06 April 2023 Morning Session Analysis

US dollar survived against the backdrop of downbeat economic data.

The dollar index, which is traded against a basket of six major currencies, managed to hold its ground after hitting the lowest level in two months despite the yesterday’s disappointing economic data. According to the Automatic Data Processing (ADP), the US Nonfarm Employment Change experienced a sharp drop in the past month, where the data reduced from 261K to 145K, weaker than consensus forecast at 200K. The downbeat data has pointed that the US labor market started to moderate after a series of rate hikes by the Federal Reserve. The situation turned even worst after the ISM reported that the US services activity decelerated. According to the Institute for Supply Management (ISM), the US Non-Manufacturing PMI fell to 51.2 in March from 55.1 in February, showing the impact of persistent rate-hike against the sector was obvious and significant. Despite, the dollar index recovered from its low as the investors lightened their short positions to book profits ahead of the all-time crucial labor data, which is the US Nonfarm Payroll. As of writing, the dollar index rose 0.29% to 101.90.

In the commodities market, crude oil prices ticked up by 0.20% to $80.40 per barrel as the past week’s US crude oil inventories fell by a bigger amount compared to the consensus forecast, according to the data from EIA. Besides, gold prices edged down by -0.02% to $2020.30 per troy ounce while the investors are eyeing on the Nonfarm payroll report.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (Mar) | 54.6 | 53.5 | – |

| 20:30 | USD – Initial Jobless Claims | 198K | 200K | – |

| 20:30 | CAD – Employment Change (Mar) | 21.8K | 12.0K | – |

| 22:00 | CAD – Ivey PMI (Mar) | 51.6 | 56.1 | – |

Technical Analysis

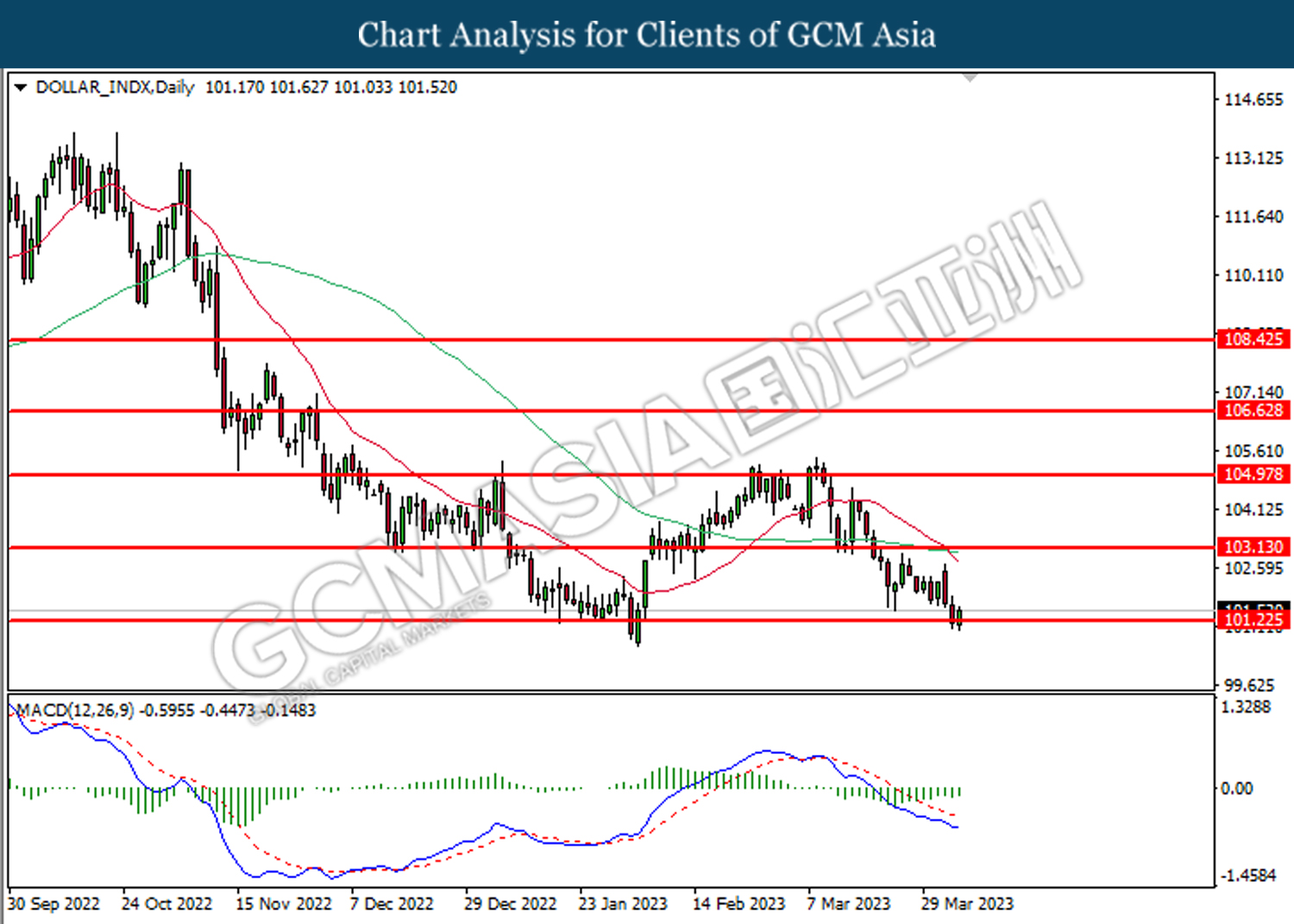

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 101.25. MACD which illustrated bearish bias momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 103.15, 105.00

