6 May 2022 Afternoon Session Analysis

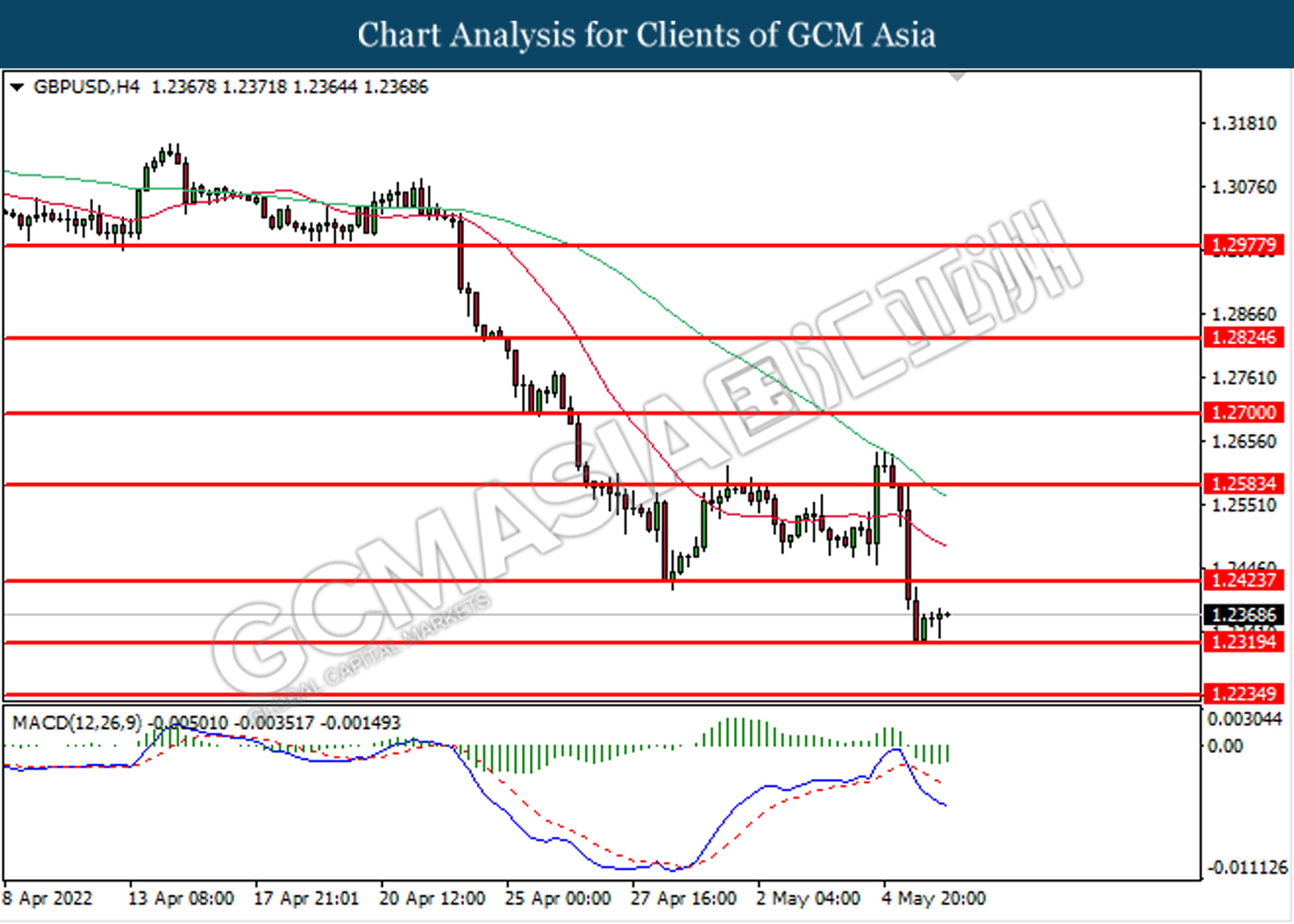

Pound dived following the sharp drop in UK bond yield

The Pound Sterling received significant bearish momentum as the UK government bond yields fell sharply despite the Bank of England increased their interest rate by 1%, lifting the cost of borrowing to the highest level in 13 years. Nonetheless, the BoE warned the UK economy was at risk of recession, sparkling further concerns for stagflation in future. Annual UK inflation hit a 30-year high of 7% in March, exceeding the BoE target level as food and energy prices continue to surged significantly. UK Consumer confidence, meanwhile plunged to a near record low in April amid negative prospect for economic growth. Currently, the BoE expects UK inflation to rise to roughly 10% this year as a result of Russia-Ukraine war and lockdowns in China, which spurring further concerns on supply disruption. Nonetheless, investors would continue to scrutinize further updates with regards of crucial economic data to receive further trading signal. As of writing, the pair of GBP/USD rebounded by 0.08% to 1.2375.

