06 June 2023 Morning Session Analysis

US dollar dipped amid weaker-than-expected Services PMI.

The dollar index, which was traded against a basket of six major currencies, failed to ride on the bullish trend further as the downbeat economic data wiped out the buying pressures in the market. According to the Institute for Supply Management (ISM), the US Services PMI printed at 50.3, lower than both the market forecast and prior reading at 51.8 and 51.9, respectively. A reading above 50 indicates expansion in the services industry, which accounts for more than two-thirds of the US economy. With that, it showed that the US services sector expanded at a slower pace in the month of May, where the sector is cooling down at this point in time. Before that, the services sector had been experiencing strong growth since the reopening of the economy. However, the Fed’s rate hikes started to put pressure on the services sector, where the cooling of demand dragged down the services inflation. As a result, it slightly reduced the possibility of further rate hikes in the next Fed meeting. On top of that, the stronger-than-expected economic data from the UK also attracted investors to move their capital into the Pound’s market, putting pressure on the dollar’s market. As of writing, the dollar index dropped -0.02% to 104.00.

In the commodities market, crude oil prices surged by 1.35% to $72.90 per barrel amid the surprise voluntary cut by Saudi Arabia, with an oversupply concern. Besides, gold prices were up by 0.01% to $1962.10 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

12:30 AUD RBA Rate Statement

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 12:30 | AUD – RBA Interest Rate Decision (Jun) | 3.85% | 3.85% | – |

| 16:30 | GBP – Construction PMI (May) | 51.1 | 51.0 | – |

| 22:00 | CAD – Ivey PMI (May) | 56.8 | 57.2 | – |

Technical Analysis

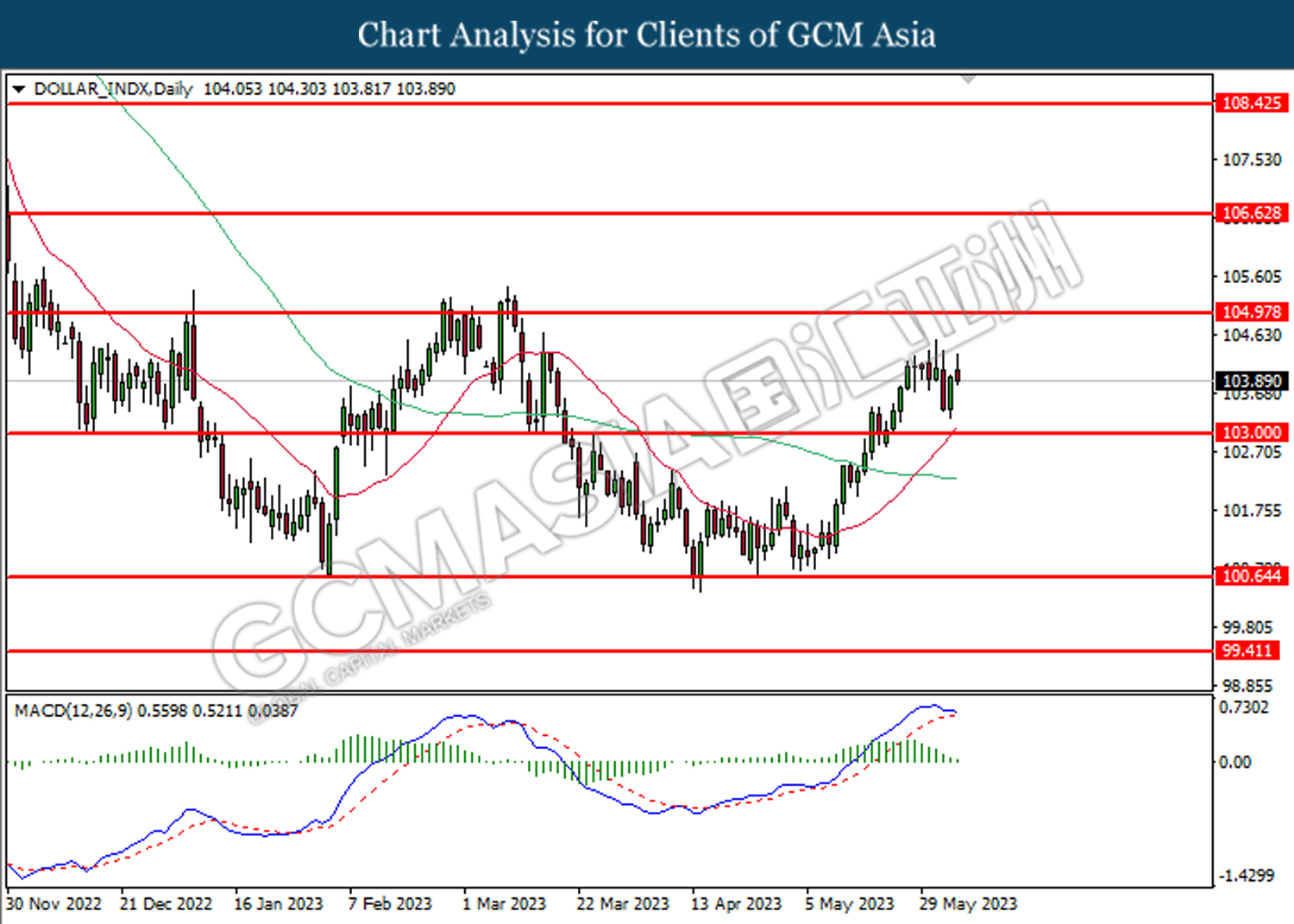

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the support level at 103.00.

