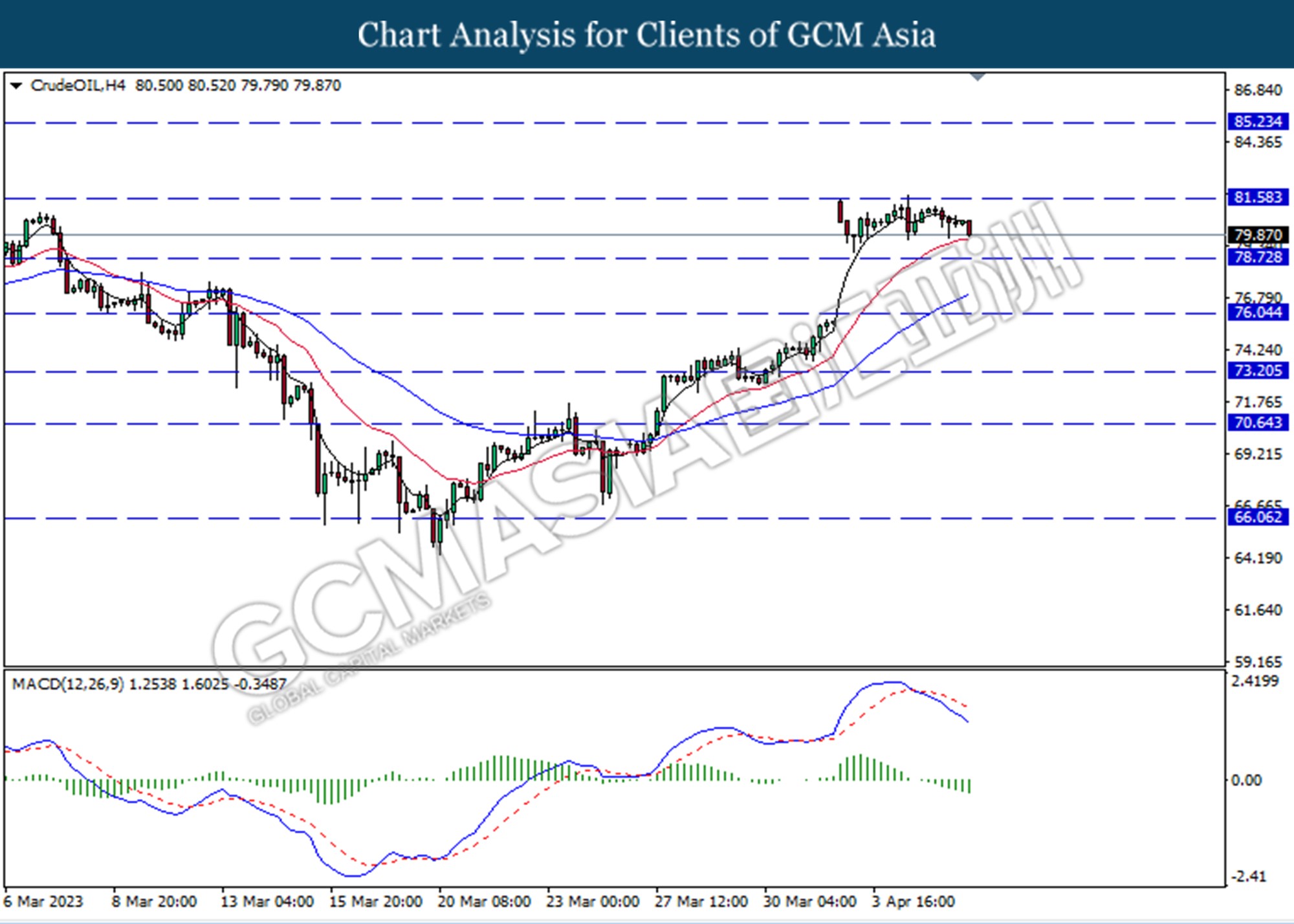

In the commodities market, crude oil prices depreciated by -0.92% to $79.87 per barrel as of writing amid the weakening economic condition in the US. On the other hand, gold prices slipped by -0.17% to $ 2017.15 per troy ounce as the dollar strengthened

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (Mar) | 54.6 | 53.5 | – |

| 20:30 | USD – Initial Jobless Claims | 198K | 200K | – |

| 20:30 | CAD – Employment Change (Mar) | 21.8K | 12.0K | – |

| 22:00 | CAD – Ivey PMI (Mar) | 51.6 | 56.1 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing for the resistance level at 101.70. MACD which increasing bullish momentum suggests the index extended its gains after it successfully breakout below the resistance level.

