6 May 2022 Morning Session Analysis

US Dollar surged amid the concerns for inflation risk.

The Dollar Index which traded against a basket of six major currencies surged on Thursday amid the concerns for inflation risk from the market, spurring further bullish momentum on the index. According to Reuters, investor sentiment cratered in the face of concerns that the Federal Reserve’s interest rate hike on the previous day would not be enough to combat surging inflation, which hinted that the market participants are expecting another aggressive rate hike from Fed in the next FOMC meetings in order to hedge with inflation risk. The rate hike decision from Fed would likely to increase the risk-free return of investors, sparkling the appeal for the US Dollar. Besides, as investors concern about the negative impacts of inflation risk, it dialed up the market optimism toward the safe-haven assets such as US Dollar, prompting investors to shift their capitals toward US Dollar which having better prospects. As of writing, the Dollar Index rallied by 0.97% to 103.59.

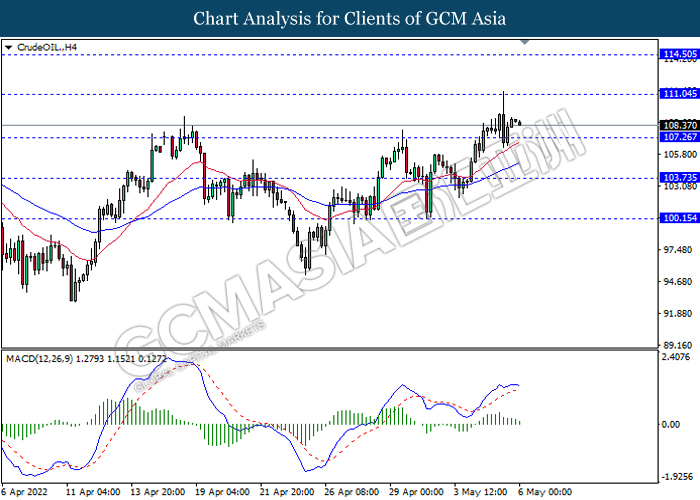

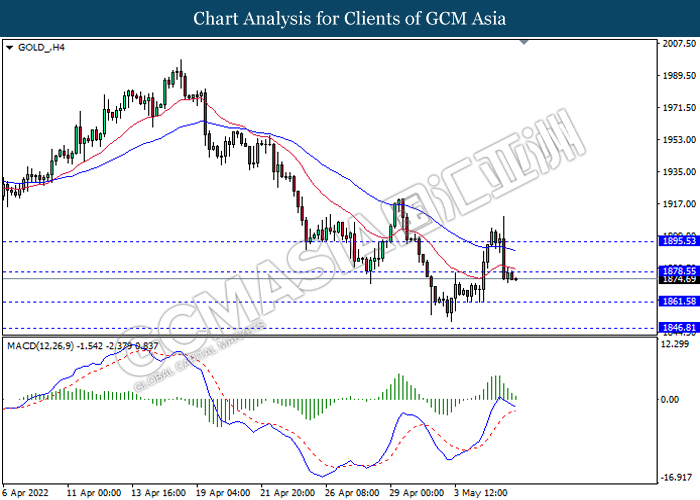

In commodities market, crude oil price appreciated by 0.45% to $108.75 per barrel as of writing over the Biden administration plans to buy 60 million barrels of crude oil as the first step in a multi-year process aimed at replenishing its emergency oil reserve. On the other hand, gold price edged up by 0.06% to $1876.87 per troy ounces as of writing. Nonetheless, the gold price still under pressure following the surge of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (Apr) | 59.1 | 58 | – |

