06 June 2023 Afternoon Session Analysis

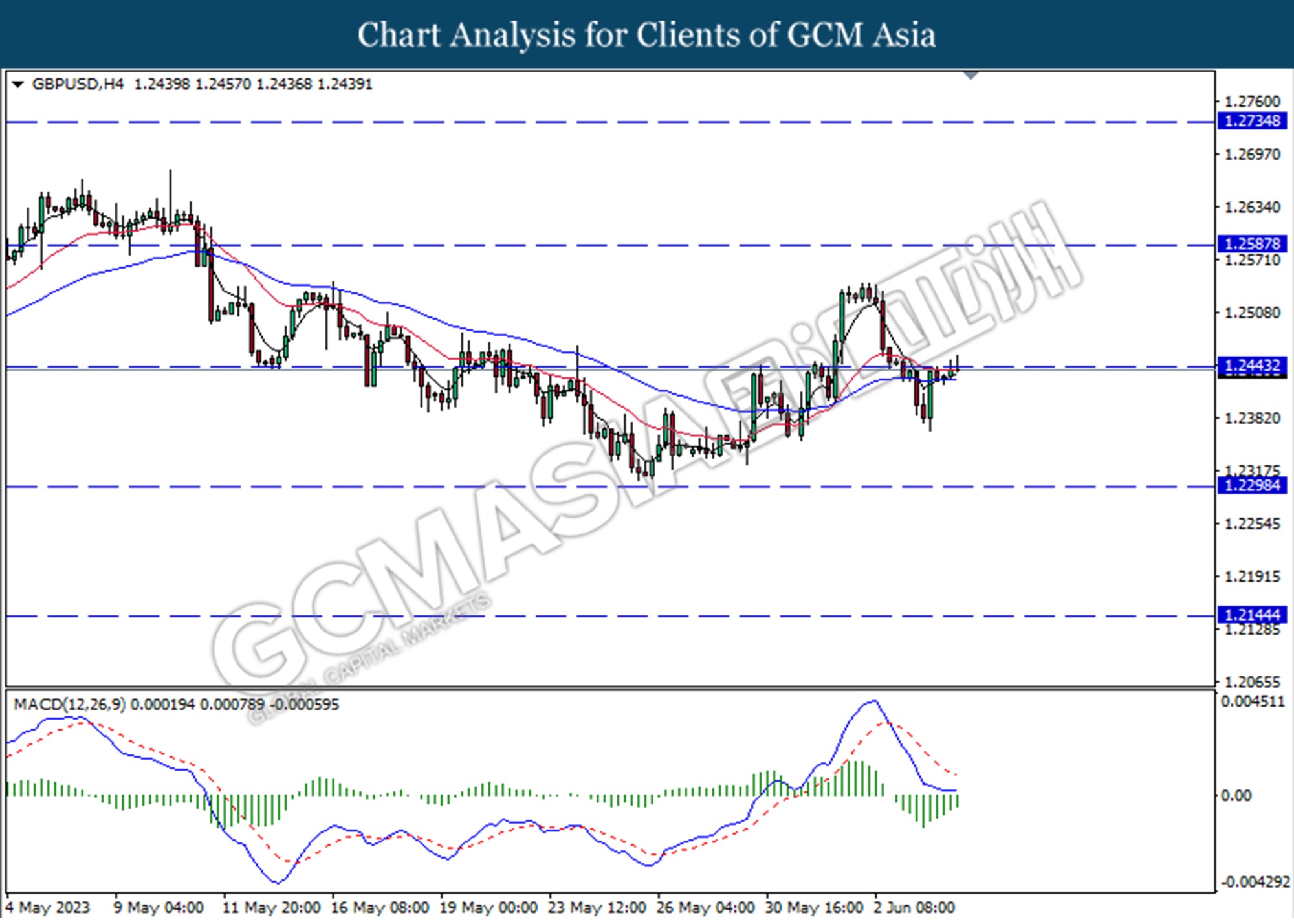

The GBPUSD lifted after PMI slips lower than expected.

The pair of the Pound sterling against the dollar index lifted after the composite PMI slipped lower than economists forecast. The UK composite PMI falls to 54.0 in May from 53.3 in April, higher than economists polled by Reuters forecast of 53.9. Besides, the service PMI slightly reduced from 55.9 in April to 55.2 in May, upbeat the market consensuses forecast at 55.2. Although the PMI reading is diminished, the readings are above the 50 threshold reflecting the overall economy expanded in the month. According to a survey by S&P Global, the main contribution to the growth of service companies in the UK was the strongest input costs, as higher wage payments led to a sharp rise in price charges. Input costs have edged up since February and, while well below their historic peak a year ago, remain above levels seen before the COVID-19 pandemic. Furthermore, the gains of the GBPUSD pairs bolster the weakening of the dollar. The US service industry reported a slowing pace of growth and recorded at 54.9 in May when compared to 53.6 the previous month, data announced by Markit. Therefore, it increases the odds that the Fed will pause on a rate hike in the next monetary policy. As of writing, the pair of GBPUSD inched up by 0.06% to 1.2447.