Resistance level: 105.00, 106.65

Support level: 103.00, 100.65

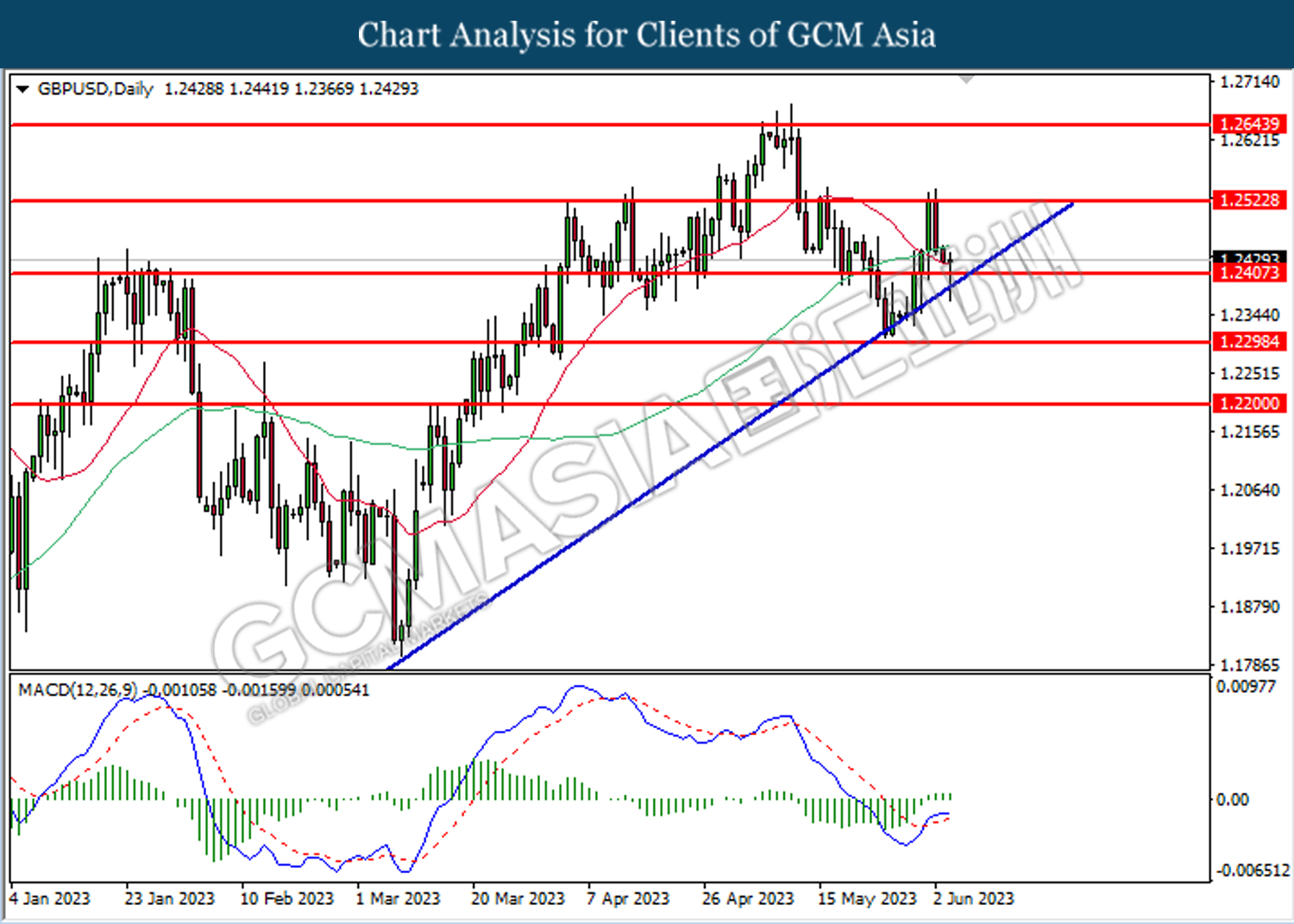

GBPUSD, Daily: GBPUSD was traded lower while currently testing support level at 1.2405. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level at 1.2405.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