| 20:30 | USD – Nonfarm Payrolls (Apr) | 431K | 391K | – |

| 20:30 | USD – Unemployment Rate (Apr) | 3.60% | 3.50% | – |

| 20:30 | CAD – Employment Change (Apr) | 72.5K | 55.0K | – |

| 22:00 | CAD – Ivey PMI (Apr) | 74.2 | 60 | – |

Technical Analysis

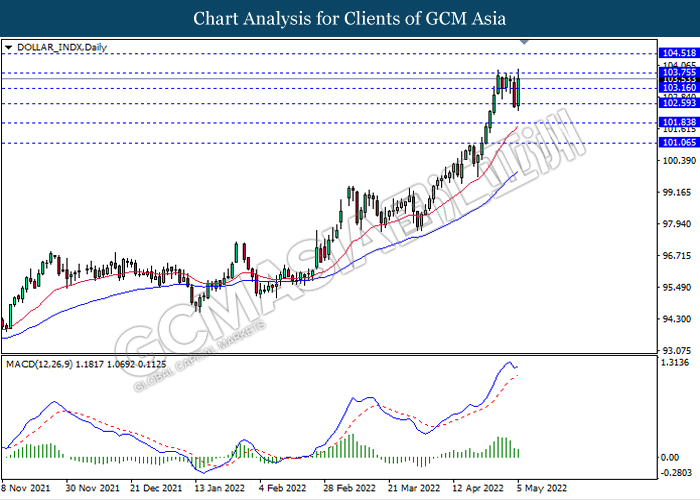

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 103.75, 104.50

Support level: 103.15, 102.60

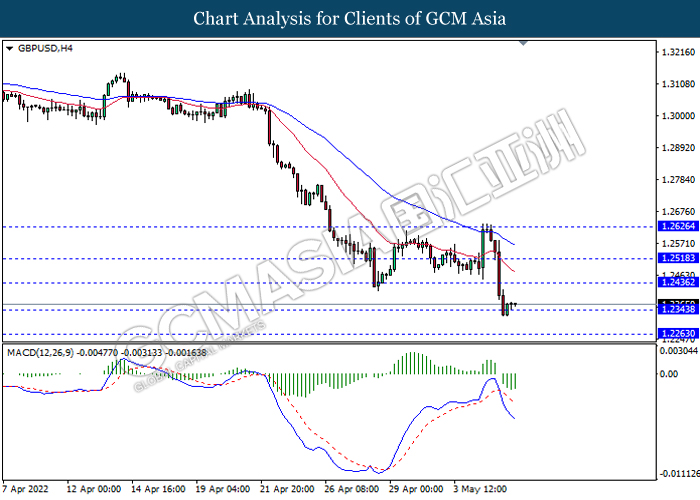

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.2435, 1.2520

Support level: 1.2345, 1.2265

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0575, 1.0655

Support level: 1.0505, 1.0420

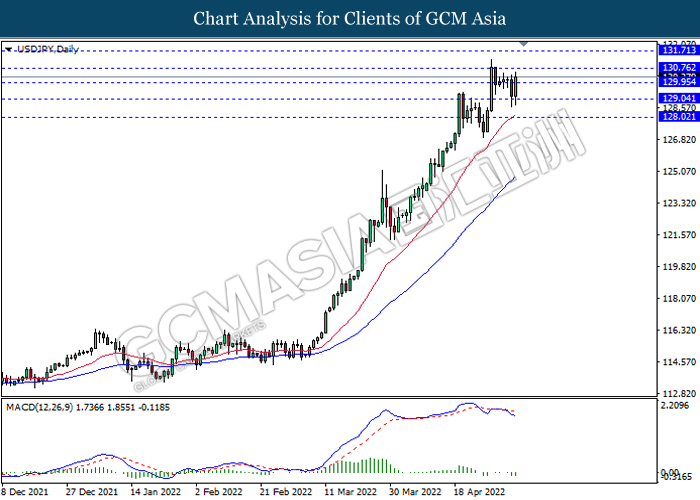

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to be extend its gains.

Resistance level: 130.75, 131.70

Support level: 129.95, 129.05

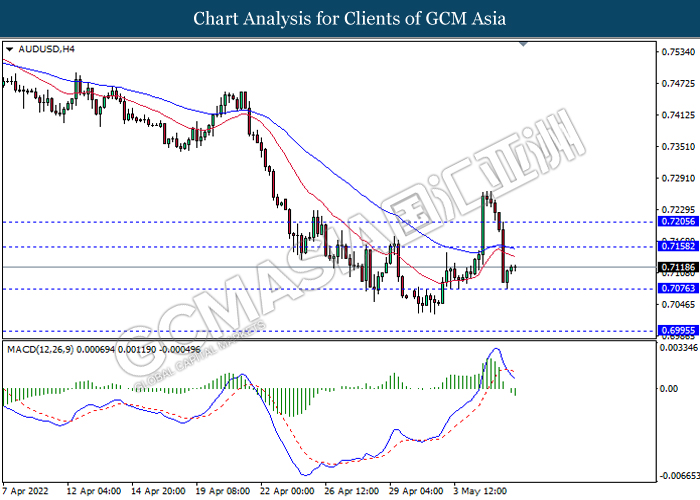

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.7160, 0.7205

Support level: 0.7075, 0.6995

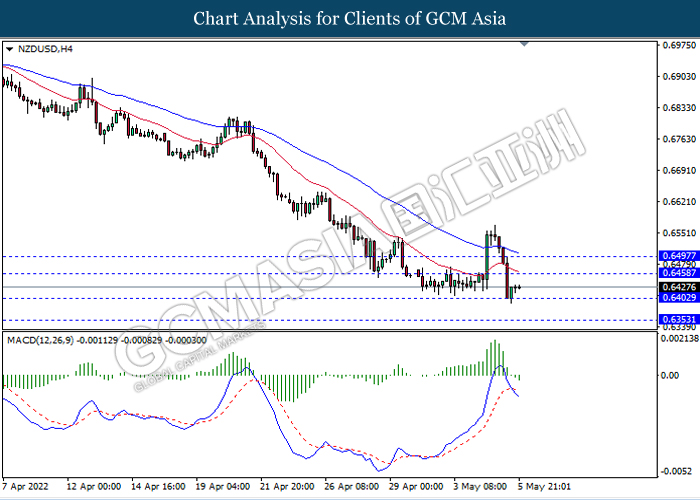

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6460, 0.6495

Support level: 0.6400, 0.6355

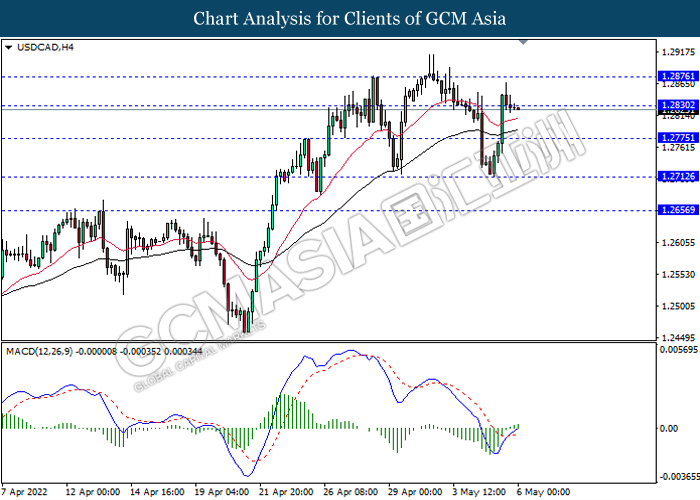

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2830, 1.2875

Support level: 1.2775, 1.2710

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9880, 0.9910

Support level: 0.9825, 0.9780

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 111.05, 114.50

Support level: 107.25, 103.75

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1878.55, 1895.55

Support level: 1861.60, 1846.80