Resistance level: 101.70, 103.00

Support level: 100.35, 99.35

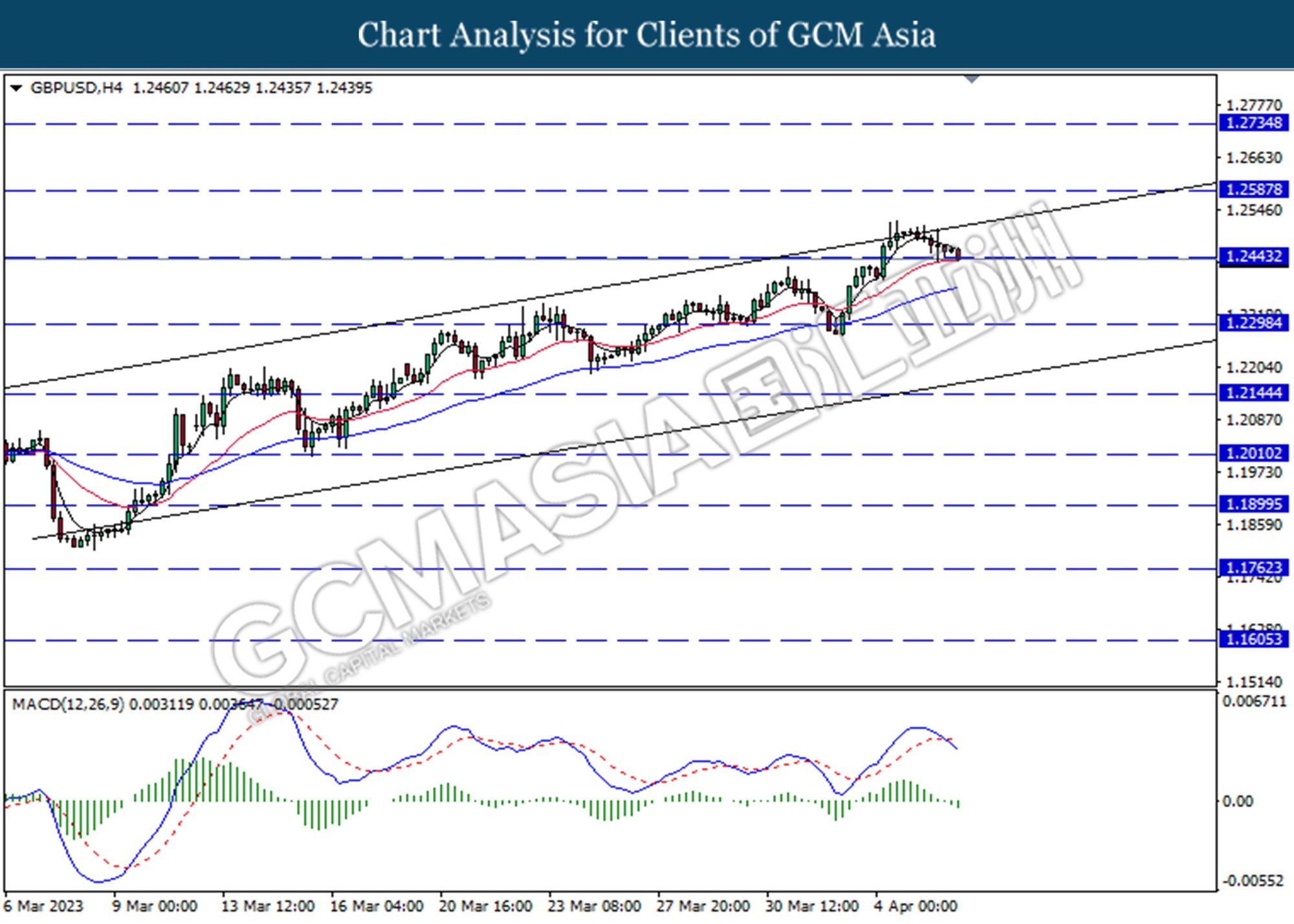

GBPUSD, H4: GBPUSD was traded lower while currently testing for the support level at 1.2445. MACD which illustrated increasing bearish momentum suggest the pair extended its losses if successfully breaks below the support level.