In the commodities market, crude oil prices were traded lower by -0.64% to $71.70 per barrel after investors digest the news on Saudi Arab production cuts. Besides, gold prices edged down by -0.10% to $1960.12 per troy ounce as the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (May) | 51.1 | 51.0 | – |

| 22:00 | CAD – Ivey PMI (May) | 56.8 | 57.2 | – |

Technical Analysis

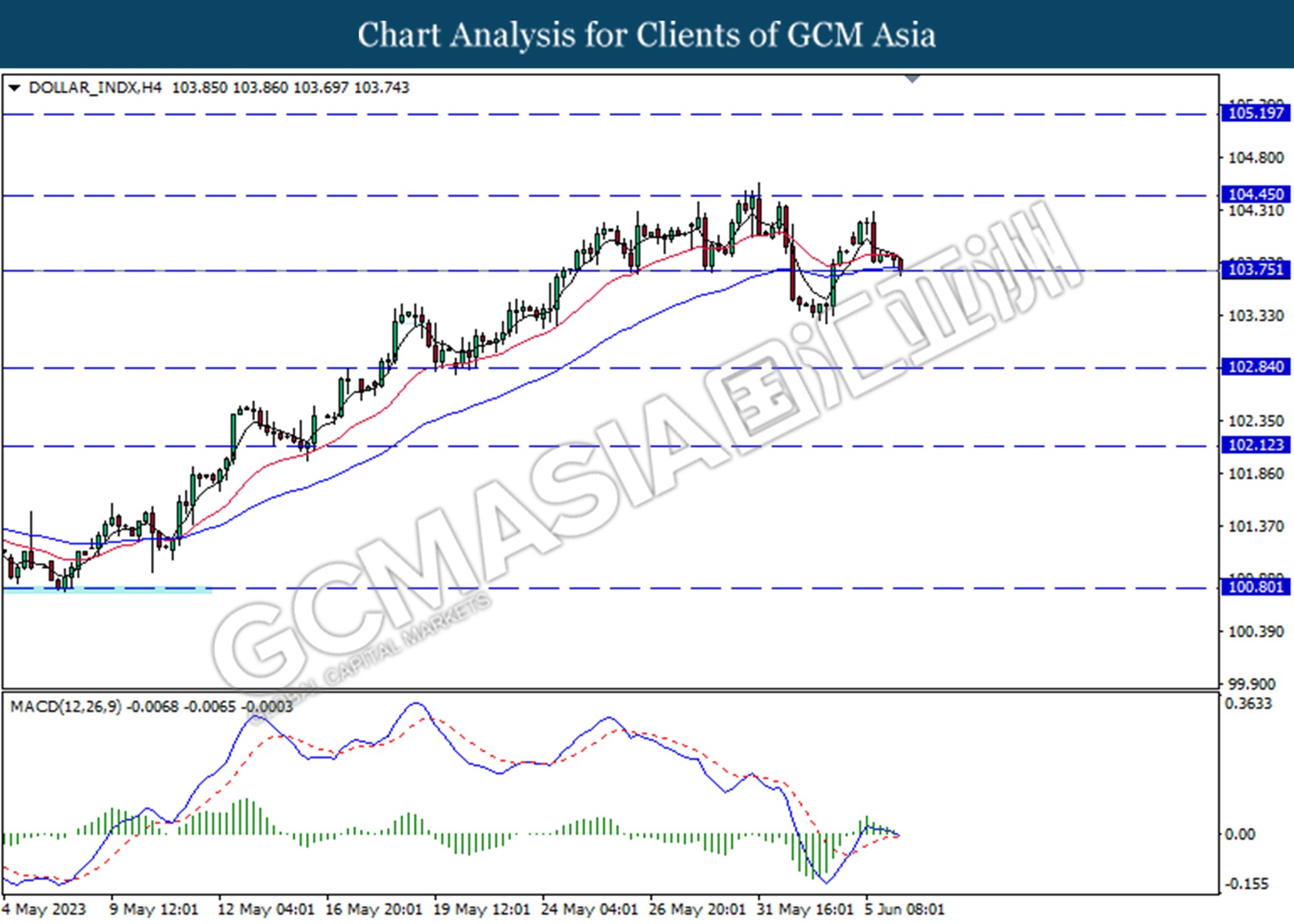

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing for the support level at 103.75. MACD which illustrated diminishing bullish momentum suggests the index extended its losses after it successfully break below the support level at 103.75.

Resistance level: 104.45, 105.20

Support level: 103.75, 102.85

GBPUSD, H4: GBPUSD was traded higher while currently testing for the resistance level at 1.2445. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains if successfully break above the resistance level.