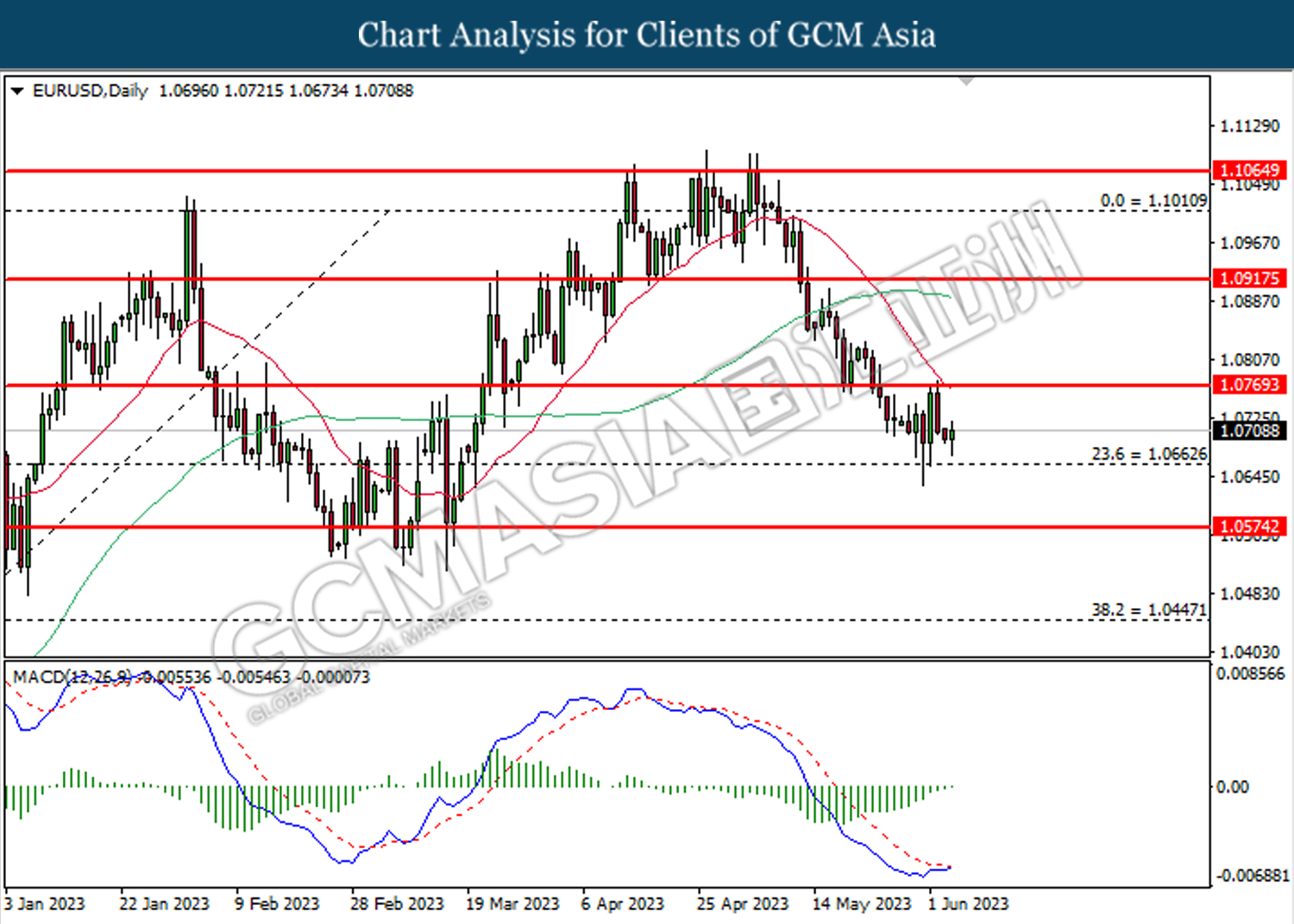

EURUSD, Daily: EURUSD was traded higher following the prior rebound from the support level at 1.0665. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0770.