Resistance level: 1.2590, 1.2735

Support level: 1.2445, 1.2300

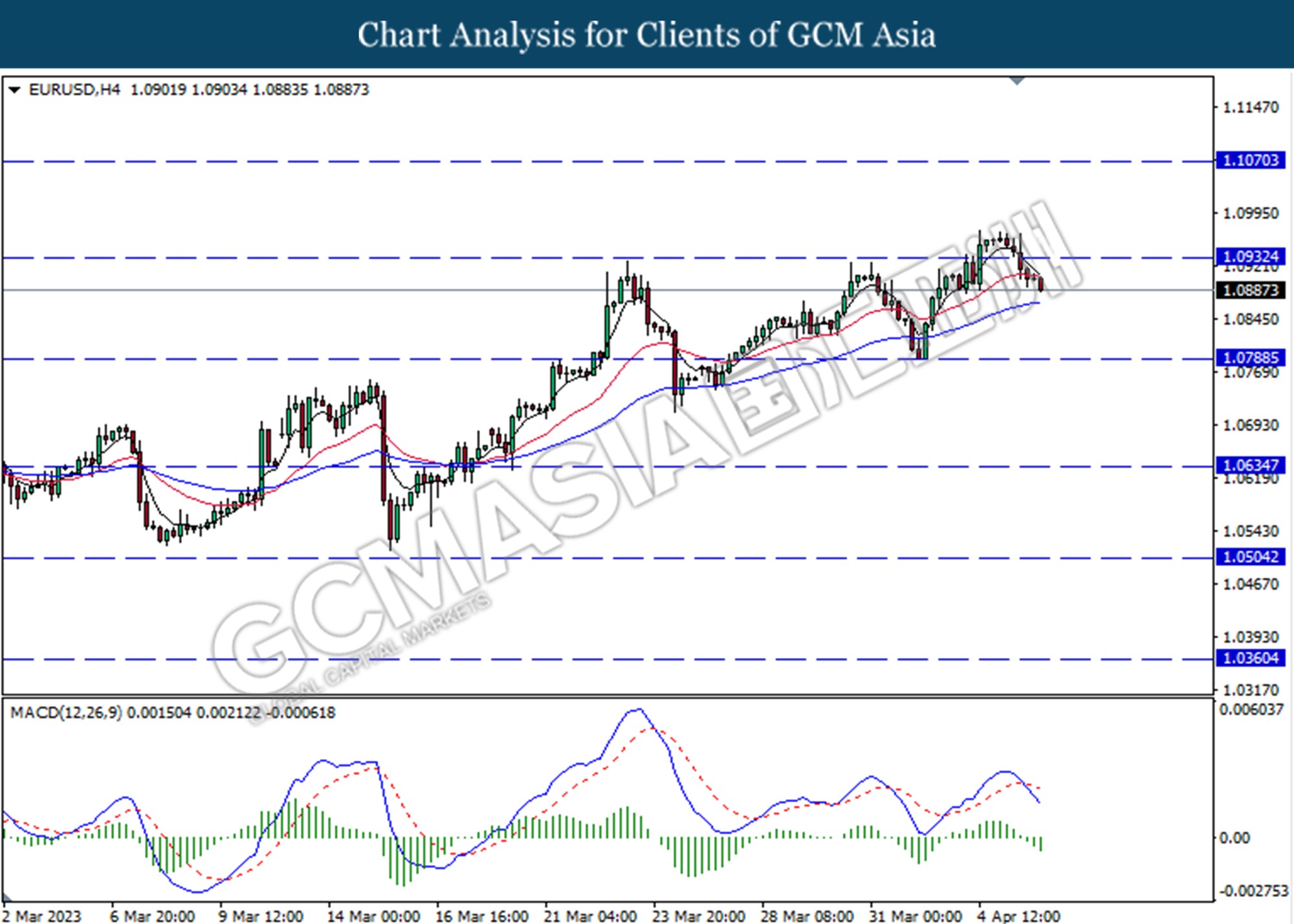

EURUSD, H4: EURUSD was traded lower following a prior break below the previous support level at 1.0930. MACD which illustrated increasing bearish momentum suggest the pair extended its losses toward the support level at 1.0790.