Support level: 101.25, 99.40

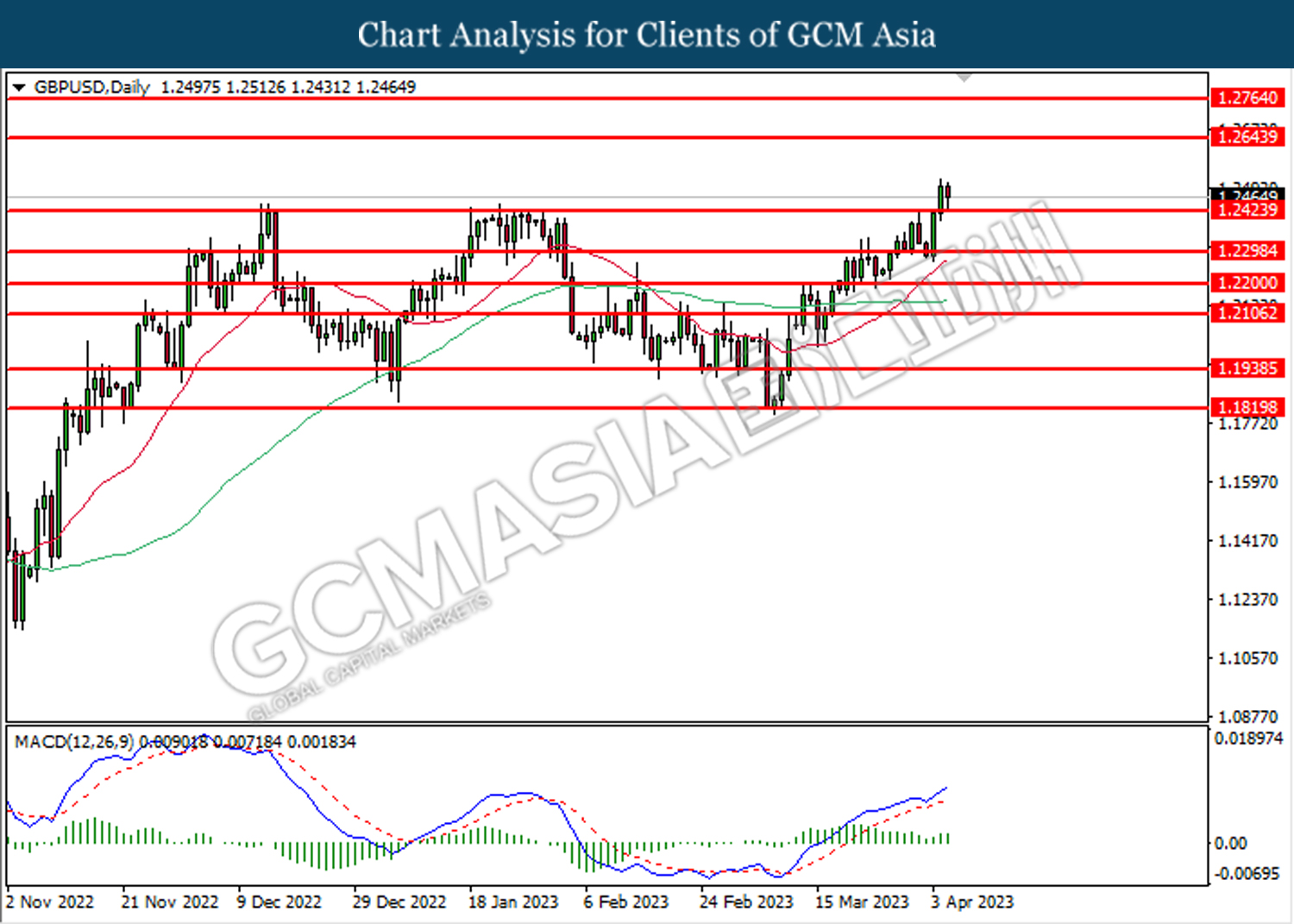

GBPUSD, Daily: GBPUSD was traded higher following the prior breakout above the previous resistance level at 1.2325. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the next resistance level at 1.2645.