Resistance level: 1.2445, 1.2590

Support level: 1.2300, 1.2145

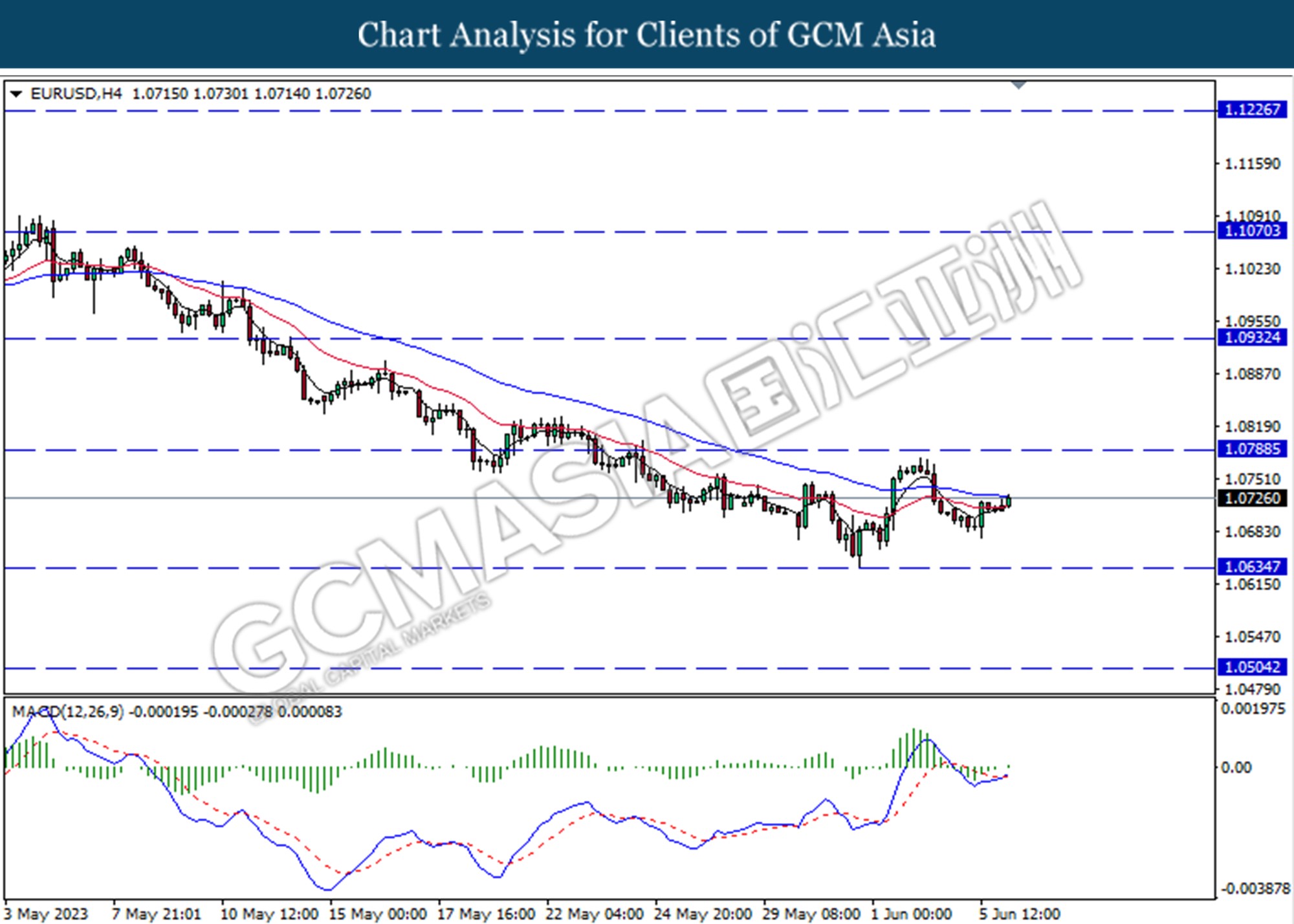

EURUSD, H4: EURUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 1.0790.