Resistance level: 1.0770, 1.0915

Support level: 1.0665, 1.0575

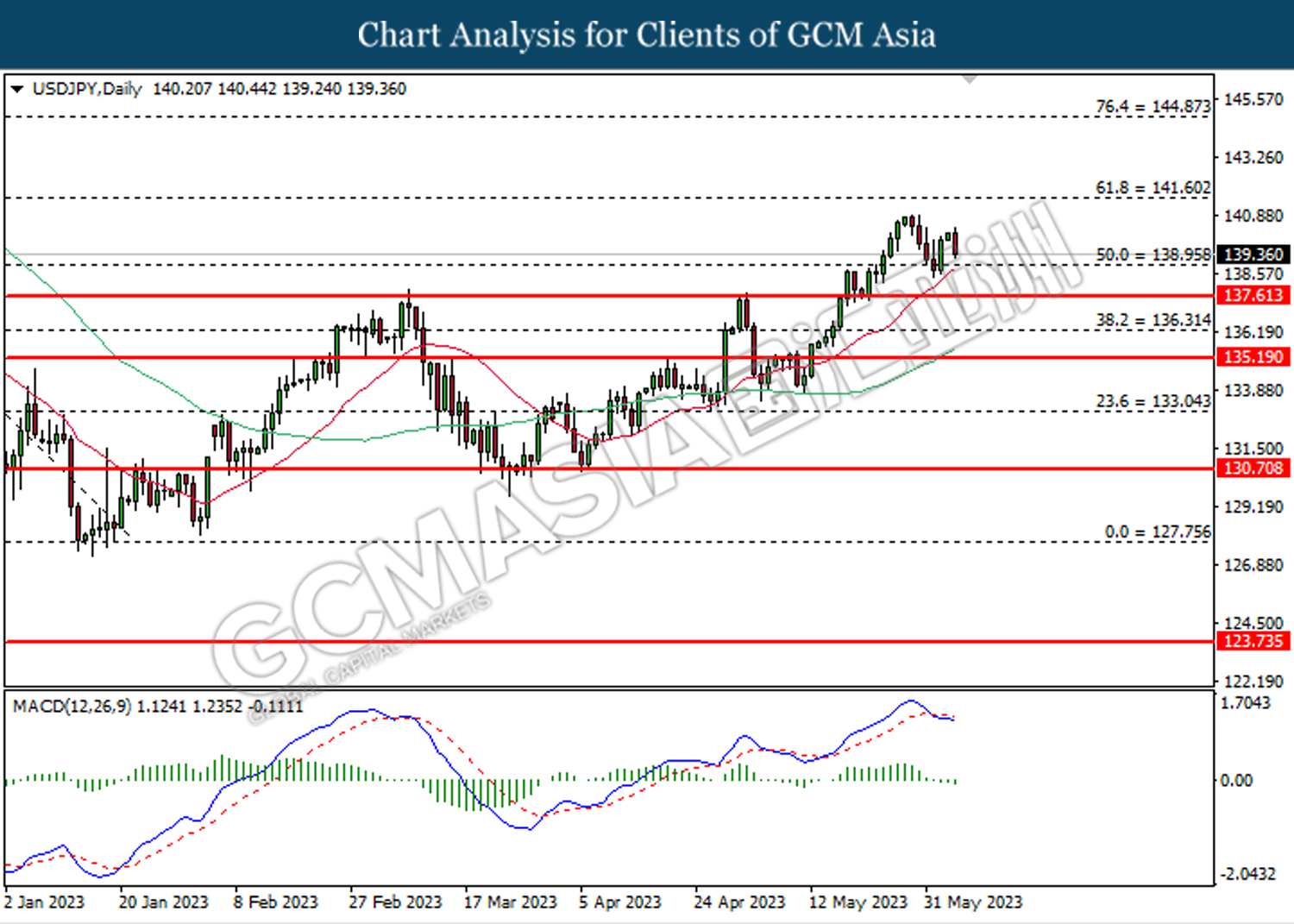

USDJPY, Daily: USDJPY was traded lower following the prior retracement from the higher level. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 138.95.