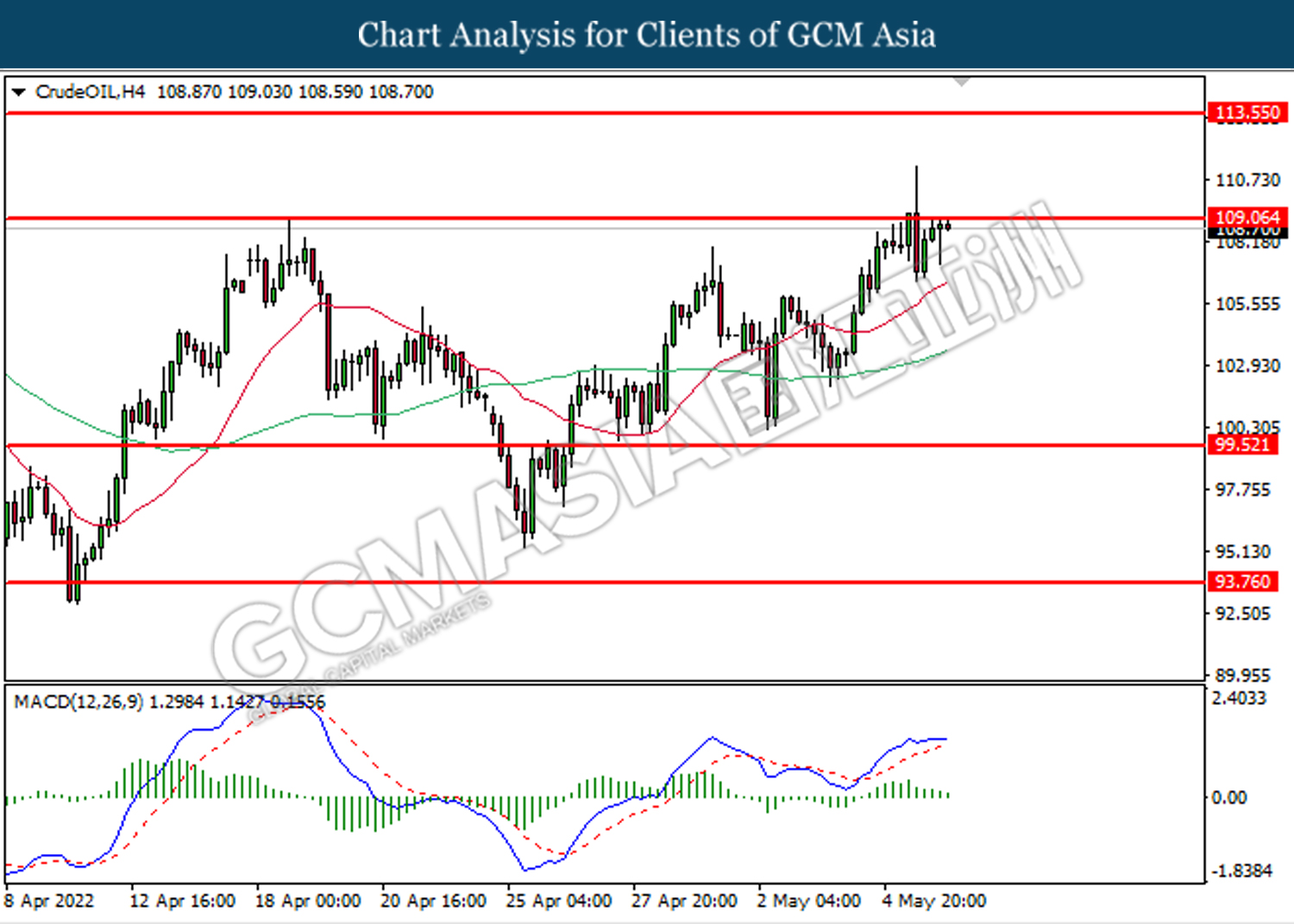

In commodities market, the crude oil price rose by 0.21% to $109.25 per barrel as the market worried about the balance between the supply and demand of oil following the EU laid out the sanction against Russia. On the other hand, gold price down by 0.01% to $1876.95 per troy ounce amid the strengthening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (Apr) | 59.1 | 58 | – |