Resistance level: 1.2645, 1.2765

Support level: 1.2425, 1.2300

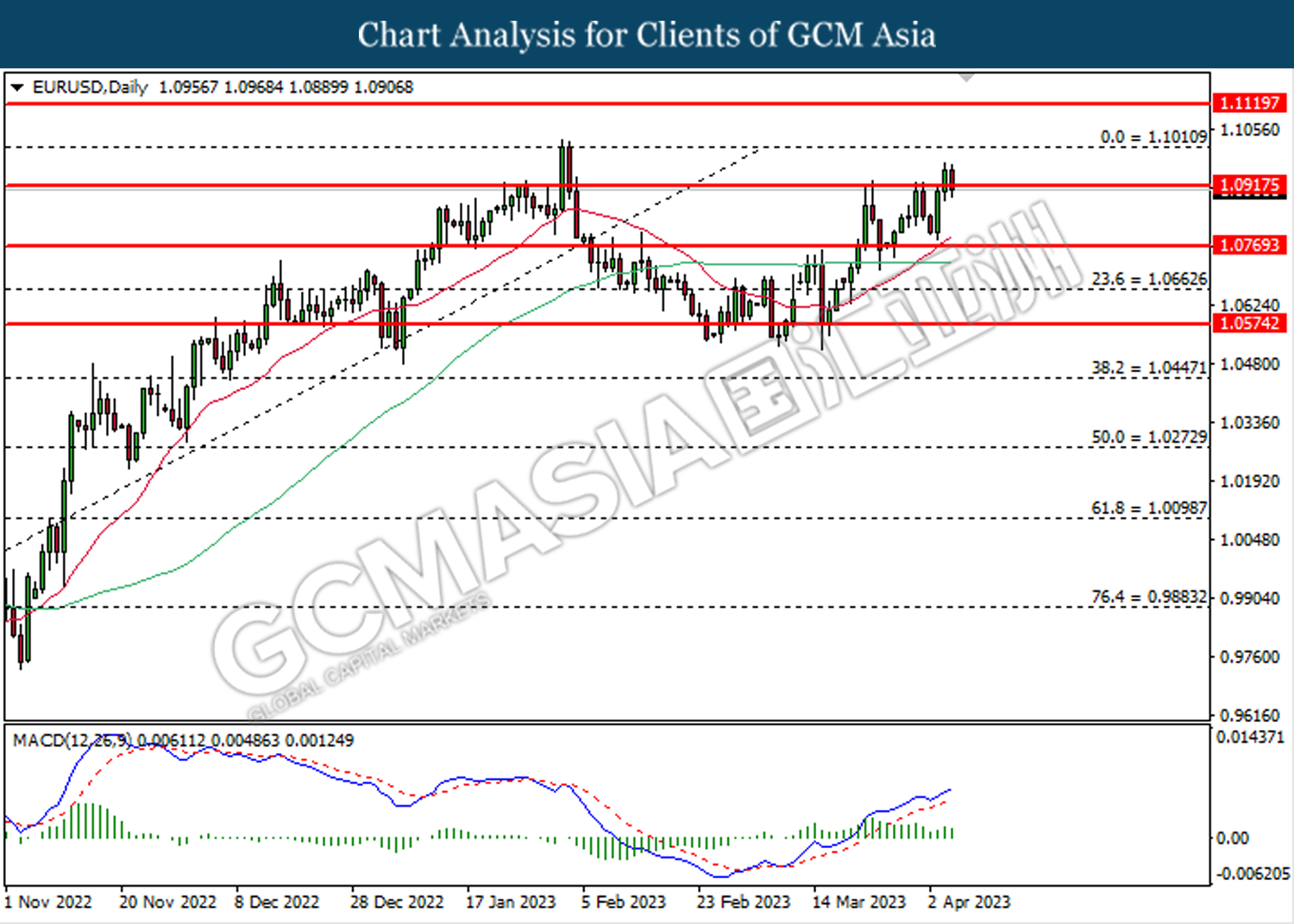

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0915. However, MACD which illustrated bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.1010, 1.1120