Resistance level: 1.0930, 1.1070

Support level: 1.0790, 1.0635

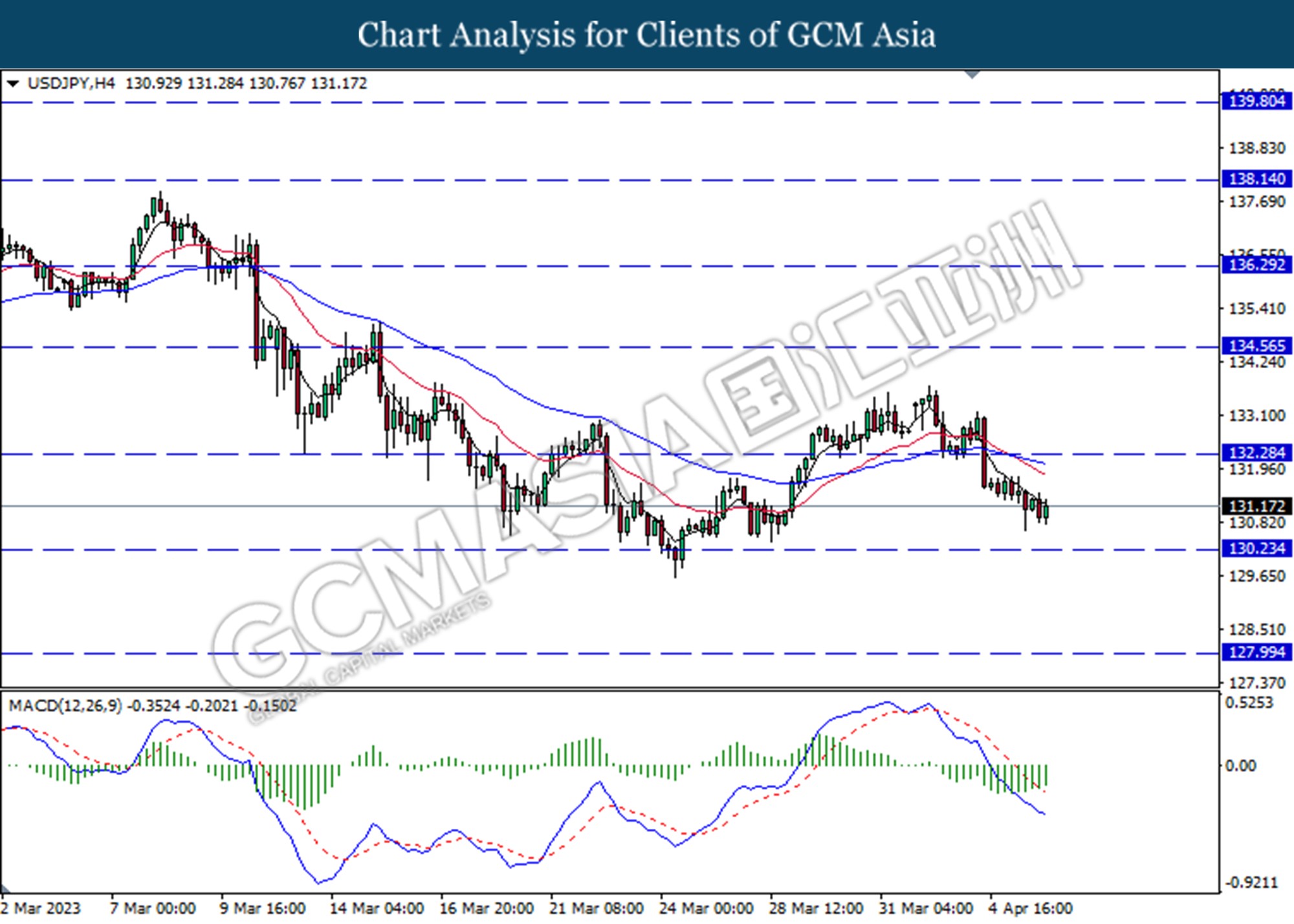

USDJPY, H4: USDJPY was traded higher following a prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the pair extended its gains toward the resistance level at 132.30.