| 20:30 | USD – Nonfarm Payrolls (Apr) | 431K | 391K | – |

| 20:30 | USD – Unemployment Rate (Apr) | 3.60% | 3.50% | – |

| 20:30 | CAD – Employment Change (Apr) | 72.5K | 55.0K | – |

| 22:00 | CAD – Ivey PMI (Apr) | 74.2 | 60 | – |

Technical Analysis

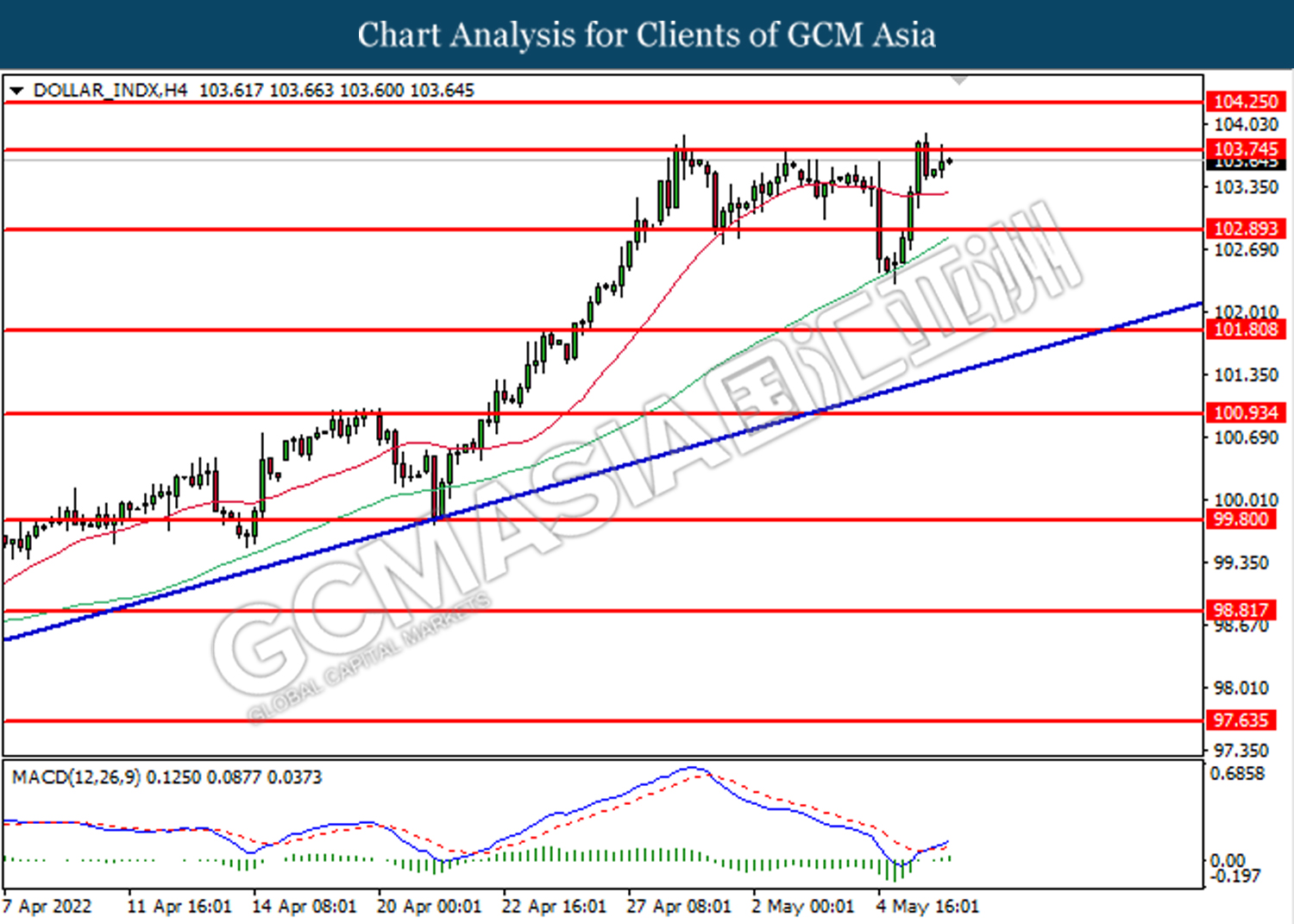

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 103.75. MACD which illustrated bullish bias momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 103.75, 104.25

Support level: 102.90, 101.80

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level at 1.2320. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2425.

Resistance level: 1.2425,1.2585

Support level: 1.2320, 1.2235

EURUSD, H4: EURUSD was traded lower following prior retracement near the resistance level at 1.0560. MACD which illustrated death cross signal suggest the pair to extend its losses toward the support level at 1.0490.