Support level: 1.0915, 1.0770

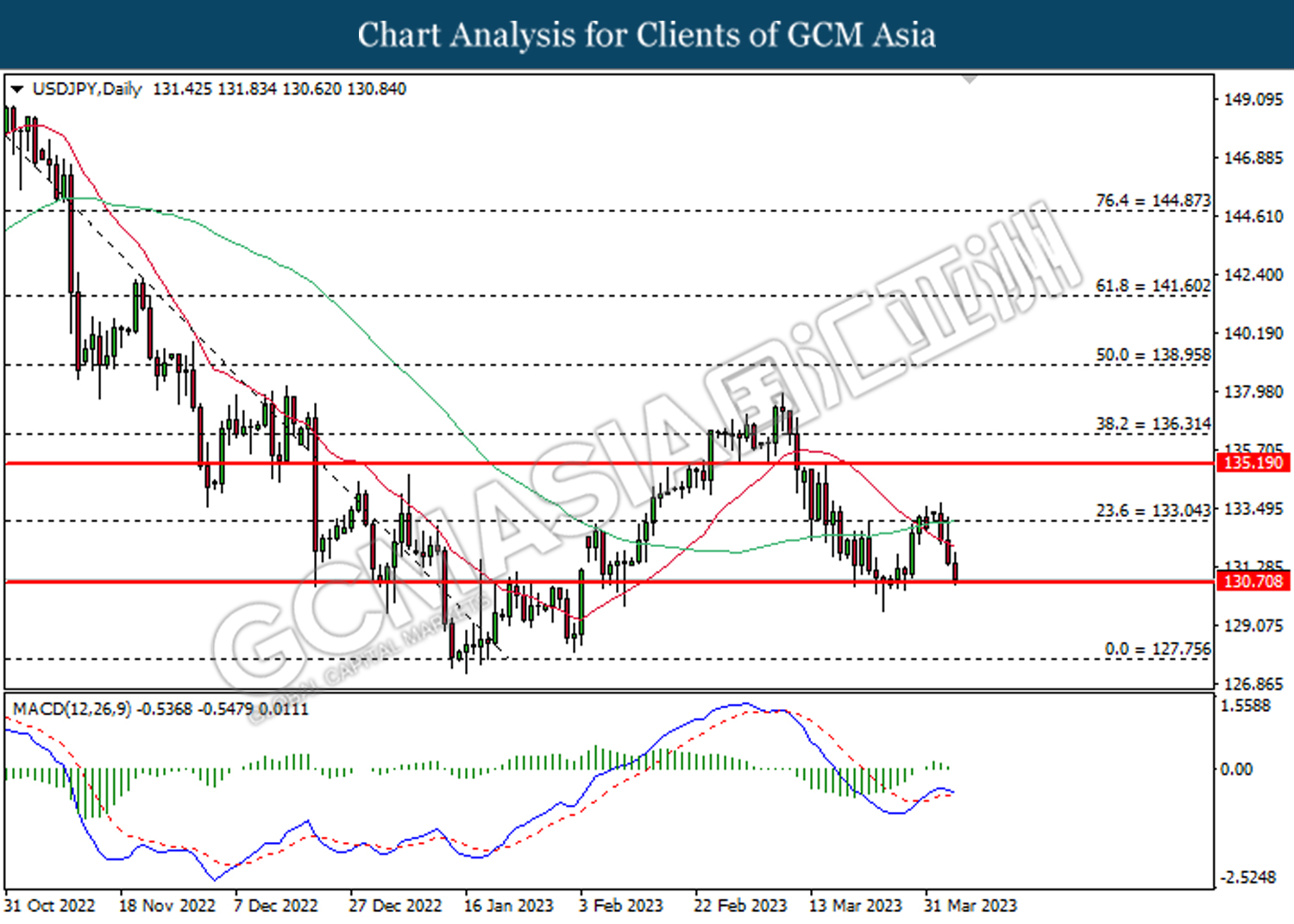

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 130.70. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 133.05, 135.20