Resistance level: 1.0790, 1.0930

Support level: 1.0635, 1.0505

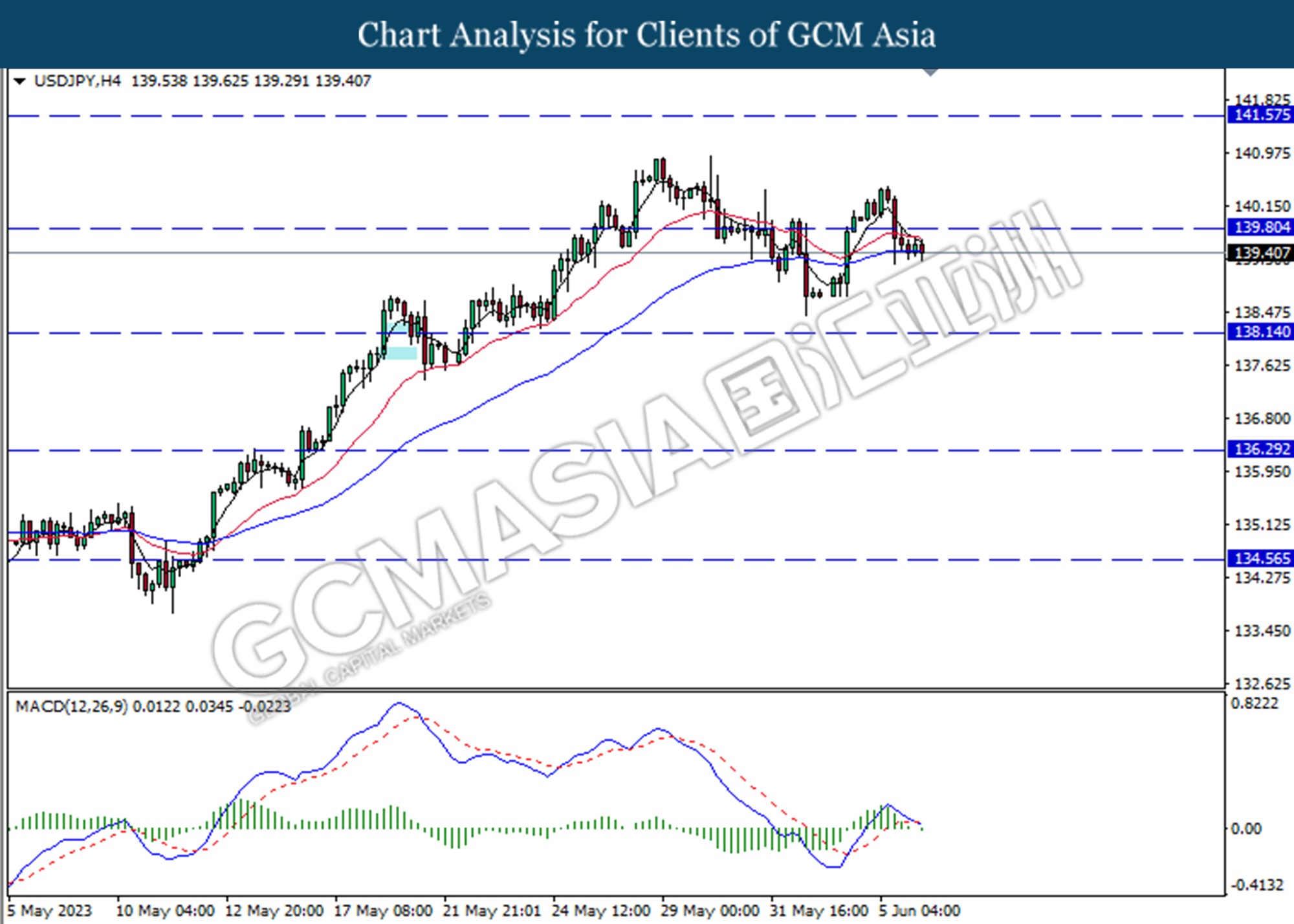

USDJPY, H4: USDJPY was traded lower following the prior breaks below from the previous resistance level at 139.80. MACD which illustrated diminishing bullish momentum suggests the pair extended its gains toward the support level.