Resistance level: 1.0560, 1.0640

Support level: 1.0490, 1.0445

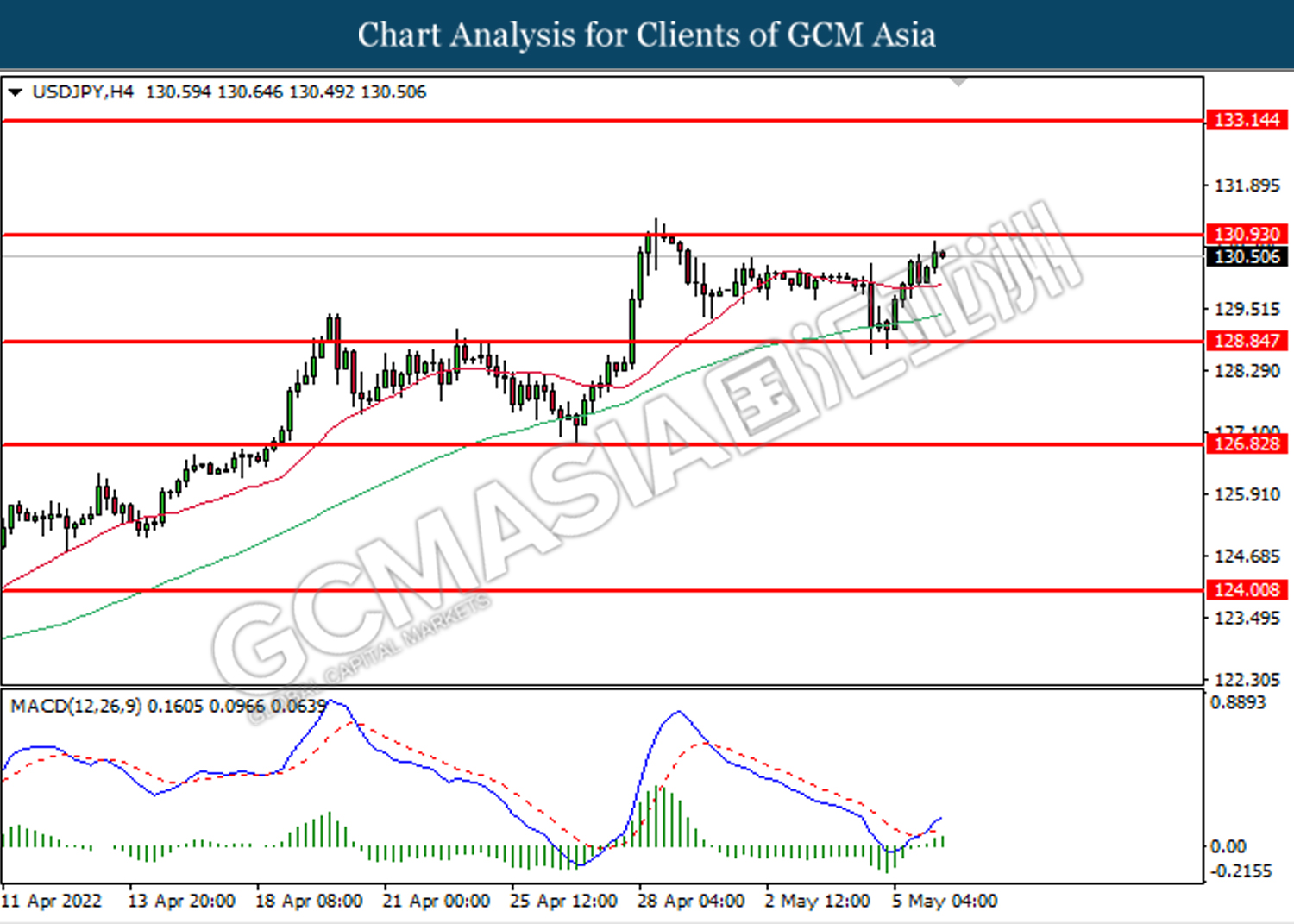

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 130.95. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after breakout happens.