Support level: 130.70, 127.75

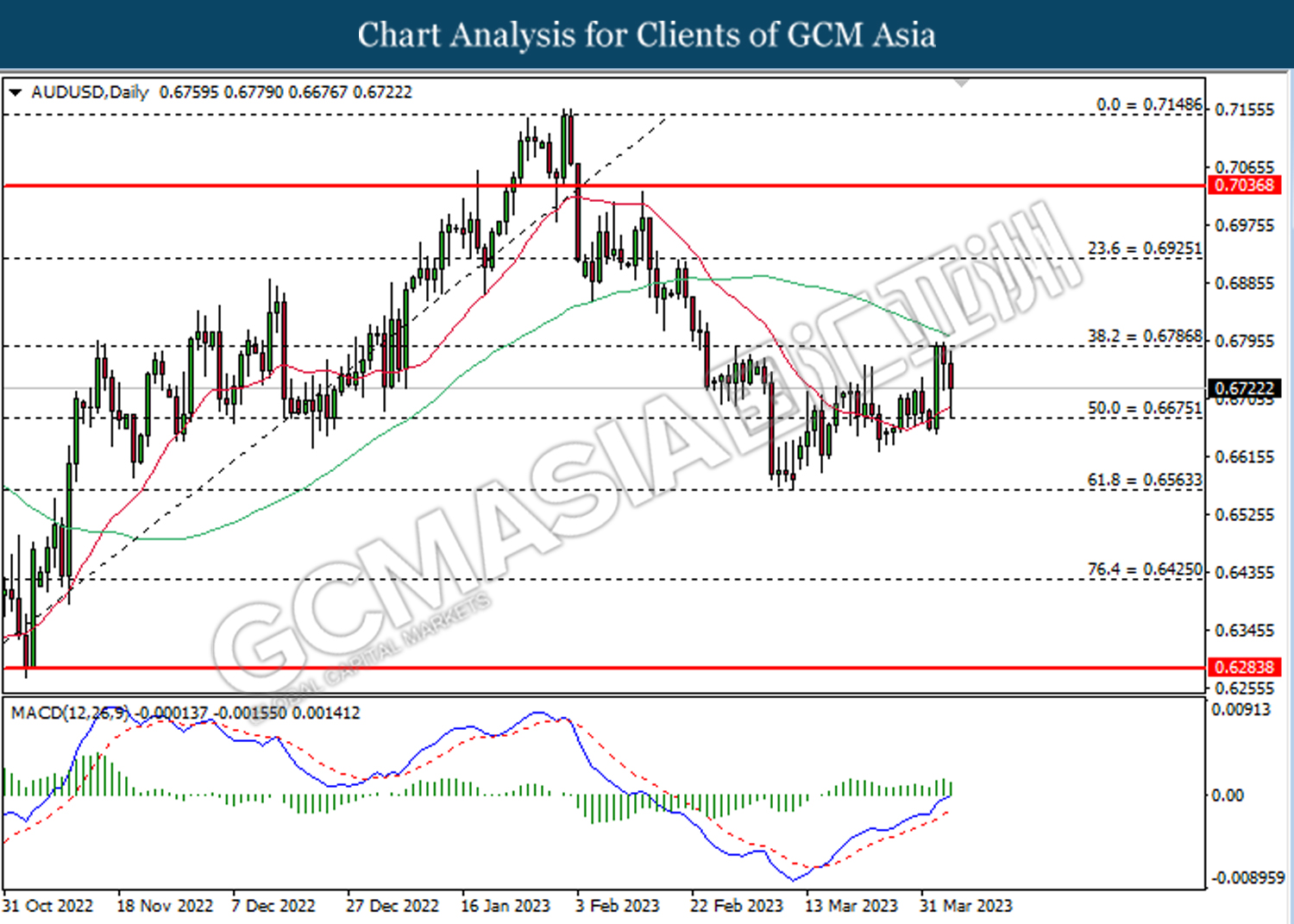

AUDUSD, Daily: AUDUSD was traded lower following the prior retracement from the resistance level at 0.6785. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6675.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

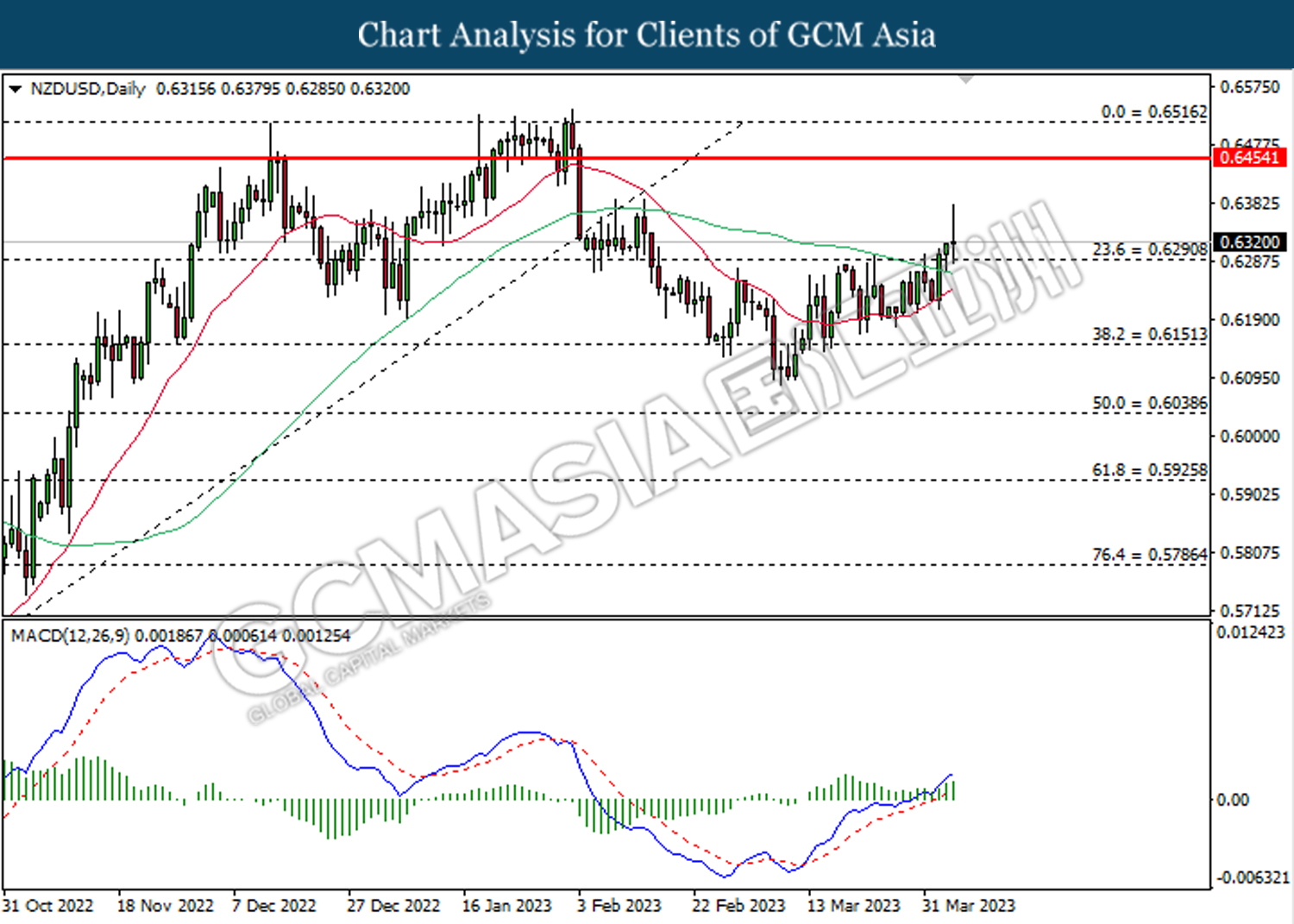

NZDUSD, Daily: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6290. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward the resistance level at 0.6455.