Resistance level: 139.80, 141.60

Support level: 138.15, 136.30

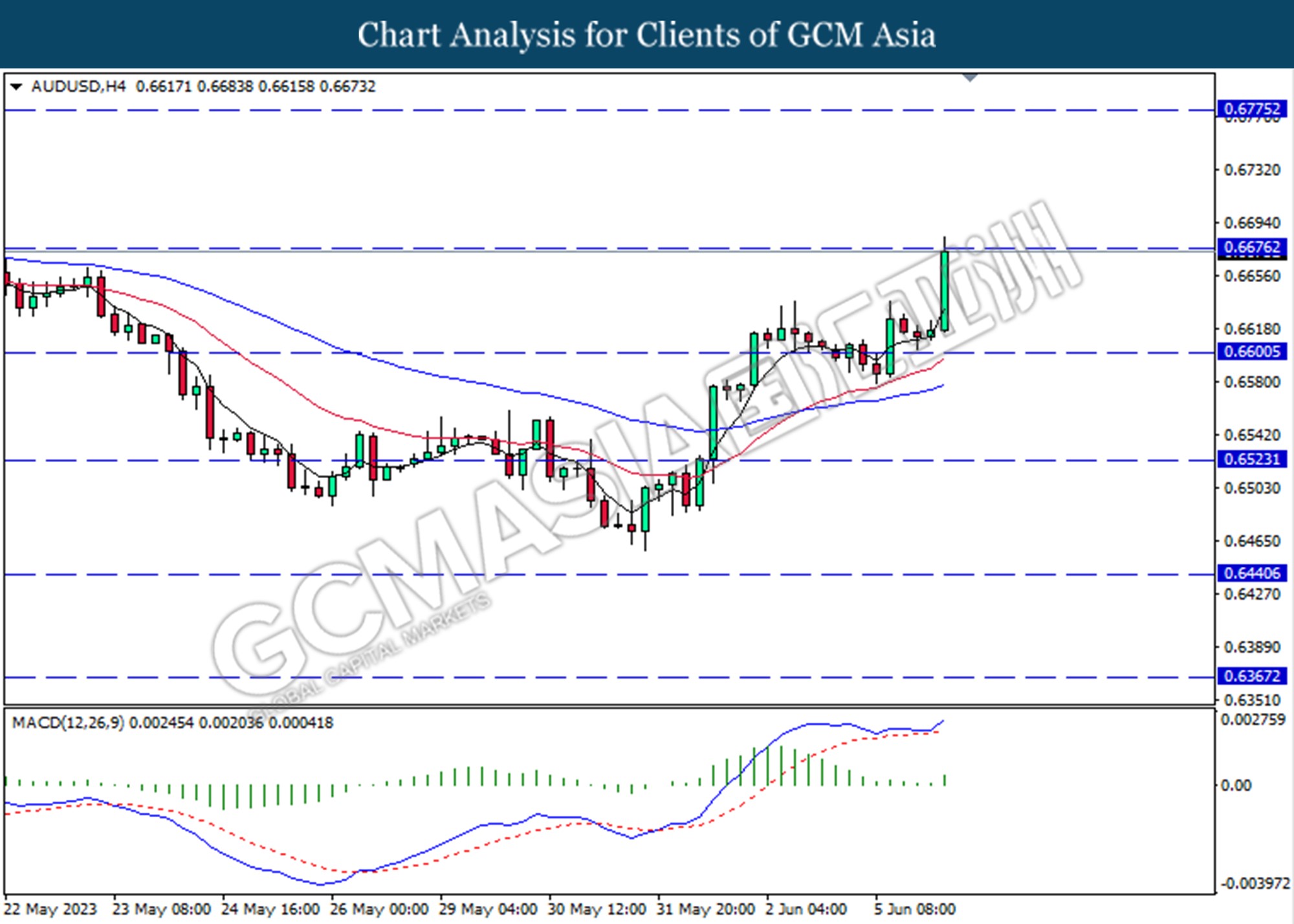

AUDUSD, H4: AUDUSD was traded higher while currently testing for the resistance level at 0.6675. MACD which illustrated increasing bullish momentum suggests the pair extended its gains if successfully break above the resistance level.

Resistance level: 0.6675, 0.6775

Support level: 0.6600, 0.6525

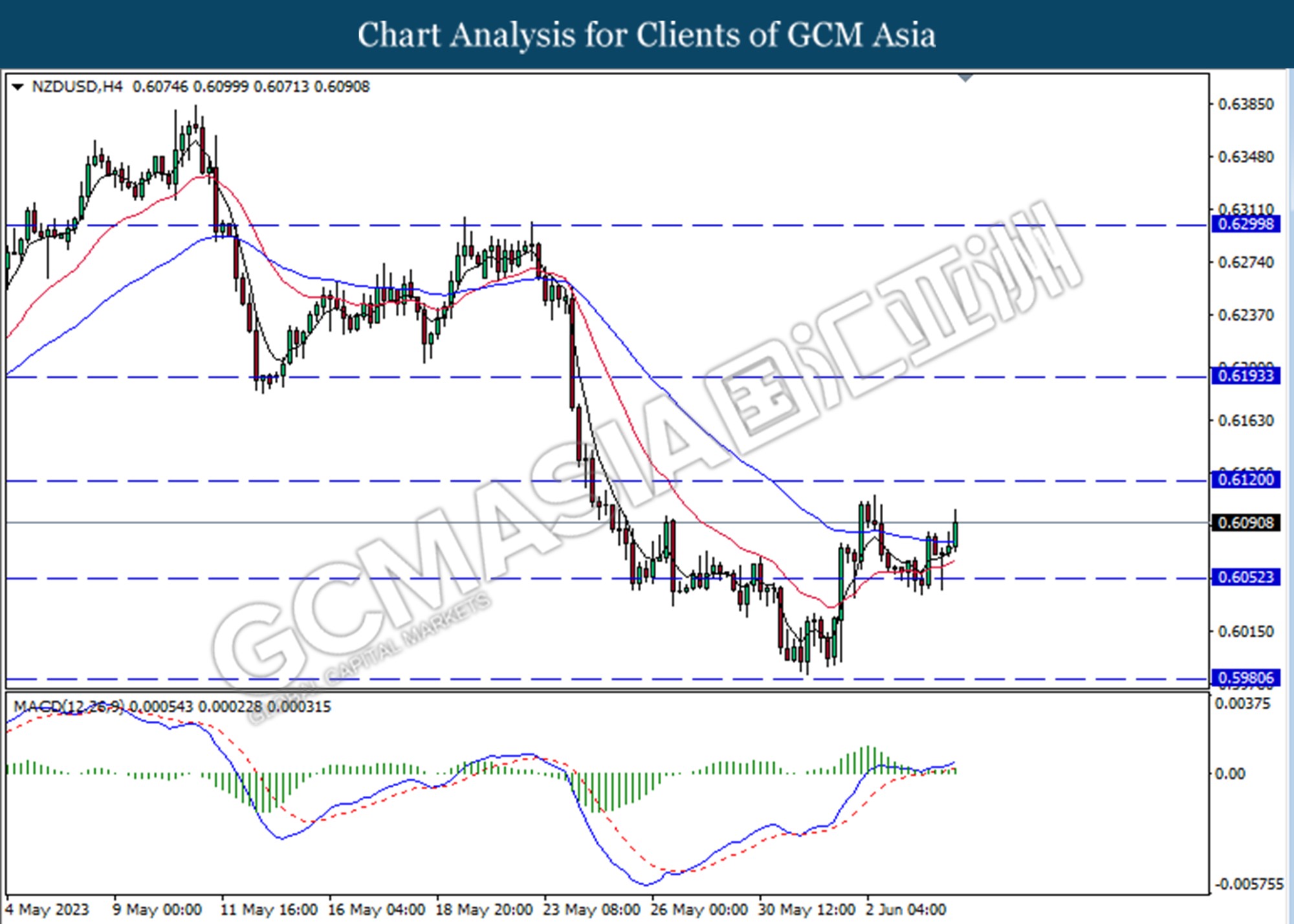

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains towards the resistance level at 0.6120