Resistance level: 130.95, 133.15

Support level: 128.85, 126.85

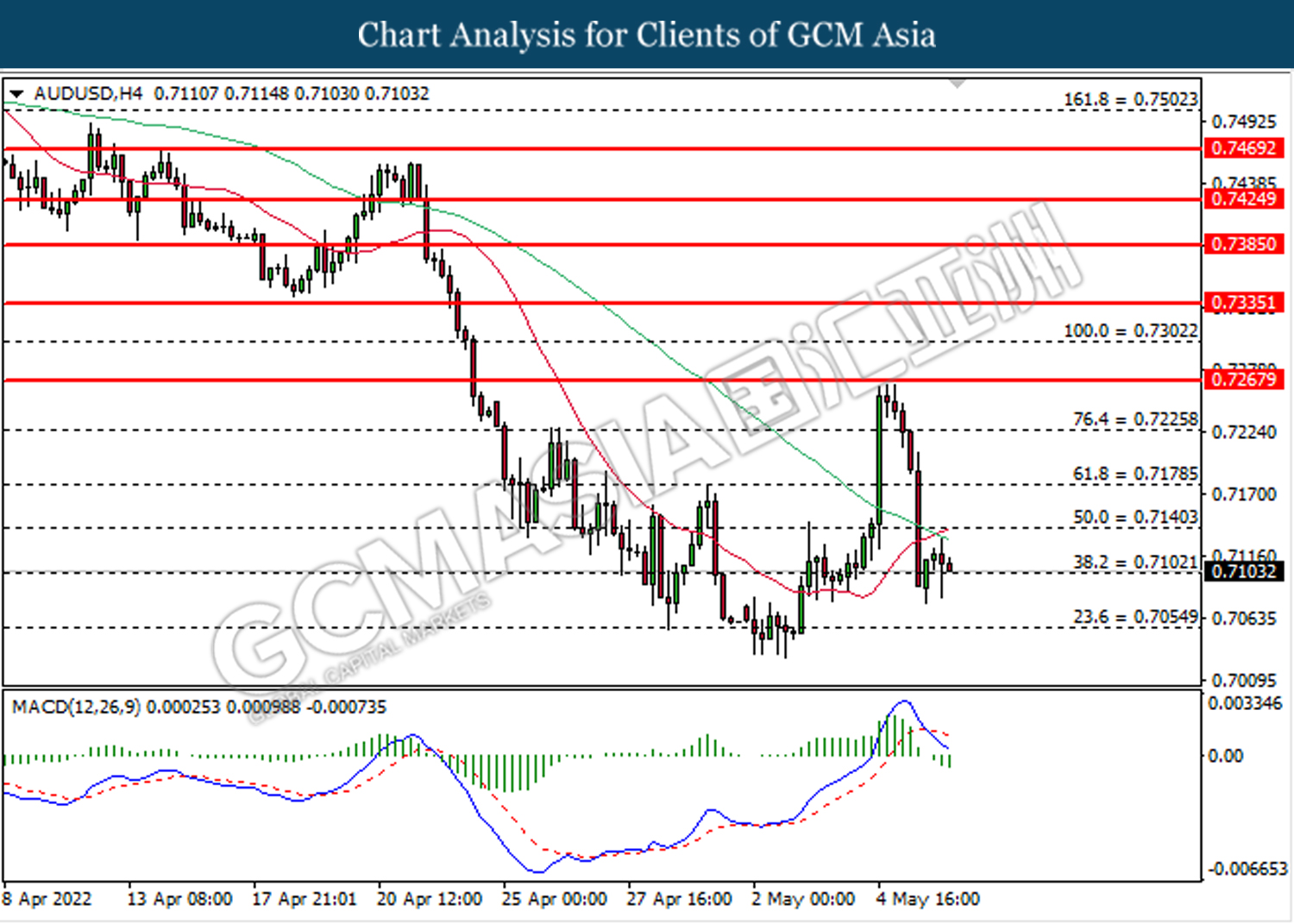

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.7100. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.7140, 0.7180

