06 July 2022 Afternoon Session Analysis

Energy crisis continue to crush European economy.

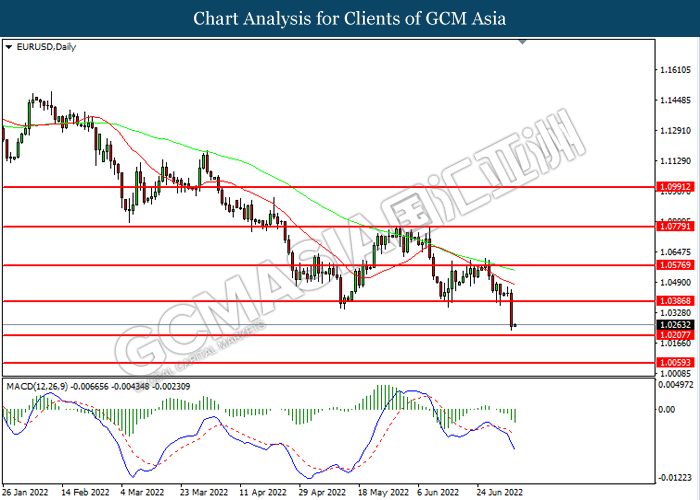

The Euro slumped into 20 years low amid the Eurozone recession fears were exacerbated by concerns about an energy crisis in Europe and by Tuesday’s crucial economic data, which fared a sharp slowdown in business growth in June. Currently, the Europe region is facing its biggest energy crisis in decades, with the rising tensions over the war in Ukraine and the implementation of sanction from Russia. Besides, Germany’s cabinet on Tuesday rushed through legislation allowing it to rescue struggling energy companies, in an effort to prevent supply crunch from seeping into the broader economy. The surging cost of gas would lead to significant stagflation risk in future, adding further tensions for the living costs. In addition, the rate hike expectation from Federal Reserve during the FOMC’s July meeting continue to prompt investors to shift their portfolio from the European region into United States, spurring further bearish momentum on the pair of EUR/USD. As of writing, EUR/USD depreciated by 0.01% to 1.0265.

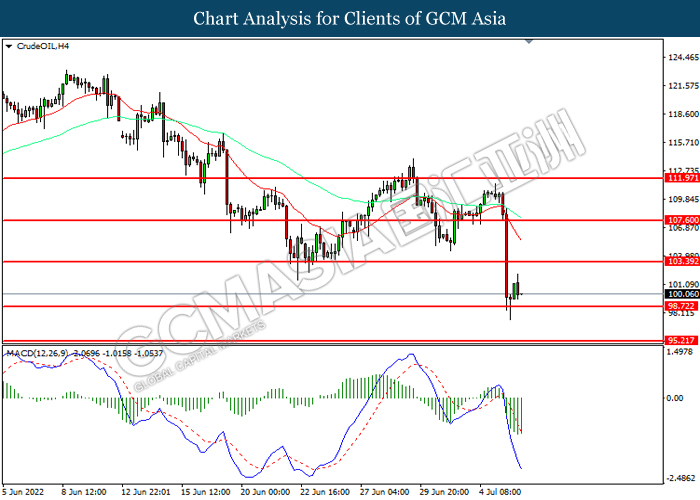

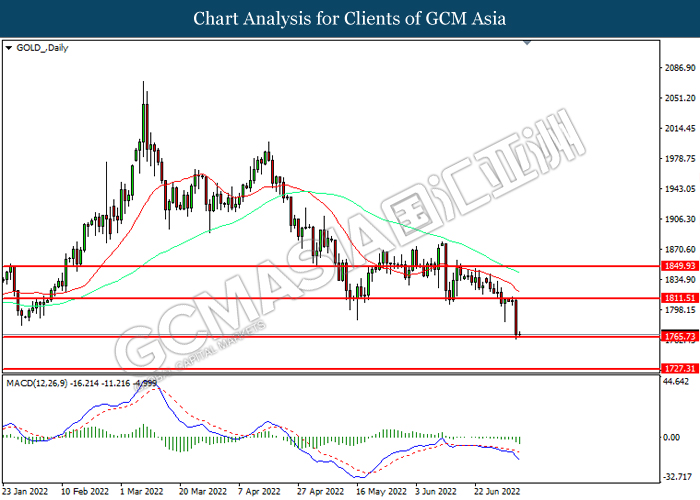

In the commodities market, the crude oil price depreciated by 0.03% to $100.80 per barrel as of writing. The oil market received significant bearish momentum amid rising recession risk in the global financial market continue to drag down the appeal for this black-commodity. On the other hand, the gold price fall amid hawkish expectation from central bank sparked further selloff for gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (Jun) | 56.4 | 55.0 | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Jun) | 55.9 | 54.5 | – |