Resistance level: 0.6120, 0.6195

Support level: 0.6050, 0.5980

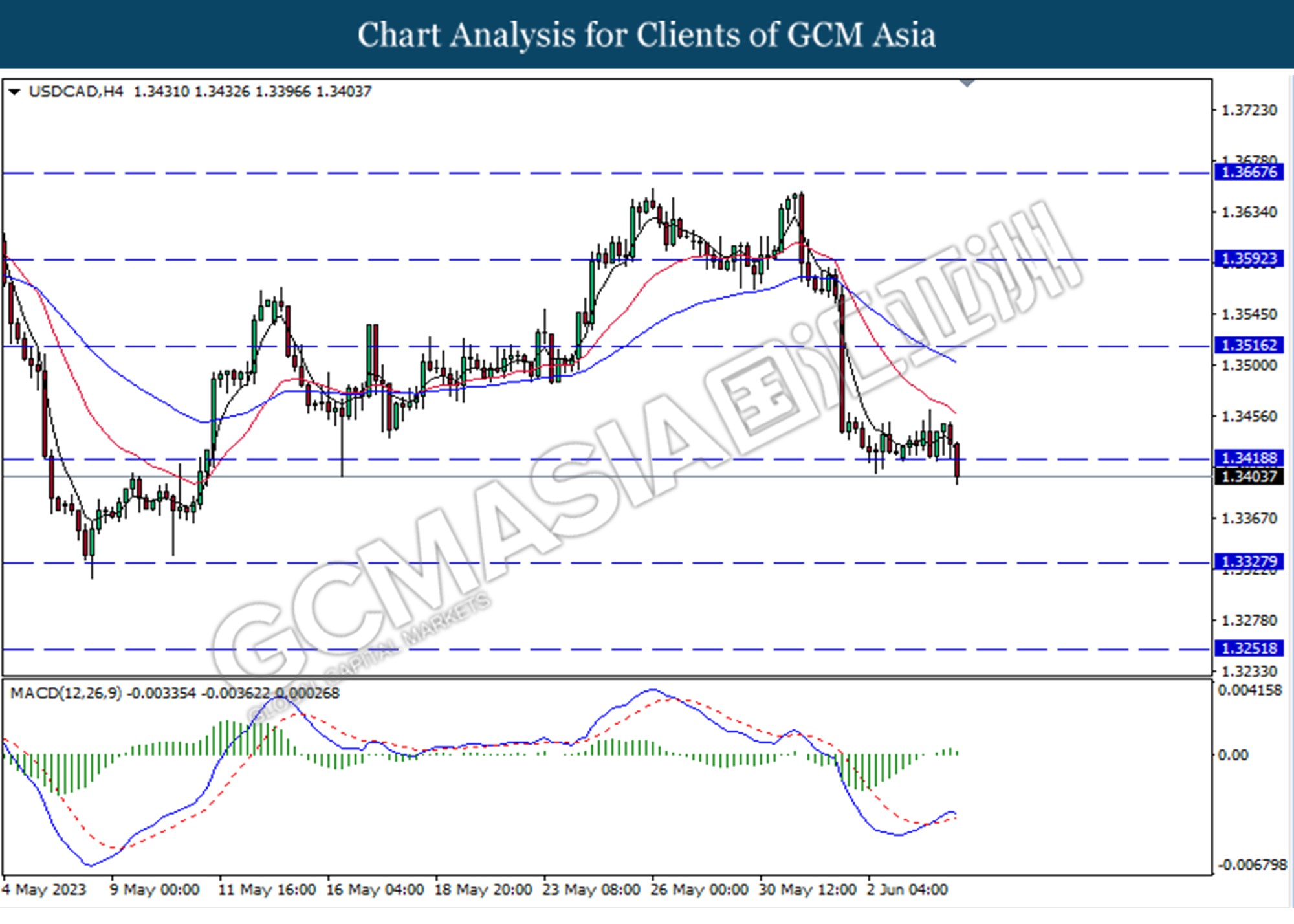

USDCAD, H4: USDCAD was traded following the prior breaks below the previous support level at 1.3420. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 1.3420, 1.3515