Support level: 0.7100, 0.7055

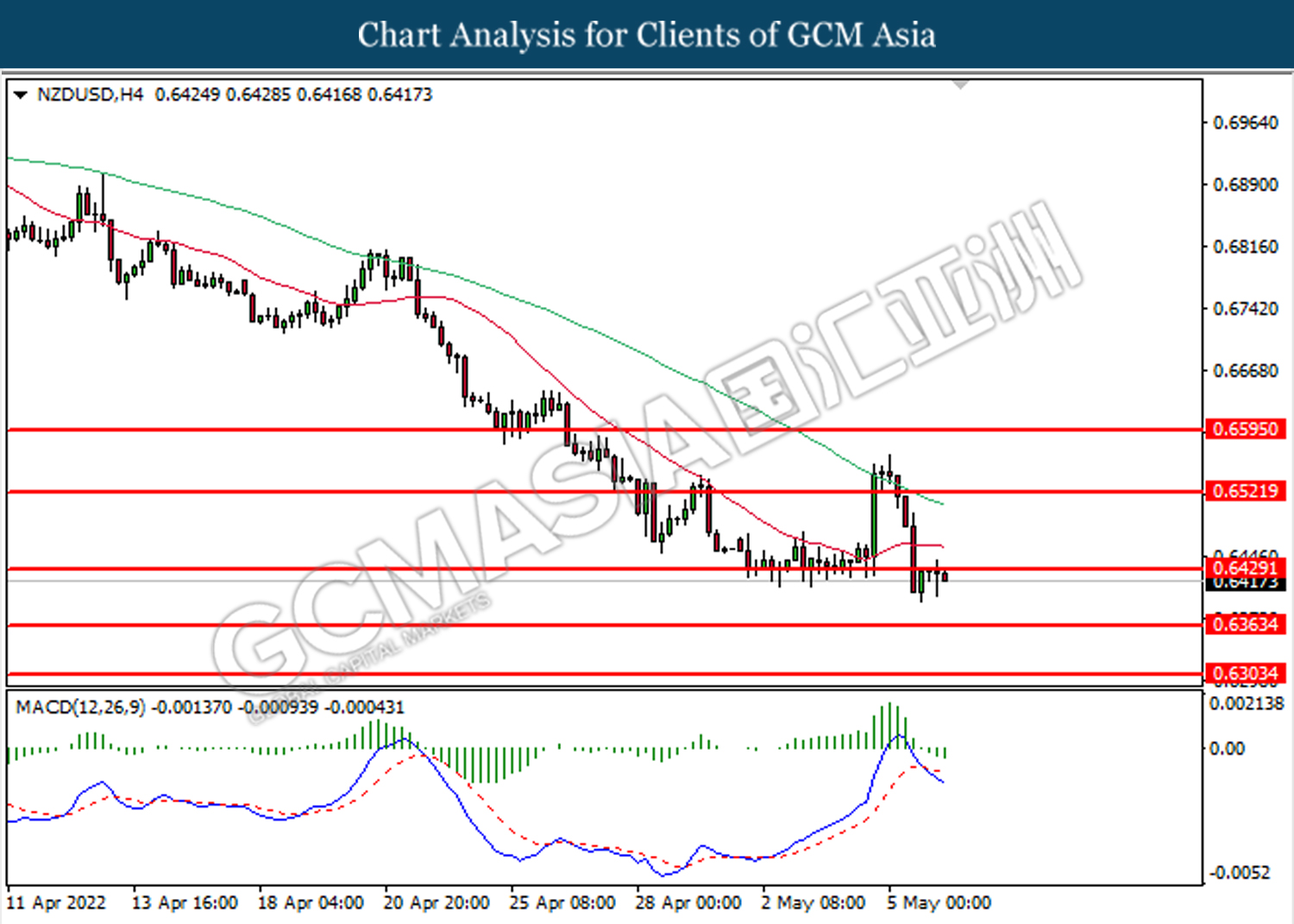

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6430, 0.6520

Support level: 0.6365, 0.6305

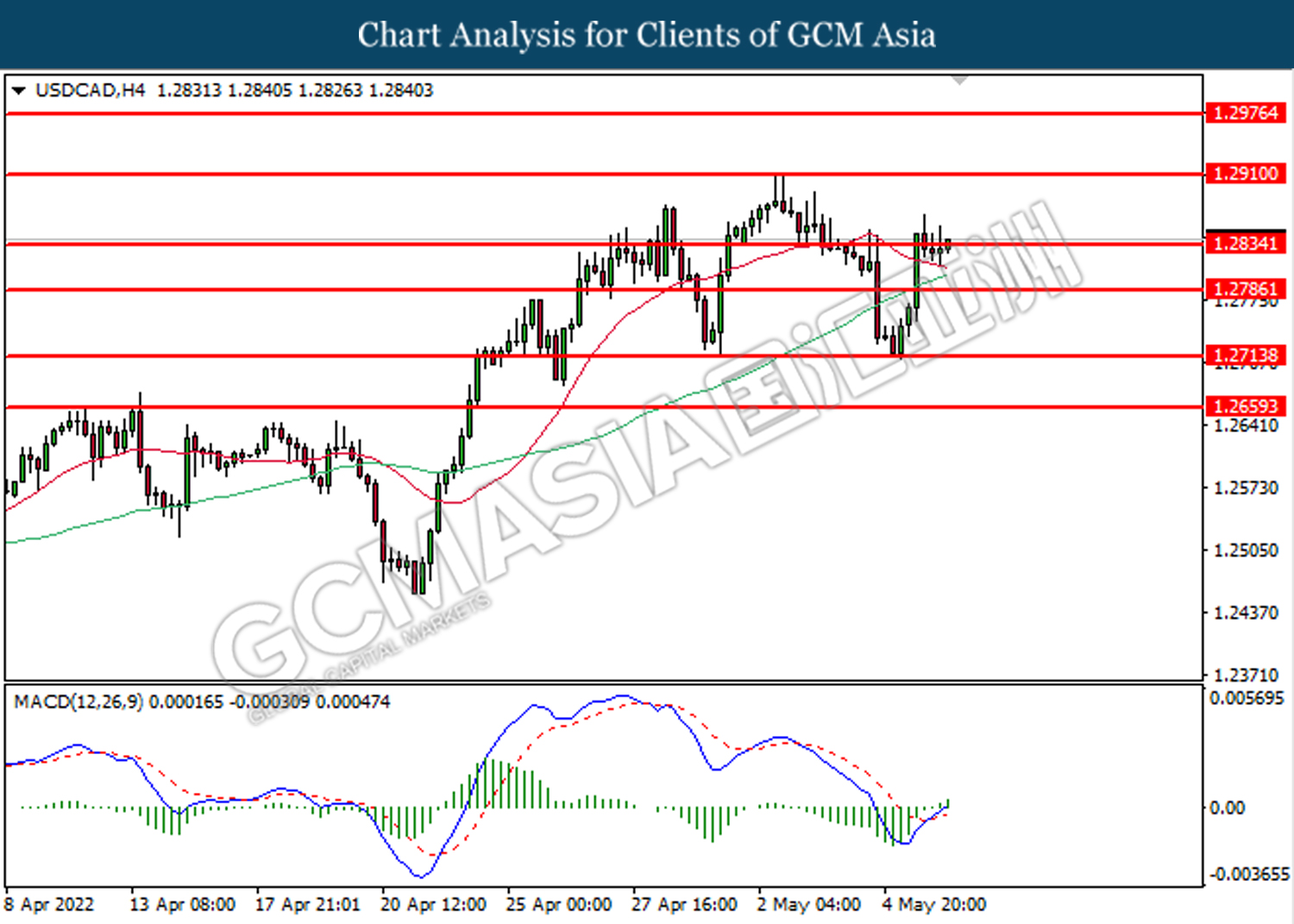

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level at 1.2835. MACD which illustrated golden