Resistance level: 132.30, 134.55

Support level: 130.25, 128.00

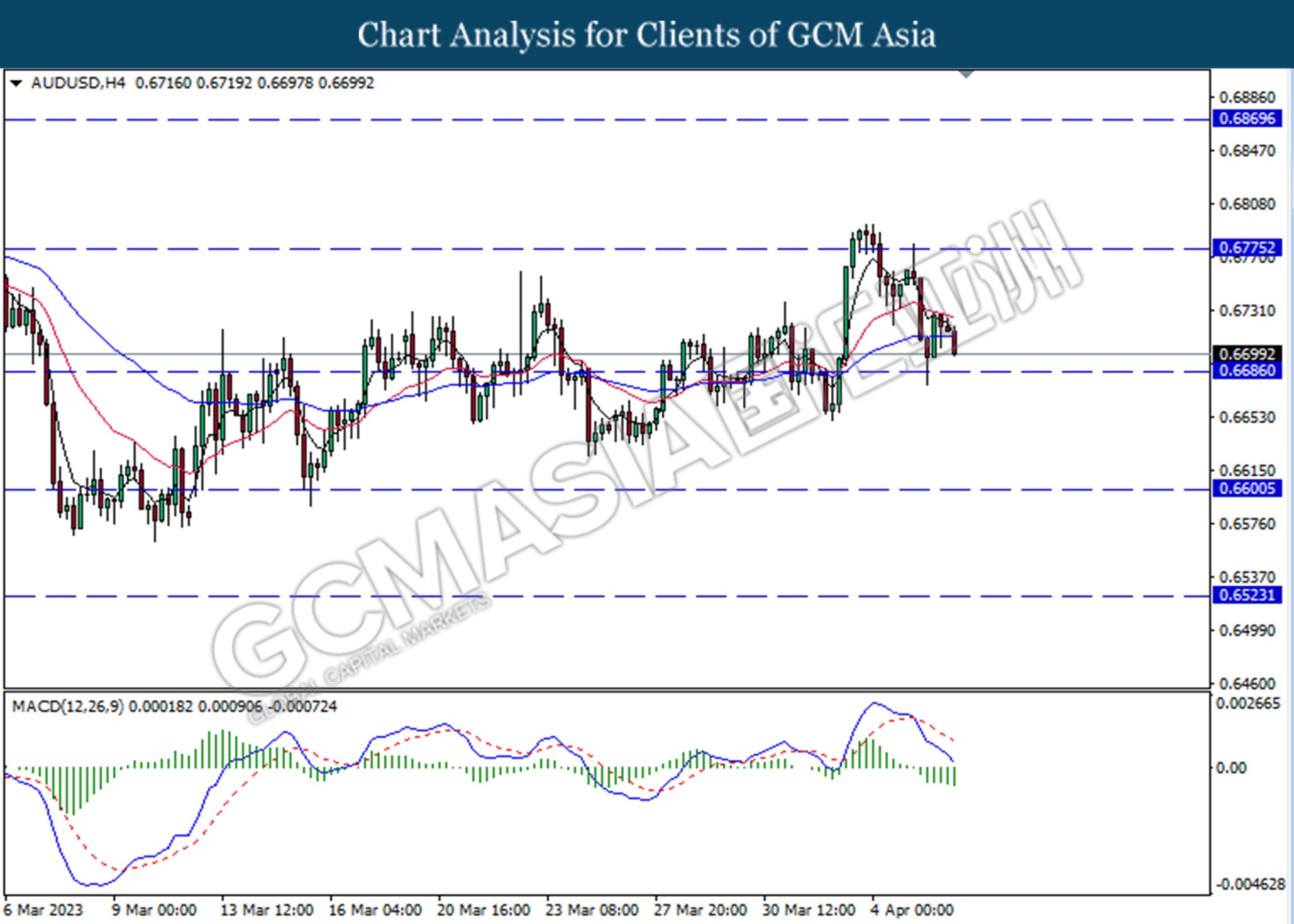

AUDUSD, H4: AUDUSD was traded lower following the prior retracement from the higher level. MACD which illustrated bearish momentum suggest the pair extended it losses toward the support level at 0.6685.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