Support level: 1.3330, 1.3250

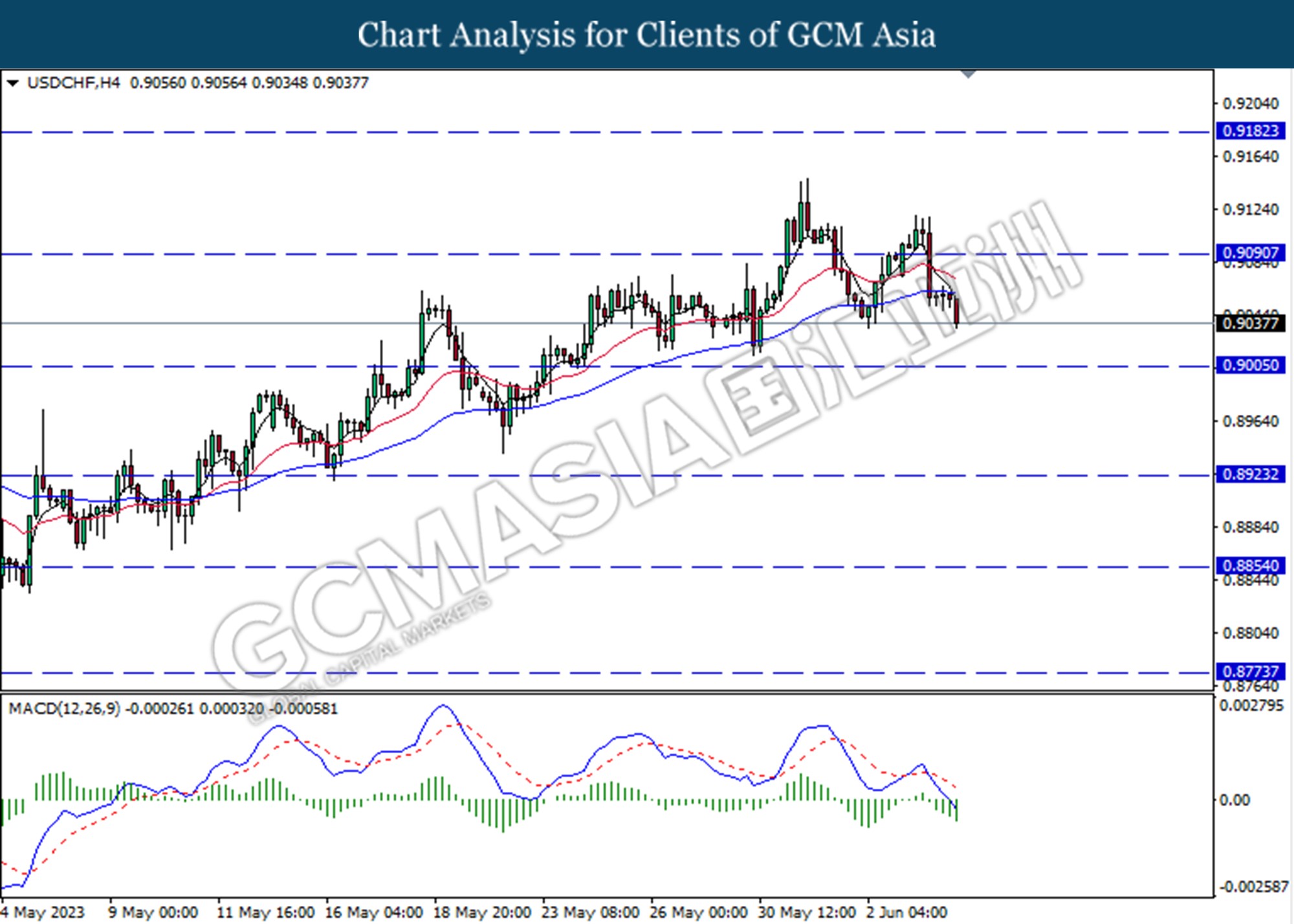

USDCHF, H4: USDCHF was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 0.9005.