Resistance level: 141.60, 144.85

Support level: 138.95, 137.60

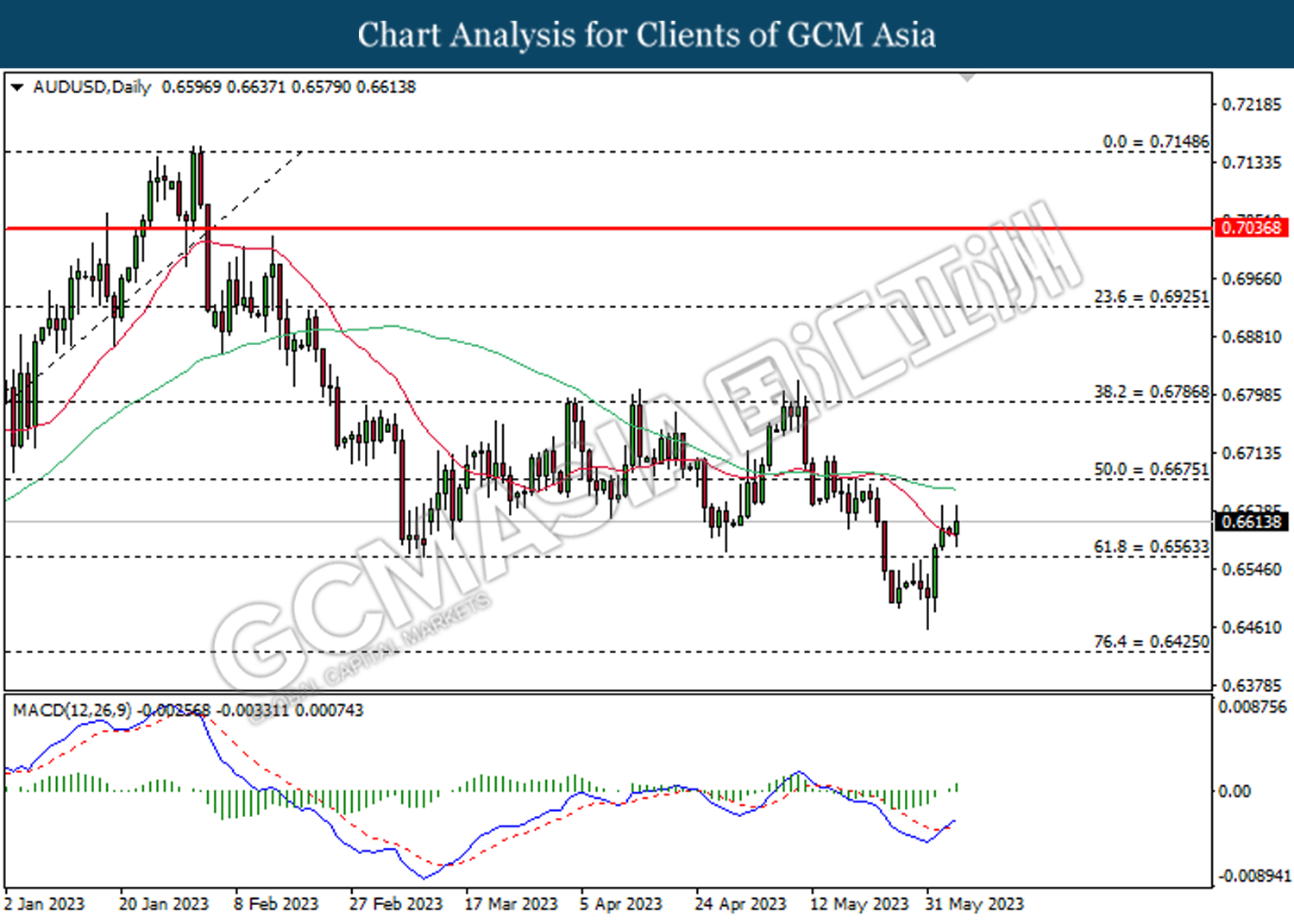

AUDUSD, Daily: AUDUSD was traded higher following the prior rebound from the support level at 0.6565. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6675.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

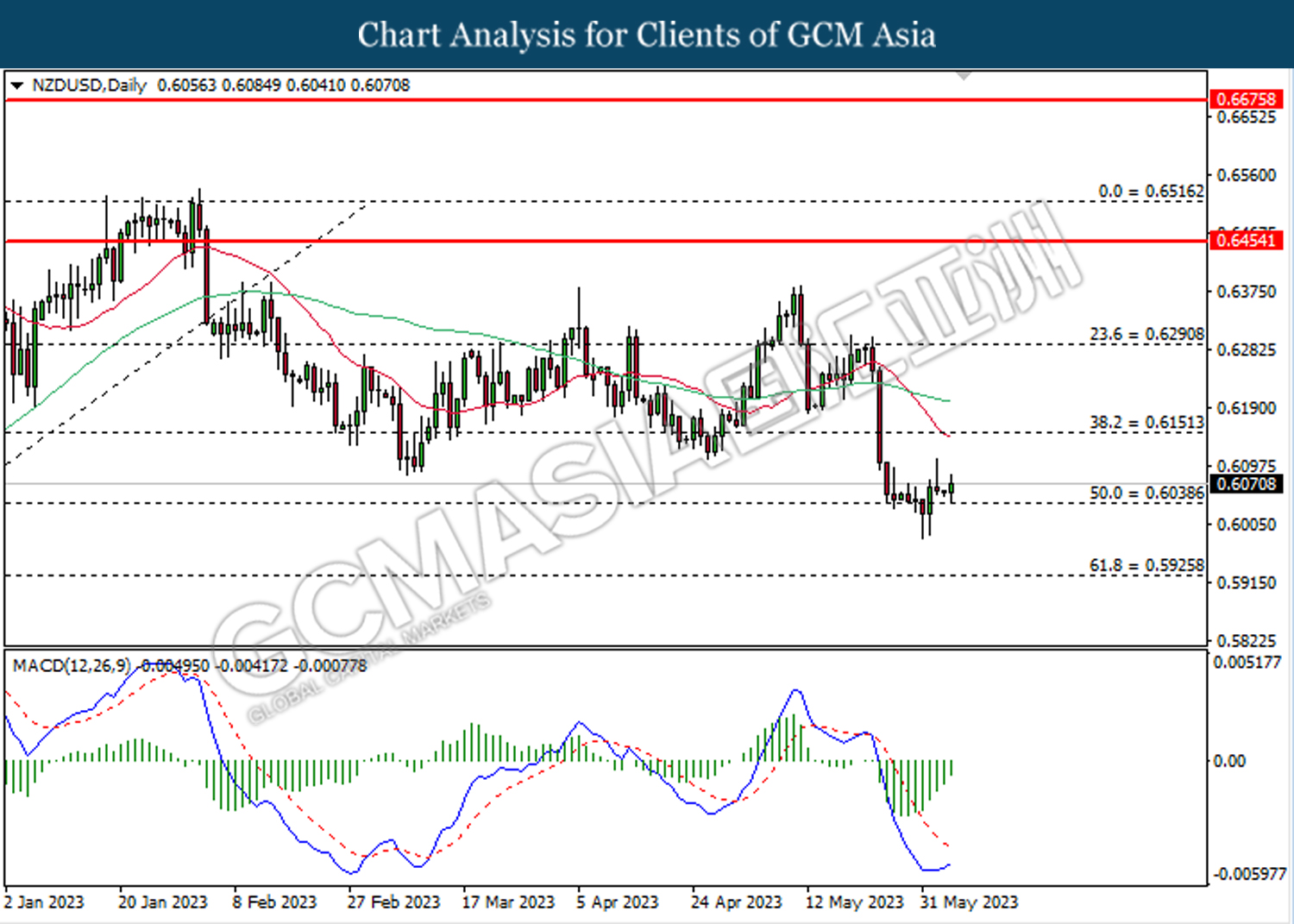

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6040. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