Resistance level: 0.6455, 0.6515

Support level: 0.6290, 0.6150

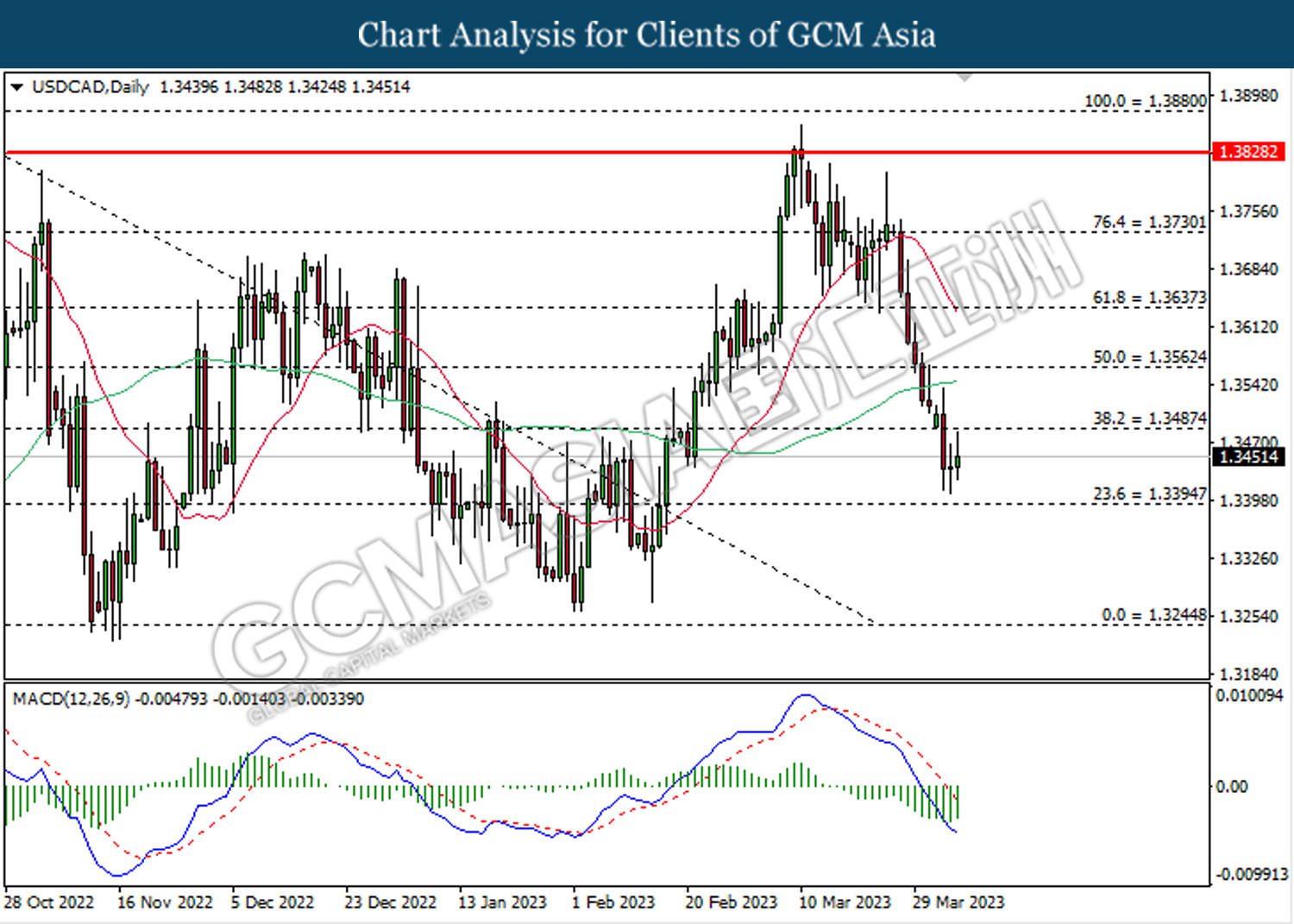

USDCAD, Daily: USDCAD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3485.