cross signal suggest the pair to extend its gains after its candle successfully closes above the resistance level.

Resistance level: 1.2835, 1.2910

Support level: 1.2785, 1.2715

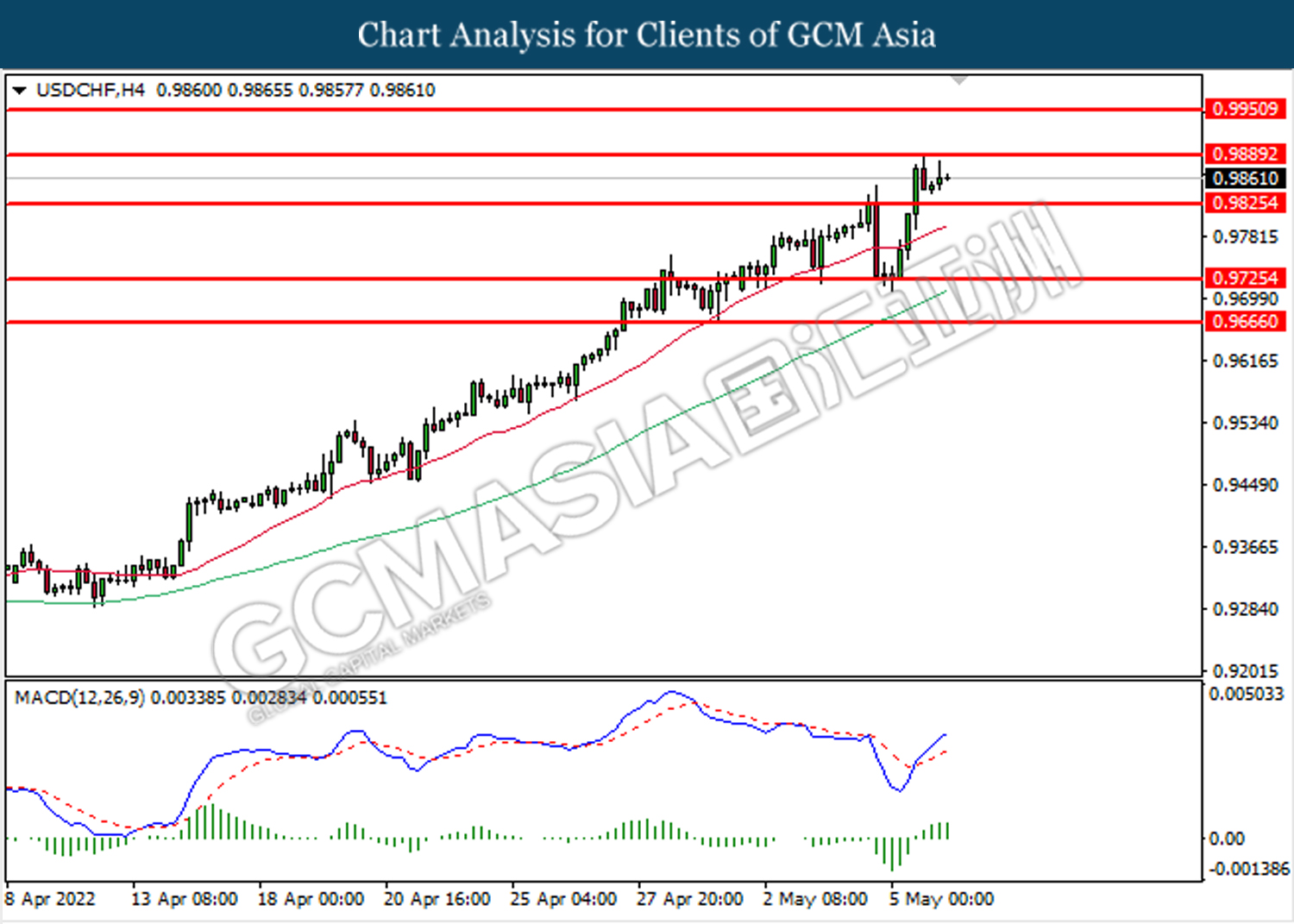

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward the resistance level at 0.9890.