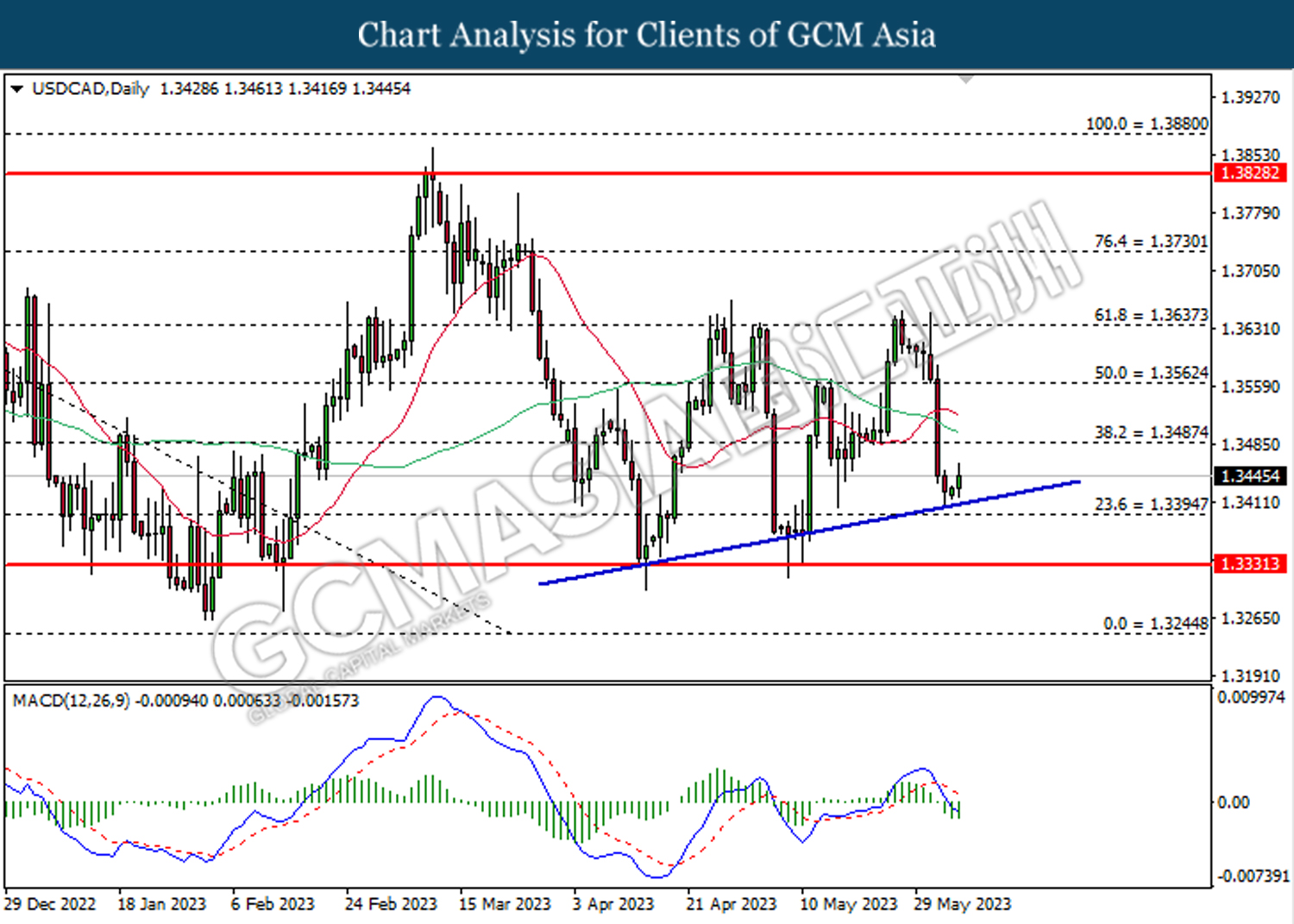

USDCAD, Daily: USDCAD was traded higher following the prior rebound from the upward trend line. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3485.