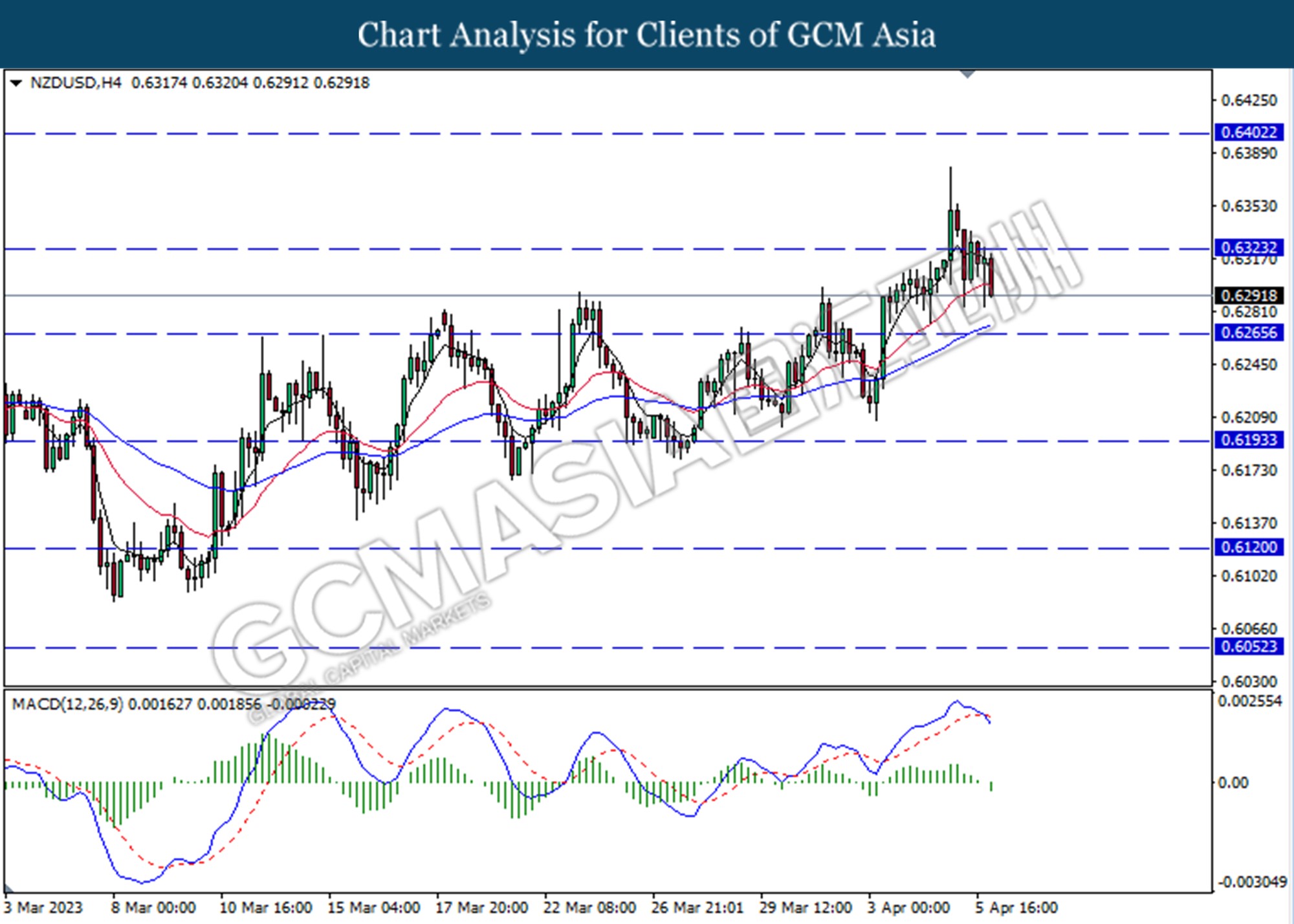

NZDUSD, H4: NZDUSD was traded lower following the prior retracement from the resistance level at 0.6325. MACD which illustrated increasing bearish momentum suggest the pair extended its losses toward the support level at 0.6265.