Resistance level: 0.9090, 0.9180

Support level: 0.9005, 0.8925

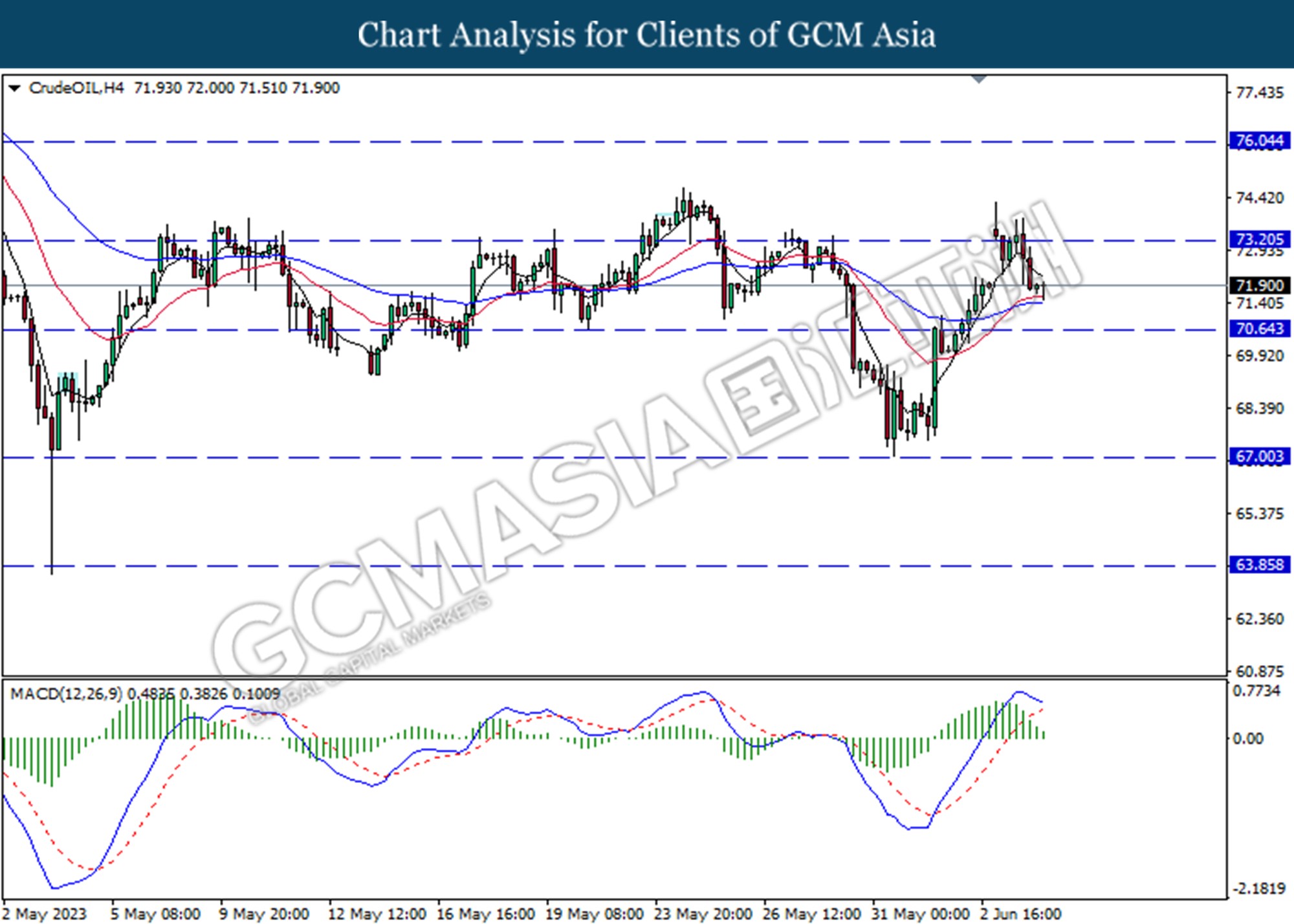

CrudeOIL, H4: Crude oil price was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the commodity extended its losses toward the support level at 70.65.

Resistance level: 73.20, 76.05

Support level: 70.65, 67.00

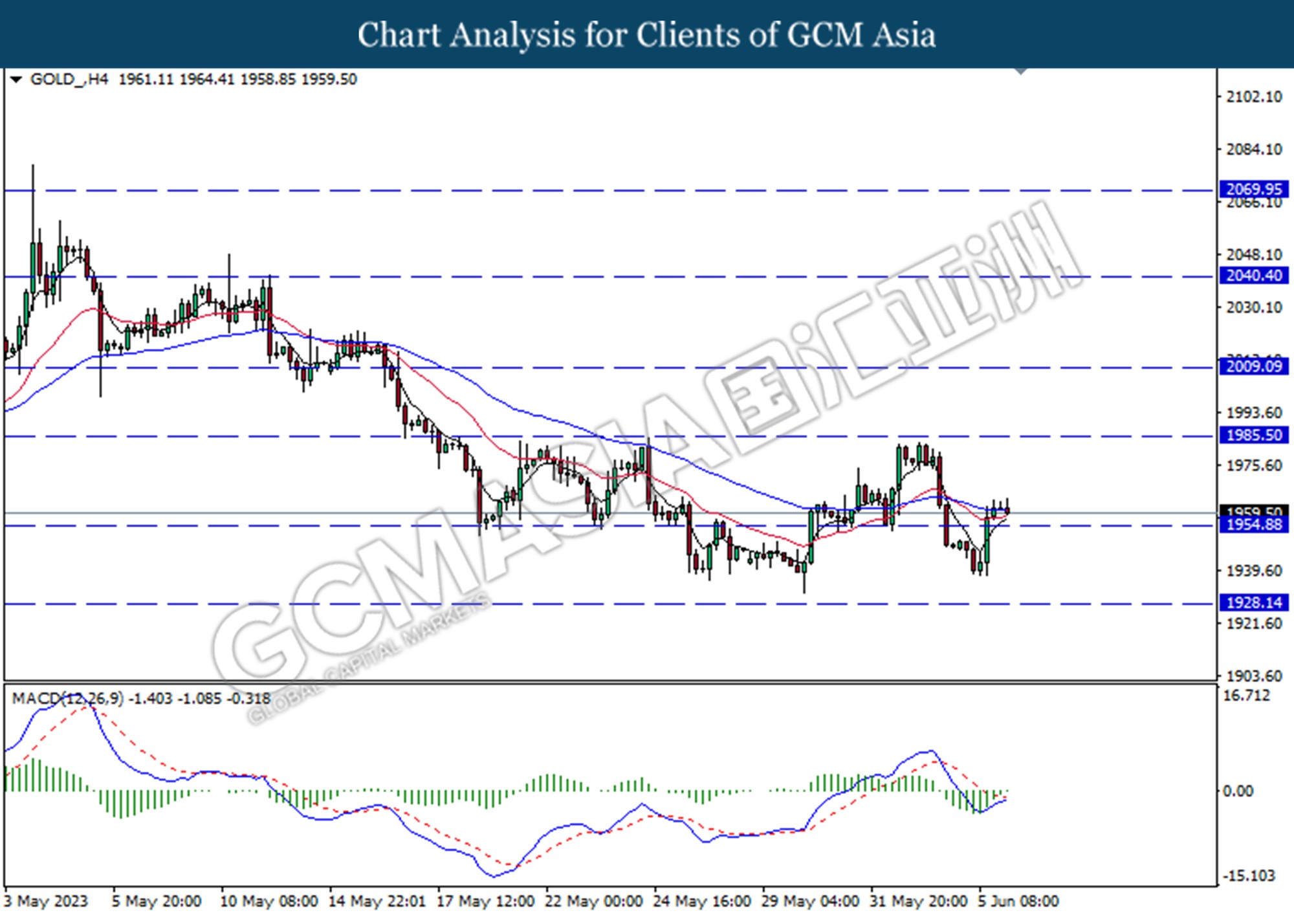

GOLD_, H4: Gold price was traded higher following the prior breaks above from the resistance level at 1954.90. MACD which illustrated diminishing bearish momentum suggests the commodity extended its gains toward the resistance level.

Resistance level: 1985.50, 2009.10

Support level: 1954.90, 1928.15