Resistance level: 1.3485, 1.3565

Support level: 1.3395, 1.3330

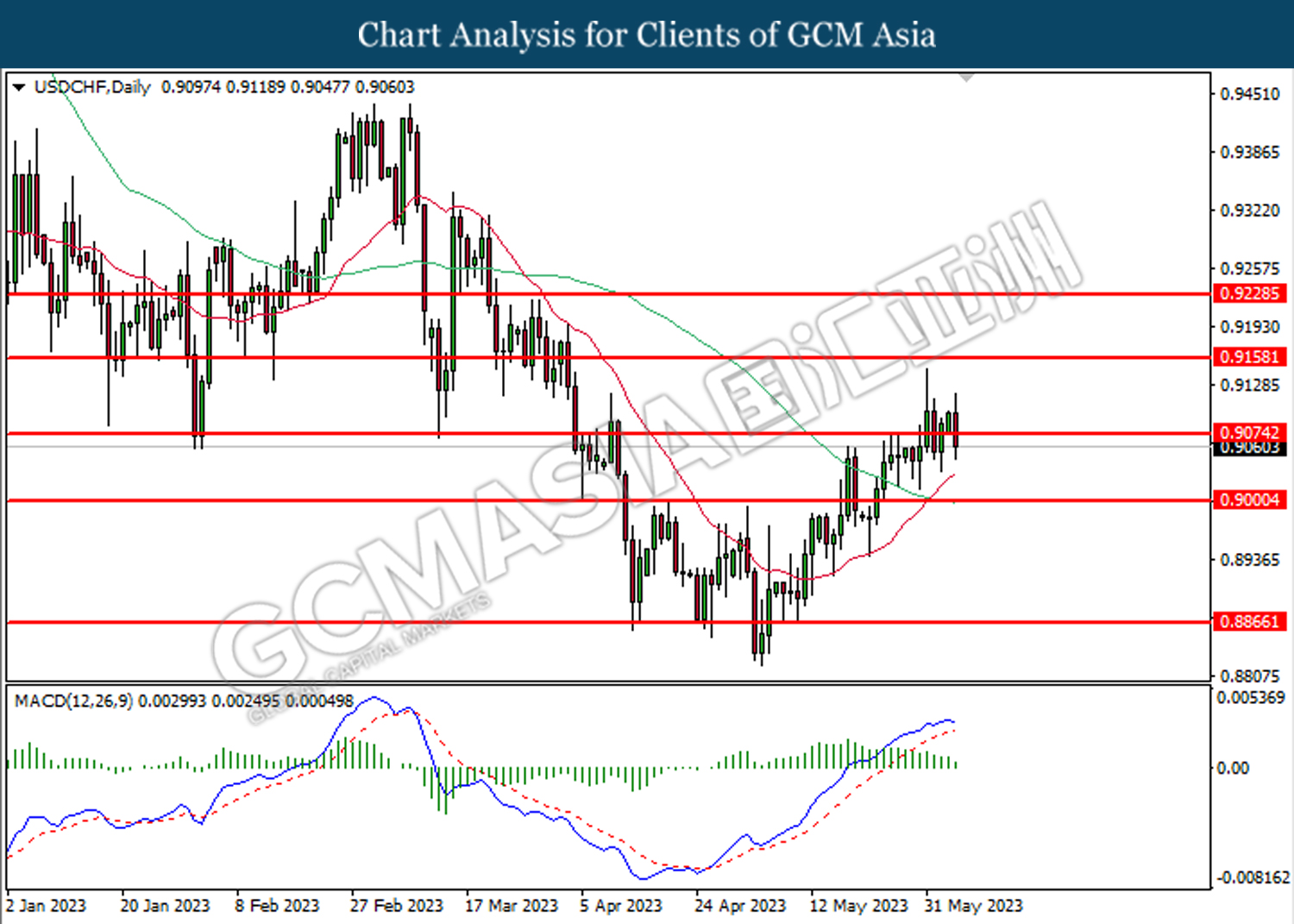

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9075. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9160, 0.9230