| 22:00 | USD – JOLTs Job Openings (May) | 11.400M | 11.050M | – |

Technical Analysis

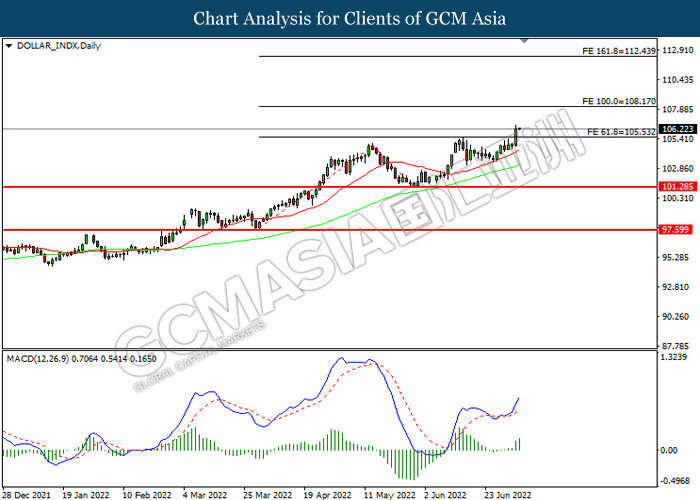

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 108.15, 112.45

Support level: 105.55, 101.30

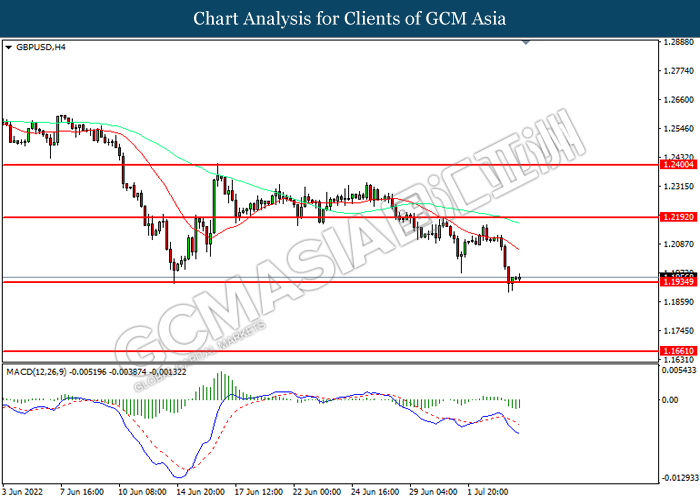

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2190, 1.2400

Support level: 1.1935, 1.1660

EURUSD, Daily: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.0385, 1.0575

Support level: 1.0205, 1.0060

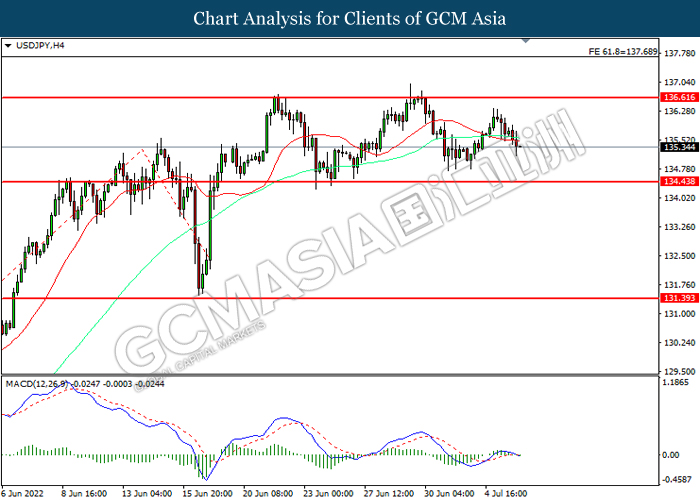

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 136.60, 137.70

Support level: 134.45, 131.40

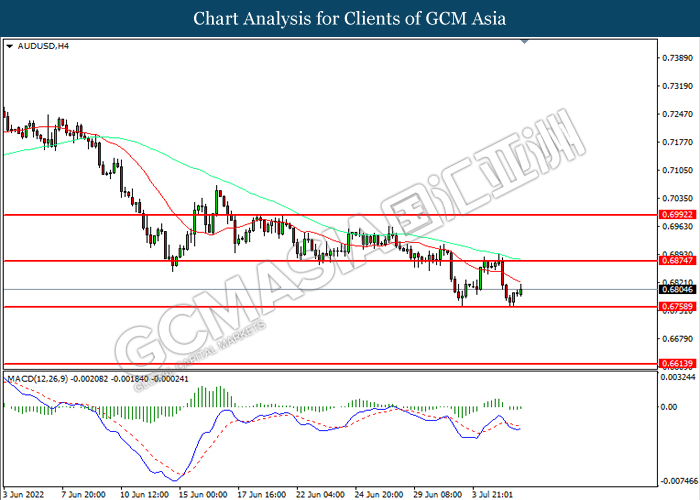