Resistance level: 0.6325, 0.6400

Support level: 0.6265, 0.6195

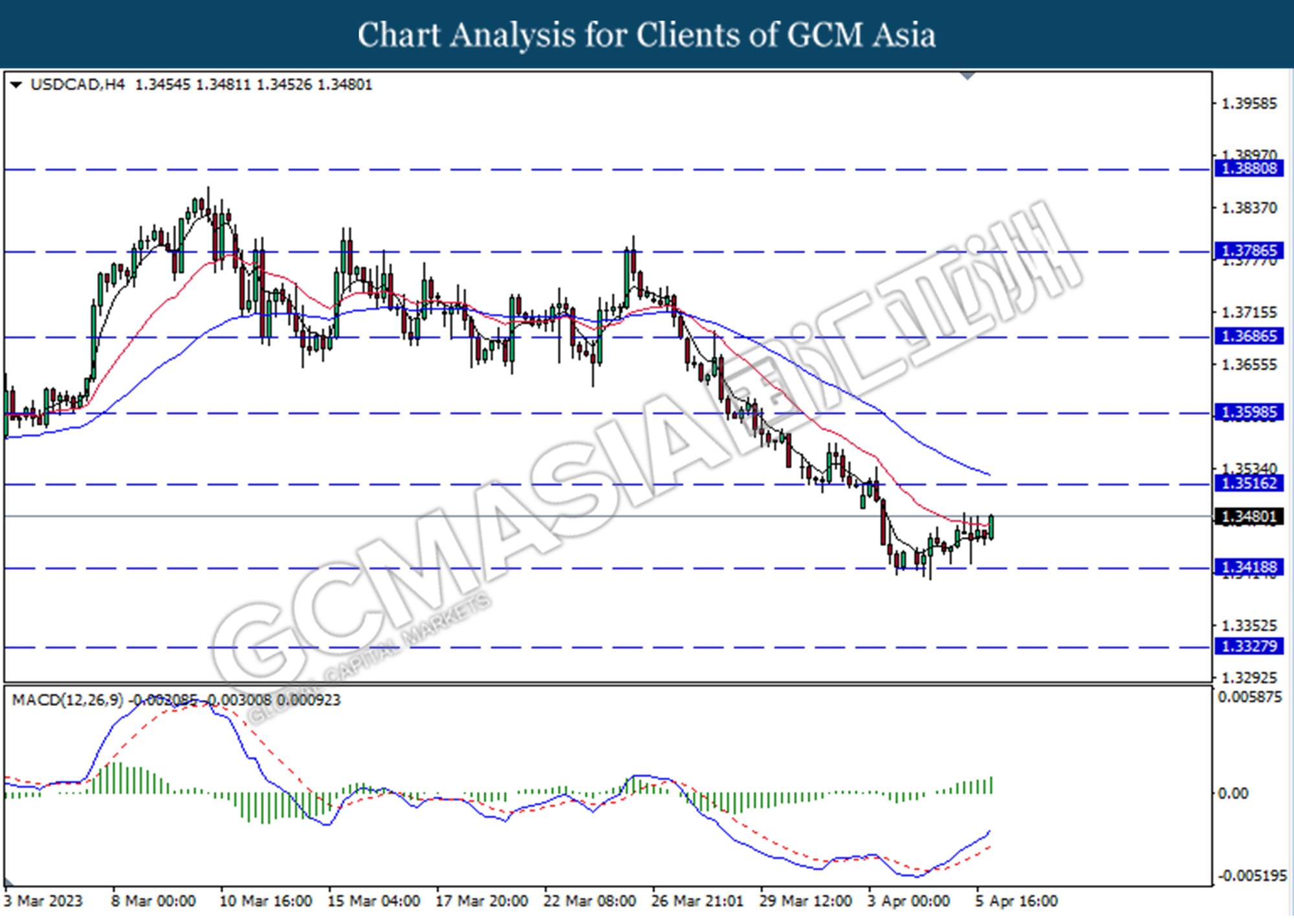

USDCAD, H4: USDCAD was traded higher following the prior rebound from the support level at 1.3420. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 1.3515.

Resistance level: 1.3515, 1.3600

Support level: 1.3420, 1.3330

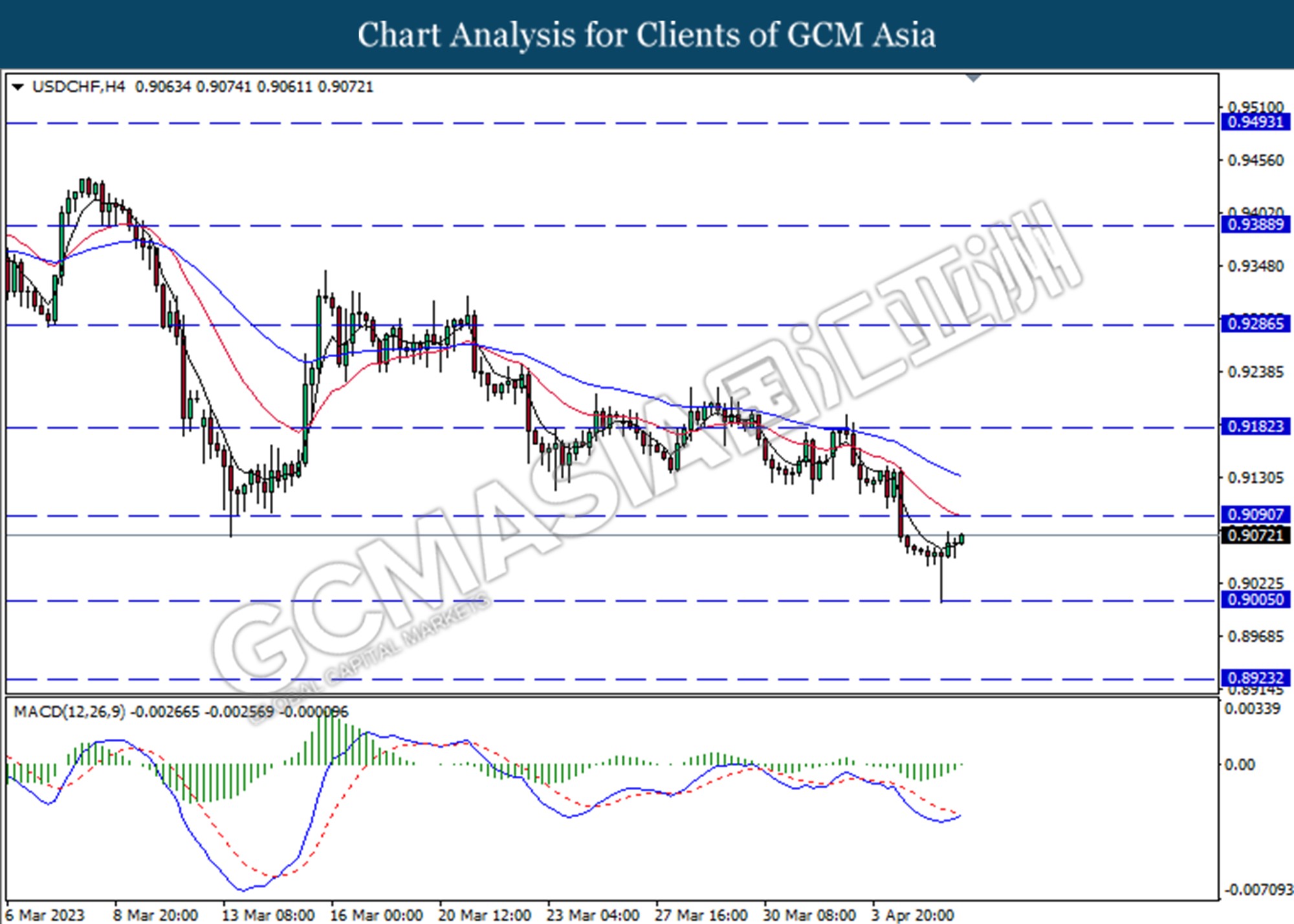

USDCHF, H4: USDCHF was traded higher following a prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the pair extended its gains towards the resistance level at 0.9090.