Resistance level: 1.3485, 1.3565

Support level: 1.3395, 1.3245

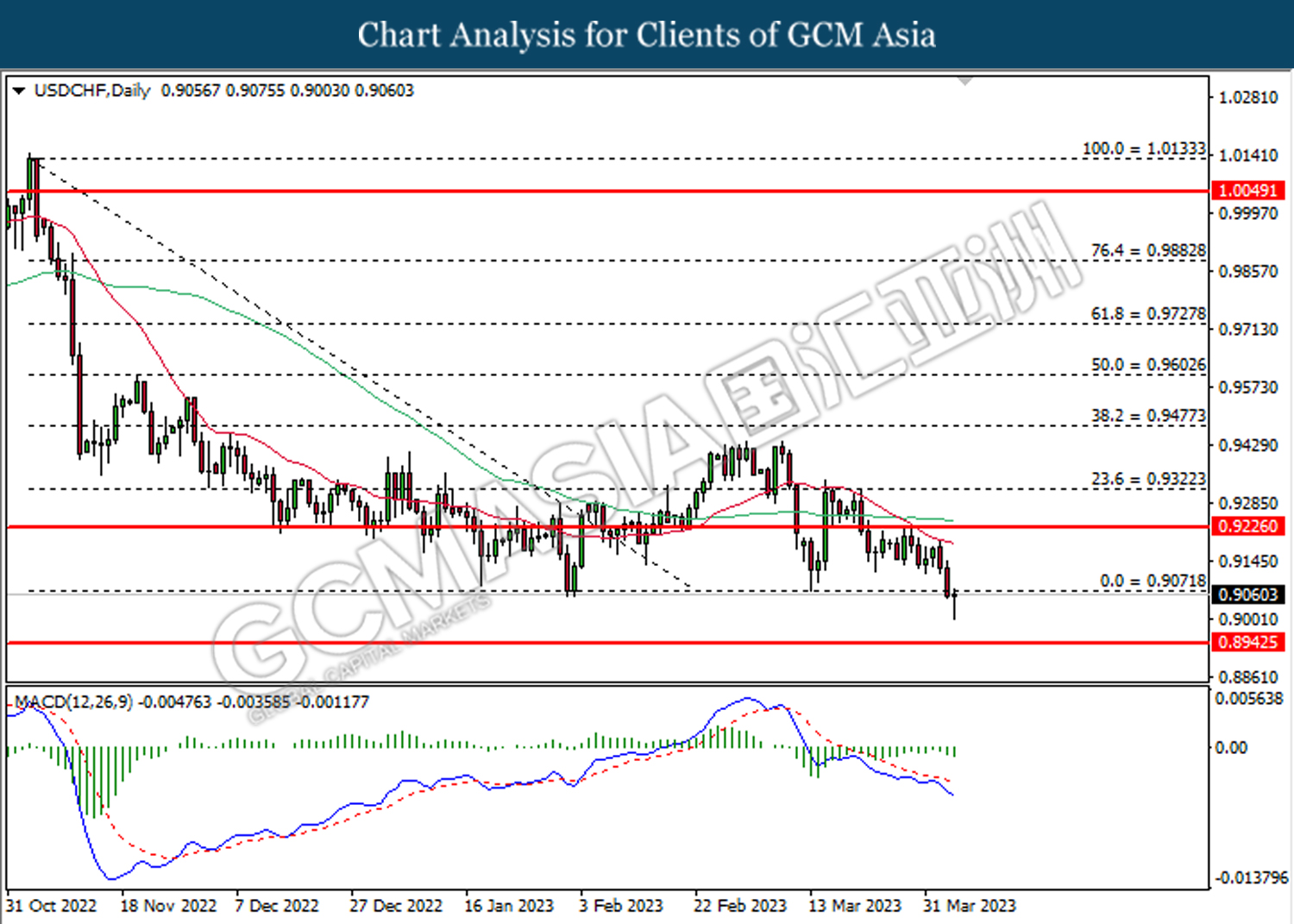

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9070. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9225, 0.9325