AUDUSD, H4: AUDUSD was traded higher following prior rebounded from the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.6875, 0.6990

Support level: 0.6760, 0.6615

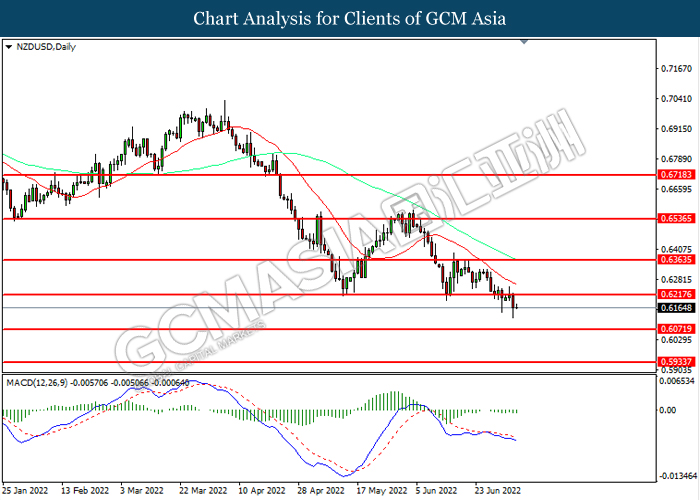

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6215, 0.6365

Support level: 0.6070, 0.5935

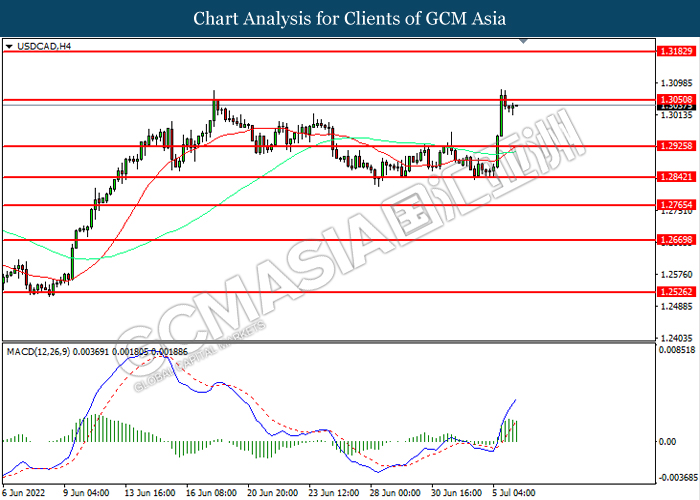

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3050, 1.3185

Support level: 1.2925, 1.2840

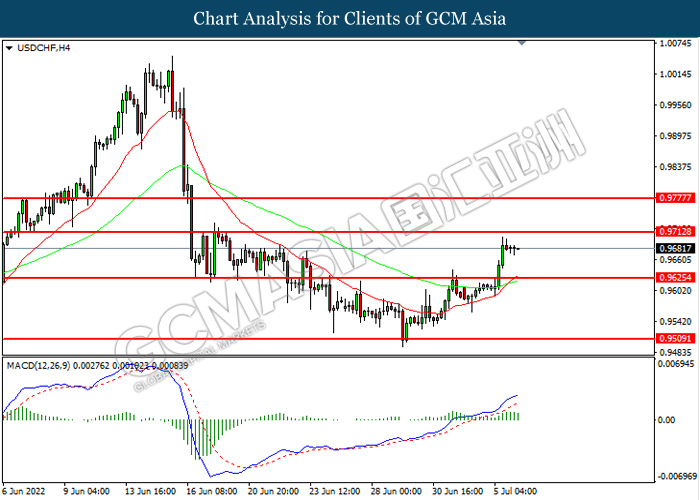

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.9715, 0.9780

Support level: 0.9625, 0.9510

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 103.40, 107.60

Support level: 98.70, 95.20

GOLD_, Daily: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1811.50, 1849.95

Support level: 1765.75, 1727.30