Resistance level: 0.9890, 0.9950

Support level: 0.9825, 0.9725

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to undergo technical correction in short term.

Resistance level: 109.05, 113.55

Support level: 99.50, 93.75

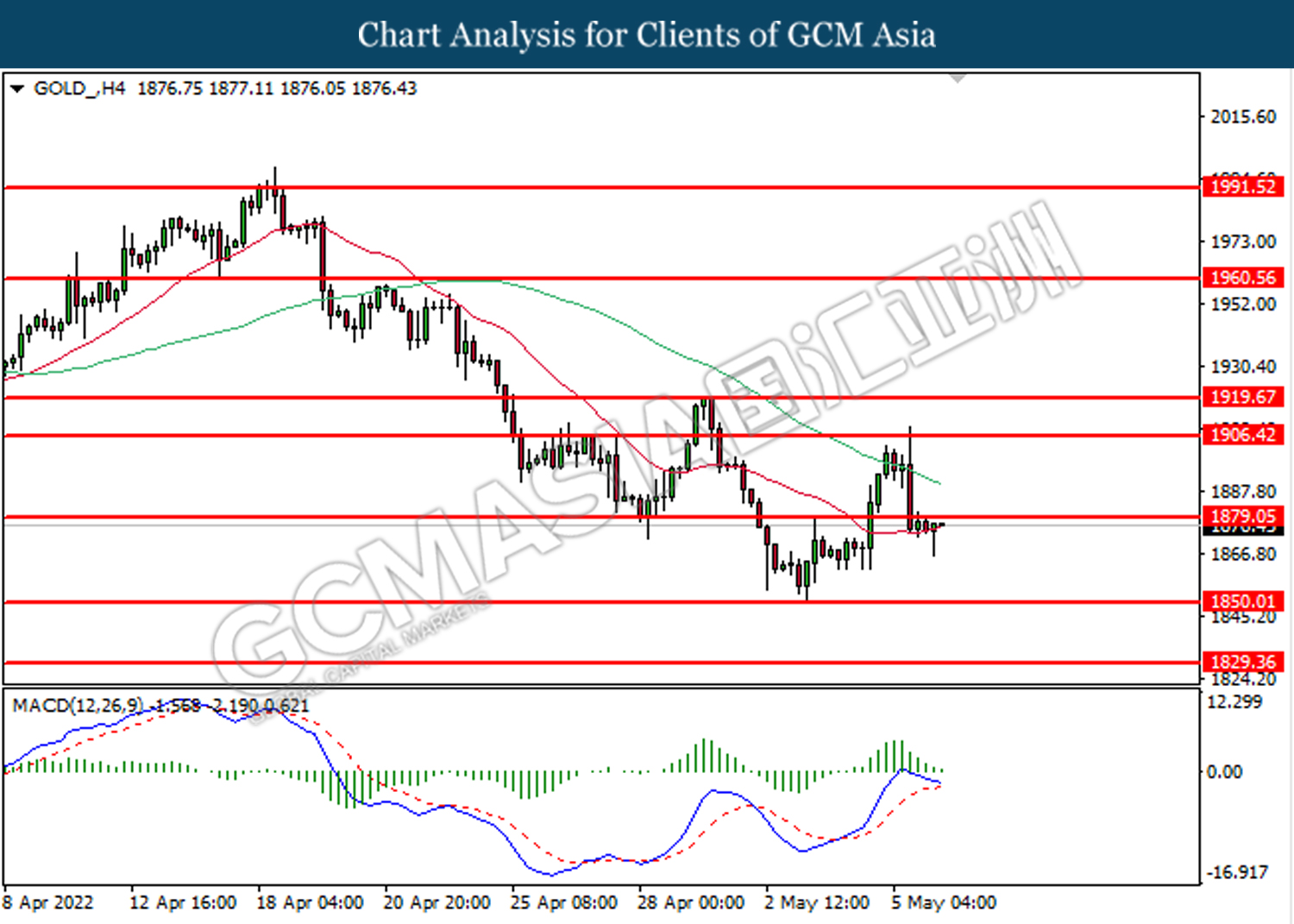

GOLD_, H4: Gold price was traded higher while retesting the previous support level at 1879.05. However, MACD which illustrated diminishing bullish momentum suggest the commodity to undergo technical correction in short term.

Resistance level: 1879.05, 1906.40

Support level: 1850.00, 1829.35