Support level: 0.9070, 0.8945

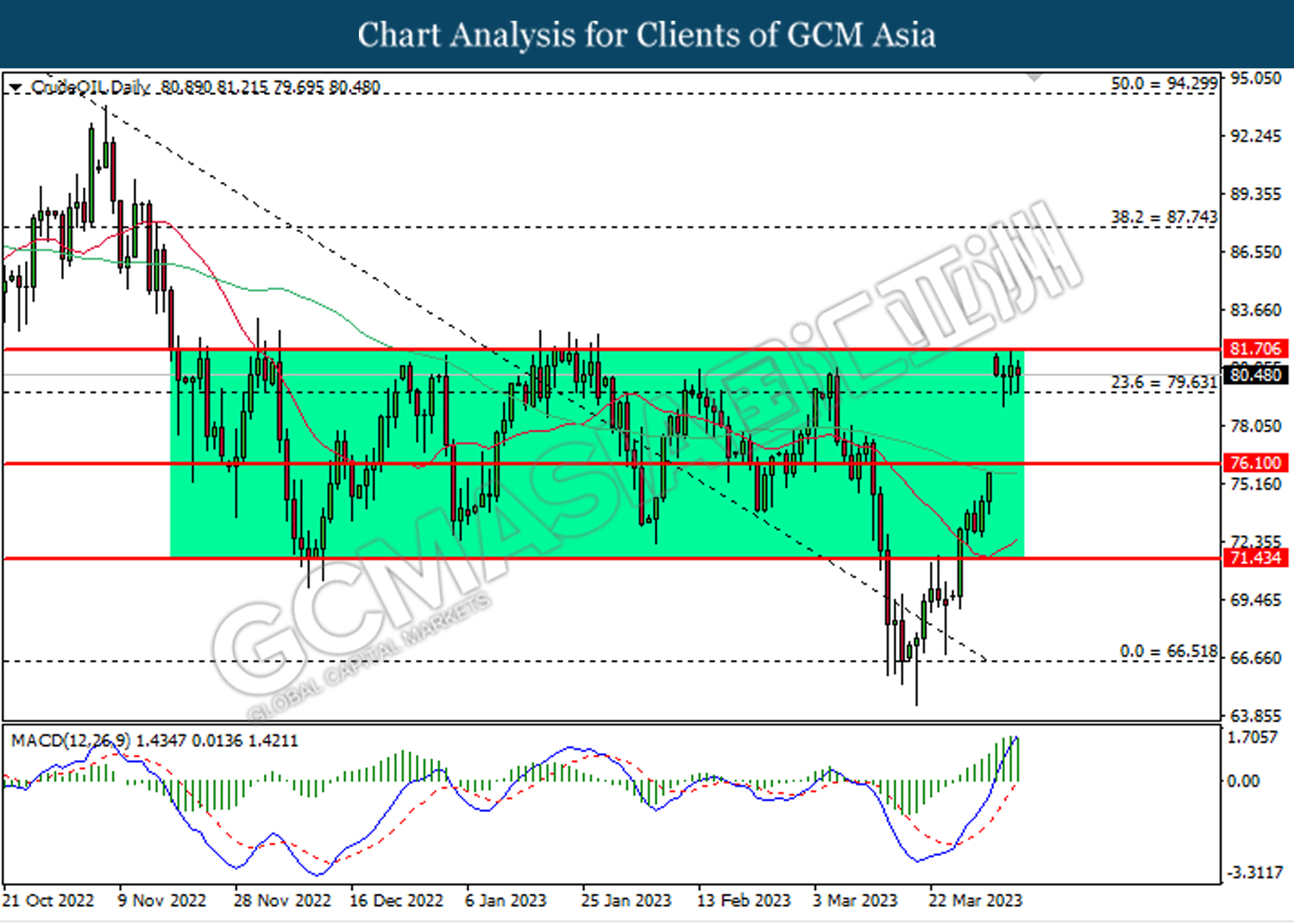

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 81.70. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 81.70, 87.75

Support level: 79.65, 76.10

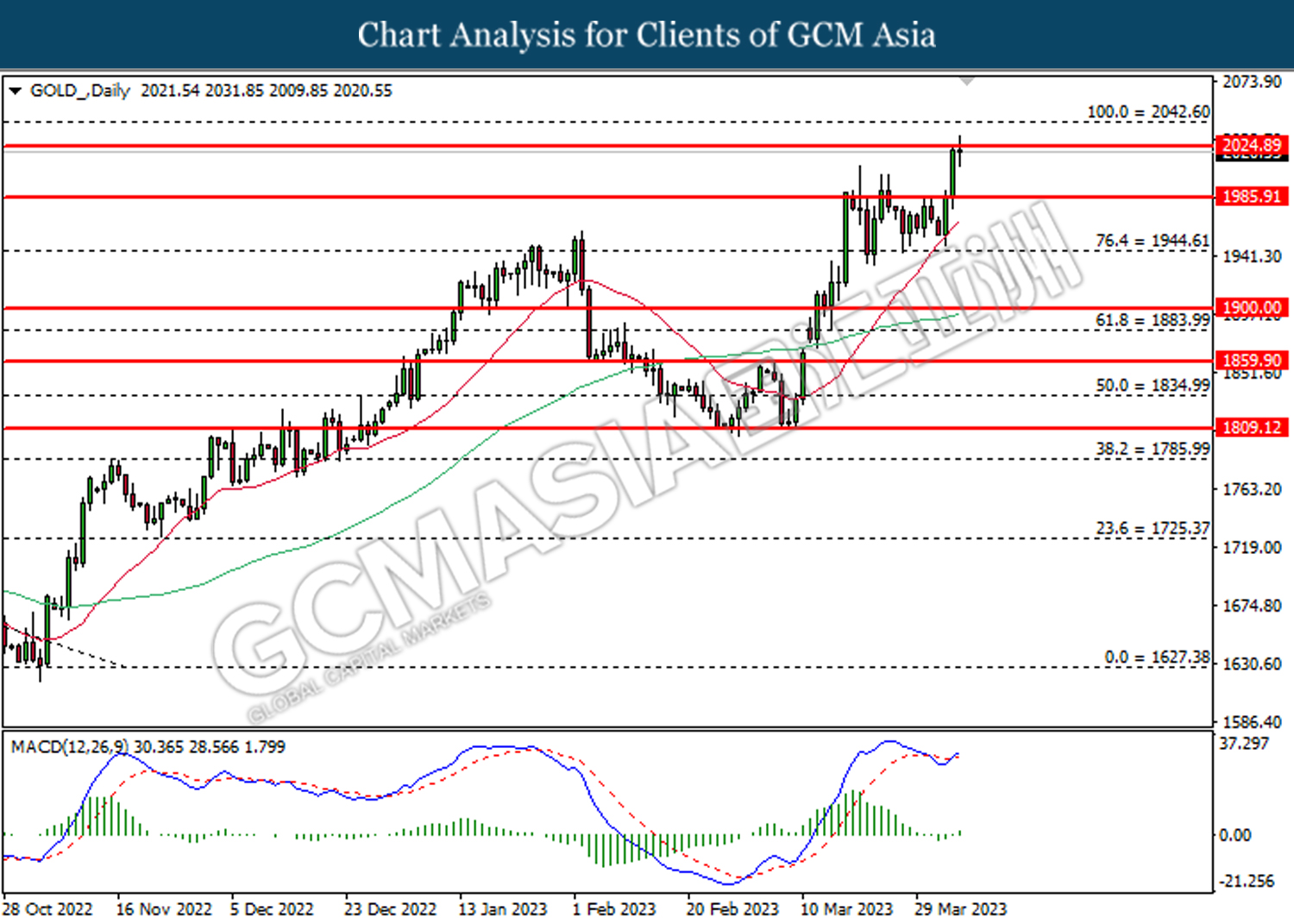

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 2024.90. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 2024.90, 2042.60

Support level: 1985.90, 1944.60