Support level: 0.9075, 0.9000

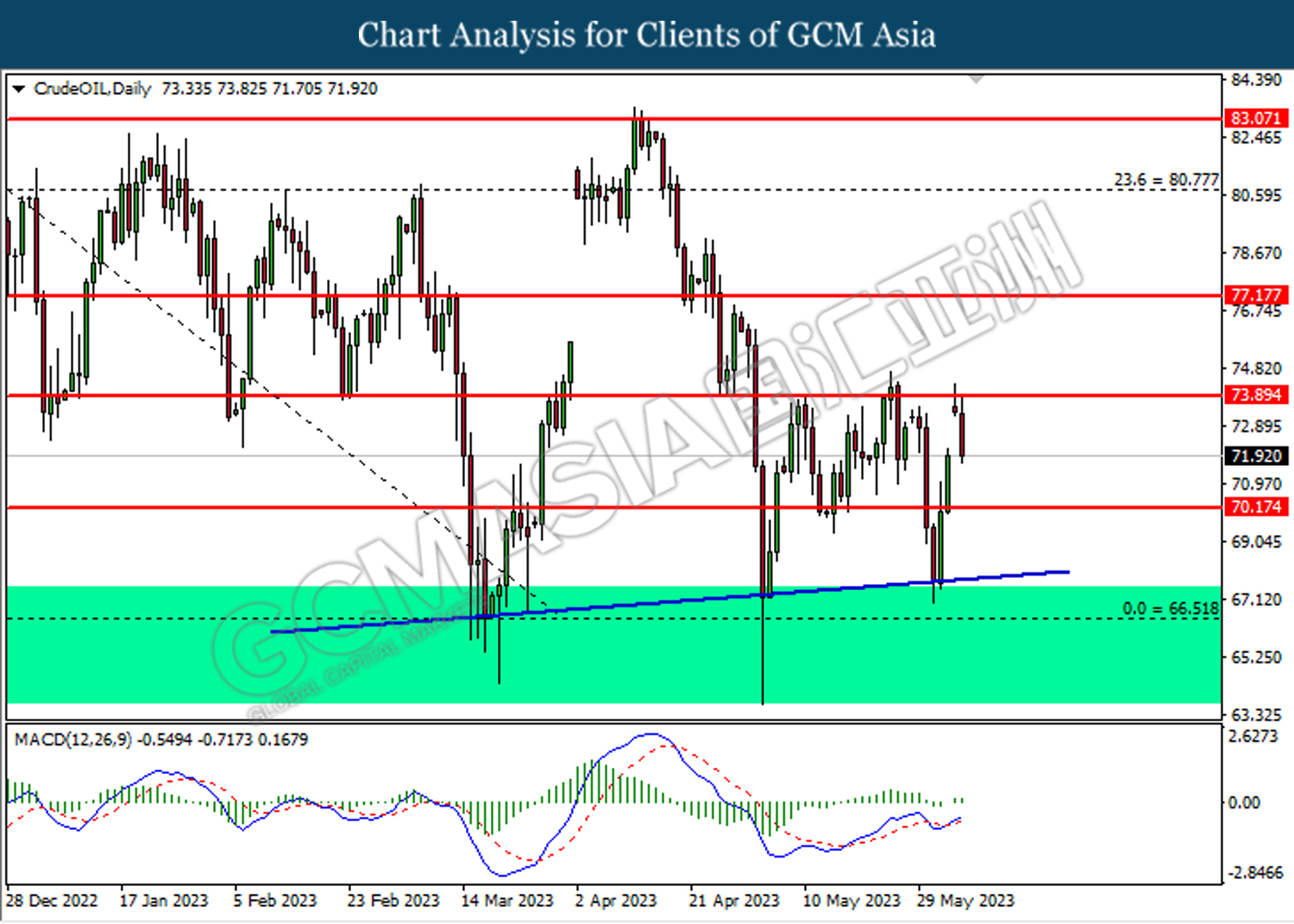

CrudeOIL, Daily: Crude oil price was traded lower following the prior retracement from the resistance level at 73.90. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 70.15.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

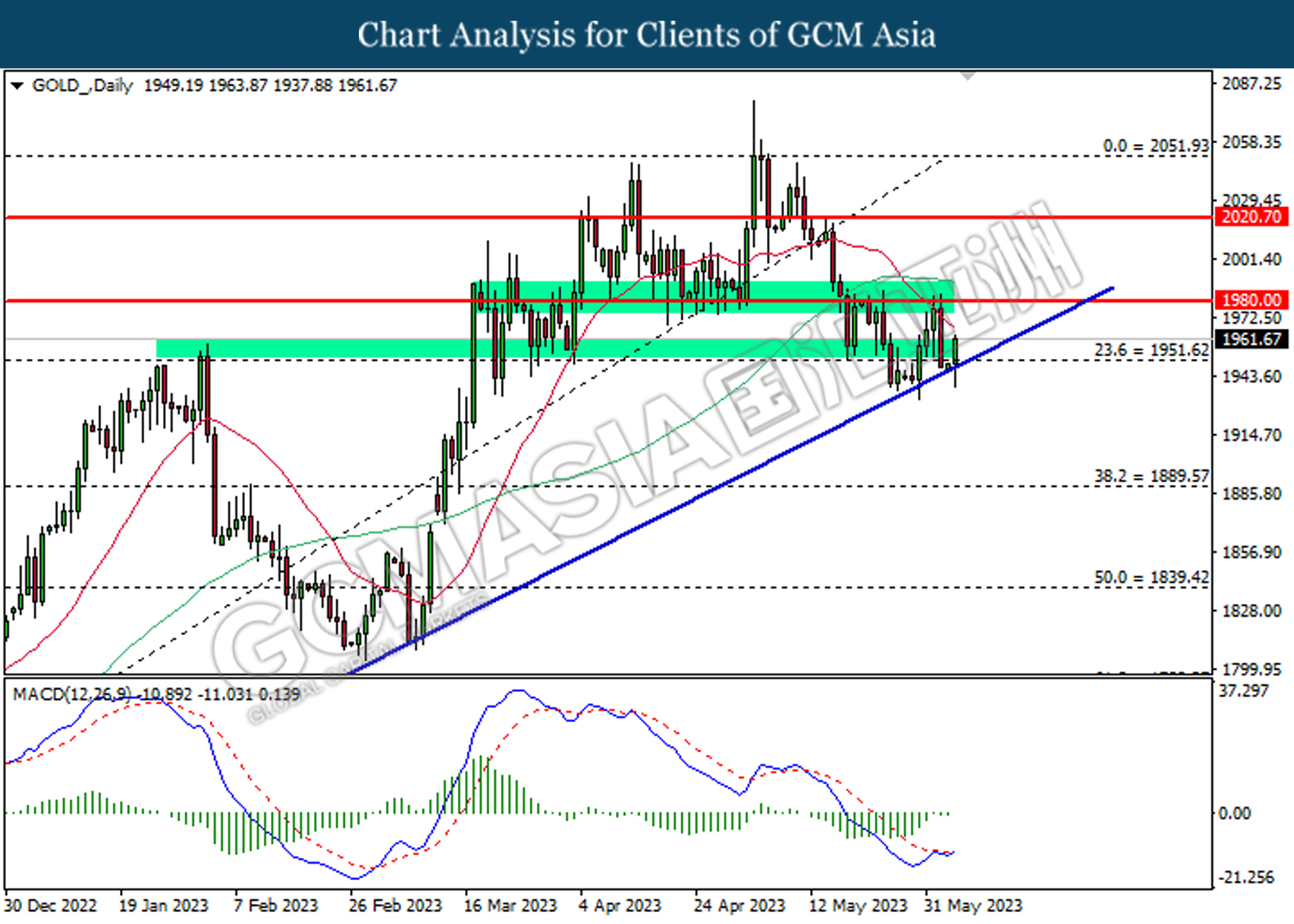

GOLD_, Daily: Gold price was traded higher following the prior rebound from the support level at 1951.60. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 1980.00.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1889.55