Resistance level: 0.9090, 0.9180

Support level: 0.9005, 0.8925

CrudeOIL, H4: Crude oil price was traded lower following a prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggest the commodity extended its losses toward the support level at 78.70.

Resistance level: 81.60, 85.25

Support level: 78.70, 76.05

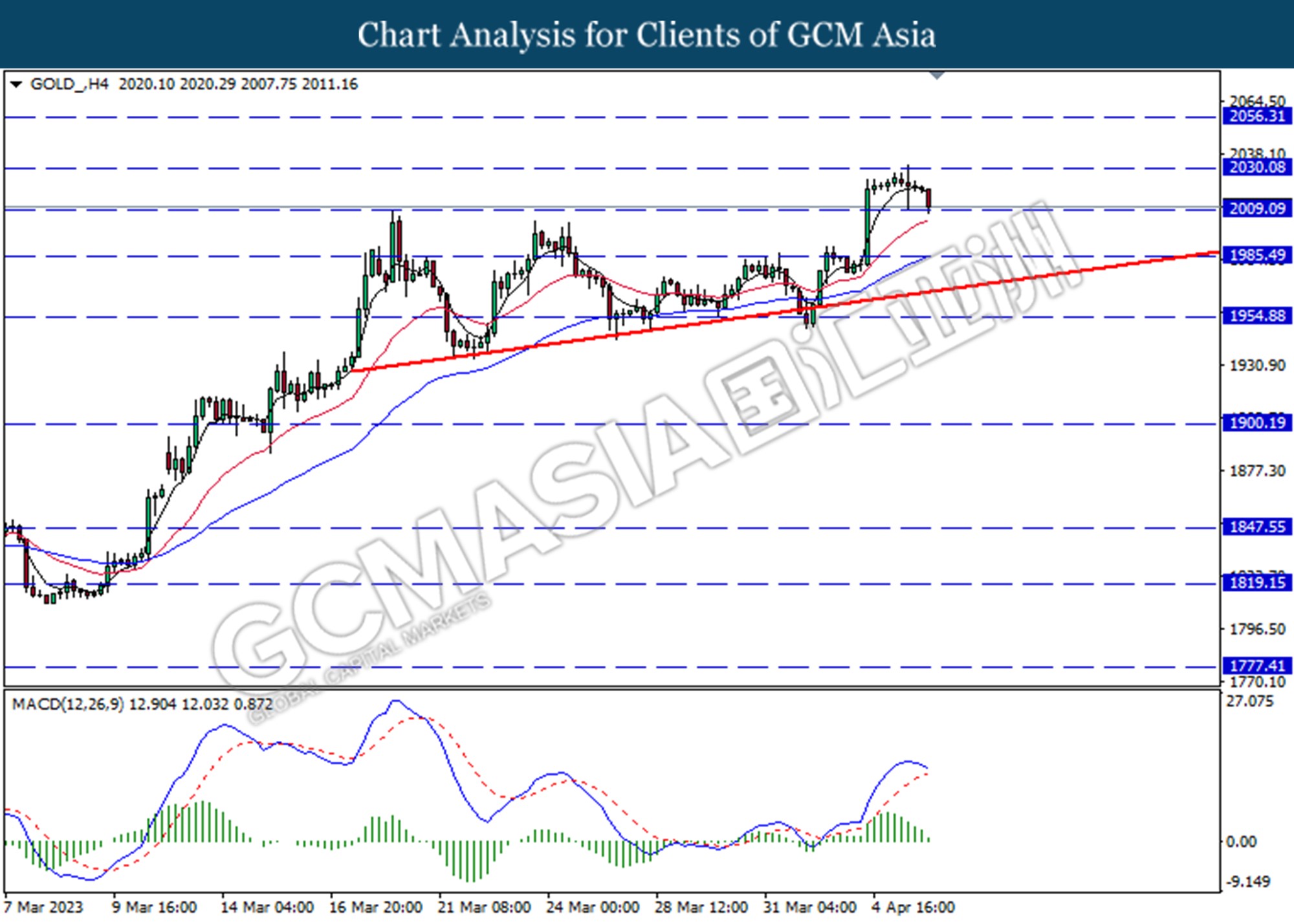

GOLD_, H4: Gold price was traded lower following a prior break below the previous support level at 2009.10. MACD which illustrated diminishing bullish momentum suggests the commodity extended its losses toward the support level at 1985.50.

Resistance level: 2009.10, 2030.10

Support level: 1985.50, 1954.90